Is Uninsured Motorist Coverage Right For Your Household

When youre looking at different types of coverage, it might be clear what you can and cant afford. Usually, if you have collision coverage, then you should add UIM onto your policy. Although what you can afford affects a lot of peoples insurance decisions, but UIM is part of Georgia states basic requirements.

The purpose of requiring people to have UIM is to ensure that people can access compensation for their injuries. Its a safety net to help people avoid falling into the financial pitfall of getting into bad accidents and then living with medical debt for decades.

How Does Uninsured Motorist Coverage Work

Many people are surprised to find out that around one in seven drivers in the United States does not have an automobile insurance policy. Some states have higher rates of uninsured drivers than others, coming in at as high as 1 to 5. If you are involved in a collision with another driver, there is a chance that they have no insurance policy to help cover the expenses. Uninsured motorist coverage provides financial protection by covering certain costs after a person who has the policy has a collision with an uninsured driver. If the other driver was both at fault and had no insurance plan, you cannot make a claim with the other driver’s insurance provider, because there is no company providing insurance to them.

The driver is still personally liable for any damages caused by accidents of this type, but many people who do not have automobile insurance do not have enough assets to pay for medical expenses and property expenses that you incur, even if you sue them. It may be impossible to claim the compensation you need to pay for your losses, but if the other driver has only a tiny sliver of the amounts of money it costs to pay the medical bills you have, you are never going to be able to get the amount you are fully owed.

Uninsured Motorist Coverage Limits

UM coverage is usually expressed as two numbers, such as 100/300. This translates to:

- $100,000 bodily injury coverage per person.

- $300,000 bodily injury coverage per accident.

So if you have 100/300 and four passengers are injured, with high medical bills, your maximum UM payout is $300,000. However, you can generally turn to health insurance after your UM coverage is exhausted.

You May Like: Is Accu Chek Covered By Medicare

What If Im Hit By An Uninsured Motorist

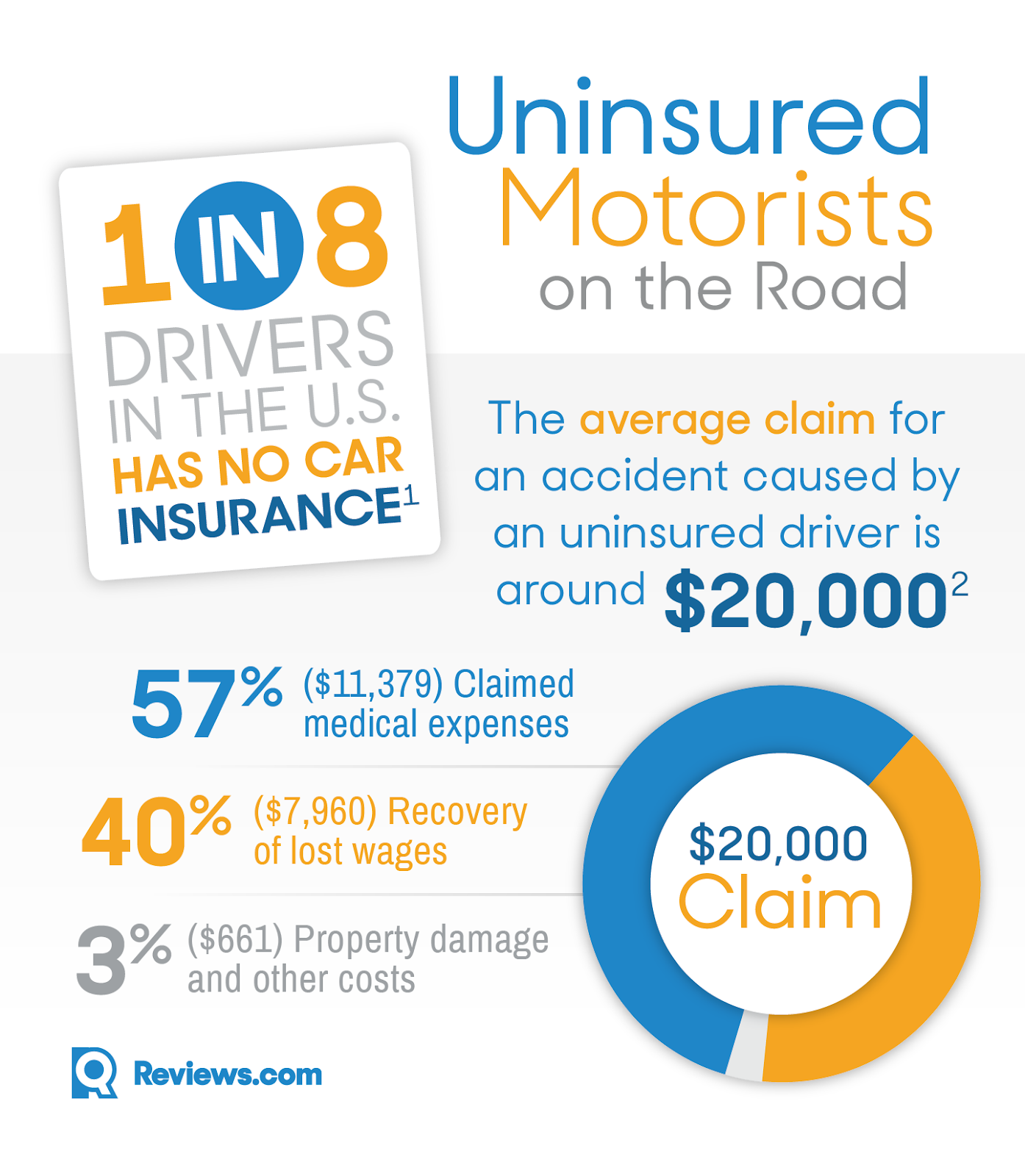

A 2015 study from the Insurance Research Council found that 1 in 8 American drivers are uninsured. They also found that approximately 20.3% of Michigan drivers dont have auto insurance. If you or a loved one were hit by an uninsured motorist, your first step should be to file a claim with your insurance company. If your injuries are severe, call our auto accident attorneys to evaluate your case.

How Does A Person Bring A Claim

Under most policies of insurance, a driver is obligated to notify the drivers insurer promptly after an accident, regardless of whose fault it is. .

But California law requires people to file a form SR-1 California accident report with the California Department of Motor Vehicles within 10 days if they are involved in an accident in which anyone is injured or the vehicle damage exceeds $1,000.2

Failure to notify the DMV as required by California law may result in the suspension of the drivers license.3

What happens after the DMV and insurers are notified?

Once an accident has been reported, the insurer will use the police report , witness statements, photographs and an examination of the insureds vehicle to determine fault for the accident.

The determination made by the insurer is not the final word. The insured party has the right to file a lawsuit to challenge the insurers decision.

And even if an insured was partially to blame for accidents filing the suit may be worthwhile because of Californias comparative fault law. This law allows people that are partly to blame for an accident to recover a portion of their damages.

Also Check: Are Chemotherapy Drugs Covered By Medicare

What Happens To An Uninsured Motorist In An Accident

An uninsured motorist involved in an automobile accident will face significant fines and the potential of criminal charges. Damage to their vehicle will not be covered and they will have to pay out of pocket to repair damages. Drivers that don’t a active auto policy could also face a lawsuit from the other driver or insurer to seek damages.

Do I Need Uninsured Motorist Coverage

You will need uninsured motorist coverage if your state requires it. Because uninsured motorist insurance can be very affordable and your liability insurance alone will not protect you against an uninsured motorist on its own, UM is certainly worth considering for most drivers.

Below are some pros and cons of UM coverage:

|

Pros of Uninsured Motorist Coverage |

Cons of Uninsured Motorist Coverage |

|---|---|

|

Low cost compared to other coverages |

Some states require UM to match high liability coverage limits |

|

Covers repair bills when responsible party doesnt have insurance |

Not all plans cover hit-and-runs |

|

Covers medical bills when responsible party doesnt have insurance |

Recommended Reading: Does Medicare Cover Cosmetic Surgery

Some Doctors On Health Insurance Plans Will Refuse To See Patients Involved In A Car Accident Claim

Also, some doctors on health insurance plans, will refuse to see patients who are involved in an injury claim or lawsuit. Itâs mostly because they donât want to ever have to testify and, while I may disagree, the doctor is allowed to choose who he/she will or wonât see. I had a case just like this earlier this year.

While our law firm is based in Miami, we represent people all over the state. I represented a client in the Jacksonville area who was in a bad car accident. He had health insurance. But after many months of therapy, it became apparent to him and his doctors that he would need surgery. But no spine surgeon in that area, on his health insurance plan, would do the surgery because a lawsuit was involved. Luckily, we were able to get the client to a reputable neurosurgeon, not on his health insurance plan, who was willing to operate on a letter of protection. If the client did not have sufficient uninsured motorist coverage he wouldnât have been able to both receive the care that he desperately needed and make a recovery for his pain and suffering.

Do I Need Uninsured Motorist Coverage If I Have Collision And Comprehensive

Uninsured motorist coverage pays your medical expenses if you are struck by an uninsured driver. This coverage is an important part of your auto insurance package. Even if you have collision and comprehensive coverage, it might not be enough. Here are some ways you can make sure youre covered.

