Do I Have To Enroll In Medicare Part B

What if you have other medical coverage, like an employers plan? Do you still have to sign up for Part B?

You can choose to delay Part B enrollment, as some people do when theyre covered under an employers or union-based health insurance plan. However, when that coverage ends, be aware that if you dont sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty.

Heres one reason you might want to sign up for Medicare Part B. Suppose you decide youd like to buy a Medicare Supplement insurance plan. Or, you want to enroll in a Medicare Advantage plan. Both of these types of coverage require you to be enrolled in both Medicare Part A and Part B.

If you stay with Original Medicare and decide to sign up for a stand-alone Medicare Part D prescription drug plan, you need to be enrolled in Medicare Part A and/or Part B.

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, youll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

Do you want to learn more about those Medicare coverage options we mentioned? Start comparing plans right away by typing your zip code where indicated on this page and clicking the button.

New To Medicare?

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover tele-health services.

- Increases Medicare payments for COVID-19related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

How Do Copays Coinsurance And Deductibles Work With Medicare Plans

Who is this for?

If you’re shopping for Medicare, this page will help you understand some common terms you might come across while you’re researching.

Copays, coinsurance and deductibles are all terms to describe money you pay toward health care services and prescription drugs when you have a health insurance plan.

Read Also: Should I Get Medicare Part C

What Else Should I Know About Medicare Supplement Insurance Plans

- Medicare Supplement insurance plans that may cover the Medicare Part B deductible are being phased out. This affects Medicare Supplement Plans C and F . If you were already eligible for Medicare on December 31, 2019 or earlier, you can keep your Plan C or Plan F, or apply for the plan. But if you qualified for Medicare on or after January 1, 2020, you wont be able to buy Plan C or Plan F.

However, Plan G is very similar to Plan F. Like Plan F, Plan G has a high-deductible version. Plan G doesnt cover the Medicare Part B deductible.

- Keep in mind that Medicare Supplement insurance plans only work with Medicare Part A and Part B. You cant use a Medicare Supplement insurance plan to pay for Medicare Advantage costs.

- Types of coverage that are not Medicare Supplement insurance plans include: TRICARE, veterans benefits, long-term care insurance policies, Medicare Advantage plans and stand-alone Medicare Part D Prescription Drug Plans.

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a guaranteed-issue right to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition*. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

Also Check: Is Eliquis Covered Under Medicare

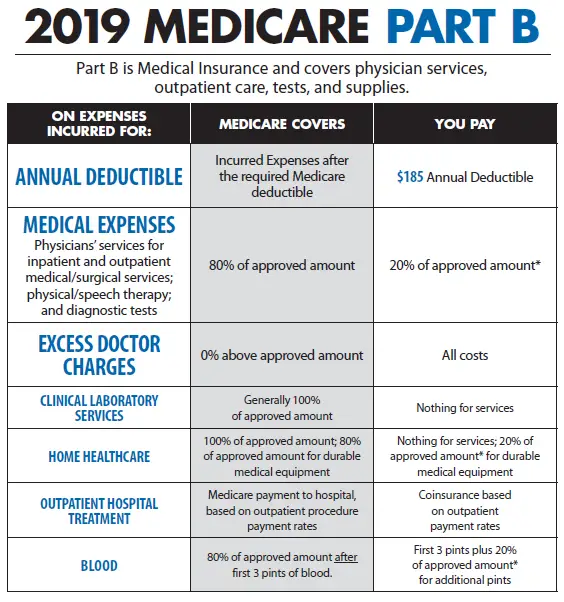

Summary Of Medicare Benefits And Cost

The chart below is a comprehensive list of Medicare Part A and B costs, including premiums, deductibles and coinsurance. Medicare supplemental insurance, known as Medigap, can help cover some of the gaps in coverage and pay for part or all of Medicares coinsurance and deductibles, depending on the policy. Some Medicare Advantage plans may also help cover these costs. See Medigap: Medicare Supplemental Insurance and Medicare Advantage for more information.

Get Someone On Your Side With Medicare

All this stuff can be very confusing, but not when you have Boomer Benefits on your side. Our clients call us for easy explanations of any billing or paperwork they receive regarding their policies. There are many times that we determine our clients dont actually owe some of the bills they ask us about. In this manner we collectively save our clients thousands of dollars every year. Dont go it alone on your Medicare policies when our services are entirely free. Give us a call today to get free claims support for the life of your policy!

Read Also: Are Lidocaine Patches Covered By Medicare

What Is A Medicare Copay

A Medicare copay is the fixed dollar amounts that you pay for a healthcare service, regardless of what the provider charges. It is not based on a percentage of your bill for that visit.

Copays may or may not count toward your annual plan deductible if you have one, but they do count toward your maximum out-of-pocket limit.

