B Deductible Also Increased For 2021

Medicare B also has a deductible, which increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

How Often Will I Get A Medicare Bill

You will receive a Medicare Premium Bill every three months if you are only paying a Part B premium. You will receive a Medicare Premium Bill every month if you also purchased Medicare Part A or if you receive an IRMAA for Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each…. You will receive these bills by the 10th of the month.Medicare.gov, Pay Part A & Part B premiums, Accessed October 20, 2021

Also Check: Does Medicare Offer Dental Plans

Medicare Part B Premium

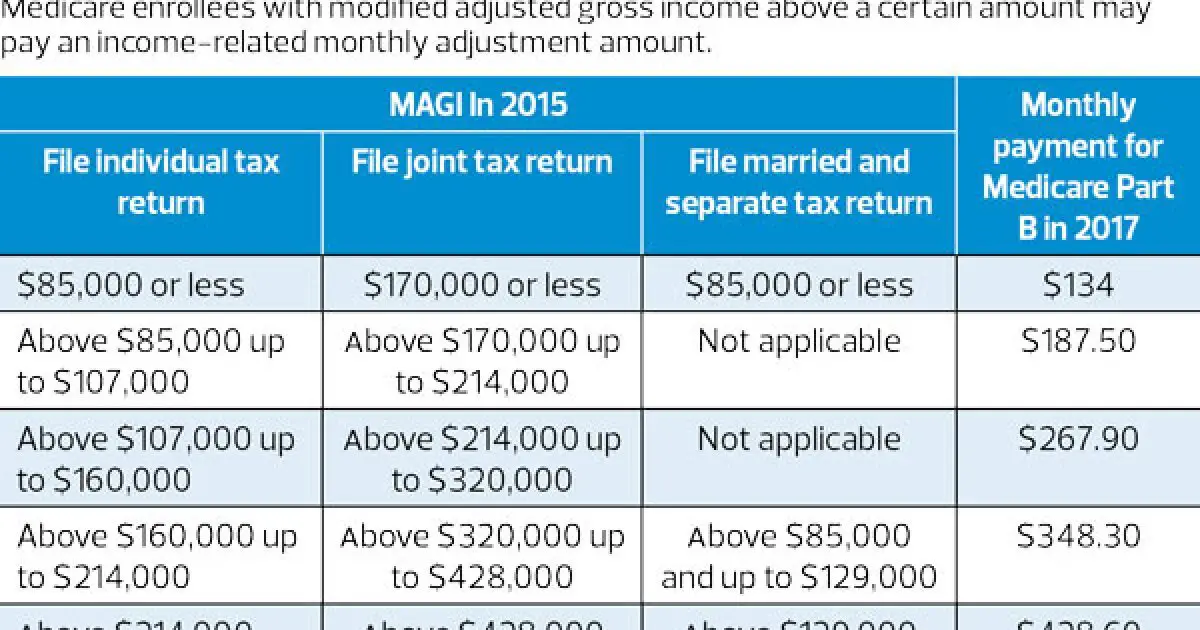

The Medicare Part B standard premium went up in 2021 to $148.50 from $144.60 a month in 2020. The CMS cited rising prices for doctor administered medications as the driving force behind the hike. People with higher incomes may have to pay higher prices.

Medicare Part B uses a complex formula to determine the amount of your monthly premium. The cost is based on your modified adjusted gross income. Thats adjusted gross income plus any tax-exempt interest reported on your most recent tax return.

The formula also takes into account whether you filed an individual tax return, a joint return or you were married but filed separately.

2021 Medicare Part B Premiums

| Filed an Individual Tax Return | Filed a Joint Tax Return | Medicare Part B Premium for 2021 |

|---|---|---|

| $88,000 or less |

How Much Does Medicare Advantage Cost

Medicare Advantage plans are private, Medicare-approved health insurance plans that provide Part A and Part B coverage, and may also include other types of coverage, such as vision or dental. The costs of these plans varies, depending on the benefits provided. Each plan offers different coverage and associated premiums, deductibles, and copay. Participants must also pay their Part B premium, along with the adjustment for high earners, if applicable.

