You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Medicare Advantage Vs Medicare Supplement: Plan Costs

It may seem obvious that many people would want either a Medicare Advantage plan or a Medicare Supplement insurance plan for the added benefits and the protection from out-of-pocket costs. However, both these types of plans may come with additional costs. You may have to spend money to save money, which is how most types of insurance generally work.

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium.

Most Medicare Supplement insurance plans also have monthly premiums. The premium you pay generally depends on the plan you select and your location.

Deductibles: A deductible is an amount you pay before your insurance begins to pay. A higher deductible means you will generally pay more out of pocket before your insurance kicks in. Sometimes insurance plans with lower premiums have higher deductibles.

Pros & Cons Of Medicare Advantage

Medicare Advantage plans communicate benefit in the name itself. There IS generally an advantage to choosing one of these plans!

One major advantage is that you have a plethora of plan options to choose from each with different benefits from the last. With Medicare Advantage, youre more likely to find a plan thats specific to your needs.

Other benefits of Medicare Advantage plans include:

You May Like: Do I Qualify For Medicare If I Am Disabled

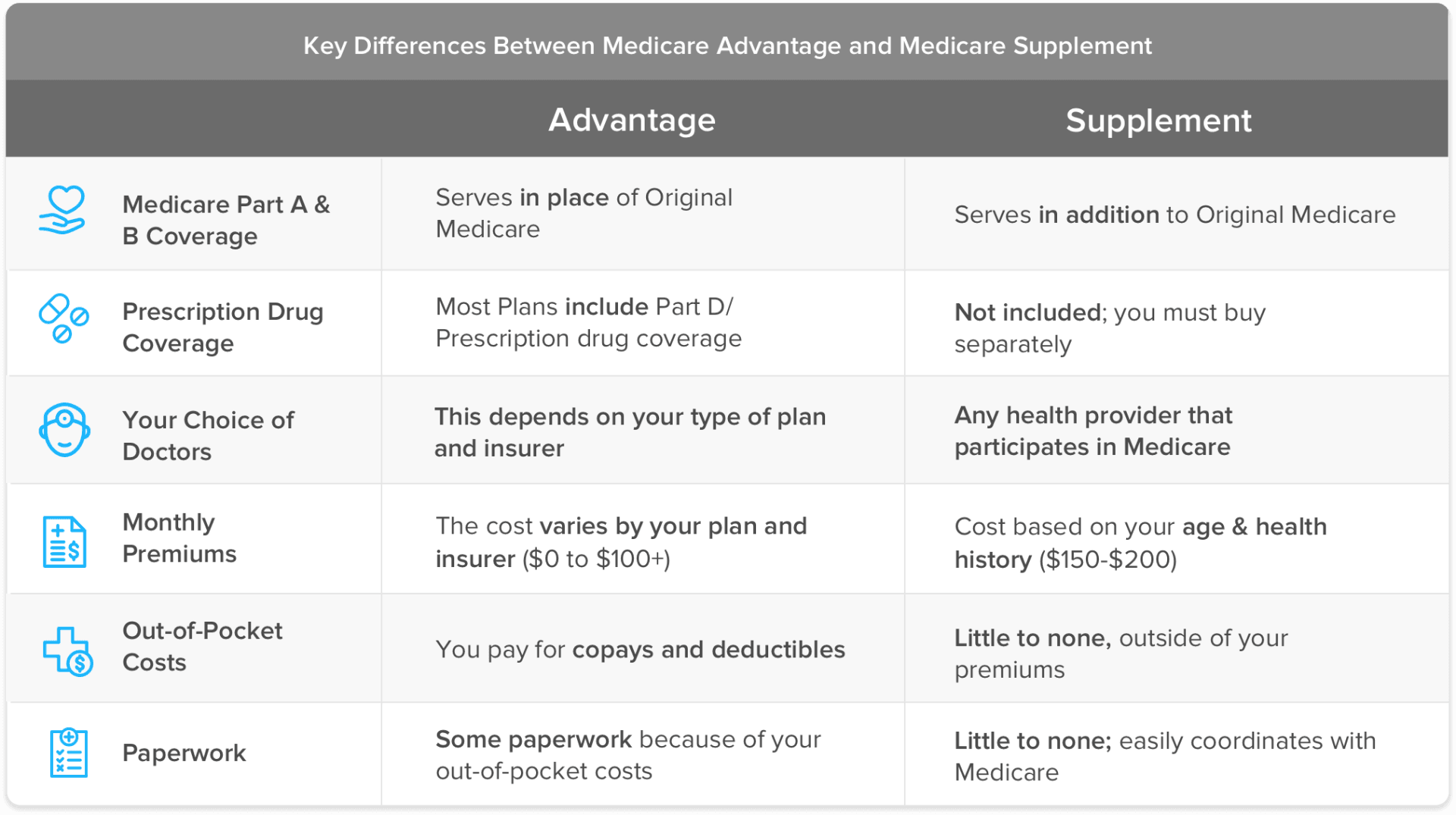

What Is The Difference Between A Medigap Plan And Medicare Advantage

The difference between a Medigap plan and a Medicare Advantage plan boils down to two main factors: cost and coverage. The Medicare Advantage plan can be cheaper, but the Medigap plan does offer the ability to pick and choose the coverage you want, whereas in most cases the Medicare Advantage plan has a set coverage scope. Medicare Advantage is still a Medicare plan it just offers a bit more all at once than Original Medicare does, as it includes prescription coverage, and in most cases coverage for vision, dental, or hearing. Medigap coverage has more individual options, but the prices can rack up for each type of supplemental coverage.

Why Should I Enroll In A Medicare Supplement Insurance Plan

When you use Medicare Part A or Part B benefits, youll often be left with some out-of-pocket expenses like deductibles, coinsurance or copayments. This is known as cost sharing.

Thats where Medicare Supplement Insurance comes into play. As the name implies, this type of plan is used alongside your Original Medicare coverage.

Here are a few examples of how a Medigap plan can work:

Read Also: Does Medicare Cover Bladder Control Pads

Beneficiaries Enrolled In Medicare Advantage And Traditional Medicare Look Similar After Separating Out Snps

