How Your Assets Impact Eligibility

Besides income, your assets will be counted toward meeting eligibility requirements. Countable assets include checking and savings account balances, CDs, stocks, and bonds.

In most states, you can retain up to $2,000 as an individual and $3,000 for a married couple outside of your countable assets. However, these amounts may vary depending on the state in which you live.

Your home, your car, personal belongings, or your savings for funeral expenses remain outside of countable assets. If you can prove other assets are not accessible , they too are exempt. A house must be a principal residence and does not count as long as the nursing home resident or their spouse lives there or intends to return there.

Upon becoming eligible for Medicaid, all of the applicant’s income must be used to pay for the nursing home where the applicant resides. However, you may be allowed to keep a monthly “allowance” and a deduction for medical needs, such as private health insurance. The amount of the allowance varies depending on your living arrangements, type of nursing facility, and state rules. If you are married, an allowance may be made for the spouse still living in the home.

Using Personal Assets To Pay For Nursing Home Care

Most residents entering a skilled nursing facility pay for their care using their own funds at least initially. This might mean dipping into your loved ones personal savings, stocks or other assets. However, its not uncommon for adult children and other family members to pool funds to help cover the costs of nursing home care until their elder dependent becomes eligible for a public benefit program like Medicaid.

Families seeking accommodations for a loved one sometimes turn to more creative ways of using personal assets to cover costs, such as by taking out a reverse mortgage. A reverse mortgage allows a homeowner to convert the home equity theyve built up over time into cash. The homeowner can then access these funds either in monthly payments, a lump sum or via a line of credit.

Regardless of how you come up with the cash for your loved ones nursing home stay, its crucial to work with reputable financial institutions and to ensure that you understand all of the terms and fees involved. Its also important to check with your skilled nursing facility about what types of care and services are included in the fees being charged, and which ones may cost extra.

Could assisted living be a better option for you?

If nursing home costs are unreasonable for your personal budget and a physician finds that constant supervision isnt necessary for your aging loved one, it may be possible that an assisted living facility could meet their care needs.

How Many Days Will Medicare Pay For Nursing Home Care At A Skilled Nursing Facility

Medicare Part A partially covers costs at an SNF for the first 100 days of each benefit period. A benefit period begins on the day that youre admitted as an inpatient to the SNF or hospital. It ends when you havent received any inpatient care at an SNF or hospital for 60 consecutive days. The Medicare Part A deductible restarts at the beginning of each benefit period.

The Medicare nursing home benefit variesdepending on the amount of time that youve been admitted.

- Days 1-20 you pay nothing

- Days 21-100 you have a daily coinsurance amount of $194.50 for each benefit period

- Days 101 onwards, youre responsible for all costs

Keep in mind that you need to ensure that the SNF accepts Medicare in order for Medicare to cover any costs. You can find an SNF thats certified by Medicare using their online tool. In addition, not all services may be covered at an SNF. For instance, Medicare wont cover a private nurse unless its deemed medically necessary. You can discuss your treatment with your healthcare provider to help ensure that the services they recommend are covered.

Don’t Miss: Does Medicare Part B Cover Home Health Care Services

Asset Limits For Medicaid Nursing Home Coverage

Unmarried Individuals

To qualify for Medicaid coverage of nursing home care, an unmarried person is allowed only limited assets. These include a maximum of $2,000 in cash, savings, stocks, or other liquid assets a life insurance policy of up to $1,500 face value and a burial plot and burial fund of up to $1,500.

In some states, an unmarried person can also keep his or her home if declaring in writing, upon admission to the nursing home, an intent to return home. However, states that permit this usually put a 6- or 12-month limit on the length of time a resident can keep the home without actually returning to it. If a Medicaid nursing home beneficiary is allowed to keep a house, Medicaid will seek reimbursement from the value of the house when its sold.

Note: Medicaid does not allow asset giveaways.

In determining how much an applicant for nursing home coverage has in assets, Medicaid examines that persons financial records for the five years prior to the application date and penalizes the applicant for any improper transfers made within that five-year period. This is referred to as the look-back period. Find out more on how the look-back period works.

Medicaid has special nursing home coverage eligibility rules when one spouse enters a nursing home and the other spouse remains at home. Medicaid looks at the combined assets of both spouses. From that combined amount, Medicaid allows the community spouse to keep:

What Does Nursing Home Insurance Cover/not Cover

Nursing home insurance pays anywhere between $50 and $120 per day for the daily costs of your long-term care, depending on your coverage. This is the cost of living in an at-home or facility nurses, and/or other additional assistance.

