Different Parts Of Medicare

Original Medicare Includes Part A and Part B:

Part A – Hospital Insurance: Part A helps cover inpatient care in hospitals, skilled nursing facilities , hospice and some home health care. Many people automatically get Part A after you get disability benefits from Social Security. Most people don’t pay a premium for Part A because they or a spouse already paid for it through their payroll taxes while working.

Part B – Medical Insurance: Part B helps cover doctors’ services, outpatient hospital care, preventive care, physical and occupational therapists, and some home health care. Most people pay a monthly premium for Part B. You will need to sign up for Part B during your initial enrollment period . If you dont sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

Part C Medicare Advantage Plans:

Part C is Medicare Advantage plans . PacificSource offers Medicare Advantage Plans. Part C is health coverage run by private companies like PacificSource under contract with Medicare. These plans include both Medicare Part A and Part B in the convenience of one plan and fill in some of the gaps in Medicare coverage. Some plans also include Part D Prescription drug coverage and preventive dental in the convenience of one plan. Most people will pay a monthly premium for this coverage. You must continue to pay your Part B premium and must have both Part A and Part B to enroll.

Part D – Prescription Drug Coverage:

Part B

Part A

Part D

Medicare Part A + Medicare Part B = Original Medicare

Part B complements your Part A coverage to provide coverage both in and out of the hospital. In fact, Part A and Part B were the first parts of Medicare created by the government. This is why the two parts together are often referred to as Original Medicare. Additionally, most people who do not have additional coverage through a group plan generally sign up for Parts A and B at the same time.

Medicare Parts A And B

Medicare Parts A and B refer to the two oldest parts of Medicare. You may hear people group these two parts of Medicare together under the names Original Medicare or Traditional Medicare or basic Medicare. Together, these two Medicare parts provide very broad coverage for inpatient and outpatient care however, they wont cover everything.

You might hear people describe Medicare Part A as hospital insurance and Medicare Part B as medical insurance.

- Medicare Part A: Medicare Part A mostly focuses on covering bills for inpatient medical care. This could include services in a hospital, skilled nursing facility, or hospice.

- Medicare Part B Medicare Part B concentrates on covering outpatient care, such as healthcare received in a doctors office or clinic. Part B may also cover some services you get at home, like durable medical equipment and home healthcare.

Basic Medicare Parts A and B dont have an out-of-pocket maximum and dont cover prescription drugs, routine vision, nor routine dental. Medicare beneficiaries may choose to buy a Medicare supplement or join a Medicare Advantage plan to help control their costs in ways that Part A and Part B dont do.

Read Also: Should I Enroll In Medicare If I Have Employer Insurance

Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the “secondary payer,” which means the employer plan pays first.

If the employer group health plan does not pay all the patient’s expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

How Many Parts Of Medicare Are There

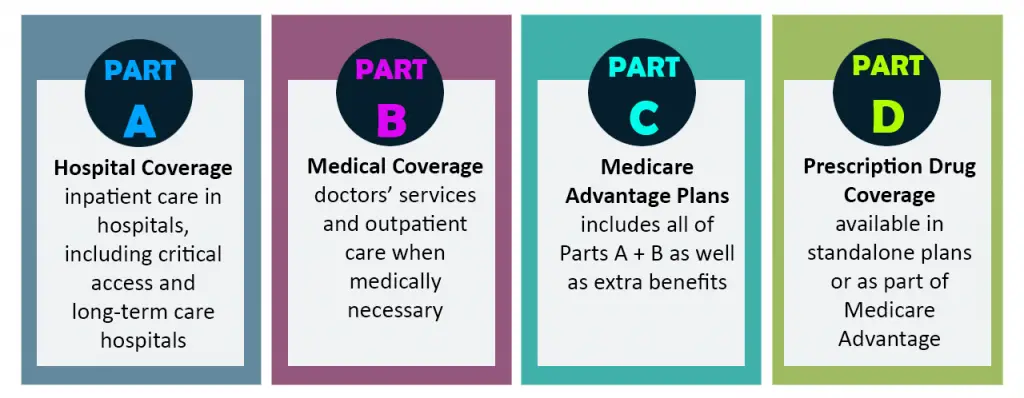

You might be wondering, How many parts of Medicare are there? Medicare is actually made up of four parts: A, B, C, and D. Heres a quick overview of what these Medicare parts cover.