After excluding beneficiaries in SNPs, beneficiaries enrolled in traditional Medicare do not differ significantly from Medicare Advantage enrollees on age, income, or receipt of a Part D low-income subsidy , which helps low-income individuals pay for prescription drugs . However, beneficiaries in traditional Medicare are significantly more likely than Medicare Advantage enrollees to reside in a nonmetropolitan area, as well as more likely to live in a long-term-care or residential facility.

Beneficiaries in SNPs are different. Given the eligibility criteria for these plans, it is not surprising that enrollees tend to have significantly lower incomes and a greater likelihood of receiving Medicaid benefits or LIS than other Medicare beneficiaries. Enrollment in SNPs for people who require an institutional level of care has been growing rapidly, leading to a similar share of SNP enrollees and beneficiaries in traditional Medicare living in a long-term-care facility.8

Racial/ethnic distribution of enrollees. The racial and ethnic distribution of beneficiaries in traditional Medicare and Medicare Advantage is similar, after separating SNPs from other Medicare Advantage plans . Most beneficiaries in traditional Medicare and Medicare Advantage plans identify as white. However, SNP enrollees are significantly more likely to identify as Hispanic or Black.

Medicare Advantage Plans Start At $0/month

In 2020, nearly two-thirds of Medicare Advantage beneficiaries paid no premium for their plan.Youll still be required to pay your Medicare Part B premium. That said, it may be an enticing option for those who dont want to juggle paying multiple premiums each month.

If youre interested in seeing Medicare Advantage Plans with $0 monthly premiums, Ensurem offers an online quote tool thatll allow you to compare plans in your area.

Recommended Reading: Does Medicare Cover Dexa Scan

Best For Simplicity And Clarity: Blue Cross Blue Shield

Blue Cross Blue Shield

-

No estimates available on the main page

-

Must go to individual plan websites for local details

-

No Medicare Advantage coverage in Mississippi and Wyoming

If you want Medicare information broken down clearly and in a straightforward manner, Blue Cross Blue Shield is the best company to go through for Medicare Advantage. We chose it primarily for features such as its Medicare Advantage Plans document, available for anyone to view on its website without having to enter any personal information. It gives a detailed look into the company’s plan offerings, explaining what types of plans are offered in which state, and who to contact if you want to enroll.

For example, in Florida, you have the option of going through multiple PPOs and HMOs as well as a HMO -D-SNP. Each of these options is sponsored by Florida Blue. Each organization may offer different plans and the plans can differ by ZIP code within the state too. So it’s important you gather information about the plans in your specific area.

The basic website is clean and easy to navigate, but its a little more complicated to actually get an estimate.

