How Did Medicare Supplement Insurance Change In 2022

Medicare Supplement Insurance, or Medigap, helps pay for certain Part A and Part B out-of-pocket expenses, such as deductibles, coinsurance and copayment.

As of 2020, Medigap Plan C and Plan F will no longer be sold to new Medicare beneficiaries.

If you became eligible for Medicare before January 1, 2020, you may still be able to buy Medigap Plan F or Plan C if either is available where you live. If you already have either plan, you can keep it.

How Much Are Medicare Premiums In 2021

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket even by just $1 you are moved to the next tier and will have to pay the higher premium.

Heres a table with the 2021 numbers.

| Individual Taxable Income | Joint Taxable Income | 2021 Monthly Part B IRMAA Premium |

| $88,000 or less | ||

|

$504.90 |

Hold Harmless Provision

What is the hold harmless rule? It ensures that if youre receiving Social Security retirement benefits, the amount of your check wont decline from one year to the next.

Medicare Part B premiums are deducted from Social Security checks, and Social Security benefit amounts are adjusted annually by the cost-of-living adjustment . As long as the COLA is enough to cover the full amount of the Part B premium increase for that year, the full amount of the premium increase can be applied the beneficiarys net Social Security benefit amount wont decrease.

But if the Part B premium increase would be more than the beneficiarys COLA amount, the full amount of the Part B premium increase cant be applied, because that would result in a year-over-year decrease in their Social Security check. The hold harmless provision doesnt apply to people who have to pay the IRMAA surcharge, however, even if theyre receiving Social Security benefits.

Understanding Medicare Part B Premiums

Medicare is a U.S. federal health program that is divided into two main parts, A and B. Part A covers a large portion of hospital-related costs for eligible people age 65 and over and only includes medically necessary and skilled care, not custodial care. It can include hospital stays, hospice, and skilled nursing facilities.

Part B is optional and pays a portion of nonhospital-provided medical care, such as doctor visits and other outpatient services. Part B also covers preventive services, ambulance services, mental health costs, and durable medical equipment.

There is a monthly fee for this program the premium depends on your modified adjusted gross income as reported on your federal tax return from two years ago. So, for example, you would use your 2019 income to determine your 2021 premiums.

| Medicare Part B Costs for 2021 |

|---|

| Individuals |

| $504.90 |

Part B coverage has a deductible of $203 in 2021. After you meet the deductible, you typically pay 20% of the Medicare-approved amount for covered services. This is known as coinsurance. Medicare helps individuals when they may have serious health problems but lack funding for treatment.

Read Also: Does Medicare Pay For Cancer Drugs

Medicare Part B Premiums

Medicare Part B premiums are calculated based on a persons modified adjusted gross income . For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds earnings.

Current year Medicare Part B premiums are based on MAGI reported on your tax return from two years earlier. For example, 2021 Medicare Part B premiums are based on MAGI reported on 2019 federal tax returns.

| Medicare Part B Premiums | |

|---|---|

| More than $412,000 | $504.90 |

Beginning in 2007, Medicare began charging higher-income beneficiaries more for their Part B coverage. This charge is called the Income-Related Monthly Adjustment Amount . Medicare Part D, which provides insurance coverage for prescription drug costs, also charges a monthly premium that is based on an IRMAA.

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Recommended Reading: What Is The Annual Deductible For Medicare

How Much Are Part B Irmaa Premiums

If an individual makes $88,000 or more or a jointly filing household makes $176,000 or more then the IRMAA assessment increases the 2021 Part B premium to the amounts shows in Table 1.

| Table 1. Part B 2021 IRMAA |

|---|

| Individual |

Source: CMS

This level has risen from 2019, when the income requirements were $85,000 and $170,000 respectively. 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation . For 2022, the lower threshold for IRMAA surcharges is projected to be $91,000 and $182,000, respectively.

How Does Medicare Determine Your Income

Original Medicare is two-fold, comprised of Part A and Part B . They differ not only in the Medicare benefits covered but also in how the premiums are determined.

Part A premium based on credits earned

Most people eligible for Part A have premium-free coverage. The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program. Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium. A sliding scale is used to determine premiums for those who work less than 40 quarters. In 2020, this equates to $252 per month for 30 to 39 quarters and $458 per month for less than 30 quarters.

