Is Part B Worth It

Another mistake we see is people who thought they didnt need Part B because they are healthy. Ive seen a number of individuals who said they didnt get sick often so they opted to only enroll in Part A. Every one of these people assumed that Part A Hospital benefits cover everything in the hospital. So they decided to skip Part B thinking that they didnt mind paying out of pocket for an occasional doctor visit. They didnt realize Part B covers many things that occur in a hospital.

Usually they discover their error when they are sent for an MRI or a surgery and find out they now owe thousands or tens of thousands of dollars. Be sure you dont make the same mistake. If you are unsure, ask your insurance agent: Do I Need Medicare Part B?

If he or she tells you no, be sure you get a full explanation on why you are able to delay your. Get a second opinion if you are unsure, and never rely on Social Security to give you the right answer. Weve seen too many people get wrong answers from inexperience government employees.

Related Article: 7 Medicare Mistakes That Could Cost You

If I Have Part A And Part B Do I Need A Medicare Supplement Plan

If you have Medicare Part A and Part B, you might also consider a Medicare Supplement Insurance plan.

Medigap plans can help cover some of the out-of-pocket costs that Medicare does not cover, such as deductibles, coinsurance and copayments.

Remember that Original Medicare does not have an out-of-pocket spending limit. This means that in the case of a serious illness, Medicare copayments and deductibles can add up quickly.

Is There Any Way To Get Out Of Late Enrollment Penalties

There are two possible scenarios:

1) If you receive bad advice from a federal employee about Medicare enrollment.

You can request equitable relief from the Social Security Administration if you are charged late enrollment penalties for failing to enroll in Medicare due to erroneous advice you received from a federal employee. To do this, you should write a letter to your local Social Security office. Be sure to include as many specific details as you can, such as who you spoke to, the date and time of your conversation, any notes you took, and the actions you took as a result of the advice you received.

2) If you had creditable coverage, but your Medicare plan does not have a record of it.

If you receive notice from your Medicare drug plan or Medicare Advantage plan that you owe late enrollment penalties, you can request a review by completing the reconsideration request form you get with the notice. You can include whatever proof necessary to make your case, such as information you have about previous creditable drug coverage.

If you lose creditable coverage through an employer or through another source, your Medicare carrier will reach out to verify your prior qualifying coverage. Be sure to respond to any correspondence about verifying creditable coverage. Without a response, a penalty will be assessed and it can be difficult to appeal the decision.

Recommended Reading: Does Medicare Cover Dexa Scan

If You Do Medicare Sign

- Read in app

Tony Farrell turned 65 four years ago the age when most people shift their health coverage to Medicare. But he was still employed and covered by his companys group insurance.

When his birthday came around, he began researching whether he needed to move to Medicare, and determined he could stick with his employers plan, said Mr. Farrell, a marketing and merchandising executive for specialty retailers. At the time, he was working for a company that makes infomercials in San Francisco.

Four months later, Mr. Farrell was laid off, but he kept the companys health insurance for himself and his family under the Consolidated Omnibus Budget Reconciliation Act , the federal law that allows employees to pay for coverage as long as 36 months after a worker leaves a job.

I just thought, this is great the coverage wont change, he recalled. I was just relying on my own logic and experience, and felt that if I didnt need a government service, I wouldnt sign up for it.

But Mr. Farrell unknowingly ran afoul of one of the complex rules that govern the transition to Medicare and now he is paying the price.

When To Sign Up For Medicare Part B

If youre retiring, the best time to enroll in Part B is during your Initial Enrollment Period. For those still working past 65, check with your health administrators whether your employer coverage is creditable.

If it is, you can enroll in Part B when you retire or leave your group health plan. Youll be eligible for a Special Enrollment Period when you can enroll without any penalties. If your group health plan is not considered creditable coverage, then you should register for Part B during your Initial Enrollment Period.

