Applying For A Medicare Supplement Insurance Plan

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you’re both age 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you apply outside of Open Enrollment or Guaranteed Issue periods, you may be denied coverage or charged more based on your health history. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

Scroll for Important Disclosures

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

WB27382ST

What Is A Pre

A pre-existing condition is a health problem that started more than six months before the start of your Medicare policy. For example, if your new plan begins on March 1, 2021, and you had a health problem within the last six months, this is not a pre-existing condition. However, if your doctor treated or diagnosed a health problem more than six months ago, it is a pre-existing condition.

According to CMS.gov, 86% of older Americans, ages 55 to 64, have a pre-existing condition. Because you are very likely to have a pre-existing condition, Medicare says, The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. During this open enrollment period, you can get a Medigap plan without medical underwriting. Thus, Medicare supplement companies can not deny you because of a pre-existing condition.

Plan F Vs Plan G Comparison

We often get questions about Plan F vs Plan G. We compare prices for both Plan F vs Plan G for nearly all new clients.

Quite often, we find that our clients can sometimes save $200 -$300 per year by looking at Plan G options. So what is the difference between Medigap Plan F and G and which is better?

The coverage is very similar to Medicare Supplement Plan F with one minor exception: the Part B deductible. On Plan G, you pay the once-annual Part B deductible yourself. However the premiums can be quite a bit cheaper, and you pocket the savings.

Plan G might help you keep more of your money in your own pocket instead of an insurance companys coffers. We can demonstrate the savings for you get quotes for Plan F vs Plan G today. We can also provide quotes for Medicare Plan N, which is the third most popular Medicare Supplement plan.

Our agency works with about 30 carriers in every state. These include Mutual of Omaha Medicare Supplements, Aetna Medicare Supplements and Cigna Medicare Supplements. All three of these carriers have competitive Plan G rates in 2021. Youll easily learn which insurance carriers offer you the greatest long-term savings and benefits.

Recommended Reading: How To Get Medicare Insurance License

Explore Your Medicare Supplement Options With Healthmarkets

The Medicare Plan F vs. Plan G decision doesnt have to be complicated. HealthMarkets can help you get the right Medicare Supplement plan for your needs. Best of all, this service comes at no cost to you.

We can help you quote and compare various Medicare Supplement plans to figure out which one is the right fit for your needs. After getting your FREE HealthMarkets FitScore®, well continuously compare plans for you, year after year. If an option that better fits your needs becomes available, youll receive an alert, courtesy of our FitScore Forever technology!

Shop once and save again and again. Get your FitScore now.

46533-HM-1020

* The cost of Plan G premiums will vary by state, age, sex, and tobacco use.

First Three Pints Of Blood

Medicare provides coverage for blood needed during a transfusion, but only beginning with the fourth pint. Unless the hospital provides the first three pints of blood for free, the cost of the first three pints are the responsibility of the beneficiary.

Medicare Supplement Plan G provides full coverage of the first three pints of blood.

Read Also: What Does Part B Cover Under Medicare

Why Do Medicare Advantage Plans Cost Less

A big difference between Medicare Advantage and supplemental Medicare insurance is when you pay your healthcare costs. With Medicare Advantage, you pay most of the costs when you use services. With a Medigap plan, you pay most costs in advance.

This causes great confusion for many people and it gets them in trouble. Unlike Medicare Advantage, there are no Medicare supplement plans with no premiums. But, there are also no surprises. Heres why:

- A Medigap plan pays its portion of approved expenses not covered by Medicare, including copayments, coinsurance, and deductibles.

- There is a variety of Medigap plans to meet your needs. Some plans cover all costs allowed by law.

- With a Medigap plan, theres no network, so you can choose any doctor or hospital that accepts Original Medicare.

- A Medigap policy is guaranteed to renew each year .

Plan G Is A Viable Alternative To Plan F

Medigap Plan G provides almost identical coverage as Plan F with one small exception.

