What Are Medicares Out Of Pocket Maximums

-

Part A: This part of Medicare covers hospitalization, hospice care, skilled nursing facility, and home health care costs. There is no Medicare Out of Pocket maximum, but there are limits on what is covered. Part A usually doesnt have a premium, but there are deductibles to pay.

-

Part B: This part covers medically necessary services, as well as preventative care services. There is also no MOOP maximum for Part B, though still limits to what is covered. You do have to pay a premium and a deductible.

-

Part C : These are plans provided by private insurance companies that cover Part A and Part B, in addition to potential prescription drug coverage. Premiums, deductible, co-insurance, and additional payments vary from plan to plan, but there is a MOOP maximum that is set that the plans must abide by.

-

Part D : Covers a wide range of prescription drugs that beneficiaries are able to take. Costs for Part D vary from plan to plan. You reach the maximum once you reach the catastrophic coverage amounts, which can change each year.

-

Medicare Supplement Insurance: Also known as Medigap. Can help offset your OOP costs. Some plans have a maximum, others do not.

Kidney Failure Driving The Change

Since the beginning of Medicare Advantage plans, individuals diagnosed with end-stage renal disease , or kidney failure, have not been able to enroll in an Advantage plan. If they were already in a plan and then diagnosed, they could keep it. But beginning in January, those who have ESRD can enroll in a Medicare Advantage plan. Because these beneficiaries typically incur higher costs, the Centers for Medicare and Medicaid Services will consider that when calculating plan limits.

Remember, the maximum limit does not apply to Part D prescription drug coverage, Original Medicare or Medicare supplement plans

What Should You Do

- Realize this may have an impact on you. There are almost 600 plans that will have the maximum limits in 2021. I found them from Connecticut to California. A family member in Arkansas just shared that the maximum limits in her PPO plan are increasing by $1,800 in-network and $6,200 for in- and out-of-network combined.

- Read your plans Annual Notice of Changes. It will note the out-of-pocket maximum.

- Check the maximum you pay for health services, whether youre electing Medicare Advantage for the first time or shopping for a new plan. In the Medicare Plan Finder, youll find this item on the plans available, plan comparison and plan details pages. Unfortunately, there is no filter for sorting by maximum limit.

- Look for a new plan, if you dont want to face the $7,550/$11,300 maximum limits, and enroll by December 7.

Also Check: What Is A Good Secondary Insurance To Medicare

Recommended Reading: How Do I Get My New Medicare Card

Average Annual Medicare Advantage Costs

A 2019 study published by the Kaiser Family Foundation found that, in 2016, people enrolled in original Medicare spent an annual average of $3,166 in medical services and $2,294 in premiumsâfor a total out-of-pocket cost of $5,460. This study excluded Medicare Advantage enrollees, however, because the terms of each Advantage plan are different.

A 2016 Journal of the American Medical Association Oncology study found that the average annual out-of-pocket cost for Medicare Advantage health maintenance organization beneficiaries with cancer was $5,976. Your individual costs can vary greatly depending on the terms of your plan, the cost of premiums, costs associated with providers, and your planâs total out-of-pocket maximum.

Donât Miss: Can I Transfer My Medicare To Another State

Covering Some Of Your Out

Medicare Supplement Insurance provides full or partial coverage for some of the out-of-pocket expenses listed above. There are currently 10 standardized Medigap plans available in most states, and each includes a unique blend of basic benefits.

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020.

All 10 standardized Medigap plans provide at least partial coverage for:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- First three pints of blood

- Medicare Part A hospice care coinsurance or copayment

| 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,490 in 2022. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,620 in 2022. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

Don’t Miss: Does Medicare Come Out Of Social Security

What Is The Maximum Medicare Out

Many people are surprised to learn that Original Medicare doesnt have out-of-pocket maximums. Original Medicare consists of two parts Part A and Part B. If you have Original Medicare, theres no ceiling on the amount of money you may have to pay for covered inpatient or outpatient services.

Instead of Original Medicare you may have, or be interested in getting, a Medicare Advantage plan. Medicare Advantage plans are an alternative way to get full Medicare coverage.

Unlike Original Medicare, Part C plans are required to have out-of-pocket maximums. This means there is an automatic limit on the amount of money you will spend for covered healthcare during any given year. For in-network services in 2021, the highest Medicare out-of-pocket maximum a Part C plan could allow was $7,550. Many Part C plans also offer lower out-of-pocket limits of $6,000 or less.

Part C plans are sold by Medicare-approved private insurers for this purpose. The Medicare out-of-pocket maximum for Part C plans is established by the insurer that manages the plan.

