Do You Need To Renew Medicare Part A

For most people, Medicare Part A hospital insurance is premium-free and once you have it, you wont have to do anything to keep it. If you are already getting Social Security when you turn 65, youll be enrolled automatically. If you arent getting Social Security, you can use Social Securitys website to enroll.

There are a few good reasons not to sign up for Medicare Part A hospital insurance when you turn 65. Most of them are related to having insurance from your employer or spouses employer. Before you reject Part A, talk to a benefits counselor for your employer and make sure you understand that you are doing the right thing for you. If your situation changes and you want to enroll in Part A, do it cautiously but quickly. You can get more information to help you understand Part A rules and how they affect you.1

Grass May Be Greener on the Other Side

Dont take for granted that there isnt something better. Medicare is a big program with lots of options.

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Do I Need Original Medicare To Apply For Medigap

This seems like a quick answer. To enroll in Medigap, you’ll first be required to have Medicare Part A and Part B. Your Open enrollment period in Medicare Part B begins on the 1st Monday of each month. During the open enrollment period, you’ll need to first complete an application for Medicare Part B. Outside of Medigap’s Open Enrollment Period, you can receive less coverage for your medical conditions.

These programs allow people to use their savings to cover other expenses or to buy more coverage. The Medicare savings programs are: The Qualified Medicare Beneficiary program. The Specified Low-Income Medicare Beneficiary program. The Qualified Individuals program. The Qualified Disabled Working Individuals program.

Also Check: When Can I Change Medicare Advantage Plans

Having Medicaid Or A Medicare Savings Program

Medicare covers many services, but it doesnt cover long-term care benefits and can leave its enrollees with large cost-sharing expenses. Medicaid pays for some services that Medicare doesnt cover for enrollees whose incomes and assets make them eligible. If you have Medicaid or a Medicare Savings Program a program where Medicaid pays for Medicare premiums and cost-sharing your enrollment options are different than if you only had Medicare.

Some Medicare Advantage plans specialize in covering low-income Medicare beneficiaries. These are known as Dual Eligible Special Needs Plans , and are available in every state. If you have Medicare and Medicaid, you should have few out-of-pocket expenses if you see providers enrolled in both programs regardless of whether you enroll in a D-SNP. Receiving coverage through a D-SNP requires you to see only providers who participate with the D-SNP insurer.

Some D-SNPs offer additional services, such as home care, dental or vision benefits. D-SNPs can also help coordinate all of the health services you receive. But low-income Medicare beneficiaries may find that theyre better off with Original Medicare paired with regular Medicaid as secondary coverage, if their providers accept those programs but not D-SNP plans. In many states, the fee-for-service Medicaid benefit also covers dental or vision care.

Here is more information about programs available to Medicare beneficiaries with limited incomes and assets.

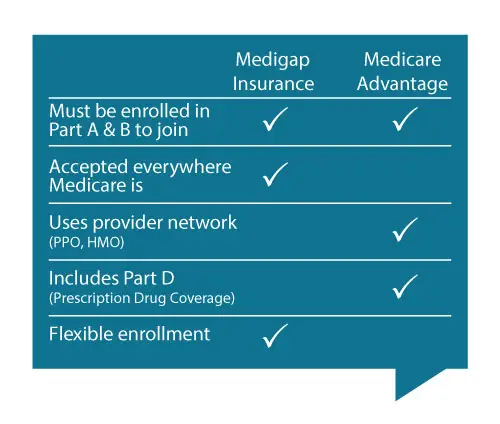

Medicare Advantage Vs Medigap

Our reviews of products and advertising are done independently by our customers. We might be compensated for visits to our recommended partner sites. The following are the links. Find the advertiser information here. Everyone interested in enrolling in Medicare has several options. What is the most important part of choosing an insurance policy?

You can find out more about Medigap plans available in your area at or your state insurance department. How Medicare Advantage is different from Medigap Medicare Advantage, also known as Medicare Part C, is an all-in-one alternative to original Medicare . Private insurance companies offer Medicare Advantage plans that Medicare approves, and they bundle together Part A hospital coverage, Part B doctor and outpatient services.

Recommended Reading: Is Inogen One Covered By Medicare

Choosing My Type Of Medicare Coverage

Your first decision when it comes to health coverage after 65 is between Original Medicare and Medicare Part C.

Original Medicare covers most hospital and doctor expenses. The balance is left to you, with no cap on how high your out-of-pocket costs can go.

Original Medicare allows you to see any doctor in the U.S. who accepts Medicare. It provides excellent flexibility: it has no networks or referral requirements.

