Cigna Has Increased Its Geographic Presence In Ma By 80% Since 2019 With Plans In 477 Counties Across 26 States

For the third straight year, health insurer Cigna is expanding its Medicare Advantage plans, growing into 108 new counties and three new states Connecticut, Oregon and Washington which will increase its geographic presence by nearly 30%.

As part of the expansion, Cigna said most current customers will pay the same or lower premiums, and promised that every market will have at least one $0 premium plan. Other benefits will include a social connection program to combat loneliness, customized plans for people with diabetes and incentives for annual wellness exams and other preventive care.

Cigna has increased its geographic presence in MA by 80% since 2019, the insurer said. The company now offers plans in 477 counties across 26 states and the District of Columbia.

WHAT’S THE IMPACT?

During the 2022 Medicare Annual Election Period, Cigna customers will be offered plans with benefits such as $0 copays for primary care, behavioral health and physical therapy in a virtual setting. While there will be at least one $0 premium MA plan available in every market similar to 2021 most MA customers with a premium will pay the same or reduced premiums compared to last year, the insurer said.

Cigna is also rolling out benefits aimed at seniors, such as the Social Connection Program, which gives some MA customers access to a partner who can help with daily living activities such as meal prep, transportation or chores, or just spend time talking or watching a movie.

What Sets Cigna Medicare Plans Apart

Cigna offers quality Medicare coverage at an affordable price. The company outperforms competitors in its ability to offer a variety of plans for those with special needs. Most of Cigna’s plans also offer prescription drug coverage.

Cigna might be the right insurance provider for you if:

-

You’re on a tight budget.

-

You are eligible for a Special Needs Plan.

-

You’re looking for an all-in-one plan that includes prescription coverage.

What Does Medicare Part G Cover

One of the most popular Cigna Medicare supplement plans, Part G, offers many of the same comprehensive types of coverage as the Cadillac plan of Medicare Supplement coverage, Plan F. However, Plan G is more affordable, giving Medicare enrollees an option to determine the right plan for their needs without breaking the bank.

With that being said, Plan G covers many of the same things as Plan F, with the exception being that it does not cover your Medicare Part B deductible.

Plan G covers your first 60 days of hospitalization and picks up your Medicare Part A deductible. Up to your 90th day, it takes care of the extra $341 per day as well as the $682 per day on the 91st day and every day thereafter.

A Cigna Medicare Supplement Plan G also takes care of many of the costs of skilled nursing facility care, provided that you are in a Medicare-approved facility and have been in a hospital for at least three days. It also covers hospice care, as well as the first three pints of blood per calendar year should you need a blood transfusion.

Get Started Today

- Start saving on monthly premiums

- Be confident in your coverage

Don’t Miss: How Much Medicare Is Taken Out Of Social Security Check

Review: Cigna Medicare Supplements In Indiana

Cigna scored 3.5 out of 5.0 based on our scoring method. Cigna has a good financial rating from A.M. Best, but their Plan F is not in the top 10 best rates and they have less than 10 years experience servicing Medicare SupplementsMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage….. We are confident in their financial strength, but feel there are better options in Indiana. See the top 10 competition.

Here are the pros and cons from our analysis:

How Does A Cigna High Deductible Plan Work

You can select a high deductible plan only if you are eligible. For example, the high deductible version of Plan F is available only to those whose Medicare coverage started before Jan. 1, 2020. With a high deductible plan option, you pay the first $2,370 before your policy pays anything, plus a separate annual deductible of $250 for foreign travel emergency services. For Cigna, the high deductible option includes a lower monthly rate.

Note: These deductible amounts apply to the calendar year 2021 and are subject to change.

You May Like: Does Medicare Cover Oral Surgery Biopsy

Compare Plan F Base Rates

| Carrier |

|---|

| Address: | P.O. Box 26580, Austin, TX 78755 |

|---|

For assistance 24 hours a day, call 800-633-4227. TTY users should call 877-486-2048 or visit www.medicare.gov. If you qualify for Medicare but have not yet enrolled or verified your enrollment status, you can do so on the Social Security Administration website.

What Is The Best Cigna Supplement Insurance Plan

As you can see from the points listed above, Cigna supplement plans aim to cover the different needs of its customers through variable adjustments. Its plans range from completely comprehensive to more value-driven. The best Cigna Medicare plan will differ depending on the customer. Deciding between the three will come down to your health and lifestyle needs balanced against your financial goals and budget.

