When Can I Enroll In A Medicare Prescription Drug Plan

You can enroll in a plan at any time during your Medicare Initial Enrollment Period, which starts three months before your 65th birthday month, includes your birthday month, and extends for three additional months. If you get Medicare because of a disability, you can generally enroll in Medicare Part D after you are on Social Security disability for 24 months.

You can make changes to your prescription drug coverage each year during the Fall Open Enrollment Period . If you get Medicare Part D as part of your Medicare Advantage plan, you can also make changes during the Medicare Advantage Open Enrollment Period which runs from January 1st through March 31st.

Its important to enroll in a plan when you are first eligible if you want to avoid a late enrollment penalty with your monthly premium. If you go without creditable prescription drug coverage and you dont enroll in Part D when you are first able, youll pay a penalty of 1% of the national base premium for each month you go without coverage. You pay this penalty for as long as you have Medicare Part D coverage.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

What You Need To Know About Medicare Parts A B C And D

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

There are four parts of Medicare: Part A, Part B, Part C, and Part D. In general, the four Medicare parts cover different services, so it’s essential that you understand the options so you can pick your Medicare coverage carefully.

Best In Broad Information: Blue Cross Blue Shield

Blue Cross Blue Shield

-

No easily accessible price comparisons

-

Limited explanation on the difference between different levels of coverage

Blue Cross Blue Shield clearly takes patient education seriously. It wants to provide accurate information from the start, and its approach and website are different from most other companies. Instead of offering estimates based on your personal information, Blue Cross Blue Shield provides lots of general, up-front information about Medicare and all its different Parts, including Part D. It also offers a state-by-state breakdown of offerings and who to contact for more information. Its quote process is not the most straightforward if you visit your states Blue Cross Blue Shield website, you will be redirected to Anthem to begin a more detailed quote process.

Also Check: What Age Can You Start To Collect Medicare

Signing Up For Medicare Part D Coverage

Youre eligible for Medicare prescription drug coverage if:

- You have Part A and/or Part B.

- You live in the service area of a Medicare plan that covers prescription drugs.

Like other parts of Medicare, you can only enroll in Part D during certain periods. Youre first eligible for Medicare prescription drug coverage during your Initial Enrollment Period for Part D, which is the seven-month period that usually coincides with your Initial Enrollment Period for Part B. This period starts three months before your 65th birthday, includes the month you turn 65, and ends three months later. If you qualify for Medicare because of disability, your IEP for Part D starts three months before your 25th month of disability benefits from Social Security or the Railroad Retirement Board and lasts seven months.

After this period has passed, your next chance to sign up for or make changes to your Medicare prescription drug coverage is during the Annual Election Period, also known as the Fall Open Enrollment, which runs from October 15 to December 7 every year. During this period, you can:

- Enroll in a Medicare Prescription Drug Plan

- Enroll in a Medicare Advantage plan that includes or doesnt include prescription drug coverage

- Switch Medicare Prescription Drug Plans

- Switch Medicare Advantage plans

- Disenroll from your Medicare Prescription Drug Plan

- Disenroll from your Medicare Advantage plan to return to Original Medicare

Tricare Is Creditable Coverage

TRICARE is creditable prescription drug coverageCoverage that pays at least as much as Medicare’s standard prescription drug coverage.. This means you wont pay extra if you decide to enroll in a Medicare prescription drug plan after your Initial Enrollment Period.

When you become eligible for Medicare Part D:

- You’ll receive a letter in the mail.

- It will explain how your TRICARE prescription drug plan works with Medicare Part D.

- Please keep this letter for your records.

- You may need it to show that you dont have to pay extra if you decide to enroll in Medicare Part D.

