What Types Of Services Are Covered Under Medicare Part B

Medicare Part B helps pay for doctors’ services, outpatient hospital care, blood, medical equipment and some home health services. It also pays for other medical services such as lab tests and physical and occupational therapy. Some preventive services such as mammograms and flu shots are also covered. Medicare Part B does NOT cover routine physical exams eye glasses custodial care dental care dentures routine foot care hearing aids orthopedic shoes or cosmetic surgery. It also does not cover most prescription drugs or health care you get while traveling outside the United States .

How Do I Check My Medicare Coverage

Medicare is the federal health insurance program available to seniors of age 65 and older. If you are already enrolled in the program or are newly eligible, you may be wondering if it is possible to check your Medicare coverage and review it.

If so, here are some tips you can follow to ensure that you are enrolled in the right Medicare plan for your specific needs!

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

Recommended Reading: Does Medicare Pay For A Caregiver In The Home

Does Medicare Cover The Costs Of Diabetic Supplies

Yes, Medicare does cover certain supplies if you have diabetes. Part B covered supplies include blood sugar self-testing equipment and supplies, insulin pumps, and therapeutic shoes or inserts. To get Medicare drug coverage, you must join a Medicare prescription drug plan. These plans typically cover insulin, anti-diabetic drugs, and certain diabetes supplies such as syringes and needles. The Medicare Coverage of Diabetes Supplies and Services booklet provides a comprehensive look what diabetes related services are covered.

Coverage Gaps Lead To Higher Health Care Costs

When individuals lose Medicaid coverage, go for a period without health care, and then reenroll, their health care costs are often higher than if they received continuous coverage. A gap in coverage may lead to interruptions in access to Medicaid, therapies, and other medical care. It can also lead to delays in screening, detection, and treatment of cancer.

Delayed or skipped treatment often leads to worsening conditions and greater use of high-cost care. Studies show individuals may only reenroll when they receive expensive hospital care, which often could have been avoided had enrollees coverage and access to care continued without interruption. For example, one study showed that adults with Type 1 diabetes who experience an interruption in coverage used acute care five times more frequently after the interruption than before.

Studies of Medicaid expenditure data have shown higher costs for individuals enrolled for shorter periods of time. An adult enrolled for a full 12 months had estimated average Medicaid costs of $326 per month, while someone enrolled for only one month has average Medicaid costs of $705 per month, data from 2012 showed.

Recommended Reading: Medicaid For Seniors In Nc

Recommended Reading: What Are Some Medicare Advantage Plans

What Are The Ways To Check Your Medicare Coverage Status

- Your account on the SSA website monitors both your SSA and Medicare benefits.

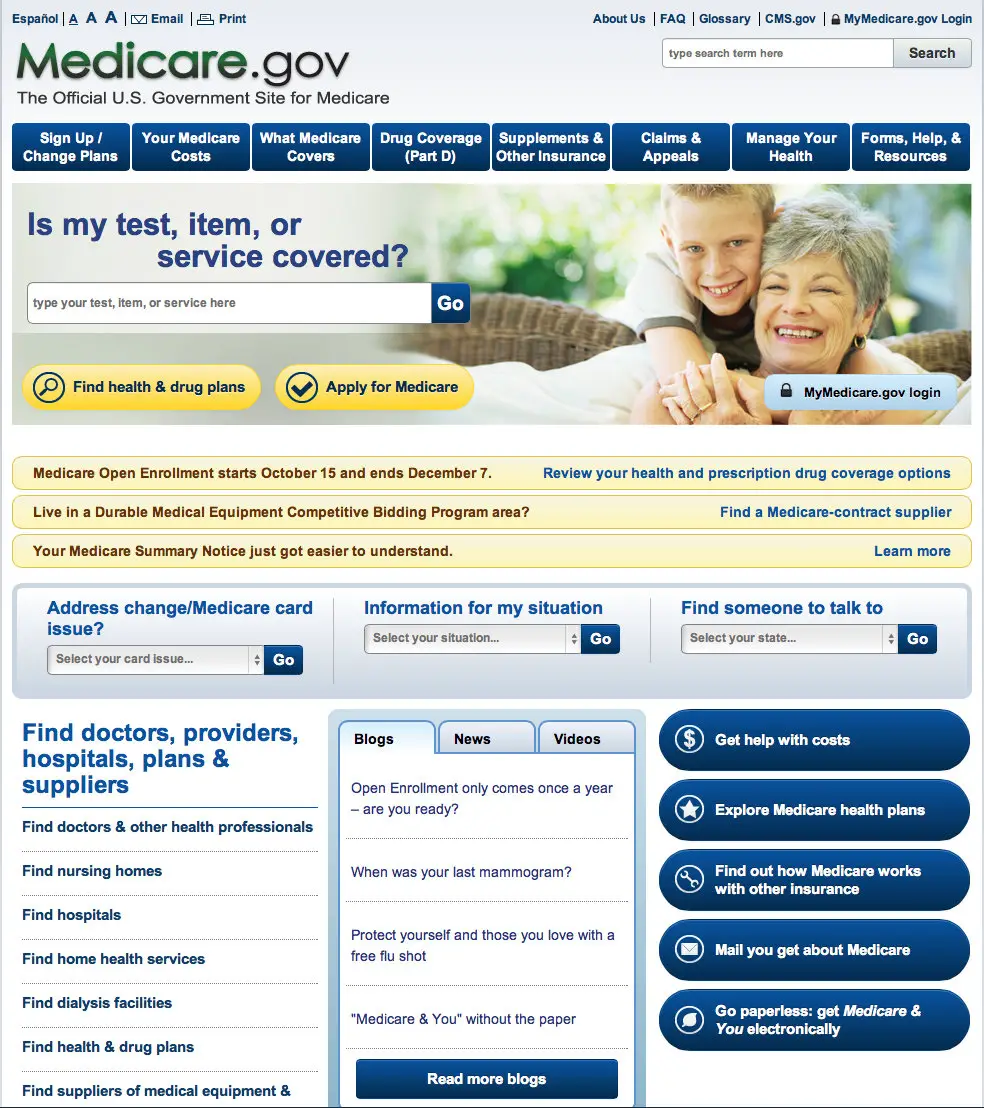

- The easiest and most inclusive way to monitor your Medicare coverage is on the agencys website. To log on to an existing account or create a new account, click the Log in link in the upper right corner of the homepage. Here you can log in to your current account or create a new account by choosing the Create an account now link.

- Chat by going to the Medicare website and choosing Chat in the upper right corner.

- Medicare Advantage, PDP, and Supplement Plans are administered by private health insurance companies that contract with Medicare. You can check your enrollment status by calling the private insurer that administers your plan or logging on to the plan providers website. There you can create a users account and track your coverage, billing, and payment history. The phone number and web address are located on your membership card, or you can do a search in your web browser.

Harness The Power Of A Smart Platform

The best technology in one place for your complete revenue cycle

Waystars award-winning platform empowers health organizations to simplify healthcare payments, all through a single, cloud-based experience. That way, providers can focus on what matters mostcaring for their patients and communities.

A better way forward

You May Like: Is Medicare Advantage Plan Worth It

Who Do I Contact To Change My Name And Address For Medicare Purposes

If you have had a recent name or address change, it will need to be reported to the Social Security Administration. Social Security will notify Medicare of the change when they change their records. Their phone number can be found in the Important Phone Numbers page of this web site. If you are in the Original Medicare Plan, you should also notify the Part B carrier of your new name or address change. The carrier processes your claims for doctor bills and other medical expenses. Check the Important Phone Numbers section of this web site for the phone number of your carrier. If you are in a Medicare managed care plan, you should contact your plan of any name or address changes.

