Is It Necessary To Sign Up For Part C And Part D

Not at all. These plans are optional, and its up to you to decide whether enrollment in Part C and/or Part D is right for you. Of course, MedicareMall is ready to help you make the most informed decision possible. Contact us now and let us put our two decades-plus of experience and expertise to work for you!

What Does Medicare Part C Pay For

Medicare Part C covers the inpatient care typically covered by Medicare Part A. If you are a Medicare Part C subscriber and are admitted to the hospital, your Medicare Advantage plan must cover a semi-private room, general nursing care, meals, hospital supplies, and medications administered as part of inpatient care.

How Much Is Medicare Advantage

Just like the additional benefits offered, the total cost of a Medicare Advantage plan will vary by provider, location and which plan you choose. For example, some Medicare Advantage plans may come with low-cost monthly premiums, while others may be $0. A plans deductible, copayment and coinsurance costs will also vary by plan, and potentially also by the health service or benefit you use.

However, there is a unique benefit to Medicare Advantage plans that other Medicare plans dont have. All Medicare Advantage plans have a yearly limit on the out-of-pocket costs you must pay for covered medical services. This limit may vary for different plans, and can change each year however, its something that only Medicare Advantage plans offer to help keep costs in check.

Its important to know that even with a Medicare Advantage plan, youll still pay the Part B premium to Medicare.

You May Like: Does Medicare Part A And Part B Cover Prescriptions

I Know Why I Should Sign Up For Medicare Part A And Part B But What Coverage Do Medicare Part C And Part D Provide

Medicare Part C plans include Medicare Private Fee-for-Service Plans, Health Maintenance Organization Plans, Medicare Preferred Provider Organization Plans, Medicare Medical Savings Account Plans, and Medicare Special Needs Plans .

Medicare Part D, meanwhile, was established by the federal government to subsidize prescription drug costs for people on Medicare.

What Benefits Can I Expect On Medicare Advantage

Medicare Advantage covers everything that original Medicare covers. However, Advantage plans also cover hearing, vision, and dental careâwhich arenât covered under original Medicare. Depending on the plan, Medicare Advantage may also cover things like gym memberships, transportation, and adult day-care.

New to Medicare Advantage plans in 2020, non-medical needs like meal delivery, home air cleaners, and home modifications are now covered by many plans.

Read Also: How To Find Out Your Medicare Number

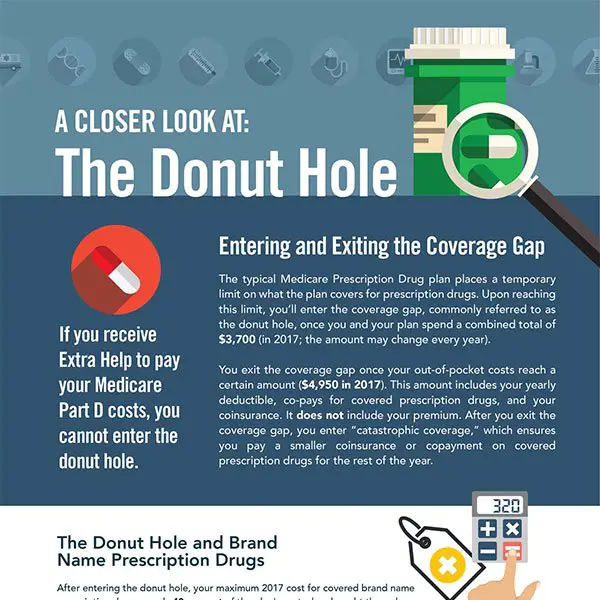

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2021, the average monthly premium for a Medicare Part D plan is $41.64 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$77.10 + your plan premium |

Whats The Difference Between Original Medicare And Medicare Advantage

The main difference between Original Medicare and Medicare Advantage is that Original Medicare benefits are administered by the government, and Medicare Advantage benefits are administered by private insurance companies.

