Compare Medicare Advantage Plans

SPEAK WITH A LICENSED AGENT NOW!

Medicare Advantage plans in 2023 are offered by many different insurance companies such as:

And many more.

There are different factors that go into choosing the right plan for you, including your area, current health condition, medications you take, as well as what plans your doctors accept.

Doing this on your own can be a challenge. By calling us today, our licensed insurance agents can help assist you in finding a plan to fit your needs for 2023.

What Do Blue Cross Blue Shield Medicare Advantage Plans Cover

Most Blue Cross Blue Shield Medicare Advantage Plans include:

- Prescription drug coverage

| Cigna MA Plans have an average CMS satisfaction rating of 4 stars. | Cigna is rated A by A.M. Best. | Cigna has a 3.4-star rating on Consumer Affairs. | Coverage is available in 26 states with benefits including vision, dental, and hearing. |

| The bottom line: While Cigna MA Plans are not yet available in all states, those who have access can take advantage of the low copays and broad range of services they offer. |

Cigna is one of the most affordable MA plan providers and you wont sacrifice benefits with its plans. Many plans offer $0 copay with virtual care when visiting a primary care physician. Plus, you get dental, vision, and hearing coverage, along with behavioral health care and preventive care.

Because the network has grown beyond HMOs, Cigna now offers PPO plans that give you the flexibility to choose an in- or out-of-network provider. Other large companies like UnitedHealthcare only offer HMOs.

The real standout is the lower out-of-pocket expense youll pay with Cigna plans. For example, annual maximums range from $3,150 to $4,400 in network compared to others that can go up to $7,550. And while plans like Kaiser offer comparably low out-of-pocket maximums, your coverage is limited to eight states and the company only offers HMOs.

Best For Large Network: Cigna

Cigna-HealthSpring

-

Confusion may result from so many different plans to choose from

-

Not all plans are available in all areas

The PFFS and MSA plans do not include prescription drug coverage, but you can enroll in a separate standalone Medicare Part D plan.

AARP/UnitedHealthcare was founded in 1977, and today is considered a national leader in healthcare management. Today, it insures millions of people through PPOs and some HMOs too. Its Medical Savings Account plans to combine a high-deductible Medicare Advantage plan with a special savings account. Funds are deposited by Medicare and withdrawn to pay for qualified healthcare services. You can see any provider you want.

For its Private Fee-For-Service plans, some have a provider network, and some dont.

Its site requires you to enter your ZIP code to find a plan in your state, or you can call AARP/UnitedHealthcare for questions about plans or how to enroll.

Don’t Miss: Will Medicare Pay For A Bedside Commode

Medicare Advantage Networks For The Future

Did you know that Medicare Advantage plans are affected by the network of the provider you buy the plan from.

This isnt true of every kind of Medicare plan. Of course, only those medical facilities that accept Medicare are going to accept the coverage of the plan you signed up for and are paying on, but Medicare Advantage plans for 2022 will also be limited by the network of the provider who sells the plan.

Each provider has their own network of clinics, doctors offices, hospitals, pharmacies, and such that have agreed to honor their insurance plans. Going outside of that network of facilities often means that you have to pay for the cost of healthcare on your own or at least a large portion of it.

There are some options for people who live outside the network but still want a certain providers plans. The PPO Advantage plan is a network option that lets you get coverage both on and off the network.

You get full coverage inside your insurers network with this plan and then partial coverage outside the network.If you live in the network, though, and you want a cheaper, more economical plan, then you can go with an HMO Advantage plan.

This covers you just for inside the network and offers no coverage for going outside the network for treatment.

You could also opt for the PFFS Advantage plan. This will cover you on the network too, but then it gives you a per-service rate that is lower than the usual cost for any services you receive outside of the network.

Best For Extra Perks: Aetna

Average Medicare star rating: 3.8 out of 5.

Service area: Available in 46 states and Washington, D.C.

Standout feature: In addition to cost help with dental, vision and hearing care, Aetna Medicare members have access to a variety of other benefits, such as in-home health visits and meal delivery after a hospital stay.