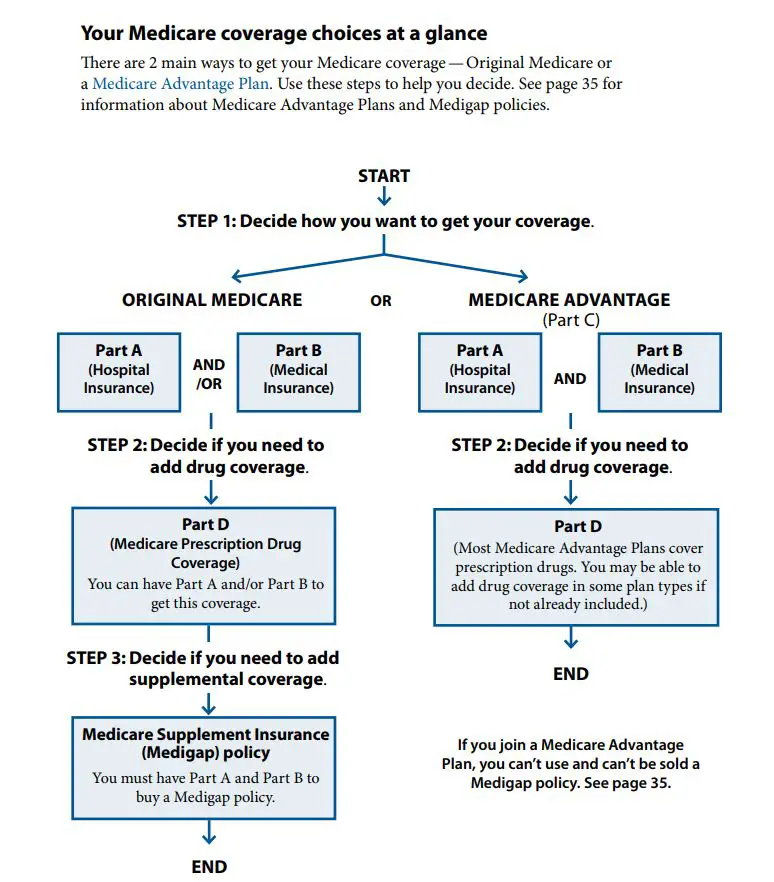

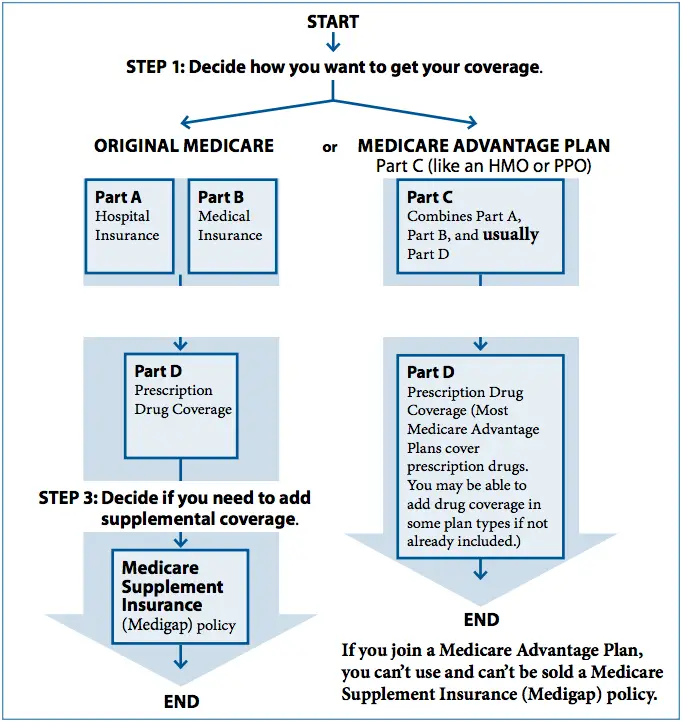

What Is A Medigap Policy

Supplemental insurance policies are sometimes called Medigap plans. Medigap plans are private health insurance policies that cover some of the costs the Original Medicare Plan does not cover. Some Medigap policies willcover services not covered by Medicare such as prescription drugs. Medigap has 10 standard plans called Plan “A” through Plan “J”. Each plan has a different set of benefits. The states of Minnesota, Wisconsin and Massachusetts have choices other than Plan “A” through Plan”J”. Your State Insurance Department can answer questions about the Medigap policies sold in your area. Check the Important Phone Numbers section of this web site for the phone number of your State Insurance Department.

