Relief After Big Premium Increase

A key driver of the 2022 hike was a projected jump in spending due to a costly new drug for Alzheimers disease, Aduhelm. However, since then, Aduhelms manufacturer has cut the price and CMS limited coverage of the drug. The agency said it would factor the lower-than-forecast spending into the 2023 premium.

Also, spending was lower than projected on other Part B items and services, which resulted in much larger reserves in the Part B trust fund, allowing the agency to limit future premium increases.

The annual deductible for Medicare Part B beneficiaries will be $226 next year, a decrease of $7 from 2022.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment and certain other medical and health services not covered by Medicare Part A.

One of the benefits of the Inflation Reduction Act, which Congress passed in August, will also kick in next year for Medicare beneficiaries. Starting July 1, cost-sharing will be capped at $35 for a one-month supply of covered insulin. Also, people with Medicare who take insulin through a pump wont have to pay a deductible. This benefit will be available to people with pumps supplied through the durable medical equipment benefit under Part B.

For 2022, seniors received a 5.9% increase, the largest in decades, but it was quickly overrun by soaring price increases.

CNNs Allie Malloy and Maegan Vazquez contributed to this report.

Heres Why Your Medicare Part B Costs May Drop In 2023

Medicare beneficiaries who saw a double-digit-percentage increase in their Part B premiums for 2022 are in line for relief next year, according to a recent statement from the head of the Department of Health and Human Services .

High expected costs connected to Aduhelm, a new Alzhemers drug, played a part in a 14.5% jump in premiums from 2021 to 2022 for most Part B users an HHS statement issued May 27 calls those expectations an overestimate and says the reduction in premium costs attributable to Aduhelm will be incorporated into Medicare premiums for 2023 to lower Part B premiums paid by Medicare beneficiaries.

Discussions of a potential rate cut took place as early as January. At the time, HHS Secretary Xavier Becerra said changes could come later in the year in the recent statement, he made clear the 2022 rates would remain in place.

We had hoped to achieve this sooner, but CMS explains that the options to accomplish this would not be feasible, Becerra said in the statement, referencing a CMS report on the issue.

Medicare officially announced in April its decision to cover Aduhlem only in cases where the patient participates in an official clinical trial. This will significantly reduce the number of Medicare beneficiaries eligible for the drug, which reportedly had been priced as high as $56,000 for a years worth of treatments a figure thats since been cut in half.

Q: How Do I Switch To $0 Premium Medicare

A: If youre looking for a Medicare plan with a lower premium, or even a $0 premium, you can make the switch to Medicare Advantage. These are privately-sponsored insurance plans that include everything covered by Medicare, and usually a lot more.

Your Personal Benefits Manager can help you find that plan that you need. Or, get started by reading up on the Medicare MSA Plan, the only Medicare Advantage option that always comes with a $0 monthly premium.

Note: The only time to switch to Medicare Advantage is either right when you turn 65 or during the Annual Enrollment Periodfrom November 1st to December 7th every year.

Don’t Miss: Does Medicare Cover You When Out Of The Country

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 was the largest year-over-year dollar increase in the programs history. But the decrease for 2023 was the first time the deductible has declined in over a decade. Heres an historical summary of Part deductibles over the last several years :

Is Social Security Getting A $200 Raise Per Month

A benefits boost: $200, plus COLA changesAnyone who is a current Social Security recipient or who will turn 62 in 2023 the earliest age at which an individual can claim Social Security would receive an extra $200 per monthly check. There are some additional tweaks that would boost benefits over the long-term.

Also Check: When Do You Start Medicare Coverage

B Premiums And Deductible

Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment and other items. According to the , the standard monthly Part B premium will be $170.10 for 2022, an increase of $21.60. In 2022, the annual deductible for Medicare Part B beneficiaries will be $233, an increase of $30.

What Changes Are Coming To Medicare In 2022

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

You May Like: Do You Have To Pay A Premium For Medicare

Cms Announces 2022 Medicare Part B Premiums

Today, the Centers for Medicare & Medicaid Services released the 2022 Medicare Parts A and B premiums, deductibles, and coinsurance amounts, and the 2022 Part D income-related monthly adjustment amounts. Most people with Medicare will see a 5.9 percent cost-of-living adjustment in their 2022 Social Security benefitsthe largest COLA in 30 years. This significant COLA increase will more than cover the increase in the Medicare Part B monthly premium.

Most people with Medicare will see a significant net increase in Social Security benefits. For example, a retired worker who currently receives $1,565 per month from Social Security can expect to receive a net increase of $70.40 more per month after the Medicare Part B premium is deducted.