Aetna, a CVS Health company, is the fourth-largest provider of Medicare Advantage plans. Most of Aetnas plans provide cost help with dental, vision and hearing care, and many offer other extras. Some valuable Aetna benefits include companionship benefits in eight states, an over-the-counter benefit that lets you pick up things like vitamins and cold medications from drugstores or online at no cost, and concierge services to help members find local resources and activities.

Pros:

-

Aetna estimates that 84% of Medicare-eligible beneficiaries in the U.S. will have access to a $0-premium Aetna Medicare Advantage plan.

-

Aetna offers some of the lowest-premium stand-alone Medicare prescription drug plans nationwide.

-

As a CVS Health company, Aetna offers members the ability to visit one of a network of walk-in clinics or MinuteClinics for the same copay as a regular visit to a primary care physician, or PCP, as long as theyre in plans that dont require a PCP visit. This network includes walk-in locations across 33 states and Washington, D.C.

Cons:

You May Like: What Is Medicare Plan G Supplement

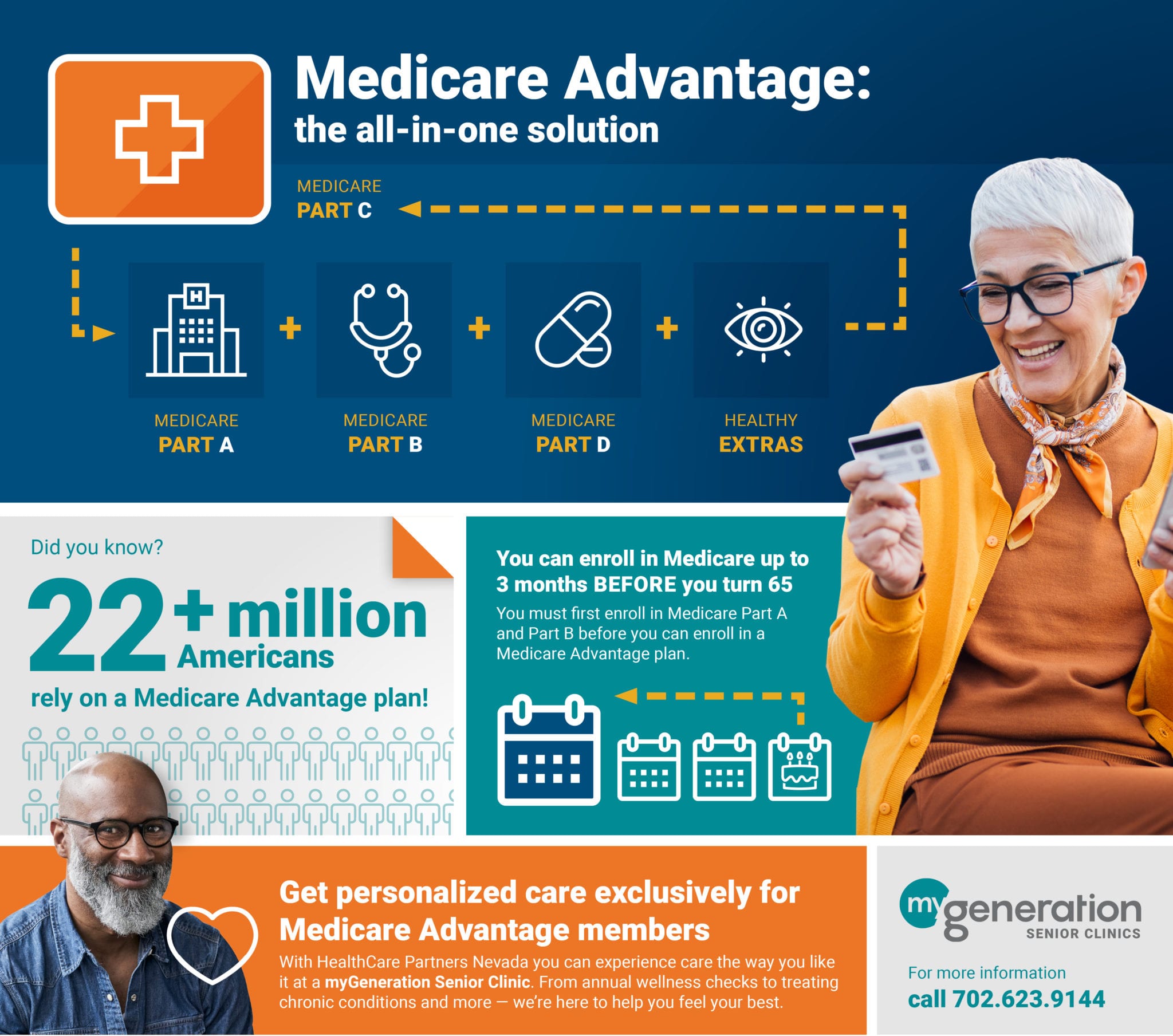

How Medicare Advantage Plans Work

MA Plans, also known as MA or Part C, take the place of Original Medicare and provide coverage for the same benefits as Medicare Part A and Part B. There are many MA plans, most of which provide Medicare prescription drug coverage to take the place of Medicare Part D.

MA Plans are regulated by the federal government but are administered by Medicare-approved private companies who set their own rules on how you receive your benefits. Cost structure and sharing are different, and all MA Plans include an out-of-pocket max to limit how much you pay for Medicare-covered services.

There are a few types of MA Plans:

What Are The Drawbacks Of Medicare Advantage

