What Is The Difference Between Medicare Part A And Medicare Part B

Medicare Part A and Medicare Part B are the two parts of Medicare that make up Original Medicare coverage. For most, Original Medicare is your primary healthcare coverage once you reach age 65 or receive disability income.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

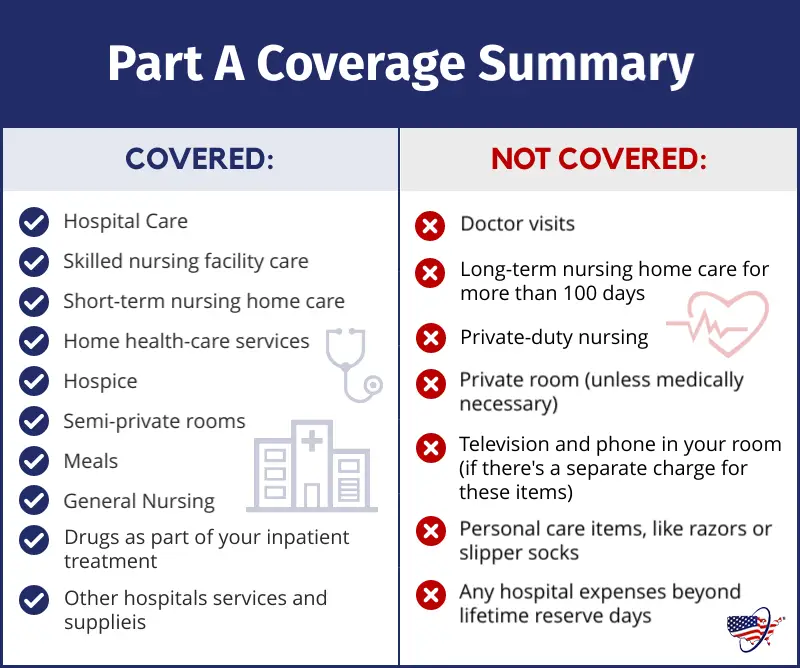

Medicare Part A handles inpatient services and benefits, whereas Medicare Part B covers outpatient, doctor, and medical supply benefits.

The two coverages work hand in hand but are not the same in terms of cost and benefits. Often, you will not need to pay a premium for Medicare Part A. However, you will need to pay a monthly premium for Medicare Part B. In terms of out-of-pocket costs, both parts of Medicare require you to pay deductibles, coinsurance, and copayments. However, those costs look very different between the two parts.

How Much Will You Pay For Medicare Part B

by Christian Worstell | Published January 20, 2022 | Reviewed by John Krahnert

The standard Part B premium in 2022 is $170.10 per month, though you could potentially pay more, depending on your income.

