Medicare Open Enrollment Begins For Nearly 23m Ohioans

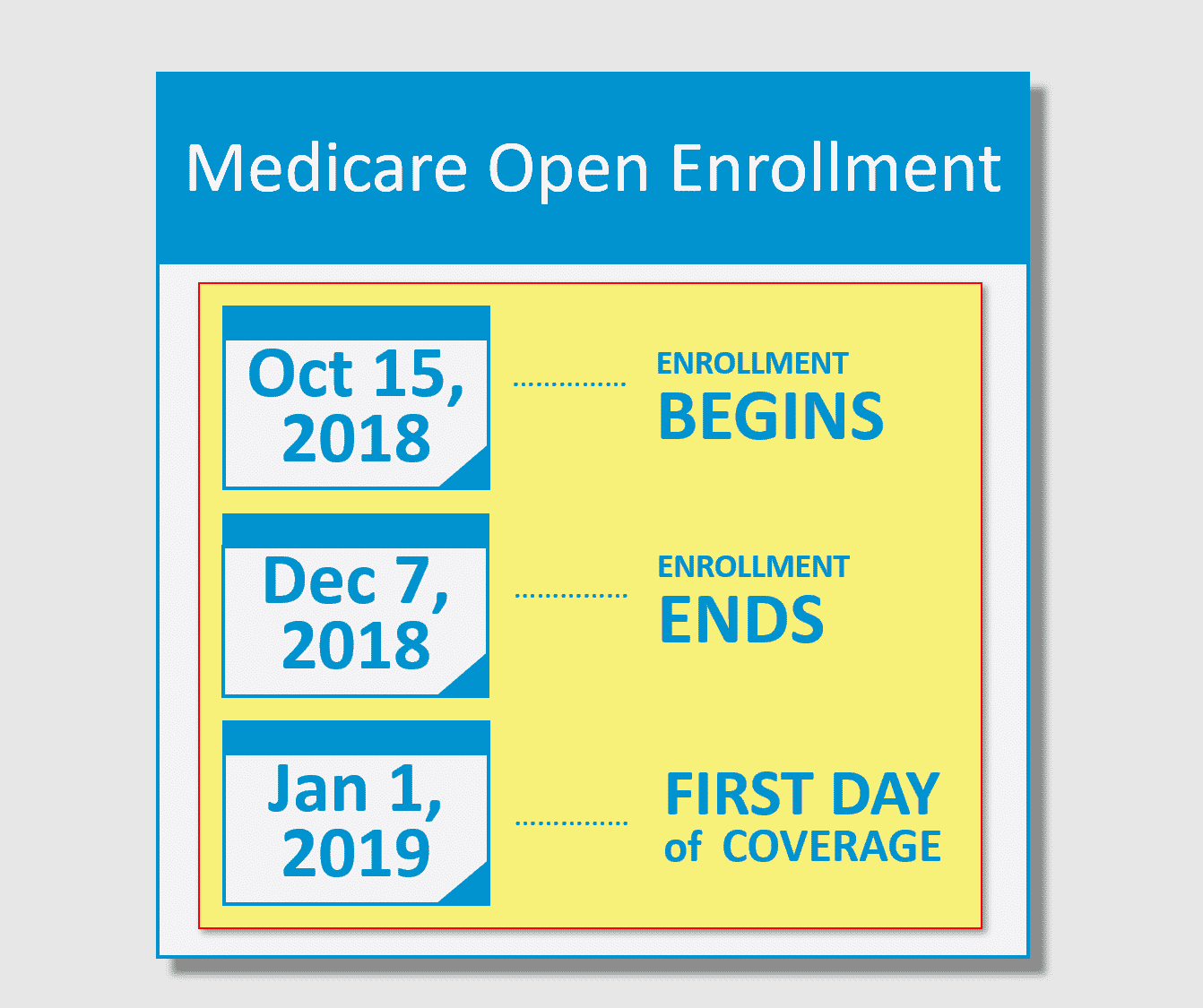

Open enrollment for Medicare, the governmental health insurance serving 2.3 million Ohioans mainly ages 65 and older, began Friday and will end Dec. 7.