The drawbacks of Medicare Advantage plans include doctor network limitations, unpredictable cost-sharing, and the inability of your coverage to travel with you. These plans have prior authorization requirements, and their summary of benefits changes annually.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Even if you enroll in the best Medicare Advantage plan in your area, you may still be subject to any of these common Medicare Advantage restrictions.

- Was this article helpful ?

Don’t Miss: Is Stelara Covered By Medicare Part B

Shopping For Medicare Advantage Plans In 2023

There are many factors that go into choosing the right Medicare Advantage plan. Your current health conditions, which doctors you use, and where you live are just a few.

When choosing a Medicare Advantage plan in 2023, you need to consider the following:

-

Is your doctor in the plans network? Its important to allow us to check to see which plans your current providers accept.

- Compare out-of-pocket costs. Each plan will have a monthly premium and a maximum out-of-pocket cost, which is the most youll pay in a year for covered health care.

-

Star ratings of the plan. The Centers for Medicaid and Medicare Services assigns star ratings to each plan for its performance.

-

Expected out-of-pocket costs while on the plan. While many Medicare Advantage plans in 2023 will offer a $0 premium, you need to consider any costs you might incur above and beyond that throughout the year.

Open Enrollment For Texans With Disabilities

People under age 65 who get Medicare because of disabilities have a six-month open enrollment period beginning the day they enroll in Medicare Part B. This open enrollment right only applies to Medicare supplement Plan A.

Note: People who have Medicare because of disabilities have another open enrollment period during the first six months after turning 65.

