Medicare Supplement Plan N Cost

Lets talk a little bit more about the differences between the two plans, and more specifically what other charges you could incur on Medicare Plan N.

Again, if youre somebody who doesnt go to the doctor very oftenand I have clients who never got to the doctor who loves Plan N because they pay lower premiums all year long.

So they absolutely love it. They know if something happens to them, theyve got outstanding coverage, but their out-of-pocket expenses are going to be minimal, even on a Plan N.

So they love Plan N because they dont go to the doctor very often, but they know they are protected very, very well, God forbid something major happens.

How Does Medicare Cover Birth Control

In most cases, Medicare Part A and Part B do not cover birth control. Medicare does cover birth control when it is part of medically necessaryServices or supplies that are needed for the diagnosis or treatment of your medical condition and meet accepted standards of medical practice…. treatment. One such example is a hysterectomy when a patient is at high risk of uterine cancer or for the treatment of heavy menstrual bleeding with a hormonal IUD.Medicare.gov, Surgery, Accessed November 3, 2021

Medicare Plan N Vs Plans F And G

A person considering Plan N may wonder how it compares with plans F and G.

Plan F is the most comprehensive Medigap plan, but it is no longer available to new enrollees who became eligible for Medicare before .

If an individual is looking for a plan with extensive coverage, Plan G is the second most comprehensive option.

Recommended Reading: How To Get Replacement Medicare Id Card

Is Medigap Plan N A Good Deal For You

Plan N can be a particularly good option for those in good health or those that do not go to the doctor much. You can look at the premium savings you would receive by going with Plan N, subtract out the deductible and add in as many co-pays as you would have in an average year. The only variable is the Part B Excess charges. You can usually call your primary physician or other physicians you see regularly to find out if they accept Medicare assignment. If they do not, that means that they can charge these excess charges. So thats a good idea if you are considering Plan N.

One additional consideration that many people do not realize is that you have to qualify medically to change Medigap plans after your initial turning 65 open enrollment period. Contrary to popular misconception, there is not an annual enrollment period that allows you to change plans. You can change Medigap plans at any time, but you have to answer medical questions and qualify to do so. This is important to understand because, if you choose Medigap Plan N, you should feel comfortable with it long-term. If your health changes, its possible you would not be eligible to switch to one of the other plans.

There are many companies that are now offering this plan as it has become a viable alternative for some people. It is advisable to compare costs extensively with a broker or by calling each company, as costs can vary as much as 50% for the exact same coverage.

Enrollment For Medigap Plan N

Enrollment begins the first day of the month you turn 65 and are covered under Medicare Part B and ends six months after your birthday month. Applying for benefits during this time is the most beneficial, as insurance companies are not permitted to use medical underwriting. That means you could get the lowest prices available.

Applying for benefits outside of the six-month time window could mean higher premiums or a denial of coverage due to your health.

Recommended Reading: How Much Does Medicare Part A And B Cover

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period in the fall. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Medicare Plan N Eligibility

You are eligible to enroll in Plan N as long as you have Medicare Parts A and B. You must also live in the plans service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period. This six-month window starts with your Part B effective date. Its your one chance to enroll in any Medigap plan without health underwriting. No insurance company can turn down your application due to health conditions.

If youve missed your one-time Medigap Open Enrollment Period, you can still apply for a Medigap Plan N. We can explore the health questions on various companys applications to see if you are able to pass.

