What Does Medicare Part C Cost In 2021

Medicare Part C plans are sold by private insurance companies, so plan premiums, deductibles and other costs can vary.

Despite regular increases in Original Medicare costs, Medicare Advantage premiums have decreased in recent years.

The average 2021 Medicare Advantage plan premium is $33.57 per month for Medicare Advantage plans that include prescription drug coverage.2

Increasing competition may be contributing to falling premiums. The number of Medicare Advantage plans available in 2021 represents a 13 percent increase from 2020 and the highest number of plans ever available.3

Its possible that the competition within the Medicare Advantage market will keep Medicare Advantage plan premiums lower.

As mentioned above, many Medicare Advantage plans feature $0 premiums.

How Insurance Companies Set Prices

Insurance companies set prices for Medigap policies in 1 of 3 ways:

Regardless of which type of pricing your Medigap insurer employs, the price will most likely increase each year because of inflation and rising health care costs.

As a general rule of thumb, premiums that are based on both age and increased medical costs typically increase faster and at a steeper rate than other premiums.

Learn more about the other out-of-pocket costs for Medigap plans A-N.

Medicare Supplement Claim And Rate Trends And Their Impact On Profitability

Issue: March 2019 | Medicare Supplement || EnglishBy Andy Baillargeon, Life/Health Chief Specialty Pricing Officer, Portland

Medicare Supplement claim costs are on the rise.

Gen Re observed 2018 year-over-year claim cost trends of approximately 8% for recently issued Medicare Supplement business . For older business, that trend is around 5%. Both numbers are up approximately 3 points over what was observed in 2017.

Gen Re measures Medicare Supplement claim cost trend as the year-over-year change in claim costs on the same lives, after removing the impacts of aging and underwriting wear off. Implicitly, this number includes the impact of the increase in medical costs, as well as the impact of changes in utilization, cost shifting between Medicare and Medicare Supplement, etc. It is an all-inclusive definition that is intended to reflect the true underlying change in costs for the Medicare Supplement product, year over year.

The 2018 Medicare Trustees Report showed a significant increase in Part B claim costs per capita in 2018 over 2017. The period 20152019 is shown below for both the 2017 and 2018 reports.

Note that the 5.9% number in the 2018 report is a reasonable average of our 8% on new business and 5% on older business that we have observed in the 2018 experience.

You May Like: How Much Does Medicare Part B Cost At Age 65

Introducing A New Plan G Option: Plan G Plus

Beginning February 1st, 2021 all three Blue Medicare Supplement Plan Gs have Plus options. Plan G Plus plans have the same medical coverage as their regular versions as well as additional benefits and programs included so members can get more out of their Blue Medicare Supplement insurance plans. Additional benefits and programs include dental, vision, hearing, and fitness. Read this chart for more details:

| Benefit |

|---|

The out-of-pocket annual limit will increase each year for inflation.

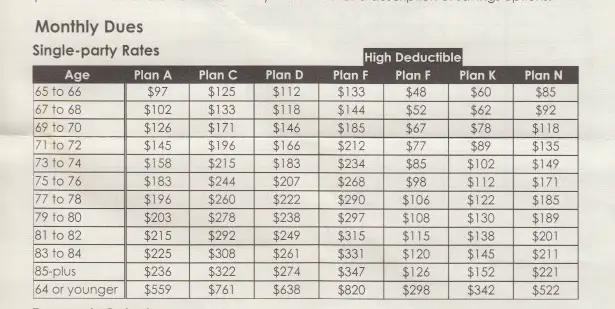

Rates as of 04/01/2020. Rates are illustrative only. Actual rates are based on your age, where you live, and your choice of coverage. Please do not send money, you cannot obtain coverage under the above plans until an application is completed and approved. Benefit exclusions and limitations might apply.

Important Information About Quotes for Medicare Supplement Insurance Plans

Quoted prices are based on the criteria specified during your search. This illustration is subject to Blue Cross and Blue Shield of Illinois’s rating or underwriting and approval, as appropriate, and does not guarantee rates, coverage or effective date. Furthermore, rates are subject to change if any of the information you have provided changes when and if a policy is approved. In addition, Blue Cross and Blue Shield of Illinois reserves the right to change rates from time to time.

Aarp Medicare Supplement Plans: Are They Right For You

AARP endorses Medicare Supplement insurance plans through UnitedHealthcare. AARP is not an insurer UnitedHealthcare pays AARP royalty fees for the use of its name. In terms of name recognition with seniors, AARP Medicare Supplement plans are noteworthy. But do those plans really stand up against other plans without the flashy endorsement? Keep these pros and cons in mind.

Read Also: Are Medicare Advantage Plans Hmos

What Makes Aarp Medicare Supplement Plans Stand Out

AARP uses community-rated pricing. This means that everyone who has the policy is charged the same premium, regardless of age. Premiums may increase because of factors like inflation and other costs, but not because of your age. This means policies can seem more expensive when you first sign up but will cost less than other policies as you get older. While other carriers premiums may increase because of age, AARPs won’t.

AARP is simply a different branding of UnitedHealthcare policies. AARP does get to choose what UnitedHealthcare plans feature the AARP name. Agents who offer AARP Medicare Supplement plans undergo additional training to understand beneficiaries needs and how to match them with the best Medicare product . Other extra benefits AARP plan members receive include:

- Membership in the At Your Best program, which offers various discounts gym memberships personalized wellness coaching access to a live, 24/7 nurse hotline and more

- Discounts on hearing screenings and hearing aids and discounts on vision products from EyeMed and Lenscrafters

- Membership in the popular SilverSneakers program

One benefit thats noticeably absent? You cant find discounts for purchasing more than one insurance policy through AARP. Many other carriers offer discounts.

How Does Age Affect Medicare Supplement Insurance Premiums

There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates in 2020.

Each type of cost model can affect the average price of a given Medigap plan.

-

Community-rated Medigap plansWith community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.

For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.

-

Issue-age-rated Medigap plansWith issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.

You will typically pay less for an issue-age-rated plan if you enroll in the plan when you’re younger. Your premiums also won’t increase based on your age.

-

Attained-age-rate Medigap plansAttained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

Medigap premiums can increase over time due to inflation and other factors, regardless of the pricing model your insurance company uses.

Also Check: Does Medicare Cover Bladder Control Pads

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203. After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Claim Costs Vs Rate Trend

Looking at the claim cost trend and premium rate trend together with some rough, hypothetical math, we can see an implied loss ratio, then and now. Since Part B coverage is such a large part of Medicare Supplement coverage, we can use the Trustees Report Part B trend numbers as a good proxy for our total Medicare Supplement claim cost trend for the period 20162018. That makes our increase in claim cost over that period:

1.021 x 1.038 x 1.059 1 = 0.122

With this as our basis, we estimate that claim costs per person have increased by roughly 12% over the last three years.

For premium, lets use the average of our rank #1 and rank #10 rate decreases, dismissing the rate decrease of companies ranked #20 as being purely indicative of market rate compression. Well average two averages: Our rank #1 average decrease of 3.3% with our rank #10 average decrease of 9.2%. Well call this new average, which equals 6.3%, the average decrease in rates for companies that are ranked in the top 10 over time.

This means weve got claim costs increasing by 12%, and premiums dropping by 6%.

To complete our hypothetical example, if rates at the end of 2015 produced a 70% loss ratio, the rates produced by our claim costs and premium rates at the end of 2018 will produce a loss ratio of 84%.

Read Also: How To Sign Up For Aetna Medicare Advantage

What Factors Determine My Medicare Supplement Premium

There are several factors that influence your Medicare Supplement premium. Although you may not be able to change any of these factors, knowing what they are can give you a better understanding when you compare rates between companies.

Before we dive in, its important to remember that Medicare Supplement plans are standardized. So, regardless of the company that you purchase your plan from or how much you pay for it, the benefits of the plan letter will be the same.

Will My Medicare Supplement Premiums Increase

by Christian Worstell | Published September 14, 2021 | Reviewed by John Krahnert

Your Medicare Supplement Insurance premiums may increase over time, but the amount and timing depend on several factors. Some insurance plans will have increases simply because you’re getting older.

Medicare Supplement Insurance companies try to limit premium increases to once a year, says Bill Gay, a licensed Medicare insurance agent and owner of Sun Coast Legacy Advisors.

Despite the limited number of price hikes, several factors affect how your premiums may increase including the plan’s pricing methods and the rising cost of Medicare.

