Qualified Disabled And Working Individuals Program

Lastly, the QDWI Program will help you pay for Medicare Part A premiums if you are disabled, working, and under 65 years old.

If any of the following situations apply to your situation, you could qualify for the QDWI Program:

- Younger than 65, disabled and working

- Lost your premium-free Part A when you returned to work

- Receive no medical assistance from your state

- Fall under the income/resource limits for your state

Speaking of income limits here are the 2020 numbers that you cannot exceed

- $4,339 for individuals

Resources limits for the Qualified Disabled and Working Individuals Program are:

- $4,000 for individuals

- $6,000 for married couples

Eligibility For The Specified Low

To be eligible for the Specified Low-Income Medicare Beneficiary Program, you must be entitled to Medicare Part A, meet income requirements, and have limited financial resources.

Maximum Gross Monthly Income

Are you wondering what the maximum gross monthly income for greater than 100%, but less than 120% of the poverty level? As an individual, in 2022, youd need a monthly income between $1,133 and $1,379. As a couple, your monthly income would need to be between $1,526 and $1,851.

If you and your spouse apply for the SLMB program, you must use the couples monthly income range. However, if only one of you is eligible, use the individual monthly income range to determine if youre eligible separately.

What should you consider as income?

- Social Security benefits

- Veteran or private pension benefits

- Earnings, wages, royalties, and rental income

- The value of food, clothing, or shelter paid by someone else

Maximum Financial Resources

To qualify for the SLMB program, you need to have limited financial resources. This means that when you add up all of your resources as an individual, those should value no more than $8,400. As a couple, your maximum countable resources should be $12,600.

See the top of this article for Maximum Financial Resources to see what should be included and excluded when accounting for your financial resources.

What To Do If You Are Denied Coverage

If you are denied eligibility for QMB, SLMB, or QI, you have a right to appeal. If you believe you should be eligible for one of the programs, go to the office where you applied. Ask about the procedure in your state for getting a hearing to appeal that decision.

At an appeal hearing, you will be able to present any documents or other papersproof of income, assets, medical billsthat you think support your claim. You will also be allowed to explain why the Medicaid decision was wrong.

The hearing itself is usually held at or near the welfare or social service office. You are permitted to have a friend, relative, social worker, lawyer, or other representative appear with you to help at the hearing. Although the exact procedure for obtaining this hearing, and the hearing itself, may be slightly different from state to state, they all resemble very closely the hearings given to applicants for Social Security benefits. For more information, see Nolo’s articles on Medicaid appeals.

Also Check: What Age Can I Take Medicare

Required Documents And Other Information

Because eligibility for the QMB, SLMB, or QI programs depends on your financial situation, many of the documents you must bring to the Medicaid office are those that will verify your income and assets.

Although a Medicaid eligibility worker might require additional specific information from you, you will at least be able to get the application process started if you bring:

- pay stubs, income tax returns, Social Security benefits information, and other evidence of your current income

- papers showing all your savings and other financial assets, such as bankbooks, insurance policies, and stock certificates

- automobile registration papers if you own a car

- your Social Security card or number

- information about your spouse’s income and separate assets, if the two of you live together, and

- medical bills from the previous three months, as well as medical records or reports to confirm any medical condition that will require treatment in the near future. If you don’t have copies of these bills, records, or reports, bring the names and addresses of the doctors, hospitals, or other medical providers who are treating you.

Benefits Of Qualified Individual

Pays Part B premiums

Gross Monthly Income Limits: Individuals $1,469 Couples $1,980

Asset Limit: Individuals $7,970 Couples $11,960

You cannot choose to apply for a certain MSP. You will be enrolled in the MSP that corresponds to your income, assets, and application detail. All three main MSPs additionally allow you to:

- Enroll in Part B outside of usual enrollment periods.

- Eliminate your Part B late enrollment penalty if you have one.

