Special Enrollment Period For Parts A And B

Some people with health care coverage through their job or union, or through their spouse’s job or union, wait to sign up for Medicare Part A and/or Part B . If you or your spouse are actively working for an employer with more than 20 employees when you turn 65, you can get a Special Enrollment Period to sign up for Parts A and/or B:

- Any time you’re still covered by the employer or union group health plan through you or your spouses current employment or

- During the eight months following the month the employer or union group health plan coverage ends, or when the employment ends .

If you delay enrolling even longer, you may have to wait for coverage and you may pay a lifetime late enrollment penalty surcharge on your Medicare premiums.

If you’re under age 65, and eligible for Medicare because you’re disabled and working , the SEP rules also apply to you as long as the employer has more than 100 employees.

Medicare Scooter Evaluation What Is Involved

There is a required on-site evaluation of the patients home performed before or at the time of the scooter delivery. A written report accompanies the evaluation.

The person conducting the evaluation confirms that the patient can maneuver their scooter inside the home, considering the physical layout, the doorways thresholds and width, and the surfaces.

Medicare Deadline: 65 Or Older And Still Working

If you are 65 or older, currently employed, and get health care coverage through your employer, you can wait to sign up for Medicare until you retire or your coverage with your employer ends. In this scenario, you have an 8-month window to sign up for Medicare . This is considered a Special Enrollment Period.

Don’t Miss: What Does Medicare Extra Help Pay For

Does Medicare Start On Your Birthday

Original Medicare coverage does not start on your actual birthday. At the earliest, coverage begins on the first day of the month you turn 65. So, if your birthday is July 24, your coverage will begin July 1.

However, there is one exception to this rule. If you are born on the first of the month, your Medicare coverage will begin one month earlier. So, if you are born on September 1, your Initial Enrollment Period will be the same as those born in August.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

- Was this article helpful ?

Proposals For Reforming Medicare

As legislators continue to seek new ways to control the cost of Medicare, a number of new proposals to reform Medicare have been introduced in recent years.

Premium support

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the governments expenses, into a publicly run health plan program that offers premium support for enrollees. The basic concept behind the proposals is that the government would make a defined contribution, that is a premium support, to the health plan of a Medicare enrollees choice. Sponsors would compete to provide Medicare benefits and this competition would set the level of fixed contribution. Additionally, enrollees would be able to purchase greater coverage by paying more in addition to the fixed government contribution. Conversely, enrollees could choose lower cost coverage and keep the difference between their coverage costs and the fixed government contribution. The goal of premium Medicare plans is for greater cost-effectiveness if such a proposal worked as planned, the financial incentive would be greatest for Medicare plans that offer the best care at the lowest cost.

Currently, public Part C Medicare health plans avoid this issue with an indexed risk formula that provides lower per capita payments to sponsors for relatively healthy plan members and higher per capita payments for less healthy members.

- Senate

Read Also: Do I Have To Have A Medicare Drug Plan

Is Medicare Enrollment Automatic

Some people do not have to enroll in Medicare because the government automatically enrolls them. This may be true for you if you get Social Security or Railroad Retirement Board benefits. If you are disabled and receive disability payments, you’ll be automatically enrolled in Medicare during the 24th month of disability payments.

If you will not be receiving Social Security or Railroad Retirement Board benefits at least 4 months before your 65th birthday, you need to enroll in Medicare.

Even though enrollment is automatic for many people, it’s still a good idea to compare your Medicare plan options. You can choose how to receive Medicare benefits when you first become eligible, as well as during open enrollment. Some beneficiaries enroll in Medicare Advantage, or choose to pay for a prescription drug plan through Medicare Part D.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

You May Like: How To Change Mailing Address For Medicare

How Long Does It Take To Get Medicare Part B After Applying

If you aren’t automatically enrolled, your Medicare Part B coverage start date depends on when you sign up.

Signing up for Medicare Part B during your IEP:

- Signing up months 1 through 3: The first day of the month that you turn 65

- If you sign up the month you turn 65: 1 month after you apply

- Signing up 1 month after you turn 65: 1 months after you apply

- Signing up 2 to 3 months after you turn 65: 3 months after you apply

If you join Medicare Part B during the General Enrollment Period , your Part B coverage begins on July 1.