Read Also: Does Medicare Pay For Ensure

Best For Simplicity: Aetna

-

Easy-to-understand information about each plan type

-

Opportunities for gap coverage for some prescription medications

-

Plans with a $0 copay and $0 deductible available

-

Premiums can be a bit pricey

-

Choice Plan deductibles for Tier 3 prescription drugs and above can have higher deductibles, ranging from $205 to $445

Aetna offers a straightforward breakdown of plans: SilverScript Smart Rx, SilverScript Choice and SilverScript Plus. The Smart Rx Plan is the lowest-priced of all plans, with the highest deductibles. The Choice Plan offers lower premiums but has moderately expensive deductible ranges. The Plus Plan offers a range of roughly double the cost of the Choice plan for monthly premiums, but with the promise of a $0 deductible for all levels of prescription medication .

The copays at preferred retailers are negligible for both plans Tier 1 medications have a $0 copay, while Tier 2 has a $5 copay for the Choice plan, and a $2 copay for the Plus plan. The Plus plan also offers “gap coverage” for the time between the end of one coverage and the beginning of another, and both plans offer mail-delivery prescriptions. Aetna breaks this down clearly and simply, without complicating details. Its also as simple as entering your ZIP code to see plans offered in your area for more personalized estimates.

Can I Change My Medicare Advantage Plan To Medicare Part D

If youve found Medicare Advantage not to your taste , its easy to switch your coverage. You may switch from your Medicare Advantage Plan to a Medicare Part D Plan during the enrollment period, which in 2021 goes from October 15 through December 7. You can change your plan during this time for the upcoming year.

Also Check: Can You Get Medicare Advantage Without Part B

What Is The Medicare Part D Late Enrollment Penalty

Its a good idea to sign up for a Part D plan when you become eligible, even if youre not taking any prescription medications. Why? Medicare adds on a permanent 1 percent late enrollment penalty to your premiuif you dont enroll within 63 days of your initial eligibility period.

The penalty rate is calculated based on the national premium rate for the current year multiplied by the number of months you didnt enroll when you were eligible. So, if you wait, your extra penalty payment will be based on how long you didnt have PartD coverage. This can add up.

The base premium changes year to year. If the premium goes up or down, your penalty changes, too.

If you have a Medicare Advantage plan, when you turn 65, you still need to have Part D coverage.

You can avoid the penalty if you have Medicare from another plan. This means you have drug coverage thats at least equal to the basic Medicare Part D coverage from another source, like an employer.

Since the penalty can add to your premium cost, it makes sense to buy a Part D plan at low cost when you become eligible. You can change plans during each open enrollment time if you need different coverage.

What Parts A And B Don’t Cover

The largest and most important item that traditional Medicare doesn’t cover is long-term care if the only care you need is custodial. If you are diagnosed with a chronic condition that requires ongoing long-term personal care assistance, the kind that requires an assisted-living facility, Medicare will cover none of the cost. However, Medicare will cover the costs for acute-care hospital services, for patients who are transferred from an intensive care or critical care unit. Services covered could include head trauma treatment or respiratory therapy.

Also Check: Is Pennsaid Covered By Medicare

Initial Enrollment Period For Part D

You can enroll in Medicare Part D coverage during your Initial Enrollment Period for Part D, which is the period that you first become eligible for Medicare Part D.

For most people, the IEP for Part D is the same as the IEP for Medicare Part B and begins three months before you turn 65 years of age, includes the month you turn 65, and ends three months after.

If you are not eligible to enroll in Medicare Part D because you do not live in a Part D-covered service area, your Initial Enrollment Period would not begin until three months before you permanently reside in the service area of a Medicare Part D Prescription Drug Plan or a Medicare Advantage plan that includes drug coverage.

If you enroll in Medicare Part D during your Initial Enrollment Period, your Medicare Part D coverage will begin on the first day of the following month that you apply for the plan.

If you enroll in one of the three months prior to turning 65 years of age, your Medicare Part D coverage begins on the first day of the month that you turn 65.

