Tips For Choosing Medicare Drug Coverage

If youre wondering how to choose a Medicare drug plan that works for you, the best way is to start by looking at your priorities. See if any of these apply to you:

- I take specific drugs.

-

Look at drug plans that include your prescription drugs on their

formulary

. Then, compare costs.

- I want extra protection from high prescription drug costs.

-

Look at drug plans offering coverage in the

coverage gap

, and then check with those plans to make sure they cover your drugs in the gap.

- I want my drug expenses to be balanced throughout the year.

-

Look at drug plans with no or a low

deductible

, or with additional coverage in the

coverage gap

- I take a lot of generic prescriptions.

-

Look at Medicare drug plans with

tiers

that charge you nothing or low copayments for generic prescriptions.

- I don’t have many drug costs now, but I want coverage for peace of mind and to avoid future penalties.

-

Look at Medicare drug plans with a low monthly

premium

for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

- I like the extra benefits and lower costs available by getting my health care and prescription drug coverage from one plan, and Im willing to pick a drug plan with restrictions on what doctors, hospitals, and other health care providers I can use.

-

Look for a

Choose The Right Prescription Drug Plan For You

Here are some tips for finding a plan that meets your budget, needs and preferences.17

- Check the prices. The monthly premium is an important consideration but look too at cost-sharing, such as deductibles, coinsurance and copays. A low premium may cost you more in the long run.

- If you prefer one-stop shopping and are willing to choose a plan that limits you to a network of providers, you may have lower premium costs with a Medicare Advantage plan with prescription drug coverage.

- If you take no or very few medications, you may want to opt for a low-premium plan. It will still cover most of the drugs that people on Medicare need.

- If you are taking specific long-term medications, check their availability and costs in various plans. If the drugs you take are generics, look for plans that charge you little or nothing for these.

- If you expect large medication expenses, it may pay to look for a plan that extends additional coverage if you reach high spending levels.

- When selecting a plan, check to see if they have a convenient preferred pharmacy, where you can often get added savings on prescription drugs.

Who Pays First For Healthcare Costs

Medicare is the primary payer when you use it with CHAMPVA. This means Medicare will be the first to pay the cost of any service you receive, then CHAMPVA will pay the rest.

Youll have very few out-of-pocket costs using CHAMPVA and Medicare together, since CHAMPVA will generally pay any copayments or coinsurance amounts.

You can expect to pay:

- nothing out of pocket for any service that both Medicare and CHAMPVA cover

- your Medicare coinsurance cost of 20 percent for a service Medicare covers but CHAMPVA doesnt

- your CHAMPVA cost sharing of 25 percent for anything CHAMPVA covers but Medicare doesnt

The same rules apply to Medicare Part D. CHAMPVA will pick up your copayments on all covered prescriptions. It will also pay 75 percent of the cost of prescriptions that your Medicare Part D plan doesnt cover.

Present both your Medicare Part D plan card and your CHAMPVA ID card at your pharmacy for coverage.

Read Also: Does Medicare Provide Life Insurance

Not Signing Up Because You Do Not Take Medications

Not everyone on Medicare takes medication. Even if they do, they may only take one or two inexpensive drugs that could cost less out of pocket than a monthly premium. It is no wonder people ask: If I do not take medications, why should I pay for prescription drug coverage?

For one, you never know what the future holds. Accidents and injuries could lead to unexpected health problems. You could have a disease that has not yet been diagnosed. Keep in mind that more than half of all Americans, regardless of age, have at least two or more chronic medical conditions. You could need prescription drug coverage in the future but you may not be able to predict when. It might be better to be safe and have prescription drug coverage than sorry and be without it.

Second, if you do not sign up when you are eligible for Part D, you may be subjected to late penalties later on. Paying more now could save you considerable money in the long run.

How Does Medicare Prescription Drug Coverage Work

Medicare prescription drug coverage is an optional benefit. Medicare drug coverage is offered to everyone with Medicare. Even if you dont use prescription drugs now, you should consider joining a Medicare drug plan. If you decide not to join a Medicare drug plan when youre first eligible, and you dont have other creditable prescription drug coverage or get Extra Help, youll likely pay a late enrollment penalty if you join a plan later. Generally, youll pay this penalty for as long as you have Medicare prescription drug coverage. To get Medicare prescription drug coverage, you must join a plan approved by Medicare that offers Medicare drug coverage. Each plan can vary in cost and specific drugs covered.

