Who Is Eligible For Ssdi

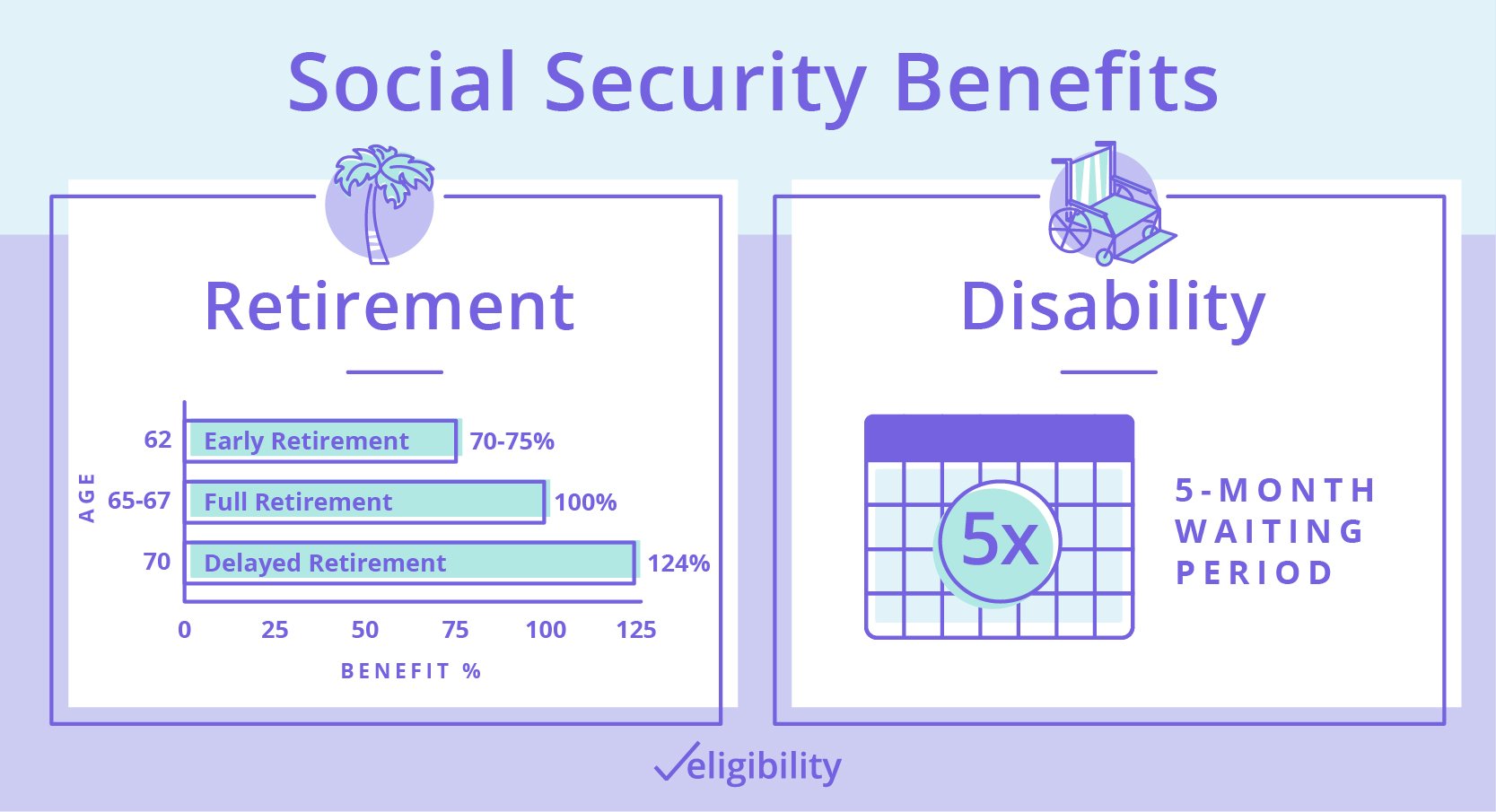

The rules are different when youre applying for SSDI. Youll need 40 work credits if youre applying at age 62 or older.

To qualify for SSDI, you must:

- be unable to work because of a medical condition that will last at least 12 months, or is terminal

- not currently have a partial or short-term disability

- meet SSAs definition of a disability

- be younger than full retirement age

You must be able to prove you meet these criteria, and this process can be difficult. Once you qualify for SSDI, the amount of disability youll receive may be based on your age and the amount of time youve worked and paid into Social Security.

