Changes To Medicare Advantage Under Obamacare

In 2014, the Affordable Care Act changed the healthcare system in America and also changed small parts of Medicare. The only real change that most people noticed is that now Medicare and Medicare Advantage plans must include preventive care and cannot reject anyone for pre-existing conditions.

There was also an initial drop in the number of Medicare Advantage plans being offered. An Avalere Health analysis found a 5 percent drop in the availability of Medicare Advantage plans. In addition, the variety of plan types also dropped, with more Medicare Advantage providers offering only HMO policies instead of PPO, PFFS and Special Needs Plans.

For the 2020 enrollment season, Medicare Advantage customers saw an increase in plan options nationwide, with a total of over 5,000 Advantage plans on the market according to state data that we analyzed from the Centers for Medicare and Medicaid Services.

The donut hole, which is a coverage gap in Medicare, has also been eliminated thanks to measures put into place under the Affordable Care Act. Now, once you reach your drug plans initial coverage limit , youll pay 25 percent of the cost of your medications until you reach the catastrophic limit on the other side.

Why Choose A Medicare Advantage Plan

Medicare Advantage Plans offered by private insurance companies provide all of the Part A and Part B benefits of Original Medicare, but many offer additional coverage. HMOs and PPOs can typically offer benefits at a lower cost by creating a specific network of providers, allowing the insurance company to manage costs and reduce your out-of-pocket expenses.

Because costs and benefits can vary, its important to compare plans before choosing one of the following.

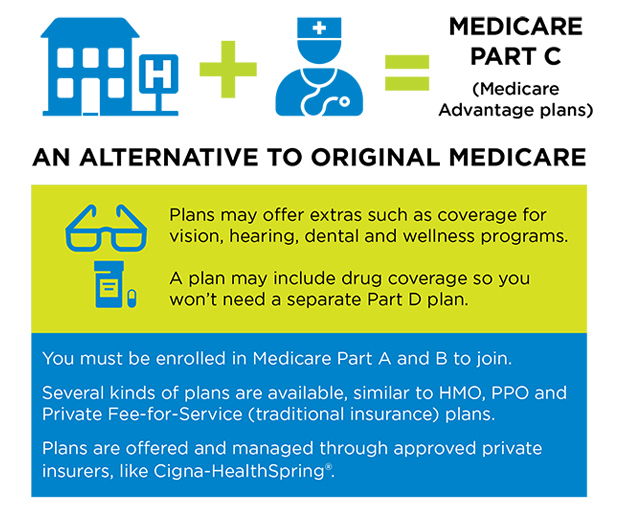

Medicare Part C Eligibility

To be eligible for Medicare Part C you must:

- Enroll in Medicare Part A

- Enroll in Medicare Part B

- Live in the service area of your selected plan

- Have a valid Medicare Advantage Enrollment Period.

To enroll in a Medicare Part C plan, there are no health questions, and you cannot be denied coverage for any reason.

After January 1, 2021, even those with end-stage renal disease are eligible for any Medicare Part C plan in their area. Prior to 2021, those diagnosed with ESRD were only eligible for Special Needs Plans. Now, those with ESRD are eligible for a broader range of plans with different coverage options.

Also Check: Does Medicare Pay For Mobility Scooters

What Are Medicare Advantage Plans

A Medicare Advantage Plan is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, youll still have Medicare but youll get most of your Medicare Part A and Medicare Part B coverage from the Medicare Advantage Plan, not Original Medicare. Most plans include Medicare prescription drug coverage . In most cases, youll need to use health care providers who participate in the plans network. However, many plans offer out-of-network coverage, but sometimes at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because youll need it if you ever switch back to Original Medicare.

Are You Eligible For Medicare Part C

You qualify for Medicare Part C if you already have Medicare parts A and B, and if you live in the service area of the Medicare Part C provider you are considering.

Due to law passed by Congress that went into effect in 2021, people with end stage renal disease are eligible to enroll in a broader range of Medicare Advantage plans. Before this law, most plans would not accept you or limit you to a Special Needs Plan if you had a diagnosis of ESRD.

what you need to know about enrolling in medicare

- Enrollment into Medicare is time-sensitive and should be started roughly 3 months before you turn age 65. You can also apply for Medicare on the month you turn 65 and the 3 months following your 65th birthday although your coverage will be delayed.

