What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

What Isnt Covered By Medicare Part C

Medicare Advantage plans must provide at least the same amount of coverage as Original Medicare. Once a plan meets the minimum requirements, its up to the insurer to determine if additional services are covered. Depending on the plan selected, Medicare Part C may not cover prescription medications. If it doesnt, subscribers have to enroll in a supplemental drug plan or pay out of pocket for their prescriptions. Although insurers are allowed to cover more services than Original Medicare does, not all Part C plans pay for routine dental care, hearing aids, or routine vision care.

For subscribers in need of inpatient care, Medicare Part C may not cover the cost of a private room, unless its deemed medically necessary. A private room is medically necessary if putting the patient in a semi-private room would endanger his or her health or the health of someone else. For example, if a subscriber has an infectious disease, Medicare Part C will cover a private room to ensure the subscriber remains isolated and prevent the disease from spreading to other patients.

Preferred Provider Organization Plans

A Medicare Advantage PPO offers more flexibility than an HMO because your insurance will usually cover out-of-network providers. It will cost you more than what you would pay if you went in-network, though. PPOs also donât require a primary care physician and they allow you to see a specialist without a referral.

Don’t Miss: Does Medicare Part D Cover Shingrix

Can I Keep My Medicare Advantage Plan If I Have End

You can have a Medicare Advantage Plan with ESRD if you meet the following criteria:

- You develop ESRD after youve already enrolled in a Medicare Advantage Plan

- You no longer have ESRD after treatment

- You join a Medicare Special Needs Plan that covers ESRD

- Your Medicare Advantage Plan leaves Medicare or no longer provides coverage in your area

Its important to note, people with ESRD were allowed to join Medicare Advantage Plans without restrictions starting in January 2021.

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

Recommended Reading: Where Do I File For Medicare

What Are The Different Medicare Part C Plans

The number of Medicare Advantage plans available to you will depend in part on where you live and how many companies offer coverage in your area.

There are 5 major types of Medicare Advantage plans:

What Should I Do If My Medicare Part C Plan Doesnt Cover Something I Need

If you are denied coverage for something you need, the first thing you may be able to do is file an appeal. You can appeal for a health care service, supply, item, or prescription drug that you think you should be able to get or that you already got. You also can appeal to pay less than you originally were requested to pay.

If your appeal is denied or if you have other frustrations with your plan, you can switch Medicare Advantage plans during the Open Enrollment Period which is October 15 December 7 every year.

Do you want to begin looking for Medicare Advantage plans in your area? Just enter your zip code on this page.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

You May Like: Can You Change Medicare Plans After Open Enrollment

How Do I Sign Up For Medicare Part C

To join a Medicare Advantage plan, the subscriber must qualify for Original Medicare, which is available to people aged 65 and older, and younger disabled individuals. Medicare Advantage plans are available to U.S. citizens, U.S. nationals, and other people who are lawfully present in the United States. A subscriber must also live in the service area covered by the plan.

Other stipulations may determine who qualifies for Medicare Advantage plans. For example, they arent typically available to people with end-stage kidney disease, except under certain circumstances.

For people who meet the eligibility requirements, its important to compare Medicare Advantage plans, since coverage and costs vary. Youll have to enter your ZIP code to find plans in your area. After choosing a plan, its necessary to fill out an enrollment form and pay the required premium to receive coverage under Medicare Part C.

What Are The Additional Benefits Of Medicare Part C Coverage

A Medicare Part C plan allows you to customize your Medicare plan to include additional benefits and coverage that arent included in original Medicare alone. You get the full coverage of Original Medicare while having the opportunity to add on additional coverage that works best for you and your lifestyle.

For instance, while Original Medicare may cover things like doctors visits and a hospital stay, it doesnt include coverage for vision or dental. A Medicare Advantage plan, on the other hand, can include all of the Original Medicare coverage, plus additional benefits such as:

- Vision coverage, including eye exams, glasses and contacts

- Hearing coverage, including hearing aids

- Dental coverage, including dentures and teeth cleaning

- Fitness program coverage, like gym memberships

- Adult daycare services

- Over-the-counter medications

- Some plans may also cover items like transportation and services that promote health and wellness

Some Medicare Part C plans also cover additional health care needs, such as providing transportation services to and from your doctor appointments, covering certain over-the-counter medications and offering other types of wellness services. There are also opportunities for individuals with chronic illnesses to customize a plan based on what benefits best serve them, which varying costs based on individual plans.

