How Does Medicaid Expansion Affect State Budgets

Expansion has produced net savings for many states, according to the Center on Budget and Policy Priorities. Thats because the federal government pays the vast majority of the cost of expansion coverage, while expansion generates offsetting savings and, in many states, raises more revenue from the taxes that some states impose on health plans and providers.

Is There A Limit On Out

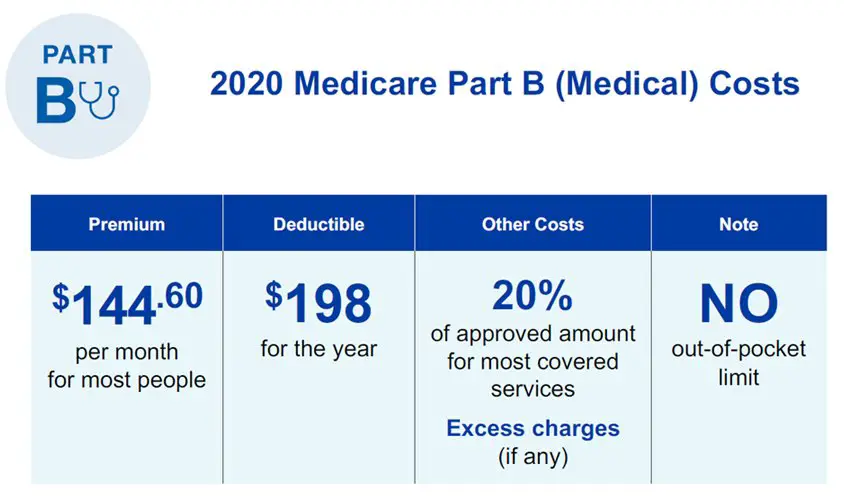

There is no out-of-pocket spending limit with Original Medicare .

Medicare Advantage plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses.

While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2022. Some plans may set lower maximum out-of-pocket limits.

Medicare Advantage plans are offered by private insurance companies. When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

Most Medicare Advantage plans provide prescription drug coverage, which is not typically covered by Original Medicare.

Some Part C plans also offer other benefits that Original Medicare doesnt cover, which may include:

- Routine hearing, dental and vision coverage

- Non-emergency transportation to approved locations

- Over-the-counter medication allowances

- Health and wellness programs, such as SilverSneakers

Depending on where you live, you may be able to find $0 premium Medicare Advantage plans.

You May Like: Can I Buy Into Medicare

What Durable Medical Equipment Is Covered By Medicare

The cost of durable medical equipment is covered by Medicare if it is deemed medically necessary, and has been prescribed by a doctor for use at home. The list of covered durable medical equipment includes:

- Wheelchairs

- Nebulizers

- Blood sugar monitors.

You will pay 20% of the Medicare-approved amount for the equipment, and you will be liable for any remaining deductible under Medicare Part B.

Recommended Reading: Where Can I Go To Apply For Medicare

Recommended Reading: How To Sign Up For Medicare And Tricare For Life

Getting Home Health Services In Certain States

If you live in Massachusetts, Michigan, Florida, Illinois, or Texas, a Medicare demonstration program might apply. Under the program, you can request a pre-claim review. This review can tell you early on whether Medicare is likely to cover your home health services. If youâre a resident of one of these states, you might want to request a pre-claim review as soon as your doctor orders home health care for you, so youâll know whether youâll have to pay anything.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

If Your Income Has Gone Down

If your income has gone down and the change makes a difference in the income level we consider, contact us to explain that you have new information. We may make a new decision about your income-related monthly adjustment amount for the following reasons:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Also Check: Does Everyone Go On Medicare At 65

