Medicare Part C Costs

If you choose to get Medicare Part C, which is also calledâ¯Medicare Advantage , you are replacing Medicare Parts A and B. Often times, MA plans also include a drug benefit, so you also replace Part D.

However,â¯you still must pay the $170.10 monthly premium for Medicare Part B.

MA premiums vary, depending on which type of plan you choose, which area youâre in, and other similar factors.â¯In general, MA premiums are quite low, and sometimes theyâre even $0.â

While the monthly premium is very low or even $0, there are some things to consider before opting in to an MA plan.â¯You can read about the pros and cons of Medicare Advantage here.

Why Is Medigap So Expensive

How Much is Medigap in California? While the birthday rule is beneficial, its also a factor in the higher costs of Medigap. Birthday rules also apply in four other states, but Californias cost of living is higher, as are Medigap premiums in the state. California doesnt have community rating laws.

How Do Premiums Deductibles Cost

Generally,the more benefits your plan pays, the more you pay in premium. But your medicalexpenses for care are lower.

Toillustrate how these costs may influence your choice of plans, consider the ACAplans.

Inaddition to the metallic plan categories, some people are eligible to purchasea plan with catastrophic coverage. Catastrophic plans have very low premiums andvery high annual deductibles . However, they pay for preventivecare regardless of the deductible. These plans may be a suitable insuranceoption for young, healthy people. To qualify for a Catastrophic plan, you mustbe under age 30 or be of any age with a hardship exemption or affordabilityexemption . Learnmore about Catastrophic coverage.

Read Also: Does Social Security Disability Include Medicare

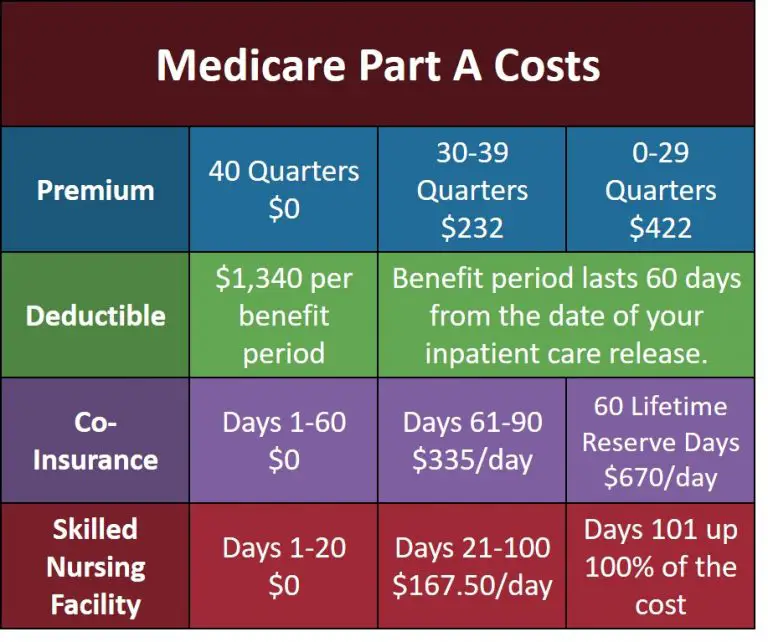

Skilled Nursing Facility Care

Part A will help cover many services in a Skilled Nursing Facility . This includes room and board, as well as administering medicine or changing sterile dressings. Medicare will cover you for up to 100 days in each benefit period. To qualify for this coverage, you must spend at least 3 days as an inpatient in a hospital within 30 days of being admitted to an SNF.