Health and drug plans under Medicare can make changes each year to things like cost, coverage, and in-network providers and pharmacies. Open enrollment allows participants to choose plans that better fit their needs.

More:Shopping for 2022 Medicare plans? Start here

The Ohio Department of Insurance will be providing help to Ohioans throughout the enrollment period through its Ohio Senior Health Insurance Information Program. More information can be found at 1-800-686-1578 or www.insurance.ohio.gov.

There will be weekly webinars to go in-depth on how to enroll, in-person and virtual one-on-one counseling and hotline staff to assist. A list of in-person events, now more limited due to the COVID-19 pandemic, can be found on the department’s website.

Enrollees should have already received a form notifying any changes to benefits, as well as information on what’s being offered by plans for next year.

If one does nothing during the enrollment period, the individual will remain in the plan he or she is currently on. But it’s important to be aware of what, if any, changes are happening with your Medicare plan, said Chris Reeg, head of the information program.

Ohioans struggling to pay a plan’s out-of-pocket costs can reach out to the Ohio Department of Insurance for assistance navigating programs offering financial assistance.

Medicare Annual Enrollment Period

If you choose not to sign up for a Medicare Advantage plan or stand-alone Medicare prescription drug coverage during your Initial Enrollment Period, you can also enroll in a Medicare Advantage plan during the annual Fall Medicare Annual Enrollment Period .

AEP is also called the Medicare Annual Election Period and the Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage.

This period runs from October 15 to December 7 every year.

During the Fall Medicare Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage, you can:

- Enroll in, make changes to or disenroll from a Medicare Advantage plan

- Enroll in, make changes to or disenroll from a Medicare Prescription Drug plan

Plan changes you make during the 2020 Medicare Fall Annual Enrollment Period go into effect January 2021.

Whats New For Medicare Part D

Many people on Original Medicare choose to buy a stand-alone Part D drug plan to help cover medication costs. The average 2022 premium for Part D coverage will be $33 per month, compared to $31.47 in 2021, CMS announced. But its important to look beyond the premium to your total costs, which Medicares tool will display if you input your medications. Some plans might have a higher premium but better coverage of your prescriptions, resulting in lower overall costs. Its really doing your homework, understanding whats in your medicine cabinet, says Gregg Ratkovic, president of Medicare for eHealth, an online broker whose licensed agents help consumers compare their Medicare choices.

Also pay attention to where you fill your prescriptions, Ratkovic says. If you switched pharmacies and your new one isnt a preferred pharmacy in your plan, that will likely mean higher costs.

Last year, CMS unveiled a new savings program for the one in three beneficiaries with diabetes. The Senior Savings Model, as its called, is designed to provide beneficiaries with Part D plans that offer a one-month supply of insulin for no more than $35. That program continues to expand this year, with some Medicare Advantage plans also participating, so beneficiaries who want to take advantage of the program have more options to compare.

Recommended Reading: Can I Enroll In Medicare Online

What To Watch For In Advantage Plans

While insurers offering Advantage Plans are federally regulated, the specifics can vary greatly from plan to plan, county to county and year to year. Some may offer extras such as dental, vision or hearing or come with no premium .

It’s important not to just focus on that monthly amount, said Cubanski, of the Kaiser foundation.

“People may want to pay attention to what a plan charges for hospitalization or skilled nursing facilities,” she said. “Even if you don’t think you’d need to be hospitalized, it’s worth figuring out how much you’d pay out of pocket if something happens.”

There are out-of-pocket limits with Advantage Plans, unlike original Medicare, so you know what your worst-case scenario would be. Those limits, however, can be different among plans, as can deductibles and other cost-sharing.

