How To: Enroll In Medicare Part A And Part B

Some people are automatically enrolled in Medicare Part A and Part B. Some people are not.

You’ll be automatically enrolled in Medicare Part A and Part B if:

- You’re receiving Social Security or Railroad Retirement Board benefits when you turn 65 or

- You’re eligible for Medicare because of a disability or medical condition.

You must enroll yourself in Medicare Part A and B if:

- You’re not receiving Social Security benefits when you become eligible for Medicare.

Medicare Part D Comes In Two Flavors

There are two ways to get Medicare prescription drug coverage. Both are available from private, Medicare-approved insurance companies.

- You can sign up for a stand-alone Medicare Part D prescription drug plan to work beside your Medicare Part A and Part B coverage.

- You can get your Medicare Part A and Part B benefits through a Medicare Advantage Prescription Drug plan. Not every Medicare Advantage plan includes prescription drug benefits, but most do.

Both types of plans have mainly similar enrollment periods.

Changing Or Canceling Your Plan

Life is full of twists and turns. You could be faced with new health challenges. Your financial situation could change if you retire or lose your job. Your insurance company could make changes to your plan. All of these things could affect how much prescription drug coverage you need and how much you can afford.

You may need to consider changing your Part D plan. The good new is you are not stuck with the same Part D plan forever. You have choices. The trick is to know when to make those changes.

Read Also: Do You Have To Enroll In Medicare

Which Medicare Part D Plan Is Right For You

Medicares free online tool enables you to search for plans offered in your area. You can enter the specific drugs you currently take and then get a cost comparison across plans based on each plans specific formulary, tier system, and whether they charge copays or coinsurance.

As noted earlier, if you opt for Medicare Advantage, your Part D coverage will most likely be included in the plan you choose. But here too you want to carefully comparison shop for the plan with the best drug coverage based on your individual needs. Hint: you and a spouse might choose different Medicare Advantage plans based on your medication needs.

Independent insurance agents that specialize in Medicare can also help you sort through all the moving pieces for plans offered in your area.. Free counseling is also available through your State Health Insurance Assistance Program .

Read Also: Does Medicare Pay For A Caregiver In The Home

Through A Private Insurance Company

Different insurance companies and even some pharmacies offer online resources to compare Part D plans. Keep in mind these tools may be tailored to their own plans. You can apply online through the plans website, by contacting the insurance company by phone, or by visiting a local insurance agency.

Remember you will need your Medicare identification number and the starting dates of your Medicare coverage to complete your applications.

Don’t Miss: How To Apply For Help Paying Medicare Premiums

If Your Existing Prescription Drug Coverage Is Creditable Stick With It

Your current coverage is considered creditable if, on average, it pays out as much as Medicare plans do. Many widely available plans are considered creditable by CMS. These include:

You may have employer-based creditable coverage that comes to an end or that you choose to drop after your initial Medicare Part D enrollment window has closed. If so, you can still avoid the late enrollment penalty. On the date your old coverage ends, you enter a 63-day special enrollment period. If you sign up for a Part D plan during that time, you wont face the late enrollment penalty.

Many insurers contact their customers each year to report whether their coverage is creditable. If you get a letter or other message from your insurer confirming your plan is creditable, hang on to it. Later, when you enroll in a Part D plan, that letter could help you prove you had creditable coverage in the past.

Why Sign Up For Medicare Part D

Medicare Part D is optional you dont have to sign up for it. Part D is the prescription drug coverage part of Medicare. But you dont automatically get Part D, even if youre one of the many who get enrolled in Medicare Part A and Part B automatically.

Original Medicare, Part A and Part B, doesnt include prescription drug coverage, except in certain cases. Part A usually covers medications given as part of your treatment when youre a hospital inpatient. Part B may cover prescription drugs administered to you in an outpatient setting, such as a clinic. But when it comes to medications you take at home, Original Medicare doesnt cover them in most cases.

Theres another reason to think about signing up for Part D: if you dont sign up when youre first eligible for Medicare, you might have to pay a late enrollment penalty if you need medications at a later date and decide to sign up. Learn more about the Part D late enrollment penalty.