The nursing home insurance does not cover any payouts for your beneficiaries upon your death, protection of your property in a facility, or medical expenses. Additional policies are required to cover these scenarios.

Read Also: How Much Medicare Is Taken Out Of Social Security Check

When Does Medicare Cover Nursing Homes

Medicare Part A covers medically necessary SNF care when skilled nursing services are needed. Again, please note that SNF, ICF, and custodial care may all be provided under one roof it is the level of skill needed to care for the patient that makes the difference. Examples include the need for sterile dressings, maintenance of surgical drains, etc. Custodial care may be covered by Medicare Part A when it is medically necessary.

Medicare Part B covers the service of physicians and other medical professionals such as nurse practitioners, nurses, respiratory therapists, and physical therapists. These services are covered regardless of location the fact that they are provided in a SNF, ICF, or in a custodial care facility is irrelevant. Part B of Medicare will also cover durable medical equipment and medical supplies if they are medically necessary. But Medicare Part B does not cover any purely custodial services.

Medicare Part C, also known as Medicare Advantage, allows plans to offer some services that are not offered under Original Medicare coverage Medicare Advantage plans may offer nursing home care that Medicare will not cover. This is totally dependent on policies of your individual plan check with the plan.

Medicare Part D covers prescription drugs only, regardless of the location where they are taken, but does not cover any nursing home stays.

What Are Your Nursing Home Care Rights Under Medicare

According to the CMS, you have rights and protections under federal and state law as a nursing home resident, including the right to:

All states must have a long-term care Ombudsman program. A nursing home ombudsman serves as an advocate for residents helping to resolve problems or violations of rights. Residents and family members can ask nursing home administrative staff about how to contact their local ombudsman.

Don’t Miss: Am I Qualified For Medicare

How Much Does Medicaid Pay Towards A Nursing Home

Some Medicaid services are covered 100 percent, but others are not. Because individual states manage their own Medicaid programs, the extent of coverage depends on your facility’s location. For example, different states might cover routine dental services or have higher cost allowances. The federal government does require Medicaid-certified nursing homes to provide the same minimum services.

Medicaid Pays For*

- Specialized rehabilitation

*Level of service varies by state

Medicaid Does not Pay For

- Private rooms

- Clothing

- Special food

- Personal comfort items

- Cosmetics or extra grooming products

- Social activities beyond the facility’s activity program

- Special care outside Medicaid-contracted coverage

How To Apply For Medicare

Seniors can sign up for Social Security at least four months before turning 65 to have automatic access to Medicare. Part A, which covers hospitalization, is free. Seniors can also choose to enroll in Part B, routine medical care coverage, with the cost determined by income. Most people will pay the standard premium for Part B , which is deducted from their monthly Social Security benefit.

Income-based increases in the cost of Part B begin for incomes over $88,000 for individuals and $176,000 for couples. Seniors can enroll in Medicare parts A and B online, and you must have both of these to apply for Medicare Part D, the prescription drug plan. Stand-alone drug plans are available, and some Medicare Advantage Plans also offer prescription drug coverage. To compare prescription drug plans and Medicare advantage Plans side-by-side, visit the Medicare prescription drug page.

Caring.com is a leading online destination for caregivers seeking information and support as they care for aging parents, spouses, and other loved ones. We offer thousands of original articles, helpful tools, advice from more than 50 leading experts, a community of caregivers, and a comprehensive directory of caregiving services.

Don’t Miss: Does Medicare Pay For Hospitalization

What Skilled Nursing Facility Costs Does Medicare Cover

Medicare can cover many of the services you receive in a skilled nursing facility, such as:

- A semiprivate room and meals

- Skilled nursing care

- Medical social services and dietary counseling

- Medications, medical equipment and supplies used in the facility

- Occupational therapy, physical therapy or speech and language pathology services if needed to meet your health goal

- Ambulance transportation if needed to receive necessary services that arent available in the facility

What Kind Of Nursing Home Care Does Medicare Cover

The term nursing home can refer to different types of places, including rest homes, nursing homes, board-and-care homes, assisted-living facilities, congregate living homes, and sheltered care homes. All of these provide whats called custodial care, which is long-term residence and non-medical assistance with the activities of daily living such as bathing, eating, walking, and dressing for people who dont have acute medical conditions but who are no longer able to care for themselves completely. This type of custodial long-term care is not covered by Medicare.

