Who Is Automatically Enrolled

Those who are automatically signed up for Original Medicare are:

- Individuals who are turning 65 years old and are already getting retirement benefits from the Social Security Administration or the Railroad Retirement Board

- Individuals less than 65 with a disability who have been receiving disability benefits from the SSA or RRB for at least 24 months

- Individuals with amyotrophic lateral sclerosis who are getting disability benefits

Note that despite the fact that youll be selected automatically, Part B is still a discretionary Medicare plan. You can decide to postpone Part B on the off chance that you wish to do so. One circumstance where this might happen is in case youre covered by another arrangement through work or a life partner.

Can You Delay Enrolling In Medicare Part B

A few groups might get Medicare Part A premium-free. However, several people need to pay a month-to-month premium for Medicare Part B. Since Medicare Part B accompanies a month-to-month premium, a few groups might decide not to join during their initial enrollment period in case they are right now covered under a business group plan .

In case you are as yet working, you should check with your medical benefits administrator to perceive how your protection would function with Medicare. If you postpone enrollment in Medicare Part B since you as of now have current manager wellbeing inclusion, you can join later during a Special Enrollment Period without suffering a late penalty. Furthermore, you can select Medicare Part B whenever that you are as yet covered by a gathering plan dependent on current business. After your managers wellbeing inclusion closes or your work closes, you have an eight-month special enrollment period to pursue Part B without a late punishment.

Remember that retired person inclusion and COBRA are not viewed as wellbeing inclusion dependent on current work and would not qualify you for a special enrollment period. On the off chance that you have COBRA after your boss inclusion closes, you ought not to delay until your COBRA inclusion finishes to pursue Medicare Part B. Your eight-month Part B special enrollment period starts following your present work or group plan closes. This is regardless of whether you get COBRA or not.

When Can I Apply

- Initial enrollment period. This is a 7-month window close to your 65th birthday celebration when you can pursue Medicare. It starts 3 months before your birthday month, includes the month of your birthday, and then stretches on for a further 3 months after your birthday. During this time, you can take on all pieces of Medicare without a punishment.

- Open enrollment period . During this time, you can change from Original Medicare to Part C , or from Part C back to Original Medicare. You can likewise switch Part C plans or add, eliminate, or change a Part D arrangement.

- General enrollment period . You can select Medicare during this period on the off chance that you didnt sign up during your initial enrollment period.

- Special enrollment period. On the off chance that you postponed Medicare enrollment for a supported explanation, you can later sign up during a special enrollment period. You have 8 months from the finish of your inclusion or the finish of your work to join without punishment.

Recommended Reading: Does Medicare Pay For A Caregiver In The Home

What Is A Deductable

The deductable refers to the amount a member is expected to pay before their coverage kicks in.

The deductible will increase from $203 to $230 in 2022. After the deductible has been reached, members will be required to pay twenty percent of the costs for various services including, most doctor services, outpatient therapy, and medical equipment.

What is causing the increase in costs?

The CMM provided a series of reasons as to why the price is increasing.

The first is that each year based on the continuous increase in the costs of providing health care. Each year, the premium increases a small amount to reflect this market-wide trend. However, from 2020 to 2021, the price only increased two percent, whereas from 2021 to 2022 it will be more than fifteen percent.

Another reason relates to Congressional action to lower the cost of premiums in 2021, “which resulted in the $3.00 per beneficiary per month increase in the Medicare Part B premium being continued through 2025.”

Why Do Some People Pay Less For Their Medicare Part B Premium

Some people who get Social Security benefits will still pay less than $148.50 in 2021. This affects around 2 million Medicare beneficiaries. Legislation prevents the cost of Medicare Part B from increasing more than the Social Security annual cost-of-living increase.

In recent years, we have had low COLA increases, so these individuals have only been paying less than the standard base Part B premium. Though the Social Security COLA increases for the last couple of years have been somewhat larger, there is still a small group of beneficiaries being protected by the hold harmless provision.

Though this all very confusing, remember that you do not have to calculate this yourself. Again, Social Security will determine your Part B premium for 2021 and notify you by mail if you exceed the Medicare income limits and must pay a higher adjusted amount.

Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2021, the Part B premium is $148.50.

You can also request your Part D premium be deducted from your Social Security check.

Most People Pay the Standard Part B Premium

Youll pay the standard Medicare Part B premium amount if:

Don’t Miss: Is Kaiser A Medicare Advantage Plan

Cost Of Medicare Supplement

The cost of a Medigap policy, also called a Medicare Supplement policy, will depend on two factors: the policy you choose and the pricing structure of the company. Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, the Medigap Plan G is a more comprehensive plan when compared to Plan K and thus warrants a higher monthly premium.