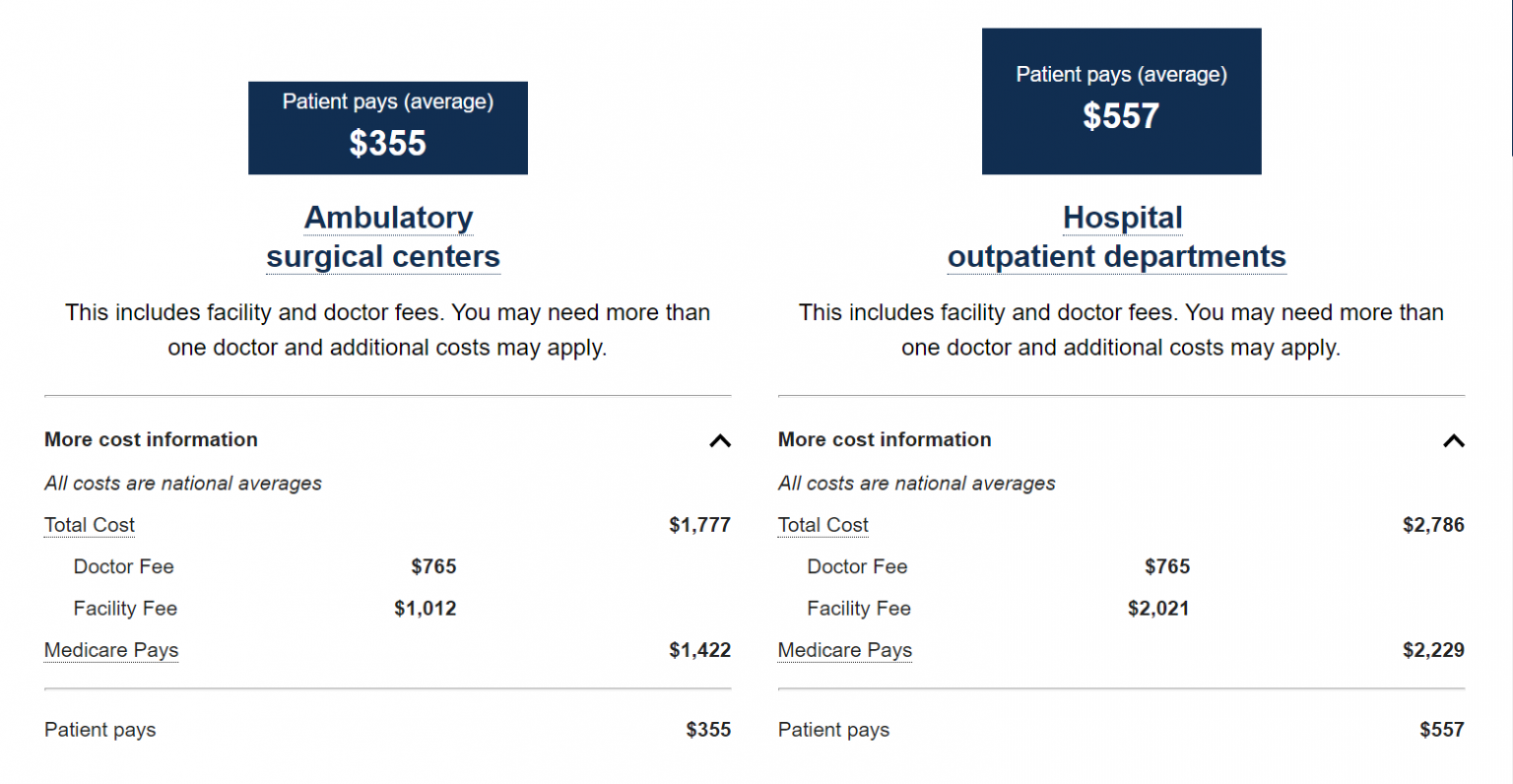

Get Extra Help With Outpatient Costs

If you have an outpatient procedure planned but are not sure how to pay for benefits your Medicare Part B plan doesnât cover, you have several options for extra help. One of the most popular choices for seniors with low income is to add Medicaid as a supplemental policy to your benefits. Unlike Medicare, Medicaid plans do not generally split their coverage between inpatient and outpatient services. Instead, in most states, your necessary medical care is eligible for coverage on a licensed practitionerâs authorization. If you have both Medicare and Medicaid, your Medicare benefits are billed first, with Medicaid picking up the unpaid remainder.

Even with both Medicare and Medicaid, you might still have a share of cost attached to the outpatient procedure you need. If you have time to investigate different providers before your procedure, and if your healthcare network permits out-of-network care, you can choose a provider that offers reduced fees for seniors and people with limited means to pay. Many university and public hospitals offer steeply discounted care for people who need it, and many keep indigent care funds to help people pay some of the uncovered costs of various medically necessary procedures. These discounts and subsidies are generally compatible with your Medicare Parts A and B benefits, and most are compatible with any authorized Part C plan you may have.

Where To Look For Home Health Care Options

Start by asking your primary care physician for a recommendation, suggests Prather. Theyll likely have good resources and referrals for you. From there, broaden the conversation and ask trusted friends and family members for their recommendations. Finally, look up potential providers online and read other patients reviews.

Also Check: Is Medicare A Social Security Benefit

Read Also: When Can I Change My Medicare Coverage

What Is The Difference Between Medicaid And Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Heres how Medicaid works for people who are age 65 and older:

Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

How Much Will Medicare Pay In 2021

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

Donât Miss: Will Medicare Pay For Therapy

Recommended Reading: What Does Original Medicare Mean

Are Medicare Premiums Tax

Some of your Medicare premiums are tax-deductible. Medicare Part B and Part D are optional coverage, and you can deduct these premiums as medical expenses on your taxes. Medicare Part A can only be deducted as medical expenses if you voluntarily enrolled in Part A and dont qualify for Social Security benefits.