Medicare Part C bundles hospital, doctor and drug coverage. It covers most of those expenses, but you pay deductibles, copayments, and coinsurance. Medicare Advantage plans cap out-of-pocket expenses.

Medicare Advantage is all-encompassing, even offering dental and vision coverage . But, you are limited to its doctor network and need referrals to see specialists.

How To Switch To Medigap When You Have Medicare Advantage

Getty

Switching to Medigap from Medicare Advantage requires some planning. There are several crucial points you should know.

Even if you haven’t considered changing plans before, understanding the process and options is beneficial. Here I’ll discuss when, how and why to consider changing plans.

When Can I Disenroll From A Medicare Advantage Plan?

There are two times to disenroll from a Medicare Advantage plan: the annual enrollment period and the Medicare Advantage open enrollment period. Annual enrollment takes place in the fall from October 15 through December 7.

The Medicare Advantage open enrollment period is one last chance to change your policy for the year. It takes place from January 1 through March 31 each year. There are other enrollment periods available, such as the initial enrollment period for those newly eligible for Medicare.

If changing from an Advantage plan to Medigap is your goal, you need to apply as early as possible. You want to be sure the Medigap plan accepts your application before you cancel your Advantage plan. The most important information any insurance agent will tell you: Never cancel a policy over a quote. It’s best to wait until you have the final plan in your hands before you cancel current coverage.

Can I Be Denied Medigap Coverage?

When Can I Change My Medicare Supplement Policy?

Why Might You Want To Change Medicare Plans?

Read Also: Does Medicare Cover Naturopathic Doctors

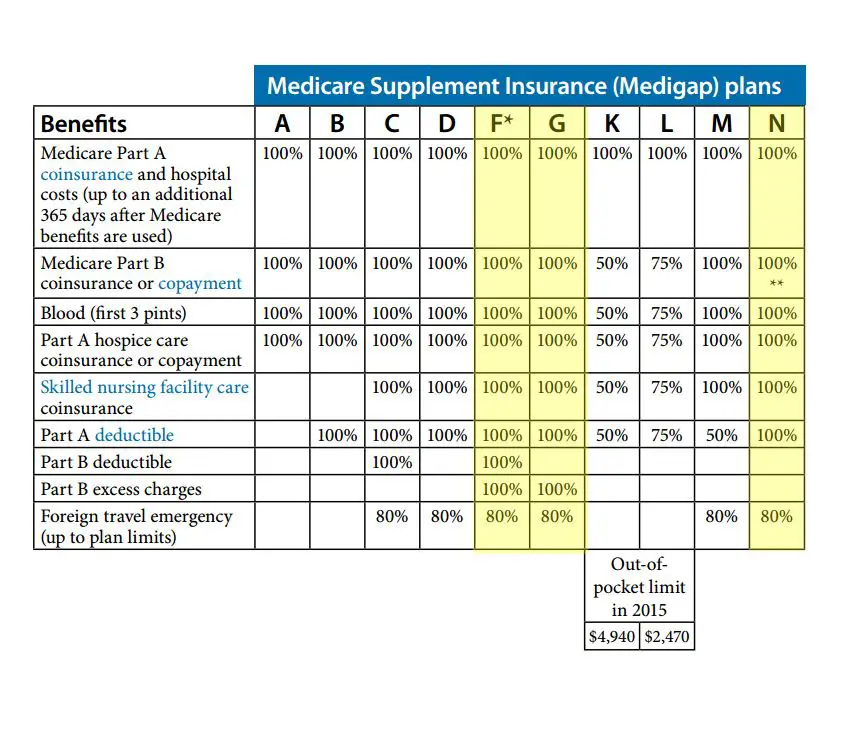

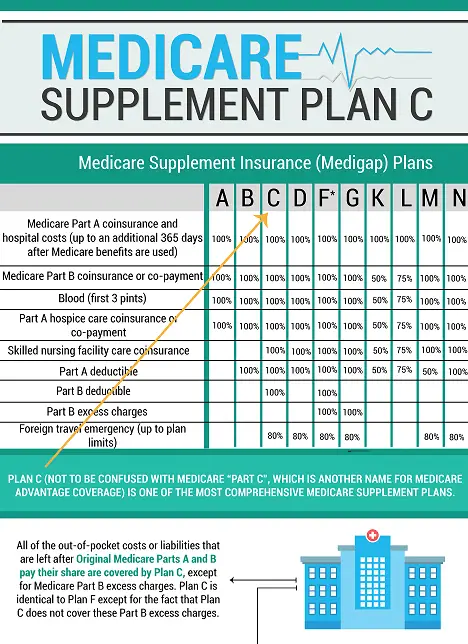

Which Plan Is Best

Heres the short answer: If you want 100% coverage of everything, an F or G plan is your choice. The other plans offer progressively less coverage for lower upfront costs.

