If You Are Under Age 65 And Disabled:

If you are under age 65 and disabled, and have been entitled to disability benefits under Social Security or the Railroad Retirement Board for 24 months, you will be automatically entitled to Medicare Part A and Part B beginning the 25th month of disability benefit entitlement. You will not need to do anything to enroll in Medicare. Your Medicare card will be mailed to you about 3 months before your Medicare entitlement date. , you get your Medicare benefits the first month you get disability benefits from Social Security or the Railroad Retirement Board.) For more information about enrollment, call the Social Security Administration at 1-800-772-1213 or visit the Social Security web site. See also Social Securitys Medicare FAQs.

For more information, see Medicare.gov

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

Receiving Social Security For A Disability

If youve received Social Security Disability Insurance for 24 months, youll automatically be enrolled in Medicare on the 25th month after your first SSDI check was received.

According to the Centers for Medicare & Medicaid Services , in 2019 there were 8.5 million people with disabilities on Medicare.

Also Check: What Is Medicare Part G

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

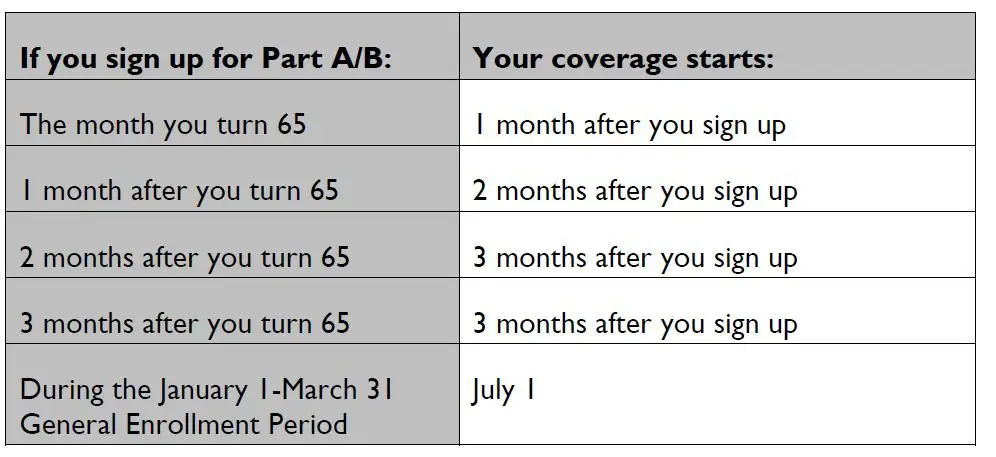

I Am Turning 65 Next Year When Can I Sign Up For Medicare

If you are eligible for Medicare, your initial enrollment period for Part A and Part B begins three months before the month of your 65th birthday and ends three months after it. For example, if your 65th birthday is in June, your enrollment period will extend from March 1 through September 30. If you join during one of the 3 months before you turn 65, coverage will begin the first day of the month you turn 65. If you join during the month you turn 65, your coverage will begin the first day of the month after you turn 65. If you join in the month after you turn 65, coverage will begin 2 months later, and if you join 2 or 3 months after you turn 65, coverage will begin 3 months later. A recent change in law limits these gaps in coverage. Starting in 2023, if you enroll in Medicare during the first 3 months after your turn 65, coverage will begin the first day of the month following the month you enroll.

Once you have Part A and Part B, you are then also eligible to enroll in a Medicare Advantage plan and/or a Part D plan. If you are already receiving Social Security benefits when you turn 65, you will automatically be enrolled in Part A and Part B. If you are not already receiving Social Security benefits and you want to enroll in Medicare, you should contact Social Security.

Don’t Miss: Is Spaceoar Covered By Medicare

Can I Get Medicare Early If I Retire Early

If you retire earlier than age 65, you will not be eligible for Medicare. Although Medicare is often thought of as insurance for retired people, the Medicare age requirement is still 65. Some people continue to work past age 65 and have insurance coverage through their employer. Many people retire before they turn 65 and must purchase health insurance or are covered on their spouses insurance plan. Although you may be eligible for social security retirement benefits if you retire early, it does not change your age requirement for Medicare health insurance coverage.

