Does Owning A Home Affect Medicare

Medicare, as a rule, does not cover long-term care settings. So, Medicare in general presents no challenge to your clear home title. … If you are likely to return home after a period of care, or your spouse or dependents live in the home, the state generally cannot take your home in order to recover payments.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

My Spouse And I Are Thinking Of Moving Out Of California Can We Keep Our Uc Plan

Theres a lot to think about if youre considering a move including what it might mean for your health insurance coverage. Its a good idea to talk to someone before you move.

If you and everyone you cover with UC insurance are in Medicare and you move to another U.S. state, youll transition to the Medicare Coordinator Program, administered by Via Benefits. You wont have the option to stay in your UC Medicare plan. Through the Medicare Coordinator Program, licensed Via Benefits advisors work with eligible UC retirees to find the Medicare medical and prescription drug plans available where they live that work best for them. These plans are not affiliated with UC.

Your enrollment in an individual medical plan through Via Benefits is paired with a Health Reimbursement Account , with a maximum annual contribution from UC of $3,000 per person. In many cases, the HRA funds provided by UC will cover the cost of the premiums as well as some additional out-of-pocket health care costs . Any costs above $3,000 are the enrollees responsibility and subject to the plans out-of-pocket limits.

Retirees must enroll through Via Benefits if all conditions below apply:

- You have a non-California home address on file

- You are eligible for UC retiree health insurance and receive a monthly retirement benefit

- All family members you cover by UC health insurance are at least 65 years old and eligible for Medicare.

Also Check: Does Medicare Pay For Breast Reconstruction

Ways To Battle High Drug Costs

A few programs can help cover the costs of your prescription drugs or even plan premiums. The Low-income Subsidy program or Extra Help is a federal plan based on income. This program can help lower or remove costs associated with deductibles, copays, coinsurance, premiums, and even the Part D penalty.

You can also check with your State Pharmaceutical Assistance Program for additional assistance.

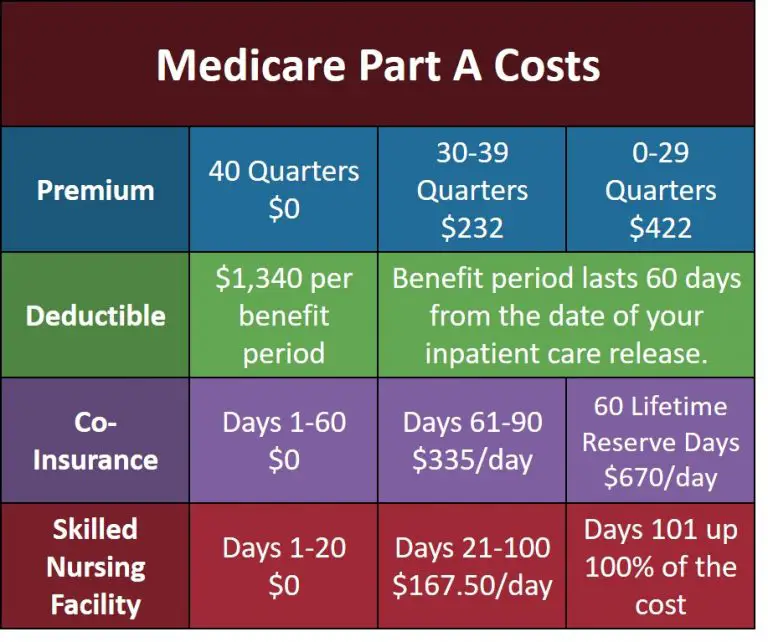

What Is The Medicare Part A Deductible

Whether you pay for Part A premiums or not, you still may have some out-of-pocket costs. Youll have to pay a hospital deductible of $1,556 for each benefit period youre hospitalized in 2022.

Its not an annual deductible like youve probably encountered with private insurance. This benefit period begins when you are admitted to a hospital or a skilled nursing facility as an inpatient and ends when youve been out of the hospital or skilled nursing facility for 60 days in a row.

You pay a single deductible even if you have more than one hospital stay during a benefit period. But if you are out of the hospital for 60 days and then have to go back in, you could pay more than one deductible during a calendar year.

Recommended Reading: Does Social Security Automatically Sign You Up For Medicare

How Do You Receive The Part B Giveback

Medicare recipients can deduct Part B of their Social Security income. Beneficiaries that aren’t covered by Social Security can receive direct payment for the Part B premiums they received.

It can be used by anyone in either the case that the Social Security benefit is not being paid out or the benefits are reduced. If you pay the premium directly to Medicare you will pay a lesser rate.

How To Find Plans That Offer The Giveback Benefit

Not everyone MA Plan offers that benefit, and you have to look for an alternative plan that can provide savings. To apply for MA plans, one must be in service zone. It may be limited by your options or you can no longer get reduced plans at your location.

You can use Medicare Planfinder to look up plans in your region offering giving back benefits. Under “premiums”, plan details have a “part B premium reduction”. The plan details what it offers and also what the monthly fee will cost.

