Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

When To Sign Up For Medicare Part B

If youre retiring, the best time to enroll in Part B is during your Initial Enrollment Period. For those still working past 65, check with your health administrators whether your employer coverage is creditable.

If it is, you can enroll in Part B when you retire or leave your group health plan. Youll be eligible for a Special Enrollment Period when you can enroll without any penalties. If your group health plan is not considered creditable coverage, then you should register for Part B during your Initial Enrollment Period.

If you missed your Initial Enrollment Period, the next enrollment window you can enroll in Part A and Part B is the General Enrollment Period.

When Should You Apply For Medicare If You Have Employer Health Coverage

Most people should sign up for Medicare Part A when theyre first eligible because it rarely costs anything. But some people delay enrolling in Part B because they dont want to pay the monthly premium. The decision usually depends on the type of health coverage you already have.

You can put off enrolling in Part B at age 65 if you have group health coverage through your or your spouses job and the employer has at least 20 employees.6 Youll be able to enroll with no penalty during the Special Enrollment Period that follows the end of your employers insurance. You can also choose to enroll in Part B while still insured and pay the premium.

If your employer has fewer than 20 employees, you should apply for Part A and Part B as soon as youre eligible.7

Be sure to talk to your employers benefits administrator about how signing up for Medicare will affect your coverage or Health Savings Account .8 You cannot contribute to an HSA if you have Medicare Part A. Your administrator can help you time the beginning and end of your coverage through work and your new health insurance so theres no gap in your coverage.

When your group coverage is ending, youll need to complete documentation and submit it to your Social Security office. If you have questions, ask Social Security.

Read Also: How Much Is Medicare Copay For A Doctor’s Visit

Step By Step Instructions For Filling Out This Application

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Recommended Reading: What Does Part B Cover Under Medicare

When To Enroll In Medicare If I Dont Want Medicare Part B:

If youre automatically enrolled in Medicare Part B, but do not wish to keep it you have a few options to drop the coverage. If your Medicare coverage hasnt started yet and you were sent a red, white, and blue Medicare card, you can follow the instructions that come with your card and send the card back. If you keep the Medicare card, you keep Part B and will need to pay Part B premiums. If you signed up for Medicare through Social Security, then you will need to contact them to drop Part B coverage. If your Medicare coverage has started and you want to drop Part B, contact Social Security for instructions on how to submit a signed request. Your coverage will end the first day of the month after Social Security gets your request.

If you have health coverage through current employment , you may decide to delay Medicare Part B enrollment. You should speak with your employers health benefits administrator so that you understand how your current coverage works with Medicare and what the consequences would be if you drop Medicare Part B.

Understanding What Medicare Part B Offers

First, lets take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications: medically necessary services and preventive services. What qualifies something as medically necessary? In general, medically necessary services must be medical treatments that are required to treat a recognized medical condition or illness. Necessary services and items might include the following:

- Diagnostic equipment

- Supplies, such as walkers or wheelchairs

- Surgeries

For example, diabetics need regular doctor visits to ensure appropriate blood levels, as well as appropriate diagnostic coverage to ensure accurate readings.

Medicare Part B beneficiaries also gain access to preventive services, like yearly screenings for the flu or certain cancers. In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

As of the 2019 plan year, the Centers for Medicare and Medicaid Services has lifted coverage caps on critical services covered under Medicare Part B. These include physical therapy, speech language pathology and occupational therapy.

But original Medicare doesnt cover everything. You may need to obtain supplemental insurance, such as Medigap, if you need coverage for the following:

Don’t Miss: Is Stem Cell Treatment Covered By Medicare

Do I Need Medicare Part B If I Have Other Insurance

Many people ask if they should sign up for Medicare Part B when they have other insurance or private insurance. At a large employer with 20 or more employees, your employer plan is primary. Medicare is secondary, so you can delay Part B until you retired if you want to.

Keep in mind that both parts of Medicare can coordinate with large employer coverage to reduce your spending. Youll need to decide whether you want to enroll in Part B or delay it until later.

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020. You can avoid that cost by simply delaying your Part B enrollment until you retire.