Cost Of Medicare Part B

- Standard cost in 2023: $164.90 per month

- Annual deductible in 2023: $226

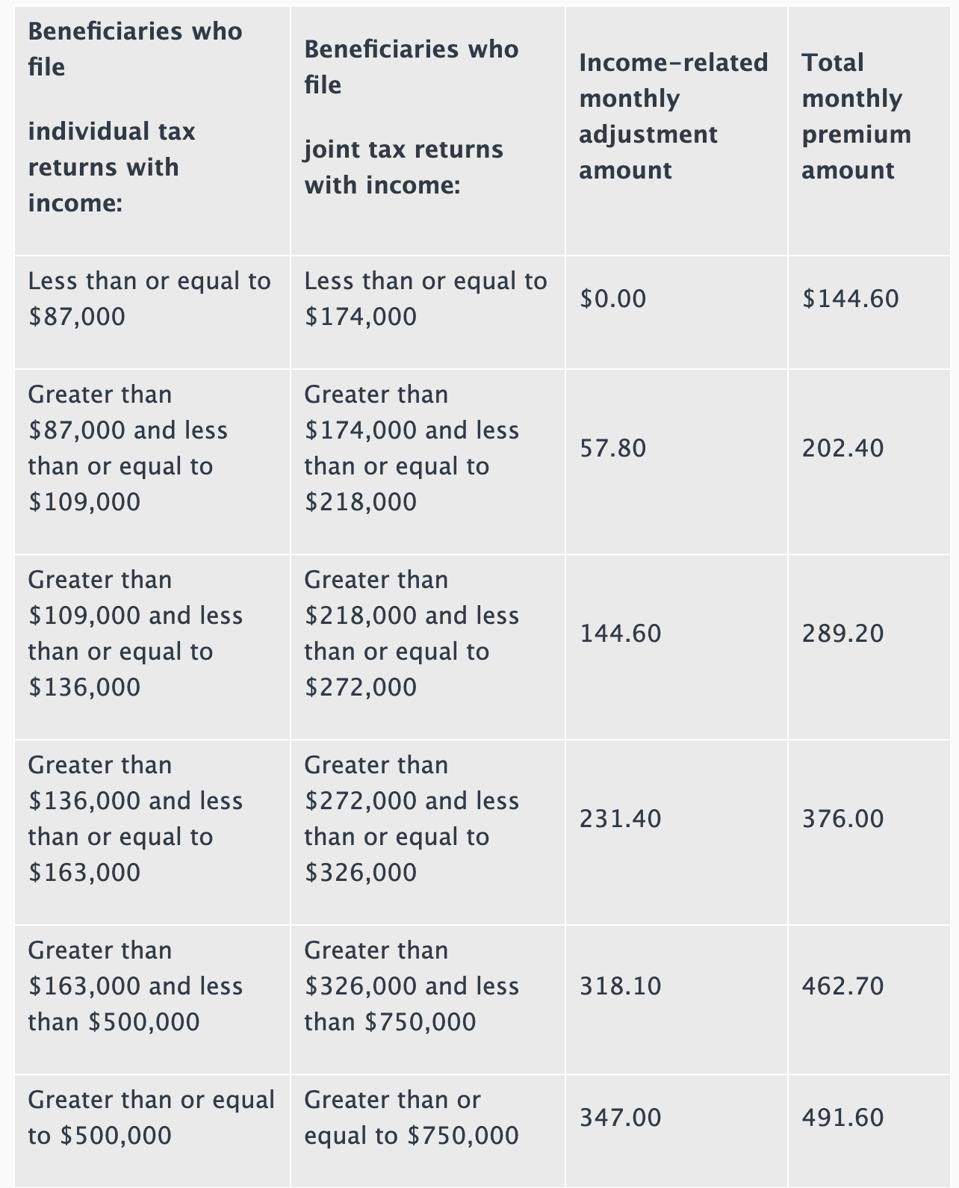

For most people, the cost of Medicare Part B for 2023 is $164.90 per month. This rate is adjusted based on income, and those earning more than $97,000 will pay higher premiums.

For high earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $560.50 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2023, the Medicare Part B deductible is $226, which means you would need to pay $226 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

Also Check: How Is Medicare Irmaa Calculated

How Much Will Medicare Cost Me Per Month In 2022

Do you know how much Medicare will cost you each month in 2022?

Planning for retirement is really important, and if youâre going to be living off of a fixed income, you need to be aware of your expected insurance costs.

So, how much will Medicare cost you in 2022?

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

You May Like: How Long Does It Take To Get Medicare After Applying

How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022 and 2023:

- An annual deductible of $1,600 in 2023 for in-patient hospital stays .

- $400 per day coinsurance payment in 2023 for in-patient hospital stays for days 61 to 90 .

- After day 91 there is a $800 daily coinsurance payment in 2023 for each lifetime reserve day used .

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

How Much Does Medicare Advantage Cost Per Month

In 2023, the average monthly premium for Medicare Advantage plans is $17.60 per month.1

Depending on your location, $0 premium plans may be available in your area.

Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the same benefits that are covered by Original Medicare, and most Medicare Advantage plans include additional benefits that Original Medicare doesnt cover.

Because Medicare Advantage plans are sold by private insurance companies, plan costs can vary based on location, carrier, benefits offered and more.