How Could Lowering The Medicare Age Affect People Eligible For Full Medicaid Benefits

What is current policy? Today, some people are eligible for both Medicare and full Medicaid benefits, while others may lose Medicaid eligibility once they become eligible for Medicare. A persons status as a Medicare beneficiary does not qualify them for full Medicaid benefits. Instead, a person must independently qualify for Medicaid through an eligibility pathway based on low income or disability. Individuals in the 60-64 age range may qualify for Medicaid through various pathways that may have different eligibility criteria and benefit packages. For example:

What are the key policy choices and implications? Lowering the age for Medicare would require policy choices about whether to allow individuals in the new age range to continue to receive full Medicaid benefits, if eligible under the ACA expansion or other poverty- or disability-related pathways, or whether these individuals would move from Medicaid to Medicare as their sole or primary source of coverage. How these eligibility issues are resolved has important implications for enrollee benefits and cost-sharing as well as state and federal costs . Additionally, Medicare enrollment is limited to specific periods, while Medicaid enrollment is open year-round. However, Medicaid eligibility must be periodically renewed, while Medicare eligibility currently continues without the need to renew eligibility once a person turns 65.

Also Check: How To Apply For Medicare In San Diego

Medicare Costs At Age 60

Medicare costs at age 60 may not be much different than they are today at age 65. For those people who have at least 40 work credits, Part A coverage would probably still be provided with no premium. If you do not qualify for premium-free Part A coverage, the monthly premium is currently either $274 or $499 per month, depending on how much work history you have. When it comes to Part B coverage, everyone pays a premium for it.

The premium for Part B coverage is currently $170.10 per month. This premium is adjusted on a sliding scale depending on your income. The more income you have, the higher your premium will be. You could pay as much as $578.30 each month for your Part B premium. Part C plans, or Medicare Advantage plans, vary in cost. Each of these plans is administered by a private insurance company, so the details of each plan vary according to the coverage details, copay amounts, and deductibles. This is also true of Medicare Part D prescription drug plans.

One difference between the new Improving Medicare Coverage Act and the existing cost structure is that the act expands subsidies for low-income beneficiaries. Those who have an income that is below 200% of the Federal poverty level would be eligible for a Medicare Cost Assistance Program that would eliminate premiums for those people. This applies to both the Part A and Part B premium, and it does not matter how many work credits you have.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Recommended Reading: How Do I Apply For Medicare In Ohio

How Does My History Of Receiving Ssdi Affect When Or If I Can Receive Medicare

You typically become eligible for Medicare after 24 months on SSDI. After receiving SSDI for 2 years, you are automatically enrolled in Medicare Part A and Part B. During the 2-year waiting period, you can apply for Medicaid or enroll in a low-cost private health plan through the marketplace at Healthcare.gov. You may be able to keep your Medicaid eligibility once you get Medicare.

Medicare Age Eligibility Exceptions

You may sign up for Medicare at any age if you meet one of the following criteria:

- A family member is enrolled in Medicare

- You get Social Security disability or Railroad Retirement Board disability insurance

- You have certain medical conditions, such as amyotrophic lateral sclerosis or end stage renal disease

Social Security disability

In case you are under age 65 and have been getting Social Security disability benefits for two years, you meet all the requirements to be eligible for Medicare. You can enroll in your 22nd month of getting these benefits, and your coverage will start in your 25th month of getting them. In case you are qualified for monthly benefits depending on an occupational disability and have been allowed a disability freeze, you become qualified for Medicare on the 30th month after the date of the freeze.

RRB disability

If you get a disability pension from the RRB and meet specific criteria, you may be qualified for Medicare before the age of 65.

Specific health conditions

In order to get Medicare disability benefits, you need to first be receiving Social Security Disability Insurance benefits for 2 years. There is usually a five-month waiting period after a worker or widow is classified as disabled before they can get SSDI benefits. During this waiting period, the individual may be qualified for coverage under an employers health plan or, through COBRA, if they are not employed anymore. You may be qualified for Medicare if you have either:

Also Check: How Does An Indemnity Plan Work With Medicare

Do You Automatically Get A Medicare Card When You Turn 65

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If youre not getting disability benefits and Medicare when you turn 65, youll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Read Also: Does Medicare Cover Labor And Delivery

Do Husband And Wife Pay Separate Medicare Premiums

You and your spouse pay separate premiums for Medicare benefits under Medicare Part B, and Medicare Part D if you sign up for it. If one or both of you choose to enroll in a Medicare Advantage plan, you will continue to pay separately the Medicare Part B premium and possibly a separate plan premium.

Read Also: Does Emory Hospital Accept Medicare

How Do You Qualify For Social Security Disability Benefits

Qualifying for SSDI is a complicated process and many people find the need to consult an attorney to expedite the process. SSA has instructions and offers an online application.

Qualification for SSDI has only two criteria, which are not entirely straightforward.

Also Check: Can You Have Medicare Before Age 65

Whathappens When A Qualifying Spouse Is Younger

A person is eligible for Medicare Part A if they or their spouse have paid Medicare taxes for at least 40 quarters of work.

