Original Medicare If You Live In More Than One Area

If you have Original Medicare, youll probably want supplemental coverage to help pay Original Medicares out-of-pocket costs, as Original Medicare on its own does not have a cap on out-of-pocket costs. More than eight out of ten Original Medicare beneficiaries have supplemental coverage, either from an employer-sponsored plan, Medicaid, or a Medigap plan.

Supplemental coverage from Medicaid includes Part D prescription drug coverage, and supplemental coverage from employers generally includes coverage for prescription drugs. But Medigap plans sold since 2006 do not include drug coverage. Medicare beneficiaries can purchase stand-alone Medicare Part D prescription coverage if they dont have creditable prescription coverage from another source.

Your Original Medicare will cover you anywhere in the nation. Youll just need to make sure that the doctors and hospital you select in your secondary location are participating providers with Medicare.

If youre going to buy a Medigap plan, youll select from among the plans available for purchase in your primary location. A Medigap plan will provide supplemental coverage anywhere in the country, as long as the doctors and hospital you visit accept Medicare.

If you have your supplemental coverage via Medicaid or an employer-sponsored plan, youll want to check with the plan for specifics about how your coverage will work when youre traveling or at your second home.

If Your Income Is High Or Very Low Or You’re Feeling Lucky You Might Be Able To Rely On Traditional Medicare Here’s Why Most People Don’t

Only 19% of Original Medicare beneficiaries have no supplemental coverage .

- Supplemental coverage can help prevent major expenses.

If youre approaching Medicare eligibility, youve probably heard about the various private-coverage options that are available to replace or supplement Medicare. These plans are popular, but are they necessary?

If you shun private coverage, can you get by on Original Medicare without purchasing supplemental coverage or using a Medicare Advantage plan?

The answer is: It depends.

Is It A Good Idea For Couples To Choose The Same Medicare Insurance Plan

Q: Is it a good idea for couples to choose the same Medicare insurance plan?

A: No, you should normally choose Medicare coverage based on your own health care needs. The exception is if both spouses are offered retiree coverage, and in that case you both may end up in a more generous plan than what is available to most Medicare enrollees.

Also Check: Does Medicare Plan F Cover International Travel

What Is The Difference Between A Medicare Supplement Plan And Medicare Advantage

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

A Medicare Supplement plan cannot be used to cover costs from an Advantage plan in fact, its illegal for anyone to try to sell you a Medicare Supplement policy while you’re enrolled in an Advantage plan unless you’re switching back to Original Medicare. If youre unhappy with your Advantage plan and switch back to a Medicare Original Plan , you then become eligible for Medicare Supplement insurance.

How To Enroll In An Aarp Medicare Supplement Plan

Before you qualify for an AARP Medicare Supplement plan, you must become an AARP member. Luckily, thats simple and inexpensive to do a membership costs about $16 per year.

Next, pay careful attention to your enrollment period. The best time to join a Medicare Supplement plan AARP or otherwise is during your Initial Enrollment Period . During this time, you are guaranteed to be accepted into a Medicare Supplement plan, regardless of any health problems. Your Initial Enrollment Period begins three months before your 65th birthday month, includes your birthday month, and ends three full months after your birthday month.

Don’t Miss: Are Blood Glucose Test Strips Covered By Medicare

Best For Cost And Overall Price Transparency: Aetna

Aetna

-

Highest household discounts

-

Also offers dental, vision, and Part D drug plans

-

Rates available online

-

Cannot enroll online

-

Rates increase based on age

Founded in 1853 as a life insurance company, Aetna entered the healthcare market in 1899. Now a subsidiary of CVS Health Corporation, these two reputable companies work together to bring you a well-rounded healthcare experience. Aetna offers Plan F in 35 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, New York, Washington, Washington D.C., and Wisconsin.

High-Deductible Plan F is also available in 35 states: Alabama, Arizona, Arkansas, California, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, and Wyoming.

Enrolling in Medicare Supplement Plan F is easy, and if you also need to plan for the prescription drug plan, it offers many that rate four stars or higher on the Medicare 5-Star Rating System. To enroll, you must reach out to a representative by phone. Its rate for Plan F was the lowest we found, starting at $142 per month for a 66-year-old man. Rates may vary based on age, preexisting medical conditions, and where you live.

Medicare Supplement Plan N

If youre eligible for Medicare, a Medicare supplement or Medigap plan offers optional supplemental insurance coverage. Medigap Plan N is a plan and not a part of Medicare, such as Part A and Part B, which cover your basic medical needs.

Medicare Supplement Plan N is one type of insurance policy that you can purchase to help lower your out-of-pocket costs from Medicare. These plans can cover costs like premiums, copays, and deductibles.

