Decide Between A Regular Plan F And High

Choose the plan that makes the most sense for you financially. Regular Plan F will offer higher monthly premiums but will begin to pay toward out-of-pocket costs right away. High-Deductible Plan F, on the other hand, offers lower monthly premiums but requires you to pay an annual deductible, set at $2,370 for 2021, before it will pay toward out-of-pocket costs.

How To Shop & Compare Medicare Plan F

The first step to enrolling in Medicare Plan F is to enroll in Original Medicare. Then, if you became eligible for Medicare before January 1, 2020, you can still apply for Plan F. If you became eligible after January 1, 2020, though, you are ineligible to apply for Plan F because the Medicare Access and CHIP Reauthorization Act went into effect, phasing out Plan F for new enrollees. However, if you already have Plan F, you are able to keep your coverage.

Step 2: Determine Which Medicare Plan F Plans Are Available in Your Area

Different providers may have different plans, pricing, and coverage available if they still offer Plan F. Most providers have the ability to see estimated coverage and costs on their websites by entering your ZIP code. In some cases, they may require slightly more information to provide you with accurate results.

Step 3: Decide If a Regular or a High-Deductible Plan F Is Best for You

Some providers offer two versions of Plan F: regular and high deductible. The main difference, as the name suggests, is the deductible amount, and beyond that, the timing of the coverage. With a high-deductible Plan F, the coverage doesnt activate until the deductible amount is met, but in exchange, you can expect much lower monthly payments than the regular Plan F, which works the same as other Plans, with lower deductibles and higher monthly payments.

Step 4: Compare Plans and Costs

Step 6: Sign Up

How To Enroll In The Silver& fit Program

To enroll, start by selecting a Medicare Advantage or Medicare Supplement plan that includes the Silver& Fit benefit. Then, register on the Silver& Fit website.

If you have questions, call Silver& Fit at 1-877-427-4788, M-F, 5 am to 6 pm Pacific Time. You can also send an email to

To find out what plans in your area include this benefit, also consider speaking with a licensed Medicare agent to help you pick the right plan for you and your needs.

To set up your appointment, go here or call 833-438-3676.

Recommended Reading: Does Medicare Cover Bladder Control Pads

Medicare Supplement Plan N

This plan covers the same benefits as Plan G, with the exception of Part B excess charges, which Plan N does not cover. In addition, please note the following details for the Part B coinsurance or copayment benefit, which Plan N covers 100% of, with the following exceptions:

- You pay a copayment of up to $20 for some doctor visits.

- You pay a copayment of up to $50 for emergency room services that dont result in you being admitted as an inpatient.

Customer Reviews And Complaints

A key reason why we didn’t rate Humana higher is that the company has a high rate of complaints from policyholders.

According to the complaint index from the National Association of Insurance Commissioners , Humana has about 31% more complaints overall than a typical insurer of its size. This is calculated using a weighted average of complaint ratios across subsidiaries.

Humana’s most common complaints relate to claim handling including denial of claims, unsatisfactory settlement and delays.

Humana has an average performance rating from the National Committee for Quality Assurance , scoring an average of 3.4 out of 5 for all subsidiaries where data is available.

Ratings on the Better Business Bureau also reveal dissatisfaction and frustration. Even though Humana has an A+ rating from the organization, showing it actively tries to resolve issues, customers gave the company an average of 1.42 stars out of 5. Common complaints include poor customer service, frustrations about coverage and delays.

There are also mediocre ratings for the MyHumana app, which has a score of 3.1 out of 5 for iOS and 3.9 out of 5 for Android.

However, when it comes to Humana’s ability to pay claims, it has an excellent financial rating, receiving an A- financial strength rating from AM Best with a stable outlook.

You May Like: What Is The Extra Help Program For Medicare

Determine Which Medicare Supplement Plan Gs Are Available

Medicare offers a Find a Plan database to help you search for Medigap plans by ZIP code. For more accurate pricing, enter your age, gender, and whether or not you use tobacco. Scroll to Medicare Plan G or Medicare Plan G High-Deductible to get a quick overview of costs and coverage. Finally, select View Policies for the list of specific insurance companies offering that plan in your area. You will need to reach out to those companies individually to get official quotes.

