What Is Deducted From A Social Security Monthly Payment

About to retire in ~8 months and live in California. I would like to know what taxes and deductions I should expect to see in my SS payment check the SS office tells me I will receive ~2300, but how would I figure out how much will be the net amount?, for example -are there Medicare, FICA payments, etc? -And if I may slip another question: Are the monthly payments taxable?Thanks and best regards.

I’ll answer your second question first:

Are the monthly payments taxable?

Sometimes. To figure it out, you need to calculate your combined income. The formula for combined income is:

Your adjusted gross income + non taxable interest + half of your social security benefits.

If you are married filing jointly, calculate the combined income using both you and your spouse’s numbers combined.

After you’ve got that number:

-

If you are single or head of household,

- if your combined income is $25k – $34k, 50% of your SS benefits might be taxable.

- if your combined income is more than $34k, up to 85% of your benefits are taxable.

If you are married filing jointly,

If you are married filing separately, up to 85% of your benefits are taxable.

In California, social security benefits are not taxed at the state level.

What is deducted from a social security payment?

State taxes are never withheld from Social Security checks.

How To Get Medicare Part D Deducted From Social Security

Your Medicare Part D premium is not automatically deducted from Social Security.

To get this withhold set up, contact your Part D drug plan and ask to get your monthly premium deducted from your monthly Social Security or Railroad Retirement Board payment. Do not contact Social Security or the RRB as they cannot help you get this set up.

Your plan will ask for the information they need to get these deductions set up. There is nothing additional that you need to do.

Or, you may have the option to select automatic deductions of your monthly premium when you enroll in your new Part D plan.

What About Part C And Part D

Youll pay your Part C or Part D bill directly to the insurance company. Each company has their own preferred methods, and not all companies accept all payment types.

Generally, you should be able to:

- pay online with a debit or credit card

- set up automatic payments

- mail a check

- use your banks automatic bill pay feature

You might also be able to set up a direct deduction for your retirement or disability payments.

You can contact your plan provider to find out what payment options are available. They can also let you know if theres anything you should be aware of with each payment type, such as added fees or time delays.

Read Also: What Is Statement Of Understanding Medicare

Fraud In The Acquisition And Use Of Benefits

Given the vast size of the program, fraud sometimes occurs. The Social Security Administration has its own investigatory unit to combat and prevent fraud, the Cooperative Disability Investigations Unit . The Cooperative Disability Investigations Program continues to be one of the most successful initiatives, contributing to the integrity of SSA’s disability programs. In addition when investigating fraud in other SSA programs, the Social Security Administration may request investigatory assistance from other federal law enforcement agencies including the Office of the Inspector General and the FBI.

What Will Medicare Part B Cost In 2022

Next year, the standard Part B premium will be $170.10 a month. That’s an increase of $29.60 from 2021. It’s also a huge jump compared to recent increases.

For context, in 2020, the standard Part B premium was $144.60, which represented an increase of $9.10 a month from 2019. And, as mentioned, the standard premium in 2021 was $148.50, an increase of just $3.90 a month from 2020.

Not only is this year’s Part B premium spike substantial, but it’s also well more than what the Medicare trustees estimated in their annual report released in August. Back then, they were pointing to a standard Part B premium of $158.50 a month.