- If you miss the initial enrollment period, open enrollment runs from October 15 through December 7 every year.

- You can sign up for original Medicare online through the Social Security Administration website.

- You can compare and shop for Medicare Part C plans online through Medicares plan finder tool.

There are two main types of Medicare Advantage plans offered, which well go over in detail next.

You May Like: What Is The Best Medicare Supplement Company

How Much Is Medicare Advantage

Just like the additional benefits offered, the total cost of a Medicare Advantage plan will vary by provider, location and which plan you choose. For example, some Medicare Advantage plans may come with low-cost monthly premiums, while others may be $0. A plans deductible, copayment and coinsurance costs will also vary by plan, and potentially also by the health service or benefit you use.

However, there is a unique benefit to Medicare Advantage plans that other Medicare plans dont have. All Medicare Advantage plans have a yearly limit on the out-of-pocket costs you must pay for covered medical services. This limit may vary for different plans, and can change each year however, its something that only Medicare Advantage plans offer to help keep costs in check.

Its important to know that even with a Medicare Advantage plan, youll still pay the Part B premium to Medicare.

When Can I Enroll In Medicare Advantage

Medicare requires that you enroll in, disenroll from, or make changes to your Medicare Advantage plan only during pre-determined enrollment periods.

If you are enrolling for the first time, you may be able to join a plan during your Initial Enrollment Period, which occurs around your 65th birthday, or around your 24th month of disability .

You also may be able to join or switch plans during the Annual Election Period , which runs from October 15 to December 7 every year.

There are also Special Enrollment Periods that may let you join a plan outside of the main enrollment periods, depending on your circumstances.

Qualifying circumstances for a Medicare Special Enrollment Period include, but aren’t limited to:

- Moving outside of your current plan’s coverage area

- Moving to an area where additional coverage options exist

- Losing employer coverage

More info: How to apply for a Medicare Advantage plan

Read Also: How Do I Register For Medicare Part A

Explore What Makes The Medicare Advantage Plan Unique And What Access It Offers You

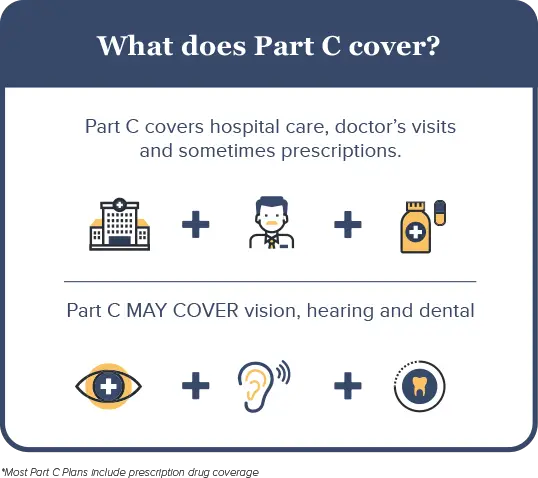

Medicare is a health insurance program run by the federal government that covers people aged 65 and older, people with certain disabilities, and younger people with long-term healthcare needs. It was enacted in 1965 and is funded by payroll taxes and general revenue. The program has several parts. Part A covers hospital costs, Part B covers outpatient care and some other services, Part C is Medicare Advantage, and Part D is private insurance to cover prescription drugs.

The federal government sets essential criteria for eligibility for each part. It also determines the services to be covered for each. The services are covered either partially or wholly. People who qualify for Medicare but do not buy parts can still get traditional Medicare, which covers hospital stays, physician visits and other inpatient treatment, and some home healthcare services. Part C is a new way of providing insurance to people who are on Medicare. It allows them to choose private health insurance companies that provide all or part of their health care coverage.

Paying A Premium For Medicare Part C

A premium is an amount you pay each month to purchase your coverage . Some Medicare Part C plans have premiums, while others do not.

People with Medicare Part C still have to pay the monthly premium for Medicare Part B since the Part C plan provides the benefits of Medicare Part A and Part B combined into one private plan.

For most Medicare beneficiaries, Medicare Part A does not have monthly premiums. But for those who don’t have enough work history to qualify for premium-free Medicare Part A, there will be a premium for Part A as well as Part B.

