What Will My Costs Be In Original Medicare

- Your costs may vary, depending on the type of health-care services you use and how often you need them. However, in general, some of your costs in Original Medicare may include:

- Monthly premium for Medicare Part B*

- Medicare Part A deductible

- Medicare Part B deductible

- Copayments or coinsurance costs

* As mentioned, Medicare Part A is free if youve worked at least 10 years or 40 quarters under Medicare-covered employment. Otherwise, you can sign up for Medicare Part A and pay a monthly premium for it, which will vary depending on the number of work quarters you have.

Its important to note that Original Medicare doesnt have an annual out-of-pocket spending limit, meaning theres no maximum cap, no matter how high your health-care costs get each year.

Keep in mind that your costs may vary, depending on the types of services you need, how often you get them, and other factors. For example, as mentioned, your costs will be lower if you use providers that accept Medicare assignment. If youre eligible for Medicaid, the state may help pay for certain out-of-pocket costs.

How can I get help with Medicare costs?

Many beneficiaries purchase Medicare Supplement insurance to help with out-of-pocket costs that Original Medicare doesnt cover, such as copayments, coinsurance, and deductibles. Medigap plans work alongside Original Medicare.

What Doesnt Medicare Cover

There are several major medical expenses that arent covered by Medicare Part A or Part B.

But remember: You can get some of these services covered if you add a Part D plan or switch to a Medicare Advantage plan.

- Long-term care: No part of Medicare including Medicare Advantage plans covers extended nursing home or assisted living facility stays. Medicare coverage for nursing care is mostly limited to short-term rehabilitative stays. If you can afford long-term care insurance, its worth considering, given the high costs of nursing care. Medicaid which assists people with low income, regardless of age can pick up the tab for long-term care, but only after youve depleted your financial resources.

- Prescription drugs: Part D coverage is necessary.

- Dental: Original Medicare doesnt cover routine dental care, including cleanings, fillings, tooth extractions and dentures, but Part A may cover emergency dental work you incur during a hospital stay.

- Vision: Original Medicare wont pay for eye exams, glasses or contact lenses.

- Hearing aids: Original Medicare doesnt pay for hearing aids or exams for fitting hearing aids.

Other services not covered by Medicare:

- Most cosmetic surgery

- Sterilization, including a hysterectomy

- Medical marijuana

- Health care outside the United States

Funding a health savings account before youre eligible for Medicare is a good way to save for the costs that Medicare wont cover.

How Do You Receive Your Medicare Benefits When You Meet Medicare Eligibility Requirements At Age 65

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

If youre not enrolled in Original Medicare automatically, you may need to file an application with the Social Security Administration. You can enroll in Medicare Part A and Part B during the period that begins three months before your 65th birthday month, includes your birthday month and ends three months after your birthday month.

Note: You have a choice if you want to keep or refuse enrollment in Medicare Part B. If you refuse it, you dont lose your Medicare Part B eligibility. However, you may have to wait for a valid enrollment period before you can enroll. You may also have to pay a late enrollment penalty for as long as you have Medicare Part B coverage.

You May Like: Does Medicare Cover Pill Pack

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

How Does Medicare Work With Employer Insurance

More and more people are starting to work past the traditional retirement age of 65 and continue to get healthcare benefits through their employer. When this happens, and they also have Medicare benefits, questions arise. Understanding how Medicare works with your employers health insurance benefits or your spouses job can help you decide if you want to sign up for Medicare when you become eligible or wait.

The first thing you want to think about is whether Medicare will be the primary or secondary payer to your current insurance through your employer. If Medicare is primary, it means that Medicare will pay any health expenses first. Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employers insurance pays first. Medicare covers any remaining costs.

Depending on your employers size, Medicare will work with your employers health insurance coverage in different ways. If your company has 20 employees or less and youre over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage a small group health plan. If your employers insurance covers more than 20 employees, Medicare will pay secondary and call your work-related coverage a Group Health Plan .

Delaying Medicare Coverage

Medicare and COBRA

Related articles:

You May Like: Does Medicare Pay For Cpap Cleaner Machine

When Do You Sign Up For Medicare

-

Starts three months before the month you turn 65

-

Includes the month that you turned 65 or

-

Ends three months after the month that you turn 65.

