Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

When To Sign Up

Most people become eligible for Medicare on the first day of the month they turn 65. To make a smooth transition from your employer plan to Medicare, you must sign up during the Initial Enrollment Period which starts three months before you turn 65 and ends three months after.

If you want to keep working and stay on your employers health plan after 65, you can delay signing up for Medicare with no penalty. When youre ready to leave your employers plan, you must sign up for Medicare during the Special Enrollment Period . This period starts the month after your employer coverage ends and lasts for eight months.

How To Choose The Right Medicare Plan: An Interview With A Carepartners Of Connecticut Licensed Medicare Agent

Choosing a Medicare plan can feel overwhelming. With so many options, how do you know which plan is right for you?

Christine has been a Licensed Medicare Agent for over 20 years. She is committed to helping people find the right plan, and has extensive knowledge about how Medicare works. We recently spoke to her about Medicare plan options, the differences between an HMO plan and a Medicare Supplement plan, why Original Medicare may not offer enough coverage, and more.

Read Also: Does Medicare Cover International Medical Emergencies

When Can You Enroll In Medicare In 2020

Your enrollment periods will depend on a few factors, such as:

- What type of coverage are you hoping to enroll in?

- Are you over the age of 65?

- Do you have a chronic condition or low income that qualifies you for a Special Enrollment Period?

- Do you have a qualifying life event such as moving to a new state where different plans are available?

What Are The Advantages And Disadvantages Of Medicare Advantage Plans

The pros and cons of a Medicare Advantage plan will depend on your unique needs. Some plans may feature premiums or network coverage that work better for you, while other plans might offer prescription drug coverage and other benefits that you need.

There are five key features to analyze when comparing Medicare Advantage plans:

Read Also: Does Medicare Cover Inspire Sleep

The Basics Of Medicare: How To Choose The Right Plan For You

When you reach 65, you face an important milestone: You are now eligible for Medicare.

Contrary to popular belief, Medicare is not free, and its important to understand the ins and outs of Medicare before you sign up. Making the wrong choices can be expensive.

Even if youve been on Medicare for years, you may want to re-evaluate your options annually to make sure youve got the right plan. The annual open enrollment period, during which you can switch Medicare plans, runs Oct. 15 through Dec. 7.

I think everyone should consider switching, says Lita Epstein, author of The Complete Idiots Guide to Social Security and Medicare.Plans change, benefits change and the premiums change.

Its especially important to re-evaluate your options if you have a Medicare Part D drug plan or a Medicare Advantage plan because those plans can change significantly from year to year, dropping and adding drugs and doctors or changing copays and deductibles. Even if theyre completely happy with their plan, they have to look because things change, says Diane J. Omdahl, founder and Medicare expert at 65 Incorporated, which helps people choose Medicare coverage.

Medicare plans are actually broken into multiple parts:

Part D covers prescription drugs. Premiums in 2018 will average $33.50, down from $34.70 this year.

More from U.S. News

How Do I Find Medicare Advantage Plans Near Me

Every region of the country has access to a different array of Medicare Advantage plans. To find locally available plans, start by going to Medicares website, Medicare.gov. Click on the Find Plans button in the middle of the screen to search for Medicare Part D and Medicare Advantage plans.

You can create an account before evaluating plan options or browse as a guest. Each plan lists out details, including costs for premiums and covered services, in-network hospitals, pharmacies, and doctors. A star quality rating assigned by Medicare is also visible to help you make an informed decision about how well a plan meets consumers needs. Seniors who are prepared to make a plan choice can begin the enrollment process online.

Anyone who is eligible for or already enrolled in Medicare Parts A and B is eligible for Medicare Advantage. You must enroll in one of the designated time periods, either when first eligible, during open enrollment, or a special enrollment period.

Choosing the right Medicare Advantage is an important decision that affects finances and health care. By understanding the available plan types and coverage options, you can move forward with Medicare Advantage with confidence.

Don’t Miss: Can I Change From Medicare Supplement To Medicare Advantage

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

How Can I Find The Best Medicare Supplement Insurance Plan For Me

If youâre wondering âWhatâs the best Medicare Supplement insurance plan?â- first be aware that there is no âbestâ plan for everyone. To find a plan that may work for your needs, consider what type of benefits the various plans cover.

