What Can You Expect To Pay For An Approved Inpatient Surgery

Medicare Part A generally covers much of the cost related to your inpatient surgery and hospital stay. You may be responsible for a Medicare Part A deductible for each benefit period. Medicare defines a benefit period as beginning the day youre admitted as an inpatient in a hospital or skilled nursing facility and ending when you have not received any inpatient hospital or SNF care for 60 days in a row. You pay this inpatient hospital deductible amount for each benefit period.

The amount you may pay for inpatient surgery can also depend on your recovery time. You wont typically pay a Medicare Part A coinsurance amount if your inpatient stay lasts between one and 60 days. However, if you spend more time in the hospital for inpatient surgery, you have to pay a coinsurance amount.

- You will pay $371 per day per benefit period for days 61 to 90.

- You will be liable for $742 per benefit period for every lifetime reserve day you spend in the hospital beyond 90 days.

- If you are still in the hospital after exhausting your lifetime reserve days, Medicare Part A generally will not continue coverage for your hospital expenses.

Medicare Part B usually pays 80 percent of the Medicare-approved amount for doctors services billed separately from the hospitals charges for inpatient surgery. You are responsible for 20% after you have met the Part B annual deductible .

To get started, simply click the Get Quotes button.

Find Plans in your area instantly!

Is Medicare Part A Free At Age 65

Premium-free Part A coverage is available if you or your spouse paid Medicare taxes for a certain amount of time while working. You can receive this if:

- You already get benefits from Social Security or Railroad Retirement Board.

- Youre eligible for Social Security or Railroad benefits but havent filed yet.

- You or your spouse has Medicare-covered government employment.

If youre under 65, you get premium-free Part A if:

- You have Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have End-Stage Renal Disease or Amyotrophic Lateral Sclerosis and meet certain requirements.

Do You Have To Pay A Part A Premium

You may be wondering does Medicare Part A cover 100 percent? And while this is not the case, there are provisions in place to make Medicare affordable to beneficiaries.

Many people dont pay a monthly premium for Medicare Part A. For example, if you worked at least ten years while paying taxes, you dont pay a premium for Part A. If you worked for fewer than 30 quarters, you generally pay $471 per month in 2021. If you worked more than 30 but fewer than 40 quarters, your premium is $259 per month in 2021

Read Also: Will Medicare Pay For A Patient Lift

Does Medicare Cover Inpatient Mental Health Treatment

You must have Medicare Part A to be covered for inpatient mental health treatment at a general or psychiatric hospital. Medicare will pay for most of your inpatient treatment services. However, you may still owe some out-of-pocket costs depending on your plan and the length of your stay.

Here are the basic costs for Medicare Part A:

- $252458 premium, if you have one

- $1,408 deductible

- 20 percent of all Medicare-approved costs during the stay

- $0 coinsurance for days 160 of treatment

- $352 coinsurance per day for days 6190 of treatment

- $704 coinsurance per day for days 91+ of treatment, through your lifetime reserve days

- beyond your lifetime reserve days, youll owe 100 percent of the treatment costs

Its important to note that while theres no limit to how much inpatient care you can receive in a general hospital, Part A will only cover up to 190 days of inpatient care in a psychiatric hospital.

Hospital Stay Coverage Under Medicare Advantage

You may choose to receive your Medicare Part A and Part B coverage through a local Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies that are approved by Medicare and cover at least the same level of benefits as Original Medicare Part A and Part B . Many Medicare Advantage plans cover extra benefits beyond Original Medicare.

Keep in mind that Medicare Advantage plans have some flexibility in setting their rates and charges you may be responsible for a monthly plan premium, deductibles, and/or copayments or coinsurance. Under a Medicare Advantage plan, you may need to receive care from hospitals and doctors participating in the plans network. Consult your Medicare Advantage plan or benefit information for coverage details.

You can do some research on your own to get familiar with Medicare plan options in your area by clicking on the Compare Plans button on this page.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

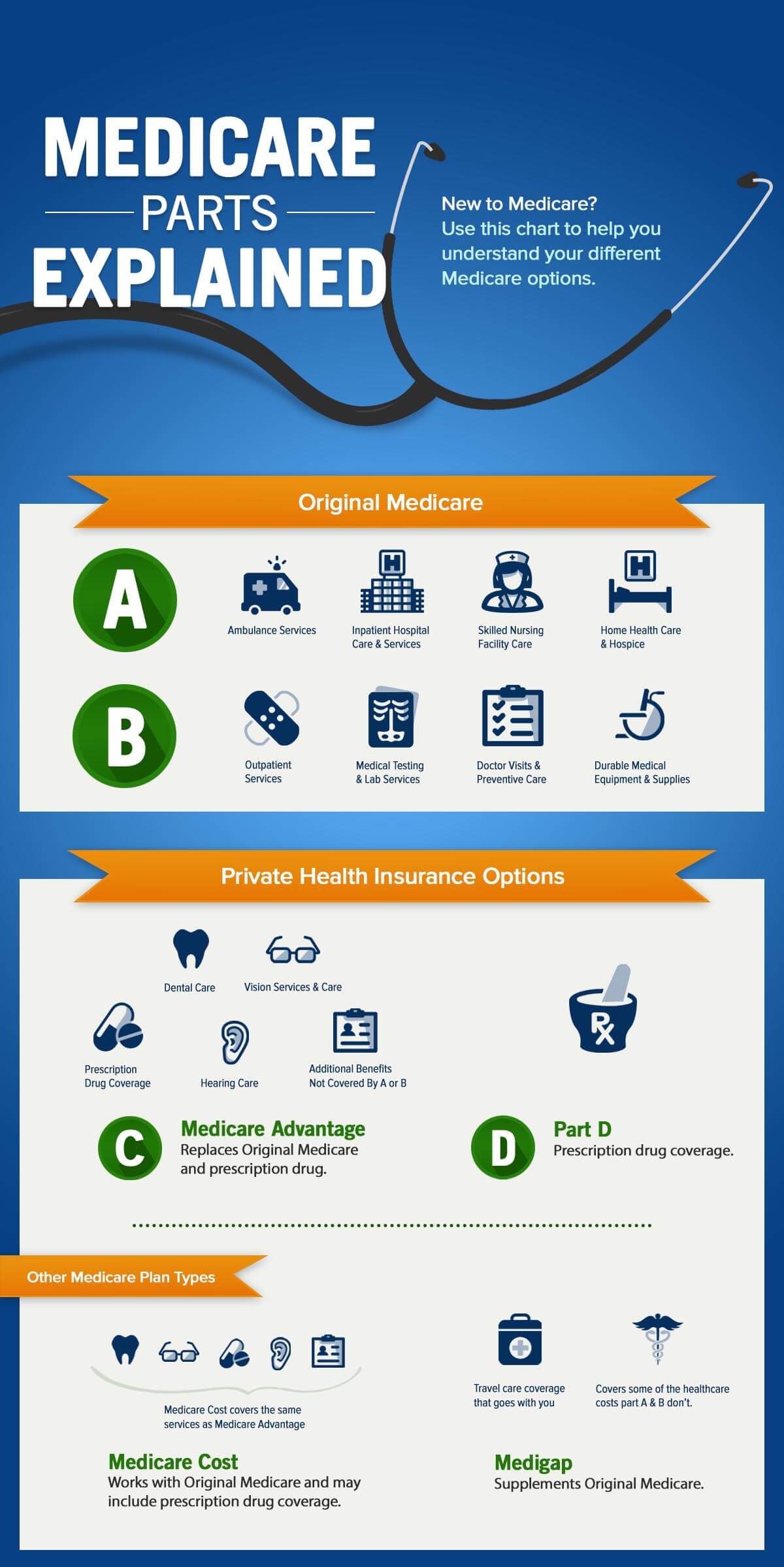

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Recommended Reading: Is Xarelto Covered By Medicare Part D

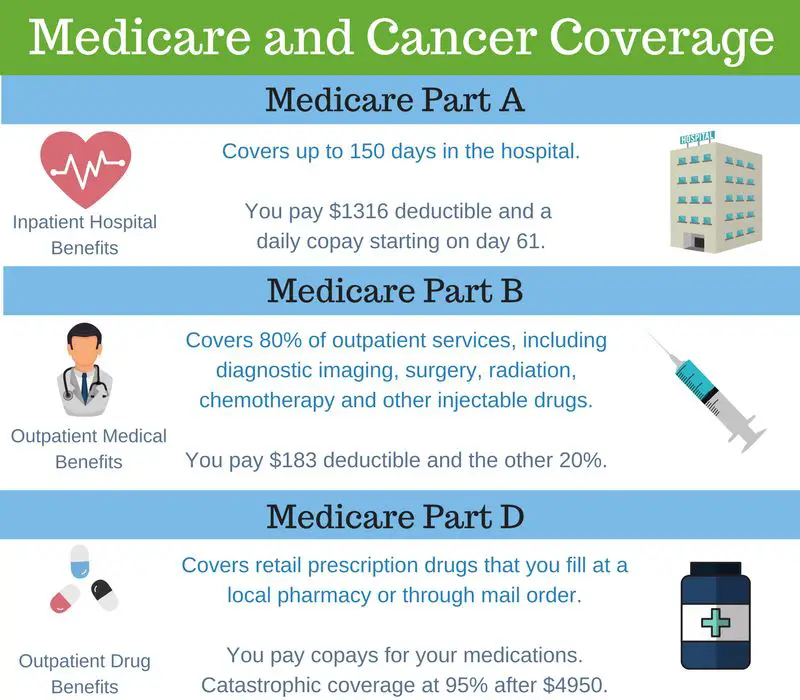

Hospital Observation Status And Medication Costs

Any prescription and over-the-counter drugs you receive in an outpatient setting arent covered by Part B. But if you have Medicare Part D , they may be covered in certain circumstances. If the drugs are covered, youll probably need to pay out of pocket and submit a claim to your drug plan for a refund.

What Medicare Part A Does Not Cover

While this part of Medicare covers stays in a nursing home, it will only do so if it is medically necessary. If you need non-medical long-term care, such as for chronic illness or disability, youâll have to consider other options like long-term care insurance. If you meet the income and asset requirements for Medicaid you can also get long term care coverage.

Medicare Part A covers the cost of an inpatient hospital stay, but fees charged by a doctor or specialist physician will be covered by Part B.

Medicare Part A does not cover the following at any hospital or facility:

-

A private room, unless medically necessary

-

In-room television and phone services

-

Personal items

-

Private-duty nursing services

You can see what hospitals accept Medicare and what specific services are covered on Medicare.gov. You can also talk to your doctor or health care provider about whether a service or treatment they are recommending is traditionally covered by Medicare.

You May Like: Can I Sign Up For Medicare Before I Turn 65

What Does Medicare Part A Cover

Medicare Part A covers the hospital charges and most of the services you receive when you’re in the hospital.

What is covered by Medicare Part A

Hospital stays and inpatient care, including:

Medications for pain and symptom management:

Up to $5 per prescription

Durable medical equipment used at home and respite care:

Home hospice patients may pay a small coinsurance amount for inpatient respite care or durable medical equipment used at home.

*Lifetime reserve days are a set number of covered hospital days you can draw on if youre in the hospital longer than 90 days. You have 60. Each lifetime reserve day may be used only once, but you may apply the days to different benefit periods. Lifetime reserve days may not be used to extend coverage in a skilled nursing facility.

How Are Benefit Periods Determined

Original Medicare measures your coverage for hospital or skilled nursing care in terms of a benefit period. Beginning the day you are admitted into a hospital or skilled nursing facility, the benefit period will end when you go 60 consecutive days without care in a hospital or skilled nursing facility. A deductible applies for each benefit period.

Your benefit period with Medicare does not end until 60 days after discharge from the hospital or the skilled nursing facility. Therefore, if you are readmitted within those 60 days, you are considered to be in the same benefit period. If you are readmitted within 60 days, you are not charged another deductible. There is no limit on the number of benefit periods Medicare will cover in your lifetime.

Example:

Uncle George goes into the hospital June 1 and is discharged July 31. On November 1, he is readmitted to the hospital. He pays his deductible again because he is starting a new benefit period. If George had been re-admitted to the hospital within 60 days of his July 31 discharge, there would have been no additional deductible.

You May Like: Does Medicare Pay For Breast Reconstruction

Medicare Coverage For Inpatient Hospital Care

Medicare Part A will help pay for inpatient hospital care when all of the following apply:

- There is an official doctor’s order admitting you to the hospital as an inpatient

- The doctor’s order says you require inpatient care to treat an illness or injury

- The hospital accepts Medicare

In some cases, the hospital’s Utilization Review Committee may need to approve your inpatient stay for hospital coverage.