Recommended Reading: What Is My Deductible For Medicare

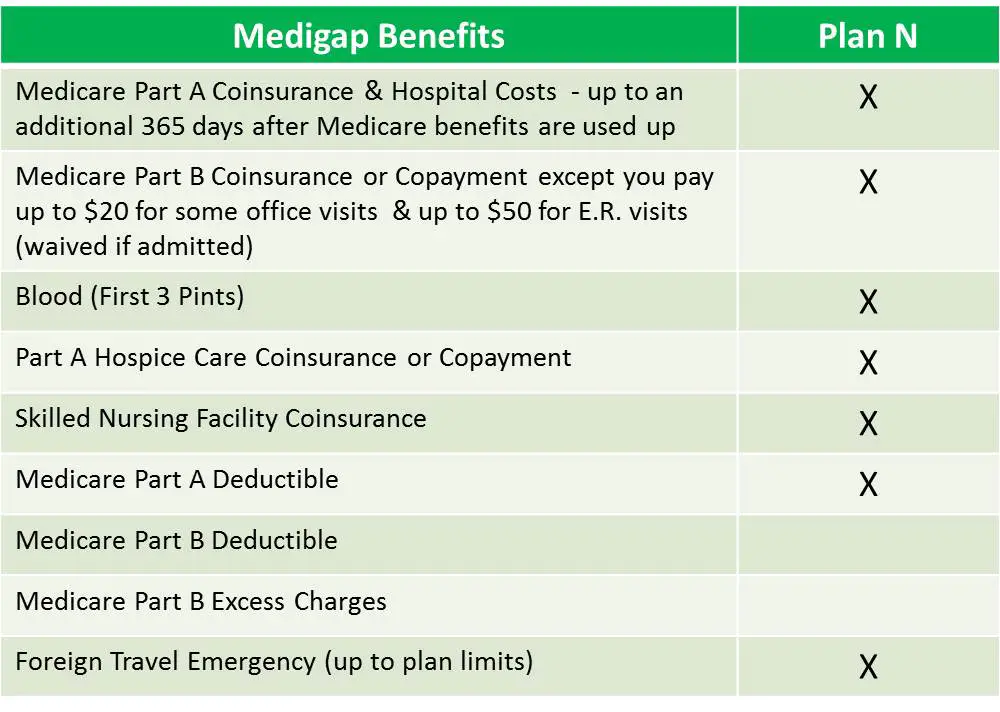

What Benefits Does Medicare Supplement Plan N From Aarp Include

Plan N is one of the newest Medigap plans. AARP offers it some areas because it helps seniors fill the gaps in their original Medicare benefits in a unique way.

Unlike Plan F and Plan G, with a Medicare Plan N policy, you’ll be required to pay a copayment of up to $20 for some doctor visits and up to $50 for emergency room care that does not require you to be admitted into the hospital. For healthy seniors, the co-pays add up to savings due to the lower monthly premiums.

Here’s how Plan N covers you:

This plan also offers the following additional benefits:

With its lower cost and good coverage, it is easy to see why Plan N’s popularity is growing.

Generally, a Plan N costs about 25% less than the more comprehensive Plan F. The lower premium is available because Plan N covers fewer gaps in Original Medicare. In addition to the co-pays, be aware that this plan does not cover the Part B deductible or Part B excess charges. For this reason, this plan is best for people who do not have chronic health conditions.

Compare Medigap Plan N With Other Medicare Supplement Insurance Plans

Like all Medigap plans, the costs associated with Medigap Plan N may vary by carrier. How a certain insurance carrier rates the Medigap Plan N premiums determines how much an individual will pay to obtain a policy. Medigap Plan N may be an attractive option for those seeking broad coverage. It is not the most comprehensive Medicare Supplement insurance plan, so it is recommended that you review the details of all ten Medigap plans in order to find a Medigap policy that works best with your needs.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

NEW TO MEDICARE?

So you are enrolled in Original Medicare , what should you do next?

Research, from DEFT, suggests that those with Original Medicare only are not overly enamored with their coverage. There are a few ways you can find comprehensive Medicare coverage for the things that matter, such as routine vision, dental, and hearing care. Keep reading to find out which Medicare plans are right for you.

To get the best value and health insurance coverage for your situation, be sure to compare your employer coverage costs to your projected healthcare costs on Medicare. Youll need to do a little research to determine the best arrangement for you.

Don’t Miss: Does Medicare Pay For Assistance At Home

Medicare Plan N Insurance Companies

59% of all insurance companies that sell Medicare Supplement Insurance offer Plan N.1

While Medigap Plan N may be found within smaller insurance companies all over the U.S., some of the most popular insurance companies in the country sell Plan N in at least some states.

What Is Medicare Supplement Insurance

Medicare Supplement Insurance is sold by private insurance companies.

While the costs of each type of Medigap plan may vary depending on where and by whom it is sold, all of the benefits remain standardized by the federal government. For example, Plan N purchased in New York will include the same coverage as a Plan N purchased in California, though the monthly premiums will vary for the two plans.

Medicare Supplement Insurance is accepted by any doctor or provider who accepts Medicare.