A licensed agent can help you determine which plan best fits your needs. Connect directly with one of our agents to get the plan thats right for you.

You May Like: How To Get A Lift Chair From Medicare

The Basics Of Cigna Medicare Supplement Insurance

Cignas Medicare Supplement plans are useful to many seniors because Medicare alone often fails to protect them from burdensome out-of-pocket healthcare costs. Original Medicare leaves patients responsible for deductibles, copays, coinsurance, and an assortment of other fees. The average beneficiary of traditional Medicare spent $5,460 on out-of-pocket healthcare costs in 2016 according to a recent Kaiser Family Foundation study. That cost has likely only grown since the study was conducted. Cigna Medicare Supplements can reduce such out-of-pocket costs and make them more predictable.

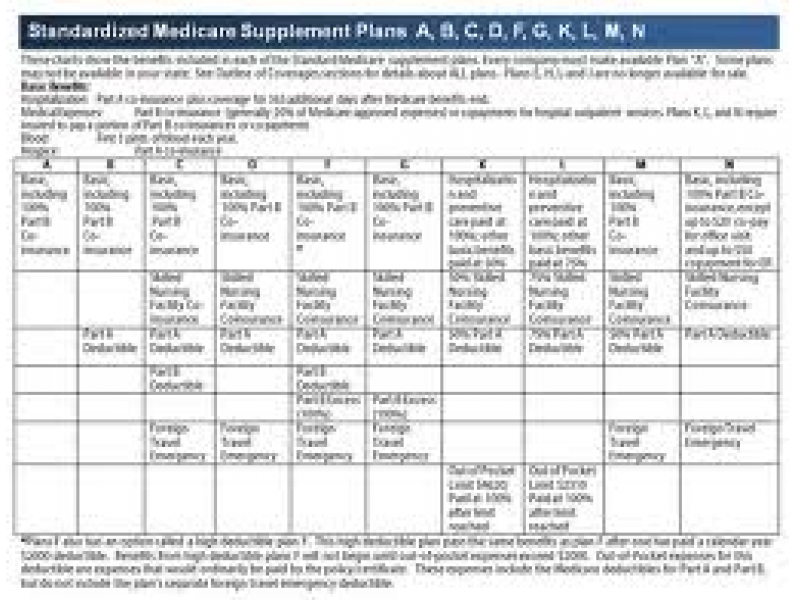

With a Medicare Supplement plan, seniors pay a monthly premium to Cigna, and Cigna takes responsibility for paying many of Medicares out-of-pocket costs as they arise. Exactly which costs are covered depends on which of the standardized plans that you choose. Medicare Supplement plans are not in any way paid for or operated by Medicare. However, the rules of how Cigna sets prices and pays for care are established by Medicare, ensuring that seniors receive fair treatment regardless of which insurance provider they choose. You can read all about Medicare Supplement regulations in Whats Medicare Supplement Insurance ? Seniors should especially be aware of the fact that Medicare Supplement plans can be combined with Part D but not with Medicare Advantage.

Individual And Family Health Insurance Plans

Posted: Disclaimer Individual and family medical and dental insurance plans are insured by Cigna Health and Life Insurance Company , Cigna HealthCare of Arizona, Inc., Cigna HealthCare of Illinois, Inc., and Cigna HealthCare of North Carolina, Inc. Group health insurance and health benefit plans are insured or administered by CHLIC, Connecticut General Life Insurance Company , or their …

You May Like: What Is Medicare Part G

Cigna Medicare Supplement Plan Perks And Discounts

One of the benefits of choosing a major insurance company like Cigna is that you can take advantage of services and discounts not usually available with smaller companies.

For example, all Cigna plan members have access to Cignas highly rated member website and health tools to track and manage your health. All members can use the 24/7 nurse hotline.

Enrollment in the Healthy Rewards program is free. The Healthy Rewards program offers discounts on gym memberships, yoga equipment, chiropractic care, therapeutic massage, and vitamins and other health supplements.

Cigna members also get discounts on vision exams, prescription eyewear, Lasik surgery, hearing exams, and hearing aids. These discounts dont take the place of vision and hearing insurance, but they can save you money when you need care.