Medicare Part B Enrollment: There’s Still Time To Sign Up

Most people get Medicare Part B when they turn 65. If you didn’t sign up for Part B then, now’s the time to decide if you want to enroll.

During Medicare’s General Enrollment Period , you can enroll in Part B and your coverage will start July 1.

Deciding to enroll in Part B is an important decision. It depends on the type of coverage you have now. Its also important to think about the Part B late enrollment penaltythis lifetime penalty gets added to your monthly Part B premium, and it goes up the longer you wait to sign up. Find out if you should get Part B based on your situation.

If you only have Medicare Part A , adding Part B can help you get the most out of your Medicare coverage. Part B helps cover:

- Services from doctors and other health care providers

- Outpatient care

Don’t Miss: How Do I Get Dental And Vision Coverage With Medicare

How To Apply For Medicare Through The Rrb

If you worked for the railroad, call the Railroad Retirement Board at 877-772-5772 or submit an online service request through the RRB website.

The best time to apply is during the Medicare Initial Enrollment Period. Or, you can sign up during the Medicare General Enrollment Period.

Note: If you are still working, you can still sign up for RRB Medicare coverage when you turn 65. No need to retire.

If you, or a family member, are already receiving a railroad retirement annuity, you will automatically be enrolled in Medicare Part A and B. Coverage begins when you turn 65.

Delaying Part B Coverage And Late Enrollment Penalties

You should enroll in Part A when youre first eligible near your 65th birthday, but some people may choose to delay Part B.

If you receive group health insurance at work or through your spouses employer you may be able to delay enrollment in Part B.

But once you stop working or that coverage ends, you must sign up for Part B within eight months. Otherwise, youll face a late enrollment penalty.

If you enroll in Part B after your group health insurance ends, you have options for how to apply.

You can do so online through an application on the Social Security website or by mail.

How to Sign Up for Part B by Mail After Employer Health Insurance Ends

Don’t Miss: Does Medicare Pay For Bunion Surgery

Do You Need To Apply For Medicare

Most people do need to apply for Medicare. But if you reach age 65 and youre already receiving retirement benefits from Social Security or the Railroad Retirement Board, youll be signed up for Medicare Part A and Part B automatically.

And if you arent receiving retirement benefits and you dont have health coverage through an employer, you will need to apply for Medicare as you approach age 65. If you need to apply, Medicare gives you several options.

How Do You Apply By Phone

Call 772-1213 or TTY 325-0778 between 7 a.m. and 7 p.m. from Monday through Friday.5 Keep in mind that this process takes longer because forms have to be mailed to you, which you then complete and send back. At peak times, applying for Medicare by phone could take a month or more.

If you worked at a railroad, you can enroll in Medicare by calling the Railroad Retirement Board at 772-5772 or TTY 751-4701, 9AM 3:30PM, Monday Friday.

You May Like: How To Get New Medicare Card Without Social Security Number

Medicare Part D And Va Benefits

You can have both VA prescription drug benefits and a Medicare prescription Part D drug plan, however you may not need one. With VA health benefits, you typically get premium-free drug coverage. However, if the VA-approved pharmacy locations or the Consolidated Mail Outpatient Pharmacy Program , doesnt work for you, then you may consider a Part D or a Part C plan with prescription drug coverage. Part D coverage may also work for your needs if you qualify for Extra Help or if your nursing home is outside of the VA health system and you need medications from the nursing home pharmacy. If you choose to enroll in Part D at a later time, you can do so without paying a penalty. Learn more about Medicare Part D.

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Read Also: Does Social Security Automatically Sign You Up For Medicare

I Want To Sign Up For Only Part A Or Both Part A & Part B

Once youre eligible to sign up for Medicare , you have 2 options:

Once you sign up , youll get a welcome package with your Medicare card.

Sign Up For A Mymedicaregov Account

After you sign up for Medicare, you can create a MyMedicare.gov account to manage your coverage.

With your MyMedicare.gov account, you can:

- Get details about the plans youre enrolled in and what they cover.

- Update your personal information.

Creating an account on MyMedicare.gov is quick and easy.

How to Sign Up for MyMedicare.gov

Recommended Reading: How Old To Be Covered By Medicare

Do Medicare Supplement Insurance Plans Renew Automatically

Yes, coverage is guaranteed renewable on an automatic basis as long as premium payments are maintained. Again, it is important to look into multiple polices and providers when it comes to Medicare Supplement coverage, as policies and rules can vary among states and providers.

:

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

NEW TO MEDICARE?

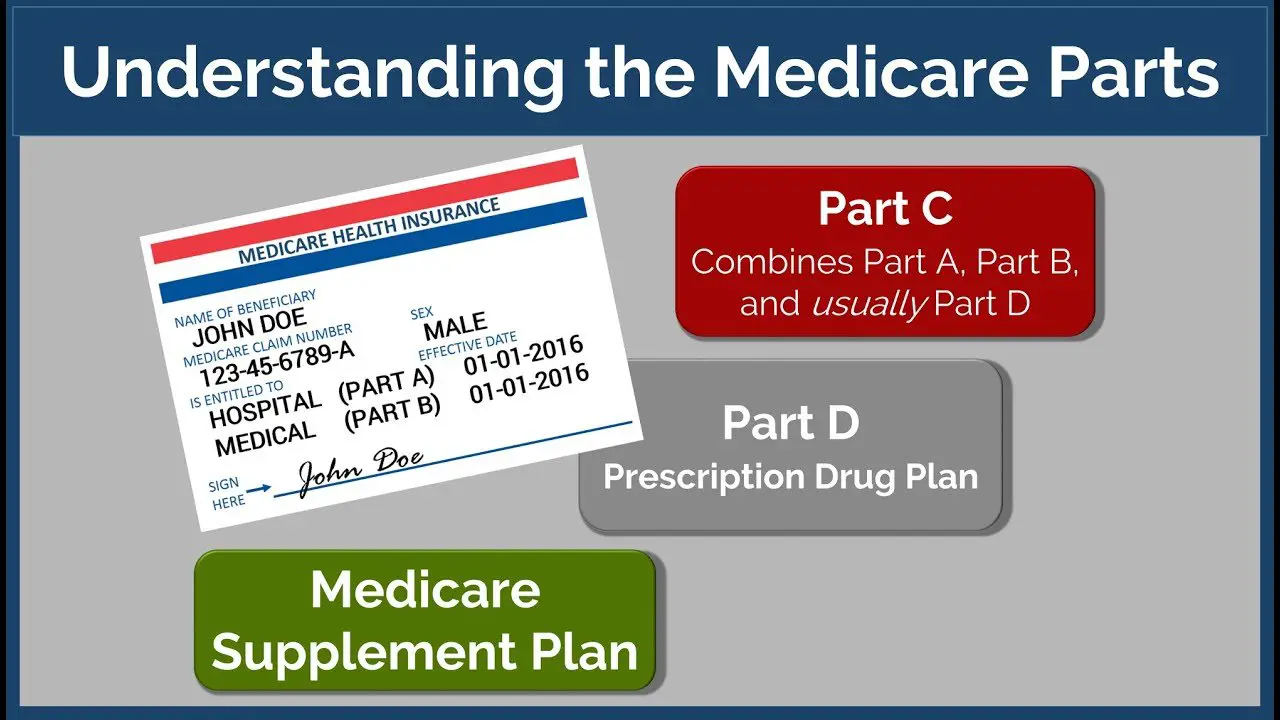

Medicare Part A: Hospital Insurance

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021.

Services covered under Part A may include surgeries, inpatient care in hospitals, skilled nursing facilities, hospice care, home healthcare services, and inpatient care in a religious non-medical healthcare institution.

This sounds straightforward, but it’s not. For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility.

Additionally, if you’re hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day’s expenses. If you’re admitted to the hospital multiple times during the year, you may need to pay a deductible each time.

You May Like: Does Medicare Require A Referral For A Colonoscopy

What Is The Part B Premium Reduction Plan

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage, youll see a section that says Part B premium buy-down this is where you can see how much of a reduction youll get. Although, your agent or the customer service number on the back of your card can also tell you about the coverage.

Ways To Apply For Disability Benefits:

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Once your disability benefits start, well mail you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up for Part B and pay a monthly late enrollment penalty.

Also Check: Can Medicare Take Your House