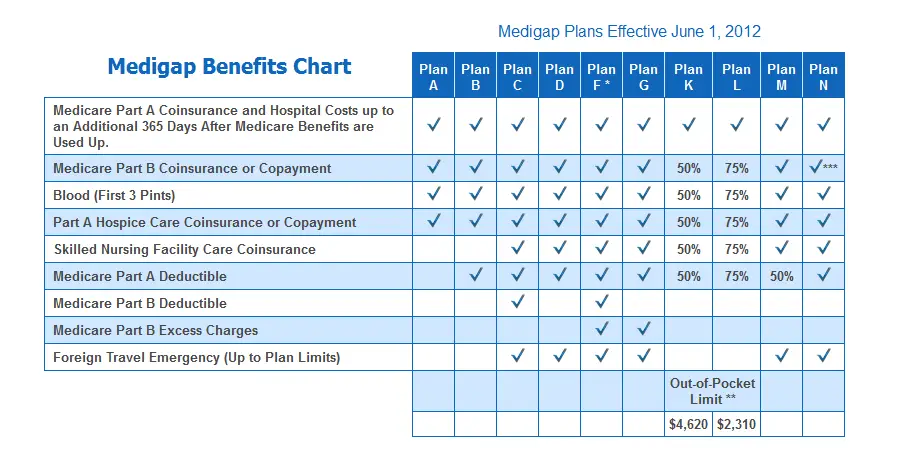

Important Things To Know About Medicare Supplement Insurance Plans2

- Medicare Supplement insurance plans are not the same as Medicare Advantage plans.

- A Medigap policy only covers 1 person. If you and your spouse both want Medigap coverage, you must buy separate policies.

- Medigap policies do not include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan .

- You will pay a monthly premium when you have a Medicare Supplement plan in addition to the Part B premium to Original Medicare.

- A Medicare Supplement policy is guaranteed renewable even if you have health problems. This means your private insurance company cant cancel your policy as long as you pay the premium and provided accurate information on your application.

- Medigap policies generally dont cover long-term care, vision or dental care, hearing aids, eyeglasses or private-duty nursing.

Don’t Miss: Which Medicare Plans Cover Silver Sneakers

Humana Premier Rx Plan

Like the Walmart Value Rx Plan, the Humana Premier Rx plan also uses Walmart as its preferred cost-sharing partner. This means that living close to a Walmart location is key to saving the most on your prescriptions.

While this plan has a higher premium than the Walmart Value Rx Plan , the Humana Premier Rx Plan includes additional benefits:

- $0 deductible on tier 1 and 2 medications

- $0 copay on 90-day supplies of tier 1 and 2 medications from Humanas mail-delivery pharmacy service

- preferred cost-sharing at Humana Pharmacy, Walmart, Walmart Neighborhood Markets, Sams Club, Publix, Kroger, Harris Teeter, HEB, and Costco pharmacies

- $445 annual deductible on tiers 3 through 5 medications nationwide and $305 in Puerto Rico

- more than 3,700 medications on the plans list of covered drugs

Does Medicare Part G Plan Cover Chiropractic Services

Medicare covers limited chiropractic services. Specifically, it covers spinal manipulation to correct a subluxation, an alignment issue of the spine that causes pain and/or functional impairments. Part B covers 80% of those costs and Part G will cover the remaining 20%. Other chiropractic services like X-rays or massage are not covered.

Recommended Reading: Does Medicare Cover Dexa Scan

Humana Medicare Advantage Plans

Humana is one of the leaders in the Medicare Advantage market. In some areas, Part C plans have options that lower Part B premium costs.

Many of these plans have a $0 premium. Additionally, Humana offers Special Needs Plans to cater to those with chronic conditions.

Many Humana plans offer fitness programs such as SilverSneakers. Also, plans can include prescription drug coverage, as well as coverage for dental, vision, and hearing. Some plans with such benefits charge slightly higher premiums. Plan availability varies by location.

The maximum out-of-pocket amounts for Humana Advantage plans range depending on the policy you choose. Your deductibles and copays go toward this amount before the plan starts paying 100%, so keep this in mind when evaluating your options.