In 2022, the Part B premium for most Medicare beneficiaries is $170.10/month . So most people with Medicare Part C have to pay at least that amount for their coverage.

As of 2022, 59% of Medicare Part C plans have no additional premium other than the premium for Part B, and these are the plans that tend to be favored by Part C enrollees. The majority of these plans also include Part D coverage in addition to the Part A and Part B benefits, but the beneficiaries only pay the premium for Part B.

Some of these plans even have a “giveback” rebate that pays a portion of the Part B premium on the enrollee’s behalf. So in some areas, it’s possible to have Medicare coverage under a Part C plan and pay less than the standard Part B premium each month.

The other 41% of Part C plans have a premium that has to be paid in addition to the Part B premium. These premiums vary from one plan to another.

Don’t Miss: Where Do I Register For Medicare

Medicare Spends Its Way Out Of Trouble: 20032010

The 2003 Medicare Modernization and Improvement Act established a larger role for private health plans in Medicare largely based on a shift away from a focus on cost containment and regulation and toward the accommodation of private interests and an ideological preference for market-based solutions that stemmed from the Republican control of both the executive and legislative branches of government . The MMA enacted the most significant changes to the Medicare program since its inception, and the emphasis of these reforms was the use of private plansincluding, we note parenthetically, in Part D. The generosity afforded to private plans via the MMA was in large part an attempt by the Bush administration and Congress to increase the private sector’s role in Medicare.

The MMA also created two more Part C plans: regional PPO plans and Special Needs Plans . Regional PPOs are like local PPO plans except that they cover regions comprising a whole state or several states . Regional PPOs were created mainly to give rural beneficiaries better access to a broader set of private plans. SNPs were created for Medicare beneficiaries who also were eligible for Medicaid and other vulnerable populations and were intended to provide the focused, specialized care particularly suited to these populations.

S To Enrolling In Medicare Part C

Enrolling in Medicare Part C is fairly straightforward. First, you will need to find a plan that meets your needs. You can do this by visiting the Medicare website or contacting a representative from a private insurer. Once you have chosen a plan, you will need to fill out the necessary paperwork and submit it to your insurer. Finally, you will need to make sure that you have paid your first months premium before your coverage begins.

Recommended Reading: Can You Have A Health Savings Account With Medicare

Types Of Medicare Advantage Plans

HMOs may offer lower premiums than other plans. You must usually stay within your plans network for care and services.

PPOs may allow you to go out-of-network for care. You will usually pay less if you stay within the plans network.

A PFFS plan may or not be network-based and requires non-network providers to accept Medicare reimbursement and the plans terms.

SNPs are designed for people with chronic conditions such as diabetes, and individuals who qualify for both Medicare and Medicaid.

MSAs combines a high-deductible plan with a designated savings account. These plans do not include prescription drug coverage.

These hybrid HMOs let you go outside the network for treatment but may have a higher cost. There can be separate deductibles for in-network and out-of-network costs.

What Are The Additional Benefits Of Medicare Part C Coverage

Part C plans can offer additional benefits beyond what Original Medicare offers. Medicare Advantage Plans can use rebate dollars paid by Medicare to cover the costs of these benefits . The scope and breadth of these benefits vary depending on your plan, but over 90% of Medicare Advantage Plans in 2022 include some coverage for:

- Eye exams and/or corrective lenses

Other less common additional benefits include:

- In-home support

To access any of these additional benefits, you must follow your plans rules, including using network providers and obtaining referrals and prior authorizations. Copays may apply. Beyond routine eye, dental, and hearing exams, most Medicare Advantage Plans provide an allowance for some benefits. For instance, you may receive $150 toward the purchase of eyeglasses if you use an in-network provider. Your benefits and how much you pay are detailed in your plans Evidence of Coverage document.

These additional benefits are not covered by Medicare but are offered as non-covered services by your Medicare Advantage Plan. Your out-of-pocket costs, such as copays, do not apply toward your maximum out-of-pocket spending limit.