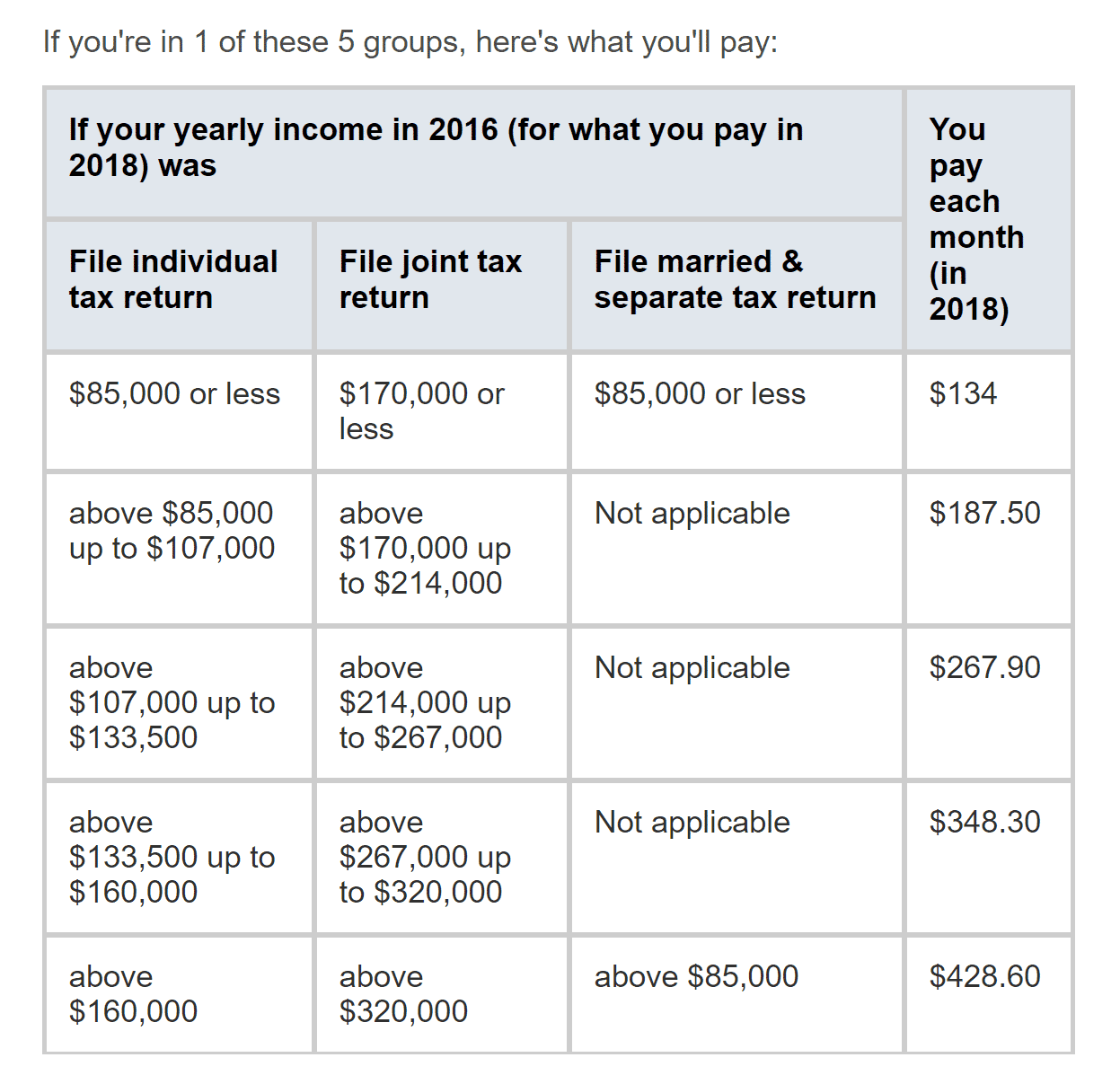

Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior. For example, your Medicare Part B premium in 2022 is based on your reported 2020 total annual income, and your 2023 premium will be based on your reported 2021 income, and so on.

Use the helpful chart below to begin determining what you can expect to pay for your Medicare Part B coverage in 2022.

|

2020 income |

2020 income |

2022 monthly Medicare Part B cost |

|

|

$91,000 or less |

|||

|

Above $170,000 and less than $500,000 |

Above $340,000 and less than $750,000 |

Above $91,000 and less than $409,000 |

$544.30 |

|

$578.30 |

How Do You Enroll In Original Medicare

To enroll in Original Medicare , you must be 65 and dont necessarily have to be retired. Initial enrollment period packages are sent to people 3 months before they turn 65 or during their 25th month of disability benefits.

If youve received Social Security disability benefits for 24 months, you are automatically enrolled in Part A and Part B.