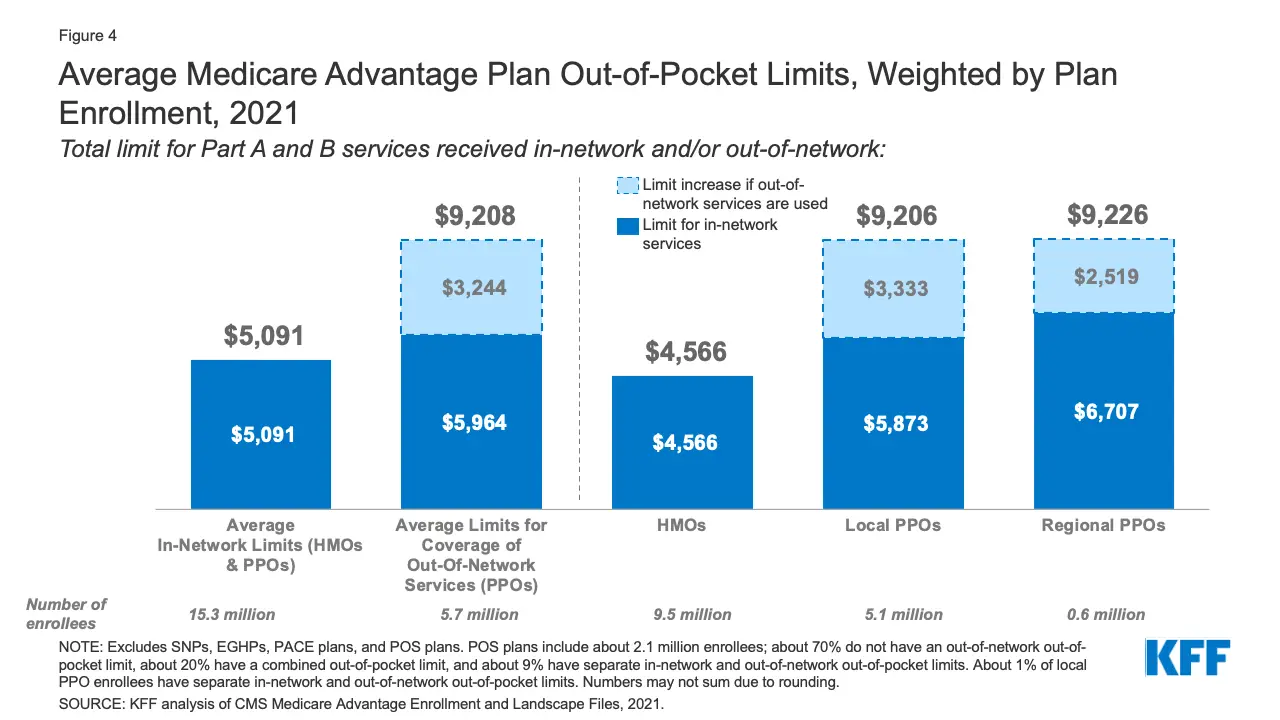

There are several different types of Part C plans, including HMOs and PPOs . Both types have provider networks, but PPO plans typically pay a percentage of your healthcare costs when you see an out-of-network provider. For that reason, Medicare Advantage PPO plans list one out-of-pocket maximum amount for in-network services, and one out-of-pocket maximum amount that combines in-network and out-of-network healthcare costs.

What Is Maximum Out

Maximum out-of-pocket coverage is essentially a cap on how much you would have to pay out of pocket each year for medical services. The idea is that, once you hit the cap, then your insurance will cover all costs that go beyond that.

The point of MOOP limits is to prevent beneficiaries from being burdened with never-ending or out-of-control expenses due to something like an ongoing health issue that you are continuously receiving treatment for.

Its important to remember, if you have a plan that includes maximum-out-of-pocket coverage, it will reset at the end of each year. This means that you will once again have to pay out-of-pocket costs in the new year, even if they are for an ongoing health issue.

MOOP only applies to treatments or services that are covered by your insurance. So, even if you hit your out-of-pocket maximum, you will still have to pay for anything that is not covered by your insurance.

Recommended Reading: Does Medicare Have Life Insurance

Why Is Medicare Advantage A Bad Choice

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan if you decide to switch to Medigap, there often are lifetime penalties.

Medicare Advantage Out Of Pocket Maximums

In 2021, the Medicare Advantage out-of-pocket limit is set at $7,750 per individual. Plans are allowed to set limits below this amount but cannot make a person pay more than that out of pocket.