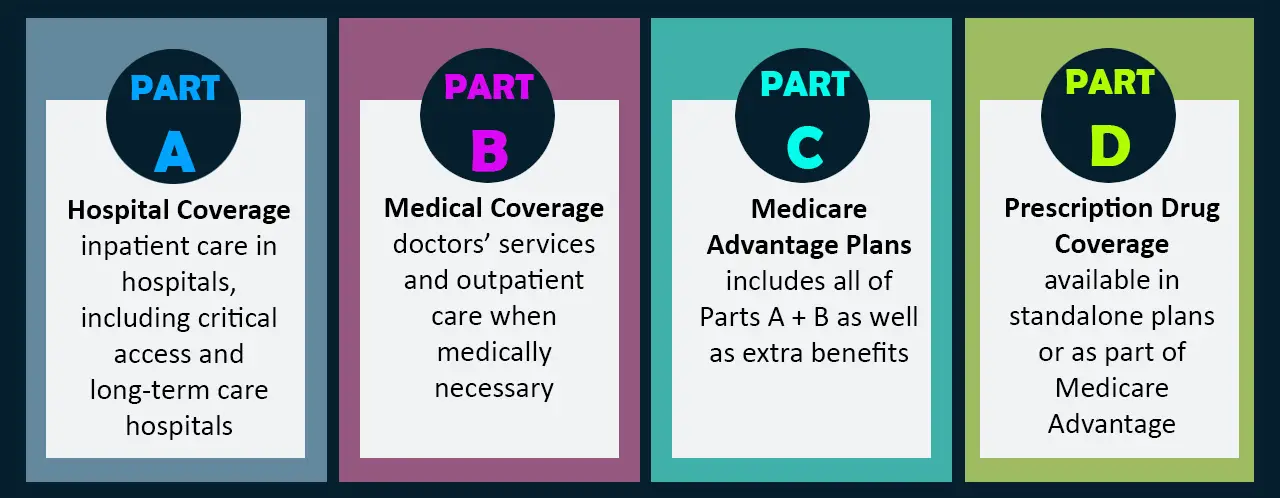

There are two ways to get Medicare prescription drug coverage:

- Medicare Prescription Drug Plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service plans, and Medicare Medical Savings Account plans. You must have Part A and/or Part B to join a Medicare Prescription Drug Plan.

- Medicare Advantage Plans or other Medicare health plans that offer Medicare prescription drug coverage. You get all of your Part A, Part B, and prescription drug coverage , through these plans. Medicare Advantage Plans with prescription drug coverage are sometimes called MA-PDs. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

Read Also: When Is The Last Day To Change Medicare Plans

What Should I Know About A Plan’s Drug List

Medicare Part D and Medicare Advantage plans have a drug list that tells you what drugs are covered by a plan. Medicare sets standards for the types of drugs Part D plans must cover, but each plan chooses the specific brand name and generic drugs to include on its formulary. Here are some important things to know:

- A plan’s drug list can change from year to year.

- Plans can choose to add or remove drugs from their drug list each year. The list can also change for other reasons. For example, if a drug is taken off the market. Your plan will let you know if there’s a coverage change to a drug you’re taking.

- Many Part D plans have a tiered formulary.

Can I Enroll In Medicare Part D After My Initial Enrollment Period

In most cases, enrollment outside of your initial enrollment period is limited to an annual enrollment period between October 15 and December 7, with coverage starting January 1 of the following year. During this time, you can switch to a new PDP or Medicare Advantage plan, and coverage is guaranteed issue. The new plan will automatically replace the old one, so you dont need to do anything other than enroll in the new plan.

If you are enrolled in a Medicare Advantage plan and want to switch to Original Medicare, you can do so either during the fall open enrollment period or during the Medicare Advantage open enrollment period . If you do so, youll also have the option to purchase a Part D plan at the same time, so that youll have prescription coverage to go along with your Original Medicare coverage.

You May Like: Does Medicare Cover Transport Wheelchairs

How Do I Get Prescription Coverage With Medicare

Once you choose a Medicare drug plan, here’s how to get prescription drug coverage:

. Then, how much will my prescriptions cost with Medicare?

Medicare Part D PremiumThe average nationwide monthly premium for 2019 is $33.19, although plan costs vary depending on the plan you choose and where you live. You will generally only want to choose a plan with low premiums if it also has the lowest overall cost per year, including the costs for the drugs you take.

Likewise, how do I choose a Medicare prescription plan? Use these steps to help you decide what coverage you want:

In this way, what prescriptions does Medicare cover?

Medicare Part D plans must cover all or substantially all drugs in six categories: antidepressants, antipsychotics, anticonvulsants, antiretrovirals , immunosuppressants and anticancer.

What does Medicare cost in 2020?

The standard monthly premium will be $144.60 for 2020, which is $9.10 more than the $135.50 in 2019. The annual deductible for Part B will rise to $198, up $13 from $185 this year. About 7% of beneficiaries will pay extra from income-related adjustment amounts.

How To Join A Drug Plan

Once you choose a Medicare drug plan, here’s how to get prescription drug coverage:

- Enroll on the Medicare Plan Finderor on the plan’s website.

- Complete a paper enrollment form.