Don’t Miss: How Much Is Medicare Going Up

How To Change A Medicare Part D Plan

You can join, switch or drop a Medicare Part C or Part D plan during:

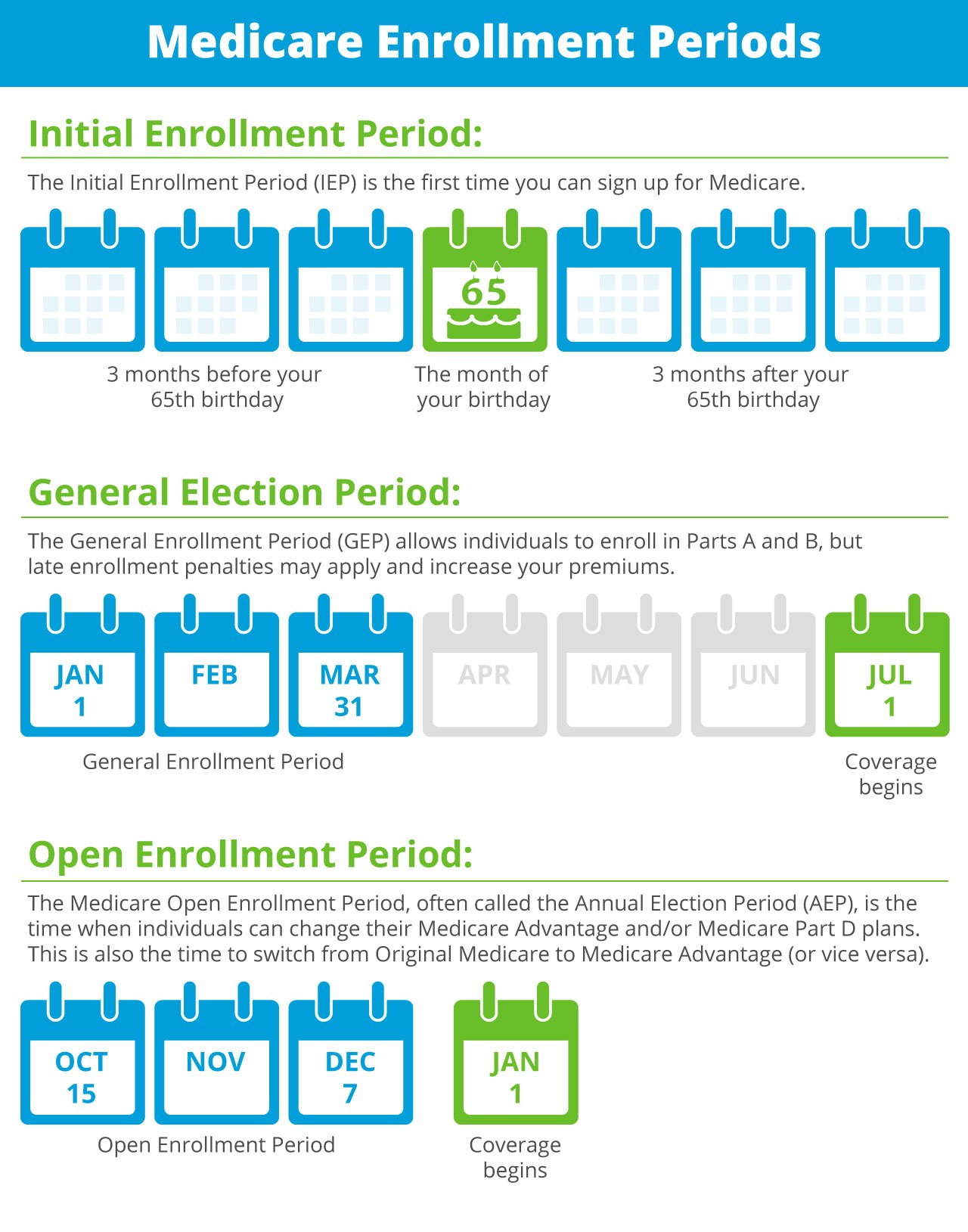

- Your Initial Enrollment Period

- Open Enrollment Period

- Medicare Advantage Open Enrollment Period

Contact your existing plan to learn the steps to take to drop coverage, and contact your new plan to enroll. Be sure to do so during a qualified enrollment period, or you may face a late enrollment penalty or risk not having coverage.

How Do I Choose A Part D Drug Plan

You can get Medicare Part D coverage from a stand-alone drug plan or a Medicare Advantage plan with built-in Part D coverage.