Recommended Reading: Does Medicare Cover Adult Daycare

Im A Retiree Under Age 65 Since Im Not Yet Eligible For Medicare Im Enrolled In A Uc Non

If youre a retiree and covered by a UC medical plan, UC will send you a Medicare information packet with enrollment instructions three months before your 65th birthday. The same is true for anyone you cover who is about to turn 65. In general, Medicare and UC require enrollment at age 65. You need to enroll in Medicare Part A and B. Medicare Part D enrollment will be handled by your plan, except for the plan without prescription drug coverage.

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19ârelated hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19ârelated services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Also Check: Can You Get Medicare Early

What Are The 4 Parts Of Medicare

The four parts of Medicare include the following:

- Part A is insurance for the costs of hospitalization and hospital treatment. Most eligible seniors get this for free.

- Part B is optional and covers medically necessary outpatient services and care. This has a monthly premium of $170.10 for most individuals as of 2022.

- Part C is also called a Medicare Advantage Plan. This is for people who want a private insurance company to administer all of their Medicare services. You can choose your own provider, and you have the option to pay for services above and beyond Medicare coverage.

- Part D is optional coverage for prescription medicine and is available from private insurance companies. If you have a Medicare Advantage Plan you can add Part D coverage to it. Or, you can buy it separately.

The Medicare site has a search function to help people find a Part C or a Part D plan.

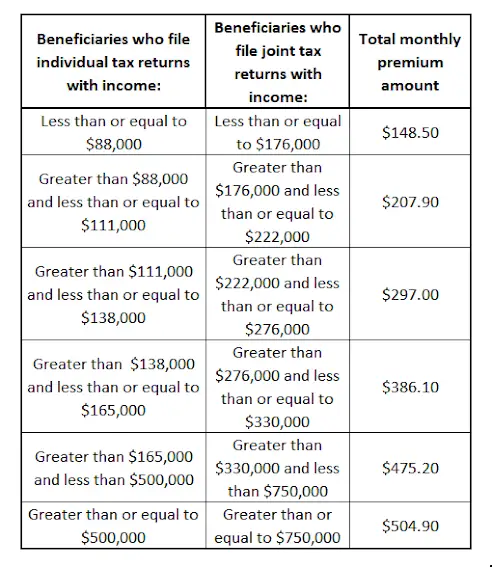

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Recommended Reading: Can I Enroll In Medicare Online

How Much Does Medicare Part B Cost

The standard cost for Medicare Part B is $170.10 per month for an individual in 2022. Individuals who earn above $91,000 pay more. The sliding scale goes from $238.10 per month to $578.30.

The average annual deductible cost for Medicare Part B coverage will be $233 in 2022.

The monthly cost of Medicare Part B depends on your income reported two years ago, and is adjusted based on tax filing status.

Cdc Shingles Vaccine Recommendations

The Centers for Disease Control and Prevention recommends Shingrix vaccination for anyone 50 years and older, even if you have already had shingles, if you had another type of shingles vaccine, and if you dont know whether or not youve had chickenpox in the past.

You should not get the vaccine if you are allergic to any of the components, are pregnant or breastfeeding, currently have shingles, or you have lab tests that definitively show that you do not have antibodies against the varicella-zoster virus. In that case, you may be better off getting the varicella vaccine instead.

Recommended Reading: Can I Sign Up For Medicare Before Age 65

Is Medicare Part A Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What Assets Are Exempt From Medicare

Exempt assets include one’s primary home, given the Medicaid applicant, or their spouse, lives in it. Some states allow an applicant’s intent to return home to qualify it as an exempt asset. There is also a home equity interest limit for exemption purposes if a non-applicant spouse does not live in the home.

Don’t Miss: What Medicare Plans Cover Silver Sneakers

What Are Other Differences Between Ucs Medicare Plans And How Do I Choose Whats Best For Me

Kaiser Permanente Senior Advantage is a Medicare Advantage Health Maintenance Organization plan with a closed network of providers. This is a good fit if you want lower out-of-pocket costs, like having one doctor manage your care, and if you are comfortable with out-of-network coverage only in emergencies.

UC Medicare Choice is a Medicare Advantage Preferred Provider Organization plan that offers access to any provider, in-network or out-of-network, at the same cost to you . Because this is a Medicare Advantage plan, your physician may need prior authorization from UnitedHealthcare for some services. This is a good fit for those who want lower premium and out-of-pocket costs and want the flexibility to see providers both in and out-of-network for the same out-of-pocket costs.

UC High Option Supplement to Medicare , is a Medicare Supplement PPO plan. It usually has the highest premium of UC’s plans, because it covers 100% of the cost for Medicare-covered services .

UC Medicare PPO is also a Medicare Supplement PPO plan. Its a best fit if you want direct access to Medicare providers without need for referrals and you are willing to pay variable costs per service .