Unlike Plan F, Plan G does not cover the Medicare Part B deductible, so youd need to fork over up to $183 once a year for any non-preventative care before the plan takes over paying.

Thats a small trade-off for whats otherwise the exact same coverage.

Read Also: How Much Is Premium For Medicare

Best For Cost And Overall Price Transparency: Aetna

Aetna

-

Highest household discounts

-

Also offers dental, vision, and Part D drug plans

-

Rates available online

-

Cannot enroll online

-

Rates increase based on age

Founded in 1853 as a life insurance company, Aetna entered the healthcare market in 1899. Now a subsidiary of CVS Health Corporation, these two reputable companies work together to bring you a well-rounded healthcare experience. Aetna offers Plan F in 35 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, New York, Washington, Washington DC and Wisconsin. High-Deductible Plan F is also available in 35 states: Alabama, Arizona, Arkansas, California, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia and Wyoming.

Enrolling in Medicare Supplement Plan F is easy and if you also need to plan for the prescription drug plan, it offers many that rate 4 stars or higher on the Medicare Five-Star Rating System. To enroll, you must reach out to a representative by phone. Its rate for Plan F was the lowest we found, starting at $142 per month for a 66-year-old man. Rates may vary based on age, preexisting medical conditions, and where you live.

Medigap Plans 2022 The 3 Most Popular

There can be 12 unique Medigap supplements planspromptly accessible for 2022, however in truth many individuals will try out one of numerous three underneath. Significantly more individuals will join Plan G, in any case, we profoundly propose to show why Medigap Plan N is plausible, your most ideal choice entering 2022 and past which you let.

Others will discover that Plan this is surely high-deductible G well for every one of them yet, the huge deductible is deflected to fulfill. Peruse beneath to see which one might be best for you

Recommended Reading: Does Medicare Cover Bladder Control Pads

How Much Does Medicare Plan F Cost

Costs vary from person to person. The price of a Medicare Plan F policy is determined based on your age, location, gender, and use of tobacco. National averages are around $300 per month, but in many areas, rates start as low as $125 per month. For the high deductible version, you may pay as little as $68. Health insurance companies will be able to help you determine eligibility and costs for the different Medigap policies.

IMPORTANT: Many people try to compare the cost of Medicare supplement insurance plans with a Medicare Advantage plan . The two types of insurance are as different as apples and oranges. With a Medigap plan, you pay for most of your medical services in advance through your monthly premiumsA premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. …. With a Part C plan, you pay most of your costs through copays and coinsurance when you use healthcare services. Both offer comprehensive coverage, but a Medicare supplement gives you peace of mind and helps you plan for your healthcare expenses. If you still have questions about how these plans differ, your insurance agent can walk you through the costs and covered services.

Which Is Better: Medicare Plan F Vs Plan G

No Medicare Supplement plan is better than another. It really depends on your needs and budget. However, as of December 31, 2019, Plan F is no longer available for new enrollment. Here are two things to consider as you evaluate keeping your Medicare Plan F.

You May Like: How Much Do Medicare Plans Cost

Medicare Plan F Vs Plan G: Which Is Better

If you cant get Plan F, because you got your Medicare benefits after 1 January 2020, or youre comparing the cost of Plan F vs. Plan G, heres what you need to know. Theres just one benefit that separates Plan F and Plan G, the annual Medicare Part B deductible. In most cases, a Plan G premium, plus the annual deductible, costs less than a Plan F policy, sometimes as much as $100 or more. You can learn more about Medicare Plan F vs. G in this comparison.

What Is A High

The benefits within the high-deductible Medicare Plan F policy are the same as the standard Part F policy, though you would have to meet the deductible before you can access its health benefits. For 2019, the deductible for the high-deductible Plan F is set at $2,300. If you want to switch from a high-deductible plan back to the standard Plan F, you may need to undergo a medical exam for underwriting.