Find out the average cost of Medicare Advantage plans in your county and state.

You May Like: Does Medicare Pay For Cancer Drugs

How Much Does The Average Medicare Supplement Plan Cost In 2022

The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age.1

Based on our analysis, we noted several key takeaways:

-

Medicare Supplement Insurance Plan F premiums in 2022 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

-

Medigap Plan G premiums in 2022 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

| Average Monthly Cost of Plan F | Age in Years |

|---|

Recommended Reading: Does Medicare Part D Cover Sildenafil

The Truth About Your Medicare Part B Premium

You probably know that your Medicare Part B premium can change each year. Do you know why? Or how the amount is calculated? Or why it may increase?

Medicare costs, including Part B premiums, deductibles and copays, are adjusted based on the Social Security Act. And in recent years Part B costs have risen. Why? According to CMS.gov, The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.1

Also Check: What Is The Cost Of Medicare Supplement Plan F

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

Also Check: What Is The Medicare Coverage Helpline

What Is The Average Cost Of Medicare Supplement Insurance

The average premium paid for a Medicare Supplement Insurance plan in 2022 was $128.08 per month.3

Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses youll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies.

These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover.

Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

| 80% | 80% |

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

How Much Are Medicare Supplement Insurance Premiums

If you have Original Medicare, you may be interested in purchasing a Medicare Supplement insurance policy to help with the costs Original Medicare may not cover.

A Medicare Supplement insurance policy is a type of supplemental insurance policy that is sold by private insurance companies.1 It is designed to cover some of the out-of-pocket expenses, like copayments, coinsurance, and deductibles that Original Medicare does not cover.1 In order to be eligible for a Medical Supplement insurance policy, you must first be enrolled in Medicare Part A and Medicare Part B.1

There are many different insurance companies that sell Medicare Supplement insurance policies, and there are several different plans to choose from.

How much can you expect to pay for a Medicare Supplement insurance policy?

Dont Miss: How To Apply For Medicare By Phone

Recommended Reading: Does Medicare Pay For A Tetanus Shot

How To Enroll In Medicare Part A

If you are eligible to enroll in Medicare, you can sign up for Part A and Part B through the Social Security website . You can sign up for Medicare in the following enrollment periods:

- Initial Enrollment Period : This period starts 3 months before you turn 65 and ends 3 months after your 65th birthday.

- General Enrollment Period : This runs from Jan. 1 to March 31 each year. If you miss your IEP, you may have to pay a monthly late enrollment penalty.

- Special Enrollment Period : In some cases, you can sign up for Medicare outside of your IEP without paying a late enrollment penalty. For example, if you are still working past 65 and get health insurance through your job, you might qualify for an SEP.

Do Medicare Supplement Plans Go Up With Age

Unlike plans based on community-rated pricing or issue-age pricing, your premium goes up as you get older. Although Medicare Supplement insurance plans based on attained-age pricing may be the least expensive initially, they can end up becoming the most expensive of the three pricing models over time.

Recommended Reading: How Do I Become A Medicare Provider

Read Also: Does Medicare Pay For Hip Replacement Surgery

How Much Does Medicare Cost If You Are Still Working

Most people don’t pay anything for Medicare while they’re still working because if you have health insurance through a job, you can postpone enrolling in Medicare Part B without a penalty. In situations where you’re working part time or are self-employed, you’d typically pay $164.90 per month for Part B, plus any additional coverage options such as Medicare Advantage, Medicare Part D or Medicare Supplement.

Does Medicare Part A Cost Anything

Medicare Part A costs will vary person-to-person, but for most people, Medicare Part A is premium-free. It still has a deductible, which you pay per benefit period, and it also requires copays for covered services in the hospital, a skilled nursing facility or for hospice.

The costs for Medicare Part A can change each year. Below are the Part A costs as of January 1, 2022, and if you want to also learn more about Part B costs for 2022, read this article.

Also Check: When Is Someone Medicare Eligible

How Much Does Original Medicare Part B Cost

What it helps cover:

Other Part B costs for 2023:

- There is a $226 . After the deductible, youll pay a 20% copay for most doctor services while hospitalized, as well as for and .

- There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

- If you receive these services at a hospital outpatient department or clinic, additional copays or coinsurance amounts may apply.