UC Medicare PPO without Prescription Drugs is offered to those who have Medicare-coordinated health insurance that covers prescription drugs through a non-UC plan . It is similar to the UC Medicare PPO, except your Part D coverage comes from another plan. You must provide proof of your Part D coverage to enroll.

How Much Does Medicare Part D Cost

What it helps cover:

- helps cover prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by Part D plans, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

You May Like: How Does United Medicare Advisors Make Money

Why Do Some People Pay Less For Their Medicare Part B Premium

Some people who get Social Security benefits will still pay less than $170.10 in 2022. This affects around 2 million Medicare beneficiaries. Legislation prevents the cost of Medicare Part B from increasing more than the Social Security annual cost-of-living increase.

In recent years, we have had low COLA increases, so these individuals have only been paying less than the standard base Part B premium. Though the Social Security COLA increases for the last couple of years have been somewhat larger, there is still a small group of beneficiaries being protected by the hold harmless provision.

Though this all very confusing, remember that you do not have to calculate this yourself. Again, Social Security will determine your Part B premium for 2022 and notify you by mail if you exceed the Medicare income limits and must pay a higher adjusted amount.

Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2022, the Part B premium is $170.10.

You can also request your Part D premium be deducted from your Social Security check.

Most People Pay the Standard Part B Premium

Youll pay the standard Medicare Part B premium amount if:

Enrolling In Medicare Part B If You Are 65 Or Older Still Working And Have Insurance From That Job

You are not required to take Part B during your Initial Enrollment Period if you are still working or your spouse is still working and one of you has coverage as a result of that current work. You should only delay Part B if this current employer insurance is the primary payer on your health care expenses . You should talk to your employer when you become eligible for Medicare to see how employer insurance will work with Medicare. Generally, if you are eligible for Medicare because you are over 65, the employer must have more than 20 employees to be the primary payer. If you are eligible for Medicare because you get SSDI, the employer must have more than 100 employees to be the primary payer.

If there are fewer than 20 employees at the company where you currently work or your spouse currently works, Medicare is your primary coverage. In this case, you should not delay enrollment into Part B. If you decline Part B, you will have noprimary insurance, which is usually like having no insurance at all.

In either case, if you have insurance from a current employer, you qualify for aSpecial Enrollment Period . During this period, you can enroll in Part B without penalty at any time while you or your spouse is still working and for up to eight months after you lose employer coverage, switch to retiree coverage, or stop working.

Recommended Reading: Do Medicare Advantage Plans Cover Home Health Care

How Can Medicare Part C Plan Have A $0 Premium

Medicare Advantage programs with a zero cost premium are rare. According to the Kaiser Family Foundation, 93 percent of Medicare recipients will get zero-prime plans by 2019. What’d happen if there was no premium? This is an important question.

Then it’s up to you to understand why the benefits are not free, despite having paid zero premiums on Medicare Advantage plans. Part C still requires a Part A deductible copayment and coinsurance.

Skilled Nursing And Hospice Care

Medicare Part A covers the full cost of hospice care, but there are specific coinsurance costs for skilled nursing care services.

In 2022, these costs are:

- $0 coinsurance for days 1 through 20 for each benefit period

- $194.50 daily coinsurance for days 21 through 100 for each benefit period

- all costs for days 101 and beyond in each benefit period

Again, a benefit period resets after youve been discharged for 60 days or you begin inpatient care for a new diagnosis or condition.

Read Also: Does Medicare Advantage Cover Annual Physicals

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

How Do I Sign Up For Part A

In most cases, youll be automatically enrolled in Medicare Part A. Youre automatically enrolled in original Medicare which is made up of parts A and B starting on the first day of the month you turn 65 years old.

If youre under age 65 and receiving Social Security or RRB disability benefits, youll automatically be enrolled in Medicare Part A when youve been receiving the disability benefits for 24 months.

If youre not automatically enrolled, you can through the Social Security Administration.

You May Like: Do You Have To Get Medicare At 65

Hospital Copays For Medicare Part A

Hospital copays are determined by the number of days youre in the hospital, and when you exceed 90 days, you begin to use your lifetime reserve days. These are a set number of covered hospital days you can use if youre in the hospital for more than 90 days in a single benefit period. You have 60 lifetime reserve days, and once you use them, theyre gone.

Copay per days in the hospital| Number of Days in Hospital | Part A Copay |

|---|

How Does The Health Insurance Marketplace Affect Medicare

The health insurance marketplace is a way for people who don’t have health insurance to get coverage. The marketplace is part of the Affordable Care Act. Here are some important things to know:

- If you have Medicare, the insurance marketplace doesn’t affect your coverage.

- It’s illegal for anyone to try to sell you a health insurance plan if they know you have Medicare.

- If you aren’t yet eligible for Medicare, you can seek insurance through the marketplace.

- If you are eligible for Medicare but aren’t yet enrolled, you can get a marketplace plan to cover you before you go on Medicare. Your marketplace plan would stop when Medicare starts. You can’t have Medicare and a marketplace plan at the same time.

You May Like: When To Sign Up For Medicare For First Time