Don’t Miss: Does Medicare Cover Ambulance Transport

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

- Visit the Check Your Enrollment page on Medicare.gov, the official website for Medicare.

- Fill out the requested information, including your zip code, Medicare number, name, date of birth and your effective date for Medicare Part A coverage or Part B coverage.

If you just recently enrolled, it may not be immediately reflected online. You may contact the plan provider directly to confirm your enrollment or check online again at a later date to see if your enrollment status has been updated.

If you are enrolled in Medicare Part A and/or Part B, your Medicare card should detail what Medicare coverage you have, as seen below.

American Hospital Association Disclaimer

The American Hospital Association has not reviewed, and is not responsible for, the completeness or accuracy of any information contained in this material, nor was the AHA or any of its affiliates, involved in the preparation of this material, or the analysis of information provided in the material. The views and/or positions presented in the material do not necessarily represent the views of the AHA. CMS and its products and services are not endorsed by the AHA or any of its affiliates.

Read Also: Does Medicare Pay For In Home Caregivers

Make Changes To Your Medicare Plan Coverage During The Right Time Of Year

One especially useful time to review your Medicare coverage is during the fall Annual Enrollment Period, or AEP.

The Medicare AEP lasts from every year. During this time, Medicare beneficiaries may do any of the following:

- Change from Original Medicare to a Medicare Advantage plan

- Change from Medicare Advantage back to Original Medicare

- Switch from one Medicare Advantage plan to another

- Enroll in or drop Medicare Part D coverage

- Switch from one Part D plan to another

Outside of AEP, your opportunities to make changes to your Medicare plan can be limited.

Another time you may be able to change your Medicare plan include:

- Special Enrollment Periods You could potentially qualify for a Special Enrollment Period at any time throughout the year, if you meet one of a set of certain circumstances. This can include moving out of the area serviced by your current plan, losing your current plan because it is no longer offered in your area, and a number of other certain circumstances.

Medicare Eligibility Verification Made Easy

The success of your healthcare organizations Medicare claims begins with eligibility verification. Trust Waystar, the Medicare experts, to prevent eligibility-related rejections and denials.

Thanks to Waystars real-time unique connection to Medicare, healthcare providers get comprehensive patient data in one quick step and within seconds. This includes patient personal information like name, birth date, gender and Medicare Beneficiary Identifier .

Youll also get Medicare coverage data, like type of coverage, Medicare Advantage plan details, deductible, preventative services, days information, Medicare Secondary Payer insurance, home health sessions and hospice periods.

Our Medicare Eligibility solution automates, simplifies and integrates Medicare eligibility directly into your daily workflow.

Fill out the form to learn more about Medicare Eligibility from Waystar.

“We couldnt believe what wed been missing out on all this time! Waystars eligibility verification has been a great resource for us. Its slashed the time spent checking eligibility in half.” Kim Kuebler // Medicare Billing Supervisor/Manager // Hospice of Cincinnati

Don’t Miss: What Are The Four Different Parts Of Medicare

Medicare When Your Non

Youll need to make some decisions about Medicare when you become eligible, whether or not you continue working past age 65.

Either way, your spouse will need health insurance until he or she is also eligible for Medicare. Here are some of the options:

- Your spouse may continue coverage through your employer plan if you keep working and keep the employer coverage.

- Your employer may offer COBRA coverage for your spouse if you retire.

- Your spouse may choose to buy individual health insurance until he or she turns 65.

Your employer benefits manager can help you and your spouse understand your choices.

If I Keep My Work Insurance Do I Need To Enroll In Medicare

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Part A: For most people, Part A does not charge a premium. Typically, Part A pays after your work insurance. Part A probably wont pay much of the bill, but doesnt cost anything to have. For that reason, most individuals enroll in Part A at age 65.

Part B: Everyone pays a monthly premium for Part B. Part B typically pays after your work coverage and may not pick up much of the bill. Enrolling in Part B will also start your one-time guarantee to purchase a Medicare Supplement. Once this 6-month time frame starts, it cannot be stopped. For these two reasons, most people wait until their work coverage ends to enroll in Part B.