Average premiums for 2022 are expected to drop to $19 a month.9

You May Like: Can I Get Glasses With Medicare

A Late Enrollment Penalty

Although most Medicare applicants dont pay a premium for Medicare Part A, those who are not eligible for a free Part A premium can expect a late enrollment penalty if they are not registered on time. If you dont enroll in Medicare Part A when youre first eligible, your monthly premium may increase by 10%.

This higher premium applies twice the years you havent enrolled. For example, if you havent been able to sign up for three years, youll have to pay a higher premium for six years.

If Youre In One Of These 5 Groups Heres What Youll Pay In :

2021 Medicare Part B IRMAA chart

Get more Medicare help on our Facebook community page.

The Medicare Cost for some people in higher income brackets went up in 2018 and 2019 due to the MACRA legislation passed a few years ago. Its a good idea to keep an eye on these Medicare income limits in the future because they may be adjusted every few years.

Also Check: How Many Parts Medicare Has

Enrolling In Medicare Part B

Some people areautomatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

Does Medicaid Cover Assisted Living

While Medicare operates at the federal level, Medicaid is a state-run program . CMS allows each state to set its own guidelines around Medicaid, as long as they meet the minimum federal requirements.

Medicaid beneficiaries in most states are eligible for some type of assistance paying for assisted living. To learn more about your state’s Medicaid program, click here.

Also Check: How Much Income Before Medicare Goes Up

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

Once you turn 65, you become eligible to enroll in Medicare, with its maddening mix of different programs, including Part A, Part B, Part C and Part D. Some of these programs charge you premiums, and some dont.

First the good news: Most Medicare enrollees arent required to pay a premium for Medicare Part A, which covers costs for inpatient hospital care, home nursing care and hospice care. That said, there are typically deductibles and copays for some Medicare Part A expenses.

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, youll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

If you opt for Original Medicare, the government will cover 80% of your Part B expenses after you meet your deductible. You can purchase a separate supplemental Medigap policy from a private insurer to cover the additional 20% youre on the hook for.

Some Medicare Advantage Plans Offer $0 Premiums

Did you know that some Medicare Advantage plans offer $0 premiums?

$0 premium plans arent available in all locations, so call a licensed insurance agent today to compare the plans that are available where you live.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

1 Cubanski, Juliette Damico, Anthony Neuman, Tricia. Medicare Part D: A First Look at Prescription Drug Plans in 2019. . Kaiser Family Foundation. Retrieved from www.kff.org/medicare/issue-brief/medicare-part-d-a-first-look-at-prescription-drug-plans-in-2019.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

Also Check: Does Medicare Cover Oral Surgery Biopsy

How Much Does Medicare Cost At Age 65

The United States national health insurance program known as Medicare has been providing people with health care insurance coverage since 1966. Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

The U.S. government has set the age of eligibility for Original Medicare Parts A and B at 65. And, while most people enroll at this age, others continue working and choose to stay on their employers insurance plan until the time they retire.

If your 65th birthday is coming up and you are planning to enroll for your Medicare benefits, you may be wondering what your costs will be. Here is a look at what you pay for Medicare insurance at the age of 65.

What Medicare costs do you have at age 65?The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

Part A

If you are not receiving Social Security benefits three months before your 65th birthday, you must sign up for Part A during your initial enrollment period which lasts for a period of seven months based on your 65th birth month.

There is no monthly premium for Part A if you meet the following requirements for premium-free Part A:

You are currently receiving retirement benefits from either the SSA or the RRB.

You have not applied for SS or RRB benefits yet, but you are eligible for them.

Days 1 60: $0 coinsurance per benefit period

Part B

What If I Need Help Paying Medicare Costs

If you have limited income and assets, you may qualify for help with your Medicare costs, including those that you pay for care you receive. There are several programs that help pay Medicare costs. Many people who could qualify never sign up, so be sure to apply if you think you might qualify. Dont hesitate to apply. Income and resource limits vary by program.