Don’t Miss: Does Medicare Cover Full Body Scans

Other Types Of Medicare Advantage Plans

If you want more freedom in health care providers or payment options, there are two other types of Medicare Advantage plans to consider.

Private Fee-For-Service plans

PFFS plans may or may not have a doctor/provider network, but cover any doctor or provider who accepts Medicare. If the plan doesn’t include prescription drug coverage, you can also enroll in a stand-alone Part D plan separately.

Medical Savings Account plans

MSA plans combine a high-deductible health plan with a special savings account. Medicare deposits funds that are withdrawn tax free to pay for qualified health care services. You can see any doctor or provider you choose. MSA plans don’t cover prescription drugs, but you can enroll in a stand-alone Part D plan separately.

Not all plans are available in all areas.

What Is The Difference Between Parts B And D

Medicare Part B covers the care you get outside the hospital. It also covers some drugs and vaccines that Part D doesnt cover, such as:

-

Injectable and infused drugs

-

Pneumococcal vaccine

-

Most drugs for outpatient or at-home dialysis

Medicare Part D covers prescription medications you get at a pharmacy or other outpatient location that isnt a hospital or inpatient treatment center. With Part D, you can buy a stand-alone prescription drug plan from a private company or get coverage through a Medicare Advantage plan if you dont have creditable drug coverage from another source, such as a former employer or union. If you put off getting creditable drug coverage for too long, you could face a late enrollment penalty that lasts for as long as you have Medicare.

If youre Medicare-eligible or take care of someone who is, you can contact the State Health Insurance Assistance Program, or SHIP, with questions on anything Medicare related. Its trained benefits counselors offer unbiased guidance for free.

Medicare Parts and Coverage Basics

| Part A |

Recommended Reading: How Much Is Medicare Copay For A Doctor’s Visit

What Does Medicare Part C Cover And Why Do I Need It

A primary reason you might consider selecting a Medicare Part C plan is because it can . Another reason to select a Part C plan is because you may receive additional benefits and coverage not found under Original Medicare.

For instance, many Medicare Advantage plans offer at least some form of:

- Out-of-pocket maximum protection

- Basic dental coverage

- Non-traditional care, such as acupuncture and chiropractors

Medicare Advantage plans are not required to provide any of these extra benefits, besides the out-of-pocket maximum. However, most of them choose to do so in order to attract more members.

Original Medicare does not cover any of these above items. So, if you need these types of services, your out-of-pocket costs could become quite high. Supplemental insurance, like individual dental, can also be expensive, and such coverage often has very few annual maximum benefits.

- Part A deductible

- Part B deductible

- Part B coinsurance

- 100% of the cost of prescription drugs

- 100% of the cost for emergency coverage outside the United States

Original Medicare doesnt put a cap on your annual costs. In other words, there is no out-of-pocket maximum limit. Unlike with health insurance provided by your job, you could potentially pay an unlimited amount for healthcare coverage in any particular year.

MORE ADVICE Discover more tips for comfortably aging in place

What Is Medicare Part C And How Does It Work

Americans are enrolling in Medicare Part C in growing numbers. Part C combines Original Medicare Part A and Part B, and usually includes Part D prescription drug coverage in addition to extras such as hearing, dental, and vision coverage.

Some of the links on this page may link to our affiliates. Learn more about our ad policies.

Part C, also known as Medicare Advantage, is offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, in addition to other offerings depending on the company.

You can be confident that when you are enrolled in a Part C plan, the following expenses will be covered:

- Inpatient hospital services

- Skilled nursing services

- Outpatient services, such as doctor appointments, lab work, and outpatient surgeries

These are the basic coverages that Original Medicare Parts A and B provide, but in addition to these benefits, many Medicare Advantage plans also cover prescription drugs. These plans are referred to as Medicare Advantage prescription drug plans .

Another valuable benefit of Part C plans is that they usually provide coverage outside the United States. So, if you are vacationing out of the country, you will be able to have peace of mind knowing that your emergency coverage comes with you.

