Two More Part B Costs

The 2023 Part B deductible will be $226, a decrease of $7. Once those who have Original Medicare pay this deductible, Medicare then pays its share. Those with Medicare Advantage do not pay this deductible. Each plan establishes its cost sharing.

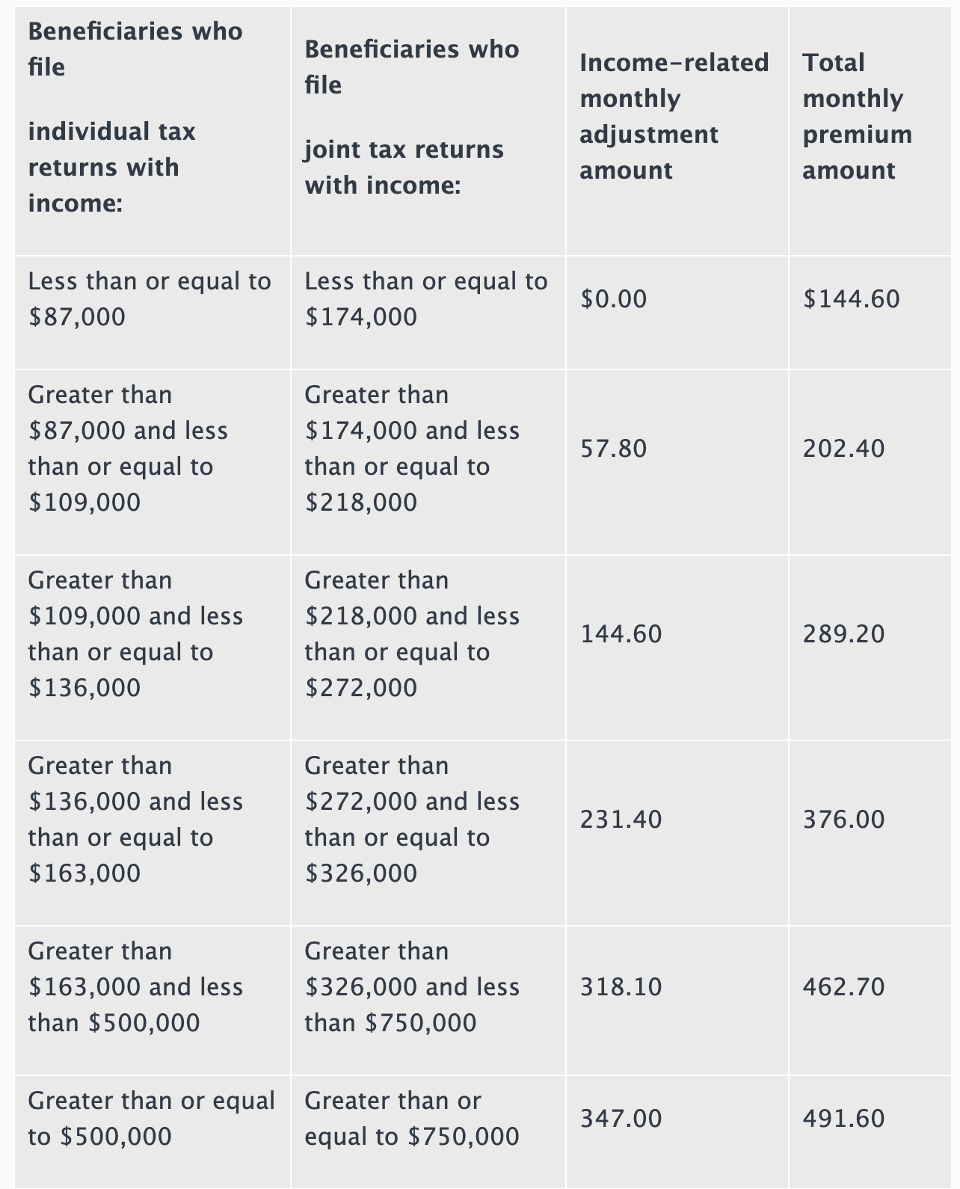

And, we cant forget about IRMAA, the income-related monthly adjustment amount. Higher-income beneficiaries pay more every month, in addition to the Part B premium. In 2023, the thresholds will be $97,000 for a single filer or a married individual filing a separate return and $194,000 for a married individual filing a joint return, compared to $91,000 and $182,000 in 2022.

Obviously, Medicare is a vast and complicated system. Nothing new there. But I can recommend two things: be patient, andfor your own peace of mindlearn all you can about the various parts of Medicare. Were paying for it one way or another. And, after all, nothing is free.

How Much Are Medicare Premiums Going Up By

Medicare’s Part B standard premium is set to jump 14.5% in 2022, meaning those relying on the coverage will face an increase of more than $21 a month.

In addition to the standard premium, the deductible for Part B will also increase next year, from $203 to $233.

That’s a 14.8% increase from 2021 to 2022.

The Medicare Part A deductible is also on the rise and will go up by $72 to $1,556.

The determining factor for Part B premiums, deductibles, and coinsurance rates is the Social Security Act, according to the CMS.

