Contact Meld Financial To Review Your Medicare Plan

If you need help planning your retirement or understanding your Medicare options, reach out to the team a Meld Financial. At Meld, we will develop your Financial Fingerprint, a financial plan which is quick to assemble, easy to understand and simple to modify as your circumstances change.

With your Financial Fingerprint, you can have confidence that you are prepared to transition to Medicare when the time is right. Contact Meld Financial today to speak to a member of our team.

You Can Receive Medicare Without Taking Your Social Security Benefits

Medicare and Social Security aid older Americans and their spouses who paid into the programs through FICA taxes during their working years.

Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older. Social Security retirement benefits act as a small pension, providing monthly income to those eligible as early as age 62.

Even if you are eligible to start receiving benefits, you do not have to start taking them. In some cases, it may be better to delay or to start taking benefits from one program but not the other.

When You’re Eligible For Social Security

Today, older adults become eligible for full Social Security retirement benefits at age 66 or 67 depending on their birth year and whether they or their spouse have met the work credit requirement.

For anyone born in 1929 or later, the minimum work credit requirement for Social Security benefits is 40 credits or 10 years of work. The year you can start taking full Social Security benefits is known as your full retirement age or normal retirement age. If you were born on January 1 of any year, refer to the previous year when calculating your full retirement age.

| Age for Receiving Full Social Security Benefits | |

|---|---|

| Birth Year | |

| 1960 and later | 67 |

Unlike Medicare, older people can opt to start taking their benefits before their full retirement age. The earliest you can begin taking Social Security benefits is age 62. However, if you begin taking Social Security payments before your full retirement age, you will receive a reduced monthly benefit for the remainder of your life.

If you are a widow or widower, you can start claiming your spouse’s reduced Social Security benefits when you are age 60, or 50 if you are disabled. You can then switch to taking your own full benefit at your full retirement age.

You can also choose to delay your Social Security benefit past full retirement age until age 70. This will often make you eligible for delayed retirement credits, which increase your monthly benefit for the remainder of your life.

Don’t Miss: What Is The Penalty For Not Enrolling In Medicare

Medicare Eligibility For Part D

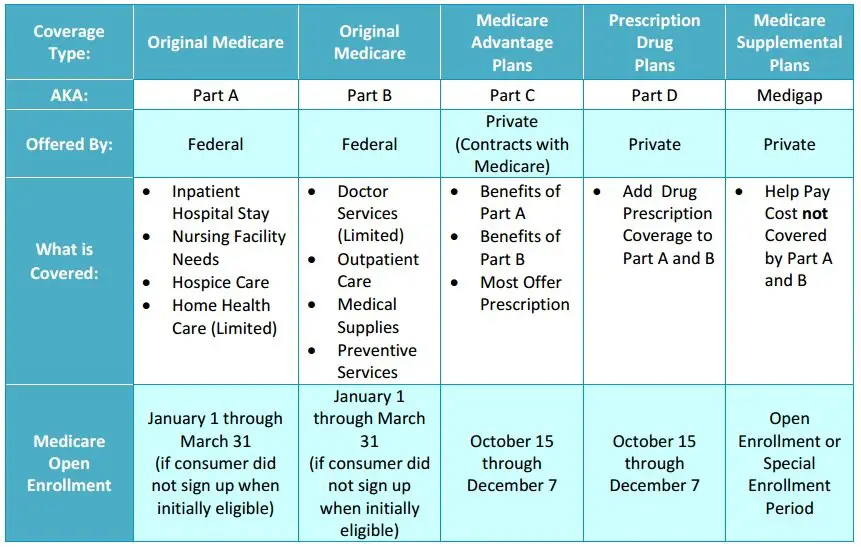

To be eligible for Medicare Part D you must be enrolled in Medicare Part A and/or Part B. You are not eligible for a Part D drug plan if you are enrolled in Medicare Part C. Medicare Part D plans are run by private insurance companies, so premium prices and covered drugs will vary by plan.

You should enroll in a Medicare Part D plan when you are first eligible for Medicare, or risk paying a late enrollment penalty.

What Is Not Covered By Medicare

Medicare does not cover a range of costs like:

- private patient costs in hospital

- extras services like dental and physiotherapy

- medical aids like glasses or hearing aids

You may choose to take out private health insurance to help with these costs. Private health insurance may cover some of your costs for things like glasses, or hearing or mobility aids. You may also be eligible for free or low-cost medical aids under the Medical Aids Subsidy Scheme.

