How Original Medicare Works

Original Medicare does not include coverage for prescription drugs or routine dental, vision and hearing care. If you choose Original Medicare, you can pay for those things out of pocket, or you can purchase a stand-alone prescription drug plan and a Medicare Supplement plan to beef up your coverage. These added plans help , although youll pay a separate premium for each.

- Medicare Part A helps cover inpatient hospital care, skilled nursing facilities, and some home health services. Most people who paid Medicare taxes while working dont have to pay a monthly premium for Part A.

- Medicare Part B helps cover medical services, including doctors visits and many preventive services. The standard Part B premium for 2022 is $170.10 or higher, depending on your income.

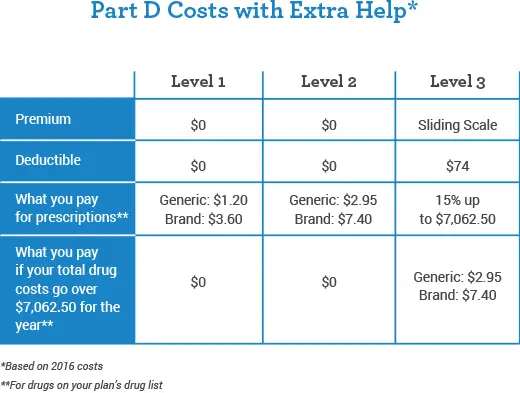

- Medicare Part D helps cover prescription drug costs. Costs for Part D depend on things like the plan you choose and what type of prescription drugs you require.

- Medicare Supplement Medicare Supplement plans may help pay out-of-pocket costs not paid for by Medicare Parts A and B, including copays, deductibles and coinsurance.*

Can You Switch From Medicare Advantage To Medicare Supplement Insurance

Yes, you can switch from one to another when the coverage you have is not meeting your needs, but only during specific time periods. Certain situations also make it easier to switch.

You can change from a Medicare Advantage plan to a Medigap in two situations. The first situation is if you enroll in a Medicare Advantage plan when you become eligible for Medicare at age 65 and you arent happy with the coverage. You are allowed by federal law to buy a Medigap policy as long as you return to Original Medicare within 12 months of joining the Medicare Advantage plan. This time is known as a trial period.

The second situation is if you had a Medigap policy and gave it up to enroll in a Medicare Advantage for the first time and you arent happy with your new Medicare Advantage coverage. There is no age requirement for this trial period. You may return to Original Medicare within 12 months of joining Medicare Advantage and get the same Medigap policy back, if the company still sells it. If not, you can buy a different Medigap policy. In these two situations, the Medigap insurance company cannot use medical underwriting or impose a waiting period for pre-existing conditions.

You may switch from Medigap to Medicare Advantage by enrolling during an enrollment period, typically between October 15 December 7 . Medicare Advantage plans must accept your enrollment so long as you have Medicare Part A and Part B and do not have kidney failure or end-stage renal disease.

Changing Plans

Can You Change From A Medicare Advantage Plan To A Medicare Supplement Plan

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period.4

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage youre seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

Recommended Reading: What Medicare Supplement Plans Cover Hearing Aids

Medigap With Nontraditional Benefits: Vision Dental And Hearing

A recently released analysis from The CommonWealth Fund looks at Medigap plans offering nontraditional benefits like vision, dental and hearing services that arent covered by Original MedicareAli R, Hellow L. Small Share of Medicare Supplement Plans Offer Access to Dental, Vision, and Other Benefits Not Covered by Traditional Medicare. The Commonwealth Fund. Accessed 9/4/2021. . Our research showed a relatively small share of plansonly 7%offering these benefits, said Jacobson. I think most people dont realize there are these plans out there with benefits comparable to Medicare Advantage.

At the federal level, there are tradeoffs in terms of policies encouraging or discouraging these benefits being offered. The American Dental Association, for example, is currently advocating for a distinct program to provide comprehensive dental care for low-income older adultsnot the Medicare Part B program that has been part of past and current proposals.

We need comprehensive oral health coverage in Medicare, as well as hearing and vision, said Amber Christ, directing attorney at Justice in Aging, an advocacy organization protecting the rights of low-income older adults. Nearly half of Medicare enrollees have no dental coverage at allthats 24 million older adults and people with disabilities who have no coverage.