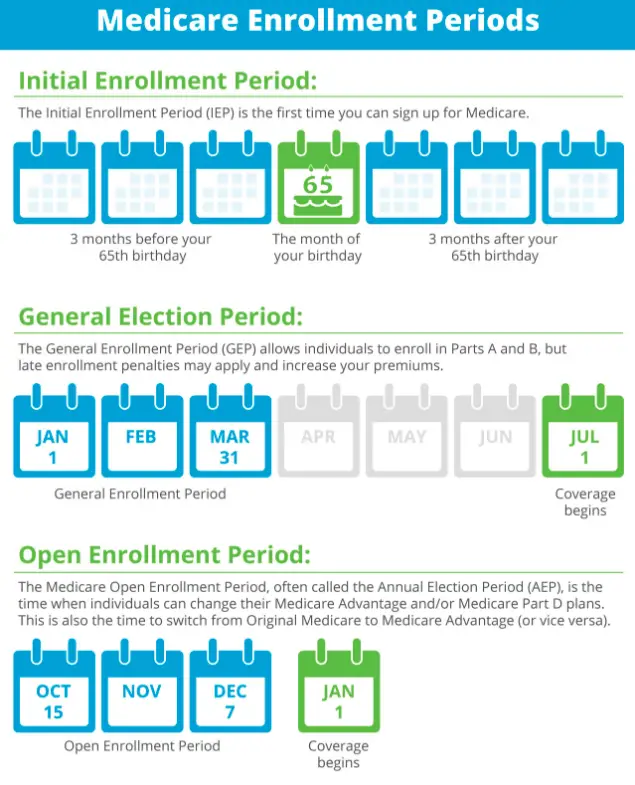

If you missed your Initial Enrollment Period, the next enrollment window you can enroll in Part A and Part B is the General Enrollment Period.

Also Check: Must I Take Medicare At 65

How Medicare Advantage Can Save You Money On Your Part B Premiums

If you don’t qualify for the above programs, you still have options. Consider a Medicare Advantage plan that offers a rebate on your Part B premium. Here’s how that works:

A Medicare Advantage plan provides the same or better coverage than Part A and Part B . To receive this coverage, most enrollees pay a premium for their Medicare Advantage plan in addition to the cost of Part B.

But in some areas, typically large cities, Medicare Advantage providers offer $0 plans to better compete with other insurance companies. A few go even further and offer enrollees a rebate on their Part B premiums. If you enroll in one of these plans, you could pay a lower monthly Part B premiumand have more benefits, such as prescription drug, dental, vision, and hearing coverage.

These plans aren’t available in all areas, but even the average Medicare Advantage plan could help save you money. With most plans, you won’t have to pay an extra premium for prescription drug coverage or dental insurance, for example, which could free up some cash to cover the Part B premium.

To find out if a Medicare Advantage plan could save you money, give us a call.

Dont Register For Medicare Alone

If youre uncomfortable with applying for Medicare alone, we can help! Our services are completely free for you. If you would like an agent by your side when applying, contact us. We can walk you through setting up all your coverage, including Medicare, Medigap, Part D, and more.

Plus, when you use us to apply, you get unlimited support from our Client Service Team. That means if you have any issues with claims or appeals, we can help at no additional cost. You can compare rates online or give us a call today at the number above.

- Was this article helpful ?

Read Also: Can I Get Medicare If I Have Cancer

How Do You Get Help With This Application

- Phone: Call Social Security at 1-800-772-1213. TTY users should call 1-800-325-0778.

- En español: Llame a SSA gratis al 1-800-772-1213 y oprima el 2 si desea el servicio en español y espere a que le atienda un agente.

- In person: Your local Social Security office. For an office near you check www.ssa.gov.

Enrolling In Medicare Advantage

To join a Medicare Advantage Plan, you will need to have Original Medicare coverage and live in an area where an Advantage plan is offered.

A Medicare Advantage plan will wrap your Medicare Part A and Part B coverage into one plan. But youll still have to pay the government a premium for Part B, in addition to the premium you pay for Medicare Advantage .

