Social Security Benefit Reductions

Two provisions may cause a reduction in your Social Security benefits: the Windfall Elimination Provision and the Government Pension Offset. Only the Social Security Administration can provide information on the actual amount of the reduction. We will not reduce your TRS benefit because of Social Security benefits you receive.

What If The Social Security Administration Finds That My Disability Has Ceased But Im Still Not Able To Work

The notice, which you will receive from the Social Security Administration following a continuing disability review, will explain your appeal rights. Read this notice carefully. If you appeal within ten days of the date you receive the notice your benefits will continue during your appeal. So be sure to act quickly.

Who Is Eligible For Ssi

You can qualify for SSI if you:

- are over 65

- are legally blind

- have a disability

As with all Social Security benefits, youll also need to be a United States citizen or legal resident and have limited income and resources. However, to apply for SSI, you dont need work credits.

You can receive SSI in addition to SSDI or retirement benefits, but it can also be a standalone payment. The amount you receive in SSI will depend on your income from other sources.

Social Security Disability Insurance is a type of Social Security benefit for those with disabilities or health conditions that prevent them from working.

Also Check: Can You Sign Up For Medicare Part A Only

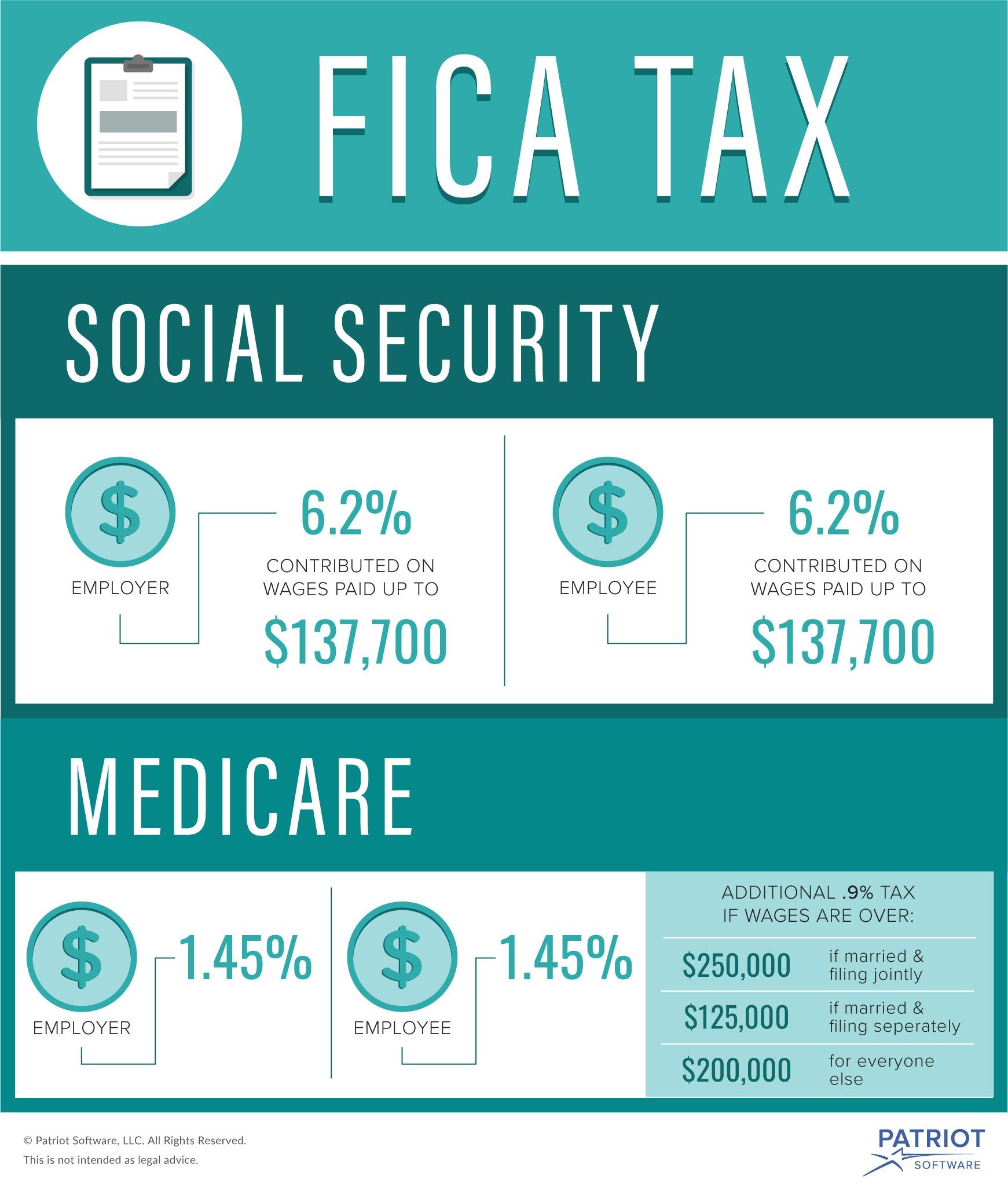

Funding For Social Security And Medicare

Both programs are primarily funded by payroll taxes, which are split evenly between employees and employers . The Social Security tax rate is higher, but theres an upper income limit above which Social Security taxes are not levied. The Medicare tax rate is lower, but it applies to all wages. Together, Medicare and Social Security payroll taxes are known as FICA taxes .