How Do I Make My Medicare Payments

If youre on federal retirement benefits, your Medicare Part B premiums get deducted from your Social Security checks. You can elect to get your Medicare Part D premiums deducted from your benefit checks, too. Contact your insurer.

If youre not on federal retirement benefits, youll get a Medicare Premium Bill for any parts of Medicare that youre paying for each month. You can pay this bill via your banks online service or by mailing back a credit card, debit card, check or money order payment.

However, Medicare Easy Pay is probably the simplest way to pay your Medicare Premium Bill. It automatically deducts your payment from a linked bank account around the 20th of each month. Deductibles and copays are generally paid directly to health care providers at the time of service.

Recommended Reading: Do You Have To Take Medicare Part A At 65

Making The Right Choice

If youre torn about which direction to go, consider these questions:

- What premium amount can you afford?

- Do you mind needing referrals to see specialists and get diagnostic testing?

- Do you travel frequently or have homes in different states?

If youre on a budget or dont mind utilizing a network of providers, Medicare Advantage may work well for you. On the other hand, if you can afford the premiums and want access to any doctor in the country, or if you travel a lot, Medicare Supplement insurance might be the best option for you.

Also Check: What Does Medicare Part B Cover 2020

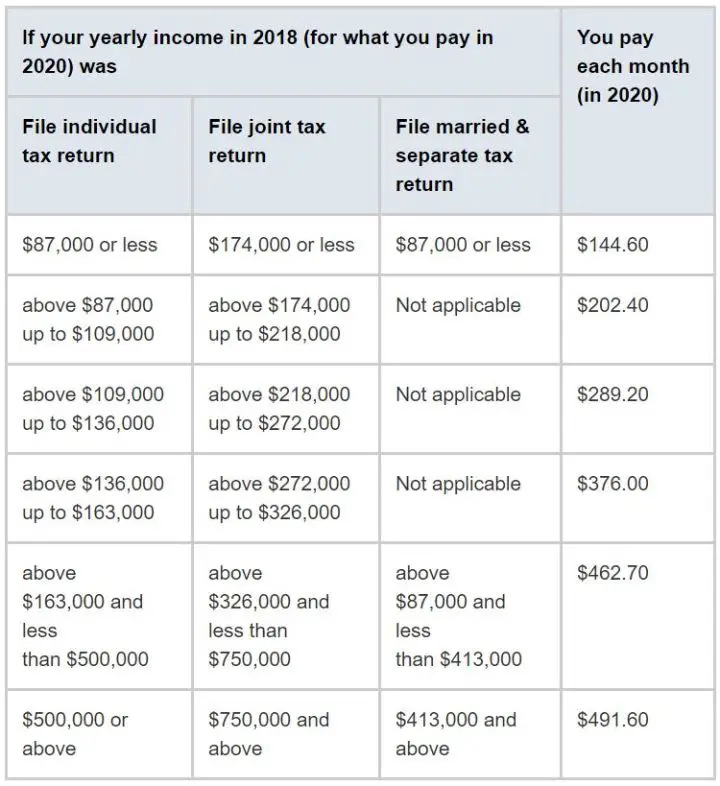

Higher Premiums For Enrollees With High

Since 2007, people who earn more than $85,000 have paid higher Part B premiums based on their income.

For the first time, the threshold for what counts as high income was adjusted for inflation as of 2020, increasing it to $87,000 for a single individual and $174,000 for a couple. It increased again for 2021, 2022, and 2023. Harry Sit, of The Finance Buff, explains how the inflation indexing works here.

Indexing the high-income threshold: The mathThe indexing is based on the percentage by which the average of the Consumer Price Index for Urban consumers for the 12-month period ending in the most recent August exceeds the average of the 12-month period that preceded that. So for 2021, for example, we can look at how the average CPI-U from September 2019-August 2020 exceeded the average CPI-I from September 2018-August 2019.

On this page, you can pull up the data for CPI-U and manually calculate how the average CPI-U has changed. Youll add up all the numbers from September 2019 through August 2020 , and divide by 12 to get the average . Then youll do the same thing for September 2018 through August 2019 . The difference between those two numbers is 3.705, which represents a 1.46% increase from the 254.016 average CPI-U for September 2018 to August 2019.

So as Sit explains here , we increase 87,000 by 1.46% which results in 88,270 and then round to the nearest $1,000. That gives us an income threshold of $88,000, which was the lower bound of high-income as of 2021.

Recommended Reading: How Much Does Medicare Pay For Dialysis Transport