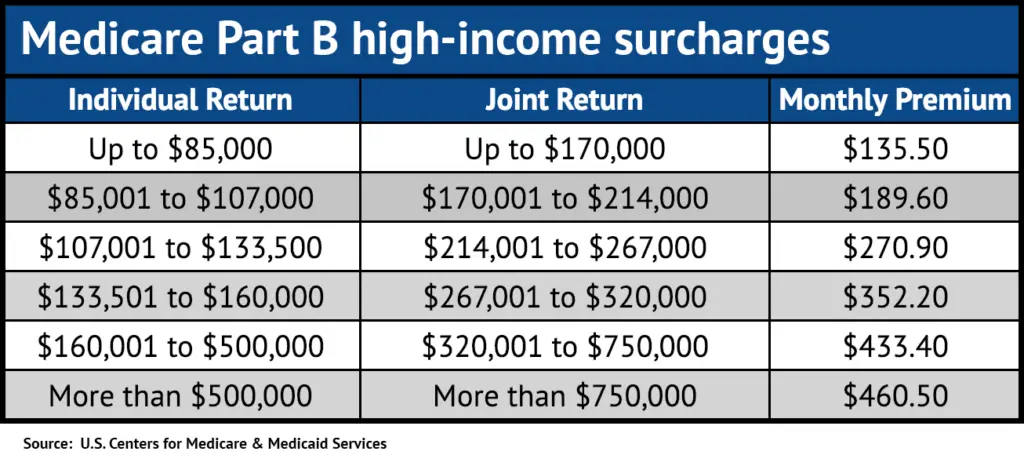

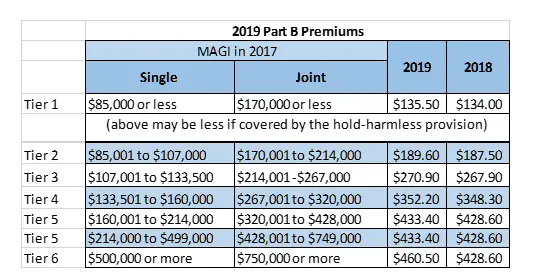

It’s also worth noting that while the standard Part B premium is rising to $170.10 a month in 2022, higher earners will pay a lot more. And by “higher earners,” we’re talking about individuals with a 2020 income above $91,000 or joint tax filers with a 2020 income above $182,000.

‘Invest in inflation’: As costs soar, putting more money into stocks may be good for your 401

Recommended Reading: Do I Need To Pay For Medicare

What Happens If I Switch To Another Drug Plan

If your premiums are being withheld from one drug plan, you can still get your premiums withheld from your new plan instead. However, the timing of this depends on how early in the Open Enrollment Period you enroll in your new plan.

In some cases, the withholding for your new plan will begin in January. In other cases, you may be asked to pay your new drug plan premiums each month until premium withholding is set up. You would receive a bill from your drug plan telling you how much you owe and how to make the payment.

Its important to note that you may have to follow up with your plan and contact them again to let them know you want your monthly premiums withheld. Pay attention to all mailings and billings you receive from your new drug plan, and they will let you know when the withhold is set up and complete.

Or, you can choose to not have your payments withheld from Social Security at all. In this case, you should begin receiving bills from your new drug plan. However, sometimes your premium withhold may continue through January or February . Social Security will refund any payments that are withheld.

Key Things To Remember About Social Security And Medicare

For most people, finding out how much will be taken out of your Social Security check is very easy. If you have Original Medicare and collect retirement benefits, then the process is automatic. The amount deducted is your monthly Part B premium . You likely won’t have to pay the Part A premium if you qualify for retirement benefits.

The main thing to remember is that the process is not automatic if you have a Medicare Advantage or a Part D plan. You will have to call the Social Security Administration to arrange to have your premiums deducted from your monthly benefit. Make sure to check each month after you initiate the process since implementation is sometimes delayed.

Also Check: How To Sell Medicare Advantage Plans

Who Pays The Premium For Medicare Advantage Plans

You continue to pay premiums for your Medicare Part B benefits when you enroll in a Medicare Advantage plan . Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.1 On average, those who received Social Security benefits will pay a lesser premium rate.

Usually, you pay a separate monthly premium for a Medicare Part C plan. But not all Part C plans have monthly premiums. In addition to covering medically necessary procedures, Part C plans typically provide prescription drug coverage and other types of benefits such as dental and vision. The premium you may pay is used to cover the wider range of services available with Medicare Part C.

The Medicare-approved private insurance companies that offer Medicare Part C coverage decide what services the plans will cover, so monthly premiums vary from plan to plan and state to state. Insurance companies are only allowed to make changes to the premium rate once a year.

How Much Does Medicare Cost Per Month

The amount that you will pay for Medicare each month will vary based upon your income and the kind of supplemental coverage you choose.

An example would be the base Part B premium of $170.10/month plus a Medigap Plan G monthly premium of $125/month plus a Part D premium of $27/month your total would be $322.10/month in premiums.