When You Need Part

Updated By Bethany K. Laurence, Attorney

Progressive health care professionals often encourage people to get out of hospitals and nursing facilities and into their own or family members homes while recovering from injury or illness. With less honorable motives, insurance companies also pressure hospitals to release patients earlier so that if they continue to receive care, it will be a less costly variety at home.

In response to both these movements, many new home health care agencies have sprung up. Youre increasingly likely to find such an agency in your local area. Most are able to provide care for patients who no longer need high-level care in a hospital but who still require part-time nursing or rehabilitative therapy.

Read Also: Does Medicare Pay For Tdap Shot

You May Like: What Is Part B Excess Charges In Medicare

There Are 2 Ways To Get Medicare Drug Coverage:

1. Medicare drug plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private FeeforService plans, and Medical Savings Account plans. You must have

and/or

to join a separate Medicare drug plan.

or other

with drug coverage. You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

To join a Medicare drug plan, Medicare Advantage Plan, or other Medicare health plan with drug coverage, you must be a United States citizen or lawfully present in the United States.

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans youre interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program .

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

You May Like: Does Medicare Cover The Shingrix Shot

Medicare Part A Costs Are Not Affected By Your Income Level

Your income level has no bearing on the amount you will pay for Medicare Part A . Part A premiums are based on how long you worked and paid Medicare taxes.

Medicare Part A premium costs in 2022 are as follows:

|

Number of quarters you paid Medicare taxes |

2022 Medicare Part A monthly premium |

|---|---|

|

40 or more |

|

|

$499 |

Most Part A beneficiaries qualify for premium-free Part A coverage.

Two of the Medicare Savings Programs that may help pay Part A premium costs for qualified individuals include:

- Qualified Medicare Beneficiary Program

- Qualified Disabled and Working Individuals Program

Medicare Advantage and Medigap costs by income level

Medicare Part C plans and Medicare Supplement Insurance plans are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Medicare And Medicaid Costs

Medicare is administered by the Centers for Medicare & Medicaid Services , a component of the Department of Health and Human Services. CMS works alongside the Department of Labor and the U.S. Treasury to enact insurance reform. The Social Security Administration determines eligibility and coverage levels.

Medicaid, on the other hand, is administered at the state level. Although all states participate in the program, they aren’t required to do so. The Affordable Care Act increased the cost to taxpayersparticularly those in the top tax bracketsby extending medical coverage to more Americans.

According to the most recent data available from the CMS, national healthcare expenditure grew 9.7% to $4.1 trillion in 2020. That’s $12,530 per person. This figure accounted for 19.7% of gross domestic product that year. If we look at each program individually, Medicare spending grew 3.5% to $829.5 billion in 2020, which is 20% of total NHE, while Medicaid spending grew 9.2% to $671.2 billion in 2020, which is 16% of total NHE.

Read Also: When Do Medicare Premiums Increase

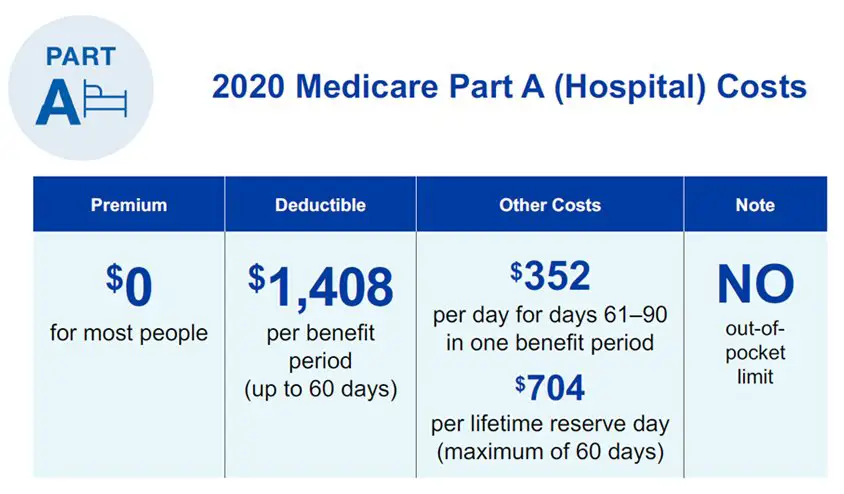

A Deductibles Copayments And Inpatient Hospital Stays

Hospital costs and skilled nursing facility costs, not surprisingly, are on the rise. According to the statistics from the latest Kaiser State Health Facts survey, including data from all 50 states and the District of Columbia, each day someone was hospitalized as an inpatient in 2019 cost $2,372 in a state/local government hospital, $2,738 in a non-profit hospital, and $2,149 in a for-profit hospital.