A high-deductible Medicare Plan F policy could be useful if you are healthier and do not think you’ll need many medical services. However, you should carefully evaluate your own medical situation before committing to the high-deductible plan, as you would be responsible for the entire $2,300 if you incurred a large medical cost.

For example, say you needed to get a colonoscopy, which can cost up to $3,500. Under a standard Medicare parts A and B plan with Medigap Plan F, the first 80% of that bill would be paid for by Medicare Part B. The remaining 20% would be covered by Plan F. You would end up paying nothing in medical expenses under this scenario, but you would pay the monthly premium of $140, which adds up to $1,680 per year.

In this scenario, you would save $500 if you have the high- deductible policy. However, this assumes you have only one medical expense during the year. For most older adults, this would not be the case. You should carefully evaluate your expected medical expenses for the year before selecting the high-deductible version of Medigap Plan F.

You May Like: Must I Take Medicare At 65

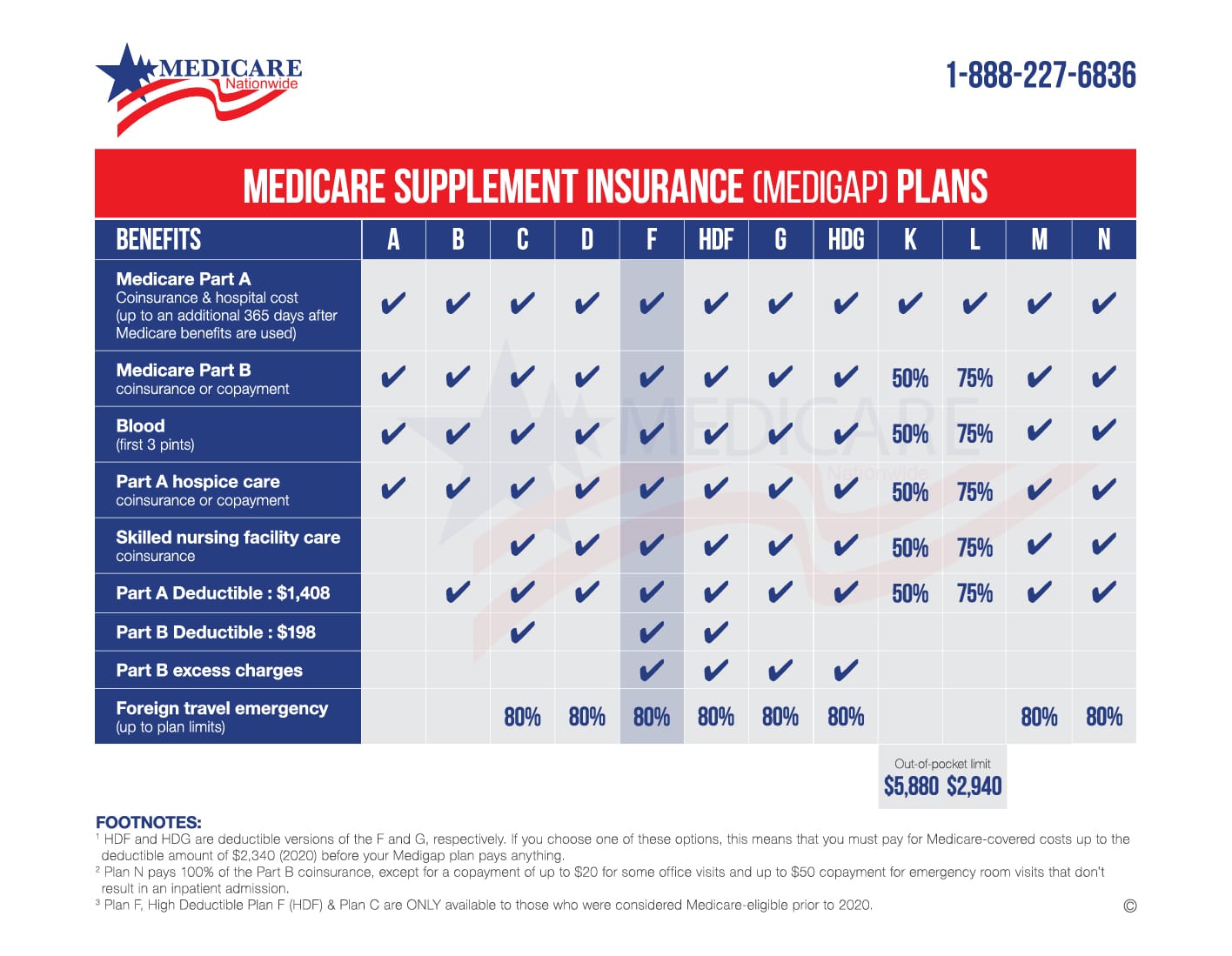

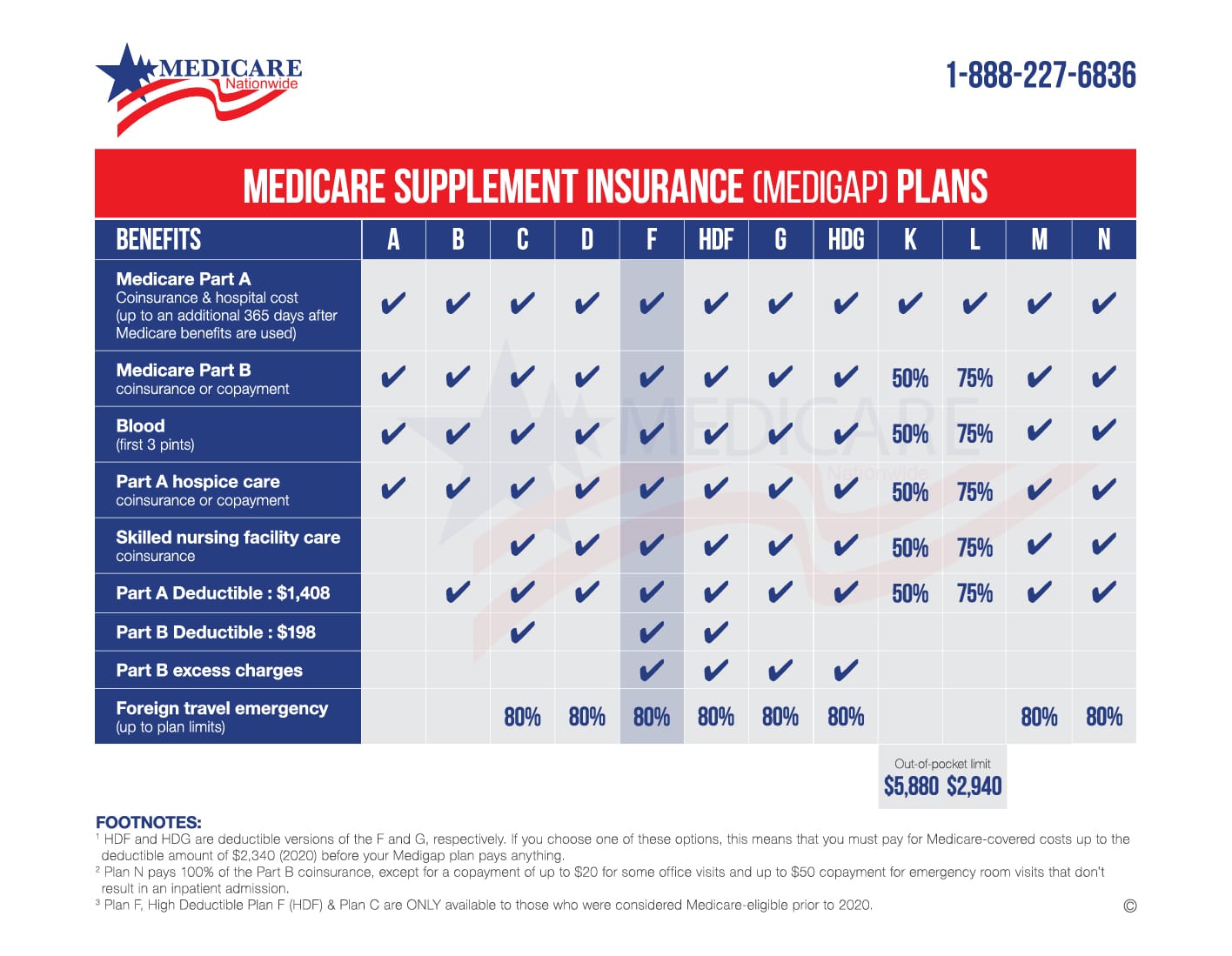

What Do Medicare Supplement Plans Cover

All 10 Medicare Supplement plans offer the following core set of benefits:

- 100 percent of Your Part A Coinsurance There is also an additional 365 days of coverage after your Part A benefits are exhausted.

