How Income Affects Medicare Premiums

May 25, 2022

You spend your whole life working hard and saving for retirement. You pay into Social Security and Medicare over the years only to find out that when it is time to use them, those assets that youve accumulated can affect your entitlements from those programs. Income from your assets whether through IRA withdrawals or by dividends, interest and capital gains from non-IRA assets can make your social security taxable or increase your Medicare premiums. This post will focus on the Medicare side.

The Medicare Income-Related Monthly Adjustment Amount is an increase in your Part B or Part D premium if your income exceeds a certain level. The IRMAA is calculated using the income you reported on your tax return two years prior. Furthermore, your Modified Adjusted Income is used, which means that it is your income before you take any deductions. It is worth noting that Roth IRA distributions are not included in MAGI. The table below from the Medicare website highlights the income levels for 2022:

If your yearly income in 2020 was:

| File individual tax return |

Lets look at an example:

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

So How Are The Medicare Premiums You Pay For Calculated

These additional Medicare premiums are all calculated through something called IRMAA, which stands for Income-Related Monthly Adjustment Amount. It is an additional amount that you may have to pay along with your Medicare premium if your modified adjusted gross income is higher than a certain threshold.

Your MAGI is calculated by taking your adjusted gross income plus any of the following that apply to you: untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories that was not already included in AGI. For most people, your MAGI will be the same as your AGI but read this report by the Congressional Research Service here for further details.

In 2022, the IRMAA surcharges only apply if your MAGI is more than $91,000 for an individual or more than $182,000 for a couple. Most people have income below these levels, so the majority of enrollees will pay the standard premium, $170.10 per month.

Also Check: Does Medicare Cover Outpatient Physical Therapy

Compare Medicare Advantage Plans In Your Area

If you have questions about you Part B premium or would like to learn more about how a Medicare Advantage plan can help you save on your health care costs, call to speak with a licensed insurance agent today.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

1 Bergman, Adam. Social Security Feels Pinch as Baby Boomers Clock Out for Good. . Forbes. Retrieved from www.forbes.com/sites/greatspeculations/2018/06/21/social-security-feels-pinch-as-baby-boomers-clock-out-for-good/#f5bc5b449951.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Medicare has neither reviewed nor endorsed this information.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Also Check: How Much Does Part C Medicare Cost

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021 . If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 . If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 . |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203 . After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Recommended Reading: Can An Employer Pay For Medicare Premiums

Higher Magi Your Monthly Medicare Costs Could Be Higherup To $365 More Per Month Per Couple

When your MAGI from two years ago is higher than a base amount, you will receive an income related monthly adjustment amount or IRMAA added to your Medicare Part B premiums. For 2021 the standard Part B premium is $148.50 per month. If you filed your taxes as single in 2019 and with a MAGI above $88,000 you would pay and extra $59.40 per month. The same amount is added for joint tax filers with a MAGI over $176,000. This is a tiered scale that you can find at Medicare.gov. The maximum IRMAA is $356.50 per month.

Good News Yes You Can Request A Reduction In Medicare Part B Premiums

Now that you are aware that the cost of Part B premiums can increase with your income, lets discuss when you may need to ask for a reduction in your premiums. The time is when you have a life-changing event, and your income is reduced. This commonly happens when someone retires at age sixty-five or later. If your income while working was much higher than your income in retirement will be, you could be paying more for Part B coverage for two years, until your tax returns catches up to your retirement income.

You may need to ask for a reduction in your premiums . . . when you have a life-changing event, and your income is reduced . . . commonly happens when someone retires at age sixty-five or later.

For example, if you file single and retire from working at age sixty-five, and your MAGI from 2019 was $90,000, you will be paying the additional $59.40 per month for the next two years. Assuming your MAGI in retirement will be less than $88,000, you can eliminate the additional premium. That is over $1,400 in savings.

Also Check: Does Medicare Pay Anything On Dental

Will There Be A Rate Increase In 2022

We dont yet have concrete details from CMS. But the Medicare Trustees Report, which was published in late August, projects that the standard Part B premium will be $158.50/month in 2022. .

CMS has projected that the average Part D premium will increase slightly, to $33/month, in 2022. But there is always significant variation in Part D premiums from one plan to another, so there are a wide range of options for enrollees.