Medicare Part A charges you a flat deductible for each inpatient hospital admission. This includes coverage for Inpatient Only surgeries.

This deductible covers all costs up to 60 days, with the exception of physician fees which are covered by Part B. After 60 days, you are charged a copayment for each additional day you are hospitalized.

| 2022 Part A Inpatient Hospital Stay Costs | |

|---|---|

| Day of Inpatient Hospital Care | Your 2022 Costs |

| $36 increase per day |

Find A Home Health Care Provider

You can search for a provider by using the online home health care provider tool at Medicare.gov. Just enter your zip code and the tool will give you a list of home health care providers in your area. You can also ask your doctor, hospital social worker or discharge administrator to arrange for a home health provider in the event you need home care after a hospital stay.

Dont let an injury or illness prevent you from getting the help you may need. Talk to your doctor and ask if you qualify for home health care.

Read Also: Which Medicare Plan Covers Hearing Aids

Don’t Miss: What Is A Medicare Set Aside In Personal Injury

Will Medicare Cover Physical Occupational And Speech Therapy

Medicare will pay for physical therapy when its required to help patients regain movement or strength following an injury or illness. Similarly, it will pay for occupational therapy to restore functionality and speech pathology to help patients regain the ability to communicate.

However, Medicare will only pay for these services if the patients condition is expected to improve in a reasonable, predictable amount of time, and if the patient truly needs a skilled therapist to administer a maintenance program to treat the injury or illness at hand.

You May Like: How To Change From Medicare Advantage To Original Medicare

Why Pay For Part C Or Part D Coverage

With just Part A and Part B coverage, you may still have to spend a large amount of money on your health services and prescriptions, especially if your medical needs are significant .

Part C and D plans cover a lot of costs not included under Parts A and B. They can actually save you money, even though your monthly premiums are usually a little bit higher when you choose Part C and Part D plans.

If youre looking for a solution to keep your expenses as low as possible, its a good idea to consider a Medicare Advantage or Medigap health plan.

For more information, download our Welcome to Medicare Guide, which will help you understand your choices even better, and can answer a lot of questions you might still have.

Independence Blue Cross is a subsidiary of Independence Health Group, Inc. independent licensees of the Blue Cross and Blue Shield Association, serving the health insurance needs of Bucks, Chester, Delaware, Montgomery, and Philadelphia counties of Pennsylvania.

Sitemap | Legal | Privacy & other policies

Independence complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex. Independence does not exclude people or treat them differently because of race, color, national origin, age, disability, or sex. View our documentation for more information and to request language assistance services.

Every year, Medicare evaluates plans based on a 5-Star rating system.

You May Like: What Are The Best Medicare Supplement Insurance Plans

Where Can I Get Long

You may be able to get long-term care at home or at a long-term care facility.

Note that the costs listed below are national medians as reported by Genworth Financial in 2020. They could vary by state.

- You may be able to continue living at home with the help of a home health aide. Median monthly cost per Genworth Financial: $4,576.

- Adult day care centers provide a safe environment to be social and engage in activities during the day while family caregivers are otherwise occupied. Median monthly cost per Genworth Financial: $1,603.

Residential care includes:

- Retirement housing that may offer social activities and transportation

- Assisted living that offers meals, supportive services and health care. Median monthly cost per Genworth Financial: $4,300

- Nursing homes which can provide 24-hour care and medical treatment. Median monthly cost per Genworth Financial: $7,756 for a semi-private room, and $8,821 for a private room.

- Memory care units for Alzheimers and dementia patients which may be locked. This might be more expensive than a semi-private room.

- Continuing care retirement communities were residents can progress through levels of care as the need arises.

Read Also: How Much Does Medicare Pay For Ambulance

Medicare Part A 2022 Deductible And Copays

Medicare Part A has a deductible that is chargedper benefit period. For 2022, this deductible amount is $1,556.

- A benefit period starts on the day when you enter a hospital or skilled nursing facility for care and ends when you have been out for 60 consecutive days. During this time, you may be in the hospital more than once.

- There is no limit to how many benefit periods you can have. Medicare will cover all of them.

- Each benefit period charges the $1,556 Part A deductible.

Medicare Part A also has copays for when youre in the hospital, in a skilled nursing facility or in hospice. The copays and rules work differently for each.

Recommended Reading: Will Medicare Pay For Breast Implant Removal