Early Benefits Shrank Your Social Security Check

For most people retiring now, the full retirement age for Social Security purposes is either 66 or 67, depending on the year when you were born. But it is possible to begin taking your Social Security retirement benefits as early as age 62. While that can give you some financial relief if youre strapped for cash, there is a tradeoff. The size of your benefits automaticallyand permanentlygoes down.

A 2020 survey of 1,727 adults in the U.S. ages 24 and older by the Nationwide Retirement Institute , a subsidiary of the Nationwide Mutual Insurance Company, found that almost three in four baby boomers , and most Gen Xers and millennials , incorrectly identify the age at which they are eligible for full retirement benefits. In that same study, future retirees over age 50 expect to receive a higher payment than what long-term retirees actually receive.

How much can taking benefits early really cost you? Lets say your normal retirement age is 67, but you decide to apply for Social Security when you turn 62. Because youre taking benefits for an extra 60 months, your Social Security check would be reduced by 30%.

If youre entitled to $1,000 a month, then youd only get $700. Thats a pretty significant chunk of money to give up, and that check will be lower for life. If youre thinking of getting benefits early, then it pays to crunch the numbers to see how much you stand to lose by doing so.

Reducing Cost Of Living Adjustment

At present, a retiree’s benefit is annually adjusted for inflation to reflect changes in the consumer price index. Some economists argue that the consumer price index overestimates price increases in the economy and therefore is not a suitable metric for adjusting benefits, while others argue that the CPI underestimates the effect of inflation on what retired people actually need to buy to live.