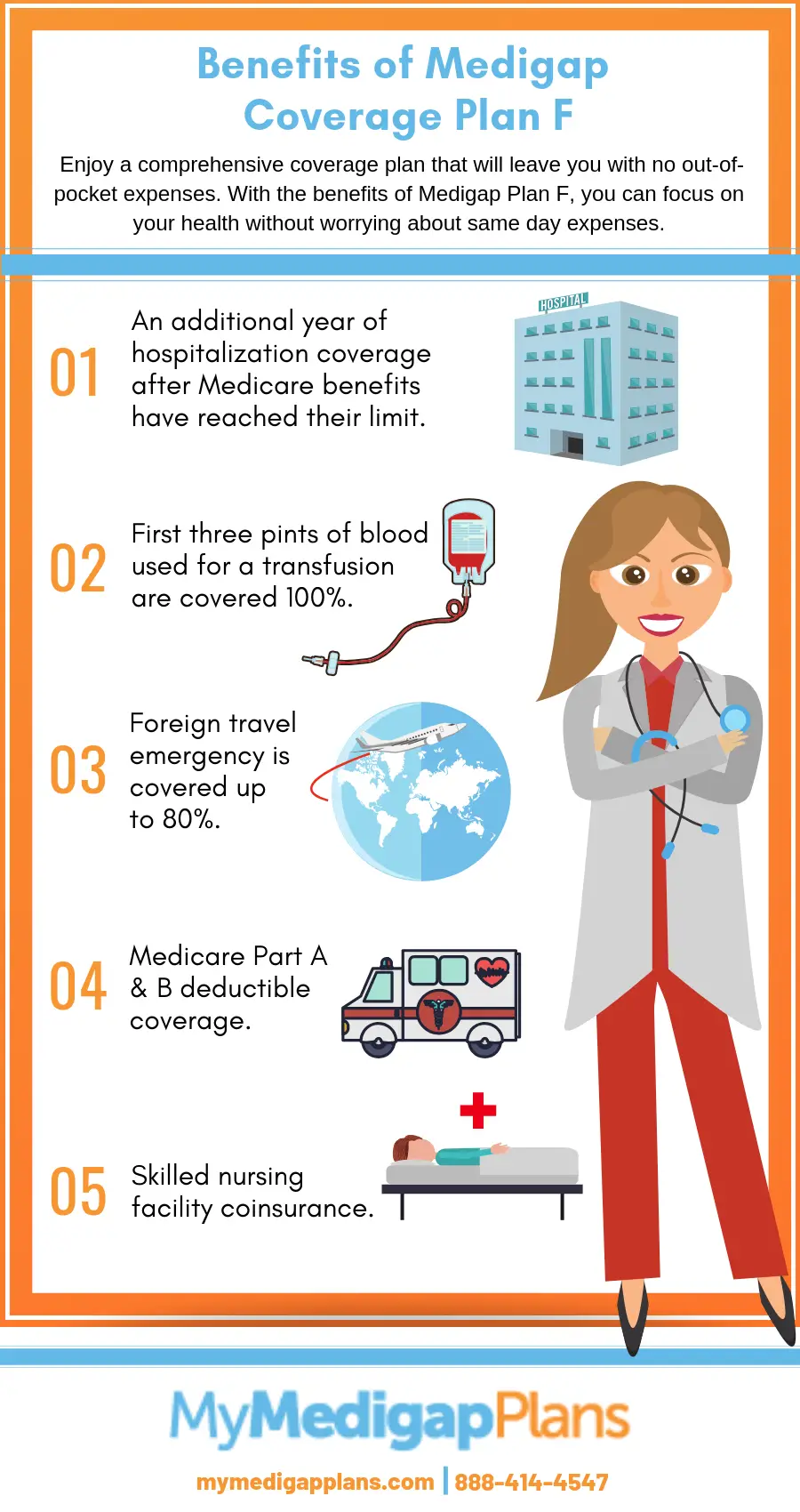

Up to 10 Medicare Supplement insurance plans are sold in most states. The plans are standardized, and plan names are labeled A, B, C*, D, F*, G, K, L, M and N.

All plans, A-N, cover Medicare Part A hospital coinsurance at 100%. Beyond hospital coinsurance, the plans begin to vary.

All plans A-N cover Medicare Part B coinsurance, the first 3 pints of blood for a medical procedure, and Part A hospice care coinsurance at least 50%. Plan K covers them at 50% Plan L covers them at 75% and Plans A, B, C*, D, F*, G, M and N cover them at 100%. Please note that Massachusetts, Wisconsin, and Minnesota have their own standardized plans.