This table explains what benefits are offered based on your age and number of years worked:

Enrolling In Additional Health Insurance Coverage

Original Medicare Medicare Part A and Medicare Part B offers a wide range of health insurance benefits but leaves some out-of-pocket health care costs to the beneficiary. You can purchase a Medicare Supplement Insurance plan from a private insurance company to help cover some of these costs.

Learn more about the basic benefits you can get with different types of Medicare Supplement Insurance plans, the age requirement for enrolling and the costs of plans in your area by connecting with a licensed agent.

But It Doesnt Have Universal Support

Most Americans support expanding Medicare coverage a 2019 Kaiser Family Foundation poll indicates that 77% of respondents support the idea of introducing a Medicare buy-in for people as young as 50.

But the idea faces detractors in Congress.

And not just from Republicans more conservative members of the Democratic party are likely to push back on any changes to the state-sponsored health system.

In response to Bidens comparatively modest proposed changes, hospital communities argued that expanded health care could encourage more people to retire younger, which would negatively impact the workforce. Theyre also concerned it would reduce the amount health care providers receive in reimbursements.

Don’t Miss: Does Cigna Have A Medicare Supplement Plan

Preparing As The Eligibility Age Nears

If a person already receives benefits from the Social Security Administration, the Administration will automatically enroll them in Medicare parts A and B.

The person will receive a âWelcome to Medicareâ packet 3 months before their 65th birthday, with instructions on how to sign up.

A person does not have to be retired to receive Medicare. If a person is not currently receiving Social Security benefits, they can apply for Medicare benefits as early as 3 months before their 65th birthday.

For example, if a person turns 65 years of age in April, they can apply for Medicare benefits in January of the same year.

Applying for Medicare benefits as early as possible may help the Social Security office process the paperwork in time for the personâs 65th birthday.

People who apply too late may face a premium 10% higher than that of those who apply on time. This premium would apply for double the time a person has been eligible but did not apply.

A person can apply for Medicare during their birth month or up to 3 months after their birth month without having to pay penalties for Medicare coverage.

However, their benefits will not begin until the Centers for Medicare and Medicaid Services process their request.

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Also Check: How To Check Medicare Status Online

Medicare Enrollment Can Be Impacted By Social Security Benefits

Depending on your situation, you with either need to enroll in Medicare at age 65 or you may be able to delay. If you continue to work past age 65 and have creditable employer coverage , you can likely delay enrolling in Medicare until you lose that employer coverage. In most cases, people turning 65 will need to get Medicare during their 7-month Initial Enrollment Period to avoid financial penalties for enrolling late. Your IEP begins 3 months before the month of your 65th birthday and ends 3 months after.

Social Security benefits fit in the Medicare enrollment journey in one special way. If you are receiving either Social Security benefits for retirement or for disability, or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare Part A and Part B when you first become eligible.

Do I Receive A Notice About Medicare When I Turn 65

If you are already receiving Social Security benefits, you will get information about Medicare in the mail three months before you turn 65. If you do not receive Social Security benefits, you must actively enroll in Medicare yourself by contacting your local Social Security office. You will not receive a notification in the mail informing you that you qualify for Medicare

Read More:

Also Check: How Can I Get My Medicare Card Number

Requalifying For Medicare At 65

If you become eligible for Medicare before you turn 65 due to disability or one of the above diagnoses, youll requalify again when you reach age 65. When you do, youll have another Initial Enrollment Period and all the benefits of a newly eligible Medicare recipient, such as a Medicare Supplement Enrollment Period.

What Are Cases When Medicare Automatically Starts

Medicare will automatically start when you turn 65 if youve received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday.

Youll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks. According to the Social Security Administration, more than 30% of seniors claim Social Security benefits early.1 For those seniors, Medicare Part A and Part B will automatically start when they reach the age of 65.

When do You Get Your Medicare Card?

You can expect to receive your Medicare card in the mail three months before your birthday. Your Medicare card will come with a complete enrollment package that includes basic information about your coverage. Your card wont be usable until you turn 65, even though youll receive the card before that time.

What Are Your Costs?

Keep in mind that youll still have to pay the usual costs of Medicare, even though youre automatically enrolled. Once your Medicare is active, the cost of your Part B premium will be deducted from your Social Security or RRB benefits.

What If You Already Enrolled in Medicare?

What about Medicare Supplement ?

What If I Switch to Medicare Advantage?

And if you want to switch to Medicare Advantage , youll have a one-time Initial Enrollment Period for Medicare Advantage that begins 3 months before the month you turn 65 and lasts for 7 months.

What I Have Part A?