-

Plans may have two different out-of-pocket maximum levels for in-network providers and out-of-network providers.

-

Deductibles, copayments, and coinsurance costs you pay as part of your Medicare Advantage plan count toward the out-of-pocket maximum.

-

Monthly premium costs nor your Part D coverages typically count toward your out-of-pocket maximum.

Read Also: When Do You Sign Up For Medicare

Caps For Medicare Advantage And Part D

Out-of-pocket expenses can be worrisome, especially if you are diagnosed with a serious illness or have a chronic medical condition. Such costs can draw the focus away from getting proper medical care.

Data from a 2019 GallupWest Health survey found that one in four people have delayed medical treatments due to cost, and 45% of people fear bankruptcy if they were to have a health crisis.

As much as Medicare is touted as being affordable, it can still be costly. Annual deductibles, monthly premiums, coinsurance, and copays add up, and Original Medicare has no cap on out-of-pocket spending.

There are, however, out-of-pocket limits set on prescription drug plans and Medicare Advantage .

What Is The Medicare Advantage Out

Although Medicare Advantage plans are sold by private insurance companies, they must follow certain rules and regulations set forth by the Centers for Medicare and Medicaid Services , which is the federal department that runs the Medicare program. One of those rules is that Medicare Advantage plans must include an annual out-of-pocket spending maximum.

All 2021 Medicare Advantage plans must include an out-of-pocket maximum that can be no higher than $7,550 for in-network care, and no higher than $11,300 total for the year. Most Medicare Advantage plans voluntarily set an out-of-pocket maximum that is lower than the required limit in order to make the plan more attractive to consumers.

The majority of Medicare Advantage plans cover prescription medications. Some of these plans may feature a separate out-of-pocket maximum exclusively for prescription drugs.

Don’t Miss: How Much Does Humira Cost With Medicare

What To Know About Medicare Savings Account Plans

Medicare Medical Savings Account plans are a type of Medicare Advantage plan.

MSA plans combine a high-deductible insurance plan with a medical savings account. You use the funds in your medical savings account to pay for healthcare.

MSA plans often have deductibles you will have to meet. The deductible amount is established by the plan.

Like all Medicare Advantage plans, MSAs must cover everything Original Medicare does. Some MSAs also cover extras such as dental, vision and hearing.

Unlike many Medicare Advantage plans, MSAs do not cover prescription drugs. If you have an MSA, you will need to buy a standalone Part D plan to cover medications.

What Is A Medicare Out

-

Medicare Out-of-Pocket Maximums are the highest amount a person must pay for approved services.

-

People who require longer hospital stays/more intense care pay much more in Out-of-Pocket Costs

-

Some aspects of Medicare have Maximum limits while others do not.

-

Out-of-Pocket Costs vary depending on the plan you choose

When navigating various Medicare and Medicare Advantage plans, there is plenty to consider. Medicare coverage is meant to help ease the financial strain for medical-related costs, but its important to understand what Medicare pays for and the costs that must be taken care of by the patient. Medicare often pays for the bulk of expenses, leaving a smaller amount of coinsurance for the beneficiary to pay. However, with Medicare Advantage plans, there is an established limit regarding how much the beneficiary will have to pay out of pocket for services. This is referred to as an Out-of-Pocket Maximum, or an out-of-pocket limit.

Also Check: Does Medicare Cover In Home Care After Surgery

Are There Income Limits For Medicare Premiums

Medicare Part B and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium.

Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

- The standard Part B premium in 2022 is $170.10 per month for anyone with an income under the IRMAA limit.

- Part D premiums are dictated by the Part D plan carrier, but beneficiaries with an income over the IRMAA limit must pay an additional amount.

The limits are based on your reported income from two years prior, so the 2022 IRMAA is based on your 2020 income.

The table below shows the Part B IRMAA amounts for various income limits.

Medicare Part B IRMAARecommended Reading: Is Joe Biden For Medicare For All

Medicare Advantage Plans Have An Out

If you have a Medicare Advantage plan, you may have different out-of-pocket costs, depending on the plan you select.

As mentioned above, Medicare Advantage plans provide all of the same benefits that are offered by Original Medicare. This means that Medicare Advantage plans cover cancer treatments, too.

Medicare Advantage plans also have an annual out-of-pocket limit that will cap your out-of-pocket spending. Original Medicare doesnt have an out-of-pocket limit.