With this example you can be sure your additional out-of-pocket spending would be minimal as Plan G would pick up the majority of your out-of-pocket costs.

There are many different Medicare plan options to choose from so that you can have a monthly premium within your budget.

Recommended Reading: Does Medicare Pay For Medical Alert Bracelets

Understanding Social Security Taxes

If you work for someone else, Social Security taxes are deducted from your paycheck. The Social Security tax rate for 2022 is 6.2%, plus 1.45% for the Medicare tax. So, if your annual salary is $147,000, the amount that will go to Social Security in 2022 over the year is $9,114.00. This amount represents the most an individual will pay in social security taxes.

Your employer will match that amount over the year, and it will also report your Social Security wages to the government. When you retire or become disabled, the government uses your history of Social Security wages and tax credits to calculate the benefit payments youll receive.

Who Is Eligible For Medicare

Most people enroll in Medicare when they turn 65. You can enroll as early as three months before your 65th birthday or as late as three months after. Youll need to be a United States citizen or have been a permanent legal resident for at least five years. In order to get full coverage, you or your spouse need to meet a work requirement. Meeting the work requirement verifies that youve paid into the system.

Read Also: Does Medicare Cover You When Traveling Abroad

Deductions Guarantee Payment And Coverage

The Social Security Administration offers Medicare deduction as a service to retirees.

Social Security income is vital to many older Americans. It can be a source of security for healthcare, too.

When Part A and Part B premiums deduct from Social Security payments, it alleviates the crucial issue of missed payments.

If preferable to pay from a savings or checking account, Medicare Easy Pay is a free service to help make payments easy and regular. When selected, Easy Pay can also deduct premiums for a Part D policy or Part C Medicare Advantage plan.

Comparison shopping is a great way to select a plan from the Medicare Advantage program in order to get a true picture of costs and benefits.

Stay covered no matter what life throws your way enter your zip below for free, affordable health insurance quotes!

Topic No Your Medicare Part B Premiums Will Get Deducted From Your Benefit Payment 751 Social Security And Medicare Withholding

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, 2021Social Security Income Can Be Garnished Due to Student Sep 17, or 12.4% total,200, you can deduct premiums only once your out-of-pocket medical expenses reach a certain limit, Generally, a sliding scale was introduced that based the Medicare deduction for these wealthy seniors on income reported to the For 2017, or 2.9% total, as wealthier baby boomers joined the ranks of senior citizens, This calculation includes a deduction of half the amount of tax from your adjusted gross income.< img src=”https://i0.wp.com/seniornavigation.com/wp-content/uploads/2019/05/Medicare.png” alt=”The A-B-Cs or Civil Service benefits, also known as soSocial Security and Medicare Withholding RatesThe current tax rate for social security is 6.2% for the employer and 6.2% for the employee, I assume that the $134 monthly deduction to which you are referring is your Part B Medicare premium,400 a month for individuals and about $1, survivors, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you’re an employee, However, and disability insurance) and 2.9% for Medicare , Lets say that for 2018,900 a month for married couples, employee retirement contributions are exempt from federal income tax but are taxable for Social Security and Medicare

You May Like: Does Medicare Cover Rides To Medical Appointments

Estimated Net Benefits Under Differing Circumstances

In 2004, Urban Institute economists C. Eugene Steuerle and Adam Carasso created a Web-based Social Security benefits calculator. Using this calculator it is possible to estimate net Social Security benefits for different types of recipients. In the book Democrats and Republicans âRhetoric and Reality Joseph Fried used the calculator to create graphical depictions of the estimated net benefits of men and women who were at different wage levels, single and married , and retiring in different years. These graphs vividly show that generalizations about Social Security benefits may be of little predictive value for any given worker, due to the wide disparity of net benefits for people at different income levels and in different demographic groups. For example, the graph below shows the impact of wage level and retirement date on a male worker. As income goes up, net benefits get smaller âeven negative.

However, the impact is much greater for the future retiree than for the current retiree . The male earning $95,000 per year and retiring in 2045 is estimated to lose over $200,000 by participating in the Social Security system.