With Original Medicare, you will be able to go to any doctor, healthcare provider, hospital, or facility that’s enrolled in Medicare and accepts new Medicare patients.

You won’t need to have a primary care doctor to use Original Medicare. You also won’t need a referral to see a specialist. But your specialist must be enrolled in Medicare, just like any primary care doctor you choose.

You won’t need to file Medicare claims. Your healthcare providers will do this for you. This includes your doctors, your hospital, any skilled nursing facilities, or home healthcare agencies that accept Medicare.

How Does Medicare Work If I Have Other Insurance

You may have other insurance besides Medicare, such as:

- Veterans benefits

- COBRA

- Workers compensation

When you have Medicare and other types of coverage, Medicare works with your other insurance to coordinate who pays first. The primary payer is the insurance that pays for your medical bills first, up to the coverage limits, and then sends the remaining balance to the secondary payer. Which type of insurance pays first depends on the type of coverage you have. For a list of possible situations, take a look at this Medicare.gov publication.

If youre still working when youre eligible for Medicare and have group coverage through your work, you may want to consider delaying Medicare Part B . Medicare Part A is usually free if youve worked at least 10 years and paid Medicare taxes otherwise, you may owe a premium for Part A and may want to consider waiting to enroll if you have employer-sponsored coverage. You can sign up for Medicare Part A and/or Part B later through a Special Enrollment Period without paying a late-enrollment penalty once you stop working or that coverage ends.

Talk to your benefits administrator for more information on how your insurance works with Medicare. Never drop your coverage without first fully understanding the consequences you may not be able to get it back.

Also Check: What Is The Yearly Deductible For Medicare

Is Signing Up For Medicare Mandatory

In some cases, yes.

If you have coverage under the Affordable Care Act, COBRA through a past employer or TRICARE for retired military members, youre required to enroll in Medicare when you turn 65.

You may not have to sign up for Medicare right away if youre still working and enrolled in your employers group health plan coverage or if your spouse is still working and youre covered under their plan. But be sure to check with your employer. Some companies will require you to enroll in Part A and Part B and use your employer insurance as secondary coverage.

Be sure youre very clear on the rules. The penalties for late enrollment are steep and, in some cases, can increase your Medicare costs for the rest of your life.

Robin Hartill is a certified financial planner and a senior editor at The Penny Hoarder. Rachel Christian is a senior writer and Certified Educator in Personal Finance.

How Does Medicare Work With My Job

Keep in mind that:

- Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security .

- If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Part A to avoid a tax penalty.

You May Like: What Is The Best And Cheapest Medicare Supplement Insurance

Can I Get Medicare Part A If I Dont Have Enough Credits

If you dont have enough credits, you can still enroll in Medicare Part A, but you may have to pay the Part A premium.

In 2021, the premium for Medicare Part A is $471 each month if you have less than 30 credits and $259 if you have 30 to 39 credits.

Typically, if you choose to buy Part A, you must also enroll in Medicare Part B and pay premiums for both Part A and Part B. In 2021, the standard Part B premium amount is $148.50. You may pay more, though, depending on your current income.

Whether or not you have enough credits for premium-free Medicare Part A, you still have to meet basic Medicare eligibility requirements including:

- being 65 years old or over

- being a U.S. citizen or a permanent legal resident who has lived in the United States for a minimum of 5 years

Can You Get Medicare If You Are Still Working

- Your current employment status is not a factor in whether or not youre eligible for Medicare at age 65.

- If you initially decline Medicare coverage, you may have to pay a penalty if you decide to enroll at a later date.

You can get Medicare if youre still working and meet the Medicare eligibility requirements.

You become eligible for Medicare once you turn 65 years old if youre a U.S. citizen or have been a permanent resident for the past 5 years. You can also enroll in Medicare even if youre covered by an employer medical plan.

Read on to learn more about what to do if youre eligible for Medicare and are still employed.

Don’t Miss: Does Medicare Cover Outpatient Mental Health Services

Medicare Part A Premiums

Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as youre eligible for Social Security or Railroad Retirement Board benefits.

You can also get premium-free Part A coverage even if youre not ready to receive Social Security retirement benefits yet. So, if youre 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

Part A does have a yearly deductible. In 2022, the deductible is $1,556. Youll need to spend this amount before your Part A coverage takes over.

