Can A 62 Year Old Get Medicaid

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

Learn more about the difference between Medicare and Medicaid.

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

When Does Medicare Start Your Coverage If Youre Automatically Signed Up For Medicare

Typically, youre automatically enrolled in Original Medicare if youre already receiving Social Security retirement benefits when you turn 65 or qualify by disability.

If youre not automatically enrolled in Medicare, the date Medicare coverage begins depends on when you enroll in Medicare Part A and/or Part B .

- If you enroll in Medicare the month before your 65th birthday, your Medicare coverage will usually start the first day of your birthday month.

- If you enroll in the month of your 65th birthday, your coverage will generally start the first day of the month after your birthday month.

- If you enroll a month after you turn age 65, coverage usually begins two months after you signed up.

- If you enroll two months after you turn age 65, coverage typically begins three months after you signed up.

- If you enrolled three months after you turn 65, coverage usually begins three months after you signed up.

Recommended Reading: Which Medicare Part Covers Prescriptions

Who Can Get The Free Tests

The 150 million Americans who have private health insurance are eligible.

Medicare is not included in the program, but those who have Medicare Advantage may be covered and should check with their plan for more details. Medicaid offers some reimbursement enrollees should contact their state program for additional guidance.

Short-term or health-care sharing plans typically don’t have to participate, said Sabrina Corlette, co-director of the Center on Health Insurance Reforms at Georgetown University’s McCourt School of Public Policy.

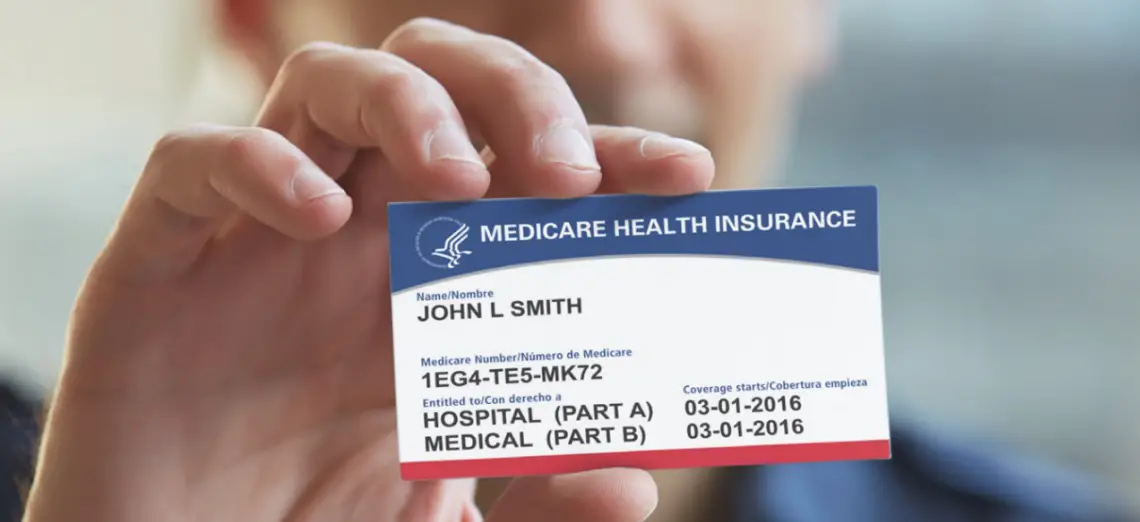

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Read Also: How Much Is Medicare B Cost

I Am Turning 65 Next Year When Can I Sign Up For Medicare

If you are eligible for Medicare, your initial enrollment period for Part A and Part B begins three months before the month of your 65th birthday and ends three months after it. For example, if your 65th birthday is in June, your enrollment period will extend from March 1 through September 30. If you join during one of the 3 months before you turn 65, coverage will begin the first day of the month you turn 65. If you join during the month you turn 65, your coverage will begin the first day of the month after you turn 65. If you join in the month after you turn 65, coverage will begin 2 months later, and if you join 2 or 3 months after you turn 65, coverage will begin 3 months later. A recent change in law limits these gaps in coverage. Starting in 2023, if you enroll in Medicare during the first 3 months after your turn 65, coverage will begin the first day of the month following the month you enroll.