This might become more challenging when an older adult with a younger spouse did not work 40 quarters but their spouse did.

If a younger spouse worked for 40 quarters, they can qualify their partner for Medicare coverage once they reach 62 years of age and the older, nonworking spouse reaches 65 years of age.

If a person reaches 65 years of age, did not pay Medicare taxes for 40 quarters, and has a spouse under the age of 62 years, they may have to pay for their Medicare Part A benefits until their qualifying spouse reaches 62 years of age.

If I Enroll Earlier Than Age 65 Is My Medicare Coverage Reduced

You donât have to worry about this, because you canât enroll in Medicare before youâre eligible.

If you qualify for Medicare before age 65 due to disability:

- You can get full Original Medicare benefits.

- If you want to buy a Medicare Supplement insurance plan , some states will let you do this and others wonât. You can check with your stateâs State Health Insurance Assistance Program agency to find out if you can get a Medicare Supplement insurance plan if youâre disabled and not yet 65.

Recommended Reading: Is It Medicaid Or Medicare

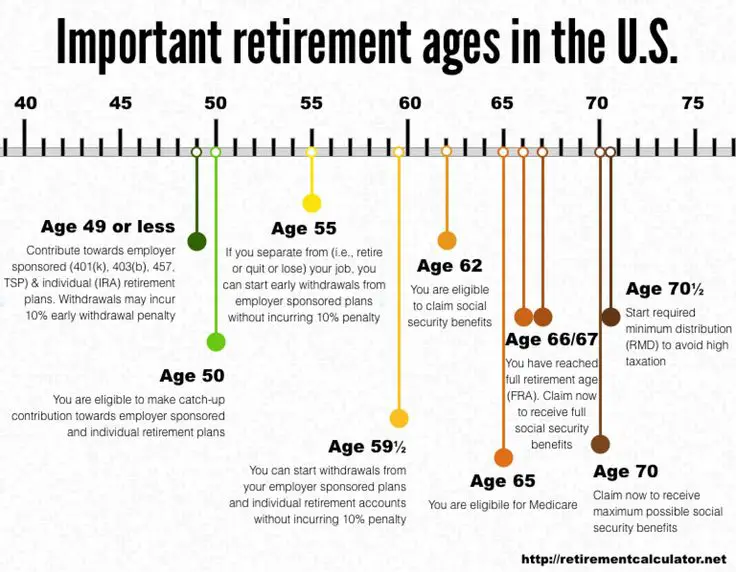

Full Retirement Age By Year

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

An easy way to think about full benefits and retirement age is this,

- Social Security will reduce your payments if you choose to receive your benefit before full retirement age. The percentage of reduced amount is highest at age 62 and decreases until you reach full retirement age.

- If you choose to receive Social Security payments when you reach full retirement, you will get the total amount.

- Suppose you choose not to receive Social Security payments when you reach full retirement and delay your benefit. In that case, you can increase the amount of your payment by earning delayed retirement credits.

If youre not sure when you reach full retirement age, our table provides the years and months you need to know for full retirement.

Can I Sign Up For Medicare Plans Online

Enrolling in Medicare coverage options online is generally easy and quick. More and more people are signing up online, according to an eHealth study. During 2018, about 16% of people in the study enrolled in Medicare coverage options online. Thatâs up from only 10% in 2017. In other words, about 60% more people in the study used eHealthâs online enrollment tool to sign up in 2018 than in 2017.

Itâs interesting to note that online enrollment was even higher during âQ4.â Q4 means the 4th quarter of the year, October through December. Thatâs when Medicareâs Fall Open Enrollment happens for Medicare Advantage and Medicare prescription drug plans. Fall Open Enrollment goes from October 15 â December 7 every year.

You May Like: How Do I Change My Primary Care Physician With Medicare

What Documents Do I Need To Apply For Medicare

You may be asked for a number of documents when you apply for Medicare, including:

-

An original birth certificate or other proof of birth

-

Proof of U.S. citizenship or permanent resident card

-

Copy of U.S. military service paper

-

Copy of W-2 forms and latest tax return

The Social Security Administration has a checklist of what you need to apply for Medicare.

What If I Am Not Eligible For Premium

- In the event that you are not qualified for premium-free Medicare Part A, you may choose to voluntarily enroll in Part A if any of the following conditions are met: You are 65 years old or older and fulfill the citizenship or residency criteria in your country of residence.

- Despite the fact that you are under the age of 65 and handicapped, your premium-free Medicare Part A coverage has expired as a result of your return to work.

Recommended Reading: Is Medicare A Social Security Benefit