Customer Reviews Of Humana Medicare Supplement Plans

For many people, reading reviews is an important part of any shopping experience. Below you can read about some of the trends that we found in reviews of Humana insurance. The average review score that Humana has, based on data from the Better Business Bureau , Trustpilot , and Google Business , was 2.2/5 stars.

Note that many online reviewers do not specify whether their insurance is a Medicare Supplement policy or some other form of Humana health insurance, so this average score reflects customers ratings of Humana as a whole.

Read Also: How To Sign Up For Aetna Medicare Advantage

Humana Medigap Plan K

Medigap Plans K, L and N cover many of the same benefits as the plans outlined above but with cost-sharing included. This means that instead of 100 percent coverage for the Part A deductible, for instance, you might be responsible for half of the cost. The tradeoff is a lower premium and an out-of-pocket cap .

Medigap Plan K Covers:

- Medicare Part A coinsurance and coverage for hospital benefits

- 50% of Medicare Part B coinsurance or copayments

- 50% of coinsurance or copayments for hospice care

- 50% of the first three pints of blood in a medical procedure

- 50% of Medicare Part A deductible

- 50% of coinsurance for skilled nursing facility care

Plan K offers the same peace of mind that many supplemental plans afford, letting you off the hook for a portion of your out-of-pocket expenses but without the higher price tag of more comprehensive plans. Under Plan K, youll also have an out-of-pocket cap that keeps costs in check. In 2018, the out-of-pocket cap for a Humana Medigap Plan K policy is $5,240. This cap increases each year based on inflation. The 65-year-old woman in Lexington County would pay about $69 a month for this coverage. Humana also offers a Plan K with dental and vision, which would cost about $80 a month.

Review: Humana Medicare Supplements In Kentucky

Humana scored 3.5 out of 5.0 based on our scoring method. Although their Plan F is not in the top 10 best rates, Humana has been servicing Medicare SupplementsMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage…. for over 10 years and has a good financial rating from A.M. Best. This is a good carrier, but there are other good Medigap carriers with lower rates in Kentucky. See the top 10 competition.

Here are the pros and cons from our analysis:

You May Like: Are Medicare Advantage Plans Hmos

Humana Customer Satisfaction Ratings

One of the key indicators of a great company is customer satisfaction. One of the groups that tracks complaints against insurance companies is the National Association of Insurance Commissioners. The NAIC keeps a complaint index and a score of less than one means the company has received fewer than expected complaints.

No company can satisfy everyone all the time, but it is helpful to know if they receive more than average.

In the most recent compiled data from 2019, the received a 1.00 which suggests average complaints. But what is more amazing is that in 2017 & 2018 their Medicare Supplement unit had no complaints, and only 1 in 2019. Thats pretty remarkable considering they have over 300,000 policyholders.

J.D. Power, the national company that measures customer satisfaction, ranked Humana as third overall for their Medicare products. They scored 806 points out of 1000.

Here are a couple of reviews from Humanas customers:

John of Indianapolis, IN

I am very satisfied with of policy from Humana. I have been in and out of the hospital over that last few years and not paid a dime out of pocket. Also when I go to my doctor there is no co pay. I understand that my policy is a little pricey but for the peace of mind it is worth it.

Jim of Plant City, FL

Humana Medicare Supplement Plan G

Medicare Supplement Plan G is currently the most popular Medigap plan because it gives you the best overall deal. It is common for eligible beneficiaries to save at least $250 per year by selecting Plan G instead of Plan F.

For instance, if a 70-year-old man in Arizona doesnt use tobacco and chooses to go with Plan F from Humana, hell be paying about $182 in premiums each month. Yet, the same beneficiarys monthly premium for Humanas Medicare Supplement Plan G in Arizona would be around $154 per month.

In most cases including this one, where the annual difference is to the tune of $336 the savings surpass the cost of the Part B deductible, which is the only cost Plan F covers that Plan G doesnt. Meaning, it could be more financially responsible to choose Plan G over Plan F.

You May Like: Does Medicare Pay For Inogen Oxygen Concentrator

What Does Medicare Plan C Cover

Plan C covers most of the costs youd have to pay for Medicare-approved medical expenses. It offers all the benefits of Plans A and B, plus coverage for skilled nursing facility care coinsurance, your Medicare Part A deductible for hospitalization, your Medicare Part B deductible for medical and hospital outpatient expenses, and medical emergency help when traveling out of the country.