There are approximately 20-30 different Part D drug plans offered by a number of different health insurance companies in each state . All Part D drug plans must offer a standard set of drug benefits as required by Medicare. Moreover, drug plans may include additional medications on their formularies.

The cost to join a plan depends on whether the plan offers benefits beyond those mandated by Medicare . The following may cause the monthly premium to be more expensive:

- The plan covers additional medications on its formulary

- The plan does not have a deductible at the beginning of the year

The ten most popular stand-alone Part D plans for 2020 have premiums that vary from $17/month to $76/month. Some of those plans are enhanced and some are basicin general, the enhanced plans have higher premiums, while the basic plans have lower premiums.

One of the most helpful online resources is the government’s Medicare plan finder tool, which allows you to compare PDPs, learn about plans offered in your state, and view each plan’s drug formulary. You can compare plans side-by-side and display only those plans that cover your medications.

Don’t Miss: What Age Do You Register For Medicare

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

When To Apply For Medicare Part D

If you dont have or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period to avoid penalties.

Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month. For example, if you turn 65 in May, your open enrollment would start on February 1 and last until August 31.

You may also qualify for a special enrollment period under certain circumstances, like if you dont enroll in Part B during your IEP. Typically a SEP lasts for 63 days.

If you miss your deadline during your IEP or SEP, youll have to wait for the Annual Open Enrollment Period in the Fall .

Learn more about enrollment periods and the circumstances surrounding them.

Don’t Miss: Does Medicare Have Life Insurance

Applying For Medicare Part D With Medicares Plan Finder

Before going to Medicares site, be sure youve finished all the prep work described in Enrolling in Medicare Part D: What youll need .

Low Income Subsidy Questions

No. The “extra help” is a subsidy that people with Medicare and Medicaid automatically qualify for without having to complete an application.

If you do not have Medicaid, but Medicaid pays your Medicare Part B premium, you automatically qualify for “extra help” and you don’t need to apply.

You may still be eligible for “extra help” to pay for the Medicare prescription drug plan premiums. To apply for extra help, you should visit or call your local Social Security Administration office or apply on line at

Don’t Miss: Will Medicare Pay For A Medical Alert Necklace

How Do I Change My Medicare Coverage

Your Medicare choices are not set in stone after the first time you enroll. You can make changes to your Medicare coverage during a few special Medicare enrollment periods.

- The Medicare Annual Enrollment Period , October 15 December 7

- The Medicare Advantage Open Enrollment Period, January 1 March 31

- The Medicare Special Enrollment Period for qualifying life events dates vary based on qualifying event

Learn how to make changes to your Medicare coverage during these three time periods:

Tips For Choosing Medicare Drug Coverage

If youre wondering how to choose a Medicare drug plan that works for you, the best way is to start by looking at your priorities. See if any of these apply to you:

- I take specific drugs.

-

Look at drug plans that include your prescription drugs on their

formulary

. Then, compare costs.

- I want extra protection from high prescription drug costs.

-

Look at drug plans offering coverage in the

coverage gap

, and then check with those plans to make sure they cover your drugs in the gap.

- I want my drug expenses to be balanced throughout the year.

-

Look at drug plans with no or a low

deductible

, or with additional coverage in the

coverage gap

- I take a lot of generic prescriptions.

-

Look at Medicare drug plans with

tiers

that charge you nothing or low copayments for generic prescriptions.

- I don’t have many drug costs now, but I want coverage for peace of mind and to avoid future penalties.

-

Look at Medicare drug plans with a low monthly

premium

for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

- I like the extra benefits and lower costs available by getting my health care and prescription drug coverage from one plan, and Im willing to pick a drug plan with restrictions on what doctors, hospitals, and other health care providers I can use.

-

Look for a

Also Check: How Much Does Social Security And Medicare Take Out

S To Sign Up For A Part D Plan

1. Compare the Part D options in your area by using the Plan Finder tool at Medicare.gov.

You can log in to your Medicare account to get information about the plans in your area. You also can use the tool without logging in.

2. If you select Continue without logging in, youll be able to choose the type of coverage you want, such as a Part D drug plan. Enter your zip code and select your county.

3. Now indicate whether you get help with your medical expenses. If youre not sure, you can find out by logging in to your Medicare account.