Lawmakers on both sides of the aisle have proposed a variety of reforms for both Social Security and Medicare, but Republicans are much more likely to focus on privatization, means testing, and increasing the age at which people become eligible for benefits.

Former Speaker of the House, Paul Ryan, proposed various Medicare reforms in budget proposals during his time in office, including privatization, means testing, and raising the eligibility age to 67. Not surprisingly, Ryans proposals failed to gain bipartisan support, but have remained quite popular with Republicans.

Similar proposals have been advanced regarding Social Security, with GOP lawmakers often calling for an increase to the full retirement age for Social Security. Theyve also proposed privatizing the program, adding means testing, or a combination of all three approaches.

Some Democrats have proposed expanding the Social Security tax so that it applies to all income, a move that would increase revenue and stabilize the program without the need to reduce benefits.

Medicare Taxes And The Affordable Care Act

The Affordable Care Act added an extra Medicare tax for high earners. This surtax is known as the Additional Medicare Tax. As of January 2013, anyone with earned income of more than $200,000 has to pay an additional 0.9% in Medicare taxes beyond the standard 1.45%. That entire 0.9% is the responsibility of the employee. It is not split between the employer and the employee.

If your income means youre subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000. If you make $250,000 a year, youll pay a 1.45% Medicare tax on the first $200,000, and 2.35% on the remaining $50,000.

Another result of ACA reforms is the Net Investment Income Tax . The NIIT, also known as the Unearned Income Medicare Contribution Surtax, is a 3.8% Medicare tax that applies to investment income and to regular income over a certain threshold. If your Modified Adjusted Gross Income exceeds $200,000 you may be subject to the NIIT. Examples of investment income that is subject to the NIIT include dividends, interest, passive income, annuities, royalties and capital gains.

The 3.8% tax applies to the lesser of either your net investment income or the amount by which your MAGI exceeds $200,000 . That means the NIIT acts as either an extra income tax or an extra capital gains tax. You can report your net investment income on IRS Form 8690.

Read Also: What’s The Medicare Deductible

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

How To Apply For Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

If you are not yet collecting Social Security at age 65, you can apply for Medicare coverage online at the Social Security website. You will be billed for your Medicare Part B premium quarterly. You can pay for this with a credit card, debit card or a bank transfer.

To avoid any potential missed payments, you might want to consider enrolling in Medicare Easy Pay, which will automatically deduct your premiums from a bank checking or savings accounts.

If you are still working at age 65 and continue to have coverage through your workplace plan, you may want to delay starting your Medicare Part B coverage. Joanne Giardini-Russell, whose insurance firm specializes in helping people navigate Medicare choices, notes that even if you automatically signed up at 65 because you were already receiving Social Security benefits, you could then opt out, if that made sense.

I often see people who just accept enrollment and start paying the premium, even though they dont need to just yet, says Giardini-Russell.

Before making that choice, be sure to consult a Medicare insurance pro to make sure you are in fact eligible to delay, or you could be slapped with a permanent penalty premium when you do eventually sign up for Part B.

Don’t Miss: When Do I Apply For Medicare Benefits

How Much Does Medicare Cost Per Month

The amount that you will pay for Medicare each month will vary based upon your income and the kind of supplemental coverage you choose.

An example would be the base Part B premium of $170.10/month plus a Medigap Plan G monthly premium of $125/month plus a Part D premium of $27/month your total would be $322.10/month in premiums.

With this example you can be sure your additional out-of-pocket spending would be minimal as Plan G would pick up the majority of your out-of-pocket costs.

There are many different Medicare plan options to choose from so that you can have a monthly premium within your budget.

How Much Of Your Social Security Is Taken By Medicare Costs

The Centers for Medicare and Medicaid Services recently announced that the standard Medicare Part B premium will be $148.50 in 2021, an increase of $3.90 per month from $144.60 in 2020. That increase, which I earlier feared would be considerably more, was restricted by legislation enacted last fall. But even with legislation to keep the Medicare Part B flat, the Part B premium still went up 2.6% over 2020, twice as much as the annual cost-of-living adjustment . This trend of Medicare costs increasing several times faster than Social Security benefits creates chronic headaches for retirees, as the Medicare Part B premium consumes a growing share of Social Security benefits.