You can enroll in a Medicare Advantage plan when youre first eligible for Medicare, or during the annual Medicare open enrollment period in the fall .

You May Like: How Do I Enroll In Medicare Part A And B

When Can You Change Your Medicare Advantage Or Medicare Part D Prescription Drug Coverage

- During your Initial Enrollment Period for Medicare, described above

- During Medicares Annual Election Period

- During the Medicare Advantage Open Enrollment Period . You cant change from one stand-alone Medicare prescription drug plan to another during this time.

- During a Special Election Period , if you qualify for one. Medicare allows SEPs for certain situations, such as losing your health-care coverage

Read more about Medicare election periods here.

I Am Receiving Social Security Retirement Or Railroad Retirement Board Benefits

You will be enrolled in Original Medicare automatically when you turn 65. Youll get your Medicare card in the mail. Coverage usually starts the first day of your 65th birthday month.

If you have other , you can delay Part B and postpone paying the premium. You can sign up later without penalty, as long as you do it within eight months after your other coverage ends. If you dont qualify to delay Part B, youll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date. Follow the directions on the back of your Medicare card if you want to refuse Part B.

Donât Miss: How To Apply For Medicare By Phone

Recommended Reading: What Are Medicare Part Abcd

Who Is Automatically Enrolled

Groups that are automatically enrolled in original Medicare are:

- those who are turning age 65 and already getting retirement benefits from the Social Security Administration or the Railroad Retirement Board

- people under age 65 with a disability who have been receiving disability benefits from the SSA or RRB for 24 months

- individuals with amyotrophic lateral sclerosis who are getting disability benefits

Its important to note thateven though youll be automatically enrolled, Part B is voluntary. You canchoose to delay Part B if you wish. One situation where this may occur is ifyoure already covered by another plan through work or a spouse.

Do I Have To Be Enrolled In Medicare Part B Before I Enroll In A Medicare Advantage Plan

Yes. The Medicare Advantage program provides the means for Medicare beneficiaries to receive Medicare Part A and Part B benefits from a Medicare Advantage plan rather than from the government-administered Medicare program. Medicare Advantage doesnt replace Original Medicare Part A and Part B coverage it simply delivers these benefits through an alternative channel: private insurance companies. Medicare Advantage plans are offered by private insurance companies that contract with Medicare. Medicare Advantage plans must offer at least the same benefits as provided under Medicare Part A and Part B . Many Medicare Advantage plans offer extra benefits not available from Original Medicare. Therefore, to enroll in a Medicare Advantage plan, you must be enrolled in both Medicare Part A and Part B. You must also reside in the plans service area.