You May Like: Does Aarp Medicare Supplement Plan Cover Silver Sneakers

The Qmb Slmb And Qi Programs Help Pay Medicare Premiums Deductibles And Co

By Joseph Matthews, Attorney

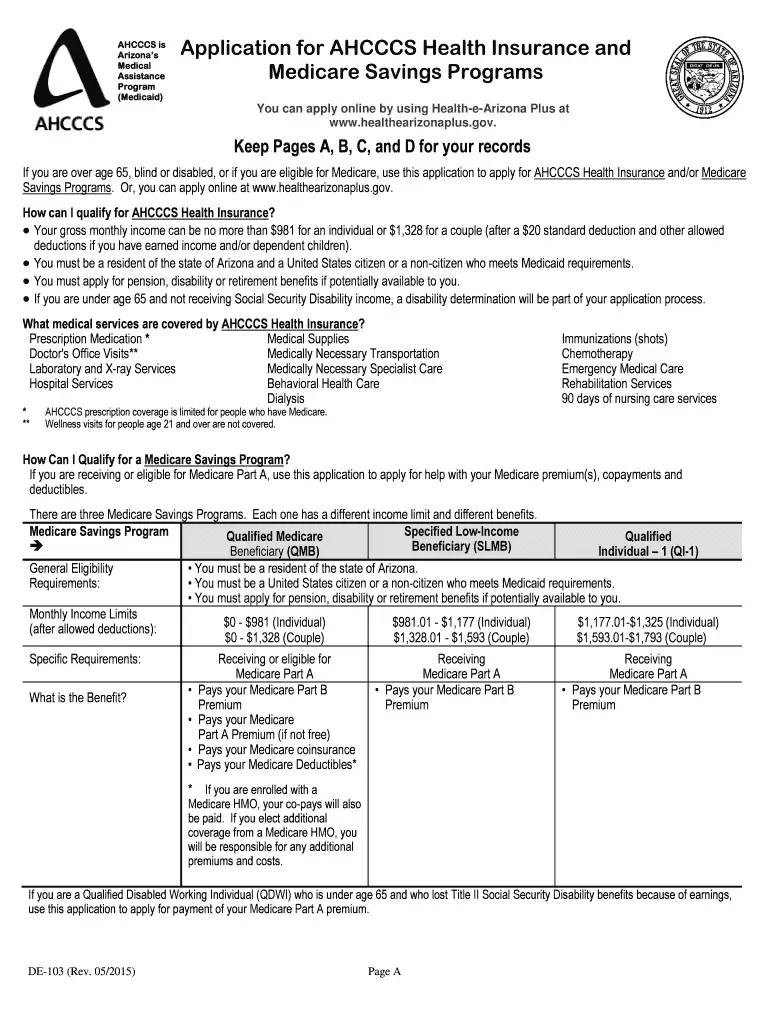

Many people who are elderly or have disabilities have trouble paying the portion of medical bills left unpaid by Medicare and cannot afford private medigap insurance or a Medicare Advantage plan, but do not qualify for Medicaid. If this is your situation, you might be able to get help paying Medicare premiums and portions of Medicare-covered costs that Medicare does not pay. Three cost-reduction programscalled Qualified Medicare Beneficiary , Specified Low-Income Medicare Beneficiary , and Qualifying Individual are administered by each state’s Medicaid program.

Enrollment Deadlines In Texas

The enrollment periods and dates for Medicare Part C are the same in Texas as they are throughout the rest of the country.

- Initial enrollment period. This refers to the first time when you are eligible for Medicare. For people who are getting Medicare because they are approaching their 65th birthday, initial enrollment begins 3 months before your birthday and ends 3 months after it takes place, for a total of 7 months.

- 25th disability benefit. If you are under age 65 and are getting Medicare due to a disability, you can sign up for Part C during the 3-month period that occurs prior to receiving your 25th disability benefit through to the 3-month period that will occur after that date.

- General enrollment. Every year from January 1 through March 31, you may enroll in Medicare. If you miss initial enrollment and have to sign up during general enrollment, you may have to pay higher premiums.

- Open enrollment. Open enrollment for Medicare is an annual event that begins on October 15 and ends on December 7. During open enrollment, you can change plans, make changes to your existing plan, and add or drop services.

Help enrolling in Medicare in Texas

Enrolling in Medicare can be confusing. These organizations can help you navigate the process in Texas:

Recommended Reading: When Can You Get Medicare Health Insurance

How The Medicare Savings Program Can Help You

These programs offer low-income Medicare beneficiaries assistance in paying for Medicare Part A and Part B premiums. If an individuals income is low enough these programs can even pay the full premiums.

Medicare beneficiaries who also have Medicaid should pay close attention to those programs because it is one of the qualifications for 3 of the 4 Medicare Savings Programs.

Medicare Advantage Plans In Texas

Medicare Advantage is a health insurance plan thats available across the United States. Its sometimes known as Medicare Part C, although unlike its counterparts, Part A and Part B, it is not administered by the federal government. Instead, Medicare Advantage is provided by private insurance companies, which results in plans that feature varying coverage levels and price points. In many cases, these plans provide additional coverage that isnt included in Original Medicare, such as prescription medications and optometry.

