How Much Does Fehb Cost Per Month

The monthly maximum government contribution is $530.53 for Self Only, $1,136.70 for Self Plus One, and $1,243.95 for Self and Family.

Why is FEHB so expensive?

There are a number of reasons why having FEHB is so rare and valuable. First, few employers offer comparable coverage. This means that if you pay $400 per month in FEHB premiums, the total premium cost will be approximately $1,400 per month. It would cost a lot more than that to find comparable coverage on your own.

Do you pay for FEHB?

You must pay both the government and the employee share of the costs. Premium conversion is a method of reducing your taxable income by the amount of your FEHB insurance premium.

Medicare Parts A And B Enrollment Periods

An individual can enroll during one of the following periods:

The following examples illustrate:

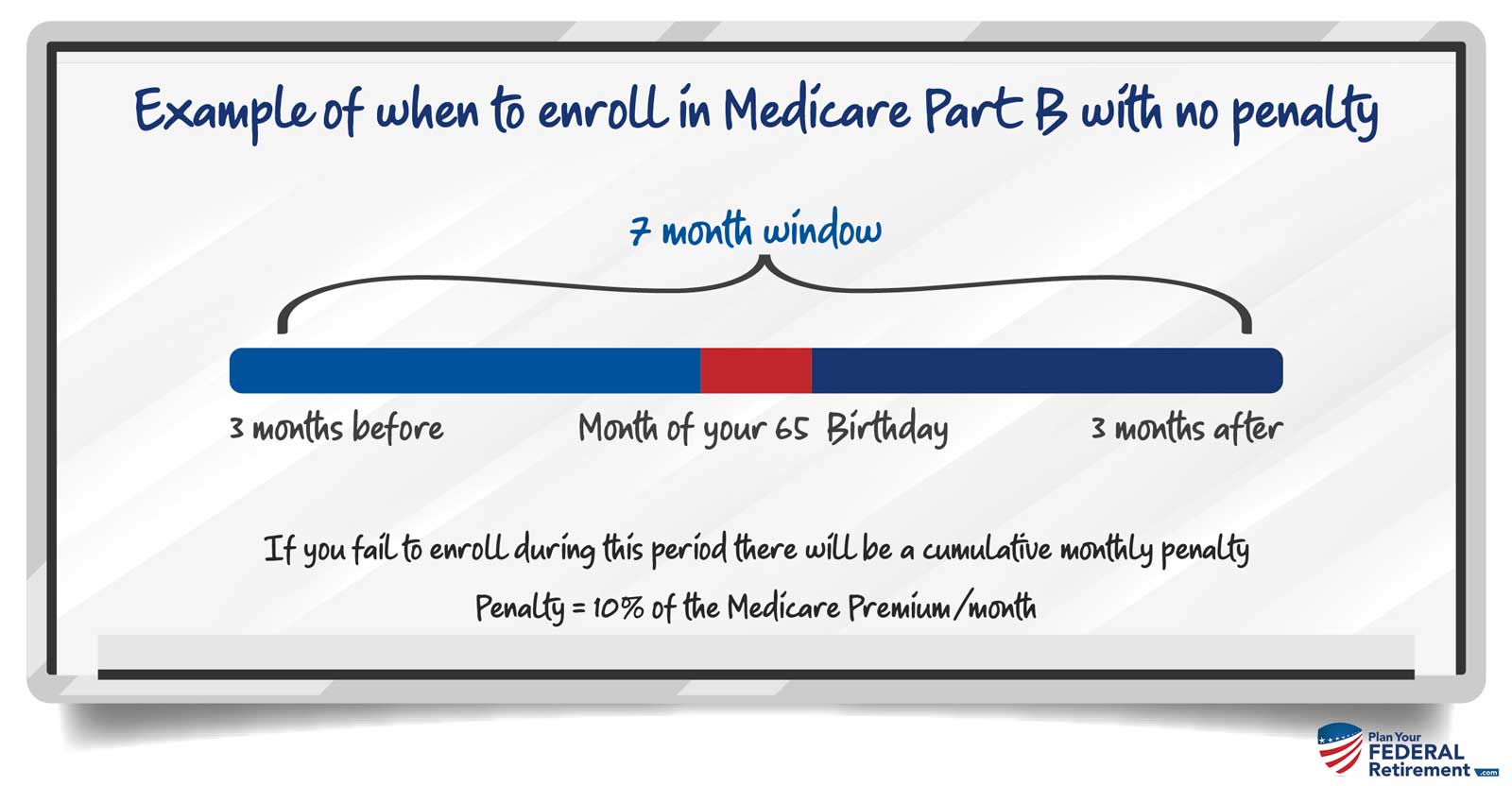

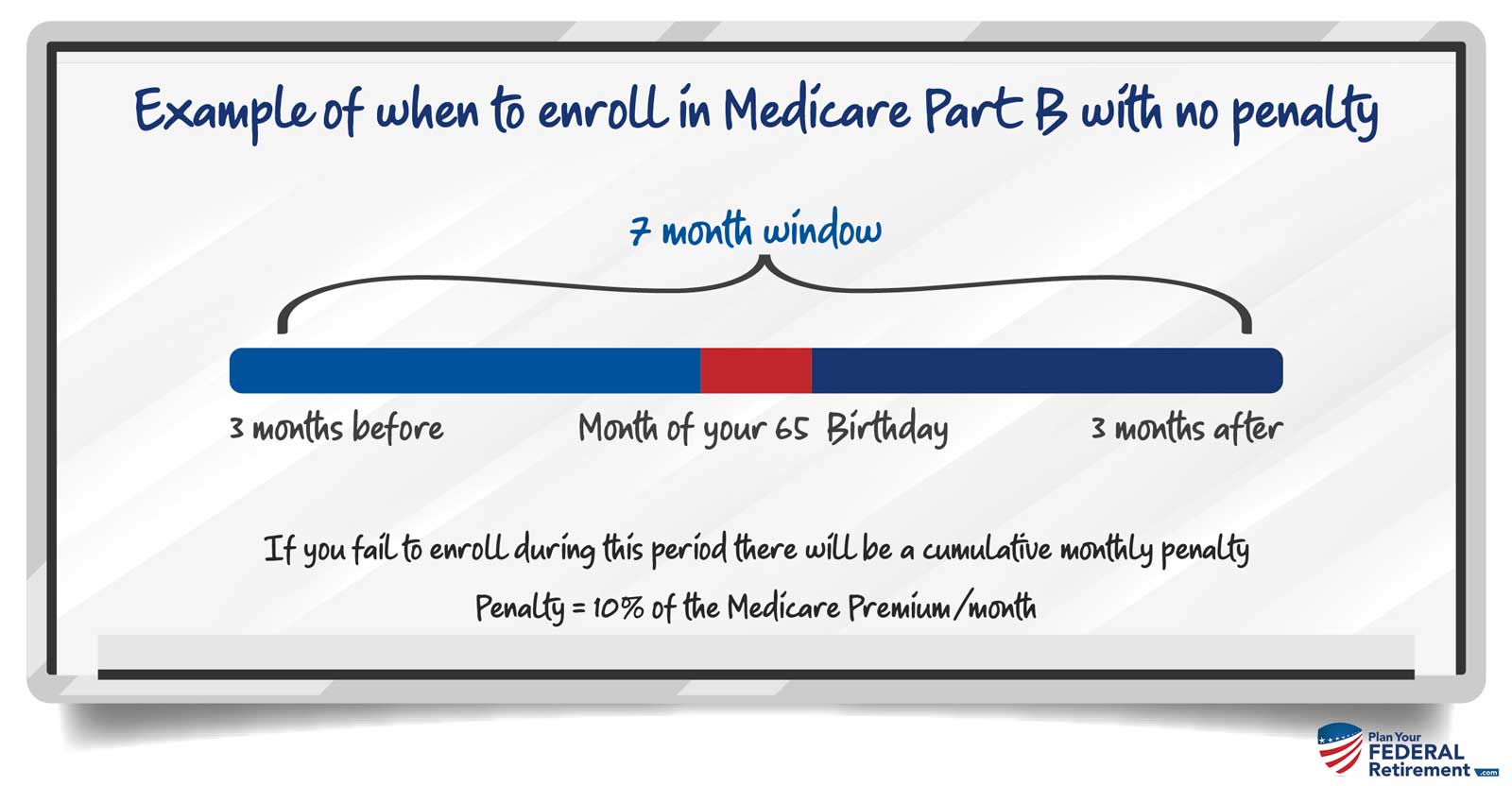

Example 1. Larry retired from federal service on Jan. 3, 2019 and will become age 65 in July 2019. Larry is enrolled in FEHB and will be throughout his retirement. Larry needs to enroll in Medicare Parts A and B between April 1, 2019 and Oct. 31, 2019 in order to avoid paying a late enrollment penalty for Part B.