Consider this, $375 per month is about one quarter of the average $1,523 per month Social Security benefit in 2021. About one third of those participating in our 2020 Senior Survey indicated they spent that much on their total healthcare costs. Another 31% said they spend more than $1,000 a month on total healthcare costs roughly two-thirds of the average Social Security benefit! These findings are particularly troubling considering that the Government Accountability Office estimated in 2019 that almost half of households with people aged 55 and older have no retirement savings or other form of pension outside of Social Security.

The following chart illustrates how survey participants responded a year ago.

Don’t Miss: Can Doctors Limit The Number Of Medicare Patients

How Much Does Medicare Part C Cost In 2022

The premium for Medicare Part C â also called Medicare Advantage â depends on your plan and the insurer, since these health plans are provided by private insurance companies.

Deductibles, copays and coinsurance for Medicare Part C vary by plan. However, there is a limit to how much you can spend on out-of-pocket expenses. After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage canât exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

The average out-of-pocket limit for Medicare Advantage enrollees was $5,059 in 2019, according to the Kaiser Family Foundation.

Learn more about Medicare Part C.

Is There Anything That I Can Do Now To Help Ensure That My Benefits Will Continue

The very best thing you can do is to continue seeing your doctor. A lot of people with long-term chronic medical problems stop seeing their doctors because no treatment seems to help. This is a mistake for two reasons. First, it means that when the Social Security Administration conducts a review, no medical evidence will exist to show that your condition is the same as it was when you were first found disabled. Second, and perhaps even more importantly, doctors recommend that even healthy people after a certain age periodically have a thorough physical examination. This is even more important for people who already have chronic medical problems.

You May Like: A Medicare Supplement Policy Must Not Contain Benefits Which

The Wealthy Can Get A Higher Maximum Social Security Benefit

In 2021, well-to-do retirees can net quite a bit more each month. According to the Social Security Administration, the maximum monthly benefit at full retirement age will increase to $3,148 in 2021, up by $137 from 2020.

Thats an extra $1,644 a year for lifetime upper-income earners during retirement.

On the other hand, The maximum amount of wages taxed for Social Security will be $142,800 in 2021, up from $137,700 in 2020.

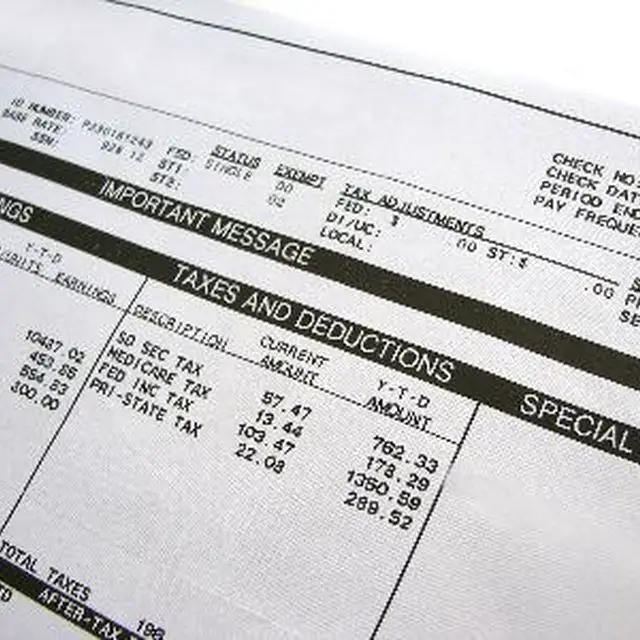

Social Security And Medicare Tax Deductions

FICA refers to the combined taxes withheld for Social Security and Medicare . On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance. Medicare is shown as Fed Med/EE.

Your FICA withholdings depend on the employee group you belong to:

You May Like: Does Social Security Disability Include Medicare

Can I Use Social Security Benefits To Pay My Medicare Premiums

Your Social Security benefits can be used to pay some of your Medicare premiums.

In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance or Social Security retirement benefits.

However, this doesnt apply to all Medicare premiums. Each part of Medicare has its own premiums and rules for interacting with Social Security.

Well discuss how this works for each part next.

Fact #: Social Security Is More Than Just A Retirement Program It Provides Important Life Insurance And Disability Insurance Protection As Well

Over 64 million people, or more than 1 in every 6 U.S. residents, collected Social Security benefits in June 2020. While older Americans make up about 4 in 5 beneficiaries, another one-fifth of beneficiaries received Social Security Disability Insurance or were young survivors of deceased workers.

In addition to Social Securitys retirement benefits, workers earn life insurance and SSDI protection by making Social Security payroll tax contributions:

- About 96 percent of people aged 20-49 who worked in jobs covered by Social Security in 2019 have earned life insurance protection through Social Security.