You May Like: How To Qualify For Medicare In Ga

How Much Does Medicare Part C Cost

Part C, or Medicare Advantage, is an alternative way to receive your Medicare benefits. These plans, offered by private insurance companies who contract with Medicare, offer the same coverage youd get with Original Medicare Part A and Part B, as well as additional benefits. These additional benefits may include vision, hearing, dental, fitness programs, prescription drug coverage and more.

While out-of-pocket costs may vary, there is an out-of-pocket maximum for Part C plans. You cannot spend more than $7,550 on healthcare expenses per year for in-network services, or $11,300 for out-of-network services.

Learn More About The Costs Of Medicare With Us

Premiums may change, but our dedication to top-notch customer service wont. Our growing clientele base and A+ Better Business Bureau rating reflect this. At Medicare Peace of Mind, you can rest easy knowing youve made the right choice. We are always attentive to your needs, and we know what policy is the best for you in the present moment, as well as a plan that may be more ideal for you in the future in case of any changes down the road. Our knowledge is yours. If you have any other questions regarding premiums or anything Medicare-related, call us today at 970-233-0633.

Read Also: Does Medicare Cover Skin Removal

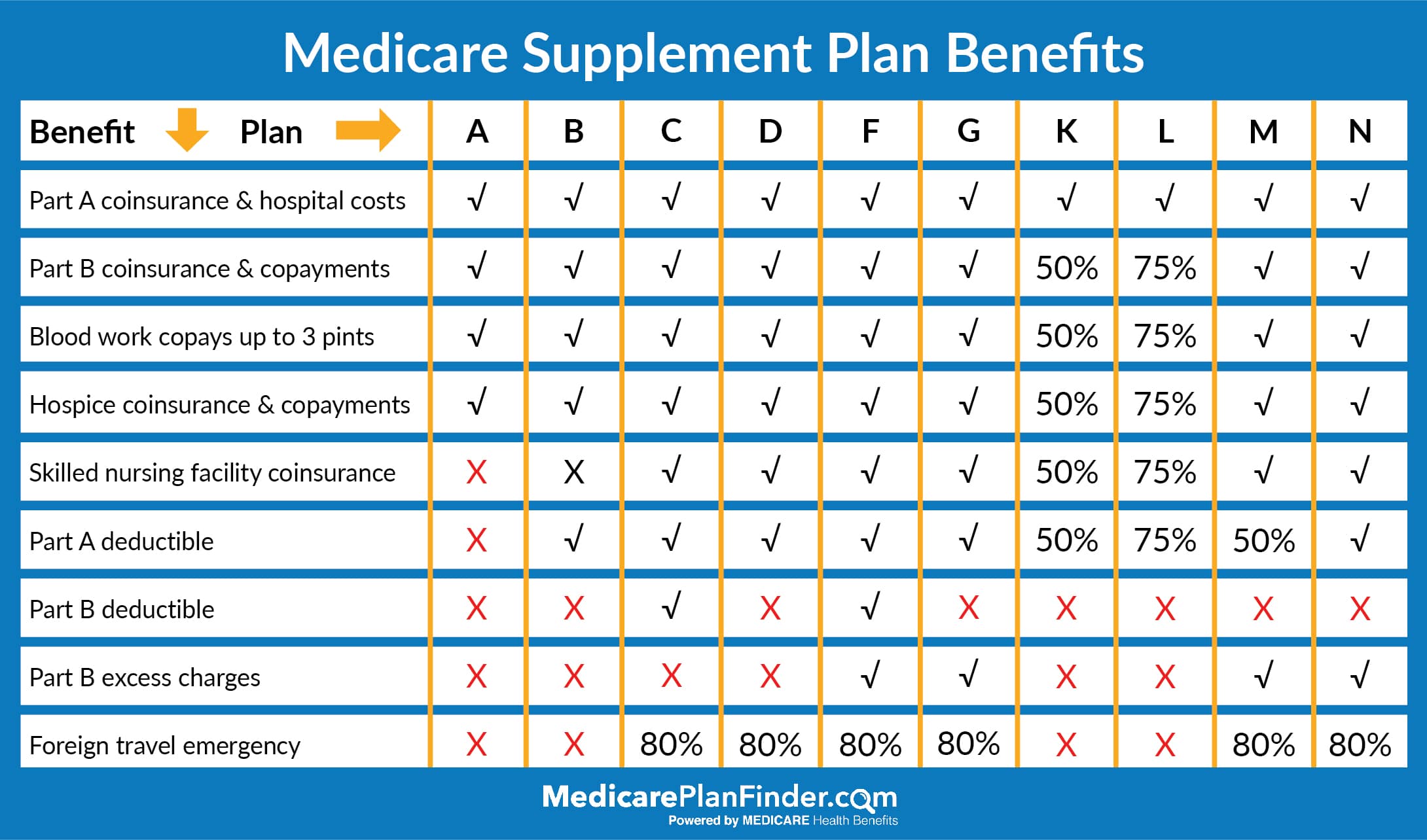

Is Medigap Plan G Better Than Plan F

While there can be a sizable difference in average premiums between Plan F vs. Plan G, there’s only a small difference in benefits these two plans offer.

-

Plan F provides coverage each of the 9 possible benefits that the 10 standardized Medigap plans can offer, including the Medicare Part B deductible.

-

Plan G does not cover the Medicare Part B deductible, but it offers coverage for all of the same out-of-pocket Medicare costs that Medigap Plan F covers.

Medigap Plan F and Plan G are the two most popular Medigap plans.2

In 2021, the Part B deductible is $203 per year.

The $203 annual deductible equates to around $17.00 per month.

This means that a Plan G with a premium of no more than $17.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

Below, Medicare expert John Barkett talks more about this and other changes coming to Medicare in 2020.

Underwriting For A Medicare Supplement:

Except for a person aging into Medicare, an applicant has to go through medical underwriting before their application can be approved. The Medigap insurance company will look at their health history to determine how much or how little they could potentially utilize the benefits of their Medigap policy. Supplemental insurance is not required to be a guaranteed issue under the Affordable Care Act. Your application may be approved as applied for at a preferred rate, a standard rate, or your application for coverage could be declined.