How Will This Cola Affect My Medicare Premiums

The COLA could push some higher earners into the bracket where they have to pay income-adjusted Medicare premiums in the future. For 2023, individuals whose 2021 income exceeded $97,000 and couples whose income exceeded $194,000 have to pay more than the standard Part B premium of $164.90 a month per person. Higher earners also pay more for Part D drug plans. The government bases the Medicare income-related monthly adjustment amount on income from two years prior, so next years COLA could affect higher income beneficiaries premiums for 2025.

There is some good news for Medicare beneficiaries for next year: the standard Part B monthly premium will decrease by $5.20 for 2023. Most recipients get their Part B premium automatically deducted from their Social Security checks, so they will benefit from the full COLA next yearunlike last year, when a larger-than-average Part B increase of 14.5% took a big bite out of the cost-of-living adjustment.

Write to Elizabeth OBrien at

Recommended Reading: How Old To Get Medicare And Medicaid

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Deductibles And Coinsurance Will Also Be Increasing

The Centers for Medicare & Medicaid Services has announced increases in premiums, deductibles, and coinsurance for Medicare Parts A and B in 2022, as well as new income-related adjustments for Medicare Part D drug coverage. Here’s a quick summary of what to expect if you participate in these programs.

Read Also: How To Calculate Modified Adjusted Gross Income For Medicare

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

I Thought The 2023 Cola Was Going To Be In The Double Digits What Gives

The COLA is based on a calculation that compares the average consumer-price index from the third quarter of 2022 with data from the same period last year. The index thats used in the calculation is the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W.

High CPI-W readings over the summer led to an earlier COLA estimate of 10.5%. Johnson calculated that estimate based on the most current consumer-price data available at the time. Gas prices have since fallen, leading to the lower COLA, Johnson said.

Read Also: What If My Medicare Card Has Expired

Are My Medicare Premiums Going Up In 2023

Are you wondering how much Medicare premiums will increase for 2023? Rising inflation coupled with a 14.5% Medicare Part B premium increase from 2021 to 2022 raises concerns about Medicare premiums in 2023.

While awaiting the official announcement, expected in the fourth quarter of 2022, projections are already a topical news story. In the meantime, answers to some of your Medicare Part B premium questions are available now.

TIP: For more great Medicare information, tips and tricks delivered directly to your inbox, .

Medicare Benefits Solutions

Does The Cola Accurately Reflect The Inflation That’s Impacting Seniors

Some advocates say that it is falling behind, partly because the formula used by the Social Security Administration relies on an inflation measure called the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W.

Some seniors and their advocates have argued that the CPI-W doesn’t accurately reflect the price pressures facing older Americans.

The CPI-W gives greater weight to gasoline and transportation costs, which are expenditures more common among workers who commute than retirees. It also puts less weight on medical costs, which are typically higher for older Americans.

Read Also: Is Medicare Supplement Plan F Going Away

Compare Medicare Advantage Plans In Your Area

If you have questions about you Part B premium or would like to learn more about how a Medicare Advantage plan can help you save on your health care costs, call to speak with a licensed insurance agent today.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Christians passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

Statement From Hhs Secretary Becerra: 2022 Medicare Part B Premium Increase Attributable To Alzheimers Drug Aduhelm Will Be Adjusted And Incorporated Into Upcoming 2023 Medicare Premium Determination

Today, U.S. Department of Health and Human Services Secretary Xavier Becerra announced that Medicare Part B premiums paid by Medicare beneficiaries for 2022 should be adjusted downward to account for an overestimate in costs attributable to the inclusion of new Alzheimer’s drug Aduhelm within the Medicare program for reimbursement. Due to the legal and operational hurdles in adjusting Medicare premiums midstream in 2022, the reduction in premium costs attributable to Aduhelm will be incorporated into Medicare premiums for 2023 to lower Part B premiums paid by Medicare beneficiaries. Secretary Becerra’s decision to lower Medicare beneficiaries’ premium payments came after he received a report from the Centers for Medicare and Medicaid Services concluding tha cost savings from lower-than-expected Medicare Part B spending on Aduhelm can be passed along to Medicare beneficiaries by lowering the 2023 Part B premium. Read the CMS report.

After receiving CMS’s report reevaluating the 2022 Medicare Part B premiums, we have determined that we can put cost-savings directly back into the pockets of people enrolled in Medicare in 2023, said Secretary Becerra. We had hoped to achieve this sooner, but CMS explains that the options to accomplish this would not be feasible. CMS and HHS are committed to lowering health care costs so we look forward to seeing this Medicare premium adjustment across the finish line to ensure seniors get their cost-savings in 2023.

Don’t Miss: Does Mutual Of Omaha Medicare Supplement Have Silver Sneakers

Here Is A Rundown Of The 2023 Medicare Part A B And D Premiums And Costs:

Why Are Medicare Costs Increasing

These increases can be attributed to a handful of factors.

Across the healthcare industry, there are rising prices and more utilization.