The Good News Is That Medicare Part B Generally Pays For Your Er Visits Whether Youve Been Hurt You Develop A Sudden Illness Or An Illness Takes A Turn

Does medicare part b cover emergency room visits. Your chandler medicare insurance agent can help you find these providers and help you understand if medicare part b is a good option for you. Emergency room visits are considered outpatient care and, as such, are not covered by medicare part a. If you have a medicare supplement it will cover the 20% medicare leaves off.

Usually covers emergency department services when you have an injury, a sudden illness, or an illness that quickly gets much worse. If you have a situation such as a heart attack, stroke, or sudden illness, medicare part b might cover some of your emergency room costs. If you are admitted, you are considered an inpatient under medicare part a.

If you have parts a and b, known as original medicare, part b will cover your urgent care visit. So, does medicare cover emergency room visits? And, since emergencies may occur anytime and anywhere, medicare coverage for er visits applies to any er or hospital in the country.

If you go to the emergency room and are treated as an outpatient, then you will receive medicare coverage under part b, not part a. If you have a situation such as a heart attack, stroke, or sudden illness, medicare part b might cover some of your emergency room costs. Part b usually covers 80% of er services when you have an injury, a sudden illness or.

What Do Parts A B Cover

Medicare Supplement Plans F G Facts And Fiction Medicare Supplement Medicare Supplement Plans Medicare

Pin On Financial

You May Like: Does Medicare Part A Cover Doctors In Hospital

When Does Medicare Cover Inpatient Surgery

Your inpatient surgery must meet two basic requirements for Medicare coverage:

- The hospital and physicians performing the inpatient surgery accept Medicare

- Inpatient surgery must be medically necessary. Medicare defines medically necessary as Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine.

- In certain cases, the Utilization Review Committee of the hospital approves your stay while youre in the hospital.

If youre enrolled in a Medicare Advantage plan, the plan may also require the hospital and doctors providing inpatient surgery to participate in the plans provider network as a condition of coverage.

If your inpatient surgery meets Medicare requirements, Medicare Part A and Medicare Advantage plans typically pay for covered hospital services. Hospital services related to inpatient surgery usually include daily room and board, laboratory services, diagnostic tests, surgical equipment and supplies, anesthesia, and the services of doctors, nurses, and other health professionals.

Medicare Part B and Medicare Advantage plans generally cover physician services, including surgeons and anesthesiologists who participate in the inpatient surgery but who are not employees of the hospital.

Difference Between Medicare Coverage For Inpatient Vs Outpatient Vs Under Observation

Many people ask, what is inpatient vs. outpatient?Inpatient care means youre admitted to the hospital on a doctors order. As soon as your admission occurs, youre an inpatient care recipient.

For example, when you visit the emergency room, youre initially outpatient, because admission to the hospital didnt happen. If your visit results in a doctor ordering admission to the hospital, then your status becomes inpatient. The care you get is inpatient until discharge.

Despite a stay in the hospital, your care may be outpatient if youre getting outpatient care on the same day of discharge. Even if you spend the night in the hospital, you could be an outpatient.

When the doctor orders observation or tests to help with the diagnosis, you remain outpatient until inpatient admission. Outpatient is when you get care without admission or have for a stay of fewer than 24 hours, even if overnight. Health services you get at a facility can be outpatient care.

Recommended Reading: Are Cancer Drugs Covered By Medicare

Does Medicare Cover Hospital Visits

Original Medicare is a federal health insurance program managed by the Centers for Medicare & Medicaid Services . It provides health-care benefits for American citizens and permanent legal residents aged 65 or older.

Find affordable Medicare plans in your area

Medicare also covers some people younger than 65 who might qualify for Medicare due to certain disabilities or health conditions.

Original Medicare is made up of two parts, Part A and Part B.

- Medicare Part A may cover certain costs if you are admitted to a hospital, skilled nursing facility, or hospice program. It may also cover limited home health services .

- Medicare Part B may cover outpatient care, physician services, durable medical equipment and supplies, and certain preventive medical services and diagnostic tests.

