Medicare Advantage Plans Coverage For Some Services And Procedures May Require Doctors Referral And Plan Authorizations

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures. Medicare Advantage plans often also require your primary care doctors referral to see specialists before they will pay for services.

What Are Medicare Advantage Plans

A Medicare Advantage Plan is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, youll still have Medicare but youll get most of your Medicare Part A and Medicare Part B coverage from the Medicare Advantage Plan, not Original Medicare. Most plans include Medicare prescription drug coverage . In most cases, youll need to use health care providers who participate in the plans network. However, many plans offer out-of-network coverage, but sometimes at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because youll need it if you ever switch back to Original Medicare.

Medicare Advantage Plans cover almost all Medicare Part A and Part B benefits

In all types of Medicare Advantage Plans, youre always covered for emergency and urgent care. Medicare Advantage Plans must cover almost all of the medically necessary services that Original Medicare covers. However, if youre in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

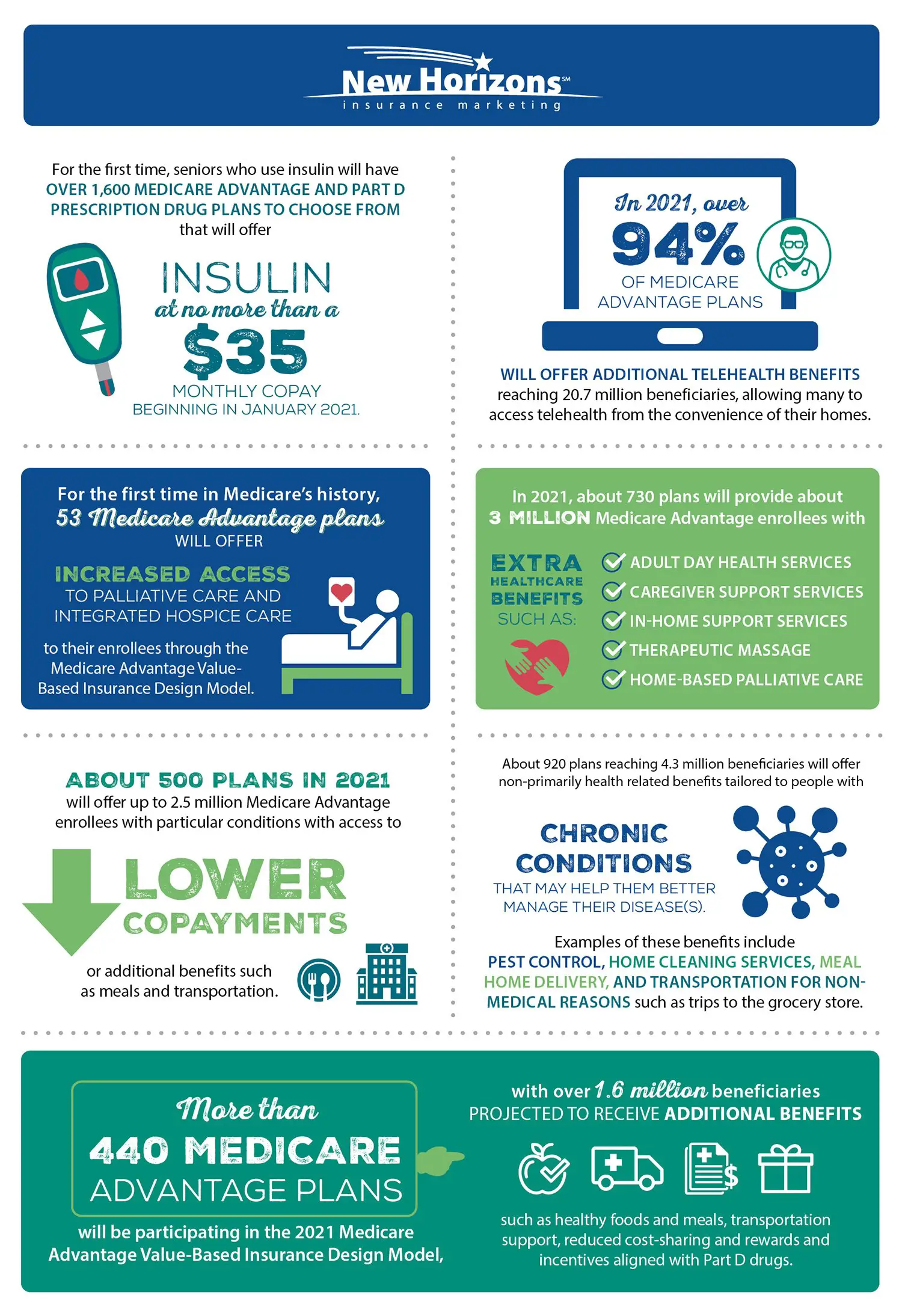