How To Become A Medicare Specialist

Entry-level Medicare specialist jobs require a high school diploma and provide on the job training. Higher level roles as require a bachelors degree in a field such as healthcare administration and experience in the field. Through education or career training programs, you study the basics of the Medicare system, including billing, coding, and enrollment, to gain the skills you need to be successful in this career.

You May Like: How Do I Replace My Medicare Card Online

All Cu Health Plans Qualify For A Medicare Exemption

Employees already covered by any CU Health Plan dont need to enroll in Medicare when they become eligible or during Medicares Open Enrollment.

CU employees and their dependents covered by any CU Health Plan can choose to opt out of Medicare enrollment until they are no longer covered or elect to decline their CU coverage.

Unfortunately, this decision is further complicated by choosing to draw Social Security benefits. Anyone who begins drawing Social Security will be automatically enrolled in Medicare Parts A and B as soon as they reach the age of eligibility with the option to delay only Part B.

Social Security Forces Medicare Enrollment

An employee who elects to begin receiving Social Security benefits will be automatically enrolled in Medicare Parts A and B as soon as they become eligible . They can only delay enrollment in Medicare Part B.

Theres another critical consideration for any employee who maintains a Health Savings Account employees must stop making HSA contributions as soon as they are enrolled in Medicare or face tax penalties. To complicate this matter, enrollment in Medicare Part A coverage is retroactive up to six months before the date you applied, but no earlier than the first of the month in which a person becomes eligible.

Altogether, the decision to enroll in a Medicare plan or to begin drawing Social Security benefits is more complex than it appears. Understanding how Medicare interacts with your current employee benefits is key. To address these essential considerations, Employee Services has developed an information page for active employees who are nearing Medicare eligibility which includes a step-by-step PDF guide and a brief online course.

Employees with additional questions about their CU health plans can reach out to Employee Services at 303-860-4200, option 3.

Read Also: Will Medicare Cover Lasik Surgery

Does Medicare Work With Health Savings Accounts

When enrolled in any Medicare parts, you CANNOT contribute to a Health Savings Account . Your employer also cant contribute to your HSA once your Medicare is active. If you continue to add to your HSA, you could face tax penalties.

If your spouse has coverage on your group insurance, they can still contribute as long as their Medicare is not active. The good news is, you can use the funds in your HSA to pay for any medical expenses.