When you join a Medicare drug plan, you’ll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

Also Check: How To Work For Medicare

Check The Plan Ratings

Every October, Medicare releases ratings on Part D plans, called the Medicare Star Rating System. Plans receive an overall rating , as well as ratings on four subcategories. These are:

- Customer service

- Member experience

- Member satisfaction, including complaints, issues experienced receiving service, and how many members choose to leave the plan

- Pricing and safety

If you have trouble deciding between two plans, a look at each plans’ ratings helps tip the scales in favor of one or the other.

An Overview Of The Medicare Part D Prescription Drug Benefit

Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare, provided through private plans approved by the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan to supplement traditional Medicare or a Medicare Advantage prescription drug plan , mainly HMOs and PPOs, that cover all Medicare benefits including drugs. In 2021, 48 million of the more than 62 million people covered by Medicare are enrolled in Part D plans. This fact sheet provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on data from the Centers for Medicare & Medicaid Services , the Congressional Budget Office , and other sources.

Recommended Reading: Do Any Medicare Supplement Plans Cover Dental

What To Expect When You Change Part D Plans

Once you enroll in your new Part D plan, you wont need to contact the provider of your old plan. Youll automatically be dropped from that plan when your new coverage begins. Keep an eye out for your new Part D Medicare card, formulary , and other plan documents. You may be able to print these online, but youll likely receive them in the mail as well.

If you switch Part D plans mid-year, some of your benefits may carry over from your old plan. What youve already paid toward your old deductible will still count toward your new one, even if your new plans deductible is different. Your progress through the Medicare Part D donut hole will transfer as well.

If your new coverage begins at the start of the new year, your deductible and progress through the donut hole will resetjust as it would if you hadnt switched plans.

Vaccines Covered By Medicare Part B

Medicare Part B covers three important vaccines as part of its preventive care benefits.

Covered vaccines include the following:

- Flu vaccine: Annual vaccine given in one shot before or during flu season, usually November through April

- Pneumonia vaccine: One-time vaccine given in two shots at least one year apart

- Hepatitis B vaccine: One-time vaccine given in two to four shots over one to six months for people who are medium to high risk, including people with diabetes

Part B also covers vaccines you may need if youre exposed to a harmful virus or bacteria by accident. You might need a tetanus shot, for example, if you step on a rusty nail. Or you may need rabies shots if youre bitten by a stray dog.

Read Also: What Is Part B Excess Charges In Medicare

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Most Medicare Advantage Plans Offer Prescription Drug Coverage

Medicare Advantage plans are an alternative to Original Medicare .

Medicare Advantage plans provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesnt cover.

Some of these additional benefits can include things like:

- Routine dental, vision and hearing care

- Membership to health and wellness programs like SilverSneakers

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Recommended Reading: Are Cancer Drugs Covered By Medicare

How Does A Tiered Formulary Work

Many plans have a tiered formulary where the plan’s list of drugs are divided into groups based on cost. In general, drugs in low tiers cost less than drugs in high tiers. Additionally, plans may charge a deductible for certain drug tiers and not for others, or the deductible amount may differ based on the tier.

Formulary tiers:

Changing Or Canceling Your Plan

Life is full of twists and turns. You could be faced with new health challenges. Your financial situation could change if you retire or lose your job. Your insurance company could make changes to your plan. All of these things could affect how much prescription drug coverage you need and how much you can afford.

You may need to consider changing your Part D plan. The good new is you are not stuck with the same Part D plan forever. You have choices. The trick is to know when to make those changes.

Recommended Reading: Is Medicare The Same As Ahcccs

Basics Of Medicare Part D

There are two ways to get prescription drug coverage through Medicare Part D.

- Enroll in a stand-alone Medicare prescription drug plan . If you enroll in a stand-alone prescription drug plan, it works alongside your Original Medicare benefits.

- Or, enroll in a Medicare Advantage plan with prescription drug coverage, or an MA-PD. A Medicare Advantage plan is an alternative way to get your Original Medicare benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance. The amounts can vary from plan to plan.

Prescription Drug plans include formularies, which are a list of the medications that are covered under the plan. Some formularies have tiers. Medications in lower tiers may have lower costs. Generic medications are often included in the lower tiers. When you are preparing for Medicare Part D enrollment, it is important to make sure the medications you take are included in the plans formulary.

Other Points To Keep In Mind:

Medicare Advantage plans have maximum out-of-pocket limits that cant exceed $6,700 in 2019, and that limit will continue to apply in 2020. But prescription costs dont count towards the out-of-pocket cap, since it only applies to services that are covered under Medicare Parts A and B.

Part D prescription drug plans vary considerably from one plan to another, but they fall into two basic categories: Basic and Enhanced. As implied by the names, Enhanced plans will provide more benefits, but also tend to have higher monthly premiums. A broker and/or the plan finder tool will help you pinpoint the best plan for your needs, but its helpful to keep the distinction between Basic and Enhanced plans in mind when comparing options.

Also Check: Does Medicare Cover Oral Surgery Biopsy

Don’t Miss: Are Doctors Required To Accept Medicare