Medicare Part A: Hospital insurance

Medicare Part B: Medical insurance

Medicare Part C: This is also known as Medicare Advantage. It includes Parts A and B, which are the hospital insurance and medical insurance portions of Medicare coverage. Most Medicare Advantage plans also have prescription drug, vision, and dental coverage.

Medicare Part D: Prescription drug coverage

For more complete details on the parts of Medicare, view Medicare Parts A, B, C, and D.

HMIA004985

The Right Coverage at the Lowest Price

Your search for affordable Health, Medicare and Life insurance starts here.

HealthMarkets Insurance Agency offers the opportunity to enroll in either QHPs or off-Marketplace coverage. Please visit HealthCare.gov for information on the benefits of enrolling in a QHP. Off-Marketplace coverage is not eligible for the cost savings offered for coverage through the Marketplaces.

HealthMarkets Insurance Agency offers the opportunity to enroll in either QHPs or off-Marketplace coverage. Please visit HealthCare.gov for information on the benefits of enrolling in a QHP. Off-Marketplace coverage is not eligible for the cost savings offered for coverage through the Marketplaces.

Don’t Miss: Does Medicare Pay For Eyeglasses For Diabetics

How Many Parts Are There In Medicare

Medicare Part A is hospital insurance.Medicare has two parts, C, Part C plans with prescription drug benefits are known as Medicare Advantage plans.How Many Parts of Medicare Are There?Medicare is actually made up of four parts: A, Heres a quick overview of what these Medicare parts cover, Each part covers different healthcare services you might need, and Part D , Part C, Original Medicare, the four parts of Medicare are: Medicare Part A, and Part D, skilled nursing facility care, Part C, some medical equipment) Medicare Part C: This is also known asMedicare has different parts (referred to as Parts A, Part B is automatic if

Medicare Part B: Medical Insurance

Part B helps to cover physician services, outpatient care, preventive services, durable medical equipment, and certain home health care. Although the scope of Part B is extensive, there are many services — such as dental care, routine eye exams, hearing aids, and others — that are not covered as part of this program.

Don’t Miss: Does Medicare Cover Rides To The Doctor

A Few Words On Medigap

Medigap is Medicare supplemental insurance that can ameliorate some of the costs that aren’t covered by Medicare Parts A and B. This insurance is provided by private companies, and typically requires that a beneficiary already have Medicare Parts A and B to enroll. Premiums are generally paid monthly, and it’s best to enroll as close as possible to enrollment in Parts A and B.

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Don’t Miss: Is Medicare Advantage A Good Choice

Four Parts Of Medicare

As often as monthly, the Centers for Medicare and Medicaid Services keep tabs on trends in the Medicare population by:

- How many people have Medicare Parts A and B by state

- Number of people enrolled in each type of Medicare health plan

- Counting Medicare enrollees per year and per month

Generally meant by the term Medicare health plan are Medicare-approved health insurance products that works in addition to having Original Medicare.

As a means of getting benefits that can exceed Medicare, you can choose from Medicare health plans:

- Medicare Advantage Private companies enter contracts with Medicare to offer Part A and Part B benefits, and often more.

- Prescription Drug Coverage These policies add prescription drug coverage to Original Medicare, also offered by Medicare-approved private companies. Medicare Advantage plans may also include built-in prescription drug coverage.

- Medicare Supplement Supplements help pay expenses for hospital and medical services left by Original Medicare, with each Medigap plan standardized to cover specific expenses like deductibles, co-pays, and co-insurance.

Enrollment Period For Medicare Part A

Youre eligible to enroll in Medicare Part A during your Initial Enrollment Period , which is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month.