Medicare Advantage programs vary between different states and as such, so do their enrolment rates. Across the United States, a total of 39% of Medicares beneficiaries are enrolled in a Medicare Advantage plan, and in Texas, the enrollment rate sits slightly above the national average at 41%. This rate is considerably higher than in neighboring states Oklahoma and Arkansas, which have enrolment rates of 24% and 29%. There are several states in the United States that have higher enrolment rates, including Florida, which sits at 48%, and Hawaii, where the enrolment rate is among the highest in the nation at 47%.

Also Check: Can Doctors Limit The Number Of Medicare Patients

What Services Does The Partnership Provide

- Medicare and Medicaid information and education

- Help with original Medicare eligibility, enrollment, benefits, complaints, rights and appeals

- Explain Medicare Supplemental insurance policy benefits and comparisons

- Explain Medicare Advantage and provide comparisons and help with enrollment and disenrollment

- Explain Medicare Prescription Drug coverage, help compare plans and search for other prescription help

- Information about long-term care insurance

The partnership also helps with the following programs. Benefit Counselors are specially trained to help you understand all the fine print to find and apply to a plan that works for you. They advocate for you with these programs and help you get the services you need.

Where Can I Apply For Medicaid In Texas

Texass Medicaid program is overseen Texas Health and Human Services Commission . You can apply for Medicaid ABD benefits or an MSP using this website.

This page contains more information about applying for Medicaid.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals. In addition to advocacy work, Josh helped implement federal and state health insurance exchanges at the technology firm hCentive. He has also held consulting roles, including at Sachs Policy Group, where he worked on Medicare and Medicaid related client projects.

Recommended Reading: Are Walkers Covered By Medicare

Who’s Eligible For Medicaid For The Aged Blind And Disabled In Texas

Medicare covers a great number services including hospitalization, physician services, and prescription drugs but Original Medicare doesnt cover important services like vision and dental benefits. Some beneficiaries those whose incomes make them eligible for Medicaid can receive coverage for those additional services if theyre enrolled in regular Medicaid for the aged, blind and disabled .

In Texas, Medicaid ABD only covers dental care in emergencies. This website has a list of low-cost dental clinics in Texas. Medicaid ABD also covers eye exams and eyeglasses or contacts every 24 months.

Medicaid ABD is called Medicaid for the Elderly and People with Disabilities in Texas.

This is less than the income limit for QMB meaning that Medicaid ABD enrollees in Texas also qualify for QMB benefits. Medicaid ABD enrollees can confirm with their Medicaid office that theyre also receiving QMB.

Asset limits: The asset limit is $2,000 if single and $3,000 if married.

Extra Help with prescription drug costs in Texas

Medicare beneficiaries who receive Medicaid, an MSP, or Supplemental Security Income also receive Extra Help a federal program that reduces their out-of-pocket prescription drug costs under Medicare Part D. Individuals can also apply for Extra Help through the Social Security Administration if they dont receive it automatically.

Types Of Medicare Savings Programs And What They Cover

Medicare Savings Programs are programs that help pay Medicare premiums and, in some cases, some of your out-of-pocket expenses like your Part A and Part B deductibles, coinsurance, copayments, and prescription drugs. These programs are also sometimes known as Medicare Buy-In Programs or Medicare Premium Payment Programs.

There are four types of Medicare Savings Programs. Depending on your individual circumstances, you may qualify for one or more of the following programs. But before we go any further, lets quickly look at the three overall questions you must answer Yes to before even being eligible to explore a Medicare Savings Program.

Also Check: Is Silver Sneakers Available To Anyone On Medicare

Other Things To Know About The Qmb Program:

Medicare providers arent allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments, except outpatient drugs. Pharmacists may charge you up to a limited amount for prescription drugs covered by Medicare Part D.

- If you get a bill for Medicare charges: Tell your provider or the debt collector that youre in the QMB Program and cant be charged for Medicare deductibles, coinsurance, and copayments.

- If you already made payments on a bill for services and items Medicare covers: You have the right to a refund.

- If you have a Medicare Advantage Plan: Contact the plan to ask them to stop the charges.

In some cases, you may be billed a small copayment through Medicaid, if one applies.

Make sure your provider knows you’re in the QMB program

The SLMB Program is a state program that helps pay Part B premiums for people who have Part A and limited income and resources.

How Do I Apply

If you naswer yes to these 3 questions, call 2-1-1 or visit www.yourtexasbenefits.com to see if you qualify for a Medicare Savings Program.