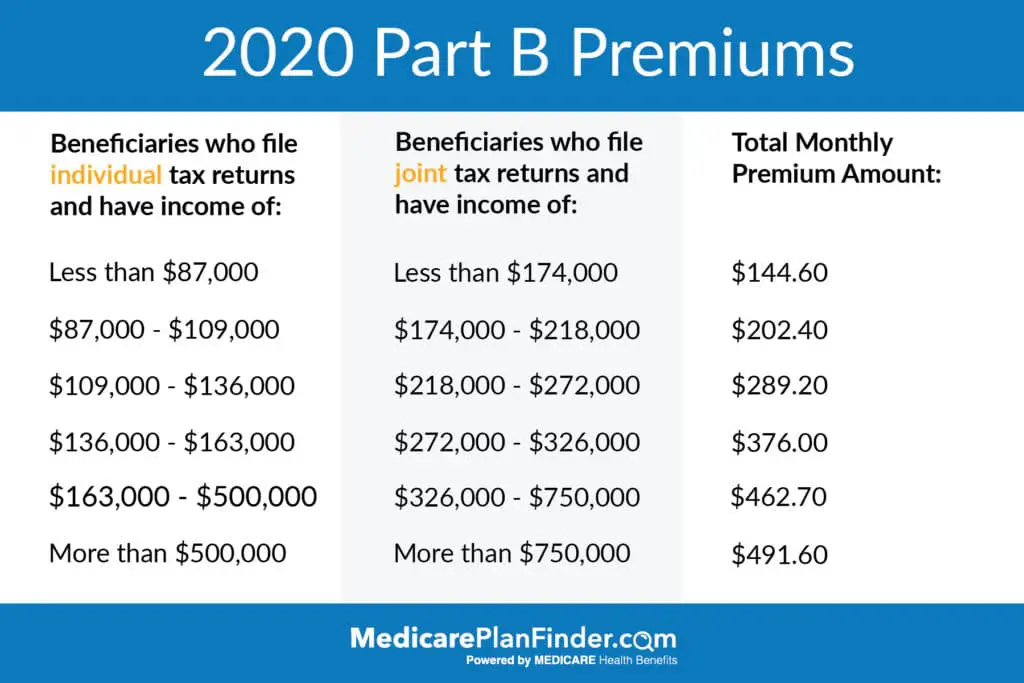

Part B premium based on annual income

The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium. Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40. As your income rises, so too does the premium amount until a certain level of income is exceeded based on tax return filing status. At that level, the monthly premium is set at $491.60. The amounts are reevaluated by Medicare annually and may change from year to year. Any amount charged above the standard premium is known as an income-related monthly adjustment amount .

Related articles:

Also Check: How Long Does It Take To Get Medicare B

I Am About To Turn 65 And Go On Medicare And My Income Is $120000 I Know That People With Higher Incomes Are Required To Pay Higher Premiums For Medicare Part B And Part D How Will These Higher Premiums Affect Me

Medicare beneficiaries with incomes above $88,000 for individuals and $176,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return. To determine your 2021 income-related premium, Social Security will use information from your tax return filed in 2020 for tax year 2019. If your income has gone down since you filed your tax return, you should contact Social Security and provide documentation regarding this change. At your current income level, in 2021, you would pay just over $4,300 in annual Medicare premiums combined for Part B and Part D .

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $148.50 for Part B premiums in 2021. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2021 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2021 is $203.

Also Check: How Much Do Medicare Supplements Increase Each Year

Officials Say Substantial Social Security Cola Will More Than Offset The Monthly Hike

by Dena Bunis, AARP, November 12, 2021

designer491 / Alamy Stock Photo

Medicare’s Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program’s history, the Centers for Medicare & Medicaid Services announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase:

CMS officials stressed that while the 14.5 percent Part B premium increase is a stiff one, the Social Security cost-of-living adjustment at 5.9 percent, the largest in 30 years – is estimated to average $71.40 per recipient. So even after the increase in the Medicare Part B premium, most Social Security recipients, whose Part B premiums are typically deducted from their Social Security benefits, will still see a net increase in their monthly check. The COLA goes into effect in January.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Join today and get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