Humana Medigap Plan C

For people who want or need additional coverage beyond the basics offered by Medigap Plans A or B, Medigap Plan C includes benefits that may meet your needs. This is a good option for people who need a lot of medical care and plan to see providers who accept Medicare assignment .

Medigap Plan C Covers:

- Coinsurance for skilled nursing facility care

- Medicare Part B deductible

- Foreign travel emergencies up to plan limits

Because this plan covers the deductibles for both Medicare Parts A and B, its a good option for people who know theyll be spending a lot of time in the doctors office or a hospital for the year. It covers all the same benefits as A and B, plus the Part B deductible, coinsurance for skilled nursing care and foreign travel emergencies up to the plan limit.

In 2020, the Part B annual deductible is $183, which is what youll need to meet before Part B benefits start. Medigap Plan C pays this deductible along with the 20 percent coinsurance rate that you would typically pay for Part B services, making Plan C a valuable investment for people who need a lot of care. Note that Plan C does not cover Part B excess charges, which are the costs that you might get billed for if you see a doctor who doesnt accept Medicare assignment for certain medical services.

Don’t Miss: When Do You Receive Medicare Card

Best For User Experience: Cigna

Cigna

-

Household discounts

-

User-friendly website and mobile apps

-

Also offers Part D plans

-

Rates increase based on age

-

Rates not available without a quote

Founded in 1792 as an insurance company, Cigna ventured into health care in 1912 and remains a leader in the industry. It offers Plan F in 46 states, excluding Massachusetts, Minnesota, New York, and Wisconsin, and offers High-Deductible Plan F in 30 states, excluding the aforementioned states as well as Alaska, Arkansas, Delaware, Hawaii, Indiana, Maine, Montana, Nebraska, North Dakota, Oregon, Pennsylvania, Rhode Island, South Carolina, Washington, West Virginia, and Wyoming.

To request a quote or enroll in Cigna Plan F, call the company or fill out the form on its website that requires basic personal information, including your start dates of Medicare Parts A and B. Plans vary based on your age, gender, medical conditions, and address. The plans are based on an attained-age model in the majority of states it services. Under this format, prices increase regularly based on your age. If you are also looking for a Medicare Part D Plan to round out your Medicare coverage, Cigna has several plans to meet your needs.

Cost-wise, Cigna is competitive. In all states except for Hawaii, Idaho, Minnesota and Vermont, it offers further savings with a 7% household discount on monthly premiums when two or more enrollees live together. In Washington, the discount only applies to spouses.

Sign Up For Medicare Supplement Plan F

You may receive marketing mail about Medicare Supplement Plans, especially during Medicare Open Enrollment. The Medigap Find a Plan site on Medicare.gov also gives phone numbers and direct website links for each Medigap plan in your state. Reach out to the insurance company of your choice for a quote. In fact, considering reaching out to multiple companies to get the best rate. There is no option to sign up through the Medicare site directly.

Read Also: Which Insulin Pumps Are Covered By Medicare

Best User Experience: Cigna

-

Household discount program

-

Two mobile apps

-

Limited high-deductible plans

-

Rates increase based on age

Cigna stands out for its customer service and user-friendly website that explains how Medicare Supplement plans work. Its customer support is rounded out by access to a 24/7 nursing line for your healthcare questions. It also offers two mobile apps, the myCigna Mobile app used to track your benefits, and the Cigna Wellbeing App that provides information about chronic conditions like diabetes, wellness tips, healthy recipes, telehealth consultations with a medical professional, and tools to track your weight, blood pressure, cholesterol, and blood sugar.

Founded in 1792, Cigna entered the healthcare industry in 1912. It offers Medicare Supplement Plan G in 46 statesMassachusetts, Minnesota, New York, and Wisconsin are excludedbut has limited options for High-Deductible Plan G, which is only available in North Carolina.

Its price structure is based on an attained model in the majority of states it serves. Under this model, prices increase regularly based on your age. Its quote process is a bit lengthy: you can request a quote online by providing your name, date of birth, zip code, phone number, email address, and start dates of Medicare Parts A and B coverage. You can also get a free quote by calling one of their representatives. Rates may vary by age, smoking status, and location.