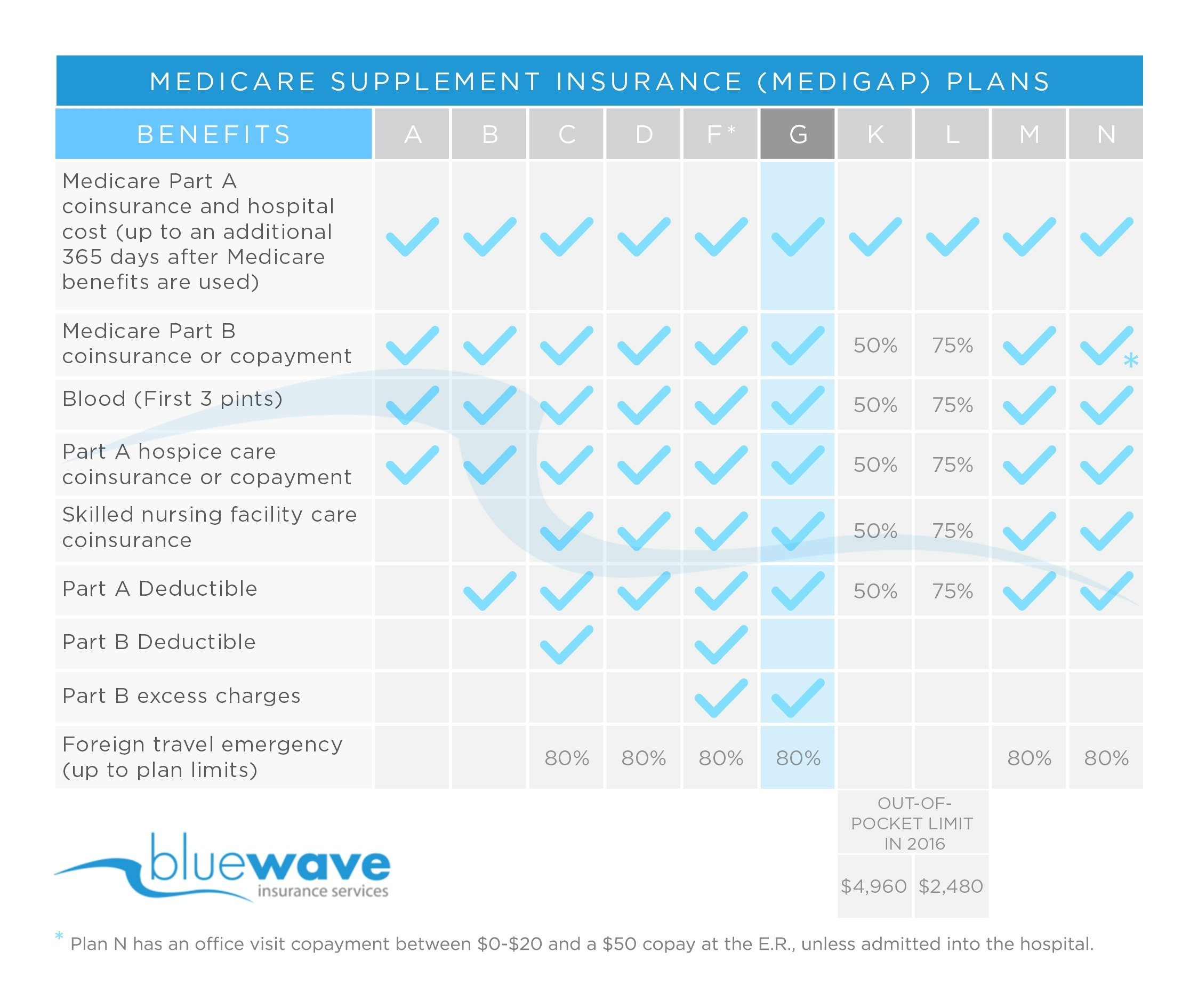

You can use the chart below to compare the different types of standardized Medicare Supplement plans.

Medicare Supplement Insurance Plans 2021

| Medicare Supplement Benefits |

Also Check: What Does Bcbs Medicare Supplement Cover

How To Enroll In Medicare Plan N

In nearly every case, you cannot simply try to search the internet to get rates on Plan N from all the top companies in just one spot. In fact, were one of the only companies that actually allows you to see any rates at all for any of the Medigap plans.

This is because we want to gain your trust and provide you with the necessary information to help you make an informed decision. And thats why our clients love our FREE service each year.

Well shop all the top companies now for you, as well as every year, to always make sure youre paying the least amount possible for your Medigap coverage.

The easiest way to enroll is to just give us a call now at 1-888-891-0229.

I promise youll be glad you called!

Aarp Medicare Supplement Plan K

Looking for more basic Medicare Supplement coverage at a lower cost? Plan K might be the right choice for you. Plan K offers partial coverage for many of the costs youd pay out of pocket. This includes:

- 100% of your coinsurance payments for inpatient hospital care

- 50% of your Part B coinsurance or copayments

- 50% of up to 3 pints of blood

- 50% of your Part A hospice care coinsurance or copayment

- 50% of your coinsurance for care provided in a skilled nursing facility

- 50% of your Part A deductible

An Additional Benefit of Plan K

Plan K is one of only two Medicare Supplement plans that includes an annual out-of-pocket limit. In 2020, this limit is set at $5,880. Once youve spent this amount, your plan will cover 100% of your Medicare costs for the remainder of the year.

Don’t Miss: Who Pays The Premium For Medicare Advantage Plans

What Medigap Plan N Covers

Heres what Plan N covers, according to Medicare.gov:

-

Part A deductible.