Additionally, make sure your preferred doctors, hospitals or other providers are still participating in the plan’s network. And assuming the plan has prescription drug coverage , ensure any prescriptions you take are still covered.

Enrolling In Medicare Plans

Unlike Original Medicare, Medicare plans are available through Medicare-contracted private insurance companies. So, instead of enrolling in a plan through Social Security or the Railroad Retirement Board, you can get this coverage directly through the insurance company, by visiting Medicare.gov, or through a licensed insurance broker like eHealth.

The Medicare Advantage Open Enrollment Period may let you switch plans. This enrollment period runs from January 1 March 31 every year. Heres how it works in a nutshell:

If you already have a Medicare Advantage plan, you can switch to a different Medicare Advantage plan.

You can drop your Medicare Advantage and return to traditional Medicare, and then sign up for a stand-alone Medicare Part D prescription drug plan.

You generally cant make other coverage changes during this period. For example, if you have traditional Medicare, Part A and Part B, you typically cant sign up for a Medicare prescription drug plan or a Medicare Advantage plan.

Not feeling the advantage in your current Medicare Advantage plan? Unhappy with your network doctors or pharmacies? Discouraged that youre stuck with a less-than-perfect plan for another whole year? Youre not alonewhich may be one of the reasons the Centers for Medicare & Medicaid Services announced a new Medicare Advantage Open Enrollment Period. If youre thinking of making a change, this may be the perfect time to check out your options for 2022 Medicare Advantage plans.

You May Like: What Is The Extra Help Program For Medicare

Medicare Supplement Insurance Enrollment

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan , the best time to sign up is during your six-month Medigap Open Enrollment Period.

- Your Medigap Open Enrollment Period starts as soon as you are age 65 or older and are enrolled in Medicare Part B.

- Insurance companies cannot deny you Medigap coverage or charge you a higher fee for pre-existing health conditions if you apply for Medicare Supplement Insurance during your Medigap Open Enrollment Period.

If you dont sign up for a Medigap plan during your Medigap Open Enrollment Period, you may still be able to buy one at any time.

Insurance companies can take your health into consideration when setting your premiums or deciding whether or not to offer you coverage, however.

You must be enrolled in Medicare Part A and Part B in order to buy a Medigap plan.

Medigap and Medicare Advantage plans are very different, and you cannot be enrolled in a Medigap plan and a Medicare Advantage plan at the same time.

Learn more about the differences between Medicare Advantage vs. Medicare Supplement Insurance.

Request a free, no-obligation Medicare Supplement Insurance quote today by visiting MedicareSupplement.com.

Medicare Enrollment Periods: When To Sign Up

When to join a Medicare Advantage Plan or Medicare Prescription Drug Plan

Its important for you to know when to sign up for Medicare or when to join a Medicare plan. Remember these times so you get the most out of your Medicare and avoid late enrollment penalties:

- Initial Medicare Enrollment Period: Most people get Medicare Part A and Part B during this period. It starts 3 months before you turn 65 and ends 3 months after you turn 65. If youre not already collecting Social Security benefits before your Initial Enrollment Period starts, youll need to sign up for Medicare online or contact Social Security.To get the most from your Medicare and avoid the Part B late enrollment penalty, complete your Medicare enrollment application during your Initial Enrollment Period. This lifetime penalty gets added to your monthly Part B premium, and it goes up the longer you wait to sign up. Find out if you should get Part B based on your situation.

- General Medicare Enrollment Period: If you miss your Initial Enrollment Period, you can sign up during Medicares General Enrollment Period , and your coverage will start July 1.

- Special Enrollment Period: Once your Initial Enrollment Period ends, you may have the chance to sign up for Medicare during a Special Enrollment Period . You can sign up for Part A and or Part B during an SEP if you have special circumstances.