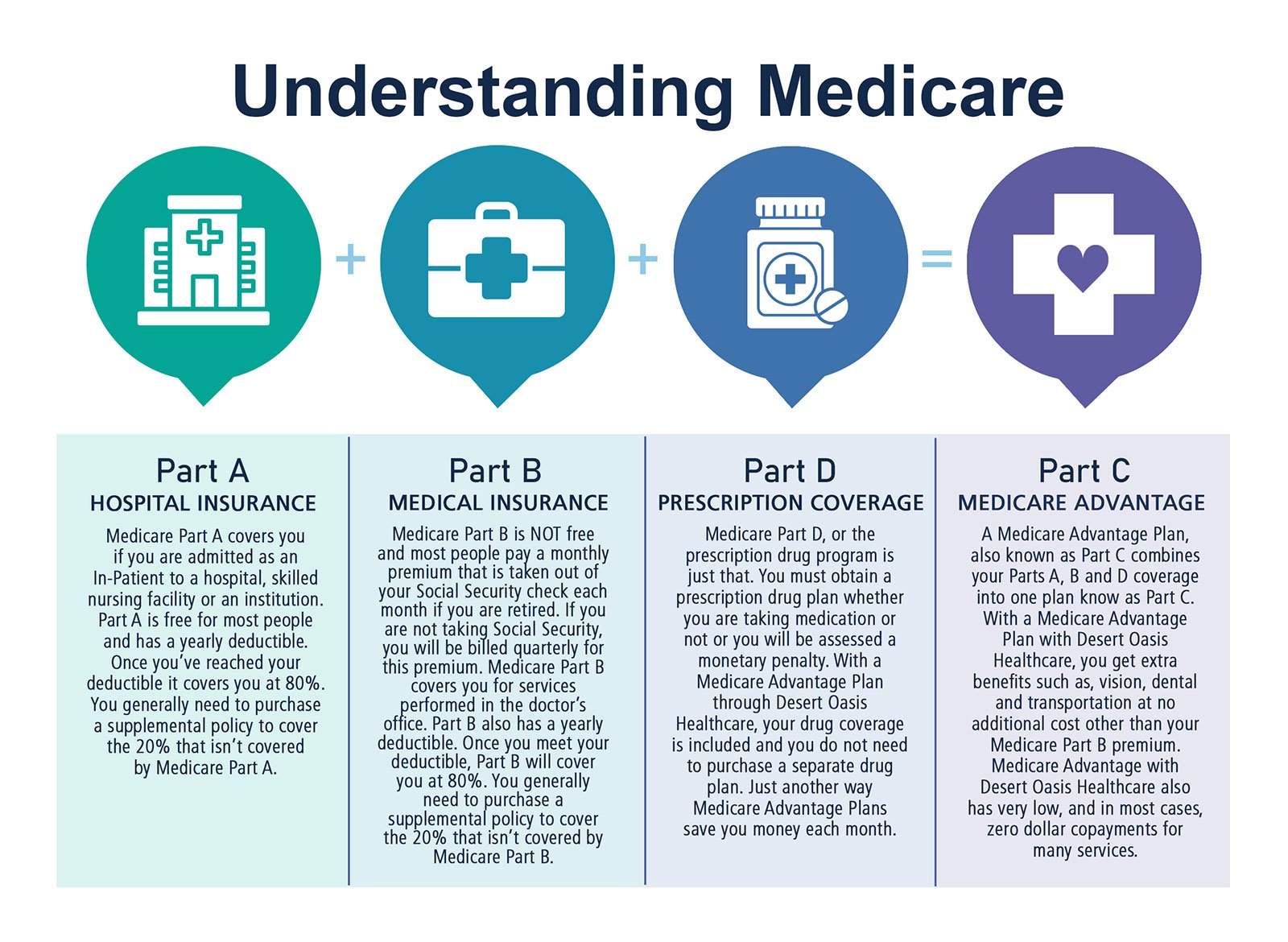

Medicare Part A is known as hospital insurance. It covers services that are considered medically necessary to treat a disease or condition you may have.

In general, Part A can cover:

- Skilled nursing facility care

- Inpatient care in a hospital

- Nursing home care

- Hospice care

- Home health services including : physical therapy, occupational therapy, and speech-language pathology services

Medicare Part B is known as medical insurance. It covers medically necessary services needed to diagnose and treat a medical condition, as well as services to prevent or detect common illnesses at an early stage.