Silver And Fit Program

Posted: Explore healthy choices with the Silver& Fit program! Exercise at home with a wide range of Home Fitness Kits and Stay Fit Kits such as yoga, Chair Exercise, Aquatic Exercise, and more. Kits may include DVDs, guides, and other items – $10 annual non-refundable fee for up to 2 Home Fitness Kits and 1 Stay Fit Kit per benefit year.

Read Also: Does Medicare Pay For Eyeglasses For Diabetics

Does Original Medicare Include Vision Coverage

Original Medicare covers basic medical and hospital care but does not include vision or eye services such as routine eye exams.

However, Medicare Part B does cover some eye care, such as cataract surgery.

For adults with diabetes, original Medicare also pays for the cost of an annual eye exam to monitor diabetic retinopathy. Services include yearly glaucoma tests, too.

Pros And Cons Of Cigna Medicare Supplement Plans

|

Pros |

|

|

Plans are available in all 50 states |

Four or fewer plan types available in most areas |

|

Part D prescription drug plans and stand-alone dental plans are available |

Cumbersome online quote process online quotes not available in all states |

|

Competitive premiums with multiple discount options |

The approval process can take up to three days, slower than some major insurance companies |

|

Health perks such as a 24/7 nurse hotline and Healthy Rewards discount program |

No vision or hearing options |

Read Also: How Can I Get My Medicare Card Number

Cigna Medicare Supplement Plan Benefits

|

Part A hospital coinsurance plus 365 days of coverage after Part A benefits are exhausted |

||

|

Part A skilled nursing facility coinsurance |

||

|

$20 copay for doctor visits and up to $50 copay for emergency room visits |

||

|

Part B excess charges |

||

|

80% of charges up to lifetime limit |

80% of charges up to lifetime limit |

80% of charges up to lifetime limit |

*High deductible Plan F offers the same coverage as regular Plan F after you meet the annual deductible, which is $2,340 in 2020.

Review: Cigna Medicare Supplements In Mississippi

Cigna scored 4.0 out of 5.0 based on our scoring method. Although they have less than 10 years experience servicing Medicare SupplementsMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage…., Cigna has a top 10 Plan F premium and a strong financial rating from A.M. Best. We also appreciate that they don’t charge a policy fee. They might be relatively new in the business, but they are financially strong and have good rates, so we feel they are one of the better options for Mississippi seniors. See the top 10 competition.

Here are the pros and cons from our analysis:

Read Also: Should I Enroll In Medicare If I Have Employer Insurance

Rates For Medicare Supplement Plan N

While the benefits of Medicare Supplement Plan N remain the same regardless of your insurance company , in some states the premium you pay may vary according to a number of factors, including age, location, gender, and overall health.

Cigna offers competitive rates and, in some states, a 7% household premium discount5 may be available for qualified applicants.

Cigna Medicare Supplement Reviews

Our agency has worked with Cigna Medicare supplement products for several years. Our team is familiar with their underwriting questions and can help you learn if you may be eligible for a policy. We also have gotten positive feedback from our clients who have given us positive Cigna Medicare supplement reviews for Plan F and Plan G.

Before we enroll, we can check the historical rate increase trend for all the Medicare supplement carriers in your specific area. Choosing a carrier is about more than just the lowest price. We want to also look at the data we have in our exclusive reporting software to analyze rate increase trends for carriers in your county.

We expect Cigna Medigap Plans 2021 to continue to be a top seller.

Also Check: Is Medicare Advantage A Good Choice

Medicare Supplement High Deductible Plan F Insurance Coverage

Review the advantages of Plan F with a high deductible.

Get a Free Online Quote

Find out what your monthly premium would be with Cigna’s1 competitive rates.

Apply online and you could save 5% on your premium. Learn more*

Mon-Fri, 8:30 am-8:30 pm, ET

This plan provides the same level of coverage as regular Plan F, except that coverage will kick in after you meet your calendar year deductible.2 This is the amount you must pay in out-of-pocket medical expenses before your plan starts sharing costs.

The tradeoff for a high deductible plan is a much lower monthly premium. This plan may be most suitable for someone who has fewer health expenses throughout the year. High Deductible Plan F is only available if you first became eligible for Medicare before January 1, 2020 or you qualified for Medicare due to a disability before January 1, 2020.

Review the chart below for all the details of High Deductible Plan F coverage or explore other Medicare Supplement plans.