Plans can offer extra benefits

Medicare Advantage Plans must follow Medicare’s rules

Who Is Eligible To Join Advantage Plans

If you live in the designated service area of the specific plan, and already have Part A and Part B , you may join a Medicare Advantage plan instead of Original Medicare . If you have union- or employer-sponsored insurance, you may be able to add an Advantage plan, but be forewarned that in some cases you may lose your employer or union coverage when you enroll in an Advantage plan.

Individuals with End-Stage Renal Disease were generally not eligible to enroll in Advantage plans prior to 2021 with the exception of Medicare Advantage ESRD Special Needs Plans, although these are not widely available. But this changed as of the 2021 plans year, as a result of the 21st Century Cures Act. Medicare Advantage plans are guaranteed-issue for all Medicare beneficiaries as of 2021, including those with ESRD.

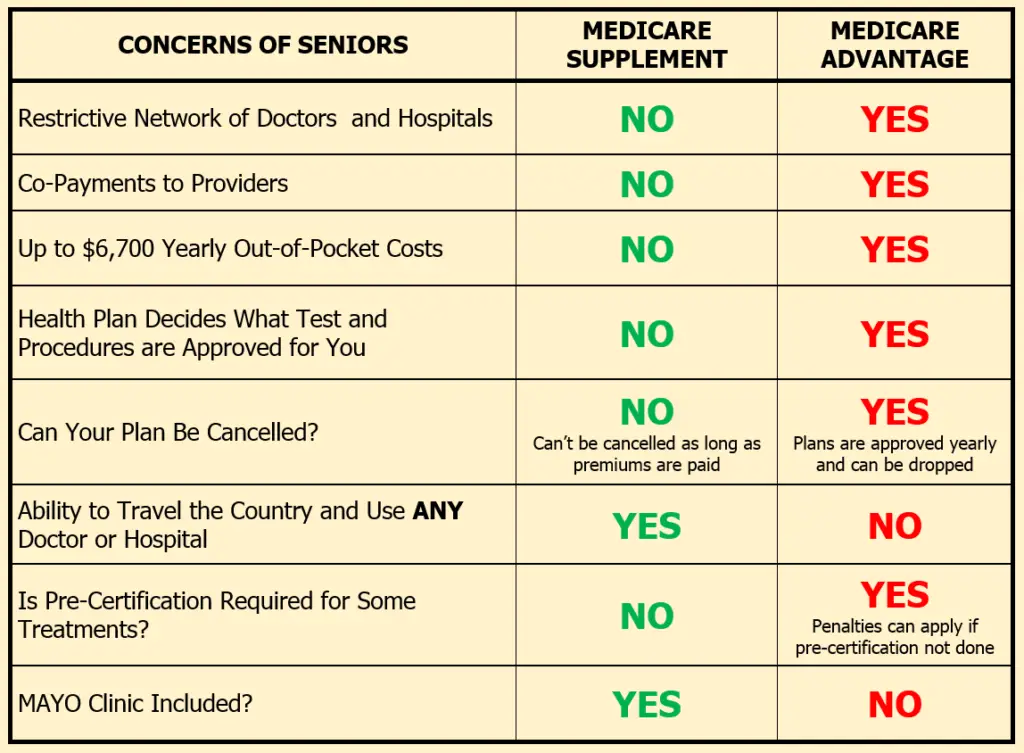

You should know that if you enroll in a Medicare Advantage Plan, you will not need to purchase Medigap coverage, nor will you be able to buy it. If you already have Medigap coverage, you can keep the coverage , although it wont pay for Medicare Advantage out-of-pocket expenses, such as copayments and deductibles.