CMS is committed to ensuring high quality care and affordable coverage for those who rely on Medicare today, while protecting Medicares sustainability for future generations,” said CMS Administrator Chiquita Brooks-LaSure. The increase in the Part B premium for 2022 is continued evidence that rising drug costs threaten the affordability and sustainability of the Medicare program. The Biden-Harris Administration is working to make drug prices more affordable and equitable for all Americans, and to advance drug pricing reform through competition, innovation, and transparency.

Is Medicare Part B Optional Or Mandatory

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you don’t have to enroll in Part B, particularly if you’re still working when you reach age 65. … You have a seven-month initial period to enroll in Medicare Part B.

Recommended Reading: Does Medicare Cover Assisted Living Expenses

Medicare Benefits 202: How Much Is Part B Premium Increasing

Increased costs in the new year

The US Centers for Medicare & Medicaid Services have announced the increases for both the standard premium for Medicare Part B, as well as the Part B deductible, for 2022.

As explained on CMS’ official website, the changes – which are quite significant – are due to a number of factors, such as the rising costs and utilisation across the health care system, as well as the fact that the US Congress had previously decided that the increase of the 2021 Medicare Part B premium should be lower than it would have been.

The premium was also affected by “the uncertainty regarding the potential use of the Alzheimer’s drug, Aduhelm, by people with Medicare.”

The Monthly Medicare Part B Premium Will Decrease In 2023 To $16490

In 2023, the standard monthly premium for Part B will decrease. The new monthly premium will be $164.90 per month. Thats an annual premium of $5.20.

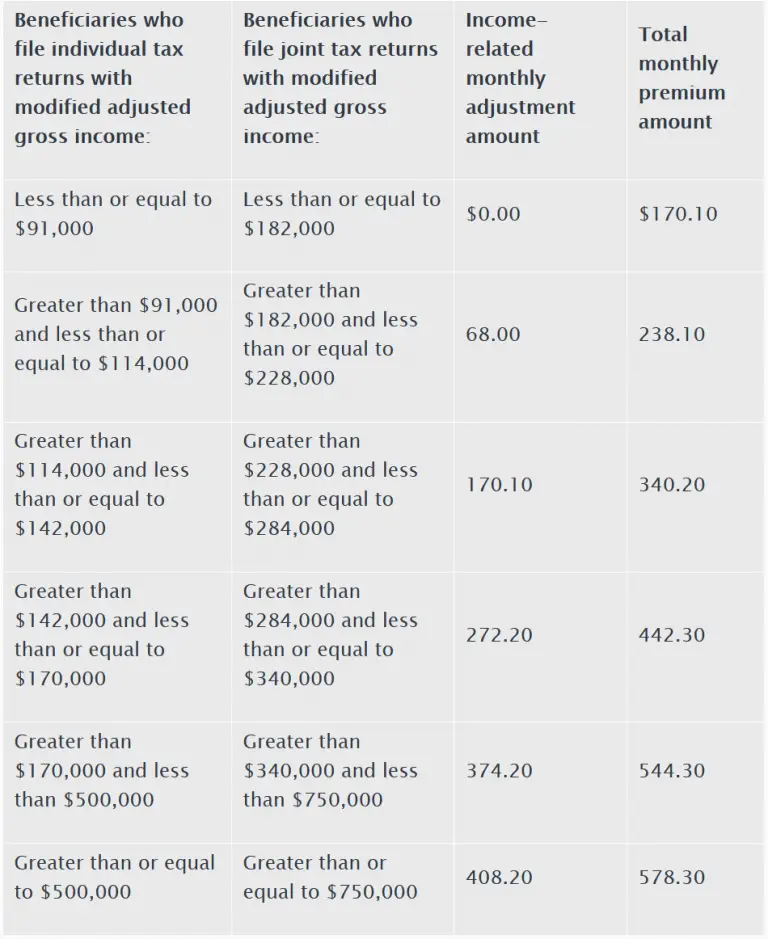

Those with a higher gross income will have an income-related monthly adjustment amount. If you make more than $97,000 on your tax return or have a joint tax return of more than $194,000, your Part B premium will range between $164.90 and $560.50, depending on your income bracket.

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-Related Monthly Adjustment Amount |

|---|

Also Check: Will Medicare Pay For Dental

How Much Will Medicare Part C Cost In 2023

Medicare Advantage plans are purchased through private health insurance providers, and so the adjustment to rates for 2023 will vary. Check with your Part C provider for updated 2023 premium rates.

The Centers for Medicare & Medicaid Services estimates that the average monthly premium for Part C plans has decreased from $19.52 in 2022 to $18 in 2023.