Other benefits that some Medicare Supplement insurance plans may cover are:

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B excess charges

- Foreign travel emergencies

Plan F* is also offered as a high-deductible plan by some insurance companies. This means that you must pay the deductible amount of $2,370 in 2021 before the Medicare Supplement insurance plan pays anything.

You might be able to buy Plan G or a high-deductible Medicare Supplement Plan G, which has most of the same benefits as those of Plan F.

Recommended Reading: How Much Will Medicare Cost In 2022

What Are The Disadvantages Of Medicare Advantage Plans

Knowing the limitations of these plans will help to give you a better understanding of whether Medicare Advantage is right for you.

The first downsides are the restrictions imposed by some Medicare Advantage plans. Here are some examples:

- You can only visit doctors and treatment facilities within your plans network, under certain plan types.

- Going outside the network, when available, typically means facing higher premiums, copayments, and deductibles.

- You may have to change doctors in case of plan network changes.

- Part C plans require pre-authorization or referrals before you can visit specialists.

The second disadvantage of Part C is that there may not be any plans offered in your location.

- You can only join Part C plans within your service area or state. Therefore, you need to check the plans offered near your location or residence.

- Many who live in rural areas often opt for only Original Medicare because it is difficult to reach doctors within the networks attached to Medicare Advantage plans they can obtain.

Still another disadvantage of Part C plans is the extra costs. Although there are long-term savings with MA plans, specialist and hospital copayments and costs for other services can add up to large sums across a year. Plus, the annual out-of-pocket limit does not apply to prescription drugs and other perks.

Therefore, depending on your case, a Medicare Advantage plan may turn out to be more expensive.

How To Find The Best Medicare Part D Drug Plan

A CR analysis found huge price differences on plans within ZIP codes, sometimes even at the same pharmacies. Here are tips on how to save hundreds on your drugs each year.

When Damian Birkel, 66, fills his prescriptions each month at his local pharmacy in Winston-Salem, N.C., he has the pharmacist run more than a dozen of his meds through his Medicare drug coverage plan, called Part D, and pays cash for three more. For those, he uses GoodRx, a company that provides discount coupons.

The owner of a small consulting firm, Birkel says using the discount coupons is the only way he can afford meds not covered by his plan. In fact, the $500 he saves with the coupons is enough to cover his 2021 Part D monthly premiums. So far, he says hes fairly satisfied with the arrangement.

But now he and his wife are among the roughly 48 million Americans enrolled in a Part D plan who must decide by Dec. 7, 2021, whether to reenroll in the same plan for next year or shop for a new one.

Because much can change from year to year, its not as straightforward a decision as it might seem.

For one thing, deductibles and monthly premium charges can go up. For another, the drugs a plan coversand how well it covers themcan also be different, says Frederic Riccardi, president of the Medicare Rights Center, a nonprofit group that counsels individuals on finding Medicare plans and advocates for pro-consumer Medicare policies.

Recommended Reading: Are Canes Covered By Medicare

Decide How Much Health Care Coverage You Want

If you’re only looking for basic, no-frills coverage, Original Medicare takes care of that. It’s the combination of Medicare Part A and Part B . To get help paying for prescription medications, you’ll also need to enroll in a stand-alone Part D plan.

Medicare Advantage plans, also known as Medicare Part C, combine Parts A and B, and often Part D . These plans may include vision, hearing, and dental benefits, and health and wellness programs that aren’t offered by Original Medicare. Medicare Advantage plans are an alternative to Original Medicare, not a supplement to it.

Even if you don’t use many health care services or prescription medications at the moment, keep in mind that even the healthiest person can experience an unexpected illness or accident, and costs can add up fast. Prepare for the unknown as you choose a plan, just in case.

Is It Important To Keep Your Monthly Payment Low

If you want a lower monthly premium, youll pay more in copays and coinsurance when you need care.

- If you are pretty healthy and dont think youll need to go to the doctor very often, a plan with a lower premium and higher copays and coinsurance might make sense.

- If you have a chronic condition or tend to go to the doctor more often, it may cost you less in the long run to pay a higher monthly premium and less in copays and coinsurance.

Keep in mind that Medicare Advantage plans cap your annual out-of-pocket costs, so youll know the most youll ever have to pay for covered services each year. With Original Medicare, there is no cap on costs.