You May Like: How Much Is Medicare B Deductible

Paying For Assisted Living With Your Life Insurance

Some life insurance policies can be used to pay for assisted living or other long-term care.

- Accelerated death benefits: Also known as ADBs, this feature gives you a cash advance on your life insurance policy. Details vary depending on your policy. Typically, you must meet certain qualifications, such as having a terminal illness, requiring long-term care, or being confined to a nursing home.

- Combination products: Some insurance companies let you combine life insurance and long-term care insurance into a single policy. This way, if you’re part of the two-thirds of people who never need long-term care insurance, there’s still a payout at the end.

- Life settlements: You may be able to sell your life insurance policy if you meet your insurer’s requirements .

- Viatical settlements: If you are terminally ill, you may choose to sell your life insurance policy to a third party and use the money to pay for long-term care. The third party that buys your policy becomes the beneficiary.

We cannot stress enough how important it is to talk to a financial advisor before making any decisions on how you’ll pay for long-term care. Most of these options have tax repercussions. And, of course, may result in either no death benefit being paid out or significantly reducing the benefit.

How Much Does Medicare Part D Cost In 2021

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2020 plans, the additional costs will be based on your 2018 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $445 in 2021, up from $435 in 2020.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

Also Check: Will Medicare Pay For Handicap Bathroom

Medicare Part B Coinsurance

Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

There is no limit on Part B coinsurance costs, which could add up if you have a lot of doctor visits or need other services.

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services. However, your out-of-pocket costs are limited to the annual plan maximum. Once youve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

If Medicare costs are a concern, you may want to take advantage of financial protection and other benefits offered by Medicare Advantage plans.

What Is The Part A Premium

If you or your spouse paid Medicare taxes while working for 40 quarters or more, you are eligible for Premium-free Part A, which means you dont owe any monthly premiums for coverage. If you paid Medicare taxes for 30-39 quarters, youll pay $259 per month those whove paid less than 30 quarters in Medicare taxes will pay $471 a month in premiums.1

Also Check: What Is The Extra Help Program For Medicare

Medicare Premiums And The Government Who Pays For What

A quick background on what Medicare premiums are may be helpful. Medicare is broken into two parts. Essentially:

- Medicare Part B Standard healthcare services

There are also options for supplemental coverage, notably:

- Medicare Supplement Highly-regulated add-ons that pay your out-of-pocket Medicare costs

- Medicare Advantage Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C.

- Medicare Part D Prescription drug coverage plans, introduced in 2006.

Generally, if youre on Medicare, you arent charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few people itemize their tax returns so only a minority of seniors use this deduction. In fact, even if you do itemize, you can only deduct medical expenses, including Medicare premiums, that exceed 10% of your adjust gross income . This further limits the number of people who can deduct their premiums.

Most ofMedicare Part B about 7% is funded through U.S. income tax revenue. But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Are Medicare Premiums Tax Deductible

Your monthly premium for Parts A and B is tax-deductible. When premiums are deducted from your social security check, payments are removed from your tax. In addition, medical services not covered by Medicare , additional out-of-pocket insurance supplements and costs, and personal out-of-pocket deductions are also allowed. Even the costs of hospital travel and medically necessary equipment in the house can be deducted from your taxes.

However, there is a trap.

A taxpayer can only deduct sickness costs if costs exceed 7.5% of adjusted gross income . Expenses incurred within 7.5% of the AGI are not eligible for the tax deduction. For example, if your AGI is $40,000 and you have more than $5,000 in medical costs, you can include $2,000 in medical costs in your abandoned deductions. 7.5% of $40,000 is $3,000, which means that the cost of medical expenses is $2,000 which exceeds that threshold is tax-deductible.

Read More:

Recommended Reading: Why Is My First Medicare Bill So High

Premium Surcharge Is Based On 2019 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2019 tax returns were filed in 2020, so those were the most current returns available when income-related premium adjustments were determined for 2021.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.