What Is The Medicare Part D Late

If youve gone 63 consecutive days without creditable prescription drug coverage, either because you didnt enroll when you were first eligible or because you lost your creditable coverage and didnt get new coverage in time, then you may have to pay a late-enrollment penalty when you do enroll into Medicare Part D.

The Medicare Part D late-enrollment penalty is added to the premium of the Part D Prescription Drug Plan you enroll into. Your Medicare Prescription Drug Plan determines this penalty by first calculating the number of uncovered months you were eligible for Medicare Part D, but didnt enroll under Part D or have creditable coverage. Your Medicare Prescription Drug Plan will then ask you if you had creditable prescription drug coverage during this time. If you didnt have creditable prescription drug coverage for 63 or more days in a row after you were first eligible, the Medicare Prescription Drug Plan must report the number of uncovered months to Medicare.

For example, lets say you disenrolled from your Medicare Prescription Drug Plan effective February 28, 2021, and then decided to enroll into another Medicare Prescription Drug Plan during the Annual Election Period, with an effective date of January 1, 2022. This means you didnt have creditable prescription drug coverage from March 2021 through December 2021, which adds up to 10 uncovered months.

Recommended Reading: Will Medicare Pay For Handicap Bathroom

When Can You Join Switch Or Drop A Medicare Drug Plan

You can join, switch, or drop a Medicare drug plan at these times:

- When you are first eligible for Medicare .

- If you get Medicare due to a disability, you can join during the 3 months before to 3 months after your 25th month of disability. You will have another chance to join 3 months before the month you turn age 65 to3 months after the month you turn age 65.

- The Annual Enrollment Period, between October 15-December 7. Your coverage will begin on January 1 of the following year, as long as the plan gets your enrollment request by December 31.

- Anytime, if you qualify for Extra Help or if you have both Medicare and Medicaid.

In most cases, you must stay enrolled for that calendar year starting the date your coverage begins. However, in certain situations, you may be able to join, switch, or drop Medicare drug plans during a special enrollment period .

Medicare Part D Premiums By Filing Status And Income

| Single | |

|---|---|

| $412,000 or more | $77.10 + your plan’s premium |

Remember that these premiums are just for Part D and they apply in addition to your Part A and Part B premiums. The premium for 2021 Part B plans is $148.50 , or more for those with higher incomes. And check out our guide to choosing your tax filing status.

Recommended Reading: How To Compare Medicare Supplement Plans

Can I Sign Up For Medicare Part D At Any Time

Not really. You can sign up for Medicare Part D when you first become eligible for Medicare . This is the best time to sign up because you wont have to pay a penalty or a higher premium.

If you decide not to enroll when you first become eligible, you can sign up for Medicare Part D between October 15 and December 7 each year, but as mentioned above, you may pay a penalty and a higher premium.

Important: This content reflects information from various individuals and organizations and may offer alternative or opposing points of view. It should not be used for medical advice, diagnosis or treatment. As always, you should consult with your healthcare provider about your specific health needs.

Medicare Part D Plan From A Trusted Agency

Home » Medicare » Medicare Part D

Original Medicare Parts A and B do not include coverage for prescription drugs. Medicare Part D was established in 2003 as part of the Medicare Prescription Drug Improvement and Modernization Act, or MMA. Medicare began to cover prescription drugs under Part D in 2006.

Understanding Medicare Part D

For more than 40 years, Medicare did not cover the cost of prescription drugs. Parts A and B still do not provide any coverage. Rather, those eligible for Medicare have two choices. They can buy a Medicare Advantage plan that includes coverage for prescription drugs or they can buy Medicare Part D. If you are enrolled in Medicare Part A and/or B, and you do not have prescription drug coverage from any other source, you should consider enrolling in Medicare Part D. However, if you choose not to enroll when youre first eligible and you do not have other creditable prescription drug coverage, you will be charged a penalty if you decide to enroll in Part D later.

How does Part D work?