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Also Check: Does Medicare Pay For Bunion Surgery

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

The Social Security Administration notifies a beneficiary of his or her Part B insurance premium and any IRMAA with the beneficiarys annual notice of Social Security benefits . SSA is responsible for issuing all initial and reconsideration determinations. It is important to remember that IRMAAs apply for only one year. A beneficiary will be notified by SSA near the end of the current year if he or she has to pay an IRMAA for the upcoming year.

What Is The Medicare Hold Harmless Rule

Your Medicare premiums arent the only thing that will go up each year: your Social Security benefit payment will typically also increase each year.

The Social Security Administration uses the consumer price index for workers to make annual adjustments to benefit payment amounts. This is called the cost of living adjustment, or COLA, and is a way to help benefit payments keep up with the cost of living.

The cost of health care often rises faster than inflation, however. Fortunately, the hold harmless rule prevents Medicare premiums from increasing by a higher amount than the Social Security COLA.

The hold harmless rule does not apply to you, however, if:

- This is your first year receiving Medicare Part B benefits

- You are enrolled in a Medicare Savings Program

- You pay an IRMAA

- You were enrolled in an MSP in 2021 but lost program coverage because your income increased

If you pay a Part B late enrollment penalty, your penalty cannot be waived as part of the hold harmless rule. In fact, your late enrollment penalty will increase according to how much the Part B premium will go up each year.

You May Like: How To Find A Medicare Number For A Patient

Do You Have To Apply For An Msp During Medicare’s Annual Election Period

No. You can apply for MSP assistance anytime. As noted above, youll do this through your states Medicaid office, which accepts applications year-round.

But the marketing and outreach before and during Medicares annual election period can be a good reminder to seek help if you need it. You might decide to make a change to your coverage during the annual open enrollment period, and simultaneously check with your states Medicaid office to see if you might be eligible for an MSP or Extra Help with your drug coverage.

Full Transcript Of Video

Hey friends, the Fearless Advisor here. Today I am going to discuss adjusting your Medicare premiums after a decline in your income.

Medicare is a program that helps with medical expenses for Americans over the age of sixty-five. The program is very specific on when you must enroll or be subject to a delayed enrollment penalty, which lasts a lifetime! These requirements can really get our emotions stirred and cause us to make decisions quickly and possibly pay some higher premiums at the beginning of our Medicare journey.

Recommended Reading: Does Emory Hospital Accept Medicare

What If My Income Has Changed

If youre wondering how Medicare is calculated, its based on your tax return from two years ago. That means if your income suddenly increases this year, you wont have to worry about paying extra until a couple of years down the road.

But if youve received a bill and wondered why did my Medicare premium go down, it could be that your income decreased with the tax return Medicare is using to calculate your premium.

What happens if you were exceeding the threshold for Medicare, but your circumstances change? You can request a review of your premiums due to a life-changing event. Qualifying events include:

- Loss of work income for you or a spouse

- Property loss due to a disaster

You can request such a review by completing this form or calling 1-800-772-1213 to schedule an interview with your local Social Security office.

How Much Will You Pay For Medicare Part B

by Christian Worstell | Published January 20, 2022 | Reviewed by John Krahnert

The standard Part B premium in 2022 is $170.10 per month, though you could potentially pay more, depending on your income.

Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior. For example, your Medicare Part B premium in 2022 is based on your reported 2020 total annual income, and your 2023 premium will be based on your reported 2021 income, and so on.

Use the helpful chart below to begin determining what you can expect to pay for your Medicare Part B coverage in 2022.

|

2020 income |

|

$578.30 |

Recommended Reading: How Much Does Medicare Cost At Age 62

Medicare Premiums To Increase Dramatically In 2022

Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

The Centers for Medicare and Medicaid Services announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicares outlay for an expensive new drug that was recently approved to treat Alzheimers disease. Because most recipients have their Medicare premium deducted from their Social Security check, the upswing in Medicare premiums means that the Social Security cost-of-living increase of 5.9 percent, which was the largest in 39 years, will be smaller for most people.