Review Your Personalized Medicare Options With A Dedicated Advisor

Your one stop shop for navigating Medicare and finding the benefits you are looking for.

Trends In Medigap Plans

There is no doubt that costs for Medicare supplement plans are increasing, more now with inflation than since these plans were modernized / improved in 2010.

Increasing inflation will be with us for several more years and will impact a lot of the decisions people make with their retirement. Many will put off their retirement, hoping for a market recovery and a little more retirement income. That will benefit Medicare to a small degree because of fewer enrollments.

What I am already seeing is those people who can afford a supplement plan, but not comfortably start looking an Advantage plan as an alternative. That is a trend that will grow in the years ahead and will help push Advantage plans to become the dominant Medicare plan.

When considering a supplement, we must consider that you may have 25-years ahead of you. Twenty-five years of prices compounding higher. You must plan for that when you consider what you can afford.

That is why we focus on companies that tend to have the lowest cost over your lifetime. Not todays cheapest plan. Because if you want to change plans or insurance companies to save money, in all but a few states you must qualify medically to do so.

Recommended Reading: What Is The Window To Sign Up For Medicare

Choosing Medicare Advantage And Enrollment

A person may be eligible for a Medicare Advantage plan if they are enrolled in original Medicare and are living in the service area of the plan they wish to join.

Medicare Advantage plans work in different ways, so it is advisable for people to compare all the available plans in their area. They can do this using Medicares find-a-plan tool.

After deciding on a specific plan, a person can enroll by doing one of the following:

- enrolling through the companys website

- completing a paper enrollment form and then mailing it to the private insurer

There are three opportunities for a person to switch from Medicare Advantage to Medigap.

- During the initial enrollment period : This 7-month period begins the month before a person reaches 65 years of age.

- During the Medicare Advantage OEP: This OEP runs from each year. Between these dates, a person can drop their Medicare Advantage plan, return to original Medicare, or enroll in a Medigap plan.

- Shortly after enrolling: When a person first becomes eligible for Medicare and enrolls in a Medicare Advantage plan, they have 3 months in which they can switch back to original Medicare and enroll with Medigap.

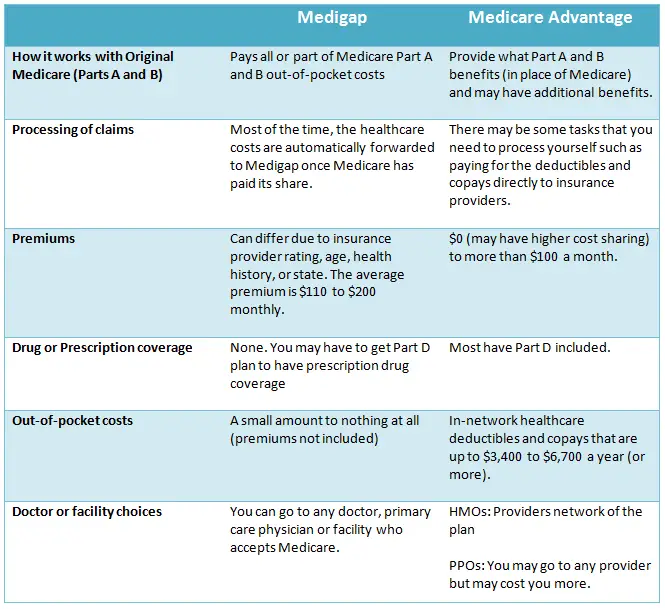

The Freedom To Choose Your Own Doctors And Hospitals

Medicare Advantage: Your choice of physicians and facilities may be limited to the plans network, whether it is HMO or PPO. You might also need a referral from a primary care physician before seeing a specialist.6

Medigap: You are free to visit any doctor or facility that accepts Medicare, and you dont need referrals to see specialists.8

Recommended Reading: Does Medicare Pay For Weight Reduction Surgery

How Do You Decide

âMake sure you have enough coverage to limit your financial liability in case of catastrophic injuries or disease,â Nance says. âWhile the plans that have better benefits often cost more, they will usually save you in the long run in terms of out-of-pocket fees.â Nance further recommends speaking to family and friends to compare experiences.