Read Also: How Much Medicare Is Taken Out Of Social Security Check

Apply For Retirement Benefits

Starting your Social Security retirement benefits is a major step on your retirement journey. This page will guide you through the process of applying for retirement benefits when youre ready to take that step. Our online application is a convenient way to apply on your own schedule, without an appointment. You can also apply by phone or by appointment at a Social Security office.

Medicare Vs Medicaid Compare Benefits

In the context of long term care for the elderly, Medicares benefits are very limited. Medicare does not pay for personal care . Medicare will pay for a very limited number of days of skilled nursing . Medicare will also pay for some home health care, provided it is medical in nature. Starting in 2019, some Medicare Advantage plans started offering long term care benefits. These services and supports are plan specific. But they may include:

- Adult day care

Also Check: How Much Is Medicare B Deductible

How Medicare Works If Your Age 62 Spouse Is Still Working And Youre On Medicare

To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 , he or she could only qualify for Medicare by disability.

Heres an example of when a younger spouse whos not yet on Medicare might help you save money.

- Suppose you reach age 65 and qualify for Medicare, but you havent worked long enough to qualify for premium-free Medicare Part A.

- And suppose your younger spouse has worked at least 10 years while paying Medicare taxes. When your spouse turns 62, youll qualify for premium-free Part A. Your spouse wont qualify for Medicare until they turn 65, but their work record will help you save money by getting Part A with no monthly premium.

NEW TO MEDICARE?

What If Youre Still Working At 65

If youre still working at 65 and receiving health insurance through your employer, you may still need to sign up for Medicare. If your company offers health insurance and has fewer than 20 employees, your health insurer will refuse to pay for costs that Medicare would have covered. Signing up for Medicare will ensure that those costs are covered.

If your company has more than 20 employees, its still a good idea to enroll in free Part A coverage right away. Your coverage will be free since you already paid Medicare taxes. However, if you have a Health Savings Account, you wont be able to contribute to it once you enroll in Medicare, even if you only enroll in Part A.

You May Like: Should I Enroll In Medicare If I Have Employer Insurance

Medicare Part D Prescription Drug Coverage Eligibility

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you cant have a standalone Part D plan if you have a Medicare Advantage plan.

To qualify for a Part D plan, you must meet the following requirements:

- You must have both Part A and B .

- You must live where plans are available.

- You must pay Part A, Part B, and Part D premiums, if applicable.

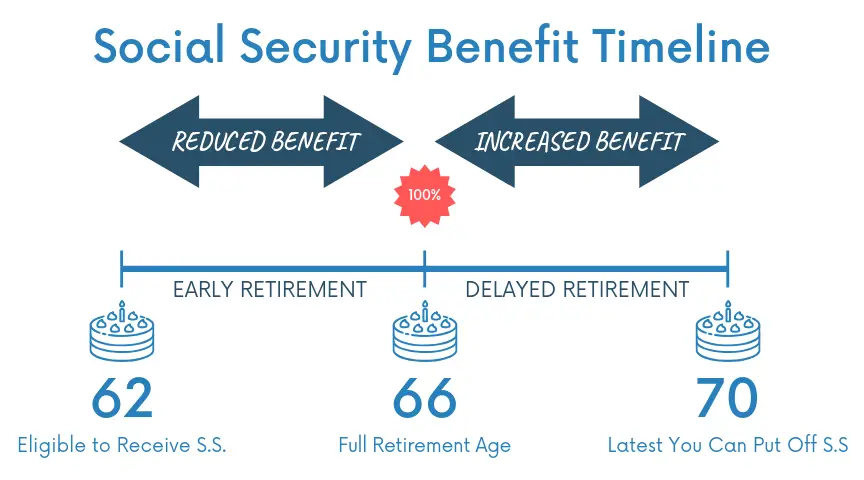

Who Is Eligible For Social Security Retirement Benefits

As mentioned, youll need to meet a few requirements to be eligible for Social Security retirement benefits. Just like with Medicare, youll need to be a United States citizen or permanent resident. You might also need to have worked and earned credits. The amount of credits you need depends on your circumstances and the type of benefit youre applying for.

Youll need at least 40 credits in order to apply for retirement benefits. Since you can earn up to four credits a year, youll earn 40 credits after 10 years of work. This rule applies to anyone born after 1929.

The amount youll receive per month will depend on your income throughout your working life. You can use the calculator on the Social Security website to estimate your retirement benefits.

Don’t Miss: Does Medicare Cover Private Home Care

What Should You Do Once You Get Medicare

Although you can rely on Original Medicare alone, 86% of Medicare enrollees also have some type of additional coverage.2 It can be from an employer, a privately-purchased plan or from a government-run program like Medicaid. Original Medicare pays for a great deal of healthcare, but still leaves you with potentially costly gaps in healthcare coverage. Supplementary plans can cover these gaps including deductibles and copayments at a fraction of the out-of-pocket rate.