Medicare Part A generally helps pay for hospital inpatient care. For each benefit period, Medicare typically pays:

- All covered costs except the Part A deductible during the first 60 days

- Coinsurance amounts for hospital stays from 61 to 90 days

After 91 days, a coinsurance amount usually applies for each lifetime reserve day. You may get up to 60 lifetime reserve days during your lifetime.

Medicare Part A Will Pay For Most Of The Costs Of Your Hospital Stay After You Pay The Part A Deductible

By Bethany K. Laurence, Attorney

Medicare Part A is also called “hospital insurance,” and it covers most of the cost of care when you are at a hospital or skilled nursing facility as an inpatient. Medicare Part A also covers hospice services. For most people over 65, Medicare Part A is free.

The following list gives you an idea of what Medicare Part A pays for, and does not pay for, during your stay in a participating hospital. However, even when Part A covers a cost, there are significant financial limitations on the length of coverage, as you’ll see below.

Don’t Miss: What Is The Cost Of Part D Medicare For 2020

Costs Of Medicare Inpatient Care

Inpatient care usually falls under Medicare Part A, but you may be responsible for some of the costs out of your own pocket.

Inpatient Care Costs with Medicare Part A for 2022

- $1,556 deductible for each benefit period

- Days 1 to 60 of Hospitalization: $0 coinsurance for each benefit period

- Days 61 to 90: $389 coinsurance per day of each benefit period

- Days 91 and beyond: $778 coinsurance per each lifetime reserve day after day 90 of each benefit period

- Beyond Lifetime Reserve Days: All costs

Medicare inpatient coverage of psychiatric hospitalization is limited to 190 days over the course of your lifetime. There are also certain hospital services that are not covered.

Abdominal Aortic Aneurysm Screening

Medicare covers a one-time screening abdominal aortic aneurysm ultrasound for people at risk. You must get a referral from your doctor or other practitioner. You pay nothing for the screening if the doctor or other qualified health care provider accepts assignment.

Note: If you have a family history of abdominal aortic aneurysms, or youre a man 6575 and youve smoked at least 100 cigarettes in your lifetime, youre considered at risk.

Read Also: How To Be Eligible For Medicare And Medicaid

What Services Are Included In Hospital Inpatient Care Coverage

Lets start by looking at the kind of inpatient care settings that may be covered by Medicare Part A. These include:

- Acute care medical hospitals, which provide medically necessary care for an illness or injury

- Long-term care hospitals, which generally specialize in treating multiple serious health conditions for those who are expected to improve with time and care, and return home

- Psychiatric hospitals, which provide medically necessary care for a behavioral issue or mental illness

- Skilled nursing and rehabilitation facilities, which provide medically necessary care for an illness or injury that requires full-time, temporary nursing and/or rehab care

Medicare Part A generally covers hospital services, including semi-private rooms, meals, nursing care and medications given as part of your inpatient treatment, and other hospital services and supplies.

However, Medicare does not pay for everything associated with inpatient care, and there may be cost-sharing for covered services, as described below.

What Does Medicare Part B Cover

Medicare Part B covers doctor visits and most routine and emergency medical services. It also covers some preventive care, like flu shots.

What is covered by Medicare Part B

- Doctor visits, including when you are in the hospital

- An annual wellness visit and preventive services, like flu shots and mammograms

- Clinical laboratory services, like blood and urine tests

- X-rays, MRIs, CT scans, EKGs and some other diagnostic tests

- Some health programs, like smoking cessation, obesity counseling and cardiac rehab

- Physical therapy, occupational therapy and speech-language pathology services

- Diabetes screenings, diabetes education and certain diabetes supplies

- Mental health care

- You enroll for the first time in 2021 or 2022.

- You aren’t receiving Social Security benefits.

- Your premiums are billed directly to you.

- You have Medicare and Medicaid, and Medicaid pays your premiums.

Your Part B premium may be less than the standard amount if you enrolled in Part B in 2020 or earlier and your premium payments are deducted from your Social Security check.

Your premium may be more than the standard amount based on your income. You will pay an incomerelated monthly adjustment amount if your reported income was above $88,000 for individuals or $176,000 for couples in 2019 or was above $91,000 for individuals or $182,000 for couples in 2020. Visit Medicare.gov to learn more about IRMAA.

You May Like: How To Bill Medicare For Home Health Services