When Does Medicare Enrollment Happen For The General Enrollment Period

The General Enrollment Period is the time each year when people who are not already enrolled in Medicare can sign up for coverage. Coverage will start July 1 if you apply during this period.

The General Enrollment Period is primarily for those who became eligible for Medicare but did not enroll in Medicare on time. They must wait until the General Enrollment Period to sign up and will face delays in the enrollment process.

Don’t Miss: Does Medicare Cover Ent Specialist

When Can You Buy A Medigap Policy

Once youre age 65 and enrolled in Medicare Part B for the first time, you have a six-month Medigap Open Enrollment Period in which you can buy a Medigap policy. During this period, you can buy any Medigap policy sold in your state, even if you have health problems .

If, though, you apply for Medicare Supplement Insurance after your Medigap Open Enrollment Period, you could be turned down for a policy if you have certain health conditions.

When Does Medicare Coverage Start

Most individuals become eligible for Medicare when they turn 65. If thats the case for you, you will begin Medicare coverage on the first day of your birth month. Medicare coverage will begin on the first day of the previous month if you turn 65 on the first day of the month.

A few more things to know:

- If you are still actively employed or you are not receiving retirement benefits at least four months before your 65th birthday, you will need to contact the Social Security Administration or Railroad Retirement Board and sign up for Medicare.

- Those with Social Security Disability Insurance will automatically be enrolled in Original Medicare on the first day of the 25th month of disability coverage.

- Those with end-stage renal disease may sign up for Medicare at any age if they meet the qualifications.

- If you receive SSA or RRB benefits, or you are a state, local, or federal government worker , you should be automatically enrolled in Original Medicare Parts A and B when you turn 65.

- Anyone who is not automatically enrolled in Part A and Part B needs to contact SSA or the RRB during the three-month period before they turn 65 the earlier, the better. It is important to make this contact three months before turning 65 and confirm that everything is in order.

- Medicare Supplement, Advantage, and Part D drug coverage can be enrolled concurrently with your Part B start date.

Recommended Reading: Do I Have Medicare Advantage

When Does Medicare Part A And B Coverage Start

To avoid a gap in coverage, sign up for Medicare Part A and Part B in the three months before your 65th birthday. If you do, your coverage will start in your birthday month.

If you sign up toward the middle or end of your Initial Enrollment Period, your coverage will start from one to six months after your birthday month, depending on when you enroll.

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Also Check: Should I Enroll In Medicare If I Have Employer Insurance

Can I Drop Other Coverage To Enroll In Part B

Once youre eligible for Part B, youre eligible.

If one of the exceptions applies that qualifies you for a Special Enrollment Period, you can drop other coverage and enroll in Part B at any time, assuming you have enrolled for Part A.

You may be automatically enrolled in Medicare Part A.

Your retiree health plan may require you to enroll in Medicare. Whether or not this is the case, many health plans coordinate benefits with Medicare.

Medicare is the usually the primary payer. You may find that adding part B coverage can help lower your overall out-of-pocket health care expenses. In any case, having other coverage doesnt typically block you from enrolling in Part B if you are eligible.

You should consult your human resources office or benefits administrator to see how your employee or retiree plan coordinates with Medicare.