Don’t Miss: Is Upwalker Covered By Medicare

How Do I Choose The Right Medicare Advantage Plan

Before the open enrollment season, check out as many Part C plans as you can to determine which options work for your budget and health needs. Each year, from October 15 to December 7, open enrollment allows you to change, switch or initially enroll in a Medicare Advantage plan. The right choice may save you thousands of dollars every year and make it easier to get the help you need when you need it the most.

A Medicare Advantage plan must cover the same services as traditional Medicare plans. These plans also should take care of some costs that would normally come out-of-pocket, without supplemental coverage. Medicare Part C plans usually require that you use healthcare facilities, doctors, physicians and other professionals already existing in the health insurance plans network.

However, most plans offer you either HMO or PPO options. If you choose an HMO Medicare Advantage plan, you will have to choose a primary care physician and receive care within the network. If you go with a PPO, then you may have more of a choice with out-of-network doctors and still receive coverage. Regardless of what you choose, youll most likely have out-of-pocket costs in the form of copayments and coinsurance, which depend on carrier and plan type.

Failed Attempt At Savings: 19972003

The BBA’s goals with respect to Medicare Advantage can be summarized in the following question: Could Medicare Advantage be reformed so that Medicare could participate in the managed care dividend enjoyed by private employers? In the latter half of the 1990s, Republicans , centrist Democrats, and some policymakers began to look to Medicare as a source for reducing the deficit . Debate centered on the idea of premium support, in which Medicare beneficiaries would be given a lump sumin effect, a voucherthat could be used to pay for a private plan or for the premium for TM, a model used by some private employers as well as the Federal Employees Health Benefit Program . Aaron and Reischauer , among others, argued that such a policy would promote competition and efficiency in Medicare, give beneficiaries a choice, and capture some of the managed care dividend for Medicare.

After an intense debate, Congress passed the BBA, in which Medicare’s at-risk contracting with health plans was formally designated as Part C of Medicare and named Medicare+Choice . The intent was to encourage competition and the growth of managed care in the Medicare program, with the hope that this would save Medicare funds. Most Democrats, however, vehemently opposed the defined-contribution initiative and succeeded in having the topic assigned to a bipartisan commission for study. In the meantime, Medicare remained a defined benefit program.

You May Like: How To Verify Medicare Eligibility Online

How To Enroll In A Medicare Advantage Plan

You can enroll in the Medicare Advantage plan anytime during the annual open enrollment period in October and November. The plans offer different types of coverage, including HMOs, PPOs and Point of Service plans. The coverage provided varies depending on which company provides the plan. Choosing a plan can be challenging because many plans have similar premiums and deductibles.

Your doctor will provide a list of plans they have contracted with, and you can select a plan from the list. If you have a plan and are happy with the service, you don’t need to re-enroll each year. Your coverage will stay in effect until your current plan expires and you choose to renew it or revise your choices. If you are unhappy with your current plan, you can change it during the annual open enrollment period. If you do not re-enroll when your current plan expires, you will automatically be enrolled in the Standard Medicare Plan.

You can sign up for a plan as an individual or a family. From time to time, some Medicare Advantage plans have a special enrollment period that allows certain people to change their plans without any or with limited waiting periods.

How To Enroll In Medicare Part C

Before you can sign up for a Medicare Part C plan, you will need to have an active Original Medicare, which includes Part A and Part B. You are not allowed to sign up for Part C without the traditional Medicare.

If you are receiving federal retirement benefits, though, you are enrolled in Medicare automatically when you turn 65. You are also automatically signed up for Original Medicare if you have federal disability payments for the past 24 months.

Now, if you have not received federal retirement benefits yet but youre already 65, then you need to enroll for Original Medicare manually. You can do so by going to a local Social Security office. You may also call the office at 1-800-772-1213. Or fill out an online application through the ssa.gov.

After you have successfully enrolled in Original Medicare, you can start shopping for Medicare Advantage plan. Use Medicares official website to find plans. But you can only sign up within the specified period per year.

If you are a new subscriber, you have seven months to purchase coverage. The period starts three months before you turn 65. Then, another three months after turn 65. This is your first enrollment period.

Outside of this initial enrollment, you can still purchase or change your plan during open enrollment. It happens from October 15 to December 7 every year. This is known as the yearly election period.

Don’t Miss: How Is Part B Medicare Premium Determined