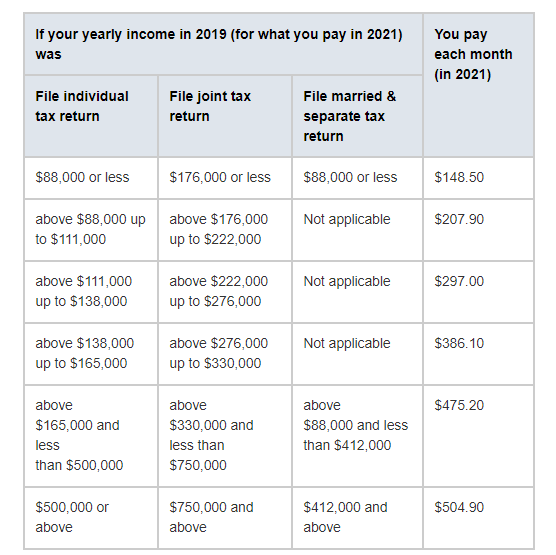

Medicare Part B Premiums To Rise 145% In 2022 With Premiums For Highest

Medicare Part B Premiums for the highest earners will top $14,000 a year in 2022.

getty

The Centers for Medicare & Medicaid Services has announced Medicare Part B premiums for 2022, and the base premium increases 14.5% from $148.50 a month in 2021 to $170.10 a month in 2022. That $21.60 monthly increase compares to a $3.90 monthly increase last year. Meanwhile income-related surcharges for high earners have been bumped up again too. The wealthiest senior couples will be paying nearly $14,000 a year in Medicare Part B premiums. Part B covers doctors and outpatient services.

The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. Last year, Congress kept the increases in the Part B premiums and the deductible in check with caps as part of a short-term budget bill. So far, no such luck this year.

The CMS announcement comes after last months Social Security Administrations COLA announcement: a 5.9% cost of living adjustment for 2022, compared to the 1.3% cost of living adjustment for 2021. The average Social Security benefit for a retired worker will rise in 2022 by $92 a month to $1,657 in 2022, while the average benefit for a retired couple will grow $154 a month to $2,753.

The income-related premium surcharges apply to Part D premiums for drug coverage too.

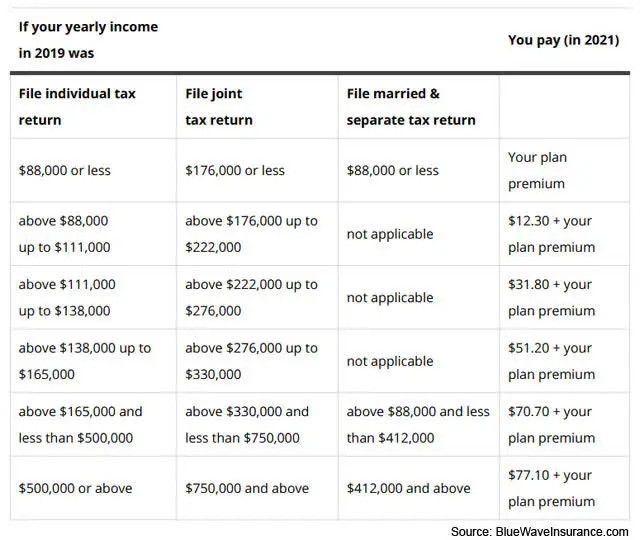

Medicare Part B Premium surcharges for high-income individuals

CMS

Further Reading:

Recommended Reading: How Much Does A Pet Scan Cost With Medicare

Why Is Medicare Part B Going Up So Much In 2022

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

Some Medicare Advantage Plans Offer $0 Premiums

Did you know that some Medicare Advantage plans offer $0 premiums?

$0 premium plans arent available in all locations, so call a licensed insurance agent today to compare the plans that are available where you live.

Compare Medicare Advantage plan costs in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Recommended Reading: Does Medicare Cover Upright Walkers

Costs That Apply To All Beneficiaries

No matter the type of Medicare coverage you have, every beneficiary needs to be aware of these costs.

The standard monthly premium for Part B, medical insurance: This will be $164.90. If youre already receiving Social Security benefits, the premium comes out of your monthly payment. Otherwise, you have been getting invoices.

Income-Related Monthly Adjustment Amount : Higher-income beneficiaries pay more for Part B and Part D, prescription drug coverage.

- The 2023 thresholds will be $97,000 for a single filer and a married individual filing separately, and $194,000 for a married individual filing a joint return.

- After crossing the threshold, the monthly amounts for Part B IRMAA will be $65.90 to $395.60.