However, Blue Cross Blue Shield is actually an association of 35 independent insurance companies, not a single insurer. To get the details of your specific options, youll have to track down the BCBS affiliate in your market. Beware: BCBS affiliation may not be obvious from its name or how its commonly referred to, such as Anthem or Highmark.

What Is The Difference Between A Medicare Plan And A Medicare Advantage Plan

A Medicare Plan includes Part A and B, and can include Part D for drug coverage, as well as Supplemental Coverage to help pay for deductibles and coinsurance related to Parts A and B. A Medicare Advantage Plan bundles Parts A, B, and usually D together and typically offers other benefits that Original Medicare doesnt. You cannot have, and do not need, Medigap insurance if you have a Medicare Advantage plan.

Original Medicare is a fee-for-service health plan. After you pay the Part B premium and deductibles, Medicare pays its share of the Medicare approved amount, and you pay your share of the costs in the form of co-insurance and deductibles. Medicare Advantage Plans may or may not have a premium and vary in their cost sharing requirements. For example, you may pay a $5 copay to see your PCP, and a $40 copay to see a specialist. You may pay a certain percentage for other services such as out-patient surgery, after meeting your deductible. These costs depend on which Medicare Advantage Plan you choose.

Don’t Miss: Do I Have To Pay For Medicare On Ssdi

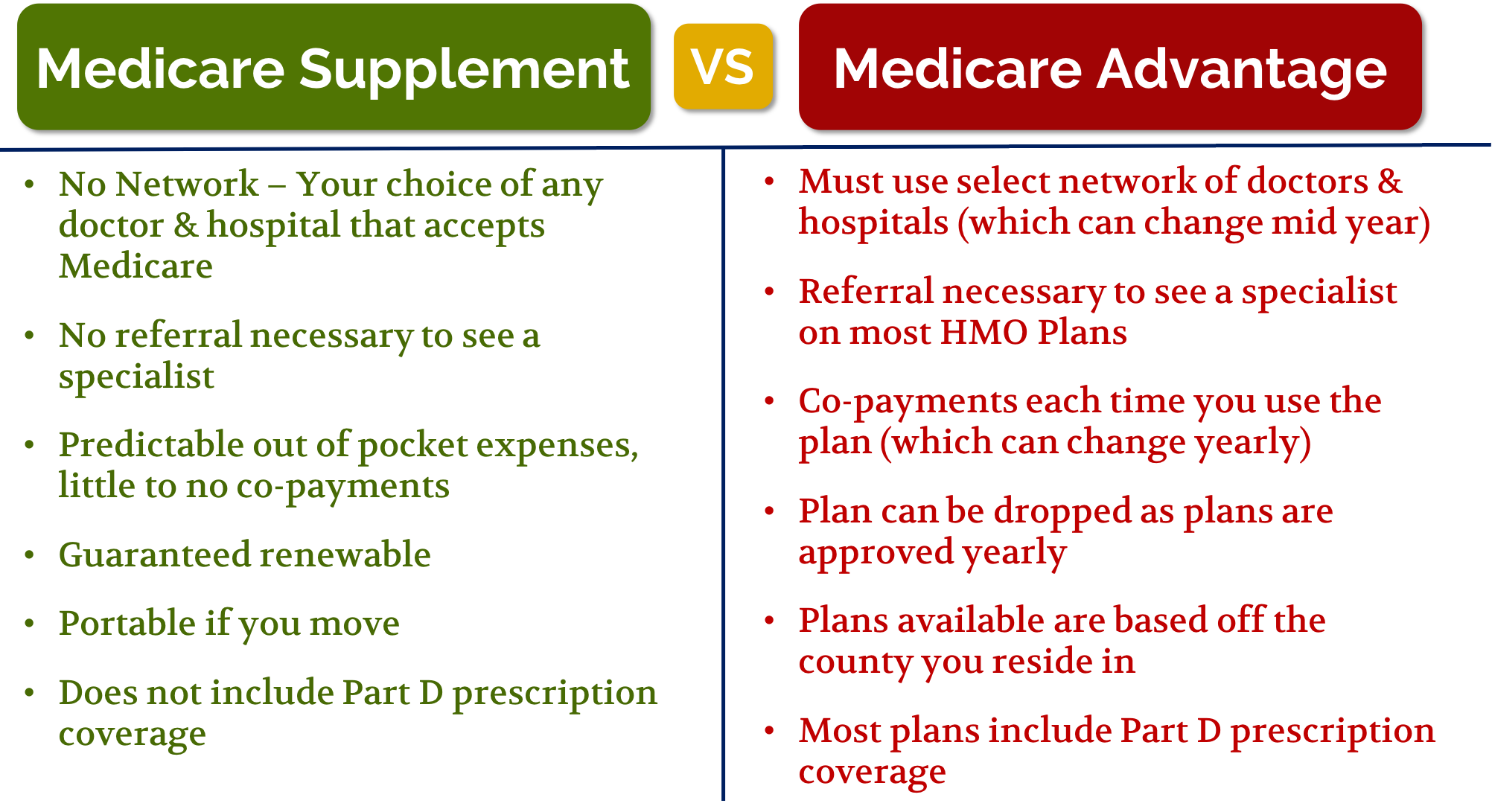

Medicare Advantage Vs Medicare Supplement

Medicare supplementplans help a person cover some of the healthcare expenses that traditionalMedicare does not include. Some people also refer to these plans as Medigap.

As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

Plans in Wisconsin, Minnesota, and Massachusetts are also different from the traditional Medigap plans.

Medicare supplementplans can help cover several costs, including:

- copayments for parts A and B

- up to 3 pints of donated blood

- coinsurance for skilled nursing facilities

- yearly out-of-pocket expenses

Peoplewith concerns about steep out-of-pocket expenses may choose a Medigap plan. Asa general rule, a person cannot have a Medicare Advantage plan and a Medigap plan at the same time.

Are There Different Types Of Medicare Advantage Plans

Many people like the flexibility that Medicare Advantage plans provide. Unlike Original Medicare, which is the same for everyone, there are several different Medicare Advantage options you may be eligible for. Some of the popular ones include:

- Health Maintenance Organizations . These plans usually have the lowest premiums and out-of-pocket costs, however, you may be required to get all your health care from providers in the plans network. Many HMOs include coverage for prescription drugs and other routine health benefits.

- Special Needs Plans are a type of HMO that limits enrollment to people with certain conditions, or who live in a nursing facility, or are eligible for both Medicare and Medicaid.