For a more detailed answer, you can do one of the following:

- Speak with a qualified insurance agent or Medicare advisor to find the plan that fits you.

- Read the Medicare publication Choosing a Medigap Policy, where youll find descriptions of each policy type and what it covers.

Cobra Coverage From An Employer Plan

Federal and state law allows people who leave their jobs to continue their employer-sponsored health coverage for a period of time. Be aware of the following:

- You have an eight-month period after your employment ends to enroll in Medicare. If you dont enroll during that eight-month window, you might have to pay a penalty when you enroll.

- If youre in your Medicare initial enrollment period, you must enroll in Medicare during that time to avoid a possible penalty.

- If you dont buy a Medicare supplement policy during your open enrollment period, youll be able to buy some Medicare supplement plans within 63 days of losing your COBRA coverage.

Talk to your employer about COBRA and Medicare eligibility.

Also Check: Do You Have To Start Medicare At 65

If Youre 65 Or Older:

If you apply for Medigap coverage after your open enrollment period, theres no guarantee an insurance company will sell you a policy. Insurers can:

- Request your medical history as part of the conditions of issuing you a plan

- Refuse to sell you a policy

- Make you wait for coverage to start

- Charge you more

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Read Also: Does Medicare Cover Toenail Clipping

How Original Medicare Works

Original Medicare does not include coverage for prescription drugs or routine dental, vision and hearing care. If you choose Original Medicare, you can pay for those things out of pocket, or you can purchase a stand-alone prescription drug plan and a Medicare Supplement plan to beef up your coverage. These added plans help , although youll pay a separate premium for each.

- Medicare Part A helps cover inpatient hospital care, skilled nursing facilities, and some home health services. Most people who paid Medicare taxes while working dont have to pay a monthly premium for Part A.

- Medicare Part B helps cover medical services, including doctors visits and many preventive services. The standard Part B premium for 2022 is $170.10 or higher, depending on your income.

- Medicare Part D helps cover prescription drug costs. Costs for Part D depend on things like the plan you choose and what type of prescription drugs you require.

- Medicare Supplement Medicare Supplement plans may help pay out-of-pocket costs not paid for by Medicare Parts A and B, including copays, deductibles and coinsurance.*

Can My Plan Be Canceled

No, thats illegal. As long as you pay your premiums, your policy is renewable for the rest of your life. You can only be dropped if any of the following apply:

- You stop paying premiums.

- You lied on your original Medigap application.

- The company goes bankrupt.

If you choose to cancel your Medigap policy, you must do so by contacting the insurance company directly.

Recommended Reading: Is Chemo Covered By Medicare

Which Is Better Advantage Plans Or Medigap Plans

A Medicare Advantage Plan may offer more flexibility for your expenses as they are protected by reducing the cost of the premium and the cost of the premiums. Medicare plus Medigap insurance generally allows you to have greater choices on how you will be cared for.

Medigap offers supplementary coverage that fills gaps by paying the deductibles incurred by Original Medicare. The Medicare Advantage plan substitutes the original Medicare plan, providing general extra coverage.

How Do I Change My Address With Medicare

To change your address with Medicare, you must contact your local Social Security office and verify your identity. From there, they can change your address on file by answering a few simple questions and providing supporting documentation.

If you have multiple addresses, you must provide your permanent residence. This is determined by where you spend the majority of your time throughout the year.

Read Also: Does Medicare Pay For Any Prescriptions

Who Qualifies For Medicare Advantage

Generally, Medicare Advantage is available for:

- Seniors age 65 or older

- Younger people with disabilities

- People with end-stage renal disease

With Medicare Advantage plans, you must also be enrolled in Medicare Part A and Part B and reside in the plans service area.

Enrollment only occurs during certain periods, but you cannot be denied coverage due to a preexisting condition. Specifically, you can join or switch to a Medicare Advantage plan with or without drug coverage during the following three windows:

- Initial Medicare Enrollment Period: Begins three months before you turn 65 and ends three months after you turn 65

- Open Enrollment Period: From Oct. 15 to Dec. 7

- Medicare Advantage Open Enrollment Period: Jan. 1 to March 31 annually

What Is The Difference Between Medicare Advantage And Medicare Supplements

When you enroll in a Medicare Advantage plan, it replaces Original Medicare as your primary source of coverage, whereas Medicare Supplement plans pay supplementary to Original Medicare.