Cigna Medigap Plan F Vs Competition

Medigap Plan FMedicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services…. is the best selling plan sold in Michigan. Below you can compare Cigna’s starting rate on Plan F vs. their top ten competitors.

Read Also: How Much Is Medicare B Deductible

Find Cheap Health Insurance Quotes In Your Area

Editor’s Rating

Good for

- Offers the three most popular Medigap plans: F, G and N

- Available in 48 states

- Fewer plan offerings than some competitors

- Higher-than-average rates

Cigna offers standard Medicare supplement plans, also called Medigap, in 48 states. In 46 of those 48 states, Cigna sells four Medigap plans Plans A, F, G and N along with a high deductible version of Plan F. In Minnesota and Wisconsin, Cigna offers specialized policies that abide by state-specific Medigap plan requirements. Overall, Cigna Medigap rates are higher than competitor prices.

Silver And Fit & Silver Sneakers Medicare Fitness Programs

Posted: Jul 10, 2019 · Silver & Fit ® Programs. This program includes multiple benefits that are available to seniors and Medicare eligibles like you. These benefits include a fitness facility program, home fitness program, a resource library, fitness challenges, rewards program, and more! Depending on your coverage, there may be no additional fees to join.

You May Like: Why Is My First Medicare Bill So High

Bronze Silver Gold And Platinum Health Plans

Posted: You can also view plans on the Marketplace, or Exchange, which is an online health insurance shopping center based at Healthcare.gov. At the Marketplace, there are four levels of plans: bronze, silver, gold, and platinum. Each level pays a different portion of your health care bills.

State Differences For Cigna Medicare Supplement Insurance

Because state regulations on Medicare vary and Cigna Medicare supplement insurance is carried by different divisions of the company, not all coverage on the summary chart on Cignas website or Medicares website is available in each state. For example, Cigna Plan C in North Carolina does not cover Medicare Part B deductibles although it may in other states or under another underwriting company. It is essential to talk to a representative to get a personalized quote and plan description for you and your location before deciding on a plan.

Does Cigna Medicare Cover Vision

- You can get Cigna Medicare Advantage vision coverage by enrolling in a Cigna Advantage plan in 2020.

- Vision coverage is part of many Cigna Medicare Advantage plans.

- Your cost will be based on where you live and which plan you choose.

You depend on your eyesight for many of your daily activities. If you wear prescription eyeglasses, keeping your prescription accurate and up to date is an important part of your healthcare needs.

Cigna Medicare Advantage vision coverage gives you access to vision and eye services, including annual eye exams, prescription eyeglasses, and contact lenses.

Vision coverage is part of most Cigna Medicare Advantage plans. These all-in-one plans will cover your basic hospital and medical needs, as well as prescription medications. They also offer added benefits like hearing and dental.

Most Cigna Medicare Advantage plans offer vision and eye care. These benefits cover a number of vision and eye services, such as:

- one routine eye exam each year

- eyeglass frames, usually one set of frames per year

- prescription lenses or bifocal lenses

- glaucoma screenings

- cataract surgery

Coverage and copay rates vary between plans, but most offer affordable coverage that lowers your out-of-pocket vision care costs.

Your costs for any Medicare Advantage plan will depend on where you live and the plan you choose.

Here are some of the 2021 costs for Cigna Medicare Advantage plans in a few different cities:

How Much Do Cigna Medigap Plans Cost

The cost of your Cigna plan will vary based on several factors, including your age, location, and sex. In the chart below, we’ve included an approximate range based on our research. Just remember, your rates may be higher or lower than our estimates based on your particular circumstances.

Pro Tip: Buying online can save you 5 percent for the life of your policy. This discount is only available in certain states and only applies if you are a new Cigna supplement policyholder. The application must be done solely online, and spouses qualify for the same discount if they are added to the policy at the time you apply.

To help with plan costs, Cigna offers a 7 percent household premium discount, which is an excellent option for spouses or family members. Cigna’s household discount is average for the industry, as some go as low as 5 percent and others as high as 14 percent. If you’re looking for a larger household discount, consider other providers we’ve reviewed, like Americo, that offer a 10 percent family discount. This discount is not available in Hawaii, Idaho, Minnesota, and Vermont. For residents of Washington, the discount only applies to spouses.

| Plan |

|---|