Local Elder Law Attorneys in Your City

City, State

While the majority of beneficiaries will pay the added amount, a “hold harmless” rule prevents Medicare recipients’ premiums from increasing more than Social Security benefits. This hold harmless provision does not apply to Medicare beneficiaries who are enrolled in Medicare but not yet receiving Social Security, new Medicare beneficiaries, seniors earning more than $91,000 a year, and “dual eligibles” who get both Medicare and Medicaid benefits.

Here are all the new Medicare payment figures:

Your “Medigap” policy may cover some of these costs.

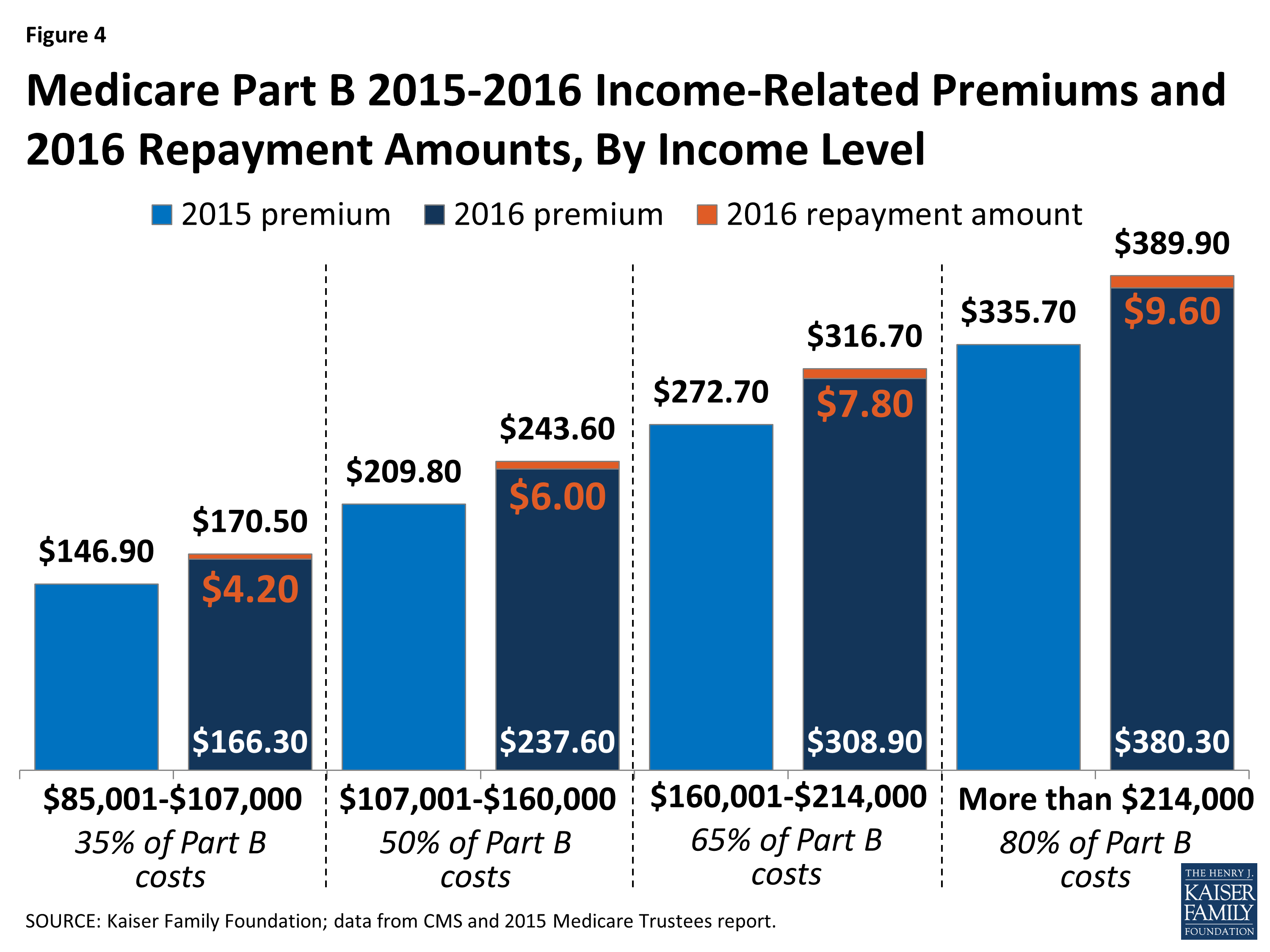

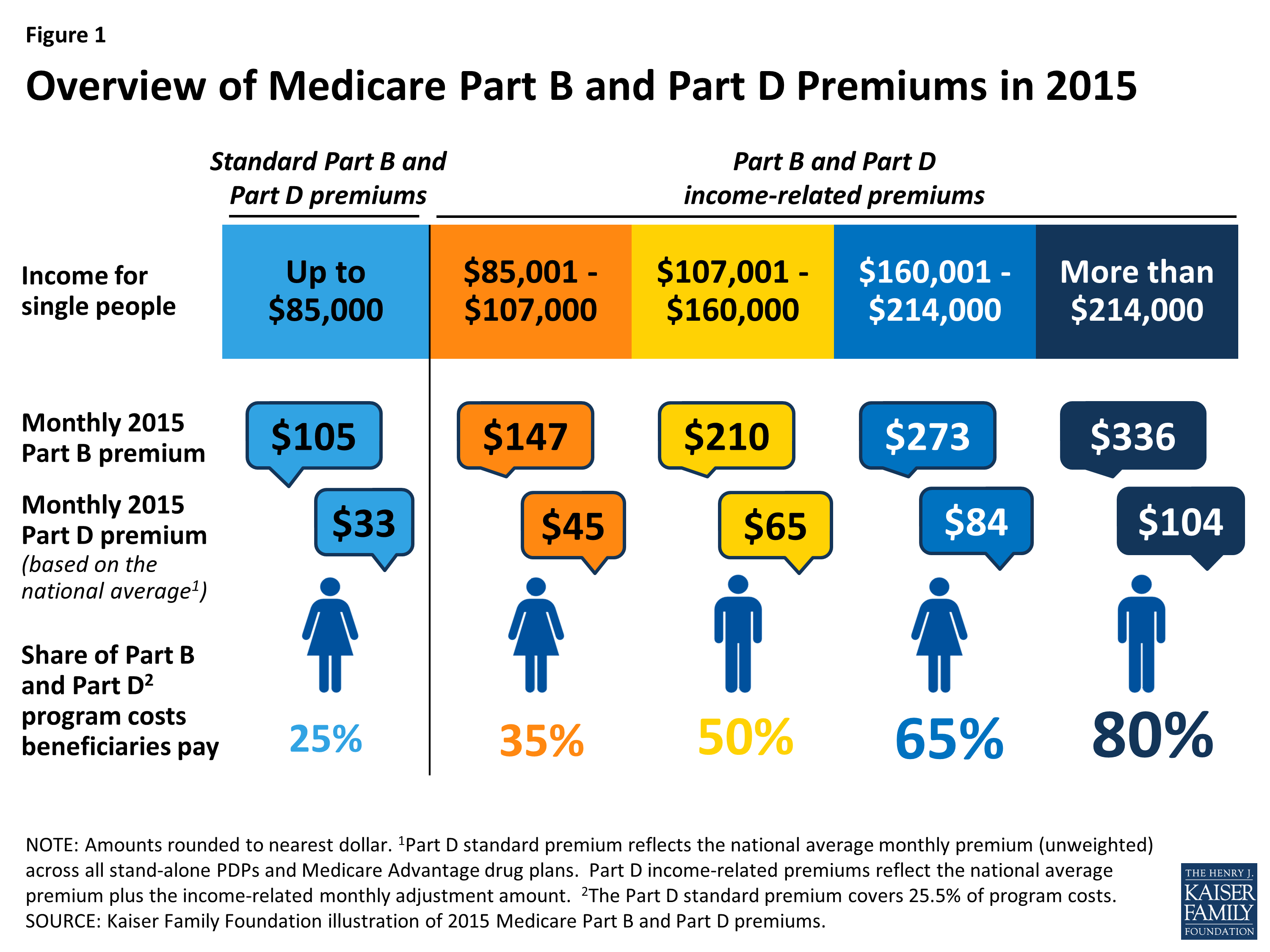

Premiums for higher-income beneficiaries are as follows: