Can One Have Dual Eligibility For Both Medicare And Medicaid

Yes, Medicare and Medicaid are not mutually exclusive programs. Persons who are eligible for both are referred to as having Dual Eligibility, Dual Eligibles, or often simply Duals. Medicare is the first payer of covered benefits, while Medicaid is the secondary payer. Typically, Medicaid will pay for Medicare premiums and co-payments for dual eligibles. In fact, many states have special programs intended to make it easier for seniors to manage their dual eligibility status as it can be confusing to know where to turn for what services. This is generally in the form of managed care.

There are also programs called Medicare Saving Programs for low-income seniors that dont quite qualify for Medicaid.

What Is The Average Social Security Benefit At Age 62

The Social Security Administration doesnt publish average data for each specific age it lumps ages 1864 together. However, it does state that someone who had made the maximum contribution to Social Security throughout their career would earn $2,324 per month in benefits it they retired at age 62 in 2021. If the same person retired at 65, they would earn $2,841 per month.

You May Like: Does Medicare Cover One Touch Test Strips

The Challenges Of Changing Medicares Age Of Eligibility

First, there are the funding issues. If lowering the age to access increased the cost to administer the Medicare program, the chances of proposed changes passing will drop.

The Part A account that funds the hospitalization and related services faces insolvency by 2026. Insolvency means that Medicare wouldnt be able to fully reimburse hospitals, nursing homes, and home health agencies for promised benefits.

If this happens, Medicare patients would be hit hard. Theres no way around this. You cannot cut provider payments for medical services without impacting the beneficiaries of those services.

In response to the funding concerns, the Democrats who are sponsoring this bill say that Medicares funding wouldnt be touched under the proposed legislation since those buying the coverage would be required to pay the entire cost.

That means whatever the cost is to the government, would also be the cost to the individual.

Second, youre going to get lots of pushback from healthcare and health insurance companies. Theyll spend millions to lobby against this, which could impact the outcome of the law changes.

From the hospitals perspective, theyll be losing millions of Americans from their most profitable group of patients: Those who are 50 and up and covered by private healthcare. There is a big difference between the reimbursement rate between a Medicare patient and a patient with private health insurance.

Also Check: Does Medicare Pay For Lift Chairs For The Elderly

How Much Do You Need To Retire At 62

The amount you need in order to retire depends on many factors that are specific and personal to each individual. To determine it, you need to go over your lifestyle goals, look at your health, estimate how much you’ll get from Social Security, and more. If you want to retire at age 62, come up with your target amount for retiring at the full retirement age of 67, determine how much you’d need per year, and then add that amount for each year you want to bump up your retirement.

Your Social Security Benefits Could Be Reducedtemporarily

Your age matters here, as we’ll see below, but any reductions that do occur are temporary. The Social Security Administration will eventually recalculate your benefit and give you credit for months when you didn’t receive a benefit, thereby boosting your future benefit. So, don’t let a temporary reduction in payments keep you from returning to work. Here’s how the age rules work:

If you haven’t yet reached your full retirement age between 66 and 67 for people born in 1943 or laterworking could mean temporarily giving up $1 in benefits for every $2 you earn above the annual limit .

Here’s an example of how that might look:

Recommended Reading: Does Medicare Part D Cover Vitamins

Spouses And Social Security

You can claim Social Security benefits based on your spouse’s work record. If claiming spousal benefits provides more, claiming before your FRA on a spouse’s record means you’ll lose even more than claiming on your own recordthe benefit reduction for a spouse is 35% while the reduction for claiming your own benefit is 30%. For instance, if you’re the spouse of Colleen in the above example and you are the same age, you’d be eligible for only $650 a month at age 6235% less than the $1000 a month you would get at your FRA of 67.

Not married? Read Viewpoints on Fidelity.com: Social Security tips for singles

Your decision to take benefits early could outlive you. If you were to die before your spouse, they would be eligible to receive your monthly amount as a survivor benefitif it’s higher than their own amount. But if you take your benefits early, say at age 62 versus waiting until age 70, your spouse’s survivor Social Security benefit could be 30% less for the remainder of their lifetime.

Can I Still Work And Have Medicare At The Same Time

Yes, but you will not be automatically enrolled in Medicare if you are not claiming Social Security benefits. As long as your workplace insurance covers your needs, you are free to stick with it. However, it’s important to consider the size of your company and take advantage of Medicare coverage if you’ve earned it through all your years as a taxpayer.

Recommended Reading: What Is The Annual Deductible For Medicare Part A

How Much Does Medicare Cost At Age 62

Medicare was signed into law by President Lyndon B. Johnson in 1965. The program was designed to provide insurance coverage of hospital expenses through Part A, and of medical costs through Part B. Medicare covers senior citizens aged 65 and older and younger individuals with specific disabilities. Medicare is available for legal permanent residents that have met the qualifying number of years worked. Those eligibilities remain in effect today.

If someone retires at the age of 62, without any of the qualifying disabilities, they will not be eligible for Medicare until the age of 65. If someone retires without a continuing employer-provided health insurance plan, they will need to purchase an individual or family health plan that will meet their medical expectations until reaching the qualifying age of 65.

Medicare Coverage Due to Disease or DisabilityDisease EligibilityImmediate eligibility for Medicare insurance is available for people under the age of 65 with ALS, commonly referred to as Lou Gehrigs disease, and for those with end-stage renal disease, or kidney failure.

Paying for Medicare and Social SecuritySocial Security RecipientsRetired individuals aged 65 and older who are receiving Social Security income will see their Medicare premiums automatically deducted from their monthly statements.

Related articles:

Medicare Eligibility For Medicare Advantage Before 65

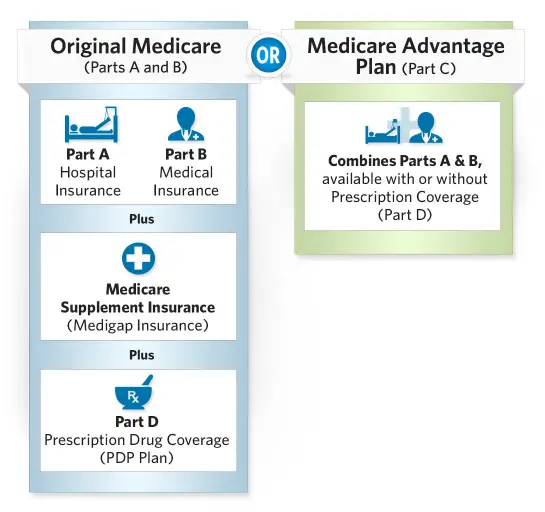

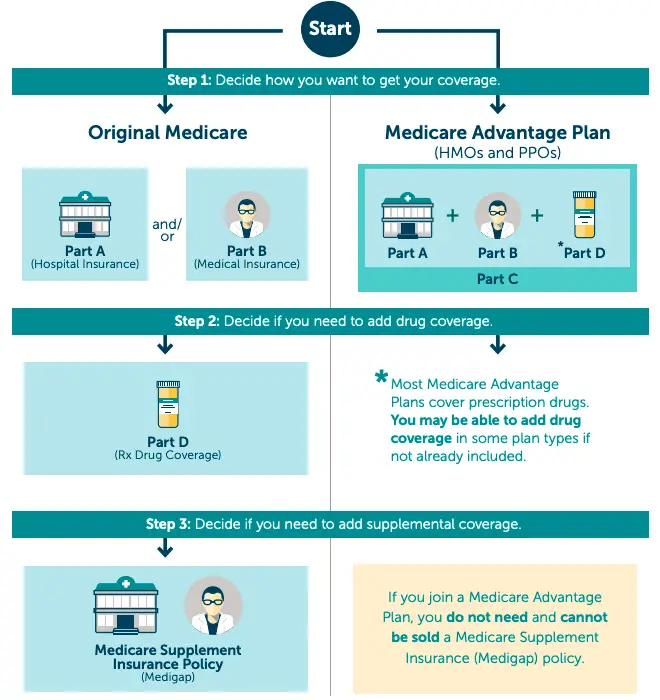

After youre enrolled in Original Medicare, you may choose to remain with Original Medicare or consider enrollment in a Medicare Advantage plan offered by a private, Medicare-approved insurance company.