Most Medicare Advantage managed care plans use a copay method of cost-sharing. You may be asked to pay $10 or $20 each time you visit the doctor, or $50 each time you go to the emergency room. Each plan sets their own copay amounts which you can find in the plans Summary of Benefits. You usually pay your Medicare copay at the time of service.

Part D prescription drug plans also frequently use a copay system. Some plans use a tiered copay schedule, in which cheaper drugs and generics have a lower copayment and more expensive drugs have a higher copayment.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

| TTY 711, 24/7

A benefit period begins the day you are admitted for inpatient care at a hospital or skilled nursing facility, and it ends when you have gone 60 consecutive days without inpatient treatment.

For example, if you are admitted for inpatient hospital care on June 1 and are discharged on June 10, you would still be in the same benefit period if you were admitted again for inpatient care on June 30. You wouldn’t have to meet your Part A deductible again if you already met that deductible during your first hospital stay.

If, however, you were discharged on June 10 and were readmitted to the hospital in October of the same year, you would be in a new benefit period. You would need to meet the Part A deductible again before your Medicare Part A coverage would kick in again.

Don’t Miss: Can I Get Glasses With Medicare

Do Medicare Advantage Plans Have Coinsurance

Medicare Advantage plans share costs with plan members, but its mostly with copays rather than coinsurance. Copays are a small fee that you pay when you receive a health care service. So, if Joe had a Medicare Advantage plan rather than Original Medicare in the example above, he might pay a $30 copay when he visited the doctor.

Medicare Advantage is an alternative to Original Medicare . Its another way to get your Medicare benefits. Plans are offered by private insurance companies approved by Medicare.

Medicare Advantage plans are required to set an out-of-pocket limit for plan members. Theres no out-of-pocket limit with Original Medicare.

Its your money, and its important to understand your Medicare costs and how they are calculated. Look over the medical bills you receive and the Medicare Summary Notices you get from Medicare. Talk to your provider or your plan, or call Medicare, if you have questions.

Cost Differences Between Part A And Part B

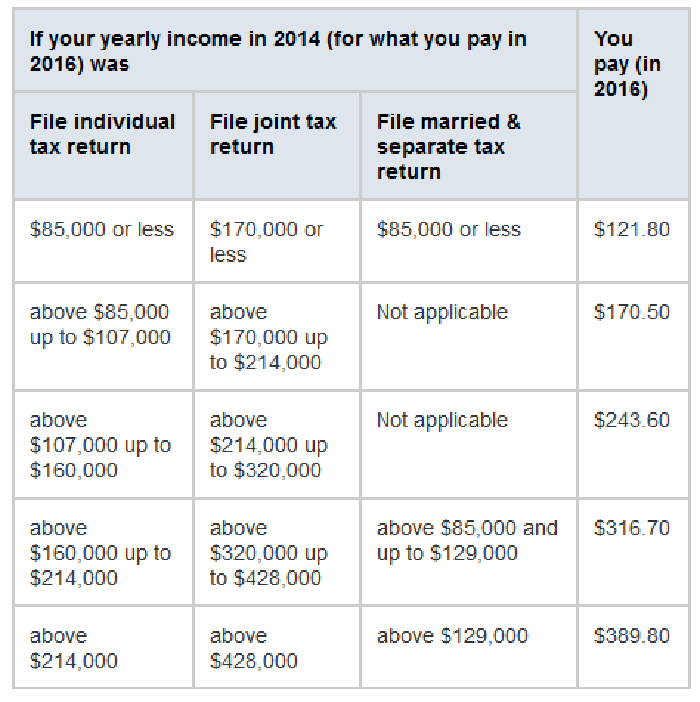

Medicare Part A is free for most Americans age 65 or older, though people who haven’t worked or paid Medicare taxes for at least 10 years will pay a large monthly Part A premium. Most people don’t get Part B for free whether they’ve reached their 65th birthday or not, but the cost is much lower and depends on your income.

You May Like: How To Get Motorized Wheelchair Through Medicare

What Is Medicare Part B And What Does It Cover

Medicare Part B is a portion of Original Medicare, which is the federal health insurance program for individuals who are 65 and older or who have a qualified disability.

Part B is known as the medical insurance portion of Medicare, meaning that it provides coverage for preventive and medically necessary services. This is in contrast to Medicare Part A, which solely provides coverage relating to hospital expenses.

Some examples of Medicare Part B expenses include:

- Ambulance services

- Transplants

What Is My Medicare Part B And Coinsurance Amount

The annual deductible for Medicare Part B is $203 in 2021. You will also be responsible for a 20% coinsurance for many covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

Just by entering your zip code in the form on this page, you can start comparing Medicare plans in your area instantly. But youre also more than welcome to reach out to us .

*Pre-existing conditions are generally health conditions that existed before the start of a policy. They may limit coverage, be excluded from coverage, or even prevent you from being approved for a policy however, the exact definition and relevant limitations or exclusions of coverage will vary with each plan, so check a specific plans official plan documents to understand how that plan handles pre-existing conditions.