Read Also: Can A Green Card Holder Apply For Medicare

What Is Medicare Part D

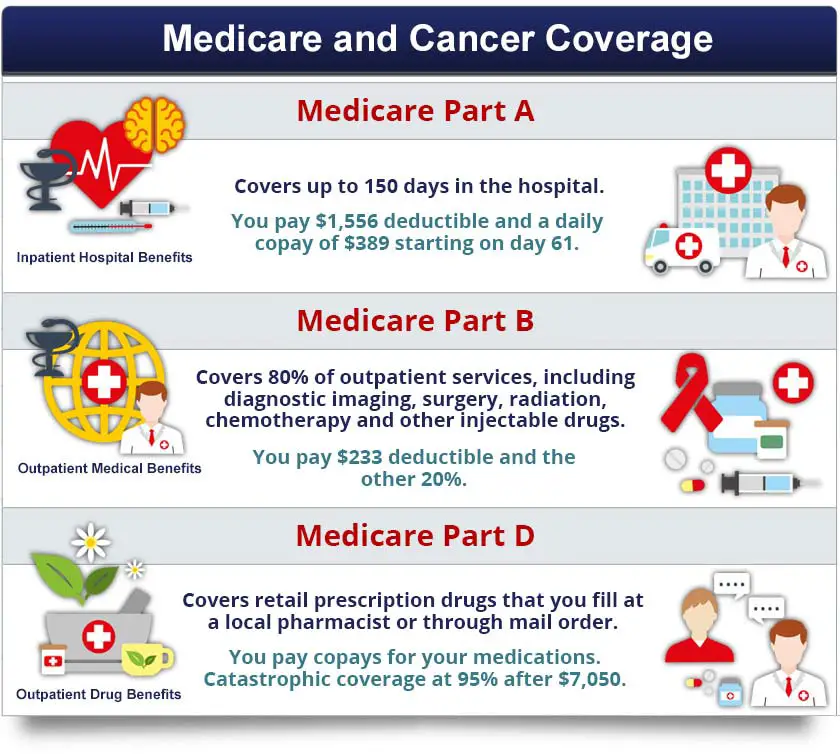

Medicare Part D is a prescription drug coverage plan that is separate from Original Medicare. Part D plans are offered by private insurance companies that contract with Medicare. You can enroll in a Part D plan if you have Original Medicare or a Medicare Advantage Plan .

If you are enrolling in a Medicare Advantage plan you are not allowed to enroll in a stand-alone Part D plan. However, if you remain on Original Medicare with a Medigap plan you can obtain a stand-alone Part D plan available in your local area.

You May Like: Is Xarelto Covered By Medicare Part D

How Do Medicare And Social Security Work Together

Youll get Medicare automatically if youre already receiving Social Security retirement or SSDI benefits. For example, if you took retirement benefits starting at age 62, youll be enrolled in Medicare three months before your 65th birthday. Youll also be automatically enrolled once youve been receiving SSDI for 24 months.

Youll need to enroll in Medicare if you turn 65 but havent taken your Social Security benefits yet. The Social Security Administration and Medicare will send you a Welcome to Medicare packet when youre eligible to enroll. The packet will walk you through your Medicare choices and help you enroll.

SSA will also determine the amount you need to pay for Medicare coverage. You wont pay premiums for Part A unless you dont meet the coverage rules discussed above, but most people will pay a premium for Part B.

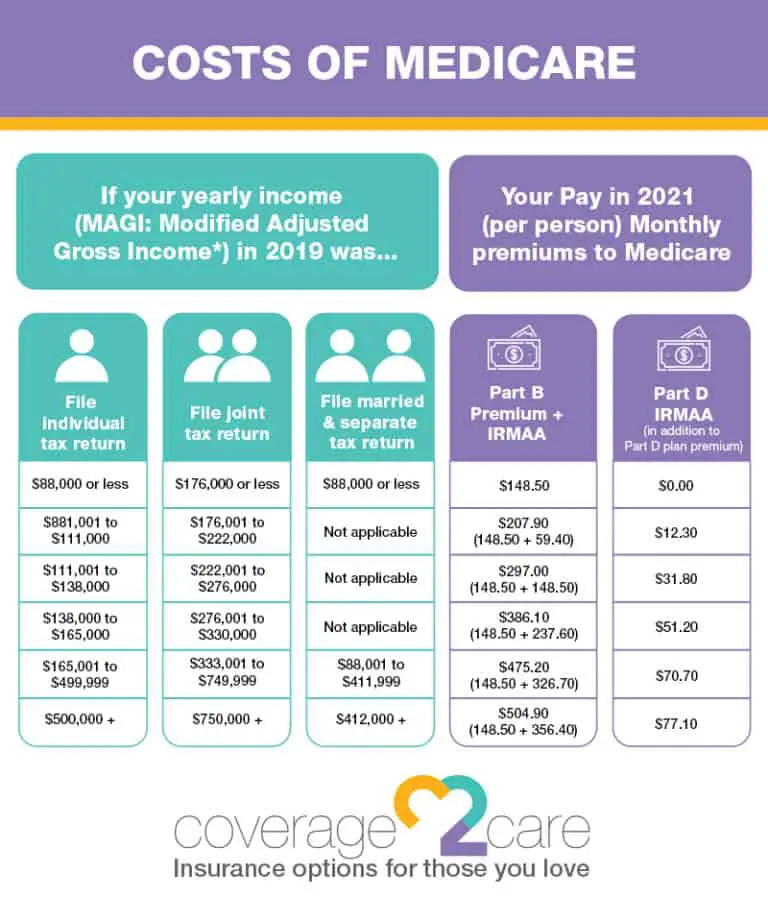

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income. Social Security uses your tax records to determine the rates you need to pay.