MORE ADVICE

You May Like: Should I Get Medicare Supplemental Insurance

I Travel Frequently Can I Get Coverage When I Travel Without Additional Costs

Medicare Advantage plans and Original Medicare dont cover care outside of the United States. Consider looking at a Medigap policy if you need coverage in other countries. As for traveling state-to-state, Medicare Advantage plans usually dont cover non-emergency care if you go outside of your plans network.

What Does Medicare Part C Cover For Inpatient Care

Medicare Part C includes Part A of Original Medicare, which is generally referred to as the inpatient hospital coverage of Medicare. You will be covered under Medicares rules if you need to go to the hospital for inpatient care. At a minimum, you would receive all Original Medicare benefits, with Medicare Part C, although your individual plan may have additional benefits included. Rest assured, you will always receive coverage for urgent and emergency care.

In addition to in-patient care at a hospital, Medicare Part A coverage also includes:

- Skilled nursing facility care: Under Medicares definition, skilled nursing facility care is short-term care that requires a health professional to provide services to you, such as IV antibiotics or wound care dressings.

- Nursing home care: Medicare has pretty specific rules for what it will pay for nursing home care, but in general this is inpatient care that doesnt involve custodial care only, which would be things like getting dressed or helping with daily activities of living.

- Hospice care

- Home health care

Some services and medications offered or used while you are a patient in a hospital may not be covered by Medicare. Although inpatient care is covered by Medicare in general, there are rules to what that entails. For example, Medicare typically only covers semi-private rooms, so you wont get covered for a private room that isnt medically necessary.

Read Also: Can I Get Medicare At Age 62

What Does Medicare Part C Cover

Medicare Part C is a type of insurance option that offers traditional Medicare coverage plus more. Its also known as Medicare Advantage.

Some Medicare Part C plans offer health coverage benefits such as gym memberships and transportation services.

In this article, well explore everything that Medicare Part C covers and how much these plans may cost.

Medicare Part C plans are insurance plans offered by private insurance companies. These plans, otherwise known as Medicare Advantage plans provide the same coverage as original Medicare with the benefit of supplemental coverage.

If you already receive Medicare Part A and Part B, youre eligible for Medicare Part C.

Medicare Part C plans follow traditional insurance structures and include:

- Health Maintenance Organization plans

- Preferred Provider Organization plans

- Private Fee-for-Service plans

- Medicare savings account plans

How Do I Compare Part C Plans

You should review the following 4 factors before enrolling in a specific Medicare Advantage plan:

A licensed insurance agent can help you compare the above information for the Medicare Advantage plans that are available where you live.

More info: Compare Medicare Advantage plans

You May Like: When Do Medicare Benefits Kick In

Added Benefits And Services

Do you need extra coverage like dental, hearing, or vision care? Some plans include extra benefits for no extra cost. Some offer them as plan “riders” for an additional monthly fee. Look for a plan that meets your budget and helps you save money on the benefits and services you need.

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2021 Part-B premium is $148.50 per month

Recommended Reading: How Much Is Premium For Medicare

Medicare Part C: What You Should Know About Medical Advantage Plans

Medicare is a federal program that provides healthcare to individuals age 65 and older and people with qualifying disabilities and illnesses of any age. To be eligible for Medicare benefits, you must be a U.S. citizen or a legal U.S. resident for at least five consecutive years.