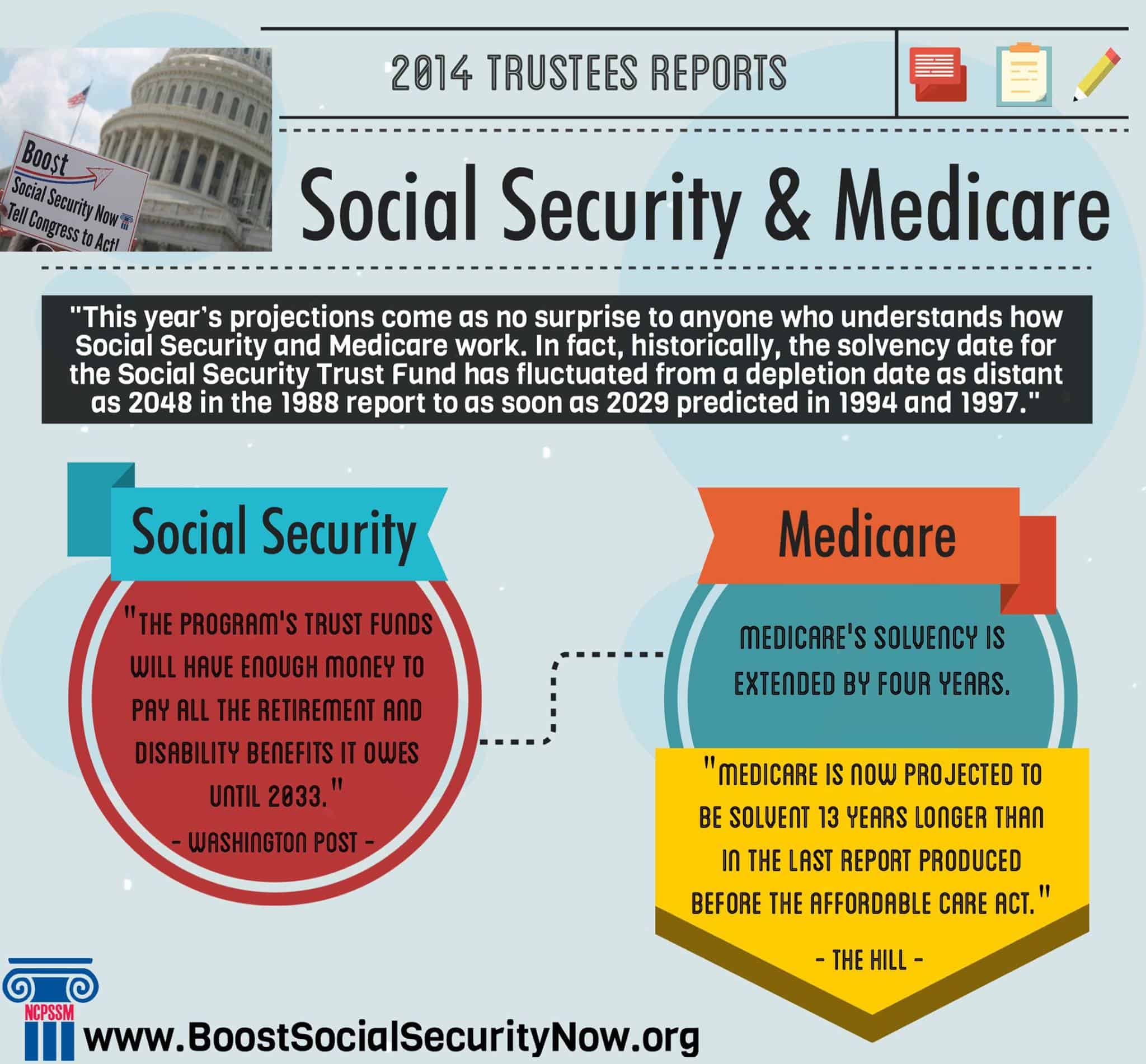

In 2003 economics researchers Hobijn and Lagakos estimated that the social security trust fund would run out of money in 40 years using CPI-W and in 35 years using CPI-E.

New Medicare Cards Will Be Issued Without Social Security Numbers

The Center of Medicare & Medicaid has announced its plan to remove Social Security numbers from Medicare ID cards. Social Security numbers have been used as the beneficiary identifier for administering services. But the Medicare Access and CHIP Reauthorization Act requires CMS to remove Social Security numbers from Medicare cards because of identity theft and fraud risks. Medicare cards with a new ID number will be issued to approximately 60 million people. Notification of the changes will be sent out around January 2018. New cards will be mailed out by January of 2019

Recommended Reading: What Is Centers For Medicare And Medicaid Services

Remove Social Security Numbers From Medicare Cards

The Social Security Administration advises Americans to keep their Social Security card in a safe place. At the same time, the Centers for Medicare and Medicaid Services tells their beneficiaries to carry their Medicare card which includes their Social Security number with them at all times. What is a Medicare beneficiary to do? And what should the government do about this conflict?

If beneficiaries carry their Medicare card in their wallet, or their Social Security card for that matter, and it falls into the wrong hands they could be setting themselves up for identity theft and/or fraudulent benefit claims submitted to the Medicare program. For many years, members of Congress and government agencies, including the Social Security Administration and the U. S. Government Accountability Office , have called on the Centers for Medicare and Medicaid Services to remove Social Security numbers from Medicare cards.

The call for removing SSNs from Medicare cards continued. In 2014 the GAO testified at congressional hearings on ways CMS could reduce fraud in Medicare, including the removal of Social Security numbers from the millions of Medicare cards. CMS testified that they agreed with the GAOs recommendations, but at that time they could not proceed for several reasons including funding limitations and the lack of a process for developing and transitioning to a new identifier.

Does Social Security Pay For Medicare

Social Security does not pay for Medicare, but if you receive Social Security payments, your Part B premiums can be deducted from your check. This means that instead of $1,500, for example, youll receive $1,386.40 and your Part B premium will be paid.

Now lets take a look at Medicare and Social Security to understand what these important benefit programs are, how you qualify, and what they mean for you.

Recommended Reading: What Is New With Medicare

Social Security And Medicare Tax Deductions

FICA refers to the combined taxes withheld for Social Security and Medicare . On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance. Medicare is shown as Fed Med/EE.

Your FICA withholdings depend on the employee group you belong to:

How To Receive Federal Benefits

To begin receiving your federal benefits, like Social Security or veterans benefits, you must sign up for electronic payments with direct deposit.

If You Have a Bank or Credit Union Account:

- Call the Go Direct Helpline at .

If You Don’t have a Bank or Credit Union Account:

- Direct Express debit card – a pre-paid debit card. Get help by calling the Go Direct Helpline at .

Make Changes to an Existing Direct Deposit Account:

Learn how to make changes to an existing direct deposit account. You also may contact the federal agency that pays your benefit for help with your enrollment.