Read Also: Do Medicare Premiums Increase With Income

Enrolling In Medicare Part B If You Are 65 Or Older Still Working And Have Insurance From That Job

You are not required to take Part B during your Initial Enrollment Period if you are still working or your spouse is still working and one of you has coverage as a result of that current work. You should only delay Part B if this current employer insurance is the primary payer on your health care expenses . You should talk to your employer when you become eligible for Medicare to see how employer insurance will work with Medicare. Generally, if you are eligible for Medicare because you are over 65, the employer must have more than 20 employees to be the primary payer. If you are eligible for Medicare because you get SSDI, the employer must have more than 100 employees to be the primary payer.

If there are fewer than 20 employees at the company where you currently work or your spouse currently works, Medicare is your primary coverage. In this case, you should not delay enrollment into Part B. If you decline Part B, you will have noprimary insurance, which is usually like having no insurance at all.

In either case, if you have insurance from a current employer, you qualify for aSpecial Enrollment Period . During this period, you can enroll in Part B without penalty at any time while you or your spouse is still working and for up to eight months after you lose employer coverage, switch to retiree coverage, or stop working.

Medicare Part B Premium Reimbursement For 2022

SPECIAL NOTICE: This article only applies to Retired Members and Qualified Surviving Spouses/Domestic Partners of the Los Angeles Fire & Police Pension Plan.

The Centers for Medicare and Medicaid Services has increased the standard Medicare Part B monthly premium to $170.10 effective January 1, 2022 however, you may pay a different amount determined by CMS.

- If you are a new Medicare Part B enrollee in 2022, you will be reimbursed the standard monthly premium of $170.10 and will only need to provide a copy of your Medicare card.

- If you received a Medicare Part B reimbursement of $148.50 or less on your pension check in 2021, you will need to provide documentation to update your Part B reimbursement amount for 2022.

- If you have been receiving a Part B reimbursement that is lower than your basic Part B premium, you may be retroactively reimbursed for your Part B premiums for up to 12 months.

Read Also: Does Medicare Cover Insulin Pens

Medicare Part B: What It Covers What It Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Part B is the portion of Medicare that covers most doctor visits and other outpatient medical services. It also covers durable medical equipment and preventive services.

Most people pay a premium of $170.10 per month in 2022. You might pay more if your income exceeds certain thresholds.

Heres what you should know about Medicare Part B.

What Is Medicare Part B

Medicare Part B is the part of Original Medicare that covers doctors visits, outpatient care, and durable medical equipment. Medicare part B covers preventative and medically necessary services that you receive under the supervision of a Medicare-accepting physician.

Once you enroll in Medicare Part B, you become eligible to enroll in a Medicare Supplement plan or a Medicare Advantage plan.

Medicare Supplement plans help cover the costs left behind by Original Medicare. Since you are not covered at 100% by Original Medicare, these Medicare Supplement plans help you create individualized full coverage benefits while still utilizing Original Medicare benefits. Medicare Supplement plans can cover the Medicare Part B coinsurance, so you are not left covering this out-of-pocket cost.

Recommended Reading: How Can I Find Out If I Have Medicare

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19ârelated hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19ârelated services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

You May Like: What Is The Medicare Out Of Pocket Maximum

What Is The Monthly Premium For Medicare Part B

The standard Medicare Part B premium for medical insurance in 2021 is $148.50.Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits. Social Security will send a letter to all people who collect Social Security benefits that states each persons exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most. Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE .

More Information

How Do I Receive The Medicare Giveback Benefit

You will not receive checks directly from your Medicare Advantage plan carrier. You can get your reduction in 2 ways:

You May Like: Does Plan N Cover Medicare Deductible

What Doesnt Count As Income And Resources

Federal law requires that states exclude certain types of assets. These are some of the main things that dont count:

| Doesnt Count as a Resource |

|---|

| Primary house |

| Items that cannot be easily converted to cash such as furniture and jewelry |

| Burial plot and burial funds valued up to $1,500 for individuals and $3,000 for couples |

| Life insurance that has less than $1,500 in cash value |

For Those Who Qualify There Are Multiple Ways To Have Your Medicare Part B Premium Paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

These Part B costs can add up quickly, which is why many beneficiaries search for a way to lower or be reimbursed for these expenses. The good news is they have options that can help maximize their savings while on Medicare.