Recommended Reading: What Medicare Supplement Covers Hearing Aids

Eligibility For People With Als

People with ALS, or Lou Gehrigs disease, can qualify for Medicare when they are under 65 years of age.

ALS is a progressive, neurodegenerative disorder that disrupts a persons ability to speak, move, eat, and ultimately breathe. The condition has no cure and is eventually fatal.

According to the ALS Association, an estimated 16,000 people in the United States have the disorder. A doctor usually diagnoses ALS between the ages of 4070 years.

Unlike ESRD, those with ALS can receive Medicare Part A benefits in their first month of receiving Social Security or RRB benefits.

The SSA automatically enrolls a person with ALS in a Medicare plan when they start paying Social Security benefits.

According to a 2017 review in Amyotrophic Lateral Sclerosis and Frontotemporal Degeneration, a persons monthly costs with ALS under Medicare can total $10,398 during the month of their diagnosis.

ALS often progresses rapidly and leads to high healthcare costs. This is why a persons Medicare benefits will usually begin as soon as possible.

Medicare After Death Of A Spouse

The death of a spouse can change many aspects of your life, including health policies. If you get benefits under your spouses retirement plan coverage may change after they pass away. If you lose Medicare coverage due to the death of a spouse, you become eligible for a Special Election Period but, that period doesnt last forever.

Social Security surplus helps fund the deficit to help those in need of survivor benefits or those on disability.

Its your responsibility to enroll in a new policy as soon as possible to ensure eligibility. If you recently lost a spouse and your Medicare policy, please call an agent at the number above to start discussing your options.

You May Like: What Is A Medicare Health Plan

Qualifying For Medicare When Receiving Disability Benefits

Medicare coverage kicks in for most SSDI recipients two years after the first month they are eligible for their monthly disability benefits. However, this doesnt automatically mean that every person approved for SSDI must wait two years to get their Medicare coverage. The two-year Medicare waiting period generally gets calculated from the date of your SSDI entitlement . Normally, this is the date your disability began plus the five-month SSDI waiting period.

However, things get a little tricky depending on your disability onset date. Depending on how far back you became disabled, you may have met a good portion of the waiting period by the time you are approved for benefits. But, because Social Security only allows a maximum of 12 months of retroactive benefits, plus the 5-month waiting period for benefits, the earliest that you can become eligible for Medicare is one year after you apply for Social Security disability.

But, if you recently become disabled and were approved with an entitlement date of August 2018, you would not become eligible to receive Medicare benefits until August 2020. There are exceptions to this rule if your disabling diagnosis is End Stage Renal Disease or Amyotrophic lateral sclerosis . People with these conditions receive expedited Medicare coverage.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Read Also: Will Medicare Pay For A Patient Lift

The Medicare Enrollment Process And How To Enroll

Those who plan on enrolling in Medicare should prioritize enrollment of the two mandatory plans, Part A and B. After enrolling in those two, then you can add-on additional coverage by selecting a Medicare Advantage Plan that includes supplemental health and prescription coverage or a Medigap Plan combined with Part D prescription coverage.

Already Retired Person Reaches Age 65

The first situation is when someone who has already retired reaches the age of 65. If the retiree is already receiving Social Security, they are automatically enrolled in Part A and B of Medicare. If not, they must enroll in Part A and B during the 7-month initial enrollment period to avoid penalties. The initial enrollment period begins 3 months before the month an individual turns 65, includes the month they turn 65 and the 3 following months.

It is important to remember that Medicare becomes the primary payer to other retiree plans, individual insurance plans, and COBRA plans. In addition, late enrollment penalties for Medicare Part D can be assessed when eligible individuals dont maintain credible prescription drug coverage without a continuous lapse of 63 or more days. If assessed, these penalties are paid for as long as you maintain Medicare Drug Coverage, and they often sneak up on individuals who are more focused on Part A & B deadlines.

Also Check: Does Medicare Pay For A Caregiver In The Home

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Full Retirement Age By Year

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

An easy way to think about full benefits and retirement age is this,

- Social Security will reduce your payments if you choose to receive your benefit before full retirement age. The percentage of reduced amount is highest at age 62 and decreases until you reach full retirement age.

- If you choose to receive Social Security payments when you reach full retirement, you will get the total amount.

- Suppose you choose not to receive Social Security payments when you reach full retirement and delay your benefit. In that case, you can increase the amount of your payment by earning delayed retirement credits.

If youre not sure when you reach full retirement age, our table provides the years and months you need to know for full retirement.