You May Like: How Do I Sign Up For Medicare In Massachusetts

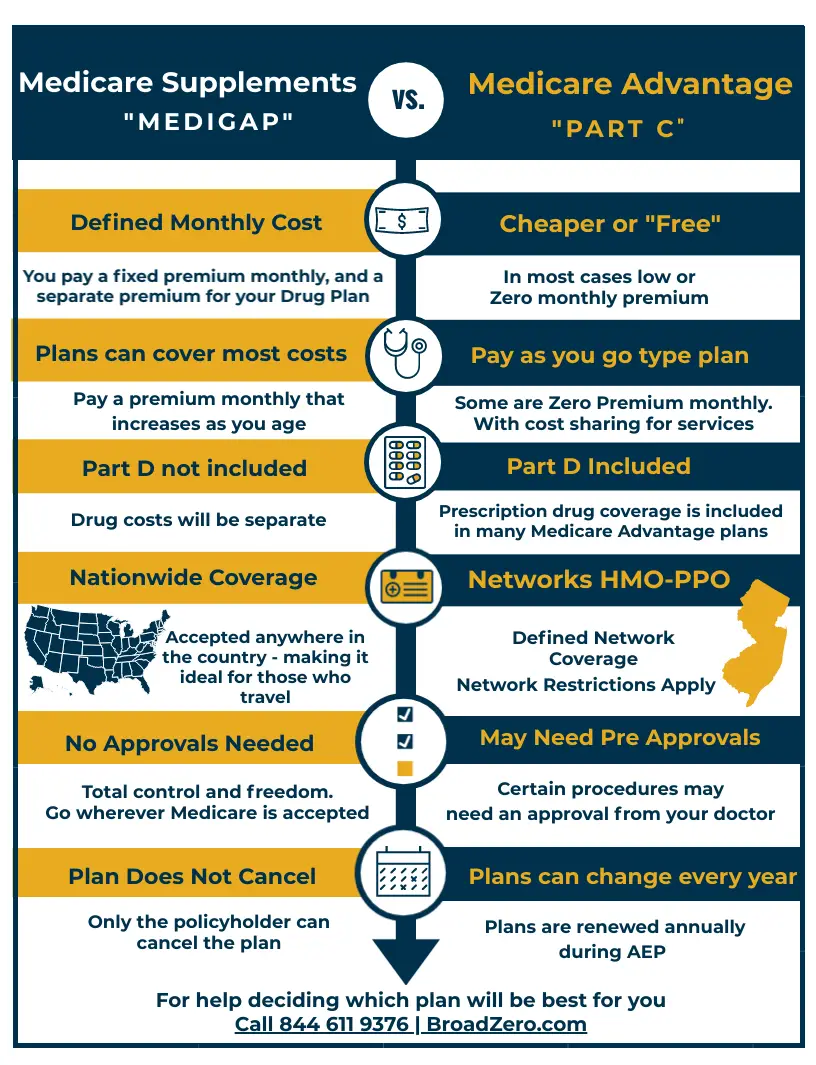

Medicare Advantage Plans May Limit Your Freedom Of Choice In Health Care Providers

With the federally administered Medicare program, you can generally go to any doctor or facility that accepts Medicare and receive the same level of Medicare benefits for covered services. In contrast, Medicare Advantage plans are more restricted in terms of their provider networks. If you go out of network, your plan may not cover your medical costs, or your costs may not apply to your out of pocket maximum.

What Should I Expect To Pay For A Medicare Advantage Plan

With Medicare Advantage, youll pay monthly premiums, deductibles, and co-insurance costs for doctors visits. The costs for these depend on the plan you choose. Remember too that youll still pay your monthly Part B premium, unless you receive special assistance.

An estimated 60% of people enrolled in Medicare Advantage dont pay a premium for their coverage.nk: For 2020, the average Medicare Advantage enrollee paid $25 per month for their Medicare Advantage premium. About 6% of people pay more than $100 a month.

Medicare Advantage plans often have higher deductibles than Original Medicare, which means you could pay more out-of-pocket.

Read Also: Does Medicare Cover Dementia Care Facilities

Can You Switch Between Original Medicare And Medicare Advantage

As a final note, no matter which option you decide is right for you, you can switch from Original Medicare to Medicare Advantage or vice versa. The two main times you can switch are the Medicare Annual Enrollment Period and the Medicare Special Enrollment Period for qualifying life events, if you qualify.