Don’t Miss: Does Medicare Come Out Of Social Security

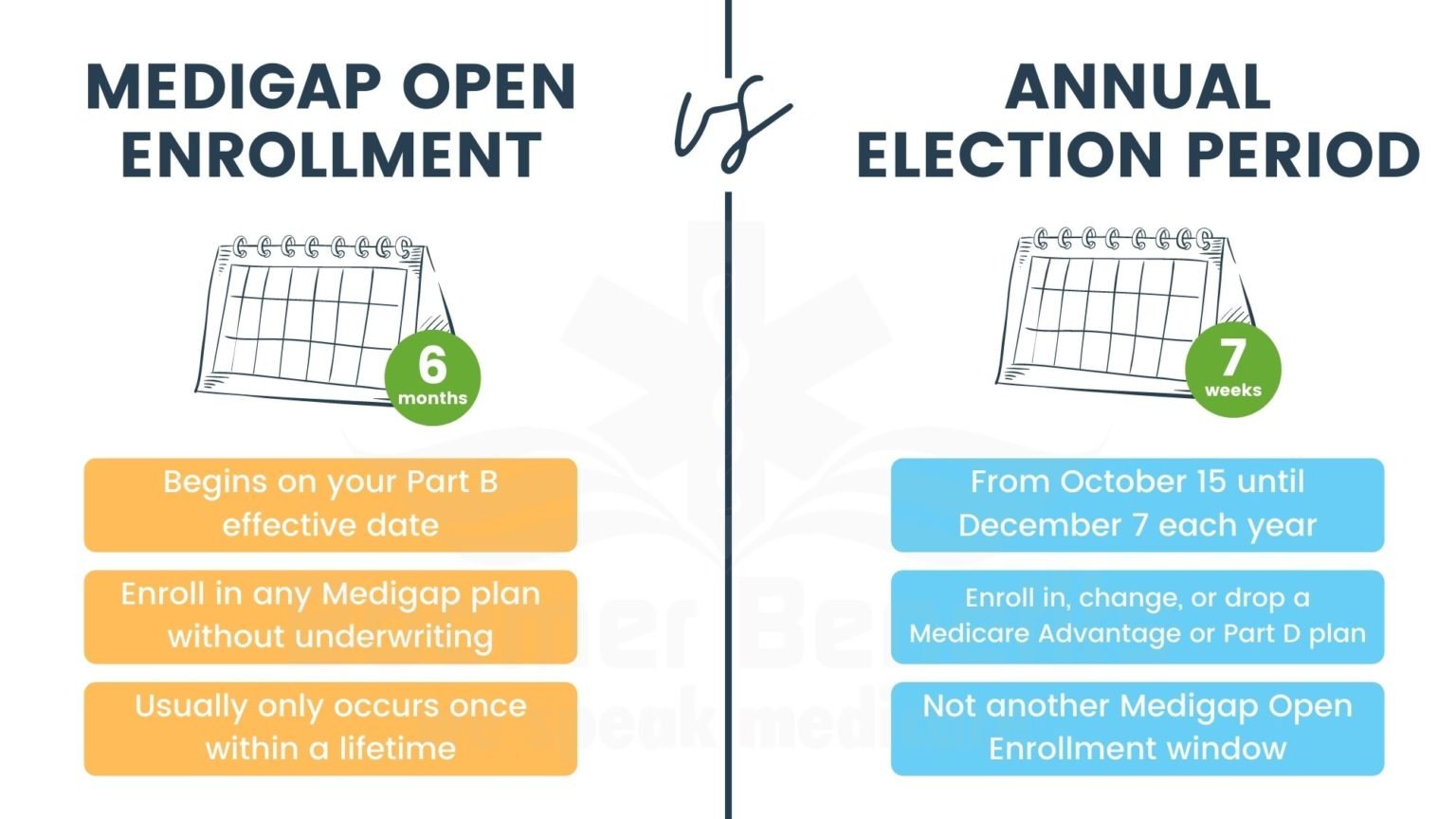

Medicare’s Annual Open Enrollment Period Offers A Chance To Reevaluate And Change Advantage Coverage

- Medicare Advantage plans must have medical loss ratios of at least 85%

- If you live in the designated service area of the specific Medicare Advantage plan, and have Part A and Part B , you may join the plan.