1. Do you have, or are you eligible for, Part A?

2. Is your income for 2020 at, or below, the income limits?

3. Do you have limited resources, below the resource limits?

It’s important to call or fill out an application if you think you could qualify for savings – even if your income or resources are higher than the amounts listed here.

Read Also: How Does Medicare For All Work

Types Of Medicare Advantage Plans

There are several Medicare Advantage plans that residents of Texas can choose from. This includes Managed Care Plans, also known as Health Maintenance Organizations, Preferred Provider Organizations and Provider Sponsored Organizations. In addition to these options, those living in the state of Texas can also access Special Needs Plans and Private Fee-For-Service Plans.

Health Maintenance Organizations

Health Maintenance Organizations act as Managed Health Care plans, so participants are required to seek care from providers within their HMOs network and typically, any specialist appointments need to be arranged by the patients primary care physician. Care that is provided by a health care practitioner outside of the patients network is typically charged entirely to the patient. While these plans are typically less expensive than other Medicare Advantage plans, their limitations can prove inconvenient for some participants. This is especially true for seniors who require care from a provider that isnt within the network. In most cases, receiving care from a provider outside of the HMOs network means that the patient is responsible for 100% of the cost.

Preferred Provider Organizations

Provider Sponsored Organizations

Special Needs Plans

Private Fee-for-Service Plans

Enrollment And Eligibility For Medicare Advantage In Texas

Prior to enrolling in Medicare Advantage, seniors must first be enrolled in Original Medicare. Anyone who is eligible for Medicare Parts A and B is also eligible to enroll in Medicare Advantage. However, certain Medicare Advantage plans, such as SNPs, may have additional eligibility requirements.

Medicare Advantage has specific enrollment periods. One can only join a Medicare Advantage plan during the following periods:

- Initial Coverage Election Period: This is the 7-month period during which everyone is eligible to enroll in a Medicare Advantage plan. The period spans from 3 months before the month of ones 65th birthday to 3 months after ones birthday month.

- Annual Election Period : Also referred to as the Open Enrollment Period, the AEP runs from October 15-December 7 each year. During this period, anyone can enroll in Medicare Advantage for the first time or change to a new plan.

- Medicare Advantage Open Enrollment Period: From January 1-March 31 each year, anyone who is already enrolled in Medicare Advantage can switch to a different plan, or disenroll and switch back to Original Medicare. This period is not open to anyone who is not currently enrolled in Medicare Advantage.

- General Enrollment Period: In some circumstances, one can join Medicare Advantage between April 1-June 30. This enrollment period only applies to those who enrolled in Medicare Part B for the first time during Medicares Open Enrollment Period .

Don’t Miss: Does Medicare Advantage Cover Chiropractic Care

Qualified Disabled And Working Individual Program

This program covers the Part A premium for certain enrollees who are under 65 and do not qualify for a premium-free Part A. To qualify for the QDWI program, you must be enrolled in Part A or must be eligible to enroll in Part A. And, of course, you must meet the monthly income and resources requirement.

The monthly income limit for individuals is $4,379, while its $5,892 for couples. As for resources, the limit for individuals is $4,000 and $6,000 for couples.

At Texas Medicare Advisors, we provide you with unbiased and expert insurance advice so you can get the Medicare coverage you need. For more information about Medicare Savings Programs, call us today at 512-900-3008.

Quick Review: Whats Medicaid

Medicaid is a federal assistance program that provides health insurance for low-income and vulnerable Americans. The program is partially funded by the states and each state can set its own eligibility requirements. Qualifying for Medicaid benefits depends largely on your income, but also on your age, disability status, pregnancy, household size, and your household role.

See if you qualify with our state-by-state guide to Medicaid.

Medicaid is a separate program from Medicare. Both programs provide health insurance, but Medicare coverage is primarily for seniors while Medicaid eligibility depends largely on your income. Itâs possible to take part in both programs at the same time. Learn more about the difference between Medicaid and Medicare.

You do not need to have Medicaid to apply for MSPs. In fact, you donât qualify for the QI program if you have Medicaid.

Read Also: Is Silver Sneakers Part Of Medicare

Qualifying Individual Program In Texas

The Qualifying Individual Program will cover your Medicare Part B premiums if you meet eligibility requirements. You cannot be eligible or receive regular Medicaid and the QI program coverage at the same time. If you are QI-eligible, you will not get regular Medicaid benefits or a medical identification card.