This information is not a complete description of benefits. Contact the plan for more information.

Limitations, copayments, and restrictions may apply.

Benefits may change on January 1 of each year.

You May Like: How To Enroll In Original Medicare

What If The Doctor Or Supplier Does Not Accept Assignment

This does not mean you cannot seek treatment from them. It also doesnt mean the service or item will be denied by Medicare. These are both common misconceptions. However, there are some distinct disadvantages to using non-participating providers:

- You may have to pay the entire charge for the service or item at the time of service.

- You will usually end up paying more out of pocket.

- In some instances, you may have to submit your own claim.

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203. After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Also Check: What Is A Medicare Special Needs Plan

What Does Medicare Part A Cover

Medicare Part A essentially covers inpatient medical care:

- Home health services, including nursing care, physical therapy, and occupational therapy

- Hospice, which is care aimed at making terminally ill individuals as comfortable as possible after they decide they no longer want to pursue treatment for their illness

- Hospital care, including long-term care facilities and inpatient rehab

- Nursing home care, but only if the beneficiary requires more than custodial care

- Skilled nursing facility care, including meals, supplies, and nurse-administered injections

How much Part A covers for these services depends on which type of facility you stay in, whether you’ve met the deductible , and how long your stay lasts.

What Is The Medicare Maximum Out

When health insurance plans talk about a maximum out-of-pocket limit, it refers to a dollar amount beyond which the plan pays 100% of covered health care costs. Generally, your copayments and coinsurance amounts contribute to the maximum out-of-pocket limit. Premiums, however, do not.

Under Original Medicare , there is no out-of-pocket maximum. You are responsible for all of your required coinsurance amounts, which is why having only Original Medicare is not enough. You need additional coverage to prevent catastrophic spending in the even of a major illness.

If you have a Medigap plan, your out-of-pocket costs for covered health care services are likely to be quite small, since these plans are designed to pay all or part of your deductibles and coinsurance amounts under Part A and Part B.

All insurance companies offering Medicare Advantage plans must include a maximum out-of-pocket limit for their members. This can vary depending on the plan you choose. However, the federal government does set a maximum each year, which is $7,550 in 2021. No plan can set an out-of-pocket maximum higher than that.

You May Like: How Do I Check On My Medicare Part B Application

Your Medicare Deductible Copay & Coinsurance

June 2, 2021 By Danielle Kunkle Roberts

Health insurance has a language all its own, and Medicare is no exception. A Medicare deductible. whats that, and how is it different from a Medicare copay?

If youre shopping for a Medicare plan, its important to understand all the different terms that define your out-of-pocket costs. This way youll understand your benefits and know what you will pay.

Heres a look at the most common terms for your expenses under Medicare and what they mean for your budget.

What Is Medicare Part B

Medicare Part B is known as medical insurance because it covers doctor visits and medical care outside the hospital. Like with Medicare Part A, treatment must be determined as medically necessary or preventative to be covered by Medicare Part B.

While Part A is required for some people on disability or those receiving other forms of government aid, Medicare Part B is not mandatory for these people. However, you may incur late enrollment penalties if you don’t sign up when you’re first.

Call a Licensed Agent:

Read Also: What Is The Best Medicare Part D Plan For 2020

What Does Medicare Part B Cover Should I Consider A Supplement Plan

The first thing you need to know is that all supplement plans sold are identical with every company that offers them. There are 11 plans .

For example, Plan F sold by one company has the same coverage as a Plan F sold by another company.

Wondering what your Part B Premium is in 2020?Submit your information here.

So when you consider purchasing a plan, your decision comes down to price and service. We deal with companies that have some of the lowest rates in NJ, PA, DE and our customer service is 2nd to none.

Our agents meet with you in person at your home, our office, or even a coffee shop so you can meet them and have everything laid out in front of you.

Unlike an HMO, Medicare Supplements offer freedom to use virtually any doctor and any hospital of your choice in the United States, and you never need a referral. You may even choose a plan that covers your entire doctor visit, tests, hospital stays, etc. without having to pay a co-pay or deductible.

Just show your card, and walk away. Its all paid for! Isnt this the way insurance is supposed to be?

Cover Your Medicare Out

There is one way that many Medicare enrollees get help covering their Medicare out-of-pocket costs.

Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage. You pay a premium to a private insurance company for enrollment in a Medigap plan, and the Medigap insurance helps pay for certain Medicare out-of-pocket costs including certain deductibles, copayments and coinsurance.

The chart below shows which Medigap plans cover certain Medicare costs including the ones previously discussed.

| 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

If you’re ready to get help paying for Medicare out-of-pocket costs, you can apply for a Medigap policy today.

You May Like: When Do Medicare Benefits Kick In