Part D: Everyone pays a monthly premium for Part D. As long as you have other “creditable coverage,” you do not have to enroll in a Part D plan. Creditable coverage means the insurance is as good as, or better than, a standard Part D plan. Check with your HR department to verify if your policy is creditable coverage. Typically, prescription insurance through work offers better coverage than what you can get through Medicare. For this reason, most people wait until their work coverage ends to enroll in Part D.

Recommended Reading: How Can Medicare Advantage Be Free

Want To Learn More About Tricare For Life

Check out the new TRICARE For Life 101 podcast series. The new series helps retired service members or their eligible family members who will turn 65 soon understand their TRICARE For Life benefits. The series covers a number of topics, from an overview of basics, to how TFL and Medicare interact, and more! > > Learn more

Are you looking to see what tests, items, or services Medicare covers? > > Learn more.

Want to order a hard copy of the TRICARE For Life Handbook? Call Wisconsin Physicians Service at 1-866-773-0404.

How To Check Your Medicare Application Online

If you applied for Medicare online, you can check the status of your application through your Medicare or Social Security account. You can also visit the Check Enrollment page on Medicare.gov and find information about your enrollment status by entering your:

- Medicare Part A effective date

You can also check the status of your application by visiting or calling a Social Security office.

You can ask your pharmacy to check the status of your Medicare Part D enrollment by sending a test claim.

You can also call the Member Services department of your Medicare Part D plan.

Read Also: Will Medicare Part B Pay For Shingrix

When Does My Coverage Start

When and how you enroll for a Medicare plan impacts when your coverage begins. Your benefits may not start until three months after you apply.

If you have not received an acceptance letter 45 to 90 days after submitting your application, call the Social Security Administration or check online. You will need your Medicare application number to do so.

Once your coverage begins, you do not need to reapply each year for Medicare benefits.

However, you will have an opportunity to change plans or adjust your coverage during the Medicare open enrollment period, which runs from Oct. 15 to Dec. 7 each year.

Annual Enrollment Ends December 7thends tomorrow

Deductibles Copays And Coinsurance

Original Medicare has an annual deductible that in the calendar year 2020 was set at $1,408 for Part A and $198 for Part B. Each Medicare Advantage plan has its list of consumer paid expenses. They include deductibles, copays, coinsurance, and cost-sharing.

These expenses are part of the coverage provided by Medicare or Medicare Advantage.

Comparison shopping is a powerful tool for finding the best value in health insurance plans. Consumers can focus on particular features such as out-of-pocket expenses to find the best choice.

Read Also: How To Replace Medicare Card If Lost

Do I Have To Pay An Enrollment Fee

No. You don’t pay any enrollment fees, but you must pay Medicare Part B monthly premiums. Your Part B premium is based on your income.

For more information about Part B premiums:

Will I Have Any Out-of-Pocket Costs?

|

TYPE OF SERVICE |

|---|

|

Billed charges |

To learn more about what TRICARE covers, click here.To learn more about what Medicare covers, click here.

How To Check My Medicare Application

How to check your Medicare application online. If you applied for Medicare online, you can check the status of your application through your Medicare or Social Security account. You can also visit the Check Enrollment page on Medicare.gov and find information about your enrollment status by entering your: ZIP code. Medicare number.

Don’t Miss: Does Medicare Cover Hearing Exams

How To Set Up A Mymedicaregov Account

Setting up a MyMedicare.gov account is easy and free. Simply follow these steps:

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

You May Like: Who Has The Best Medicare Supplement

Can I Get Medicare Or Medicaid While Receiving Social Security Disability Payments

After being approved for disability benefits, whether you receive Medicaid or Medicare will depend on whether youre also getting SSI or SSDI benefits. Those who qualify for Supplemental Security Income are eligible for Medicaid, while those who receive Social Security Disability Insurance qualify for Medicare. However, SSD recipients wont receive medical benefits from Medicare until two years after their application has been approved. Those who receive SSI dont have to wait before receiving Medicaid. Lets take a closer look at SSI, SSDI, and Medicare/Medicaid.

You May Like: Dentist In Ashland Ky That Take Medicaid