Recommended Reading: Does Medicare Cover Organ Transplants

Health Insurance Will Not Pay For Lost Wages Or Pain And Suffering

But, you can have the best health insurance in the world and you should still get UM coverage because health insurance only pays for Medical treatment. In a serious car accident, you are entitled to more than just medical treatment. If the at-fault party doesnât have insurance, or enough insurance to compensate you, Uninsured Motorists coverage pays for lost wages and pain and suffering.

What To Do If You Don’t Have Uninsured/underinsured Motorist Coverage

Your auto policy might not include uninsured/underinsured motorist coverage. If you don’t have this coverage, you’ll need to rely on other coverage you might’ve bought. Collision coverage, for example, may pay for your damaged car. Personal injury protection can be used for injuries related to the accident.

If you don’t have any of these coverages, you’ll need to pay for repairs, medical bills , and maybe a rental car. You may then personally pursue the at-fault party directly to recover your costs.

Read Also: Does Medicare Offer Dental Plans

Uninsured Motorist Property Damage Vs Collision Coverage

Uninsured motorist coverage for property damage and collision coverage both pay for damage by a driver with no or not enough insurance. However, collision coverage will only pay for damages to your car, regardless of who is at fault, while UMPD depending on your state may cover damages to both your car and other property caused by an uninsured or underinsured driver.

What Is Physical Damage Insurance Coverage

Physical damage coverage is not an all-in-one car insurance. Typically, it only includes your collision insurance and comprehensive insurance policies. This means physical damage insurance can give you coverage for damages caused by fire and theft. So, if someone breaks into your car, it’ll help pay for the repairs.

Don’t Miss: Where Do You Apply For Medicare

What Should I Ask For In A Settlement

5 Questions To Ask Before Accepting A Settlement

- Will It Cover Future Medical Bills? …

- Are All Your Lost Wages Covered? …

- Are You Being Compensated For Pain And Suffering? …

- Is Property Damage Included? …

- Will This Impact A Claim For Punitive Damages? …

- Have The Settlement Offer Reviewed By A Lawyer For Free.

How Much Uninsured Motorist Do I Need

All policies in Ontario have UM limits. The minimum limit is $200,000. This may or may not be enough depending on the type of accident and damages. Drivers have the option to increase limits by using the Family Protection Endorsement, OPCF 44R, where you can get additional protection up to $2 million.

Also Check: Does Medicare Part B Cover Inpatient Hospital Services

Is Uninsured Motorist Necessary

Yes. In Canada, there are about 8 million registered passenger vehicles and an estimated 2% of all drivers on the road in Canada do not have it. UM policies ensures you are covered if you are involved in an accident with a driver who does not have an active policy.

However, even with minimum requirements, you may not be protected for all damages caused by a UM. This is why its recommended to increase your limits.

What Happens If I Dont Have Uninsured Motorist Coverage

If you dont have uninsured motorist coverage and get hit by someone without insurance, you could sue the at-fault driver in court. But you would most likely need to hire a lawyer and the legal process could be time-consuming.

Uninsured motorist coverage not only pays for your medical expenses, but also for lost wages, pain and suffering and funeral expenses. Its easier to have your insurance company take care of your medical bills than take your chances in court.

You May Like: Is Root Canal Covered By Medicare

How Health Insurance And Uninsured Motorists Coverage Work Together In A Car Accident

Generally, more insurance is better than less insurance. He or she who has both health insurance and uninsured motorists coverage will have more options for treatment, less likely to owe any medical bills, and more likely to make a financial recovery.

Health insurance and UM auto insurance can work in tandem. To explain how, Iâll use the example of a car accident that requires emergency room treatment. What you as the car accident victim will do is present both your car insurance card and your health insurance card to the hospital billing department. If the bills exceed your no-fault PIP insurance benefits, the hospital will then bill your health insurance.

If you need follow up care, you will have the option of seeing a doctor who takes your health insurance â or you can see a doctor who will see you on whatâs called a letter of protection â where the doctor agrees to treat you now with no out-of-pocket co-pays or deductibles, with the understanding that the provider will get paid after the case is settled. Immediately, you may notice that this opens up some options.

Optional Automobile Insurance Coverage

Uninsured/underinsured motorist coverage. Uninsured/underinsured motorist coverage is optional in Colorado. This coverage pays for the insured’s bodily injury losses caused by a hitandrun driver, a driver with no automobile insurance, or a driver of an underinsured vehicle. UM/UIM coverage takes the place of the insurance the other driver should have purchased, or protects the insured when the atfault driver’s vehicle is insured, but the bodily injury liability limits of his or her policy are less than the limits of the insured’s UM/UIM coverage. This coverage does not protect the other driver, and it does not cover damage to the insured’s vehicle. Under current law, all insurers in the state must provide UM/UIM coverage in an amount equal to the policyholder’s current level of liability coverage for bodily injury, unless this coverage is waived by the policyholder in writing. A policyholder making such a rejection may opt to carry a lower level of coverage or reject coverage completely.