Below we have outlined the monthly premium of each Medigap policy. Notice that a range is given since different plan providers offer different premiums.

| Medigap plan | |

|---|---|

| Plan N | $146$289 |

Secondly, Medigap prices will differ based on the pricing structure, which can include your age, depending on what the health insurance company selects. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

How Much Is Taken Out Of Social Security For Medicare

If you receive Medicare health insurance benefits and Social Security retirement benefits at the same time, you can have your Medicare premiums automatically deducted from your Social Security check each month. This can save a lot of time and energy, as you wont have to worry about paying your premiums manually. This option is available for every part of Medicare, including private plans like Medicare Advantage and Medicare Part D.

This article explains everything you need to know to understand how much will be deducted from your Social Security benefits.

Recommended Reading: How Much Is Medicare B Deductible

Why Are Medicare Costs Increasing

These increases can be attributed to a handful of factors.

Across the healthcare industry, there are rising prices and more utilization.

This drives higher premiums while accounting for anticipated increases due to the intensity of provided care.

Congress also acted to lower the expected 2021 Part B premium increase.

As a result, there is a small $3 per beneficiary, per month increase in the Part B premium through 2025.

There are also contingency reserves needed because of the new Alzheimer’s disease drug, Aduhelm.

Due to the drug’s newness, having gained FDA approval over the summer, it is still unclear how and if it will be covered by Medicare beneficiaries in 2022.

As a result, the program is planning for “higher expenditures” to offset the potential costs of new treatments, according to the CMS.