At the other end of the nursing home spectrum is high-level inpatient medical care, referred to as skilled nursing or rehabilitation care. Under certain circumstances, Medicare Part A covers this skilled care for a limited time while a patient is recovering from a serious illness, condition or injury. For Medicare to cover this care, it must be provided in the skilled nursing facility wing of a hospital, in a stand-alone skilled nursing or rehabilitation facility, or in the skilled nursing or rehabilitation unit within a multilevel facility.

You May Like: Does Medicare Pay For Tdap Shot

Does Medicaid Cover Nursing Homes

Medicaid covers nursing home costs if you qualify. Medicaid is the largest fund-source for nursing home care. For eligible seniors, Medicaid covers long-term nursing home care in Medicaid-certified facilities4 when medically necessary. You’ll have to be under a certain income level and meet other state-specific requirements to qualify.5

All 50 states offer Medicaid, but nursing home services, cost coverage, and eligibility requirements vary widely by state. For example, each state sets its own income limit to determine if you are eligible for Medicaid. Not all nursing homes accept Medicaid, so check with each facility.

Unlike Medicare, Medicaid does not impose an official time limit on nursing home stays as long as they’re in a licensed and certified Medicaid nursing facility.

What Is Covered by Medicaid

- Long-term care covers nursing home stays for qualifying patients needing ongoing care for a chronic mental or physical condition.

- Skilled nursing and related medical care.

- Rehabilitation from illness, injury, or disability.

How Much Does Assisted Living Cost

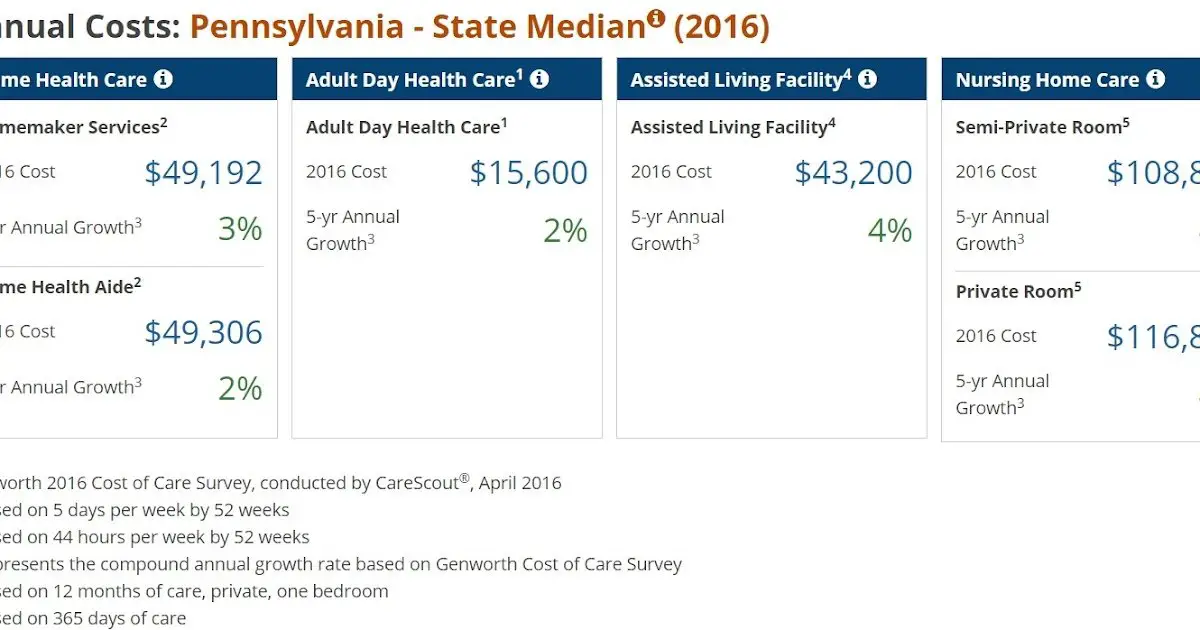

The price of assisted living can vary based on several factors. According to the 2021 Genworth Cost of Care Survey, the average cost of assisted living in the U.S. is $4,500 a month.10 Its important to remember that what you pay for assisted living may differ based on where you live, the type of facility you choose, or the level of care and service provided.11

Also Check: Are You Eligible For Medicare If You Never Worked

Does The Medicare Pace Program Cover Nursing Homes

PACEprovides in-home care services that are similar to whats offered in a nursinghome. PACE may not be available in your area, and you have to meet specificincome requirements to qualify. Your costs for PACE services will vary based onyour income, so you should consult with PACE directly to determine what you maybe responsible for.