Enroll In Medicare When You Turn 65

As long as youre still employed, this is not a UC or Medicare requirement, since your UC medical plan will continue to be your primary coverage. Most employees do enroll in Part A since there is typically no cost. People who are receiving a Social Security benefit are automatically enrolled in Medicare Parts A and B you’ll need to contact Social Security if you do not want to be enrolled. If you’re in the UC Health Savings Plan, you should not enroll in Medicare, since the IRS does not allow Medicare enrollees to have a Health Savings Account. This rule applies to any Medicare-eligible enrolled family members as well.

Ninety days before your 65th birthday, RASC will send you a letter with information about enrolling in Medicare. Remember, you and/or your spouse can hold off on enrolling in Medicare as long as youre working just be sure to enroll when you retire. However, domestic partners are usually not eligible to defer enrollment into Part B without incurring late enrollment penalties. These individuals are advised to contact Social Security three months before turning age 65 to inquire about Part B enrollment options and whether late enrollment penalties apply if enrollment is deferred.

To keep your UC-sponsored coverage, youll need to pay your Medicare Part B premiums without interruption and on time to maintain your Medicare enrollment. Depending on your income you may need to pay an additional premium for Part D as well.

- Resources

You May Like: Where Can I Go To Sign Up For Medicare

Should Federal Annuitants Enroll In Medicare Part B After Age 65

There are advantages to enrolling in Part B as a complement to FEHBcoverage . Almost all ofthe national plans waive their hospital and medical deductibles, copays,and coinsurance for members enrolled in both Medicare Part A andPart B . In effect, they “wrap around” Medicare. HMOs generallyhave only nominal deductibles or copayments and most of them do not providesuch waivers. However, an increasing number do. For example, in theWashington, DC area CareFirst and M.D. IPA provide wrap around benefits toretirees with both parts of Medicare. In other parts of the nation, theHumana plans offer similar savings. With Medicare Parts A and B and mostnational Federal plans, you will have close to 100 percent coverage ofalmost all medical expenses . Coverage for dental andprescription drug expenses will still differ depending on which plan youchoose.

However, Medicare Part B will rarely save you nearly as much money as youspend on the Part B premium. This is because the cost sharing for physicianvisits and tests in almost all FEHB plans is already so low. And as wediscuss below, for those who pay more for Part B than the normal premium,it is almost always a bad buy in purely financial terms.

Part B does have some important advantages. Perhaps most importantly, inalmost all the plans that wrap around Part B,enrollment in Part B gives you the freedom to go outside the plan’snetworkat no cost.

There are some circumstances to which the conclusions above do not apply:

Will Fehb Be My Primary Coverage Or Medicare

If you have FEHB and do enroll in Medicare, then Medicare will be your primary coverage and your FEHB plan will pay after Medicare does. Having Medicare could reduce your out-of-pocket costs, because many FEHB plans waive cost sharing for enrollees who have Medicare. Even if this isnt the case, as long as your provider takes both your FEHB plan and Medicare, the most youd have to pay for care is the difference between what Medicare and your FEHB plan pay and Medicares limiting charge.

. Some states dont allow excess Medicare charges. If you live in one of these states or you see a doctor in any state that accepts Medicares rate as full payment youd only have to pay the difference between what Medicare and your FEHB plan pay and Medicares rate. Part Bs limits on what you can be charged dont apply to some services, and Part A doesnt have these limits.)

If you enroll in Part A but decline Part B, your FEHB coverage will pay after Medicare does for Part A services, but will be your primary insurer for other medical care. Medicare would no longer be your primary insurer if you return to work for the federal government, however, and in that case your FEHB plan would pay first, with Medicare paying at least some of your remaining costs.

Read Also: When Does Permission To Contact Expire Medicare

You Paid For Medicare So Do You Still Need Fehb In Retirement

Heres question retirees turning age 65 often ask: Since I paid for Medicare Part A when I was working, do I still need to be covered by the FEHB program after I retire?

Good question. But the answer is simple. Yes.

Thats because Medicare Part A only covers hospital costs. In order to get coverage for physicians services, youd have to enroll in Medicare Part B and pay the premiums. And every year the premiums for Part B keep going up.

In 2020 the monthly premium for most individuals with an income of $85,000 or less is $144.60 a month. The premiums rise for those with at higher income levels.

So, the question becomes, is the combination of FEHB and Medicare Part A enough or do you also need Medicare Part B?

While FEHB and Medicare cover many of the same benefits, neither of them cover exactly the same things or at the same levels. Further, each has deductibles or copayments. And neither Medicare Parts A or B provide prescription drug coverage. You can only get that if you enroll in Medicare Part D, which is an additional expense that will grow over time.

So, what are you to do? The consensus of opinion among the experts is that most Medicare-eligible federal retirees only need their FEHB enrollment and premium-free Part A. Thats because this combination of coverage will give them the greatest protection for the least amount of money. Only those with specific needs covered by Part B need to enroll in that. And even fewer need Part D.