Part B can cover:

- Outpatient medical services

- Ambulance services, including emergency ground transportation to a critical access hospital or skilled nursing facility when you cant be safely transported by car or taxi

- Durable medical equipment , including canes, oxygen equipment, and blood sugar monitors

- Mental health services, including inpatient, outpatient, and partial hospitalization

- Second opinions before non-emergency surgery to know and understand your treatment options

- Limited outpatient prescription drugs under limited conditions

- Clinical research

You May Like: Is Keystone First Medicaid Or Medicare

Who Is Eligible For Part C Medicare

You may be eligible for Part C Medicare if the following applies:

- Enrollment in Medicare Parts A and B

- Residence in the Medicare Advantage plans service area

So, before you can even qualify for a Medicare Advantage plan, you must first be eligible for Medicare.

You may be eligible for Medicare if one or more of the following applies to you:

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

Recommended Reading: How Do You Qualify For Medicare Part A And B

How Do I Sign Up For Medicare Part C And/or Part D

You need to sign up for Medicare Part A and Medicare Part B first. If youve already done this, its easy to sign up for Part C and Part D. You can go to your local Social Security office to sign up, or you can save a lot of time by enrolling online here in a matter of minutes.

If youre newly eligible for Medicare, you can sign up for Medicare Part C and Medicare Part D during your Initial Enrollment Period. If, like most Americans, you become eligible for Medicare at age 65, your Initial Enrollment Period begins three months before the month you turn 65 and ends three months after the month you turn 65. That means, for example, if your birthday is on June 15, your Initial Enrollment Period will be from March 1 until September 30. Also, note that if your birthday falls on the first of the month, your Medicare coverage can begin on the first of the month before your birthday.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

You May Like: What Medications Are Covered By Medicare Part D

What Is Medigap Plan C

Medicare supplement insurance, also called Medigap, has 10 plans, identified by letters: A, B, C, D, F, G, K, L, M, and N.

From , no Medigap policy is allowed to pay the Part B deductible, which means Medigap Plan C cannot be offered to new enrollees in Medicare. However, a person previously enrolled in Plan C can keep the policy.

Medigap Plan C helps pay for the following costs:

- Part A deductible

- Part B coinsurance or copayment

- blood, first 3 pints

- foreign travel exchange, up to 80%

However, there are two benefits Plan C does not cover, including the Part B excess charge and the out-of-pocket limit.

Because Medicare Part C and Medigap Plan C are different, eligibility is also different.

What Does Medicare Advantage Cover

Medicare Advantage plans must cover everything that Original Medicare covers, including inpatient hospital and skilled nursing facility care, emergency and urgent care, doctor visits, surgery, preventive care, certain vaccines and medical equipment such as wheelchairs and walkers. 2

Medicare Advantage plans may also cover additional services not included in Part A and Part B. Most plans include Part D prescription drug coverage. Many offer some coverage for dental and vision care, hearing aids, and fitness centers. Plans recently have been permitted to provide other benefits, including adult daycare, in-home support services, and home safety modifications, such as grab bars and wheelchair ramps. Traditional Medicare does generally not cover those services.3

Recommended Reading: How To Apply For Medicare Insurance

Recommended Reading: Must I Enroll In Medicare At Age 65

When Can I Sign Up For Medicare Part C Or Part D Or Change Plans

- If youre new to Medicare, you can enroll in Medicare Part C or Part D during your Initial Enrollment Period.

- The fall may be a good time to compare plans and see if youre getting the best possible Medicare health or prescription drug plan for your needs. You can change plans during the Annual Election Period.

Is it time to compare plans to see if theres any plan in your area that may be better for you? Just click the button on this page to get started with no obligation. You can also contact eHealth to reach our licensed insurance agent.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

How Much Does Medicare Advantage Cost

Medicare still costs money even though its funded through the government via taxes. The government sponsors Medicare Part C, and extra services may be included in the plan, which can drive up costs. In general, costs break down as follows:

- In order to enroll in Medicare Advantage, you must have both Part A and Part B, which means that you have to pay a Part B premium. In 2021, the standard Part B premium is $148.50 per month for new beneficiaries. This will increase to $170.10 in 2022.

- The cutoff amount for the standard premium is an income of $88,000 or less per year . If you have a higher income based on tax returns from two years ago, that is you will generally pay a higher premium.

- The deductible is $203 per year in 2021, which increases to $233 in 2022.

- You also pay a 20 percent coinsurance or 20 percent of all medical costs after meeting the deductible for Part B.