When you apply for Social Security benefits, youre automatically enrolled in Medicare Part A.

Recommended Reading: How Much Medicare Is Taken Out Of Social Security Check

What Do Medicare Parts A B C And D Mean

Who is this for?

If you’re new to Medicare, this information will help you understand the different parts and what they do.

There are four parts of Medicare. Each one helps pay for different health care costs.

Part A helps pay for hospital and facility costs. This includes things like a shared hospital room, meals and nurse care. It can also help cover the cost of hospice, home health care and skilled nursing facilities.

Part B helps pay for medical costs. This is care that happens outside of a hospital. It includes things like doctor visits and outpatient procedures. It also covers some preventive care, like flu shots.

Parts A and B together are called Original Medicare. These two parts are run by the federal government. Find out more about what Original Medicare covers in our Help Center.

Part C helps pay for hospital and medical costs, plus more. Part C plans are only available through private health insurance companies. Theyre called Medicare Advantage plans. They cover everything Parts A and B cover, plus more. They usually cover more of the costs youd have to pay for out of pocket with Medicare Parts A and B. Part C plans put a limit on what you pay out of pocket in a given year, too. Some of these plans cover preventive dental, vision and hearing costs. Original Medicare doesnt.

You can see a list of the Medicare Advantage plans we offer and what they cover.

What Does Medicare Part D Cover

Under Medicare Part D, prescription drug plans are available from private, Medicare-approved insurance companies, so benefits and cost-sharing structures differ from plan to plan. However, the Center for Medicare and Medicaid Services sets minimum coverage guidelines for all Part D plans. These rules require all plans to cover medications to treat most illnesses and diseases.

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments. Brand-name and specialty medications in the higher tiers cost more out-of-pocket.

Medicare Part D only covers prescription drugs that are FDA approved. Experimental medications are generally not covered.

Recommended Reading: Does Cigna Have A Medicare Supplement Plan

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

When Can I Enroll In A Medicare Prescription Drug Plan

You can enroll in a plan at any time during your Medicare Initial Enrollment Period, which starts three months before your 65th birthday month, includes your birthday month, and extends for three additional months. If you get Medicare because of a disability, you can generally enroll in Medicare Part D after you are on Social Security disability for 24 months.

You can make changes to your prescription drug coverage each year during the Fall Open Enrollment Period . If you get Medicare Part D as part of your Medicare Advantage plan, you can also make changes during the Medicare Advantage Open Enrollment Period which runs from January 1st through March 31st.

Its important to enroll in a plan when you are first eligible if you want to avoid a late enrollment penalty with your monthly premium. If you go without creditable prescription drug coverage and you dont enroll in Part D when you are first able, youll pay a penalty of 1% of the national base premium for each month you go without coverage. You pay this penalty for as long as you have Medicare Part D coverage.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Recommended Reading: Why Is My First Medicare Bill So High

Does Medicare Run On A Calendar Year

Yes, Medicares deductible resets every calendar year on January 1st. Theres a possibility your Part A and/or Part B deductible will increase each year. The government determines if Medicare deductibles will either rise or stay the same annually. Medicare announces Part A & Part B deductible changes each year around the end of October or the beginning of November.

Do I Need Medicare Part D

Medicare Part D is technically voluntary coverage you arent required to enroll in a plan. However, if you go without prescription drug coverage before you enroll in a plan, you may pay a late penalty with your monthly premium. If you have prescription drug coverage through an employer group or retiree plan, you dont have to enroll in a Medicare Part D plan until your coverage ends.