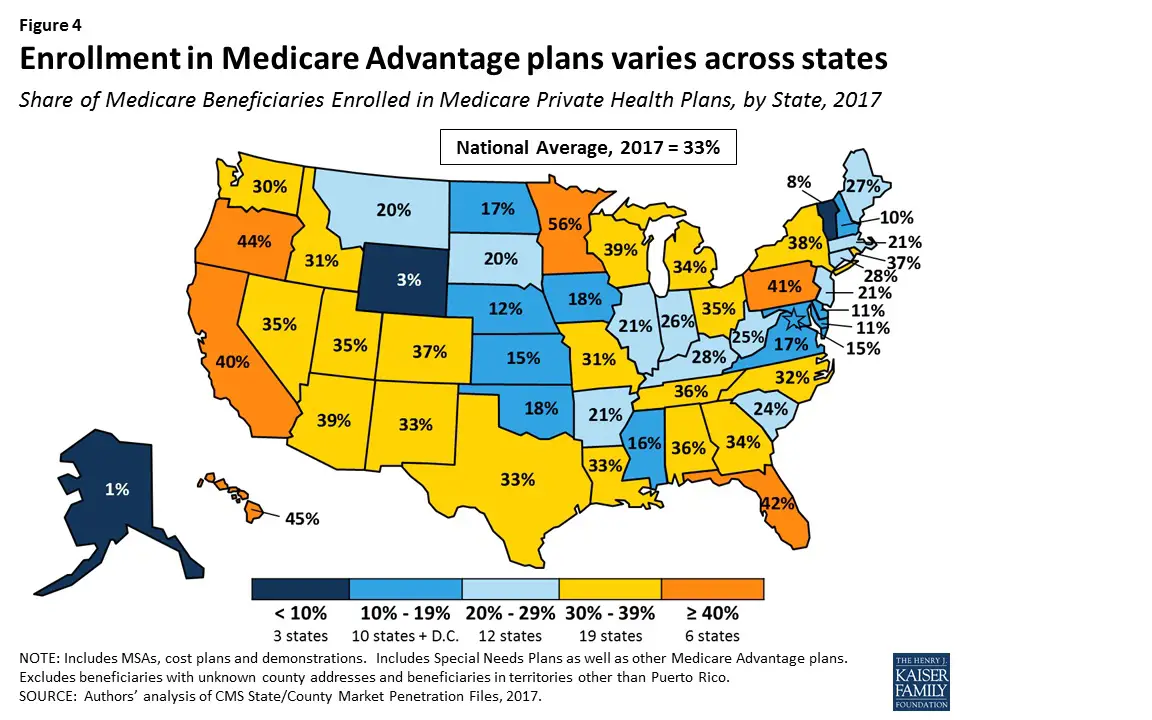

Medicare Advantage Plan Quality By State

Every year, the Centers for Medicare & Medicaid Services rates all Medicare Advantage plans according to a five-star scale based on various quality metrics. Three stars represents a plan of average quality, while four stars is considered above average and five stars is excellent.

The metrics used in scoring a plan include:

Nationally, 55% of Medicare Advantage plans have earned either a 4-star or 5-star rating for 2022, meaning they are top-rated Medicare plans.

North and South Dakotas high plan costs can be partly justified by their high plan quality. Both states average at least 86% of plans carrying a 4-star or 5-star rating. Other states with high quality plans include Iowa, Minnesota, Maryland, Montana and Utah.

Plan quality is lowest in Wyoming, Georgia and Arkansas, with all three states having just a quarter of their Medicare Advantage plans rated 4 stars or higher.

Read Also: Do Any Medicare Supplement Plans Cover Dental And Vision

Unitedhealthcare And Humana Account For Nearly Half Of All Medicare Advantage Enrollees Nationwide In 2022

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana together account for 46 percent of all Medicare Advantage enrollees nationwide. In nearly a third of counties , these two firms account for at least 75% of Medicare Advantage enrollment. account for 14 percent of enrollment, and four firms account for another 24 percent of enrollment in 2022.

How Much Does Dental Care Cost With Medicare Advantage

Dental costs on a Medicare Advantage plan will vary by plan and by service. Some plans require a copay or coinsurance for every service. For instance, if theres 50% coinsurance required for a filling, you would pay 50% of the cost. Some services have a $0 copay if you use an in-network provider but require coinsurance or arent covered if you go out of network.

Its worth noting that services may often be covered at a $0 copay, but with a dollar limit to what the plan will cover. For instance, there may be a $1,000 annual maximum benefit for preventive or comprehensive services . For people enrolled in plans with more comprehensive dental benefits, the average annual dollar limit on coverage is $1,300, according to the Kaiser Family Foundation. Its important to read a plans Evidence of Coverage to understand the limits on any dental coverage being offered.

Also Check: How To Fight Medicare Denial

How To Enroll In A Medicare Advantage Plan

Your first chance to sign up for Medicare Advantage is during your . The IEP for Medicare starts 3 months before the month you turn 65 and ends 3 months after.

If you are already enrolled in Medicare Advantage, you can switch plans during the . The Medicare Advantage OEP runs from Jan. 1 to March 31, or the annual enrollment period for Medicare.

If you have Original Medicare and want to enroll in Medicare Advantage for the first time, you can choose a Medicare Advantage plan during . Medicares AEP runs from Oct. 15 to Dec. 7.