MedicareGuide.coms plan selector is designed to intelligently bring you the best Medicare Supplement plans. These plans, also known as Medigap policies, fill the gaps in coverage that you would otherwise be charged by Original Medicare.

New Proposal To Lower Medicare Age To 50 Could Be A Lifeline To Millions

A group of 21 Democratic senators have reintroduced legislation in Congress to lower the qualifying age for Medicare from 65 to 50.

When it comes to providing affordable health care for every American, there is more we must do right now to change the status quo, improve our health care system and lower costs, said Sen. Tammy Baldwin, a Democrat from Wisconsin and one of the cosponsors of the bill.

Baldwin added that this legislation would give millions of Americans an option to get the health care coverage they need at a price they can afford.

Heres what you need to know about the proposed reform and how to find affordable health coverage even if youre nowhere close to age 50.

You May Like: Should I Get Medicare Supplemental Insurance

What Should I Do As I Am Waiting To Reach The Medicare Eligible Age

If you retire at 62, your wait for your Medicare eligible age may only be 3 years. As you wait, you can start researching about Medicare so that you are prepared to make well-informed coverage decisions. For example, you may not know that:

- Original Medicare doesnt generally cover prescription drugs you take at home. You can get coverage for prescription drugs through Medicare Part D, which is offered by private insurance companies contracted with Medicare.

- Original Medicare generally doesnt cover routine dental, hearing aids, or eyeglasses. You may be able to get coverage for these benefits through a Medicare Advantage plan offered by a private insurance company. Medicare Advantage plans must cover everything Original Medicare covers, with the exception of hospice care, which is still covered by Part A.

- Original Medicare has no out-of-pocket maximum. To get help paying for out-of-pocket costs such as copayments, coinsurance, and deductibles, you can get a Medicare Supplement insurance plan, also offered by private insurance companies.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Three Approaches To Reform

The NASI study bit.ly/2K4Aya7 offers a fascinating in-depth look at three approaches to expanding Medicare eligibility: lowering the eligibility age, establishing Medicare for All, and creating a Medicare buy-in. The report was created by a study panel made up of 27 experts from a broad range of perspectives, such as economics, health policy, political science, sociology, medicine and law.

The report draws some surprising conclusions about the practicality of actually executing these approaches. Yes, Medicare for All might be the toughest putt from a political standpoint – but the optional buy-in – which sounded great rolling off the tongues of moderate candidates like Pete Buttigieg – actually is the most difficult to execute.

A lot of people think that Medicare for All sounds nice, but that it is aspirational and very difficult, if not impossible to do in practice, said Moon. And the buy-in just sounds like its not a big change. But we quickly realized that the buy-in was very complicated, because you take a complicated program like Medicare, which has a lot of moving parts, and then the even more complex Affordable Care Act structure and you try to marry the two in some way. Its very difficult to do.

Don’t Miss: How To Get A Lift Chair From Medicare

When Can I Apply For Medicare

You can apply for Medicare during the Initial Enrollment Period . IEP is the seven months surrounding your 65th birthday. It includes the three months before you turn 65, the month you turn 65, and the three months after. If you have current employer insurance, you can also register while you are working and for up to eight months after you stop working or lose your coverage. This is a window of time called the Special Registration Period for Part B , if you do not register during these times, you can register during the General Registration Period , which runs from January 1 through March 31 of each year. Your coverage will start on the 1st of July of the year in which you register. You may face a late registration penalty if you qualify for Part B prior to enrolling during the GEP. If you receive Social Security Disability Insurance for 24 months, you are automatically registered with Medicare the 25th month that you receive SSDI.

Is It Mandatory To Sign Up For Medicare After Age 65

No, it isnt mandatory to join Medicare. People can opt to sign up, or not.

If you don’t qualify for Social Security retirement benefits yet, you may need to manually enroll in Medicare at your local Social Security office, online or over the phone when you turn 65. You can also apply online for your Medicare coverage at www.medicare.gov.

Enrolling in Medicare as soon as youre eligible ensures you get the subsidized health care you deserve without waiting periods or financial penalties.

If you continue to work for a company employing 20 or more people after you turn 65, you could delay your Medicare enrollment. Your employee group plan provides enough medical coverage while youre working, meaning you may be able to wait to sign up for Medicare once you retire without incurring any late penalties.

Don’t Miss: Does Medicare Pay For Eyeglasses For Diabetics