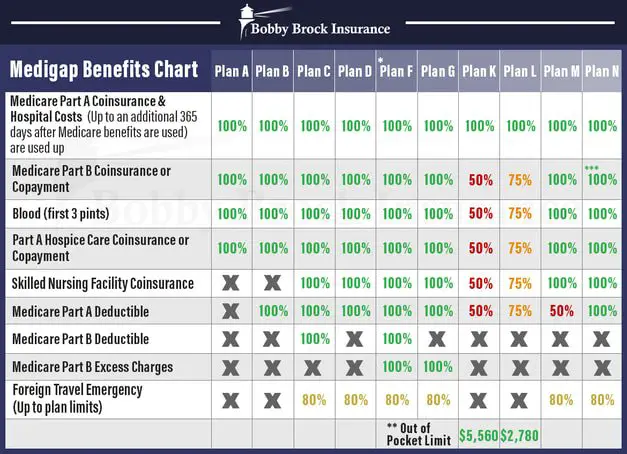

Choosing a Medigap plan can be confusing since various plans offer different levels of coverage and benefits. Understanding these benefits can help you choose a Medigap plan thats right for you.

Don’t Miss: Does Medicare Cover Mental Health Visits

What Do Medicare Supplement Plans Not Cover

Medigap policies do not extend coverage beyond Original Medicare.

For instance, they do not cover dental and vision care, hearing aids and non-skilled home care.

Except for plans written before 2006, Medigap also does not cover prescription drugs. Separate plans, called Medicare Part D, are available through private insurers approved by the federal government.

Lastly, Medigap does not cover private-duty nursing or long-term care. Such coverage would have to come from a standalone long-term care insurance policy.

Other Points To Keep In Mind When Switching Medigap Plans

- If you decide to change Medigap plans, you have a 30-day free look period where you can temporarily carry both plans to see which one you like better. However, during this period, youll pay premiums on both plans, and you must cancel the first policy after the first month. Or, if you decide youd rather stay with your original Medigap plan, you can cancel the second policy after the 30-day trial period.

- As mentioned above, you dont need a Medigap plan when you have a Medicare Advantage policy. Medigap only covers out-of-pocket costs associated with Original Medicare, Part A and Part B.

To learn about Medicare plans you may be eligible for, you can:

- Contact the Medicare plan directly.

- Contact a licensed insurance agency such as Medicare Consumer Guides parent company, eHealth.

- Or enter your zip code where requested on this page to see quote.

Don’t Miss: Does Medicare Cover A1c Test

What Is Medicare Supplement Insurance

Original Medicare does not cover all costs. Medicare Supplement insurance, or Medigap, can cover what Medicare does not. Private insurance companies vetted by the federal government offer it to help manage out-of-pocket expenses. These policies do not add coverage. Instead, they help pay for what Medicare Part A and B does not, including copays, coinsurance, and deductibles.2 It does not affect which doctors you can see.

To understand the value of a Medicare supplemental plan, you need to understand what Original Medicare does and doesnt cover.

Original Medicare is made up of Part A and Part B .

Part A has a deductible you must pay before any benefits kick in for hospitalization. It covers the first 60 days of Medicare-eligible inpatient hospital care in a benefit period. After that, you pay daily coinsurance amounts, depending on the length of your stay.

Part B also has an annual deductible. Once you reach it, Part B covers 80% of eligible doctor-related, testing and medical-equipment expenses. You are responsible for the balance .

In 2021, the Part A deductible for hospitalization is $1,484 per benefit period and the Part B annual deductible is $233.3

Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

How Much Do Medigap Plans Cost

Although Medigap plans are standardized the same way in nearly every state meaning that the benefits they provide are the same, regardless of which insurance company offers the plan the prices vary considerably from one insurer to another. And of course, the prices also vary from one plan level to another, as each plan level provides different benefits .

You can see Medigap plan costs in your area by entering your zip code, age, gender, and tobacco status into Medicares plan finder tool. But just to give you an idea, Medigap Plan A for a 65-year-old non-smoker tends to range from around $70 or $80 per month to as much as $300/month or more. But in New York, where Medigap premiums dont vary based on age, Plan A pricing starts at around $150. However, the same premiums would apply to an 85-year-old in New York, whereas an 85-year-old in most states would pay more than a 65-year-old.

Plan G, which is the most comprehensive Medigap policy available to newly-eligible Medicare beneficiaries, tends to have premiums that start around $110 to $130 per month, and range well above $300 per month, depending on the insurance company thats offering the plan.

Recommended Reading: How Do I Choose The Best Medicare Advantage Plan

Verify The Providers Reputation

A companyâs reputation may help you choose between insurers with similarly priced plans.

- Financial strength: Working with a financially stable company ensures that it will be able to pay for services long into the future, even if costs rise substantially or a disaster requires the company to pay for care for hundreds or thousands of policyholders. AM Best, Moodyâs, Fitch, and Standard & Poorâs are independent agencies that rate insurance companiesâ financial stability. You can visit these agenciesâ websites to see how they rate the financial stability of a specific company. Although many insurance companies list ratings on their websites, you can see the most reliable and recent rating on the independent agenciesâ websites.