There are various costs associated with Medicare Part D. Upon enrolling, you will pay a premium. This will be in addition to any premium you pay for Part B. Your premium will be higher if you are subject to the late enrollment penalty.

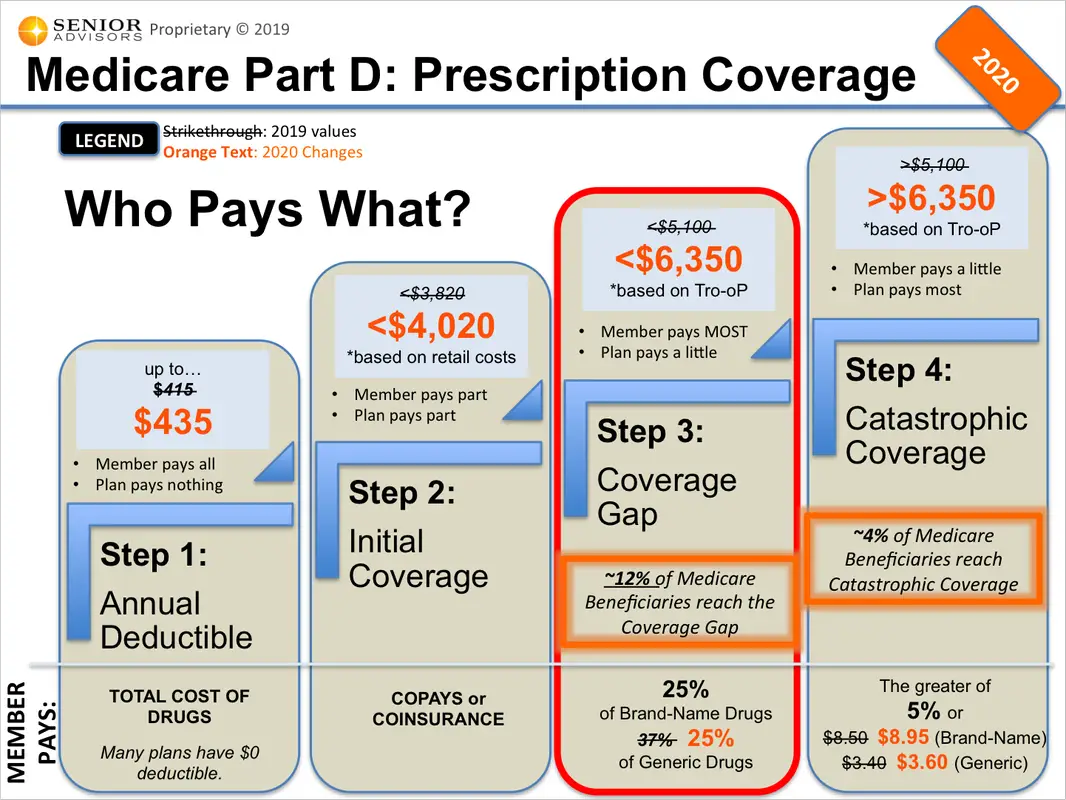

Medicare Part D deductible.

Medicare Part D coverage gap.

Catastrophic coverage.

You might not need Part D if you have Medicare Advantage.

Read Also: When Can You Apply For Part B Medicare

What Is Medicare Part D

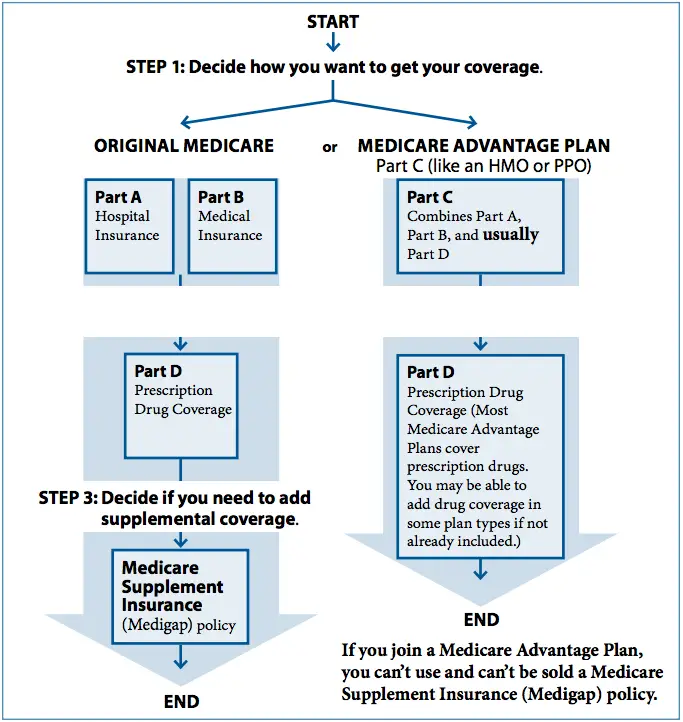

There are four parts to the Medicare program:

- Part A, which is your hospital insurance

- Part B, which covers outpatient services and durable medical equipment

- Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare

- Part D, which is your prescription drug coverage

Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

When Can I Join A Medicare Part D Drug Plan

If you are eligible for Medicare benefits because you are 65 or have a disability, you can enroll in a Medicare Part D drug plan. You can enroll the month you turn 65, or in the three months before or three months after you turn 65 . If you do not enroll during that seven-month period, you may have to pay a late enrollment penalty in the form of a higher premium.

If you have Medicare, you can enroll in a Part D drug plan during the open enrollment period, which begins on October 15 and lasts until December 7 each year, with plan selections effective on January 1. If you have a Part D drug plan already, you can change to a different plan during this enrollment period.

You can enroll in the Part D drug plan at any time without paying a penalty if you have both Medicaid and Medicare, or if your income makes you eligible for extra help .

Read Also: Which Insulin Pumps Are Covered By Medicare

Does Everyone Get The Same Coverage

No. Each plan must offer a minimum level of coverage specified in law. But some offer better benefits, lower costs and different overall designs than the one Congress originally envisaged.

Also, you may get more coverage and pay less out of pocket if your income is limited and you qualify for Extra Help, or you are in a state pharmacy assistance program, or you have employer or union coverage that supplements Medicare.

Whats Medicare Part D

Medicare Part D is the Medicare prescription drug coverage program. Medicare Part D is optional coverage and you can get it from private, Medicare-approved insurance companies in a couple of different ways.

- If youre enrolled in Original Medicare, Part A and/or Part B, you can sign up for a stand-alone Medicare Part D prescription drug plan.

- If youd rather enroll in a Medicare Advantage plan , chances are you can get Medicare Part D coverage through your Medicare Advantage plan.

NEW TO MEDICARE?

Recommended Reading: Does Medicare Cover Skin Removal

Should I Get A Medicare Part D Plan

If you have Original Medicare but you donât have prescription drug coverage, you should purchase a Medicare Part D plan. Make sure to enroll as soon as youâre eligible so you can avoid the late penalty.

If you have prescription drug coverage through an employer, union, or trade group, check to see if their plan covers more than the Medicare Part D plans you can buy in your area. For most people, workplace coverage terminates for good once they buy a Part D plan.

When you should consider Medicare Part D:

-

You have no other prescription drug coverage

-

Original Medicare and Medicare Part D are cheaper than your other coverage

-

You qualify for Extra Help, a program that helps low-income Americans pay Part D prescription drug costs

-

You have Medicare Supplement Insurance Medigap policies can no longer be sold with prescription drug coverage

When you can possibly skip Medicare Part D:

-

You have prescription drug coverage through Medicare Advantage

-

You have better prescription drug coverage through a past or current employer

-

You get better coverage through other federal programs or agencies, including the VA, TRICARE or the Federal Employee Health Benefits Program