Once you have Part A and Part B, you are then also eligible to enroll in a Medicare Advantage plan and/or a Part D plan. If you are already receiving Social Security benefits when you turn 65, you will automatically be enrolled in Part A and Part B. If you are not already receiving Social Security benefits and you want to enroll in Medicare, you should contact Social Security.

How Reaching Age 62 Can Affect Your Spouses Medicare

While you may not be eligible to enroll in Medicare when you turn 62, your age can have an impact on your spouses benefits.

If you are in the workforce and your spouse is not, then you turning 62 can give them access to the premium-free Part A of Original Medicare.

You may also be eligible to receive Social Security benefits but dont have to start taking them. This is a requirement because if your spouse didnt work, they are essentially reliant upon your work history for their eligibility.

Part A premiums can also be significant in 2022, they can be as much as $499 a month.

To be eligible for the premium-free Part A when you turn 65 and can enroll in Medicare, you must have paid Medicare taxes for at least 10 years and be eligible for or receive benefits from Social Security or the Railroad Retirement Board.

You also could qualify for the premium-free Part A if you had Medicare-covered government employment.

Recommended Reading: What Medicare Supplement Covers Dental

Signing Up For Medicare At Age 65

You can first sign up for Medicare during your 7-month Initial Enrollment Period. Your IEP includes the month you turn 65, the three months before, and the three months after.

Watch this video below for a quick overview of all the required Medicare qualifications.

An animated white speech bubble appears over an animated character’s blue and yellow head.

ON SCREEN TEXT: When can I enroll in Medicare?

The character and speech bubble exit on the right side of the screen.Blue text appears in a vertical line. White text appears next to each letter.

ON SCREEN TEXT: I Initial

ON SCREEN TEXT: E Enrollment

ON SCREEN TEXT: P Period

The camera pans down and shows a bunch of yellow pencils with green tips. One pencil makes a green check mark in a white box.

ON SCREEN TEXT: This is the first time you can enroll in Medicare.

Some of the pencils disappear and a row of calendars appear.

ON SCREEN TEXT: The IEP lasts for 7 months. It begins 3 months before the month of your 65th birthday.

ON SCREEN TEXT: 3 months until 65

ON SCREEN TEXT: 2 months until 65

ON SCREEN TEXT: 1 month until 65

ON SCREEN TEXT: Happy 65th

The calendars slide to the left and confetti explodes from the “Happy 65th” calendar.

ON SCREEN TEXT: the month of your 65th birthday

ON SCREEN TEXT: and ends 3 months after.

ON SCREEN TEXT: 1 month after 65

ON SCREEN TEXT: 2 months after 65

ON SCREEN TEXT: 3 months after 65

A form for Part C slides up, below blue text.

The form for Part D is highlighted.

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plan’s denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

Don’t Miss: Does Aetna Medicare Advantage Cover Dental

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

The Quick Answer: It Depends

Millions of seniors rely on Medicare to pay for their health-related needs. But many near-retirees make one dangerous assumption: that they’ll be eligible for Medicare coverage the moment they leave the workforce.

If you’re wondering whether you can get on Medicare as soon as you retire, the answer is that it depends on when you decide to bring your career to a close. Pull the trigger too early, and you’ll be on your own for healthcare until Medicare eligibility sets in.

You May Like: Does Medicare Pay For Vitamins

How Do I Get Reimbursed For At

As of Jan. 15, health insurance companies will be required to reimburse Americans for eight at-home antigen tests per person a month, under a plan announced by President Joe Biden. If an individual has been directed to undergo COVID testing by their medical provider, because of underlying health conditions or other factors, there is no limit on the number of tests covered.