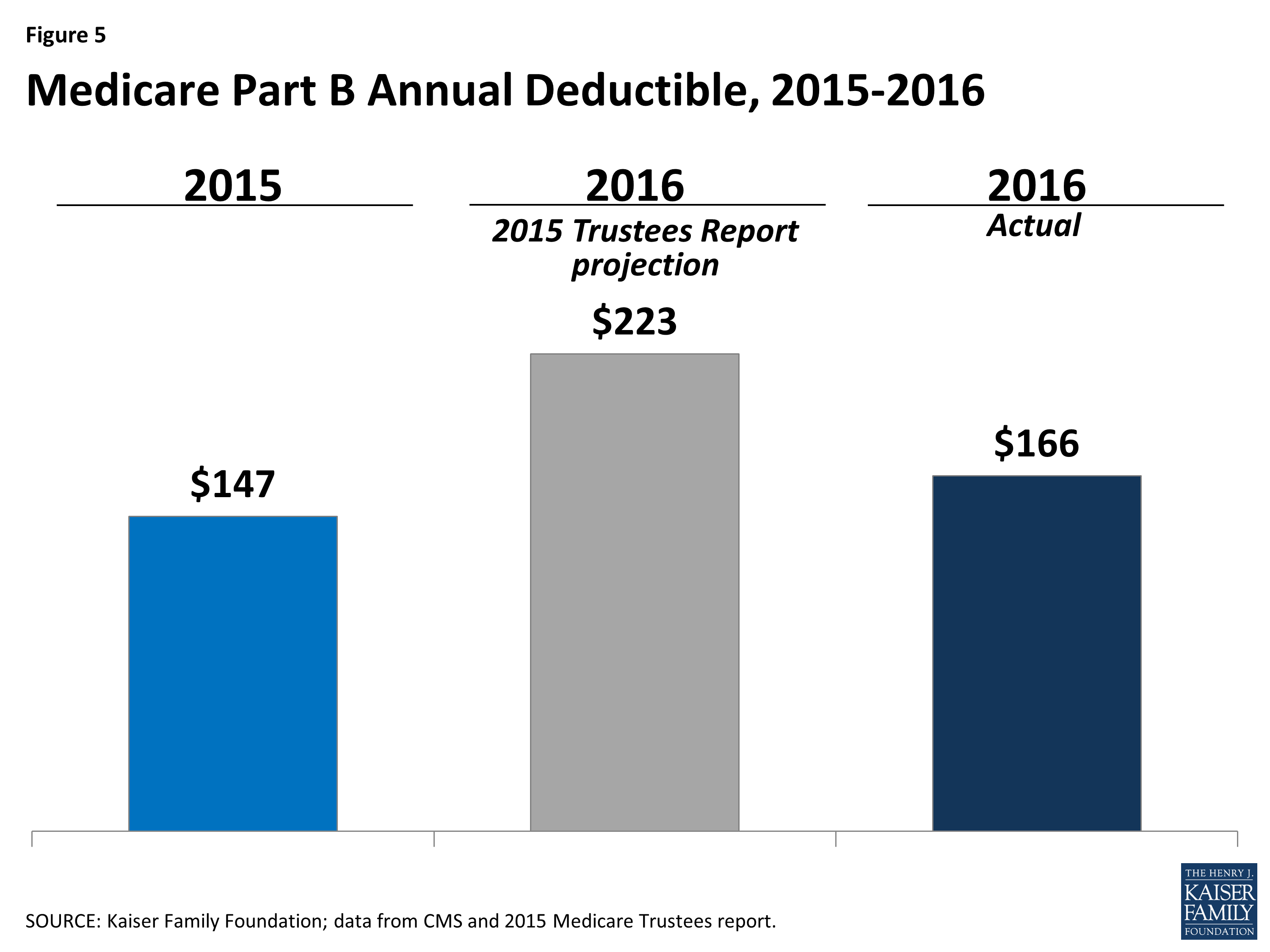

B Deductible Also Increased For 2021

Medicare B also has a deductible, which increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Also Check: Does Medicare Cover Gastric Bypass Revision

What Is Medicare Part B Coverage And What Does It Cover

Medicare Part B, along with Part A, constitutes what is known as original Medicare. It is estimated that in 2016, 67 percent of individuals using Medicare were enlisted in Original Medicare.

Part B protects a wide range of medically necessary outpatient services. A service is considered medically necessary if required to diagnose or treat a medical condition effectively.

Part B services include the following:

- emergency ambulance transportation

- long-term care

- complementary health services such as acupuncture and massage

- If you want prescription coverage, you can buy Part D plans. Medicare Part D programs are provided by private insurance organizations and cover most prescription drugs.