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Read on to learn about Part B savings options that you may be able to take advantage of.

Read Also: How Old Do You Have To Be To Have Medicare

When Are Medicare Premiums Due

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of billing timeline

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

You May Like: Are Pre Existing Conditions Covered Under Medicare

When Youre Ready Contact Social Security To Sign Up:

- Apply online This is the easiest and fastest way to sign up and get any financial help you may need. Youll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online.

- Contact your local Social Security office.

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Medicare Savings Programs Income And Resource Limits

Your income and resources are some of the factors that Medicaid uses to determine if you qualify for help with Medicare premiums. MSPs have different monthly income limits, and most states have the same limits. Alaska and Hawaii are the only two states that have different income limits. Three of the four MSPs have the same resources limits, and these limits are the same for all states including Alaska and Hawaii. If you earn equal to or less than these limits, then you may qualify for assistance.

| Program Name |

|---|

Also Check: Is Humana Choice A Medicare Advantage Plan

Help Paying Original Medicare Premiums

Most MSPs provide help for Medicare Part A or Part B only. All programs require eligibility for Medicare Part A, but the main difference between each is the income range that those seeking help must be within.

Parts A and B: The Qualified Medicare Beneficiary program is the only Medicare assistance program that pays premiums for both parts of Original Medicare. If youre approved as a QMB, youre the program will help pay for your Medicare costs .4

Part A Only: If you need help with just your Part A premiums, you may get assistance through the Qualified Disabled and Working Individual program. To get full or partial aid, you must:4

- No longer be eligible for a premium waiver of your Part A benefits because youre working

Part B Only: Both the Specified Low-Income Medicare Beneficiary and Qualifying Individual programs will help pay for Medicare Part B premiums.4

- SLMB program: Must meet low-income limits to get aid.

- QI program: Aid is provided on a first-come-first-served basis, with preference given to previous year QI enrollees. You must apply for this program each year.

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment for its services, some people may find it difficult to pay for the monthly costs associated with this portion of Medicare. Those with limited incomes, in particular, may wonder if there are cost assistance programs in place to help mitigate the financial burden.

In fact, there are a few ways that you can reduce your monthly premiums, or at least make your healthcare more affordable using different programs. One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

The Qualified Medicare Beneficiary Program

- The Qualifying Individual Program

- The Specified Low-Income Medicare Beneficiary Program

Each program has its own eligibility requirements. For example, members of the QI Program must apply every year for assistance. Acceptance is based on a first-come, first-served basis, with priority given to past recipients. You also wont qualify for the QI Program if you receive Medicaid benefits. If you think that you qualify for one of these programs or need financial assistance, then you should contact the Medicaid program in your state to find out more information.

You May Like: Is Medicare Part B Based On Income

Medicare Part B Coverage

Medicare Part B covers two kinds of services: medically necessary outpatient care and preventive services

Medically necessary outpatient care

Medicare Part B covers a variety of outpatient care and services when theyre medically necessary. According to the Centers for Medicare & Medicaid Services, medically necessary services are services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

After youve paid your Medicare Part B deductible for the year, Part B generally pays for 80% of covered medically necessary services. Youre responsible for a 20% Part B coinsurance for most covered services.

Here are some examples of medically necessary services covered by Medicare Part B:

Medicare preventive services

Medicare Part B also covers preventive care and services including certain disease and cancer screenings, tests, shots and counseling.

While most medically necessary services require a 20% Part B coinsurance, you dont pay anything for most preventive services.

Here are a few examples of preventive services for which youll pay nothing under Medicare Part B

Certain preventive services are limited to certain sexes and/or have conditions on how often Medicare covers them. To pay nothing for some services, you need to get them from a health care provider who accepts Medicare assignment. You can find specific details for how individual services are covered at medicare.gov/coverage.