Should I Enroll In Part B If I Have Fehb Coverage

Deciding whether to enroll in Part B is complicated. And unlike Medicare Part A, all enrollees pay a premium for Medicare Part B . While FEHB plans cover most of the same types of expenses that Medicare covers, FEHB plans coverage may be more limited than Medicare Part B when it comes to orthopedic and prosthetic devices, durable medical equipment, home healthcare, medical supplies, and chiropractic care. Conversely, FEHB plans cover emergency care received outside the United States, and this isnt covered by Original Medicare at all and is rarely covered by Medicare Advantage. FEHB plans may also pay for vision and dental care thats not covered by Original Medicare and is limited in Medicare Advantage.

If you are covered by an FEHB HMO plan, youre normally limited to seeing providers who are part of your plan. Having Part B means you can go outside the HMOs network and see other providers, as long as theyre part of Medicare.

You May Like: Do You Have To Take Medicare

Do You Need Medicare Part D

Most federal retirees would do better to keep their FEHB prescription coverage. Medicare designates prescription drug plans as when they offer similar benefits to Part D at a similar price, and FEHB prescription coverage qualifies as creditable.

The only exception is for federal annuitants who have limited income and resources, which may qualify you for Extra Help. This Medicare program covers many of your prescription drug costs. Click here to see if you qualify.

Do Feds Need Medicare When They Already Have Fehb

As we kick off Open Season 2019, one topic shaking up conversations with feds is how FEHB interacts with Medicare. While Federal Employee Health Benefits offer complete health coverage to Federal Employees who are 65 and older, are there benefits to obtaining both FEHB and Medicare?

When you combine the FEHB benefits with Medicare, the result is an otherwise bizarre arrangement with massively wasteful extra spending as Walton Francis states giving his input on the subject.

That means some beneficiaries wont find value in having both FEHB and Medicare coverage.

For most of the working class, Medicare Part A enrollment is automatic. Yet too many federal employees remain unclear and still have lingering questions about benefits.

So why should federal retirees enroll in Medicare if they have benefits through the FEHB program?

For some, coordinating these benefits together saves them money. However, this isnt the case for everyone. Retirees want a clear understanding of the relationship between the FEHB Program and Medicare.

Recommended Reading: Can You Draw Medicare At 62

I Will Be Retiring Soon From My Job In The Federal Government I Will Continue To Receive Good Health Coverage From The Federal Employees Health Benefits Program So Do I Need Medicare Part B

En español | When you stop working, you dont have to enroll in Medicare Part B if you dont want to, and your FEHB plan cant require you to. Your benefits under the plan you choose are the same whether you sign up for Part B or not. If you want to have both types of coverage , or if you want to drop the FEHB plan and rely wholly on Medicare, those are choices youre free to make. Still, the Office of Personnel Management, which administers the FEHB program, suggests some points to consider:

- Medicare may pay for some services that your FEHB plan doesnt cover, such as home health care, some medical equipment and supplies, and orthopedic or prosthetic devices.

- Your FEHB plan may pay for some services that Medicare doesnt cover, such as annual physicals, routine dental and vision care, and emergency coverage outside of the United States.

- If you have both an FEHB plan and Medicare, your benefits are coordinated so that you dont have to file claims yourself. Depending on your plan, having both types of coverage may combine to pay almost all of your medical expenses. Some FEHB plans waive their own deductibles and copays for services that are also covered by Part B.

- If you dont sign up for Part B when you retire, but need to do so at some future date for example, if you lose FEHBP coverage or it becomes too expensive to maintain you would be liable for Part B late penalties.

What Happens If I Decline Fehb Coverage

If you decline FEHB coverage, you would give up the subsidy the government pays toward it, which ranges from a low of about $350 for self-only coverage to $1,000 or more if youre also covering family members. If your family members are covered under FEHB, their coverage would end if you terminate yours.

You May Like: How Do I Know What Medicare Coverage I Have

Fehb And Medicare Part C Enrollment

To enroll in Medicare Part C, you must enroll in Part A and B coverage. FEHB benefits are likely to continue.

Because Medicare Advantage Plans offer similar benefits to the FEHB program, for many, theres no need to enroll in a Part C plan.

However, individuals may suspend their FEHB benefits if they choose to enroll in a Medicare Part C plan. Before the suspension of benefits, the retirement system requires beneficiaries to show their coverage documentation at the time of enrollment.

Life happens and some circumstances require the change or adjustment of benefits. Say a beneficiary loses or cancels their Part C policy they may re-enroll in the FEHB program.