Furthermore, Medicare Part C programs include all benefits covered under traditional Medicare services and some additional services such as vision, dental, and even fitness plans. If you think youll need these medical services, consider a Part C program.

Medicare Part D Premiums

Medicare Part D plans, which provide coverage exclusively for prescription medications, are also sold by private insurance companies. Part D plan premiums will vary from plan to plan.

The average Part D plan premium in 2022 is $47.59 per month.2

Part D plan premiums can also be subject to a Medicare IRMAA for higher income earners. The table below shows the extra amount you might pay for Medicare Part D premiums in 2022 based on your reported income from 2022.

The full breakdown is as follows:

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

Are you looking for Medicare prescription drug plan? You can compare Part D plans in your area and enroll in a Part D prescription drug plan or a Medicare Advantage plan that includes prescription drug coverage online.

You can find out if any plans available near you cover the prescription drugs you take, and the cost you can expect to pay under the plan.

Compare Medicare drug coverage options in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

You can also compare Part D prescription drug plans and enroll online when you visit MyRxPlans.com.

Read Also: Can You Apply For Medicare After 65

How Do I Qualify For Medicare Part B

You should be 65 or older, be a citizen or eternal resident of the US, and have been employed in pastime wherein Medicare taxes have been paid. If you qualify for social protection, a railroad retirement, or a government pension then you definitely without a doubt meet the requirements.

If you are near 65 and get keep of SSDI then you definitely without a doubt are also eligible. You should be 65 years old, or near 65 and receiving SSDI for disability for 2 years. You pay monthly prices which come out of your Social Security payment. Part B covers as many as eighty% of the bills. If that does not paint for you, you could purchase Medigap supplemental insurance.

Cola And The Hold Harmless Rule

As the cost of living around us increases, the Cost of Living Adjustment provision helps combat rising costs. COLA is calculated each year through the Consumer Price Index for Urban Wage Earners. This adjustment helps to steady cash flow for retired seniors by counteracting the effects of inflation.

For example: If Ms. Johnson received $10,000 last year in Social Security benefits and the COLA that year was 4%, her benefits would then become $10,400.

Even if the inflation that year is negative, the COLA adjustment will never be lower than 0.0%. The Hold Harmless Rule is a stipulation to COLA that states Medicare Part B premiums cannot rise faster than what Social Security pays out.

This ensures that Social Security payments do not decrease if Medicare Part B premiums rise. The Hold Harmless Rule is calculated based on the change in net benefits payments . For those who are Medicaid beneficiaries, delay Social Security, or are subject to higher premiums through the IRMAA, the rule does not apply.

Also Check: Does Medicare Cover Mental Health Visits

What Is The Exceptional Opportunity To Medicare Part B

There are essentially alternatives to Medicare Part B:

Private medical health insurance or a Medicare Advantage plan. In most cases, Medicare Part B pays much less than a non-public medical health insurance plan of comparable benefits. According to ValuePenguin, the not unusual place rate of a bronze-tiered medical health insurance plan on the exchange in 2016 was $201 in step with month for an individual. Meanwhile, the monthly premium for Medicare Part B is just $134 in step with month and most humans will in truth pay lots much less than that. Most humans qualify for premium-unfastened Part A, and having every Part A and Part B will provide excellent coverage at a rate that is typically extra than non-public medical health insurance.

Also the attention that non-public medical health insurance companies are allowed to price up to a few times extra in prices for an older person. Medicare Advantage plans through the law need to provide at least the same coverage benefits as Original Medicare and can then offer some more benefits on top. These plans are presented on the non-public marketplace and need to be popular through Medicare.

Medicare Advantage plans range drastically further to their rate, so the super thing to do is discover approximately the coverage of plans presented for your region and examine the aspect of the rate to that of Original Medicare. Visit us to know more.

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

The Social Security Administration notifies a beneficiary of his or her Part B insurance premium and any IRMAA with the beneficiarys annual notice of Social Security benefits . SSA is responsible for issuing all initial and reconsideration determinations. It is important to remember that IRMAAs apply for only one year. A beneficiary will be notified by SSA near the end of the current year if he or she has to pay an IRMAA for the upcoming year.

Don’t Miss: How Long Do You Have To Sign Up For Medicare