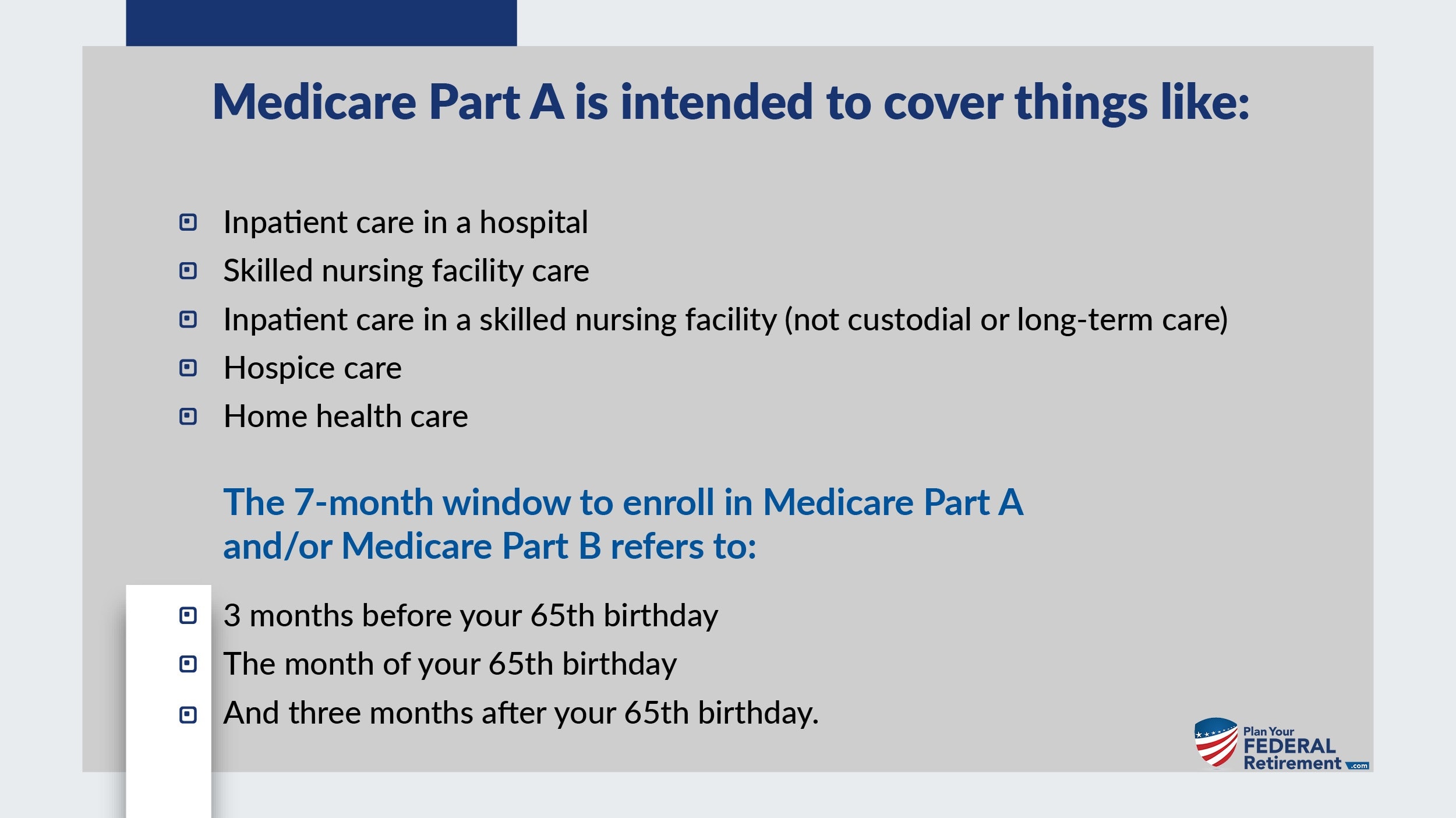

The Initial Enrollment Period is the first chance you have to enroll in Original Medicare, Part A and/or Part B. Your Initial Enrollment Period starts three months before you first meet all the eligibility requirements for Medicare and lasts for seven months.

To enroll in a Medicare Advantage plan, however, you have to be entitled to Medicare Part A and enrolled in Medicare Part B. This can occur simultaneously with the Initial Enrollment Period. You are likely to hear this enrollment period referred to as the Initial Coverage Election Period. This is the first time Medicare beneficiaries may enroll in a Medicare Advantage plan.

Read Also: How Much Is Premium For Medicare

Consequences Of Canceling Part B

If you have a gap in coverage, the Medicare program could tack late-enrollment penalties onto your Part B premiums if you re-enroll in coverage again later. Avoid this pitfall by working with your human resources department to ensure that your company’s insurance is indeed creditable . You may need to provide documentation of creditable coverage during your Part B cancellation interview.

A gap in coverage could also adversely affect your health if you avoid seeing the doctor because you dont have health insurance. And you may have to go without other forms of coverage too. Without Part B, you can’t enroll in other parts of Medicare, such as Part D prescription drug coverage, Medicare Supplement , or Medicare Advantage. These gaps will remain until you re-enroll in Part B again later.

Sign Up: Within 8 Months After You Or Your Spouse Stopped Working

Your current coverage might not pay for health services if you dont have both Part A and Part B .