You May Like: Do I Need Medicare If I Have Tricare

An Example Of Taxed Benefits

Lets say you receive the maximum Social Security benefit for a worker retiring at FRA in 2021: $3,148 per month. Your spouse receives half as much, or $1,574 a month. Together, you receive $4,722 a month, or $56,664 per year. Half of that, or $28,332, counts toward your combined income for determining whether you have to pay tax on part of your Social Security benefits. Lets further assume that you dont have any nontaxable interest, wages, or other income except for your traditional individual retirement accounts required minimum distribution of $10,000 for the year.

Your combined income would be $38,332half of your Social Security income, plus your IRA distributionwhich would make up to 50% of your Social Security benefits taxable, because youve exceeded the $32,000 threshold. Now, you may be thinking, 50% of $56,664 is $28,332, and Im in the 12% tax bracket, so the tax on my Social Security benefits will be $3,399.84.

Fortunately, the calculation takes other factors into account, and your tax would really be a mere $225. You can read all about the taxation of Social Security benefits in Internal Revenue Service Publication 915.

The History Of Social Security

The Social Security system in the U.S. came into existence on Aug. 14, 1935, when President Franklin D. Roosevelt signed the Social Security Act into law. The first monthly benefits checks became payable on Jan. 1, 1940, and the first person to collect one was Ida M. Fuller, a retired legal secretary in Vermont. Her check was for $22.54.

The system and its rules have evolved in the decades since. Today, Social Security is one of the largest government programs in the world, paying out hundreds of billions of dollars each year.

Don’t Miss: What Does Part B Cover Under Medicare

Using Your Medicare Card

Youll need to have your Medicare card with you any time you have any medical-related visits or services. This is true even if you have Medicare Advantage, Medicare Part D prescription drug coverage or Medigap supplemental insurance.

Your regular doctor may make a copy of your card on your first visit so they will have it readily available on file. But pharmacies, testing labs, some doctors and other health care providers will require you to show it on each visit.

Be sure to let your doctor or other health care provider know if youve received a replacement or updated Medicare card. They will need the new information.

Recommended Reading: Are Motorized Wheelchairs Covered By Medicare

What Is Deducted From Social Security Retirement Benefits

Social Security benefits are a solid means of support for millions of retirees. When economic weakness and low interest rates sap the income-producing power of some of your assets, Social Security payments are a financial resource upon which you can rely during difficult times. Also, Social Security benefits, like stocks and bonds or a well-stocked bank account, can help you realize your retirement dreams. Be aware, however, that your benefits may be reduced for a number of reasons:

You May Like: Does Medicare Help With The Cost Of Hearing Aids

Tax On Wages And Self

Benefits are funded by taxes imposed on wages of employees and self-employed persons. As explained below, in the case of employment, the employer and employee are each responsible for one half of the Social Security tax, with the employee’s half being withheld from the employee’s pay check. In the case of self-employed persons , the self-employed person is responsible for the entire amount of Social Security tax.

The portion of taxes collected from the employee for Social Security are referred to as “trust fund taxes” and the employer is required to remit them to the government. These taxes take priority over everything, and represent the only debts of a corporation or LLC that can impose personal liability upon its officers or managers. A sole proprietor and officers of a corporation and managers of an LLC can be held personally liable for non-payment of the income tax and social security taxes whether or not actually collected from the employee.

A separate payroll tax of 1.45% of an employee’s income is paid directly by the employer, and an additional 1.45% deducted from the employee’s paycheck, yielding a total tax rate of 2.90%. There is no maximum limit on this portion of the tax. This portion of the tax is used to fund the Medicare program, which is primarily responsible for providing health benefits to retirees.

The Social Security tax rates from 1937â2010 can be accessed on the Social Security Administration‘s website.

Wages not subject to tax

What Insurance Do You Get With Social Security Disability

In most cases, people receiving Social Security Disability Income are automatically enrolled in Original Medicare after serving a 24-month waiting period.

The CMS waives this waiting period for people with ALS or end-stage renal disease. People with these conditions receive Medicare coverage as soon as they collect SSDI.

Read Also: What Is Medicare Part G

Protect Your Medicare Number Like A Credit Card

Only give personal information, like your Medicare Number, to health care providers, your insurance companies or health plans , or people you trust that work with Medicare, like your State Health Insurance Assistance Program .