- Medicare Part C has additional costs, which mean that you pay a monthly premium for it as well. These premiums vary but can be as low as $0 per month. Per our analysis of 2022 state data from the Centers for Medicare and Medicaid Services, premiums average to around $23 a month next year.

Read Also: Will Medicare Cover A Mobility Scooter

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

What Else Do You Pay For When You Have Medicare Part C

When considering your Medicare expenses, there are two costs to consider in addition to your monthly premium.

Coverage for dental, vision or hearing varies. These benefits may be included in a Part C plan, which means you’d have no additional cost. You could also have to pay a fee to add this coverage or purchase a stand-alone plan.

A cheaper policy is less likely to include these benefits, and the extra costs can add up. For example, in addition to a $15 Part C plan, you could pay an extra $25 per month for dental coverage and $15 for vision, bringing your total to $55 per month. If you want these coverages, compare the total cost of a cheap policy with add-ons to a more comprehensive policy with a higher price. You may pay less overall by choosing a bundled plan that includes dental and vision coverage.

Read Also: Does Medicare Cover Life Alert Cost

S Of Medicare Basics Part C

The best place to start learning about Medicare is with the basics with Parts A, B, C and D. The third in a four-blog series, this months Medicare Basics blog will focus on Medicare Part C, which is also known as Medicare Advantage.

Medicare Advantage is an alternative to Original Medicare . These are all-in-one plans and are only provided by Medicare-approved private insurance companies.

When Is It Possible To Enroll In A Medicare Advantage Plan

Medicare enrollment is only available during particular times of the year. You cannot always sign up when you want it is crucial to understand when you can enroll in the various elements of Medicare. Then continue reading.

You can apply for a Medicare Advantage plan online or over the phone once you have found the one you like.

You must supply your Medicare number and the dates when your Medicare Part A and Part B coverage began when you applied for coverage. On your Medicare card, you will find these dates.

Read Also: Can You Have Kaiser And Medicare

What Are Medicare Advantage Plans And Which Plans Are Available In Iowa

Medicare Advantage plans are offered by private companies which contract with Medicare to provide Medicare Part A, B and sometimes D benefits. When you enroll in a Medicare Advantage plan you do not lose Medicare, you just get your benefits in a different way.

There are four types of Medicare Advantage plans in Iowa: HMO , POS , PPO , PPFS , and SNP . In addition, a special type of health plan called a Cost Plan is offered in some counties.

Before you enroll in a Medicare Advantage plan its important to know the following:

- Do all of your providers accept the plan?

- You must have both Medicare Parts A and B and live in the service area for the plan.

- You must stay in the plan until the end of the calendar year .

- Each year plans can change benefits, premiums, service areas, provider networks , and can terminate their contract with Medicare.

- You do not need a Medicare supplement insurance policy. In fact, Medicare supplements cannot pay benefits when you are enrolled in a Medicare Advantage plan.

For more information on plans available in Iowa, use the link below to view and download our consumer guide.

Persons Covered By Medicare Parts A And B Can Enroll Directly With Private Insurance Companies

Enrolling in Medicare Part C usually simply requires signing up directly with a qualified insurance company. It is important that you understand premium costs, covered care and expenses, and out of pocket expenses before signing up for Medicare Part C coverage.

Private insurance companies that are qualified to provide and administer Medicare Part C coverage are paid directly by the federal government to cover individual enrollees.

Also Check: Does Medicare Cover Hepatitis A Vaccine

Medicare Part C Pros And Cons

Medicare Part C pros:

- Generally lower premiums than Original Medicare + Medigap + Part D

- No need to purchase any additional coverage

- Coverage includes a cap on out-of-pocket costs

- Various supplemental benefits are included, depending on the plan

- Available to all Medicare beneficiaries who live in the plan’s service area, even if they’re under 65 and eligible for Medicare due to a disability

- Annual opportunities to switch to a different Medicare Part C plan or Original Medicare

Medicare Part C cons:

- Provider networks are more limited than Original Medicare’s nationwide provider access.

- Out-of-pocket costs are often higher than a person would have with Original Medicare and a Medigap plan.

- Prior authorization and referrals are much more likely to be required with Medicare Part C than with Original Medicare + Medigap.

- After an initial 12-month trial period, Medicare Part C enrollees with pre-existing conditions may find it impossible to buy a Medigap plan if they want to switch to Original Medicare.