Medicare Advantage Vs Medicare Supplement Insurance Plans

Summary:

Are you trying to decide between Medicare Advantage vs. Medicare Supplement insurance? Hereâs a rundown of the two types of coverage.

While Original Medicare covers many health-care expenses, it doesnât cover everything. Even with covered health-cares services, beneficiaries are still responsible for a number of copayments and deductibles, which can easily add up. In addition, Medicare Part A and Part B also donât cover certain benefits, such as routine vision and dental, prescription drugs, or overseas emergency health coverage. If all you have is Original Medicare, youâll need to pay for these costs out-of-pocket.

As a result, many people with Medicare enroll in two types of plans to cover these gaps in coverage. There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement insurance plans work alongside your Original Medicare coverage. These plans have significant differences when it comes to costs, benefits, and how they work. Itâs important to understand these differences as you review your Medicare coverage options.

Don’t Miss: How Do I Find Out What My Medicare Number Is

Original Medicare Vs Medicare Advantage: Providers

A final key difference to consider when choosing between Original Medicare and a Medicare Advantage plan is what health care providers you can see.

With Original Medicare you can go to any hospital and see any doctor or provider within the U.S. who accept Medicare. You do have limited coverage in foreign countries, though.

With Medicare Advantage, most plans have a network of doctors and providers you can see. If you go outside the plans network, its likely youll have to pay more to do so. However, emergency and urgent care are covered nationwide. You also have limited coverage in foreign countries, though some plans may offer special foreign coverage or travel benefits.

Which Medicare Supplement Plan Is The Most Popular

In fact, 66% of people who choose a supplement purchase a Medicare Supplement Plan G, the highest benefit available to those new to Medicare and highest cost. It is what I call the Peace of mind plan. I have a video linked above my shoulder on how I suggest you go about choosing which supplement plan is right for you.

You May Like: How Do Medicare Insurance Brokers Get Paid

What Attracts People To Medicare Supplement Plans

This goes back to what I stated earlier was one of the most important observations about who chooses original Medicare.

When you choose a supplement plan, you are keeping Original Medicare as your primary insurer. That means you keep all the benefits of Original Medicare. You can see any doctor in the US or its territories, as long as the accept Original Medicare.

Your supplement has no say in your coverage. Medicares intent is to cover everything medically necessary and they rely on your doctor to make that determination. Your coverage is between and your doctor.

People who choose a Medicare supplement plans value their freedom to choose a doctor and have healthcare directed by their doctor.

In addition, they like that the benefits never change. Medicare supplement plans are Standardized. That means the benefits are the same regardless of the insurance company and they are guaranteed renewable. Once you have a Medigap plan, not even an act of Congress can change the benefits or take the plan away from you.

Control over their healthcare and being free of network limitations are the driving reasons for their choice. Premiums, the cost of the plan is secondary.

The Politics Of Medicare Coverage

As Advantage plans become dominant, we are going to see more pressure on those insurance companies. Many have abused the Medicare payment system they get money from the government for every person that enrolls. The abuses are alleged to amount to Billions of dollars. Politicians will be more inclined to pressure insurance companies under the guise of being fiscally responsible, without attacking Medicare.

Medicare will also continue to try ideas that attack Original Medicare. Unfortunately, what I have seen so far are ideas that insert a third-party middleman into the equation. You cant increase people involved in Medicare decisions and reduce cost at the same time. It doesnt work.

Also Check: How Much Do You Get From Medicare

What Is The Difference Between Medicare Supplement And Medicare Advantage

Licensed insurance advisor John Clark explains the main difference between Medicare Supplement plans and Medicare Advantage plans. You may have fewer choices in terms of doctors and health care providers in some cases with Medicare Advantage plans. With Medigap, you have access to any doctor or provider who accepts Medicare.

Why Is Medicare So Complicated

By the government’s last count in 2021, 64 million adults were enrolled in Medicare. But that doesn’t mean it’s simple to navigate. The Medicare maze is growing more entangled over the years, as Congress adds new benefits, exceptions, and penalties.

Let’s break it down:

Once you turn 65, you are eligible to enroll in Medicare. There are four different parts.

Part A: Covers hospital stays.

Part B: Covers medical insurance, like doctor appointments and outpatient care.

Part C: Also known as Medicare Advantage, covers the same benefits as A and B but is offered by private insurers.