Not everyone who applies for Medicare after the enrollment period will be subject to underwriting. For example, when a person loses their group plan, Medicare Advantage plan, or other qualifying coverage, they are entitled to a guaranteed issue Medicare supplement plan. But not all plans are eligible. Plan F, the most comprehensive of all of them, is one plan that is eligible for guaranteed issue eligible.

Plan F has always been the plan of choice because it provides first-dollar coverage. First dollar coverage means that your insurance company will pay your Medicare-approved health care expenses without your paying copayments or deductibles. Plan G is not currently eligible for guaranteed issue, but that changes in 2020.

Recommended Reading: Will Medicare Pay For A Bed

How Aarp Medicare Supplement Plans Work

A Medicare Supplement plan helps you cover the out-of-pocket costs of Original Medicare . These costs include deductibles, coinsurance, copays, and extended hospital care. Because Medicare Supplement insurance is standardized among nearly all U.S. states, these features and benefits of specific AARP Medicare Supplement plans are the same as with any other carrier.

- You can receive care anywhere in the United States.

- You can see any provider who accepts Medicare.

- You dont need a referral to see a specialist.

- You can sign up during your Initial Enrollment Period. When youre first eligible for Medicare, your plan cant cancel your coverage or increase your premiums because of health issues.

- You can combine your Medicare Supplement plan with a Medicare Part D prescription drug plan.

To 2019 Medicare Part B Premiums

Medicare Part B premiums for tax year 2019 started at $135.50 and increased to up to $460.50, depending on your income. The rate of $135.50 was for single or married individuals who filed separately with MAGIs of $85,000 or less, and for married taxpayers who filed jointly with MAGIs of $170,000 or less.

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration’s cost-of-living adjustments .

Medicare has a “hold harmless” provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. While this keeps seniors from paying more than they should, you’ll have to pay the increased premiums if your COLA is higher than the increase.

Read Also: Is Prolia Covered By Medicare Part B Or Part D

Best Medicare Supplement Companies

Unlike health insurance, where policies differ among providers, Medicare supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans. Itâs important that you take this into account along with each providerâs financial strength and history of rate increases. Some companies may offer cheap rates but will increase your rates more quickly as you age.

Cigna, similar to UHC and Aetna, currently has an AM Best rating of A, meaning that it has the financial strength to continue to pay health insurance claims in the future. Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.