Recommended Reading: What Is A Medicare Discount Card

Does Medicare Have A Maximum Out

There is no limit to your potential medical bills under Original Medicare. Under current rules, there is no Medicare out of pocket maximum if you have a chronic health condition or an unexpected health crisis, you could pay thousands in medical costs.

Under Original Medicare, you are responsible for your annual Part B deductible, a Part A deductible for each benefit period , and your coinsurance and copayment amounts.

You can get a Medicare Supplement insurance plan to help cover your Medicare out of pocket costs.

Questions About Medicare Coverage

RetireMed puts a team of trusted advisors in Medicare at your fingertips. We can talk you through your plan options and ensure you receive the right coverage for your needs.

To speak with an advisor, you can call 1-866-407-5180. You can also email your Medicare questions to .

Already a RetireMed client? Your client advisors are available at 1-877-222-1942 or .

Don’t Miss: Is Labcorp Covered By Medicare

Added Benefits And Services

Do you need extra coverage like dental, hearing, or vision care? Some plans include extra benefits for no extra cost. Some offer them as plan riders for an additional monthly fee. Look for a plan that meets your budget and helps you save money on the benefits and services you need.

Dont Miss: Does Medicare Cover Parkinsons Disease

How To Predict Out Of Pocket Costs On Medicare Advantage

Medicare Advantage, or private health insurance available through Medicare, is significantly more affordable than traditional health insurance plans, but it is not free. Youâll pay monthly premiums and medical co-pays, and youâll have to pay for any medical services that are not covered by your plan. Because Medicare Advantage plans cap annual out-of-pocket expenses, however, itâs possible to get a fairly accurate estimate of your total costs.

Recommended Reading: What Brand Of Diabetic Test Strips Does Medicare Cover

Also Check: How Do I Apply For Medicare At Age 65

What Are The Coverage Limits During The Medicare Part D Donut Hole

Medicare Part D prescription drug plans feature a temporary coverage gap, or donut hole. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs.

- Once you and your plan combine to spend $4,430 on covered drugs in 2022, you will enter the donut hole.

- Once you enter the donut hole in 2022, you will pay no more than 25 percent of the costs for brand name drugs and generic drugs until you reach the catastrophic coverage phase.

- After you spend $7,050 out-of-pocket on covered drugs in 2022, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What Is A Deductible

Your annual deductible is the amount you need to pay out of pocket for health care expenses before your insurer starts to cover some of your costs. Deductibles might range anywhere from $0 to $8,700 for an individual, or $0 to $17,400 for a family. Generally, a plan with a higher deductible will have lower premiums because youre expected to spend more of your own money on care and the insurance company pays less.

The following costs do not count toward your deductible:

-

Your monthly premiums

-

Copays

-

Care you receive that isnt covered by your insurance

Your health plan may also have multiple deductibles. For example, a plan may have one deductible for your spending at in-network health care providers, one deductible for out-of-network medical costs, and yet another for prescription drugs.

Recommended Reading: When Must The Medicare Supplement Buyer’s Guide Be Presented

Healthmarkets Can Help You Find The Right Plan

Medicare out-of-pocket costs are a lot of information to take in. And if youre feeling overwhelmed, HealthMarkets can help. Start comparing plans online now to find one thats right for your coverage needs. You can also speak to a licensed insurance agent by calling .

MULTIPLAN_HMOUTOFPOCKET_2022_M

Calculation Of The Oop Annual Limits:

The annual OOP limits are determined in accordance with section 1882 of the Social Security Act. That provision prescribed an OOP limit for 2006 of $4,000 for Plan K and $2,000 for Plan L, and directed that these amounts increase each subsequent year by an appropriate inflation adjustment specified by the Secretary of the United States Department of Health & Human Services. For 2022 the calculation of the OOP limits is based on estimates of the United States Per Capita Costs of the Medicare program developed by CMS as published with the announcement of Calendar Year 2021 and CY 2022 Medicare Advantage payment rates.

The inflation adjustment for 2022 is calculated by applying the percentage increase from 2021 to 2022 of the current estimates of the Total USPCC non-ESRD for Medicare Part A and Part B to the 2021 OOP limits. An adjustment is made to account for corrections to prior years’ estimates.

For further information, contact: Martha Wagley at 786-3778 for actuarial issues or Derrick Claggett at 786-2113 for policy issues.

If you need help regarding enrollment in a Medigap plan please contact your local State Health Insurance Assistance Program . Find your local SHIP on Medicare.gov at . You can find Medigap plans available in your area on Medicare.gov at .

Don’t Miss: How Much Does Medicare Cover For Nursing Home Care