In order to satisfy your coverage requirements for the entire calendar year, Medicare pays a specific amount to the provider of the Medicare Advantage plan in which you participate.

New Medicare beneficiaries can see that Medicare Advantage plans are advertised somewhat frequently, but Medicare Supplement plans are rarely if ever, promoted.

This is because Medicare Advantage and Medicare Supplement plans have different carrier profit margins.

One plan type will work better for you depending on your demands in terms of lifestyle, spending, and medical coverage.

Medicare Supplement vs. Medicare Advantage Pros and Cons

Medicare Advantage and Medicare Supplement plans differ in a number of ways. Medicare Part Cs Medicare Advantage plans are designed as all-inclusive choices with affordable monthly premiums.

Low to no out-of-pocket expenses are provided by Medicare Supplement plans, which provide supplemental coverage to Original Medicare. The advantages and disadvantages of Medicare Advantage and Medicare Supplement plans are listed in the chart below.

Plans for Medicare Advantage

Plans for Medicare Supplements Pros Cons Pros Cons

- Additional benefits

- Low monthly premiums

- Additional plans for dental, vision, and prescription required

- 12 Plan options available

Find Medicare Plans in 3 Easy Steps

Also Check: How To Check Patient Medicare Eligibility

Pros & Cons Of Medicare Advantage And Medigap Plans

There are pros and cons for both Medigap and Medicare Advantage plans based on each individuals financial situation and health circumstances.

You should compare the differences between the Medigap and Medicare Advantage plans you are considering before deciding which one you want to purchase.

Do You Have Medicare Part A Coverage Overseas

Medicare Part A doesnt generally cover care outside the U.S., but it may cover inpatient care in a foreign hospital in special circumstances. Overall, Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and home healthcare.

There are three situations where Medicare may pay for foreign hospital care:

Read Also: How Much Do You Pay For Medicare Part A

How To Enroll In A Medicare Advantage Plan

Once youve done your research and found a Medicare Advantage plan that fits your needs, there are various ways to enroll:

-

Use Medicares Plan Finder to find the plan in your area. Click on Enroll.

-

Go to the plans website to see if you can enroll online. Contact the plan to get a paper enrollment form. Fill it out and return it to the plan provider.

You will need your Medicare number and the date your Medicare Part A and/or Part B coverage started. You must be enrolled in Medicare Parts A and B before you can buy a Medicare Advantage plan.

Keep in mind that you can only enroll in a Medicare Advantage plan during your Initial Enrollment Period or during the Open Enrollment Period from Oct. 15 to Dec. 7. Once youre enrolled in a Medicare Advantage plan, you can switch plans during Medicare Advantage Open Enrollment from Jan. 1 to March 31 each year.

Some disadvantages of Medigap plans include:

- Higher monthly premiums

- Having to navigate the different types of plans

- No prescription coverage

Why Medicare Advantage Plans Can Fall Short

For many older Americans, Medicare Advantage plans can work well. A JAMA study found that Advantage enrollees often receive more preventive care than those in traditional Medicare. Advantage plans are competing not just on cost but on delivering quality care, says Kenton Johnston, PhD, associate professor of health management and policy at Saint Louis University, co- author of the study.

But if you have chronic conditions or severe health needs, you may want to think twice about Medicare Advantage because of the requirements for pre-authorization and staying in-network, says Melinda Caughill, co-founder of 65 Incorporated, a firm that provides Medicare enrollment guidance to financial advisers and individuals.

If you need to see multiple specialists, and you have to get referrals for each appointment or fight to overturn denials, it can be really challenging, Caughill says.

Steven Feld, 65, a retiree in South Pasadena, Fla., struggled to get coverage for an injection to treat his arthritic knee. The treatment, a prefilled injection administered in a doctors office, is deemed a medical device by the FDA, so the plan twice denied the coverage. When I was on my employers group plan, there was no problem getting the injection covered, says Feld, who joined his Medicare Advantage plan in May.

Recommended Reading: Does Medicare Pay For Entyvio

Do You Have To Pay Back Provider Of Medicaid

You may haveto payMedicaidback if: Bills were paid when you were not eligible for Medicaid. If you are age 55 or older, the state may recover what has been paid in medical services from your estate after you pass away. Recovery can only be made if at the time of death, youhave no surviving spouse, no child under the age of 21, or no child