Ultimately, if you or a loved one may need long-term care at a nursing home or assisted living services in the future, you shouldnt rely on Medicare coverage to pay for them. You may want to review your options for a long-term care insurance policy, as theyre designed to cover these costs.

Nothing on this website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

Medicares Benefits For Nursing Homes

The benefits that Medicare, also known as Original Medicare, offers toward the cost of nursing home care are limited. Medicare is not intended to provide a long term care solution. Rather, it is designed for those who need skilled nursing care for a limited time. Note that some people refer to short-term nursing home care as convalescent care. Medicare will pay for twenty days of care at 100% of the cost. For the eighty days following, Medicare requires care recipients to pay a portion of the daily cost. As of 2020, the daily co-payment is $185.50. For those who subscribe to a Medicare Supplemental Insurance plan, the secondary insurance will pay the remaining cost for the last eighty days of coverage. Neither Medicare nor Medicare Supplemental Insurance will pay for nursing home care after the 100-day maximum is reached. A minor exception to this rule exists, when the nursing home doubles as a psychiatric hospital and the individual is in residence for a psychiatric condition.

Don’t Miss: What Benefits Do You Get With Medicare

What Medicare Does Cover In Assisted Living

For seniors in assisted living, Medicare continues to cover medical care and the cost of medical supplies and prescription drugs. However, Medicare doesnt pay for any of the personal care costs associated with assisted living. There are rare exceptions to this rule, and guidelines vary by state. Well explore this in more detail, along with other financial aid options that can make assisted living more affordable.

When Medicare Won’t Pay For Nursing Home Care

Shereen Lehman, MS, is a healthcare journalist and fact checker. She has co-authored two books for the popular Dummies Series .

Medicare is not a one-stop-shop. While it covers a wide breadth of services, it may leave you to fend for yourself when it comes to certain healthcare essentials as you grow older. For example, it doesn’t cover corrective lenses , dentures, hearing aids, or white canes for the blind. Certain medications are off the table, too, even if you have a Part D prescription drug plan.

This is because Medicare does not consider these things to be medically necessary. Unfortunately, what they also do not see as medically necessary are custodial care and long-term nursing home placement.

Also Check: What Is A Medicare Advantage Medical Savings Account

When Does Medicare Cover Nursing Home Costs At A Skilled Nursing Facility

While Medicare wont cover long-term care at a nursinghome, it does cover short-term stays at a skilled nursing facility . Youmay have coverage at an SNF if you meet the following criteria:

- Youre entering the SNF within 30 days after beingadmitted as in inpatient at the hospital for at least 3 days

- Youre entering the SNF for the same reason that youwere hospitalized

- You need a skilled level of care that cant beprovided at home or in an outpatient setting

Servicescovered in a skilled nursing facility include:

- Intravenous injections

- Medication management

Medicaid Eligibility For Nursing Home Care

Medicaid coverage, like many other financial assistance programs, is dependent on a variety of factors such as age, financial status, assets, and level of care. If you need assistance for long-term nursing home care, you should check to see if you meet the Medicaid eligibility requirements in the state that youre currently residing in. Typically, one of the requirements of eligibility is that a majority of your income needs to be used to pay for the cost of your nursing home.

Don’t Miss: What Urgent Care Takes Medicare

Medicaid Covers Some Nursing Home Costs For Those Who Qualify

Medicaid covers some costs of long-term custodial nursing home care and home health care for individuals with little savings and income. People who exhaust their financial resources while in a nursing home often eventually qualify for Medicaid.

Because it’s a joint federal and state program, Medicaid benefits vary. Contact your states Medicaid office for coverage details.

Even if you financially qualify for Medicaid, there may be copays for some services that youll need in long-term care. Especially when it comes to nursing home coverage, its important to understand the differences between Medicare and Medicaid.