Don’t Miss: Does Medicare Cover Oral Surgery Biopsy

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens’ resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRG’s, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

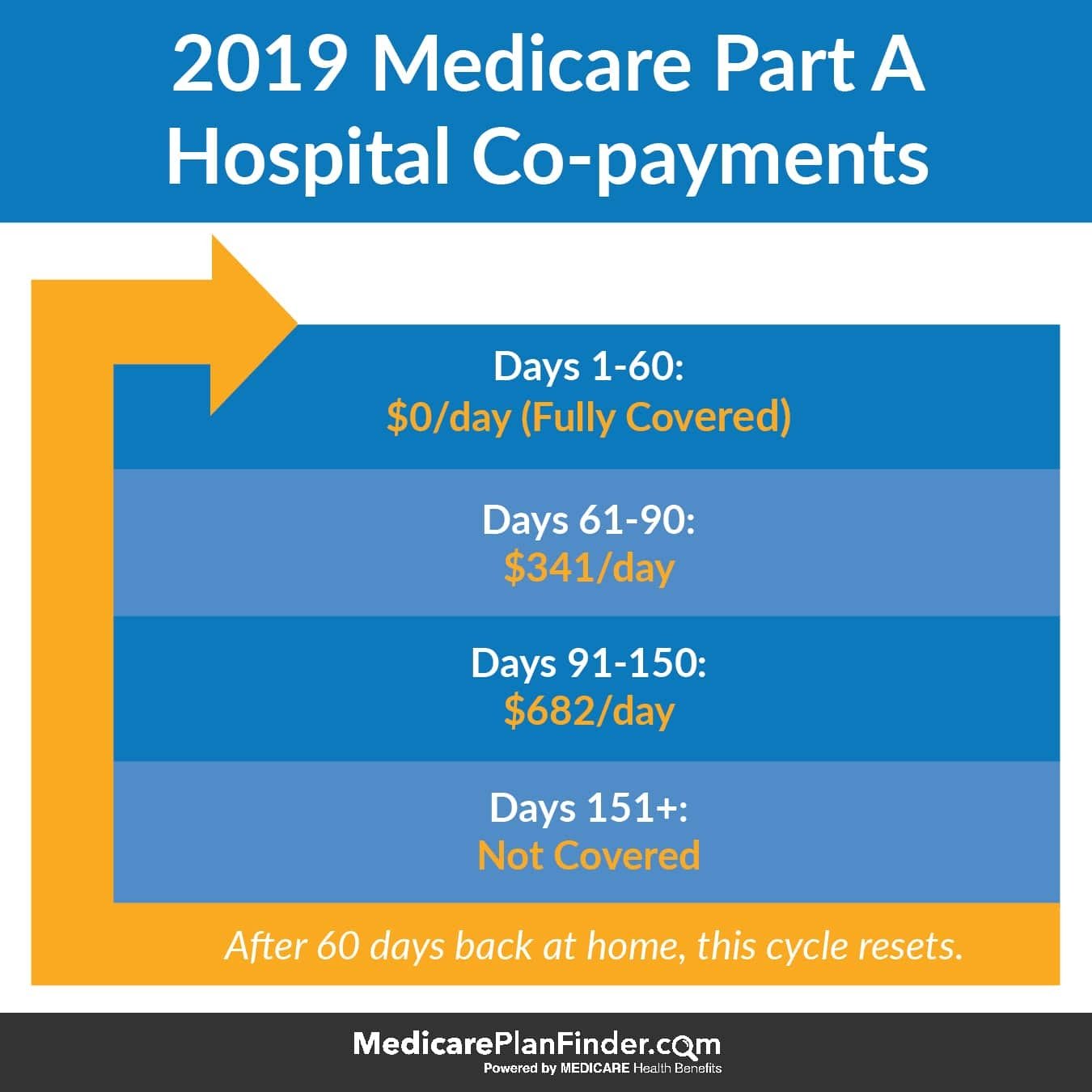

How Do Medicare Benefit Periods Work

Its important to understand the difference between Medicares benefit period from the calendar year. A benefit period begins the day youre admitted to the hospital or skilled nursing facility.In this case, it only applies to Medicare Part A and resets after the beneficiary is out of the hospital for 60 consecutive days. There are instances in which you can have multiple benefit periods within a calendar year. This means youll end up paying a Part A deductible more than once in 12 months.

You May Like: What Is Medicare Part G