Medicare eligibility for Medicare Part C works a little differently. Youre eligible for Medicare Advantage plans if you have Part A and Part B and live in the service area of a Medicare Advantage plan. If you have End Stage Renal Disease , you usually cant enroll in a Medicare Advantage plan, but there may be some exceptions, such as a Medicare Advantage plan offered by the same insurance company as your employer-based health plan, or a Medicare Special Needs Plan .

When you enroll in a Medicare Advantage plan, youre still in the Medicare program and need to pay your monthly Medicare Part B premium and any premium the plan charges. The Medicare Advantage program offers an alternative way of receiving Original Medicare coverage but may offer additional benefits. For example, Original Medicare doesnt include prescription drug coverage or routine dental/vision care, but a Medicare Advantage plan may include these benefits and more. Benefits, availability and plan costs vary among plans.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Don’t Miss: Who Do You Call To Sign Up For Medicare

How Do You Qualify For Medicare Early If You Have A Disability

If you have a disability, you may be eligible for Medicare if youâre younger than 65 and:

- You have been collecting Social Security disability benefits for at least 24 months. In this case, youâll likely be automatically signed up for Medicare coverage starting in month 25.

- You have end-stage renal disease . You wonât be automatically signed up for Medicare, though. Youâll still need to contact Social Security or visit their website to enroll.

- You have amyotrophic lateral sclerosis , also known as Lou Gehrigâs disease. If you have ALS, youâll be automatically signed up for Medicare the same month your Social Security disability benefits start.

What Are The Typical Age Requirements For Medicare Coverage

The typical Medicare age requirement is 65, or younger if you qualify for disability benefits. In addition to meeting the age requirement of 65, you must also be a U.S. citizen or legal permanent resident before you are eligible for Medicare.

Most people who are 65 qualify for premium-free Medicare Part A because they have worked for at least ten years and have paid Medicare taxes. Medicare Part A helps cover hospitalization, skilled nursing facility, home health care, and hospice costs. If you are not eligible for premium-free Part A because you have not worked and paid Medicare taxes, but are a citizen with permanent residency and are 65, you can pay premiums to have Part A coverage. If your spouse has worked long enough to qualify for premium-free Part A, your Part A premiums will be free after your spouse turns 62.

When you meet the requirements for Part A, you also qualify for Medicare Part B which helps cover medical out patient costs such as doctors visits, urgent care, durable medical equipment , some preventive care, and more. If you have Part B, there is a monthly premium you pay, which is $148.50 for 2021, and an annual deductible of $203.

Don’t Miss: Does Medicare Cover Full Body Scans

Retiring At 62 Or Before 9 Ways To Cover Your Health Costs For An Early Retirement

There are a lot of hurdles to overcome when figuring out how to retire early before 65. However, early retirement health care is one of the most fiscally challenging. Medical care is going to be expensive no matter when you retire, but the picture is more serious for those who retire early, by choice or otherwise.

Medicare isnt available until age 65 and self-insurance in your 40s, 50s, and 60s can be prohibitively expensive. Never mind that you typically face more health challenges as you age and are therefore more likely to use health care.

Use the NewRetirement Retirement Planner to find out now if you can afford an early retirement and explore the following 9 possibilities for how to cover early retirement health care costs:

If My Spouse Is 65 And Im 62 How Will That Affect My Spouses Medicare Costs

Your spouseâs costs will depend on the type of Medicare plan they choose â Original Medicare from the government or Medicare Advantage from a private insurer. And it will depend on the number of years youâve both worked.

Hereâs the lowdown: At the age of 65, your spouse will qualify for traditional Medicare, also called Original Medicare. That includes Medicare Part A, which covers hospital costs, and Medicare Part B, which covers doctor visits, among other things. If they need additional benefits, like coverage for prescription drugs, vision, hearing, or dental care, they must buy either additional Medicare Supplement plans or enroll in a Medicare Advantage plan that bundles those benefits in one policy.

Chances are that your spouse will have to pay a monthly premium for Part B . But they probably wonât have to pay for Part A. The reason: If your spouse has worked for at least 10 years , theyâve paid taxes to Medicare, so they wonât have to pay a premium for Part A.