When to join a Medicare Advantage Plan or Medicare Prescription Drug Plan

Also Check: Does Medicare Cover Skin Removal

Is Medicare Coverage The Same For Everyone

No. There are two ways to get your Medicare coverage. You can go with traditional Medicares fee-for-service . This gives you the option to take out Medicare Supplement insurance coverage to help fill in the gaps left by traditional Medicare. Traditional Medicare generally covers about 80% of your Part B services. Or, you can go with the managed care approach of Medicare Advantage .

Medicare Advantage is the alternative to traditional Medicare, meaning you surrender Parts A and B, along with the option to buy Medicare Supplement insurance. Medicare Advantage is offered by private insurers to offer comparable services to traditional Medicare, and generally includes prescription drug coverage and some other benefits.

What Is Medicare Open Enrollment

Medicare has a few enrollment windows, which are the only times that you can make changes to your Medicare plan. Open enrollment is the only enrollment period where all Medicare beneficiaries can make changes if they want.

Medicare open enrollment starts October 15, 2021, and ends December 7, 2021 for 2022 plans.

Specifically, open enrollment allows you to

-

Switch from Original Medicare to Medicare Advantage

-

Switch from a Medicare Advantage plan to Original Medicare

-

Switch from one Medicare Advantage plan to another

-

Enroll in a Medicare Part D plan

-

Switch from one Medicare prescription drug plan to another

Recommended Reading: Should I Enroll In Medicare If I Have Employer Insurance

What Changes Can You Make During The Medicare Open Enrollment Period

If youre enrolled in Medicare, you can leave Medicare and switch to Medicare Advantage. If youre enrolled in an Advantage plan, you can leave the plan and switch back to Medicare.

You can also join, leave, or change your stand-alone Part D drug plan. When you switch back to Medicare, you can then choose to enroll in a Medigap plan.

Preparing For Medicare Open Enrollment

Medicare recipients are overloaded with information throughout the year but especially during the Medicare open enrollment period, which lasts from Oct. 15 to Dec. 7, 2021. During this time, junk mailings increase alongside the bombardment of commercials about Medicare insurance plans promising vision, dental, transportation, meals and other benefits.

Some plans may offer these supplemental services, but be careful to read the fine print as you may not be eligible for these extra services.

However, there are ways you can avoid falling into this trap or erroneously switching to a plan that seems promising. Carefully read all plan materials, look at the plans web site and call the provider behind the plan to verify how much the plan will cost and what it will cover. Be sure to ask your health care providers if they participate in the plan. Visit the Medicare website to enroll in a My Medicare account, and compare the costs of different plans that cover your medications.

If doing it yourself seems daunting, the Virginia Insurance Counseling and Assistance Program provides free, unbiased, individualized counseling to help residents understand and navigate the complex world of Medicare. VICAP counselors are available year-round. During open enrollment, counselors can do a benefits check up to assist in reviewing and comparing Medicare prescription plans to ensure you enroll in the plan that best meets your needs.

- TAGS

Read Also: When Does Medicare Coverage Start

Medicare Supplement Insurance Coverage

Medicare Supplement Insurance, also known as Medigap, helps beneficiaries pay out-of-pocket expenses associated with Original Medicare, including your copays, deductibles, and coinsurance. If youâre struggling with out-of-pocket costs, consider a Medicare supplement plan.

To apply for a Medigap plan, you must already be enrolled in Original Medicare. Once you enroll in Medicare Part B, you will have a six-month period to enroll in Medigap plans. You can also enroll in a Medigap plan during the standard Medicare open enrollment. Itâs possible to cancel and enroll in a new Medigap plan at any time during the year, but insurers arenât required to accept you for a new plan outside of the Medigap enrollment period.

Medicare Annual Open Enrollment Period

Medicares annual open enrollment period is October 15 through December 7. During this time, you can select a new Medicare Advantage or Prescription Drug Plan with coverage that will begin January 1. It is also a chance to review and compare your coverage with other available plans and enroll in a new plan.