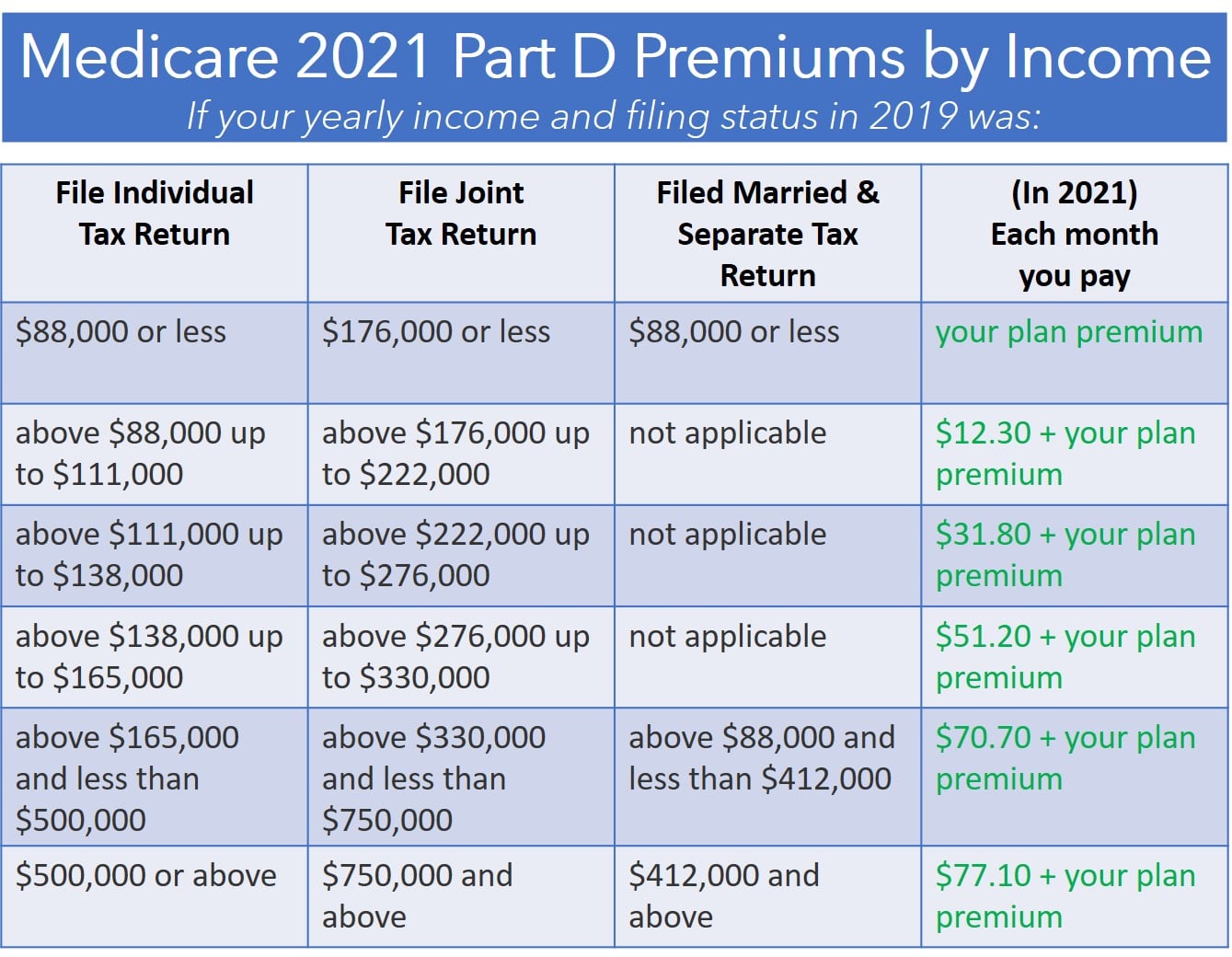

How Much Does Medicare Part D Cost In 2021

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2020 plans, the additional costs will be based on your 2018 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $445 in 2021, up from $435 in 2020.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

You May Like: Does Medicare Cover Gastric Bypass Revision

How Much Will Medicare Part C Cost In 2022

Medicare Advantage plans are purchased through private health insurance providers, and so the adjustment to rates for 2022 will vary. Check with your Part C provider for updated 2022 premium rates.

The Centers for Medicare & Medicaid Services estimates that the average monthly premium for Part C plans has decreased from $21.22 in 2021 to $19 in 2022.

How Does Medicare Part B Compare With Other Plans

Your decision of what plan to choose will rely upon your individual requirements. You can choose to get an Advantage plan rather than Medicare parts A, B, and D if you decide. Medicare Advantage plans change both from Medicare Part B and from one another. Moreover, they might have various expenses, rules, and limitations related to them. For instance, some Medicare Advantage plans limit the doctors you can see to an in-network bunch. Medicare Part B might have a bigger pool of doctors for you to look over.

Medicare Advantage plans are needed to cover basically as much as Medicare parts A and B. Some cover extra services, like dental, hearing, and vision care. Remember that youre not committed to continuing with your Medicare plan decision in the event that you find that it sometimes falls short for you if your requirements change, or under any condition. You can pick an alternate Medicare plan during open enrollment periods yearly . This will permit you to move from original Medicare to a Medicare Advantage plan or the other way around. During open enrollment periods, you can likewise add services like Medicare Part D and Medicare supplemental protection plans .

Read Also: Will Medicare Pay For Handicap Bathroom

Does The Medicare Part B Premium Change Every Year Based On Income

Medicare premiums are calculated based on MAGI, which is your modified adjusted gross income. If your MAGI from two years prior is under $88,000, or under $176,000 for a couple, then youll only have to pay the standard Part B premium of $148.50. If youre a higher-income earner, youll see an increase between $57-$347 per month depending on which income bracket you fall under.

What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

Don’t Miss: Does Medicare Cover Cancer Treatment Centers Of America

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2021 standard premium for Part B is $148.50 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $14.85 per month to your Part B premium.

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Recommended Reading: Are Motorized Wheelchairs Covered By Medicare

Medicare Part A Premiums

Medicare calculates Part A premium costs by how long you or your spouse have paid Medicare taxes.

Here is an explanation of monthly premiums for Plan A in 2021:

If you or your spouse paid Medicare taxes for ten years or more

$259/mo.

If you or your spouse paid Medicare taxes for more than 7.5 years but less than 10

If you paid Medicare taxes for fewer than 7.5 years

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare in 2021 report. .

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Don’t Miss: Does Medicare Offer Gym Memberships

What Medicare Part B Does Not Cover

As with other parts of Medicare, and health insurance in general, Part B has exceptions. It does not cover the following:

-

Nonmedical long-term care

-

Prescription drug coverage

-

Skilled nursing facility services

You can find out if a service, item or procedure is covered by Medicare Part B on the Medicare website. You can also ask your doctor or health care provider if Medicare will cover something theyâre prescribing.

What Is Part A Coinsurance

Medicare refers to the payments that you make when you see a doctor, stay in a skilled nursing facility, or have an extended hospital stay as coinsurance, although theyre fixed amounts rather than a percentage of costs. For the 61st to 90th day of inpatient hospital treatment with Medicare, you must pay coinsurance of $371 per day. The next 60 days are part of your lifetime reserve benefit, and youll owe $742 per day, up to 60 days over your lifetime.3

Youll also have to pay coinsurance for skilled nursing care for days 21 through 100 at a rate of $185.50 per day.4

You May Like: How To Order A Medicare Card