Part D: Covers prescription drugs.

Medicare Adviser Nate Rubenstein said, the first thing you need to know is whether you even need Medicare at all.

“The most common confusion is when people are going to continue to work past their 65 birthday. If they have what’s called Creditable Coverage, they do not need to do anything with Medicare. They can delay their Medicare enrollment until they ultimately decide to retire,” said Rubenstein.

Creditable Coverage is something like employer health insurance, and must be at least as good as what Medicare provides.

But if you aren’t covered when you turn 65, you’ll have to decide whether to enroll in original Medicare or Medicare Advantage.

Sung said both programs will cover the same services, but there are key differences. Original Medicare is made up of parts A and B, and the federal government is negotiating prices on your behalf.

You May Like: Is Medicare A Social Security Benefit

What Is The Average Cost Of Medicare Supplement Insurance

The estimated average monthly premium for a Medicare Supplement plan can range from $150 to around $200, depending on the state you live in and your insurer.

Just like Medicare Advantage plans, its good to shop around65-year-olds stand to save an average of $840 a year with Medicare Supplement Plan G or $648 a year with Plan N if they enroll in the lowest-cost option available in their areas, according to a price comparison analysis by eHealth, Inc.

We continue looking at how private plans and Medicare can be more efficient, effective and equitable for people, says Jacobson. The good story here is in the data. Weve seen pretty consistently that inequities are much smaller in Medicare than any other source of coverage.

| Medicare Advantage vs. Medicare Supplement: Which Is Right For You? | |

|---|---|

| Medicare Advantage | |

|

|

Choosing Medigap And Enrollment

Having Medicare parts A and B is a requirement for enrolling in a Medigap plan. The best time to buy a Medigap plan is during the 6-month open enrollment period . This window automatically begins the month a person reaches the age of 65 years.

Once the OEP ends, the company offering the Medigap plan may decline coverage if a person has specific medical conditions.

If the company does not accept the persons application until after the 6-month period, a higher monthly premium may apply.

Medigap plans may differ depending on location, so a person can use Medicares search tool to look at the Medigap plans available in a particular zip code.

The website provides a range of plans with different deductibles. Medigap plans are standardized, which means that they all provide the same basic benefits. However, some plans may offer additional benefits.

Once a person decides on a plan, Medicare will provide contact information for the company administering the plan. A person can then complete enrollment by contacting the company directly.

Read Also: What Is The Cost Of Medicare Insurance

Keeping Your Coverage If You Move

If you are moving to another county or state, make sure your Medicare plan will still be in effect after you move.

If you have original Medicare, federal rules usually allow you to keep your Medicare supplement policy. There are exceptions to this if you have a Medicare Select plan or if you have a plan that includes added benefits, such as vision coverage or discounts that were available only where you bought the plan.

If you have a Medicare Advantage plan, ask the plan whether its available in your new ZIP code. If the plan isnt available, youll have to get a new one. You can switch to another Medicare Advantage plan in your new area or to original Medicare.

What Are The Benefits Of Medicare Advantage

Medicare Advantage plans provide all the same benefits provided by Original Medicare, plus coverage for items and services not covered by Original Medicare, including some vision, some dental, hearing and wellness programs like gym memberships.

Some plans even provide transportation to doctor visits and adult day care services, says Amanda Baethke, director of corporate development at Aeroflow Healthcare in North Carolina, referring to newly expanded supplemental benefits. Plans can also tailor their benefit packages to offer benefits to those who are chronically ill.

Cigna, for example, launched free COVID-19 vaccination transportation for its Medicare Advantage customers. Over 500,000 customers in 23 states are eligible for four one-way trips, up to 60 miles each way, to get a vaccine.

Another bonus to consider is that coverage is expanding. According to a new report commissioned by the Better Medicare Alliance, the number of Medicare Advantage plans offering Special Supplemental Benefits for the Chronically Ill rose from 245 plans in 2020 to 845 in 2021. Some of the top new non-medical benefits offered includeNORC at the University of Chicago. Innovative Approaches to Addressing Social Determinants of Health for Medicare Advantage Beneficiaries. Better Medical Alliance. Accessed 9/6/21. :

- Resources addressing social needs

Recommended Reading: How To Pay For Medicare Part B