Help with health care costs

If you are finding it difficult to pay for your health care costs, you may qualify for help paying your Medicare premiums, deductibles, and copays/coinsurance.

Vision and dental care

- Original Medicare and Medigap plans, generally dont include extras like routine dental, vision, and hearing benefits.

- Youll need to pay for these routine services out of your own pocket if you dont have a Medicare Advantage or plan that covers them.

- If extras like these are important to you, consider a Medicare Advantage plan, that offers the benefits you want or need.

Health discounts

Seniors and dental health

Dental health is directly tied to our overall health. And, we can be at more risk for certain oral health conditions like gum disease, tooth loss, oral cancer, and dry mouth as we get older.

Also Check: Can I Change Medicare Plans Anytime

Original Medicare Vs Medigap

As noted above, Medigap plans work alongside your Original Medicare coverage to help pay for deductibles, coinsurance and copayments that Original Medicare doesnt cover.

Having a Medigap plan can help you lower your out-of-pocket Medicare costs in exchange for a monthly plan premium.

Anyone who wishes to reduce the unexpected out-of-pocket costs associated with Original Medicare might consider applying for a Medigap plan. A Medigap plan can help make your health care spending more predictable and easier to budget for.

How Often Do I Travel And Need Coverage When Im Away From Home

In the U.S. and its territories

If you choose Original Medicare only and need care while traveling in the U.S. or one if its territories, you can go to any doctor, clinic, or hospital that accepts Medicare.

If you choose a Medicare Advantage and Medigap plan and need care while traveling in the U.S, where you can get care covered by your plan depends on your plans network and plan details.

Travel outside the U.S.

Original Medicare does not provide coverage if you need care outside of the U.S. Youre responsible for any charges for that care.

Some Medicare Advantage and Medigap plans provide coverage for emergency care you need when youre traveling out of the country. Be sure to check the plan details if youre planning to travel abroad.

Don’t Miss: How Much Is Taken Out Of Ss For Medicare

What Are The Medicare Supplement Insurance Plans

Another essential aspect you should know about is the Medigap or Medical Supplement Insurance Plans. These plans are designed to fill the gaps in your Original Medicare out-of-pocket costs.

Medigap plans are labeled Plan A all the way through Plan N, with the most popular plan being Plan G. Each plan covers a different amount of the Medicare out-of-pocket expenses..

When first starting Medicare Part B, you will have an enrollment period to choose any medicare supplement plan available in your area without having to answer any health questions to determine your eligibility. You are automatically accepted.

After your initial enrollment period, you will have to medically qualify in order to enroll in a Medicare Supplement plan. Conditions such as heart issues, diabetes with high insulin, and others can be declinable reasons for Medicare Supplements.

The amount you pay for a medicare supplement is determined by several factors including your age, zip code, gender, and smoker status.

Do A Thorough Pharmacy Search

Determining which pharmacies in your area are preferred vs. in-network might be the most confusing part of signing up for a Part D plan, says Stephen Schondelmeyer, PharmD, a professor of pharmacoeconomics at the University of Minnesota in Minneapolis.

When we sorted by lowest drug + premium cost using the Medicare plan finder tool, which is the default setting, our spot check found that preferred pharmacies might offer some of the lowest prices on generic meds in particular.

Take, for example, two plans in Denver. For our list of medications, with the Humana Walmart Value Rx plan you would spend $463.56 on the plans premiums plus annual drug costs if you filled your prescriptions at Walmart, a preferred pharmacy. But those same drugs at that same pharmacy would cost $1,182 if you signed up for the Wellcare Value Script plan, which doesnt include Walmart as a preferred pharmacy.

On the other hand, if you did go to one of Wellcare Value Scripts preferred pharmacies, in this case a Safeway, youd pay $670.80. Thats still more expensive than the Humana Walmart plan using a Walmart pharmacy but a lot less than using a nonpreferred pharmacy.

Then look for the pharmacy and Part D plan that have the lowest total amount for both drug and premium cost.

Recommended Reading: Who Is The Medicare Coverage Helpline

What About A Medicare Supplement Plan

A Medicare Supplement plan will help cover gaps in Original Medicare. Generally, Medicare Supplement plans have higher monthly premiums than HMO plans, but you can see any doctor who accepts Medicare. Although, with a Medicare Supplement plan, you would need to purchase a separate prescription drug plan if you want prescription drug coverage.