The reason why a person no longer has an Advantage Plan determines when they can re-enroll. Beneficiaries may re-apply for FEHB benefits for up to 60 days after the loss of an Advantage Plan.

This example is only for beneficiaries that lost a policy due to the plan leaving an area or if a person moves out of their plans service area.

FEHB Re-Enrollment Period

On the other hand, simply canceling a plan for personal reasons may delay the re-enrollment process until the next Open Season.

The FEHB Open Season typically runs from Nov. 12 through Dec. 10 annually benefits start Jan. 1 the following year. This is the re-enrollment period for otherwise ineligible beneficiaries.

Current federal employees have two new nationwide FEHB plans to consider this fall during the FEHB Open Season.

Can You Opt Out Of Plan B

Yes, you can opt out of Part B. (But make sure your new employer insurance policy is primary for Medicare. Medicare is pushing for an interview to make sure you know what the consequences will be if you dont part B steps. for example that you may have to pay a late fine if you want to re-enrol for the course in the future.

Can you have Medicare Part B without Part A?

While it is always advisable to have Part A, you can purchase Medicare Part B without having to purchase Medicare Part A , as long as you are: 65 years of age And a U.S. citizen or legal resident who has at least five years in the US.

Can I stop my Medicare Part B?

You can voluntarily terminate your Medicare Part B . However, as this is a serious decision, you may need to have a face-to-face meeting. A Social Security representative will assist you in completing Form CMS 1763. You may also contact the nearest Social Security office.

Read Also: Does Medicare Cover Bariatric Surgery

Do Federal Retirees Need Medicare Part D

Federal retirees needing prescription drug coverage often find themselves asking is FEHB credible coverage? Can I postpone enrolling in Medicare Part D?

The answer: yes! FEHB coverage is comparable to Medicare coverage. Therefore, beneficiaries in the federal program may delay joining a Part D plan likewise, theyre exempt from any Part D late enrollment penalties.

The federal employee plans often include prescription drug benefits, although drug coverage may vary. Like any prescription drug plan, check for specific drugs within the plans formulary.

Part D likely pays primarily for prescriptions even with FEHB. Beneficiaries must continue to keep drug coverage from the FEHB program as its health and medication coverage may not be separate.

Who Qualifies For Medicare Money Back

Who doesnt love getting a refund? Each year, Basic Option members enrolled in Medicare Part A and Part B can get money back into their bank account. The Blue Cross and Blue Shield Service Benefit Plan reimburses these members up to $600 per calendar year for their Medicare Part B premium payments.

Does Medicare give back money?

The Medicare Giveback benefit is a Part B premium reduction offered by some Medicare Part C plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier pays some or all of your monthly Part B premium.

How can I get money back from Medicare?

Each year, Basic Option members enrolled in Medicare Part A and Part B can get money back into their bank account. The Blue Cross and Blue Shield Service Benefit Plan reimburses these members up to $600 per calendar year for their Medicare Part B premium payments.

Also Check: What Medicare Supplement Plans Cover Hearing Aids

Tricare Health Insurance Coverage And Medicare

Those federal employees who are receiving, or who will be receiving, military retirement pay are or will be eligible for TriCare health insurance coverage. There are different types of TriCare health insurance, including TriCare Standard and TriCare Prime. But at age 65, a military retiree receiving retirement pay is eligible to enroll in TriCare-for-Life health insurance. There is no monthly premium cost for TriCare-for-Life provided the military retiree is enrolled in Medicare Parts A and B. This is because when a military retiree becomes age 65, Medicare is considered primary coverage and TriCare is considered secondary coverage.

Why Should I Consider Enrolling In Medicare

When you turn 65 and are retired, many health insurance carriers assume that youll be on Medicare Part B. In turn, many people experience slight changes in their health insurance coverage as time goes on, even with FEHB. Does it impact everyone? Sometimes not someones health needs may be more simplistic and their FEHB in retirement sufficiently covers their needs. For others, it might be different.

Remember, health insurance carriers are for-profit organizations, even those through FEHB. As such, they will make business decisions about certain health coverages in a manner that works best for them. Carriers frequently change their health care coverage, and some day that coverage change could impact you in a way that can be devastating. This is why we always encourage the families we serve to review their health coverages again in open season, even if theyre not making changes.

I have a client who personally experienced receiving health services that were no longer covered by FEHB as they progressed through retirement, because the insurance carrier passed on that coverage responsibility to Medicare as the primary insurer. They didnt have Medicare Part B, which in turn required them to pay out of pocket for those expenses.

Don’t Miss: Does Medicare Part D Cover Shingrix