- Part B Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Your First Three Pints of Blood Each Year Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Part A Hospice Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

Some plans build on these baseline benefits and cover other out-of-pocket costs, such as your Part A and Part B deductibles, Part A skilled nursing facility coinsurance, and Part B excess charges. A few plans even offer a foreign travel emergency benefit that helps cover medical costs if you need care while traveling outside the United States.

What Does Medicare Supplement Plan N Cover

Medicare Supplement Plan N doesnt cover your Part B deductible or Part B excess charges. Otherwise, it has the same benefits as Plan F.

There are additional charges to keep in mind if youre considering Medicare Supplement Plan N. If you buy Plan N, you may have to pay a $20 copayment for certain office visits, and a copayment up to $50 if you go to the emergency room and arent admitted to the hospital as an inpatient.

Read Also: Is Keystone 65 A Medicare Advantage Plan

Best For Ease Of Use: Mutual Of Omaha

Mutual of Omaha

-

Smooth, clean website with easy-to-follow instructions

-

Detailed information not required to get an estimate

-

High percentage increase of monthly premium

Mutual of Omaha gets to the point. All of the different Medicare supplemental insurance coverage options, including Plan F, are listed on the same page when you start your estimate process. All it needs to know is your gender, birth date, and ZIP code before generating an estimate for you. Unfortunately, Mutual of Omaha is recognized as a provider with high premiums and high increases year over year. In most cases, expect to pay a bit more than with other choices.

Best Discounts For People New To Medicare: Aarp By Unitedhealthcare

AARP by UnitedHealthcare

-

New to Medicare Discount

-

Rates do not increase based on age

-

Also offers Part D drug plans

-

No High-Deductible Plan F

-

Requires dues for AARP membership

UnitedHealth Group was founded in 1977 and its insurance arm, UnitedHealthcare, has been in partnership with AARP since 1997. Combining quality healthcare offerings with one of Americas largest advocacy groups for people over 50, AARP by UnitedHealthcare Medicare Supplement Plans are highly ranked. It offers Plan F, but not High-Deductible Plan F, in all states except for Massachusetts, Minnesota, and Wisconsin.

Enrollment in Medicare Supplement Plan F requires AARP membership, which in 2021 is $16 unless signing up for automatic renewal which makes it $12. Membership comes with added perks, including financial planning services, shopping discounts, and more. Once you are a member, you can reach out to UnitedHealthcare to sign up for Plan F and, if you’re interested, one of the company’s highly-rated Medicare Part D plans for prescription drug coverage. Reach out to a representative seven days a week, or chat with an agent online at its website. The site is easy to use and provides a wealth of information about Medicare and Medicare Supplement Plans. The company did not provide a quote to us over the phone because we were not applying for a plan.

Also Check: What Is Blue Cross Blue Shield Medicare Advantage

Choosing Between Plan F And Plan G For Comprehensive Coverage

In almost all situations, Medicare Supplement Plan G is likely more affordable, even when taking the Part B deductible into account. As time goes on and the number of Plan F members decrease , its expected for Plan F premiums to steadily increase.

Take into account, as well, the probability of purchasing Plan G and never needing to pay the Part B deductible simply because your health doesnt require you to have anything but a preventative doctor visit. Youd be saving even more of your hard-earned cash!

When Can I Get Medicare Supplement Plan F

As long as the Part A start date on your Medicare card is before January 1st, 2020, youre eligible to apply for Medicare Supplement Plan F. However, if you currently have a Medicare Advantage plan, you may have to wait for an enrollment period. Unlike Medicare Supplement plans, which you can change at any time during the year, youll most likely have to wait for the Annual Enrollment Period or the Medicare Advantage Open Enrollment Period .

Don’t Miss: What Age Does Medicare Eligibility Start

Top Supplemental Medicare Plans For 2022

Home / FAQs / General Medicare / Top Supplemental Medicare Plans for 2022

Supplemental Medicare coverage isnt one size fits all. With so many options to choose from, we understand shopping around can be stressful and complicated. As your Medicare experts, we want you to help find the best healthcare coverage for you. We put together a list of all the top supplemental plans & carriers for 2022.

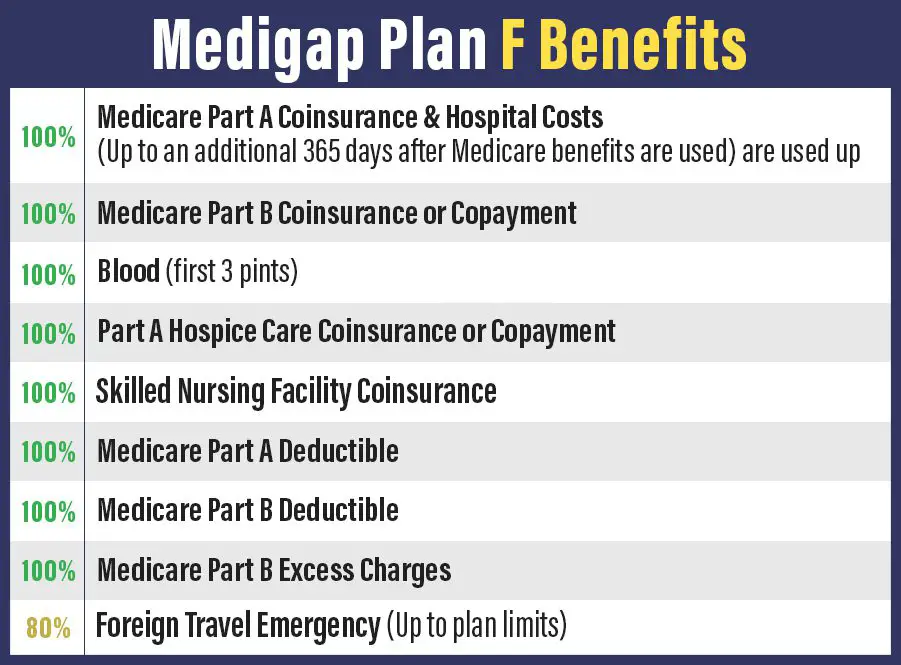

What Does Medicare Supplement Plan F Cover

Medicare Supplement Plan F covers the costs for the services you receive under Original Medicare. Original Medicare is divided into Part A and Part B, and they represent your inpatient and outpatient services. Usually, Original Medicare only pays up to 80% of your bill . Instead of having to pay the remainder out-of-pocket yourself, Plan F pays for you.

Medicare Supplement Plan F coverage includes:

- Medicare Part A coinsurance and hospital costs

- Medicare Part A deductible

- Medicare Part B coinsurance and copayment

- The Medicare Part B deductible

- Blood

Also Check: When Does Medicare Part D Start