If you make more than $87,000 a year, SSA will send you an Income-Related Monthly Adjustment Amount . Your IRMAA notification will tell you the amount above the standard premium you need to pay. Youll also be responsible for an IRMAA if you choose to buy a separate Part D plan and you make over $87,000.

Can Medicare Part B Be Backdated

Although Part A coverage can be backdated by 6 months , the same is rarely true of Medicare Part B.

However, you may be able to appeal the Medicare Part B late enrollment penalty IF you can prove that a federal employee supplied incorrect information and that this misinformation is why you delayed enrolling in Part B when you were first eligible. If you can prove this, you will be granted retroactive enrollment in Medicare Part B .

You do not qualify for equitable relief if the reason you did not sign up for Part B on time was due to misinformation received from an employer or group health plan.

You May Like: Why Is Medicare Advantage Free

Medicare Deadline: 65 Or Older And Have Health Insurance Through Your Spouse

If you have health insurance through your spouses employer, you dont need to sign up for Medicare when you turn 65 or retire. You can sign up for Part A and Part B up to 8 months after your spouses employer coverage ends. This is considered a Special Enrollment Period.

Important reminder: You are not automatically covered by Medicare through your spouse. Unlike health insurance you may have had through your employer, Medicare does not allow you to receive coverage through your spouse. In order to receive Medicare coverage, you must apply for it individually.

Recommended Reading: Are Medicare Advantage Premiums Deducted From Social Security

When Does Medicare Coverage Begin If You Enroll During The Initial Enrollment Period

The Initial Enrollment Period is the time when people can first sign up for Medicare. It lasts for a total of seven months and begins three months prior to turning 65 and ends three months after your 65th birthday month.

It is critical to begin the process of signing up for Medicare three months before you turn 65 to ensure you receive your Medicare card in the mail in enough time to sign up for a Medicare Supplemental plan, Medicare Advantage plan, and Part D coverage.

Medicare coverage will begin on the first of your birthday month. As an example, if your birthday is on July 18 your Medicare will start on July 1.

Read Also: Does Medicare Cover Ear Nose And Throat Doctors

Medicare Special Enrollment Period

You may choose not to enroll in Medicare Part B when you are first eligible because you are already covered by group medical insurance through an employer or union. If you lose your group insurance, or if you decide you want to switch from your group coverage to Medicare, you can sign up at any time that you are still covered by the group plan or during a Special Enrollment Period.

Your eight-month special enrollment period begins either the month that your employment ends or when your group health coverage ends, whichever occurs first. If you enroll during an SEP, you generally do not have to pay a late enrollment penalty.

The Special Enrollment Period does not apply if youre eligible for Medicare because you have ESRD. Please also keep in mind that COBRA and retiree health coverage are not considered current employer coverage and would not qualify you for a special enrollment period.

What Is A Late Enrollment Penalty

If you sign up for Medicare late, you may have to pay a late enrollment penalty. The penalties are as follows:

- Part A: Your monthly premium could increase by 10%, if you have a premium.

- Part B: Your monthly premium could increase by 10% for every 12-month period during which you were eligible for Medicare but did not enroll.

- Part D: If you do not enroll in prescription drug coverage within 3 months of enrolling in Parts A and B, you will pay a penalty if you enroll later. In general, you will need to pay the penalty for the entire duration of your Medicare drug coverage. The penalty is 1% of the national base beneficiary premium multiplied by the number of months you delayed enrollment or didn’t have creditable coverage. The figure is then rounded to the nearest 10 cents. For example, in 2019, the national base beneficiary premium was $33.19. If you delayed enrollment for 6 months, you would pay a monthly penalty of $1.99 per month.

You May Like: How Much Does Medicare Cover For Hospital Stay

When Does Medicare Advantage Coverage Start

The date your Medicare Advantage plan starts depends on the enrollment period and your eligibility. Those turning 65 and enrolling in Medicare can select a Medicare Advantage plan up to three months before the effective date.

When you pre-enroll in your plan, you save yourself from scrambling. Starting Medicare is one thing you do not want to procrastinate.

Many people change plans during the Annual Enrollment Period. If you make a change during this window, your policy will begin on January 1 of the following year.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today