Mutual Of Omaha Medigap

The cost for a Plan G from Mutual of Omaha is often similar to what you’d pay for a plan from AARP/UnitedHealthcare, and if you qualify for Mutual of Omaha’s household discount of 7% to 12%, the plan could be one of the cheapest options available.

Pros

| $36 | 3.5 |

Cost is the national monthly average for Part D plans, and ratings are the average Medicare.gov star rating for prescription drug plans. Note that star ratings for Part D plans tend to be lower, and 89% of enrollees have a plan with 3.5 or 4 stars.

Find Cheap Medicare Plans in Your Area

What you pay for cancer medications largely depends on their tier classification. For example, generic drugs are usually cheaper than new, experimental or specialty drugs.

Additionally, each insurance company sets its own formulary about the drugs it covers. While all companies will provide broad coverage across all types of medication, choosing the best prescription plan usually means matching your list of prescriptions to a drug plan’s formulary.

When managing your cancer treatment, remember that with all Medicare prescription plans, you can request an exception to the list of covered drugs in your plan’s formulary or a drug’s tier classification. To do this, your doctor must say that a particular medication is required for treatment and there are no cheaper options available. While this process can require more paperwork, it’s a useful way to make sure your cancer medications are affordable and accessible.

Read Also: Is Aarp Medicare Part D

Questions We’re Ready To Help

Call UnitedHealthcare at:FED TFN

8 a.m. – 8 p.m., 7 days a week.*

*Alaska and Hawaii: 8 a.m. – 8 p.m. Monday – Friday,8 a.m. – 5 p.m. Saturday and Sunday

Already a member? Call the number on the back of your member ID card.

MO10050ST

7 a.m. – 11 p.m. ET, Monday – Friday 9 a.m. – 5 p.m. ET, Saturday.

Already a member? Call the number on the back of your member ID card.

MO10050ST

Are you a Plan Member?

Go to the Member Site to Sign In or Register for an account.

This plan has been saved to your profile.

A plan has been removed from your profile.

No plans or drugs have been saved.

Get plan information, forms and documents you may need now or in the future.

Plan Types

Tools to help you choose a plan

Best For Size Of Dental Network: Unitedhealthcare

Average Medicare star rating: 4.2 out of 5.

Service area: Available in 50 states and Washington, D.C.

Standout feature: UnitedHealthcare has the largest network of dental providers of all Medicare Advantage companies, with approximately 100,000 providers.

UnitedHealthcare is the biggest provider of Medicare Advantage plans in the U.S., with a presence in all 50 states and plans available in almost three-quarters of U.S. counties. UnitedHealthcare also partners with AARP and insures Medicare products with the AARP name. Many of UHCs members are in plans with high star ratings.

Pros:

-

UHC offers the largest Medicare dental network, with approximately 100,000 providers.

-

UHC plans with comprehensive dental coverage include an average of six services per plan.

-

Three-quarters of UHC Medicare Advantage members are in highly rated plans.

Cons:

-

Only 75% of UHC plans offer comprehensive dental coverage, one of the lowest among the major Medicare Advantage providers.

-

UHC tied for sixth out of nine providers on J.D. Powers latest Medicare Advantage study, which measured member satisfaction.

Also Check: How Many Chiropractic Visits Does Medicare Allow

Good Cancer Coverage: Medicare Advantage Plan With A Low Cap On Your Medical Spending

With Medicare Advantage, plans are generally cheap and include lots of perks. However, your costs can vary widely based on the amount of medical care you need, which is a key consideration for those who are comparing Medicare Advantage vs. Medigap.

The different coverage options with Medicare Advantage plans means there are several key steps to take when choosing a plan that has the best cancer coverage.

Who Should Get A Medicare Advantage Plan

Consider a MA Plan if you want your health care and Medicare prescription drug benefits bundled in one plan, and if you dont mind choosing to receive your benefits from a network of providers.

You may also prefer cost-effective extra benefits that come with most MA Plans but understand those costs dont apply toward your out-of-pocket max. MA Plans typically have lower monthly premiums than Medigap plans do, so if you dont need much health care, you can save on upfront costs. Understand the risk of not being able to purchase a Medigap plan if you decide to return to Original Medicare more than a year after having a MA Plan.

You May Like: Will Medicare Help Pay For Hearing Aids