And if your spouse hasnât worked for at least 10 years? They can still qualify for premium-free Part A if youâve worked for that amount of time and have paid taxes to Medicare.

If, on the other hand, neither you nor your spouse has worked for at least 10 years, you both may need to pay a premium for Part A. That cost can be as much as $499 a month. Part B is at least $170.10.

Don’t Miss: Does Medicare Cover Cpap Cleaner

Best Rates Health Insurance Before 65

When you go to purchase family member health insurance for elderly over 61 protection, youll definitely want to take the time to evaluate and contrast the rates and deductibles that different organizations offer. Nowadays youll realize that there are many different health insurance age 62 to 65 plan organizations and they offer a variety of programs. With so many competitive programs.

Youll want to evaluate and contrast what the health insurance before 65 programs offer and the prices that youll pay. While it may take a bit of time, it will definitely be worth your time when you are able to get the best possible deal. When comparing programs, make sure you are comparing apples to apples, since the protection limits and deductibles are almost always different in various programs.

The Benefits Of Lowering The Age Of Eligibility For Medicare

From 10,000 feet up, the idea of lowering the age is good news for some. Ive had clients who were able to save large sums and could financially afford to retire but felt like they had to keep working until they could get guaranteed health coverage at age 65 through Medicare.

And then there are those who are forced into early retirement. If you lose your job and are over 55, finding a new job isnt always easy. So what do you do for healthcare at that point?

The plans you can buy on the healthcare exchange plans are very expensive for older Americans. This is where access to Medicare at 62 or even younger ages could help.

According to one study, a typical 60-year-old could buy into Medicare for about $8,000 less per year as compared to a gold-level plan on the insurance exchanges, and $3,700 less than buying a bronze-level plan.

A 2019 Kaiser Family Foundation poll also found most Americans support expanding Medicare coverage. 77% of respondents support the idea of introducing a Medicare buy-in for people as young as 50. This support seems bipartisan 85% of Democrats and 69% of Republicans polled approved of the idea.

At face value, it seems that lowering the eligibility age could be the perfect solution that provides the most options for individuals who are nearing retirement age.

But despite the broad idea of this proposal having public support, there are a few roadblocks that any of these proposals to lower the age will likely meet.

You May Like: Do I Have To Use Medicare When I Turn 65

When & How Do I Sign Up For Medicare

You can sign up anytime while you are still working and you have health insurance through that employer. You also have 8 months after you stop working to sign up.

- Your 8-month Special Enrollment Period starts when you stop working, even if you choose COBRA or other coverage thats not Medicare.

- Your coverage will start the month after Social Security gets your completed forms.

Youll need to have your employer fill out a Form CMS-L564 . If the employer cant fill it out, complete Section B of the form as best you can, but dont sign it. Youll need to submit proof of job-based health insurance when you sign up.

The way you sign up depends on if you already have Part A coverage or if youre signing up for both Part A and Part B. Get forms and ways to sign up.

Avoid the penalty & gap in coverage

Do You Need Extra Help Paying Medicare Premiums

If you never worked and are not eligible for premium-free Medicare, health care can become a considerable expense for you in retirement. There are some options available if you need help paying your Medicare premiums.

You may want to look into Medicaid, an assistance program designed to help cover your health care if you cant afford other forms of insurance. You typically can only qualify for Medicaid if you have a very low level of income.

Another option could be to take advantage of a Medicare Savings Program, where your state can help you pay some of your Medicare costs like your deductible or coinsurance. According to the Medicare website, there are four different programs with their own qualifications, but you typically need to show that you have low income or lack of resources.

You also could qualify for Supplemental Security Income benefits to help lighten your financial burden. SSI benefits are available if you have limited income and are 65 and older, blind or have a disability.

An option that could help specifically with drug prices is Extra Help. This program can pay your prescription drug costs, and you should be eligible for it if you qualify for Medicaid, a Medicare Savings Program or SSI benefits.

-

Not everyone will qualify for subsidized premiums.

-

Does not offer plans in all states

-

International coverage must be purchased separately.

Read Also: What Is A Medicare Medigap Plan