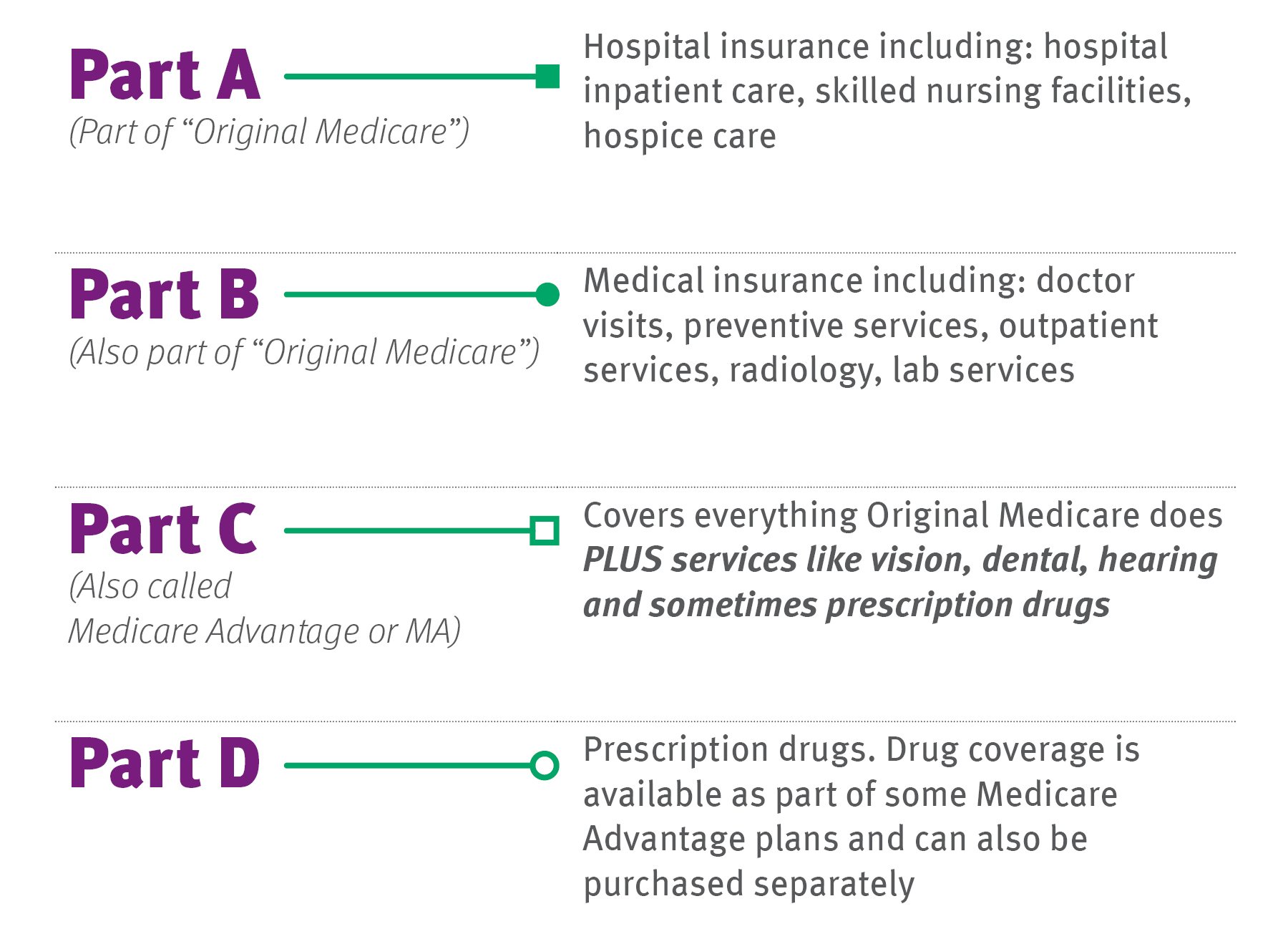

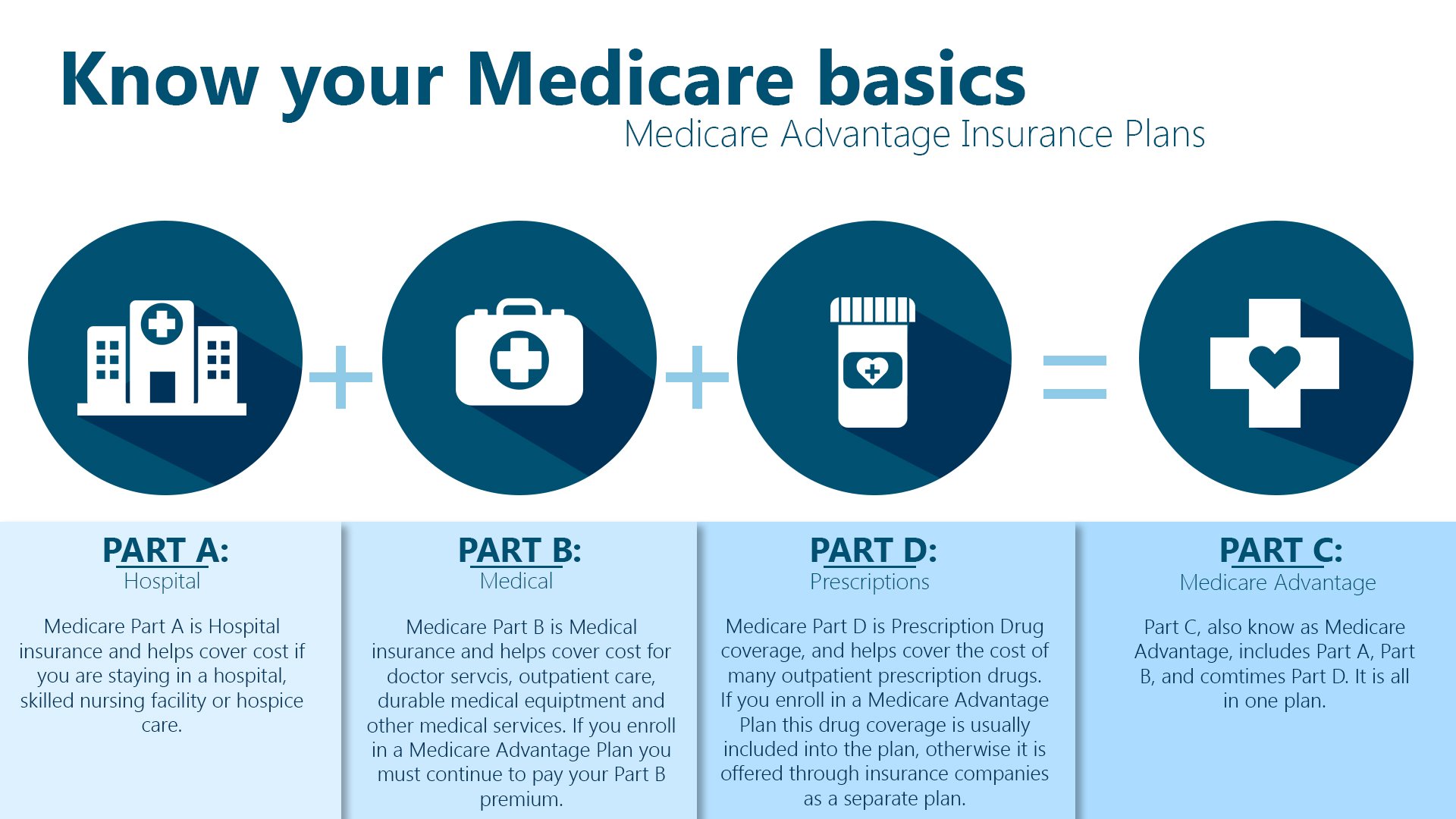

Often referred to as Original Medicare, Medicare Parts A and B cover hospital care and outpatient medical care. Part C is an alternative to Original Medicareoften called Medicare Advantageoffered by private insurers. Part D provides prescription drug coverage.

Understanding Medicares parts and how they work together will help you choose the coverage that meets your individual healthcare and budget needs.

Eligibility And Enrollment Part B Vs Part C

Original Medicare and Advantage plans vary in their eligibility and enrollment requirements.

Part B

After a person gets Social Security benefits at age 65, Medicare automatically enrolls them in Part A and Part B. If a person meets the age requirement but does not receive Social Security benefits, they will not automatically get Medicare and will need to sign up for it.

If someone does not sign up for Part A and Part B during the Initial Enrollment Period when they first become eligible, they may sign up during the general enrollment period, which is from January 1 to March 31 every year.

An individual may apply for Medicare online here.

Part C

A person who has Medicare Part A and Part B and does not have end stage renal disease is eligible for an Advantage plan. An individual may switch from Part A and Part B to an Advantage plan during the initial enrollment period or the open enrollment period, which is from October 15 to December 7 of every year.

To enroll in an Advantage plan, a person first needs to select a plan in their area. After they decide on a plan, they may request an enrollment form from the insurance company offering it or enroll on the companys website.

Don’t Miss: What Is The Extra Help Program For Medicare