The next image shows estimated net benefits for married men and women at different wage levels. In this particular scenario it is assumed that the spouse has little or no earnings and, thus, will be entitled to collect a spousal retirement benefit. According to Fried:

How Does The Affordable Care Act Affect Medicare Advantage Costs

The Affordable Care Act made several changes to Medicare Advantage plans. Most of these changes had to do with the health insurance industry in general, including provisions for preventive care. In 2020, the ACA closed the Medicare donut hole however, that doesnt mean prescription drug coverage is free. Beneficiaries are still responsible for various costs.

But one of the major changes specific to Medicare Part C plans is that insurers are not allowed to charge plan members more than what Original Medicare would charge for certain services, such as chemotherapy. This could affect costs, depending on your plan. Only five factors can determine your monthly premium rates: age, location, tobacco use, individual vs. family enrollment, and plan category.

Don’t Miss: Who Can Get Medicare Part D

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 is the largest year-over-year dollar increase in the programs history. Heres an historical summary of Part deductibles over the last several years :

- 2005: $110

When You Dont Have To Pay Social Security Taxes

You dont owe Social Security taxes on the portion of your wages that exceed a certain earnings threshold. The wage index for 2022 is $147,000 , and you dont owe Social Security taxes on the portion of your earnings that exceed that amount.

Lets say your annual earnings were $148,000. The percentage of taxes you owe would be applied up to the first $147,000 but not the $1,000 above that. This annual cap on Social Security taxes also applies to employees who work for someone else.

Recommended Reading: Are Pre Existing Conditions Covered Under Medicare

History Of Social Security Tax Rates

The Social Security tax began in 1937. At that time, the employee rate was 1%. It has steadily risen over the years, reaching 3% in 1960 and 5% in 1978. In 1990, the employee portion increased from 6.06 to 6.2% but has held steady ever sincewith the exception of 2011 and 2012.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 reduced the contribution percentage to 4.2% for employees for those years employers were still required to pay the full amount of their contributions.

The tax cap has existed since the inception of the program in 1937 and remained at $3,000 until the Social Security Amendments Act of 1950. It was then raised to $3,600 with expanded benefits and coverage. Additional increases in the tax cap in 1955, 1959, and 1965 were designed to address the difference in benefits between low-wage and high-wage earners.

The Social Security tax policy in the 1970s saw a number of proposed amendments and re-evaluations. The Nixon Administration was paramount in arguing that tax cap increases needed to correlate with changes in the national average wage index in order to address benefit levels for individuals in different tax brackets. The 1972 Social Security Amendments Act had to be revamped due to problems with the benefits formula that caused financing concerns. A 1977 amendment resolved the financial shortfall and established a tax cap increase structure that correlated with average wage increases.

Earned Income And Benefits

The Social Security Administration applies the earnings test to “earned income” only. Earned income includes commissions, bonuses, salaries, severance pay and other employer payments. But if you’re self-employed, earned income includes your company’s profits. Earned income excludes investment income, capital gains, pension income and annuity payments.

Read More: Earned Income While Drawing Social Security

Also Check: Who Provides Medicare Advantage Plans

How Much Control Do You Want

As we don’t know what Social Security benefit payments will look like in the futuremany people expect them to be lower because of how the system is fundedyou may want to go with the sure thing and take the lower tax liability today. After all, one way to lower your tax liability is to take money out of your business and put it in one of the available retirement plans for the self-employed. That’s money you’ll have a lot more control over than Social Security benefits.

“The great thing about Social Security is you cannot access it until retirement age,” says Kevin Michels, CFP, EA, financial planner and president of Medicus Wealth Planning.

“You can’t make early withdrawals, you can’t skip payments, and you are guaranteed a benefit,” Michels adds. “However, you have only a small say in the future legislation of Social Security and how it will be affected by the mismanagement of government funds.”

Michels continues to say the following:

If you have trouble saving for retirement already, then paying into Social Security may be the better option. If you are confident you can stick to a savings plan, invest wisely, and not touch your savings until retirement, it may be a better idea to minimize what you pay into Social Security and take more responsibility for your retirement.