Comprehensive and collision coverage. Comprehensive insurance protects the insured against other types of damage to his or her vehicle, such as falling objects, fire, natural disaster, theft, or vandalism,. Collision insurance pays for damage to a vehicle from a collision with another vehicle or object, or from a rollover. While not required by law, collision coverage may be required by lenders as a condition of vehicle financing.

Also Check: Does Medicare Cover Flu Shots

How Does An Uninsured Motorist Coverage Claim Work

Normally the way car insurance works is that if an accident occurs and you are not the at-fault driver, then your claim can be filed easily with the insurance company of the other party involved in the accident.

The insurance company then provides compensation for your car and medical expenses, depending on the severity of the injury.

Every state, except for New Hampshire, requires that each driver must have auto liability insurance, which keeps you protected from at-fault drivers. However, if the accident you are in occurs with an at-fault driver who is uninsured or underinsured, without underinsured motorist insurance you would have to pay out of pocket.

In the same scenario, where the at-fault drivers auto liability coverage cannot pay for all the damages, or if they are uninsured, but you have uninsured motorists insurance then your insurance will pay for the extra expenses. This saves you from an excess liability fee.

How Do I Get Uninsured Motorist Coverage

People should get free quotes on car insurance policies from Policy. On this website, you get the tools to compare car insurance prices from multiple companies and find the best rates. Keep in mind that if you are adding on car insurance, are purchasing additional car insurance, or have had a significant life event such as a marriage, child, or a move, getting additional quotes for automobile insurance can save you a lot of money.

Also Check: Does Medicare Cover A1c Test

On And After July 1 2020

Michigan will still be a no-fault auto insurance state on and after July 1, 2020. However, Michigan drivers wont be required to carry unlimited PIP coverage . Lawmakers are hoping that the new options for PIP coverage will help Michigan drivers save money in the long run. The lower your PIP coverage, the lower your premium.

Your new options for PIP coverage will be:

Injured By An Uninsured Driver In California Contact Us For Help

If you or someone you know has been injured by an uninsured motorist we invite you to contact us for a free consultation.

Contact us to discuss your options with a caring and knowledgeable California injury attorney.

You may be entitled to more compensation than your insurance company has offered.

We may also be able to help if you have been injured by an uninsured driver in Nevada.

Legal references:

There are five proven things you can do to help defend yourself against false accusations. These are: seek the help of a criminal defense attorney, conduct a pre-file investigation, gather evidence to support your side of the story, obtain evidence to impeach the accuser, and take a private polygraph test. There are also three important …

If you use counterfeit money to pay for up to nine hundred fifty dollars worth of merchandise at a California store, you are guilty of shoplifting under PC 459.5, Californias shoplifting lawand not of a more serious crime like PC 459 burglary. Penal Code 459.5 PC, Californias new shoplifting law, was created by Proposition 47. This …

Don’t Miss: What Is Trump Medicare Plan

Does Uninsured Motorist Insurance Cover Hit

Yes. If a driver hits your vehicle and flees, you can file a claim against your policy’s uninsured motorist coverage. However, in some states, uninsured motorist coverage for property damage will not cover hit-and-run incidents. In this case, you would need collision coverage for your insurance to cover the damage to your vehicle from a hit-and-run driver.

What Is A Letter Of Protection

Unfortunately, some injured people do not have health insurance or available funds to pay for health care. If injured in a car accident, this is where PIP / no-fault insurance helps . But it is quite easy for medical care to exceed 10K and doctors do not work for free.

Enter the Letter of Protection, commonly referred to as an LOP. An LOP is signed by both the patient/client and the attorney. An LOP is a lien against your case. Its similar to a mortgage on your house . If you sell the house, the bank gets money first â up to the amount of their lien. You would get whatever is left over.

The attorney signs the LOP confirming that they will pay the medical provider out of any recovery achieved by settlement or judgment.

The patient/client signs the LOP acknowledging this AND confirming that, even if there is no recovery, the client will STILL be held personally responsible for the medical bill incurred. In other words, the client will remain on the hook.

Essentially, the medical provider is saying â Weâll wait until your case is resolved to get paid. But no matter the outcome of your claim or trial, we are owed money for the services we provide to you.

If you would like to speak to a Miami personal-injury attorney, please call and ask for Jason Neufeld or he can be emailed directly at

Also Check: Do I Need To Keep Medicare Summary Notices