You May Like: Can You Have Medicare And Medical At The Same Time

What Happens If One Of You Becomes Eligible For Medicare Before The Other

Unless you and your spouse were born in the same month of the same year, one of you will become eligible for Medicare before the other. If you both are covered by your employer health insurance, and one of you turns 65, youll have decisions to make about Medicare. In this case, it will depend on the employer and their rules around covered dependents of Medicare age. Some employers may require spouses who are eligible to get Medicare to do so at age 65 in order to remain on the employer plan.

You can learn more about your potential options by talking with your employer benefits administrator.

Enrolling In Medicare Prescription Drug Coverage

As mentioned earlier, those eligible for Medicare and seeking Medicare Part D coverage should enroll before their credible prescription coverage has lapsed for 63 days. After that point late enrollment penalties could begin to accrue.

To enroll in one of these programs, you should first choose the Medicare Drug Plan this is right for you. You can compare plans and enroll using the Medicare website or you can complete a paper enrollment form. You can also get help by calling 1-800-MEDICARE.

You May Like: Can You Get Dental On Medicare

Is My Spouse Eligible For Medicare Part A

Medicare eligibility and enrollment is an individual thing, so the rules regarding Medicare Part A spouse eligibility are the same for both people. However, it is possible for a spouse to help you qualify for Part A without a monthly premium.

Heres how it works: If you dont qualify for a no-cost Part A premium, you can use your spouses work history to qualify. If you havent paid Medicare taxes for 10 years but your spouse has, you are eligible for Part A without a premium.

One caveat: Your spouse must be at least 62 years old. But remember, Medicare Part A eligibility is an individual thing, so your spouse still wont qualify for Part A until age 65.

What Exactly Is Medicare Part A

Part A of the federal governments Medicare program is commonly referred to as hospital insurance, and for good reason.

In a nutshell, Part A is health insurance that covers inpatient hospital stays. Inpatient stays generally are defined by Medicare as medically necessary stays crossing over two or more midnights in a hospital or similar facility. Usually, the hospital-related expenses for your qualifying stay are 100 percent covered by Medicare Part A for stays of 60 days or less after you pay the benefit period deductible .

Find a local Medicare plan that fits your needs

Don’t Miss: Does Medicare Pay For Someone To Sit With Elderly

Who Is Eligible For Premium

Theres a monthly premium for Medicare Part A. You generally dont have to pay a Part A premium if either of these applies to you:

- You or your spouse worked long enough while paying Medicare taxes

- You or your spouse had Medicare-covered government employment or retiree who has paid Medicare payroll taxes while working but has not paid into Social Security.

Normally, you pay a monthly premium for Medicare Part B, no matter how many years youve worked. Read more about the Part A and Part B premiums.

Enrolling In Medigap Coverage Or Medicare Advantage

If you would want additional coverage, you can select and enroll in a Medicare Advantage or a Medigap plan once you have enrolled in Part A and Part B. Medicare Advantage typically includes Part D prescription drug coverage, but those who select Medigap will need to apply for Part D separately. Most importantly, those who apply for Medigap within 8 months of enrolling in Medicare Part B are guaranteed issue of the policy without additional underwriting. After 8 months, these plans may not be issued for all individuals.

If youre looking to enroll in Medigap coverage, you can start at the Medicare website. There you will find a 4-step process designed to help you select and enroll in a Medigap insurance plan. If you are interested in Medicare Advantage, use the Medicare Plan Finder to evaluate your options.

Recommended Reading: Does Medicare Cover Dental In Ny

How To Enroll Early

A person should contact the SSA with any questions about their work history and eligibility for Medicare by visiting the Contact Us section of their site or calling 1-800-772-1213 .

If a person receives benefits from the RRB, they can call 1-877-772-5772 to find out more about qualifying for Medicare.

Taking Medicare But Not Social Security

It is possible to enroll in Medicare coverage but delay taking your Social Security retirement benefits. For many workers, this strategy might be financially advantageous.

For most older people, it is a good idea to enroll in all parts of Medicare coverage they plan to use as soon as they are eligible at age 65. If you delay enrolling, Medicare Part D may become more expensive. If you delay signing up for Part B, you may also experience a gap in your coverage or have to pay a late enrollment penalty.

However, if you can afford to, it is often a smart financial decision to delay receiving Social Security benefits until at least your full retirement age in order to increase the benefit you receive. This may mean that there are several years during which you are enrolled and covered by Medicare but not yet receiving your monthly Social Security benefit.

Don’t Miss: How Does An Indemnity Plan Work With Medicare