During the open enrollment period you can:

- Buy a new Medicare Advantage plan if you are enrolled in Original Medicare .

- Switch back to Original Medicare if you currently have a Medicare Advantage plan.

- Change to a new Medicare Advantage or Part D plan if you currently have a Medicare Advantage or Part D plan.

- Buy or cancel a Part D plan if you have, or are signing up for, Original Medicare.

This open enrollment period cannot be used to enroll in Part A and/or Part B for the first time. For information about enrolling in Part A and/or Part B for the first time visit www.medicare.gov or call 800-633-4227.

Note: Each year, insurance companies can make changes to Medicare plans, including changes to the prescription drugs they cover. It is a good idea to review your current Medicare plan every year to make sure it still meets your needs.

For more information about Medicares annual open enrollment period, or assistance with your review and plan comparison, contact the Michigan Medicare/Medicaid Assistance Program at 800-803-7174 or visit their website at mmapinc.org.

Recommended Reading: How Much Medicare Is Taken Out Of Social Security Check

What You Can Do During Open Enrollment

If you are already enrolled in Medicare Part A or Part B, you can add or drop a Part D prescription drug plan. You can also choose a different Part D drug plan if youre unhappy with your current one. Additionally, you can switch from Original Medicare to a Medicare Advantage plan.

If you currently have a Medicare Advantage plan, you can choose a plan that better suits your needs. You can switch to another Medicare Advantage plan without drug coverage, for example, and vice versa. You can also switch to Original Medicare if you prefer. Be aware that if you go back to Original Medicare, you may not be able to get a Medigap policy, and you may want to separately purchase Part D drug coverage.

If you go 63 or more days without creditable prescription drug coverage once your initial enrollment period is over, and later you want Part D, you will be assessed a late enrollment penalty. The penalty is permanently added to your Part D premium and increases the longer you go without coverage.

Visit Medicare.gov/plan-compare to compare plans against your current one for coverage, price, providers, and other benefits.

Whats The Medicare Open Enrollment Period

Medicare health and drug plans can make changes each yearthings like cost, coverage, and what providers and pharmacies are in their networks. October 15 to December 7 is when all people with Medicare can change their Medicare health plans and prescription drug coverage for the following year to better meet their needs.

Read Also: Can I Use Medicare For Dental

When You Should Make Changes To Your Medicare Coverage

As we approach this years Medicare Open Enrollment Period, you will have to consider whether you need to make changes to your Medicare coverage. This can be a difficult decision as there are many factors that come into play.

The following are questions to ask yourself when considering changing your Medicare coverage:

- Have your premiums increased to a rate you cannot sustain?

- Is your family physician still within your Advantage Plans Network?

- Is your prescription drug still covered in Part D?

- Do you plan on moving or travelling in the coming year?

- Have you gained any ancillary benefits?

- Do you anticipate needing more healthcare in the coming year?

- Are you satisfied with your current Medicare coverage?

Depending on your answer to these questions, you may or may not choose to make changes to your Medicare coverage for 2022. Whatever you decide, know that your healthcare is an important personal decision that deserves your comprehensive consideration.

Enrolling In A Medicare Supplement

During your initial Medigap enrollment period you cant be denied Medigap coverage or be charged more for the coverage because of your medical history.

But after that window ends, Medigap insurers in most states can use medical underwriting to determine your premiums and eligibility for coverage.

If youre under 65 and eligible for Medicare because of a disability, there are 33 states that provide some sort of guaranteed issue period during which you can purchase a Medigap plan. But in the majority of those states, the carriers can charge additional premiums for people under 65. You can click on a state on this map to see how Medigap plans are regulated in the state.

To find out about Medigap policies in your state, contact your State Department of Insurance or your State Health Insurance Assistance Program, or call 1-855-593-5633 to speak with one of our partners, who can help you find a plan in your area.

Recommended Reading: Does Medicare Pay For Dtap Shots