- For a young worker with average earnings, a spouse, and two children, thats equivalent to a life insurance policy with a face value of over $725,000 in 2018, according to Social Securitys actuaries.

- About 89 percent of people aged 21-64 who worked in covered employment in 2019 are insured through Social Security in case of severe disability.

The risk of disability or premature death is greater than many realize. Some 6 percent of recent entrants to the labor force will die before reaching the full retirement age, and many more will become disabled.

Recommended Reading: How To Apply For Medicare Through Spouse

Paying For Medicare When You Have Social Security

The federal government takes the premium cost directly out of your Social Security check to pay for Original Medicare.

However, if you have Medicare Advantage, you can pay the private health insurer directly instead of having the money taken out of your check. The same goes for if you have a Part D prescription drug plan.

How Much Of Your Paycheck Goes To Social Security Tax It Depends How Much You Make

Photo: 401kcalculator.org via Flickr

The Social Security tax rate in the United States is currently 12.4%. However, you only pay half of this amount, or 6.2%, out of your paycheck — the other half is paid by your employer. And, Social Security taxes are only applied to the first $118,500 in wages for the 2015 tax year, which can make the effective Social Security tax rate less for higher-income individuals.

ExamplesFor a basic example, consider the case of a worker who earns a salary of $50,000 per year. Since this is below the wage limit, the 6.2% Social Security tax rate would apply to the entire income — so this person would pay $3,100 in Social Security taxes throughout the course of the year. Assuming a bi-weekly pay schedule, this amount translates to about $119 per paycheck.

Or, consider a higher-income individual who’s salary is $250,000. Because this is over the wage cap, only the first $118,500 of this person’s earnings is subject to the 6.2% tax. So, $7,347 of this worker’s income is paid as Social Security tax, making the effective Social Security tax rate just 2.9%.

Self-employed individualsIf you are self-employed, you are responsible for paying both the employer’s and employee’s portion of the Social Security tax — also known as the “self-employment tax.” The combined rate is 12.4% , and the same $118,500 wage cap applies for the Social Security tax. Medicare tax is paid on all wages.

Also Check: Does Medicare Pay For Cosmetic Surgery

Account For The Employers Portion Of Fica Taxes

After you have completed the FICA tax calculations for all employees, you must set aside an amount equal to the total for your employer portion of the FICA taxes. This amount includes:

- 6.2% of the employees total FICA wages for Social Security, with no maximum, and

- 1.45% of the employees total FICA wages for Medicare .

Why Do You Have To Pay A Medicare Tax

The Medicare tax helps fund the Hospital Insurance Trust Fund. Its one of two trust funds that pay for Medicare.

The HI Trust Fund pays for Medicare Part A benefits including inpatient hospital care, skilled nursing facility care, home health care and hospice care. It also pays for administering the Medicare program. It covers the costs of fighting Medicare fraud and abuse, collecting Medicare taxes and paying benefits.

A second, Supplementary Medical Insurance Trust fund receives money from Congress and interest earned on trust fund investments. It pays for Medicare Part B benefits and Part D prescription drug coverage.

Read Also: Is Medicare Issuing New Plastic Cards

Look Closely At Your Bill

The type of Medicare Premium Bill you get shows if youre at risk of losing your Medicare coverage for late payments:

If the box in the upper right corner says |

It means |

|

|---|---|---|

| Medicare didnt get your full payment by the due date shown on the First Bill. | Send in payment for the total amount due by the bills due date. | |

| Delinquent Bill | Medicare didnt get your full payment by the due date shown on the Second Bill. If you dont pay the total amount due, youll lose your Medicare coverage. | Send in payment for the total amount due by the bills due date so that you dont lose your Medicare coverage. This is the last bill youll get. |

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. For example, Medicare runs the bill for April on March 27th. Youll get the bill in early April, and its due on April 25th.

Child Support And Alimony

If beneficiaries are ordered to pay child support or alimony, payments can be garnished from their Social Security checks to satisfy their obligations. Social Security Act 459 authorizes the legal enforcement of child support and alimony support orders by having monies owed by beneficiaries deducted from their Social Security benefits.

Don’t Miss: Does Medicare Part C Cover Dentures

Employee Total Fica Calculation

Your two required FICA deductions in 2020 equal 7.65 percent of your gross wages. To calculate your total FICA hit each pay period or annually, multiply your gross income by the decimal equivalent of the mandated percentage rate. For example, since 0.0765 multiplied by $100 equals $7.65, for every $1,000 of gross pay, youll lose $76.50 to FICA.

If your annual gross wages are $20,000, your FICA deductions for the year total $1,530. The Social Security portion of your annual FICA payment equals $1,240. The Medicare portion will total $290. Normally, your employer will show the amount of your deductions for each pay period and your total contributions to date.