But carriers are being encouraged to cover the cost of tests upfront at in-network pharmacies, rather than requiring members to file for reimbursement — a cumbersome process that could discourage many from purchasing tests. “The Biden Administration’s testing guidance protects insurers against price gouging by unscrupulous retailers, but only if the insurance company provides a way for consumers to get at-home tests for free at pharmacies with no upfront payment,” Larry Levitt, a health policy expert at the Kaiser Family Foundation, tweeted on Monday.

Though the Biden plan is not retroactive, some states, including Vermont, mandated insurers start paying for at-home kits earlier.

You may also want to check with your employer, as some private companies also began offering reimbursement options for at-home tests before the Jan. 15 deadline.

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Don’t Miss: How To Qualify For Oxygen With Medicare

Als And Esrd Exceptions

If you’re younger than 65 and have amyotrophic lateral sclerosis , you’ll automatically get Medicare Part A and Part B the month your disability benefits begin.

There used to be a five-month waiting period between diagnosis with ALS and the start of disability benefits. But legislation that was enacted in late 2020 eliminated that waiting period. This means that disability benefitsand Medicare coveragecan begin as soon as a person is diagnosed with ALS.

If you’re undergoing dialysis for ESRD, your Medicare coverage usually starts the first day of the fourth month of dialysis treatments.

However, if you go through training for a home dialysis program and your healthcare provider thinks you’ll be able to do your own dialysis at home, coverage can start as early as the first month of dialysis.

Depending on where you live, you may be able to join a Medicare Special Needs Plan for people with ESRD, if there’s one in your area.

If I Dont Like My Plan When Can I Change

Each year between October 15 and December 7, there is an annual enrollment period for Medicare beneficiaries. At this time, you can change your MAPD or PDP plans for a January 1 start date. There are other special enrollment periods that may allow you to change your plan during the rest of year. Read this article to find out more.

Also Check: What Is Uhc Medicare Advantage

Is It Mandatory To Sign Up For Medicare After Age 65

No, it isnt mandatory to join Medicare. People can opt to sign up, or not.

If you don’t qualify for Social Security retirement benefits yet, you may need to manually enroll in Medicare at your local Social Security office, online or over the phone when you turn 65. You can also apply online for your Medicare coverage at www.medicare.gov.

Enrolling in Medicare as soon as youre eligible ensures you get the subsidized health care you deserve without waiting periods or financial penalties.

If you continue to work for a company employing 20 or more people after you turn 65, you could delay your Medicare enrollment. Your employee group plan provides enough medical coverage while youre working, meaning you may be able to wait to sign up for Medicare once you retire without incurring any late penalties.

What Is Original Medicare And What Are Medicare Supplemental Plans

When you take out your Part A and Part B, youre on whats called Original Medicare. That means Medicare covers 80% of your inpatient and outpatient costs while you pay the other 20% out of pocket, in addition to the Original Medicare deductibles. For example, those on Original Medicare will not only pay 20% of all costs, but they will be responsible for the Part A deductible of $1,484 each time they go to the hospital.

This is where a Medicare supplement plan comes in. A Medicare supplemental plan helps you cover that 20%. These plans are offered by private insurance companies and usually fall into three categories: Medicare Advantage, Medicare Supplement, and Prescription Drug.

Medicare Advantage plans are like an all-in-one plan. They combine Parts A, B, and D. Usually, members on these plans need to have a primary care doctor who they receive referrals from before seeing a specialist. The benefits of MAPD plans vary widely between insurance companies, so its important you talk to someone, like a Medicare Insurance Agent, who can show you the differences between the cost of plans in your area.

Medicare Supplement plans combine Parts A and B but do not include Part D. When you have a Medicare Supplement plan, you should have a separate Prescription Drug Plan for two reasons:

You May Like: Does Medicare Pay For Laser Eye Surgery