- Preferred Provider Organizations *. PPOs let you see any provider who accepts your plan, but your costs are much lower if you use in-network providers. You can often find plans that include Part D prescription drug coverage.

- Private Fee-for-Service plans . With PFFS plans, you can get health care from any provider who accepts the terms of your plan. However, doctors are not required to accept your plan even if they participate in the Medicare program. Youll need to ask each time you get care, even if youve used the provider in the past.

Not every type of plan may be available where you live, and plan benefits and premiums vary. Keep these questions in mind when you evaluate the Medicare Advantage plans youre eligible for:

Read Also: What Is The Average Premium For Medicare Advantage Plans

Can You Switch Between Original Medicare And Medicare Advantage

As a final note, no matter which option you decide is right for you, you can switch from Original Medicare to Medicare Advantage or vice versa. The two main times you can switch are the Medicare Annual Enrollment Period and the Medicare Special Enrollment Period for qualifying life events, if you qualify.

What Are The Pros And Cons Of Medicare Advantage Vs Original Medicare

Fact checked Reviewed by: Leron Moore, Medicare consultant –

When you become eligible for Medicare, you can choose from one of two main ways to get your Medicare coverage. You can opt for Original Medicare or a Medicare Advantage plan . It is important to weigh the pros and cons of each, taking into consideration your preferences, needs, and budget.

What you should know

- 1Medicare beneficiaries can choose to get their health care coverage through Original Medicare or a Medicare Advantage plan, and it is important to explore options based on preferences, needs, and budget.

- 2Original Medicare allows you to see Medicare-approved providers anywhere in the United States, but depending on how much healthcare you need, costs can be unpredictable.

- 3Medicare Advantage plans offer more benefits and have a limit on out-of-pocket costs, but generally require use of in-network providers and referrals for specialists.

- 4Original Medicare is a government plan, while Medicare Advantage plans are managed by private insurance companies. In either case, you pay a Part B monthly premium.

Don’t Miss: Will Medicare Pay For My Nebulizer

Theres No Right Answer

We work with a broker in Colorado who explains that theres no one-size-fits-all when it comes to Medicare plan options. Two of her clients are siblings who live in the same town one has a zero-premium Medicare Advantage plan, while the other has Original Medicare plus a comprehensive Medigap plan and a Part D prescription plan.

The one with the Medicare Advantage plan would rather save money on premiums, and doesnt mind the higher out-of-pocket exposure and limited provider network. The other sibling, on the other hand, is willing to pay higher premiums in trade for the lower out-of-pocket costs and nationwide provider choice that comes with Original Medicare.