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Recommended Reading: Which Is Better Medicare Supplement Or Medicare Advantage

Benefits Of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage of this program, as it could help offset the cost of ongoing medical care. Depending on your eligibility, you may not have a choice when it comes to Medicare Part B.

However, financial need could help you pay for a portion or all of your monthly premiums. Dont hesitate to contact a representative from your local Social Security office to find out more about your unique situation. Just remember to conduct your own research well ahead of time, so that you dont incur unnecessary late fees in the future.

When Does Your Medigap Policy Coverage Begin

Once you receive your Medicare card, you can apply for a Medigap policy. Its best to apply as soon as you have your Medicare card. If you apply one to three months before your 65th birthday month, that will allow enough time for your application to be processed and will also ensure your Medicare Supplement Insurance coverage begins the same month that Medicare kicks in for you.

You May Like: Does Costco Pharmacy Accept Medicare

What Does Medicare Part B Cost

Medicare Part B coverage comes with a monthly premium, so some beneficiaries prefer to delay or drop Part B enrollment when they have other coverage. However, it makes sense to keep Medicare Part A if you get it premium-free as most people do after working a minimum number of quarters.

You should contact your employer or union benefits administrator before delaying Medicare Part B coverage. In some cases, your employer may require you to enroll in Medicare Part A and Part B in order to get your full coverage.

Should I Get Medicare Part B

Another way to put the question is this: when dont you need Part B?

Two situations in which you might not rely on Medicare Part B coverage include:

- A Medicare Advantage plan is an alternative to Part A and Part B . Your Medicare Advantage plan carrier provides all of your Part A and Part B benefits, instead of the federal government. Many Medicare Advantage plans may provide additional benefits Original Medicare doesnt cover, such as prescription drug coverage.

- You may have that Medicare regards as equivalent to Part B.Situations in which you have creditable coverage include:

- Having an employer health insurance plan

- Having a retiree health plan provided by a prior employer

- Being covered under someone elses employer health insurance or retiree health insurance plan

You May Like: Do You Have To Pay For Part B Medicare

Signing Up For Medicare

If you’re collecting Social Security benefits. If you claim Social Security benefits at age 65 or earlier, you will automatically be enrolled in Medicare when you turn 65, in both Part A and Part B. You can disenroll from Part B but not from Part A.

To enroll in Part B after age 65 later , you can fill out an Application for Enrollment in Medicare Part B and bring it or mail it to a Social Security office.

If you’re not collecting Social Security benefits. If you are 64 years and nine months or older and you have not started collecting Social Security benefits, you can sign up for both Part A and Part B online at .

How Medicare enrollment affects HSAs. Note that, when you’re enrolled in Part A, you are no longer allowed to make pre-tax contributions to your health savings account , though you cancontinue to use the funds already in your HSA account. Since anyone collecting Social Security retirement benefits has to be enrolled in Part A, this means that no one collecting Social Security can contribute to an HSA.

For 2018 premiums and deductibles, see Nolo’s 2018 Medicare cost update.

When You Should Consider Enrolling In Medicare Part B

If you qualify to delay enrolling in Medicare, deciding to do so is a personal choice.

Some may choose to delay, and for others, it may still be a good fit for your health and lifestyle to enroll in Part B. Consider the following when trying to decide whether to enroll in Part B or delay while still working:

- Is Medicare less expensive than your current health insurance?

- Does Medicare offer better coverage than your current health insurance?

- Do you want to keep your current insurance but also take advantage of Medicare benefits

- Do you want to enroll in either a Medigap or Medicare Advantage plan?

- Is your prescription drug coverage considered creditable by Medicare?

Answering the above questions can help you decide whether or not to delay enrollment. Its important to carefully consider the last item regarding prescription drug coverage. While most employer coverage is considered creditable, you should still verify if it is or could end up facing a late enrollment penalty for Medicare Part D.

Read Also: Can You Sign Up For Medicare Part B Anytime