- Years in business: The amount of time a company has been in business can indicate that they have reliable business practices and good customer service. You may also wish to compare how long a company has offered Medicare supplement insurance.

- Recommendations: Ask friends and family members to tell you about their experiences with different insurance companies. Read online reviews to determine how the company deals with customers.

What Qualifies A Pre

In insurance, pre-existing conditions are any medical condition for which youve been diagnosed with, treated for, or had treatment recommended for, prior to applying for coverage with a carrier. For instance, the following examples may be considered as pre-existing conditions when youre applying for a Medicare Supplement plan:

- You had a heart attack 12 years ago

- You use an inhaler as needed for asthma

- Your doctor has recommended cataract surgery in the future

- You have arthritis

- Youre receiving treatment for cancer

As you can see, thats quite a range of situations a pre-existing condition doesnt necessarily need to be a grave diagnosis.

Recommended Reading: Are Medicare Supplement Plans Worth It

What Companies Sell Medicare Supplements

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

How To Change Your Address With Medicare

If you are a Medicare beneficiary and move to another state, you can change your address that’s on file with Medicare by contacting the Social Security Administration .

Here are some ways you can contact the SSA:

- Visit the SSA website and submit an address change notice through the website.

- Visit your local SSA office in person.

Also Check: When Can I Apply For Medicare Insurance

Will I Still Have Out

If you have multiple health insurance policies, youll have to pay any applicable premiums and deductibles for both plans. Your secondary insurance wont pay toward your primarys deductible. You may also owe other cost sharing or out-of-pocket costs, such as copayments or coinsurance.

Even if you have multiple health insurance policies, remember that plan rules still apply. For example, if youre in a PPO plan, your primary policy may have provider network rules. If you see an out-of-network provider who isnt covered by your plan, your primary insurance wont cover the costs and your secondary insurance wont cover the costs because you didnt follow your primary plans rules.

As another example, you may have out-of-pocket costs if your provider charges you more than your plan consider reasonable, customary, or allowed under plan rules. If youd like help understanding different out-of-pocket expenses you may have with more than one plan, an eHealth licensed insurance agent can explain those costs.

What Is Accident Insurance

Supplemental accident insurance is protection designed to help you handle the out-of-pocket costs that add up after an accidental injury. Benefit payments are made as lump-sum cash deposits directly to the beneficiary. So, you can use your benefits however you want. This could include emergency treatment, hospital stays, medical exams, and other related expenses like transportation costs or lodging needs. It can even be used to help pay for some of your living expenses. It is important to note that supplemental accident insurance is purchased in addition to, not in place of, major medical coverage. This video helps to explain what accident insurance is and how it can be a benefit.

You May Like: Is It Too Late To Change Medicare Advantage Plans

Medicare Advantage Is Growing In Popularity

The trend is undeniable. In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42% of the total Medicare population.1

By 2030, more than 51% of Medicare members are expected to choose Medicare Advantage plans.2

*Costs for Medicare Supplement plans vary by the state you live in and the plan you choose. Medicare Supplement plans can only be paired with Original Medicare.

Explore Medicare

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in any Humana plan depends on contract renewal.

Y0040_GNHKHNSEN

What Does Medicare Supplement Plan N Cover

Medigap Plan N has coverage for four basic areas:

Additionally, Medicare Supplement Plan N pays for skilled nursing facility care and the Medicare Part A deductible for hospitalization.

Read Also: How To Verify Medicare Eligibility Online

Best Set Pricing: Aarp

-

Must join AARP to enroll

-

Need birthday and current Medicare information for price details

-

No link to Medicare Supplement coverage from the main website

AARP is a nonprofit, nonpartisan membership organization that helps people who are ages 50-plus with a variety of services and information. One of the most trusted names for retirees and other seniors, the organization boasts 38 million members and is insured through UnitedHealthcare, which earns an A rating from AM Best for financial strength.

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesnt charge more as you grow older. This is especially helpful if you are still covered under your employer’s insurance and may require coverage after the age of 65.

AARP covers Parts A, B, C, F, G, K, L, and N, though its important to note that plans C and F are only available if you were enrolled in Medicare before January 2020. You can get pricing information easily by entering your ZIP code, and there’s a Spanish language website as well.

When Can I Buy Medicare Supplemental Insurance

Remember, the best time to purchase a Medigap policy is during the 6-month open enrollment period, which begins the day you have Medicare Part B insurance if youre 65 or older. During open enrollment, you can purchase any Medigap policy in your state, regardless of health problems. If you wait until this period closes, you may not be able to buy a Medicare supplemental insurance plan. This makes it especially smart to start comparing your options and getting quotes from Benzingas recommended providers early so you dont miss your enrollment window.

Also Check: What Does Part A Of Medicare Pay For