-

Part A coinsurance and hospital stays up to an additional 365 days after Medicare benefits are used up.

-

Part A hospice care coinsurance or copayment.

-

Part B coinsurance .

-

Blood transfusion .

-

Skilled nursing facility care coinsurance.

-

Emergency health care cost for the first 60 days when traveling outside the U.S., and 80% after $250 deductible is met.

A Coinsurance And Hospital Costs

Medicare Part A requires daily coinsurance payments for inpatient hospital stays beginning on day 61 of a benefit period. In 2021, these Part A coinsurance costs are $371 per day for days 61-90 of an inpatient stay and $742 per day for days 91 and beyond for up to 60 lifetime reserve days.

Medicare Supplement Plan N covers Medicare Part A coinsurance costs in full along with 365 days of inpatient hospital costs after all Medicare benefits are exhausted.

You May Like: Does Medicare Advantage Pay For Hearing Aids

Aarp Medicare Supplement Plan G

Like Plan F, Plan G is one of the most comprehensive Medicare Supplement plans available. Plan G does not cover your Medicare Part B deductible. However, it does cover all of the standard benefits included with Plan A. It also includes:

- Medicare Part B excess charges

- Coinsurance for care provided in a skilled nursing facility

- Your Medicare Part A deductible

- 100% of approved foreign travel emergency costs

AARP Medicare Supplement Plan G: The High-Deductible Option

AARP also offers a high-deductible version of Plan G. This option will require you to pay a deductible of $2,340 before the plan begins to assist with costs. Once youve met your deductible, the plan will pay 100% of covered costs for the remainder of the year. This plan does not cover your Part B deductible. However, it will count your payment toward your Plan G deductible.

How Much Is The Copays For Medicare Plan N

In exchange for lower monthly premiums, youre responsible for a small copay of $50 when visiting the emergency room and a $20 copay at the doctors office. Yet, if you visit an Urgent Care center, there is NO copay.

Thus, if you cant get an appointment with your primary care physician, instead of going to the emergency room over something minor, you can go to urgent care and avoid copays. Remember that these copays will NOT count towards the Part B deductible.

Read Also: Is Balloon Sinuplasty Covered By Medicare

Your Medigap Plan N Costs

Medicare Supplement Plan N offers identical basic benefits like the more popular Plan G, but you agree to pay a share of a few things that you wouldnt pay on Plan G. First, you agree to pay the small annual Part B deductible . You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay.

Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows. This is called an excess charge. Plan N does not cover this for you like Plan F or G would. This can result in small bills from time to time.

However, you can avoid this by simply asking your providers up front if they accept Medicare assignment. If they do, you need not worry about excess charges. Another option is to compare Medicare Plan N v Plan G. People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

Medicare Supplement Plan N Eligibility And Enrollment

Like other Medigap plans, youre eligible to enroll in Plan N if:

- You are enrolled in both Medicare Part A and Part B

- There is a Plan N available in your service area.

The best time to enroll in Medigap Plan N is during your Medigap Open Enrollment Period, which is the six-month period that automatically starts on the first day of the month that you are both 65 or older and enrolled in Medicare Part B. During this time, you have a guaranteed-issue right to enroll in any Medigap plan available in your service area, regardless of any pre-existing conditions* or disabilities you may have. Insurance companies arent allowed to reject you based on your medical status or charge you more if you have health problems. After your Medigap Open Enrollment Period is over, you may have more difficulty enrolling in a Medicare Supplement plan if you have health problems. Insurance companies are also allowed to use medical underwriting after this period and may charge you higher premiums based on your health status. You may also be denied coverage entirely due to your health status.

Do you have questions about Medigap Plan N and whether it may work for your situation? Feel free to use our eHealth plan finder tool to compare Plan N or other Medigap options in your location just enter your zip code into the tool on this page to get started. If you need immediate assistance, contact eHealth to speak with a licensed insurance agent and get answers to your Medicare questions.

New To Medicare?

Recommended Reading: How Do You Qualify For Medicare In Texas

Aarp Medicare Supplement Plan N

Plan N is the final Medicare Supplement plan available from AARP. It covers the following benefits:

- 100% of your coinsurance payments for inpatient hospital care

- 100% of your coinsurance or copayments for hospice care

- 100% of your Medicare Part A deductible

- 100% of your Medicare Part B coinsurance or copayments*

- 100% of up to 3 pints of blood to be used in a medical procedure

- 100% of your coinsurance for care provided in a skilled nursing facility

- 100% of approved foreign travel emergency costs

* Certain Part B copays do not qualify for coverage under Plan N. This includes:

- A copayment of up to $20 for some office visits

- A copayment of up to $50 for emergency room visits that do not result in an inpatient admission

MORE ADVICE