This drives higher premiums while accounting for anticipated increases due to the intensity of provided care.

Congress also acted to lower the expected 2021 Part B premium increase.

As a result, there is a small $3 per beneficiary, per month increase in the Part B premium through 2025.

There are also contingency reserves needed because of the new Alzheimer’s disease drug, Aduhelm.

Due to the drug’s newness, having gained FDA approval over the summer, it is still unclear how and if it will be covered by Medicare beneficiaries in 2022.

As a result, the program is planning for “higher expenditures” to offset the potential costs of new treatments, according to the CMS.

Also Check: Does Medicare Cover Refraction Test

Are There Ways To Save On My Medicare Out

If youre concerned about the rising cost of Medicare, you can consider a few options that may be able to help you save on your out-of-pocket Medicare costs:

- Medicare Savings Programs are available to qualified Medicare beneficiaries who have limited incomes and financial resources. These programs can help cover specific Medicare premiums, deductibles and/or coinsurance costs.

- Medicare Supplement Insurance plans can provide coverage for certain Medicare out-of-pocket expenses. While Medigap plans dont cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses.

- Medicare Advantage plans provide all the same benefits as Medicare Part A and Part B . Most Medicare Advantage plans also offer extra benefits such as dental, vision and prescription drug coverage. You must still pay your Medicare Part B premium, but the money you can potentially save on other covered health care costs can help you better afford your Part B premium.

Will Medical Costs Eat Into The 2023 Cola

There’s some good news on this front.

Medicare, the health insurance plan for older Americans, last month said it would drop its premiums next year by about 3% for its Medicare Part B plan.

That’s important because Medicare’s Part B plan, which covers routine doctor visits and other outpatient care, boosted its premiums in 2022 by 14.5%, an increase that ate up much of the cost-of-living adjustment seniors received in their Social Security checks.

The typical Part B premium will decrease by $5.20 a month, trimming the standard monthly premium to $164.90. About 85% to 90% of Americans on the government health insurance program pay the standard rate, with the premium deducted directly from their Social Security checks.

Another piece of good news is the insulin price cap for Medicare beneficiaries, which is directed by the Inflation Reduction Act. Starting in 2023, seniors on Medicare won’t pay more than $35 a month for the medication.

However, one of the Inflation Reduction Act’s most impactful provisions for medical costs a cap of $2,000 per year on out-of-pocket spending on drugs won’t go into effect until 2025, which means some seniors could still face higher medication costs and out-of-pocket expenses in 2023.

Don’t Miss: Does Medicare Pay For Dexcom

Medicare Part D Donut Hole

After you and your Medicare drug plan spend $4,660 on covered drugs in 2023, you enter what’s called the Medicare donut hole coverage gap. While you’re in the gap, you pay no more than 25% of the cost for covered brand-name or generic drugs.

The 2023 Medicare Part D drug plan catastrophic coverage phase begins once you and your plan have combined to pay for $7,400 of covered drugs in the year. Once you spend this amount, your drug plan will cover your covered drugs for the rest of the year with minimal copay/coinsurance costs to you.

Medicare Advantage and Medicare Part D plan members will receive a letter in the mail each fall called an Annual Notice of Change. This letter details any changes to the plan and its important to review the notice each year so you can determine if you wish to remain in the plan or shop for a different plan during the Annual Enrollment Period , also called the fall Medicare open enrollment period.

Hhs: Higher Medicare Premiums Stay In Place This Year Will Drop In 2023

Medicare’s highest-ever price increase in 2022 was driven by estimated costs for the controversial Alzheimer’s drug Aduhelm. But even with severely limited coverage, the Centers for Medicare and Medicaid Services determined that a mid-year premium adjustment is not operationally feasible. HHS Secretary Xavier Becerra announced though that they would go down next year.

AP:Medicare Recipients To See Premium Cut But Not Until 2023Medicare recipients will get a premium reduction but not until next year reflecting what Health and Human Services Secretary Xavier Becerra said Friday was an overestimate in costs of covering an expensive and controversial new Alzheimers drug. Becerras statement said the 2022 premium should be adjusted downward but legal and operational hurdles prevented officials from doing that in the middle of the year. He did not say how much the premium would be adjusted.

Stat:Biden Administration Wont Lower Seniors Medicare Premiums This YearHealth and Human Services Secretary Xavier Becerra in January publicly announced he was ordering Medicare to consider dropping older adults premiums in the middle of this year, which would have been an unprecedented move. But the administration decided against a change due to legal and operational hurdles, the department said Friday afternoon. The overpayments will instead be factored into next years premiums.

In related news about CMS and the Affordable Care Act

Recommended Reading: Does Medicare Cover In Home Help

The Truth About Your Medicare Part B Premium

You probably know that your Medicare Part B premium can change each year. Do you know why? Or how the amount is calculated? Or why it may increase?

Medicare costs, including Part B premiums, deductibles and copays, are adjusted based on the Social Security Act. And in recent years Part B costs have risen. Why? According to CMS.gov, The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.1

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

You May Like: Who Can Help With Medicare Enrollment