- You can switch back to Original Medicare during the annual open enrollment period or the Medicare Advantage open enrollment period.

Per Beneficiary Expenditure Differences Between Ma And Original Medicare

Medicare-managed care plans may have the potential to provide better quality care at less cost than original Medicare.5 In fact, prior to the BBA, private plans were paid 95% of the cost of Medicare, in part because of this presumed greater efficiency. However, the current payment mechanism does not encourage plans to be more efficient than original Medicare, because it pays plans at least as much as the cost of Medicare, and on average, more. According to the Medicare Payment Advisory Commission , Medicare is expected to pay private plans an average of 14% more per beneficiary in 2009 than it does for beneficiaries enrolled in the original Medicare program. In 2008, the maximum amount Medicare was willing to pay MA plans to provide Medicare covered benefits was, on average, 18% higher than the estimated cost of providing those same benefits under original Medicare.6 MA health maintenance organizations were the only plan type that, on average, estimated their cost of providing Medicare-covered benefits at below the cost of original Medicare this suggests MA health maintenance organizations can be more cost effective than original Medicare.

Recommended Reading: Does Medicare Come Out Of Your Paycheck

Beneficiaries’ Access And Choice Of Plans

From 1997 to 2003, the widespread exit of MA plans reduced beneficiaries’ choices and weakened confidence in Part C. Moreover, with the exception of floor counties, the BBRA and the BIPA failed to reverse the declining participation of the plans and the enrollment of beneficiaries. By 2003, the number of what Medicare now called coordinated-care plan contracts had fallen 50 percent, to 151 from 309 in 1999 , although some of the drop was attributable to the health plans’ mergers and acquisitions. There still were few other plan types offered besides HMOs, and there continued to be a wide geographic variation in plans’ availability across markets, with 40 percent of beneficiaries still lacking access to a Medicare managed care plan .

Medicare Advantage Plans May Limit Your Freedom Of Choice In Health Care Providers

With the federally administered Medicare program, you can generally go to any doctor or facility that accepts Medicare and receive the same level of Medicare benefits for covered services. In contrast, Medicare Advantage plans are more restricted in terms of their provider networks. If you go out of network, your plan may not cover your medical costs, or your costs may not apply to your out of pocket maximum.

Don’t Miss: Are Hospital Beds Covered By Medicare

How Do Msa Plans Work With Medicare Advantage

Typically you will pay your medical bills after you receive care with a dedicated debit card that your MSA plan mails to you.

The premium for an MSA is $0, but that doesnt mean your total costs are always zero. Its best to set some money aside in case you have health care costs above what is in the savings account.

Until you meet your deductible, youre responsible for paying 100% of the Medicare-approved amount for your care. You can use the money from your medical savings account to pay for these expenses. When its used up, you will pay for health expenses out of pocket until you reach your deductible. Then the plan pays 100% of the Medicare-approved amount.

What Is The Best Medicare Advantage Plan

If youve read this far, youre probably wondering which Medicare Advantage plan is the best. Is it Humana, AARP, Aetna, Blue Cross Blue Shield, Cigna, Wellcare, or Kaiser?

Its easy to answer the question, What is the best Medicare supplement insurance plan? Its Plan F. It offers the most coverage.

We wish the answer was as clear-cut with Medicare Advantage, but its not. Heres why.

When you combine all of the standard Medicare Advantage plans, employer plans, and Special Needs Plans, there are literally over 70,000 plan options. Its a truly staggering number.

The good news is that all of those plans are organized across nearly 2,800 U.S. counties. Why? Because most plans use local provider networks, making county boundaries the most logical way to organize private health insurance.

To find the best private health plan for you, use our Plan Finder tool. It will show you all of the plans in your area, their 5-star rating, premiums, copaymentsA copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service…., and extra benefits, too. If you have both Medicare and Medicaid, use the SNP Plan Finder. Plus, every plan page has a free PDF document you can download with basic cost and coverage information.

Read Also: When Does One Qualify For Medicare

How Much Are Medicare Premiums Going Up By

Medicare’s Part B standard premium is set to jump 14.5% in 2022, meaning those relying on the coverage will face an increase of more than $21 a month.