4. If you dont receive any help, youll be asked if you want to see your drug costs when you compare plans. Click Yes so you can get a sense of how much you would spend with each plan.

5. Enter the names of your medications. Be sure to include ones you take regularly so that youll get a good estimate of ongoing costs. Youll also need to select the dosage and quantity and indicate how frequently you need to refill your prescriptions. To add another medication, click Add Another Drug. When youre finished, click Done Adding Drugs.

6. Choose up to five pharmacies where you want to fill your prescriptions. Many plans charge lower copayments for preferred pharmacies. You can see how plans work with the pharmacies and what your copayments would be for each one. Enter the names of pharmacies you use or search by your address or zip code.

For help signing up for a Part D plan, contact your State Health Insurance Assistance Program .

Medicare Prescription Drug Eligibility And Enrollment

This page contains enrollment and disenrollment guidance for current and future contracting Part D plan sponsors and other parties interested in the operational and regulatory aspects of Part D plan enrollment and disenrollment.

New! Revisions to the Prescription Drug Plan Enrollment and Disenrollment Guidance and Individual Enrollment Request Form to Enroll in a Part D plan for CY 2021

On August 11, 2020, CMS released the Enrollment Guidance Policy Changes and Updates and Model Medicare Advantage and Prescription Drug Plan Individual Enrollment Request Form for Contract Year 2021 memorandum via our Health Plan Management System to provide guidance and the new PDP model enrollment request form updates. The policy and technical changes reflect the recently published regulation changes in CMS-4190-F to include:

- The removal of enrollment prohibitions on beneficiaries with End-Stage Renal Disease who choose to join a Medicare Advantage plan

- The establishment of two new Special Enrollment Periods for exceptional circumstances and the codification of previously adopted SEPs for exceptional conditions implemented through sub regulatory guidance in addition, to,

- The new Model Individual Enrollment Request Form to enroll in a Part D plan, OMB No. 0938-1378 and

- Changes to the Electronic enrollment process to include new flexibility for Electronic Signatures.

Good Cause Flow Process and Frequently Asked Questions

- Frequently Asked Questions

- Good Cause Triage Process Flow Chart

Recommended Reading: When You Are On Medicare Do You Need Supplemental Insurance

When You Can Change Or Cancel Your Plan

When you sign your contract, you are committing to pay monthly premiums through January 1 of the following year, so you cannot change or cancel your Part D plan whenever you want.

Not paying those premiums could result not only in loss of your prescription drug coverage but could also affect your credit history. But, Medicare recognizes that needs change.

The government allows you to change your plan once a year during the Open Enrollment Period and if you have a Medicare Advantage plan, and also during the Medicare Advantage Open Enrollment Period. They also allow you to make changes under special circumstances, when the Open Enrollment Period may be too far away.

Understanding when you can make these changes could save you money and get you Part D coverage that better meets your needs.

Open Enrollment Period

You can change your prescription drug coverage during the Open Enrollment Period every year from October 15 to December 7. During this time, you can swap Part D plans, change between Medicare Advantage plans with drug coverage, or switch from a Part D plan to a Medicare Advantage plan with drug coverage and vice versa. Since each of these options allows you to continue Medicare benefits uninterrupted, no late penalties will result with any of these changes.

Medicare Advantage Open Enrollment Period

Special Enrollment Periods

You have financial hardships.

You move to another address.

Your Part D plan changes.

You want a Five-Star plan.

Initial Enrollment Period For Part D

You can enroll in Medicare Part D coverage during your Initial Enrollment Period for Part D, which is the period that you first become eligible for Medicare Part D.

For most people, the IEP for Part D is the same as the IEP for Medicare Part B and begins three months before you turn 65 years of age, includes the month you turn 65, and ends three months after.

If you are not eligible to enroll in Medicare Part D because you do not live in a Part D-covered service area, your Initial Enrollment Period would not begin until three months before you permanently reside in the service area of a Medicare Part D Prescription Drug Plan or a Medicare Advantage plan that includes drug coverage.

If you enroll in Medicare Part D during your Initial Enrollment Period, your Medicare Part D coverage will begin on the first day of the following month that you apply for the plan.

If you enroll in one of the three months prior to turning 65 years of age, your Medicare Part D coverage begins on the first day of the month that you turn 65.

Read Also: How Do You Apply For Extra Help With Medicare