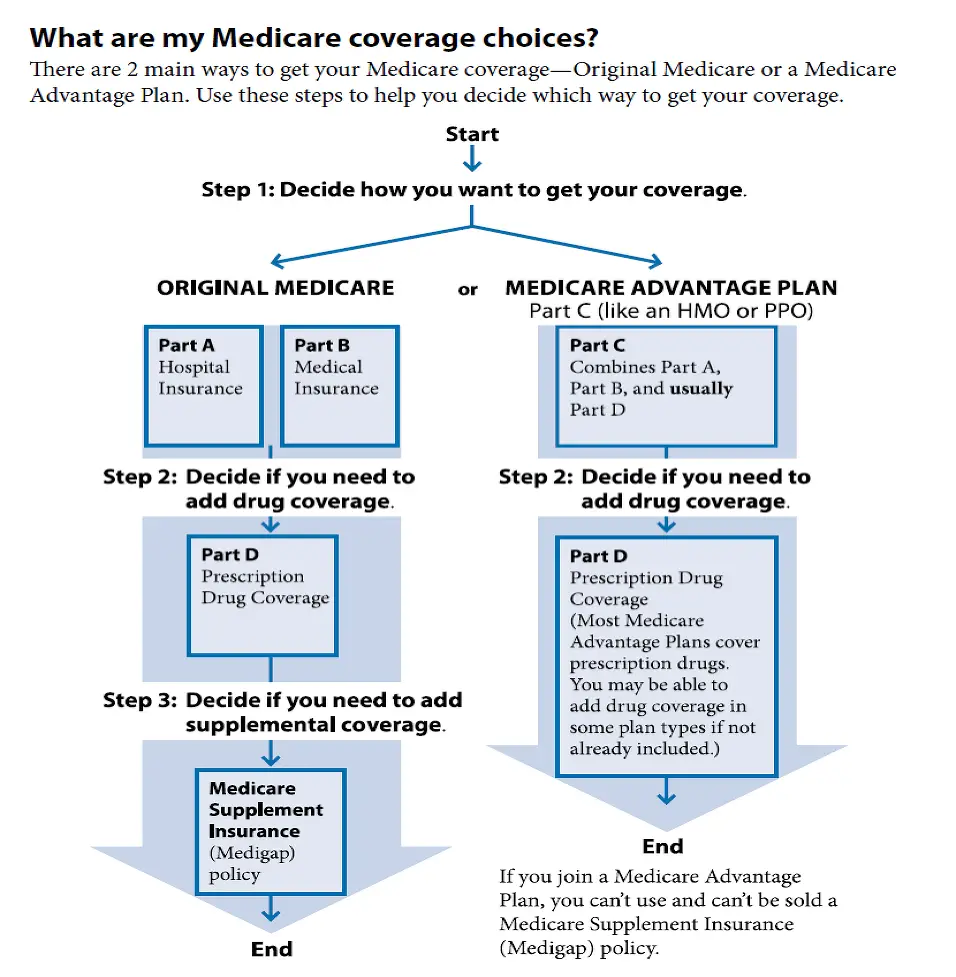

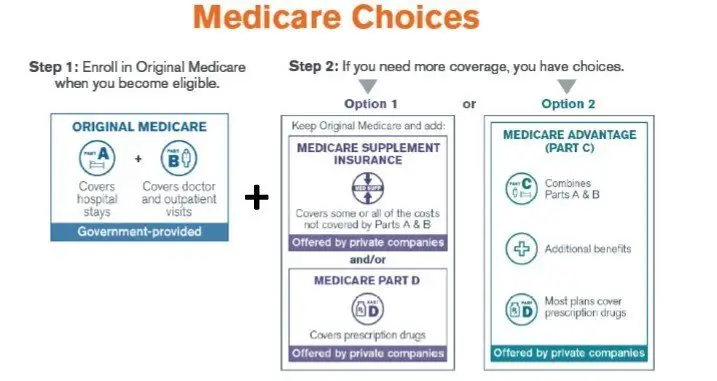

How Does Medicare Work And What Are The Different Parts

Original Medicare, also known as traditional Medicare, includes Part A and Part B. Original Medicare covers hospital stays, doctor visits, durable medical equipment, home health care and other medical services. However, it doesnt cover vision, dental or hearing.

Medicare Part D is optional prescription drug coverage, and serves as a supplement to Original Medicare.

Medicare Part C, better known as Medicare Advantage, is an alternative to Original Medicare. Its provided by federally approved private insurance companies and bundles features of Part A, Part B and usually Part D drug coverage into a single plan.

You can have other insurance, such as employer coverage, and Medicare at the same time. In this situation, Medicare pays first and your other insurance is the secondary payer.

Part A: Hospital Coverage

Medicare Part A is basically hospital insurance. Its premium-free for most Medicare beneficiaries because you paid into it during your working years via those Medicare taxes.

However, Part A isnt completely free. Youll still have Part A deductibles and coinsurance costs.

Medicare Part A covers:

2021 Medicare Part A costs include:

All the costs above are per benefit period. The clock for a benefit period begins when youre admitted to the hospital or a skilled nursing facility as an in-patient. It ends once you havent had any in-patient care for 60 days.

So if you had a 75-day hospitalization, youd pay a $1,484 deductible, plus coinsurance of $5,565 .

Medigap

Recommended Reading: How Much Does Medicare Supplemental Insurance Cost Per Month

If You Work For A Big Company

The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance . At that point, you’d be subject to various deadlines to sign up or else face late-enrollment penalties.

While everyone’s situation is different, there’s a good chance your current insurance through work is a more cost-effective option, said Danielle Roberts, co-founder of insurance firm Boomer Benefits in Fort Worth, Texas.

This may be due to lower premiums and other cost-sharing aspects such as copays or co-insurance, or lower costs for prescriptions under the group plan.

More from Personal Finance:

On the other hand, if you take a specialty drug that is covered by your group plan, it might be wise to continue with it if that drug would be more expensive under Medicare.

Some 65-year-olds with younger spouses also might want to keep their group plan. Unlike your company’s option, your spouse must qualify on their own for Medicare either by reaching age 65 or having a disability if younger than that regardless of your own eligibility.