In addition to the standard premium, the deductible for Part B will also increase next year, from $203 to $233.

That’s a 14.8% increase from 2021 to 2022.

The Medicare Part A deductible is also on the rise and will go up by $72 to $1,556.

The determining factor for Part B premiums, deductibles, and coinsurance rates is the Social Security Act, according to the CMS.

More Benefits More Flexibility

Legislation and regulatory changes in recent years have favored Advantage by permitting new supplemental benefits and more favorable enrollment rules.

Since the Affordable Care Act was passed in 2010, the governments per-patient reimbursement rates for Advantage plans have been roughly equal to those in the original program. But Advantage plans can qualify for bonus payments under a quality rating system that many experts say uses flawed methods. MedPAC, an independent agency that advises Congress on Medicare, has recommended replacing the system.

Moreover, an investigation by the Department of Health and Human Services Office of Inspector General found that Advantage plans were receiving extra payments from Medicare by adding medical conditions such as diabetes and cancer to patient records that may not have been justified. An estimated $2.7 billion in additional payments in 2017 were not linked to a specific service or a face-to-face visit with a patient, the report found.

The report did not conclude specifically that insurers were fraudulently overbilling Medicare, and the problem may be linked to record keeping.

It gives people in Advantage plans more flexibility to make changes in their coverage, said David Lipschutz, an associate director at the Center for Medicare Advocacy. People enrolled in traditional Medicare with a stand-alone prescription drug plan dont have that flexibility.

Don’t Miss: Does Medicare Cover In Home Caregivers

What Year Did Medicare D Start

Medicare Part D Prescription Drug benefit Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans. These plans are sometimes called Part C or MA Plans. The MMA also expanded Medicare to include an optional prescription drug benefit, Part D, which went into effect in 2006.

Why Medicare Advantage Plans Are Bad: 7 Top Complaints

by David Bynon, December 11, 2021

One of the most common questions we get here at MedicareWireMedicareWire is a Medicare insurance consulting agency. We founded MedicareWire after seeing and hearing how confusing and frustrating it is to find, understand, and choose a plan. Our services are free to the consumer…. is, are Medicare Advantage plansMedicare Advantage , also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare …. bad? So, if youre trying to figure out the top advantages and disadvantages of Medicare Advantage plans for yourself, read on. In this article, we will explore this exceptionally important question by contrasting the private health plan option vs. Original Medicare and Medigap.

Recommended Reading: What Age Does Medicare Eligibility Start

What Does Medicaid Pay For

Medicaid covers a broad array of health services and limits enrollee out-of-pocket costs. Medicaid finances nearly a fifth of all personal health care spending in the U.S., providing significant financing for hospitals, community health centers, physicians, nursing homes, and jobs in the health care sector.

The Addition Of Free Preventive Services In 2010

In 2010, former President Barack Obama signed the Affordable Care Act into law. The law made numerous changes to healthcare in America, including some to Medicare.

The law added Medicare coverage for preventive care and health screenings and made these services free for Medicare enrollees. The law also reduced the out-of-pocket costs of using Medicare Part D.

Recommended Reading: Is Kaiser A Medicare Advantage Plan

How Did Medicare Part D Get Passed

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription drug spending in the United States.

Best For Member Satisfaction: Kaiser Permanente

Average Medicare star rating: 5 out of 5.

Service area: Available in eight states and Washington, D.C.

Standout feature: Kaiser stands head-and-shoulders above other providers in terms of the companys Medicare star ratings, and the company tops a list of nine providers for member satisfaction.

Kaiser Permanente is the fifth-largest provider of Medicare Advantage plans, with more than 1.7 million members enrolled in 2021. Kaiser is also the largest not-for-profit health maintenance organization in the U.S., and the company uses an integrated care model, which means members can get all their care in one place and all their providers are connected. Kaiser plans are available in only eight states and Washington, D.C.

Pros:

-

Kaiser Permanente earned 846 points out of 1,000 in J.D. Powers latest U.S. Medicare Advantage Study, netting it the top spot for customer satisfaction out of nine providers measured.

-

Only seven Medicare health plans received a 5 out of 5 rating from the National Committee for Quality Assurance, and four of them are Kaiser Permanente plans.