- The Part D adjustments will be $12.20 to $76.40.

Part D prescription drug coverage: Whether you have a standalone Part D plan or a Medicare Advantage plan with drug coverage, these are some costs.

- The base beneficiary premium will be $32.74. No one actually pays this amount rather it is the basis of the Part D late enrollment penalty and other drug costs.

- The standard deductible will be $505. Plans can charge any amount, up to the set limit.

- Total drug costs of $4,660 will land you in the Coverage Gap .

- Cost-sharing in Catastrophic Coverage will be the greater of $4.15 for most generic medications and $10.35 for other drugs or 5%.

Medicare Costs To Go Down In 2023

Lower-than-expected spending on an expensive drug and other things means beneficiaries will pay less next year.

Medicare beneficiaries are getting a rare bit of good news as their Part B premiums and deductibles will tick down next year after the government health insurance plan spent less than projected in 2022. Unfortunately, the cost reductions beneficiaries will see next year are much smaller than the increases they shouldered this year. But costs will also go down for Medicare Advantage and Medicare Part D prescription drug plans. At the same time, deductibles for hospitalization costs under Part A will be going up. If youre new to Medicare and wondering what these letters are all about, well get to that see Medicare Open Enrollment Presents Choices, below.

The Centers for Medicare and Medicaid Services has announced the standard Medicare premiums for Part B beneficiaries will be $164.90 a month in 2023, down $5.20 from the $170.10 monthly charge in 2022, or about 3% less. The annual deductible for all Medicare Part B beneficiaries will be $226 in 2023, which is $7 less than the 2022 deductible of $233.

Don’t Miss: When Will Medicare Cover Hearing Aids

Medicare Open Enrollment Presents Choices

Medicare Open Enrollment will be Oct. 15 through Dec. 7. During this time, Medicare enrollees are encouraged to review their coverage to determine if their needs have changed.

Medicare Part B is the general insurance that covers items like doctors and other health care providers, outpatient and home health care, as well as medical equipment and preventive services like vaccines and yearly wellness visits.

Part A covers inpatient hospitalizations, care in skilled nursing facilities, hospice, inpatient rehabilitation, and some home health care services. It generally does not impose a premium.

Part D provides prescription drug coverage through private insurance companies

The other option is known as Part C or Medicare Advantage. This is a private insurance plan that takes the place of Part B and often Part D.

According to CMS, the projected average premium for 2023 Medicare Advantage plans is $18 per month, a decline of nearly 8% from the 2022 average premium of $19.52.

How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022 and 2023:

- An annual deductible of $1,600 in 2023 for in-patient hospital stays .

- $400 per day coinsurance payment in 2023 for in-patient hospital stays for days 61 to 90 .

- After day 91 there is a $800 daily coinsurance payment in 2023 for each lifetime reserve day used .

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

Read Also: How Do I Find Out My Medicare Number

How Much Will Ssi Checks Be In 2022

$841As the Social Security Administration explains, the monthly SSI maximum increased from $794 per month in 2021 for one person to a monthly amount of $841 in 2022. This affects many people in the US, with an SSA report in July finding that more than 7.8 million Americans receive SSI benefits.Jan 23, 2022

Humana Medicare Supplement Plans

When you have Original Medicare, finding a Medicare Supplement plan is vital to ensuring you have the best coverage possible for your healthcare needs. Luckily, Humana Medicare Supplement plans are among the highest-rated on the market.

Humana is one of the most widely available carriers, offering plans in all 50 states and 84% of counties nationwide. By empowering their members to lead healthy lifestyles and offering a diverse line of insurance products, Humana serves many types of Medicare customers.

Below, we discuss plan options, customer reviews, and what makes Humana stand apart from other carriers.

Read Also: Will Medicare Pay For A Therapy Pool

Does Medicare Part B Premium Change Every Year Based On Income

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you’re being charged and follow up with Medicare or the IRS if you have questions.

Discounts And Financial Assistance

Just like there are various methods of paying Medicare premiums, there are also some different ways to get help paying them.

- Medicare Savings Programs can help pay for Part A and Part B premiums, and potentially other out-of-pocket costs.

- Extra Help is a federal program that helps pay for Part D premiums.

- PACE can help alleviate the cost of a Part D plan.

In addition, because Medicare Advantage, Part D and Medigap plans are sold by private insurers, companies may offer various discounts and cost-saving incentives to customers.

Some of the offers that can be found may include discounts for households or married partners, non-smokers and more, but these will vary based on the plan provider.

Also Check: What Is The Annual Deductible For Medicare