Say no to scams

Medicare will never call you uninvited and ask you to give us personal or private information. Learn more about the limited situations in which Medicare can call you.

Guard Your Card And Protect Your Personal Information

- To help protect against identity theft, Medicare has mailed new Medicare cards to people with Medicare. Your new card has a new Medicare Number thats unique to you, instead of your Social Security Number.

- Dont share your Medicare Number or other personal information with anyone who contacts you by phone, email, or by approaching you in person, unless youve given them permission in advance.

- Medicare, or someone representing Medicare, will only call and ask for personal information in these situations:

- A Medicare health or drug plan can call you if youre already a member of the plan. The agent who helped you join can also call you.

- A customer service representative from 1-800-MEDICARE can call you if youve called and left a message or a representative said that someone would call you back.

- Only give personal information like your Medicare Number to doctors, insurers acting on your behalf, or trusted people in the community who work with Medicare like your State Health Insurance Assistance Program .

- Be familiar with how Medicare uses your personal information. If you join a Medicare plan, the plan will let you know how it will use your personal information.

If someone calls you and asks for your Medicare Number or other personal information, hang up and call us at 1-800-MEDICARE . TTY: 1-877-486-2048.

If you suspect identity theft, or feel like you gave your personal information to someone you shouldnt have, contact the Federal Trade Commission.

You May Like: Does Medicare Cover End Of Life Care

Office Of Hearings Operations

On August 8, 2017, Acting Commissioner Nancy A. Berryhill informed employees that the Office of Disability Adjudication and Review would be renamed to Office of Hearings Operations . The hearing offices had been known as “ODAR” since 2006, and the Office of Hearings and Appeals before that. OHO administers the ALJ hearings for the Social Security Administration. Administrative Law Judges conduct hearings and issue decisions. After an ALJ decision, the Appeals Council considers requests for review of ALJ decisions, and acts as the final level of administrative review for the Social Security Administration .

Eligibility For The Two Programs

For people who are aging into Social Security and Medicare , eligibility ages vary between the two programs. Beneficiaries qualify for Medicare when they turn 65, with a seven-month enrollment window that straddles the month they turn 65.

But theres significantly more flexibility in terms of eligibility for Social Security. You can elect to begin receiving Social Security payments as early as age 62, but the earlier you begin collecting benefits, the lower your monthly check will be. Waiting to claim Social Security benefits until age 70 results in the highest monthly income payments.

Both Social Security and Medicare are available regardless of income, so benefits are provided to wealthy Americans as well as those with lower incomes. Thats in contrast with Medicaid, which is only available to low-income Americans.

Also Check: How Long Does It Take To Get Medicare B

If You Already Receive Benefits From Social Security:

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A and Part B starting the first day of the month you turn age 65. You will not need to do anything to enroll. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If your 65th birthday is February 20, 2010, your Medicare effective date would be February 1, 2010.

Get Ssa Benefits While Living Overseas

U.S. citizens can travel to or live in most, but not all, foreign countries and still receive their Social Security benefits. You can find out if you can receive benefits overseas by using the Social Security Administrations payment verification tool. Once you access the tool, pick the country you’re visiting or living in from the drop-down menu options.

Recommended Reading: Are Synvisc Injections Covered By Medicare

What If The Social Security Administration Finds That My Disability Has Ceased But Im Still Not Able To Work

The notice, which you will receive from the Social Security Administration following a continuing disability review, will explain your appeal rights. Read this notice carefully. If you appeal within ten days of the date you receive the notice your benefits will continue during your appeal. So be sure to act quickly.

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

You May Like: Does Medicare Cover Outside Usa

How To Stop Social Security Check Payments

The SSA can not pay benefits for the month of a recipients death. That means if the person died in July, the check received in August must be returned. Find out how to return a check to the SSA.

If the payment is by direct deposit, notify the financial institution as soon as possible so it can return any payments received after death. For more about the requirement to return benefits for the month of a beneficiarys death, see the top of page 11 of this SSA publication.

Family members may be eligible for Social Security survivors benefits when a person getting benefits dies. Visit the SSA’s Survivors Benefits page to learn more.