Cons:

-

Kaiser Permanente plans are available only in eight states and Washington, D.C., so the majority of U.S. adults cant access them.

-

Kaiser offers only HMO plans, so members must work within Kaisers network of medical providers.

Don’t Miss: How Much Is The Cost Of Medicare Part B

What Do Medicare Advantage Plans Cover

We just went through the top reason people dont like Medicare Advantage, but do the pros and cons match with what the private health plans are designed to provide?

Medicare Advantage plans combine Original Medicare coverage into a private health plan and often offer extra benefits. The Medicare Part C program allows plans to offer the following benefits to its plan members:

- hospitalization

- Special Needs Plans .

- Medical Savings Account .

The different types of all-in-one Medicare coverage help serve different needs. Not all plan types are available in all areas. PPO plans, for example, allow members to get care out of their provider network, but members pay more when they do. SNP plans help people who are institutionalized, have a chronic illness, or have special financial needs. In comparison, Original Medicare is a one-size-fits-all system.

Medicare Advantage Plans Have Specific Service Areas

Most Medicare Advantage plans have regional networks of participating providers. To enroll, you must reside in the Medicare Advantage plans service area at least 6 months of the year. If you divide your time between homes located in different areas, this requirement may be difficult to meet.

The bottom line is that Medicare Advantage plans may provide more affordable coverage than you would receive otherwise. The trade-off is that you have to follow the Medicare Advantage plans rules to receive payment for covered services.

Do you have other questions about Medicare Advantage? Call us and speak with a licensed insurance agent about finding Medicare Advantage plans in your area and your Medicare coverage options. Or just enter you zip code on this page.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Also Check: What Do The Different Parts Of Medicare Cover

How Did Medicare Begin

The idea of a national healthcare program originated more than 100 years ago as far back as former President Teddy Roosevelts 1912 campaign.

A serious push for a program took hold in 1945 under former President Harry Truman. He called for a national healthcare plan during his term and presented the idea to Congress. However, his proposals didnt make it through Congress at that time.

At the time, most Americans had no access to insurance after retiring. This left millions of people without coverage. In 1962, President Kennedy introduced a plan to create a healthcare program for older adults using their Social Security contributions, but it wasnt approved by Congress.

In 1964, former President Lyndon Johnson called on Congress to create the program that is now Medicare. The program was signed into law in 1965.

In recognition of his dedication to a national healthcare plan during his own term, former President Truman and his wife, Bess, were the first people to receive Medicare cards after it was signed it into law.

When first introduced, Medicare had only two parts: Medicare Part A and Medicare Part B. Thats why youll often see those two parts referred to as original Medicare today.

Parts A and B looked pretty similar to original Medicare as you may know it, although the costs have changed over time. Just like today, Medicare Part A was hospital insurance and Medicare Part B was medical insurance.

Some of major changes are discussed below.

What Does Medicare Part C Mean For Independent Physicians

The Structure of Medicare

Patients who qualify for Medicare can receive their coverage through one of two programs: Original Medicare, or Medicare Advantage Plans .

Over the past few decades, the Medicare Advantage program has expanded to cover 31% of Medicare beneficiaries during this time, Medicare Advantage plans shifted their focus from producing savings to expanding the coverage of plans and providing extra benefits to their patients. Consequently, the payment structure of the healthcare industry has evolved along with Medicare Advantage plans, and healthcare costs have risen significantly in 2009, Medicare paid private Medicare Advantage plans 14% more per beneficiary than the cost of care for beneficiaries in traditional Medicare. Additionally, by requiring beneficiaries to see a primary care physician, many Medicare Advantage plans have served to centralize the role of primary care physicians in the provision of healthcare. Thus, it is extremely important that independent providers understand the role of Medicare Advantage and the changes that it continues to undergo due to the Affordable Care Act of 2010.

Original Medicare

Original Medicare is composed of Part A and Part B . For Part A, Medicare estimates the expected resources required to provide hospital care for a specific patient, and then determines a payment to the hospital. If the hospital can provide care to the patient at a lesser cost, the hospital retains the difference as profit.

Don’t Miss: Can I Sign Up For Medicare Part B Online