Ultimately, the choice between Medicare Advantage and Original Medicare with supplements is a personal one that reflects each applicants health, risk tolerance, and approach to personal finances.

And there are varying degrees of coverage within each type of plan. Medicare Advantage plans include extra benefits that arent available with Original Medicare + supplemental coverage, and some Medicare Advantage plans have out-of-pocket maximums well below the federally-allowed limit. And while some Medigap plans, like Plans C and D , cover most of an enrollees out-of-pocket costs under Original Medicare, other Medigap plans, like Plan N, for example, are less robust.

Finding Part D Drug Insurance

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings.

If you dont take many prescription drugs, look for a plan with a low monthly premium. All plans must still cover most drugs used by people with Medicare. If, on the other hand, you have high prescription drug costs, check into plans that cover your drugs in the donut hole, the coverage gap period that kicks in after you and the plan have spent $4,130 on covered drugs in 2021.

Recommended Reading: Is Eliquis Covered Under Medicare

Which Is Better Original Medicare Or Medicare Advantage

Medicare Advantage plans must offer coverage at least as good as Medicare. But, Original Medicare tends to have more flexibility. Most insurance agents agree that some coverage is better than none, making Medicare Advantage plans a tad better than Original Medicare but not as good as Medigap.

Medicare Advantage plans do work for some individuals, but not all. They are a good option for those who cannot get a Medigap plan for one reason or another, and those under 65 on disability. If you have a rainy day fund, then a Medicare Advantage plan could work for you as well.

If youre truly looking for comprehensive coverage, then Medigap would make the most sense in addition to a Part D prescription drug plan. With Part A, Part B, Part D, + a Medigap plan, youll never have to worry about the costs of your medical expenses during your retirement years. When you compare Part C vs. Medigap, youll see why one is better for some and another is better for others.

Medicare Advantage Vs Original Medicare

| Medicare Part A and Part B covered services | Yes | |

| Prescription drug coverage | Yes, with most plans | Includes limited prescription drug coverage in certain situations. Doesnt typically cover prescriptions you take at home. |

| Your choice of any doctor who takes Medicare assignment | It depends on the plan. Some Medicare Advantage plans require you to use doctors in the plans network. | Yes |

| Extra benefits, like routine vision or dental services, routine hearing services, membership in fitness programs, and more. | Yes, with many plans. The extra benefits may vary from one plan to another. | No |

| Covered services when you travel anywhere in the USA | Usually, no. You must live within your plans service area, except in emergencies. | Yes |

| Some plans may have deductibles. | Yes | |

| Generally, yes, for most services | Generally, yes, for most services | |

| Premiums | It depends on the plan. Some plans have premiums as low as $0.

You still need to pay the Medicare Part B monthly premium as well. |

Medicare Part A has a monthly premium, but most people dont have to pay it.*

Most people pay a Medicare Part B monthly premium. |

| Other features | ||

| Annual maximum out-of-pocket spending limit. If you reach this limit, the plan may pay your medical expenses for the rest of the year. | Yes. This amount will vary among plans and might change year to year. | No |

* If youve worked at least 10 years while paying Medicare taxes, you generally dont pay a premium for Medicare Part A.

You May Like: What Is The Cost Of Part D Medicare For 2020

How To Switch Medicare Advantage Plans

If you want to change Medicare Advantage Plans, you can do so once a year, either during Medicare’s fall open enrollment period or the Medicare Advantage open enrollment period .

You also can change to Original Medicare during these periods, but it could be hard to get a Medicare Supplemental Insurance policy if you switch after the first year. Insurers are required to issue you Medigap policies only during your initial Medigap enrollment period , or if you switch out of your Medicare Advantage Plan in the first year. After that, insurers may deny you a Medigap policy if you have health problems, or they can require a waiting period before your preexisting conditions are covered.

Original Medicare Vs Medicare Advantage: Providers

A final key difference to consider when choosing between Original Medicare and a Medicare Advantage plan is what health care providers you can see.

With Original Medicare you can go to any hospital and see any doctor or provider within the U.S. who accept Medicare. You do have limited coverage in foreign countries, though.

With Medicare Advantage, most plans have a network of doctors and providers you can see. If you go outside the plans network, its likely youll have to pay more to do so. However, emergency and urgent care are covered nationwide. You also have limited coverage in foreign countries, though some plans may offer special foreign coverage or travel benefits.

Don’t Miss: Who Do You Call To Sign Up For Medicare